Deck 14: Adjustments and the Work Sheet for a Merchandising Business

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

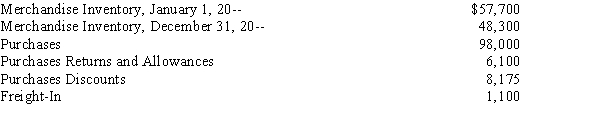

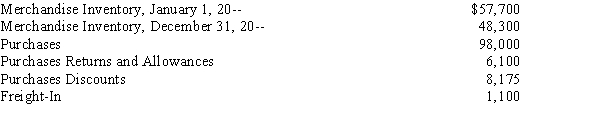

سؤال

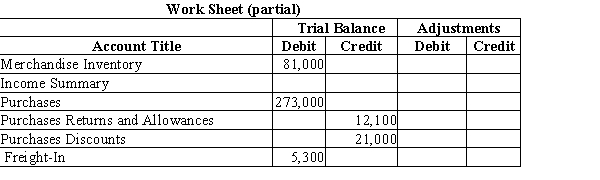

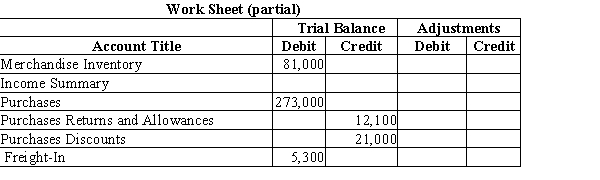

سؤال

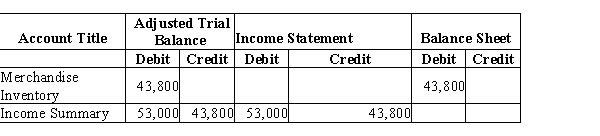

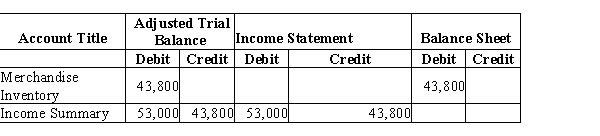

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/70

العب

ملء الشاشة (f)

Deck 14: Adjustments and the Work Sheet for a Merchandising Business

1

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

If beginning inventory is $30,000 and ending inventory is $35,000, the cost of the inventory on hand at the end of the accounting period is $35,000.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

If beginning inventory is $30,000 and ending inventory is $35,000, the cost of the inventory on hand at the end of the accounting period is $35,000.

True

2

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The merchandise inventory account is never debited or credited during the year using the periodic method.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The merchandise inventory account is never debited or credited during the year using the periodic method.

True

3

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The income summary account will always reflect the same balance as the merchandise inventory account at the end of the accounting period.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The income summary account will always reflect the same balance as the merchandise inventory account at the end of the accounting period.

False

4

The credit to the merchandise inventory account when making adjustments at the end of the accounting period will be the same amount as was debited at the end of the previous accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

5

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The credit amount for Income Summary in the Adjusted Trial Balance column reflects the inventory on hand at the end of the accounting period.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The credit amount for Income Summary in the Adjusted Trial Balance column reflects the inventory on hand at the end of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

6

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

Merchandise Inventory has a normal credit balance.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

Merchandise Inventory has a normal credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

7

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

After adjustments are made to the merchandise inventory account and posting is completed, the income summary account will reflect both the amount of beginning and ending inventory.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

After adjustments are made to the merchandise inventory account and posting is completed, the income summary account will reflect both the amount of beginning and ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

8

Some businesses require payment before delivering a product or performing a service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

9

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

If beginning inventory is $12,000 and ending inventory is $9,000, the first step in the adjusting process is to credit Merchandise Inventory for $12,000.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

If beginning inventory is $12,000 and ending inventory is $9,000, the first step in the adjusting process is to credit Merchandise Inventory for $12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

10

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

Two adjustments are made to the merchandise inventory account on the work sheet.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

Two adjustments are made to the merchandise inventory account on the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

11

Unearned Revenue is a liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

12

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

Both the debit and credit amounts in the merchandise inventory account at the end of an accounting period are used to calculate the cost of goods sold.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

Both the debit and credit amounts in the merchandise inventory account at the end of an accounting period are used to calculate the cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

13

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The merchandise inventory account always reflects the current inventory on hand.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The merchandise inventory account always reflects the current inventory on hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the cash basis of accounting, revenue is recorded when earned regardless of when cash is received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cash received in advance for performing a service or delivering a product is called unearned revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

16

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

At the end of the accounting period, the merchandise inventory account is credited for the beginning inventory amount.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

At the end of the accounting period, the merchandise inventory account is credited for the beginning inventory amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

17

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

If the ending inventory is understated for any reason, net income will be overstated.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

If the ending inventory is understated for any reason, net income will be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

18

If beginning inventory is $80,000 and ending inventory is $10,000, the balance of the merchandise inventory account after adjustments will be $70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

19

Match the terms with the definitions.a.average cost

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The amount of inventory on hand is determined by physically counting the goods on hand and determining the cost of those goods.

b.weighted-average method

c.consignee

d.consigned goods

e.specific identification method

f.retail method

g.cost

h.physical inventory

i.periodic inventory system

j.in transit

k.inventory sheet

l.natural business year

m.lower-of-cost-or-market method

The amount of inventory on hand is determined by physically counting the goods on hand and determining the cost of those goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

20

The transaction to record unearned revenue results in an increase to an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

21

In journalizing adjusting entries, Merchandise Inventory is credited for the amount of ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

22

The balance of Unearned Revenue is reported on the income statement at the end of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

23

The adjusted balance of the merchandise inventory account is extended to the Balance Sheet columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

24

A contra-revenue account is given a ".1" extension to its related ledger account's number.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

25

Purchases Discounts is a contra-cost account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

26

Adjustments are made on the work sheet for both beginning and ending Merchandise Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

27

In journalizing adjusting entries, an Unearned Revenue account is credited for any portion earned during the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

28

Only the debit adjustment amount in the merchandise inventory account is extended to the Adjusted Trial Balance columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

29

When part of the amount of unearned revenue has been earned and the account adjusted accordingly, a revenue account must be adjusted by that partial amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

30

Only the adjusted credit balance in the merchandise inventory account is extended to the Adjusted Trial Balance columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

31

When unearned revenue is finally earned, a revenue account is debited to reflect the amount of the revenue earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

32

An increase in a revenue account may reflect a decrease in a liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

33

After journalizing adjusting entries, the amounts must be posted to the accounts in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

34

When part of the amount of unearned revenue has been earned, the unearned revenue account must be adjusted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following accounts is never debited or credited during the accounting period?

A) Owner's Capital

B) Purchases Returns and Allowances

C) Merchandise Inventory

D) Interest Income

A) Owner's Capital

B) Purchases Returns and Allowances

C) Merchandise Inventory

D) Interest Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

36

An increase in a revenue account may reflect an increase in an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

37

Only the debit amount for the income summary account must be extended in the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

38

Purchases Returns and Allowances is a contra-revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

39

Actually counting the goods on hand at the end of the accounting period and determining the cost of these goods by reviewing the accounting records is called

A) the cost of goods sold.

B) the physical inventory.

C) freight-in.

D) accumulated depreciation.

A) the cost of goods sold.

B) the physical inventory.

C) freight-in.

D) accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

40

A beginning inventory of $75,000 is removed from the merchandise inventory account by

A) debiting $75,000 to Merchandise Inventory.

B) crediting $75,000 to Merchandise Inventory.

C) debiting $75,000 to Purchases.

D) crediting $75,000 to Income Summary.

A) debiting $75,000 to Merchandise Inventory.

B) crediting $75,000 to Merchandise Inventory.

C) debiting $75,000 to Purchases.

D) crediting $75,000 to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following accounts would NOT be found under the heading of "Cost of Goods Sold" in a chart of accounts?

A) Purchases

B) Purchases Returns and Allowances

C) Freight-In

D) Supplies

A) Purchases

B) Purchases Returns and Allowances

C) Freight-In

D) Supplies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

42

An example of a contra-revenue account is

A) Purchases.

B) Purchases Returns and Allowances.

C) Purchases Discounts.

D) Sales Returns and Allowances.

A) Purchases.

B) Purchases Returns and Allowances.

C) Purchases Discounts.

D) Sales Returns and Allowances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

43

On a work sheet, the amount entered in the Credit column of the Balance Sheet to balance the debits and credits is $56,000. This represents

A) an error of $28,000 in balancing the accounts.

B) a net income of $56,000.

C) a net loss of $56,000.

D) accumulated depreciation and other expenses.

A) an error of $28,000 in balancing the accounts.

B) a net income of $56,000.

C) a net loss of $56,000.

D) accumulated depreciation and other expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

44

Sports, Inc., plans to sell season football tickets for the 10 games played from September through November. These tickets sell for $5 each at the gate or for $45 per season package purchased before April 30. On April 30, the office reports that it has sold 200 season ticket packages and has only 50 left. The correct entry to record the sale of the season tickets is

A) debit Cash and credit Unearned Revenue for $9,000.

B) debit Cash and credit Revenue for $11,250.

C) debit Unearned Revenue and credit Revenue for $9,000.

D) to determine cost of goods sold.

A) debit Cash and credit Unearned Revenue for $9,000.

B) debit Cash and credit Revenue for $11,250.

C) debit Unearned Revenue and credit Revenue for $9,000.

D) to determine cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

45

If the ending inventory is understated for any reason,

A) net income will be overstated.

B) net income will be understated.

C) liabilities will be overstated.

D) liabilities will be understated.

A) net income will be overstated.

B) net income will be understated.

C) liabilities will be overstated.

D) liabilities will be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

46

Unearned revenue is reported as a(n)

A) current liability on the balance sheet.

B) contra-asset account on the chart of accounts.

C) owner's equity account on the work sheet.

D) asset on the balance sheet.

A) current liability on the balance sheet.

B) contra-asset account on the chart of accounts.

C) owner's equity account on the work sheet.

D) asset on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

47

If a difference is found between the physical count and the amount in the perpetual inventory records, an adjusting entry is made to which of the following accounts?

A) Inventory Short and Over

B) Purchases

C) Accounts Payable

D) Accounts Receivable

A) Inventory Short and Over

B) Purchases

C) Accounts Payable

D) Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

48

The income summary account, after adjusting entries are posted, reflects the

A) beginning inventory amount.

B) ending inventory amount.

C) beginning and ending inventory amounts.

D) cash income from business transactions.

A) beginning inventory amount.

B) ending inventory amount.

C) beginning and ending inventory amounts.

D) cash income from business transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which account balance is NOT used to compute the cost of goods sold?

A) Sales

B) Merchandise Inventory

C) Purchases

D) Purchases Discounts

A) Sales

B) Merchandise Inventory

C) Purchases

D) Purchases Discounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

50

Under the perpetual inventory method, when inventory is purchased, Merchandise Inventory

A) is debited and Cash or Accounts Payable is credited.

B) is credited and Cash or Accounts Payable is debited.

C) and Accounts Payable are credited and Cash is debited.

D) and Accounts Payable are debited and Cash is credited.

A) is debited and Cash or Accounts Payable is credited.

B) is credited and Cash or Accounts Payable is debited.

C) and Accounts Payable are credited and Cash is debited.

D) and Accounts Payable are debited and Cash is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

51

Cash received prior to delivering a product or performing a service is called a(n)

A) unearned asset.

B) unearned revenue.

C) unearned expense.

D) unearned contra-asset.

A) unearned asset.

B) unearned revenue.

C) unearned expense.

D) unearned contra-asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

52

A work sheet is prepared

A) from [date] to [date].

B) for the [period] ended [date].

C) at any time in the accounting period.

D) always on December 31.

A) from [date] to [date].

B) for the [period] ended [date].

C) at any time in the accounting period.

D) always on December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

53

Merchandise Inventory is listed as a(n)

A) current asset.

B) current liability.

C) expense.

D) revenue.

A) current asset.

B) current liability.

C) expense.

D) revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is NOT a formal part of the accounting system?

A) balance sheet

B) income statement

C) statement of owner's equity

D) the work sheet

A) balance sheet

B) income statement

C) statement of owner's equity

D) the work sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

55

A typical account found under the heading of "Revenue" in a chart of accounts is

A) Cash.

B) Sales.

C) Freight-In.

D) Purchases.

A) Cash.

B) Sales.

C) Freight-In.

D) Purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

56

On a work sheet, the Debit column of the Income Statement totals $550,356 and the Credit column totals $734,225. This represents

A) unbalanced totals indicating that an error exists.

B) a net loss to the business.

C) other expenses.

D) a net income for the business.

A) unbalanced totals indicating that an error exists.

B) a net loss to the business.

C) other expenses.

D) a net income for the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

57

On a work sheet, the Debit columns of the Income Statement and the Balance Sheet both total more than the Credit columns. This represents

A) an error in the accounting procedures for the period.

B) a net loss.

C) a net income.

D) no gain or loss.

A) an error in the accounting procedures for the period.

B) a net loss.

C) a net income.

D) no gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

58

During the accounting period, the Unearned Revenue account had a balance of $50,000 for computer equipment and software yet to be delivered. On March 31, a delivery of all of the equipment was made, leaving $5,000 worth of software pending. The correct journal entry to record this activity on March 31 is to

A) debit Unearned Revenue and credit Revenue for $45,000.

B) debit Unearned Revenue and credit Revenue for $5,000.

C) debit Cash and credit Unearned Revenue for $45,000.

D) debit Computer Equipment and credit Cash for $45,000.

A) debit Unearned Revenue and credit Revenue for $45,000.

B) debit Unearned Revenue and credit Revenue for $5,000.

C) debit Cash and credit Unearned Revenue for $45,000.

D) debit Computer Equipment and credit Cash for $45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

59

Both the debit and credit amounts from which of the following accounts are extended to the Adjusted Trial Balance columns of the work sheet?

A) Merchandise Inventory

B) Purchases Returns and Allowances

C) Interest Revenue

D) Income Summary

A) Merchandise Inventory

B) Purchases Returns and Allowances

C) Interest Revenue

D) Income Summary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

60

At the end of the accounting period, the correct entry in the general journal to adjust for ending inventory is to

A) debit Merchandise Inventory and credit Unearned Revenue.

B) debit Income Summary and credit Merchandise Inventory.

C) debit Merchandise Inventory and credit Income Summary.

D) debit Other Revenue and credit Income Summary.

A) debit Merchandise Inventory and credit Unearned Revenue.

B) debit Income Summary and credit Merchandise Inventory.

C) debit Merchandise Inventory and credit Income Summary.

D) debit Other Revenue and credit Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

61

Match the terms with the definitions.a.contra-cost accounts

b.contra-revenue accounts

c.physical inventory

d.unearned revenue

A physical count of goods on hand.

b.contra-revenue accounts

c.physical inventory

d.unearned revenue

A physical count of goods on hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use the following information to prepare the cost of goods sold section of the income statement for Beth's Jewels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

63

Journalize the necessary adjusting entries for the following (partial) trial balance. Based on a physical count, the ending merchandise inventory is $67,000. Unearned revenue at year-end was $4,230.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

64

Journalize the adjusting entries from the partial work sheet for a merchandising firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

65

Prepare the cost of goods sold section of the income statement for L. I. Grill from the information given below:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

66

Match the terms with the definitions.a.contra-cost accounts

b.contra-revenue accounts

c.physical inventory

d.unearned revenue

Accounts that are deducted from the Purchases account when computing cost of goods sold (i.e., Purchases Returns and Allowances, Purchases Discounts).

b.contra-revenue accounts

c.physical inventory

d.unearned revenue

Accounts that are deducted from the Purchases account when computing cost of goods sold (i.e., Purchases Returns and Allowances, Purchases Discounts).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

67

Match the terms with the definitions.a.contra-cost accounts

b.contra-revenue accounts

c.physical inventory

d.unearned revenue

Accounts that are deducted from Sales on the income statement (i.e., Sales Returns and Allowances, Sales Discounts).

b.contra-revenue accounts

c.physical inventory

d.unearned revenue

Accounts that are deducted from Sales on the income statement (i.e., Sales Returns and Allowances, Sales Discounts).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

68

Match the terms with the definitions.a.contra-cost accounts

b.contra-revenue accounts

c.physical inventory

d.unearned revenue

Cash received in advance of delivering a product or performing a service.

b.contra-revenue accounts

c.physical inventory

d.unearned revenue

Cash received in advance of delivering a product or performing a service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

69

Complete the Adjustments column of the work sheet represented below. Ending merchandise inventory is $92,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

70

At the end of the accounting period, the correct entry in the general journal to adjust for beginning inventory is to

A) debit Purchases and credit Merchandise Inventory.

B) debit Merchandise Inventory and credit Sales.

C) debit Income Summary and credit Merchandise Inventory.

D) debit the Capital account and credit a revenue account.

A) debit Purchases and credit Merchandise Inventory.

B) debit Merchandise Inventory and credit Sales.

C) debit Income Summary and credit Merchandise Inventory.

D) debit the Capital account and credit a revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck