Deck 19: Accounting for Partnerships

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/77

العب

ملء الشاشة (f)

Deck 19: Accounting for Partnerships

1

If the partnership agreement does not state how profits and losses are to be shared, they are allocated according to the partners' capital interests.

False

2

Partnerships are not subject to federal income taxes.

True

3

The basis on which profits and losses are to be shared is a matter of agreement between the partners and not necessarily the same as their investment ratio.

True

4

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

Only one partner can be individually liable for all of the debts of the partnership.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

Only one partner can be individually liable for all of the debts of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

5

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

It is desirable that a partnership agreement be evidenced by a written contract.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

It is desirable that a partnership agreement be evidenced by a written contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

6

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

A written agreement containing the various provisions under which a partnership is to operate is known as a partnership agreement.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

A written agreement containing the various provisions under which a partnership is to operate is known as a partnership agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

7

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

Partner compensation is reported on the income statement but is not used to compute net income.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

Partner compensation is reported on the income statement but is not used to compute net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

8

Since partners' salaries are not treated as an expense of the partnership, it is not necessary to keep a salary expense account for each partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

9

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

If one partner contributes an asset to the business, the asset is jointly owned by all partners.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

If one partner contributes an asset to the business, the asset is jointly owned by all partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

10

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

If the partnership cannot pay a bill, creditors will expect payment from the personal assets of the partners.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

If the partnership cannot pay a bill, creditors will expect payment from the personal assets of the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

11

Assuming there are no known bad debts when two single proprietors decide to combine their businesses, it is usual practice to enter the full amount of the Accounts Receivable as a debit and the amount of the Allowance for Bad Debts as a credit in placing each partner's investment in the books of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

12

In opening the books for a partnership, it is customary to prepare a single journal entry for the investment of all partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

13

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

Termination of the partnership agreement, bankruptcy of the firm, or death of one of the partners dissolves the partnership.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

Termination of the partnership agreement, bankruptcy of the firm, or death of one of the partners dissolves the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

14

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

The interest of a partner in the partnership can be transferred freely without the consent of the other partners.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

The interest of a partner in the partnership can be transferred freely without the consent of the other partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

15

When two single proprietors decide to combine their businesses, generally accepted accounting principles usually require that noncash assets be recorded at their market value as of the date of formation of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

16

The compensation of partners (other than their share of profits) may be in the form of salaries, royalties, commissions, or bonuses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

17

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

The Uniform Partnership Act states that a "corporation is an association of two or more persons who carry on, as co-owners, a business for profit."

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

The Uniform Partnership Act states that a "corporation is an association of two or more persons who carry on, as co-owners, a business for profit."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

18

Match the terms with the definitions.a.Accelerated Cost Recovery System (ACRS)

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

The partnership form of organization is more popular among professional service enterprises than among merchandise enterprises.

b.accelerated depreciation methods

c.amortization

d.trademark

e.cash equivalent price

f.long-term assets

g.copyright

h.cost

i.patent

j.depreciable cost (base)

k.depreciation

l.physical depreciation

m.tangible assets

n.sum-of-the-years'-digits method

o.salvage value

p.property, plant, and equipment

The partnership form of organization is more popular among professional service enterprises than among merchandise enterprises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

19

Partners may invest property or cash in the partnership, but only property increases their capital account balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

20

When two sole proprietors decide to combine their businesses, assets should be recorded at their book value as of the date of formation of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a partner is permitted to withdraw more than the book value of his/her interest, the effect of the transaction will increase the capital accounts of the remaining partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

22

One of the primary characteristics of the partnership form of organization is its limited liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

23

Partners are taxed on the amount withdrawn, not on their share of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

24

When two or more individuals engage in an enterprise as co-owners, the organization is known as a

A) single proprietorship.

B) corporation.

C) partnership.

D) closed corporation.

A) single proprietorship.

B) corporation.

C) partnership.

D) closed corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

25

Liquidation of a partnership usually means that assets are sold, liabilities are paid, and remaining cash is distributed to the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a retiring partner agrees to withdraw less than the book value of his/her interest, the effect of the transaction will decrease the capital accounts of the remaining partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

27

Partnerships file federal income tax returns for informational purposes and to notify partners of the amount of partnership income that must be reported on their individual federal income tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the retiring partner's interest is sold to one of the remaining partners, the retiring partner's equity is merely transferred to the other partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

29

For a new partner to be admitted to a partnership, there must be a consensus of the existing partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

30

When a partner retires from the business, the partner's interest may be purchased by one or more of the remaining partners or by an outside party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

31

Under the laws of some states, all partners may limit their liability for the debts of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

32

In the liquidation of the partnership, adjusting and closing entries are made when normal operations are discontinued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

33

The allocation of net income and its impact on the partners' equity balances should be disclosed in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

34

In the liquidation of the partnership, the first cash realized is allocated to the creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

35

The statement of partners' equity reflects the equity of each partner and summarizes the allocation of net income for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

36

The book value of a partner's interest is shown by the credit balance of the partner's capital account, after all profits or losses have been allocated in accordance with the partnership agreement, and the books have been closed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

37

The admission of a new partner calls for the amendment of the old partnership agreement, but not dissolve the old partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

38

Only the income statement is affected by the allocation of net income in a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

39

A gain on the sale of assets in the liquidation process is recognized and allocated to the partners' capital accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

40

Partners may agree that the most equitable method of allocating profits and losses is to base salaries on the services rendered by each partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

41

After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Boswell, $40,000; Aikido, $60,000; Cooke, $55,000. Partners share profits and losses as follows: Boswell, 20%; Aikido, 30%; and Cooke, 50%. If Cooke retired and withdrew $65,000 in settlement of his equity and settlements are allocated according to capital interests, the amount entered in Aikido's capital account would be a

A) $4,000 debit.

B) $4,000 credit.

C) $6,000 debit.

D) $6,000 credit.

A) $4,000 debit.

B) $4,000 credit.

C) $6,000 debit.

D) $6,000 credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

42

The basis on which profits and losses are to be shared between partners is

A) a matter of agreement between the partners.

B) the same as their investment ratio.

C) the same as their withdrawal ratio.

D) always equal between all partners.

A) a matter of agreement between the partners.

B) the same as their investment ratio.

C) the same as their withdrawal ratio.

D) always equal between all partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

43

After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Zott, $45,000; Payne, $60,000; Tejada, $47,000. If Tejada retired and withdrew $47,000 in settlement of his equity, the debit to his capital account would be in the amount of

A) $60,000.

B) $58,000.

C) $47,000.

D) $94,000.

A) $60,000.

B) $58,000.

C) $47,000.

D) $94,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

44

After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Rhodes, $40,000; Serrata, $60,000; Shepard, $75,000. Partners share profits and losses as follows: Rhodes, 20%; Serrata, 30%; and Shepard, 50%. If Shepard retired and withdrew $85,000 in settlement of his equity and settlements are allocated according to capital interests, the amount entered in Rhodes' capital account would be a

A) $4,000 debit.

B) $4,000 credit.

C) $6,000 debit.

D) $6,000 credit.

A) $4,000 debit.

B) $4,000 credit.

C) $6,000 debit.

D) $6,000 credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

45

A disadvantage that is NOT peculiar to the partnership form of organization includes

A) each partner is individually liable for all of the debts of the partnership.

B) the interest of a partner in the partnership cannot be transferred without the consent of the other partners.

C) termination of the partnership agreement, bankruptcy of the firm, or death of one of the partners dissolves the partnership.

D) the partners do not make the decisions that run the business.

A) each partner is individually liable for all of the debts of the partnership.

B) the interest of a partner in the partnership cannot be transferred without the consent of the other partners.

C) termination of the partnership agreement, bankruptcy of the firm, or death of one of the partners dissolves the partnership.

D) the partners do not make the decisions that run the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

46

When two proprietors decide to combine their businesses, generally accepted accounting principles usually require that noncash assets be taken over at their

A) historical cost value as of the date of formation.

B) fair market value as of the date of formation.

C) book value as of the date of formation.

D) residual value as of the date of formation.

A) historical cost value as of the date of formation.

B) fair market value as of the date of formation.

C) book value as of the date of formation.

D) residual value as of the date of formation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

47

In the absence of any agreement between partners, profits and losses must be shared

A) equally among all partners.

B) on the basis of the ratio of the partners' investment.

C) on the basis of the ratio of the partners' withdrawal.

D) in accordance with the Uniform Partnership Act.

A) equally among all partners.

B) on the basis of the ratio of the partners' investment.

C) on the basis of the ratio of the partners' withdrawal.

D) in accordance with the Uniform Partnership Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

48

Bernstein invests office equipment with a fair market value of $62,000, delivery equipment with a fair market value of $75,000, and cash of $30,000. He owes $27,000, represented by a note on the delivery equipment. The amount of Bernsteins' capital would be

A) $30,000.

B) $167,000.

C) $140,000.

D) $137,000.

A) $30,000.

B) $167,000.

C) $140,000.

D) $137,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

49

In comparison with the single proprietorship form of organization, the partnership form offers which of the following advantages?

A) simple transfer of interest in the partnership to outsiders

B) combination of ability and experience of the partners

C) legal liability of each partner for all the debts of the partnership

D) limited life

A) simple transfer of interest in the partnership to outsiders

B) combination of ability and experience of the partners

C) legal liability of each partner for all the debts of the partnership

D) limited life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

50

After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Sanchez, $20,000; Dorvinsky, $30,000; Davenport, $45,000. Partners share profits and losses as follows: Sanchez, 20%; Dorvinsky, 30%; and Davenport, 50%. If Davenport retired and withdrew $40,000 in settlement of his/her equity and settlements are allocated according to capital interests, the amount entered in Dorvinsky's capital account would be a

A) $2,000 credit.

B) $2,000 debit.

C) $3,000 credit.

D) $3,000 debit.

A) $2,000 credit.

B) $2,000 debit.

C) $3,000 credit.

D) $3,000 debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

51

When a new partner is admitted,

A) the old partnership continues to exist and the name of the new partner is added.

B) the old partnership is dissolved and a new one is created.

C) the old partnership is dissolved and a new form of ownership must be chosen.

D) the old partnership continues to exist and the new partner invests in the existing business.

A) the old partnership continues to exist and the name of the new partner is added.

B) the old partnership is dissolved and a new one is created.

C) the old partnership is dissolved and a new form of ownership must be chosen.

D) the old partnership continues to exist and the new partner invests in the existing business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

52

Partners are taxed on

A) the amount of cash they withdraw from the company.

B) their share of the net profit of the company.

C) the total amount of the net profit of the company.

D) the gross sales of the company.

A) the amount of cash they withdraw from the company.

B) their share of the net profit of the company.

C) the total amount of the net profit of the company.

D) the gross sales of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

53

Dissolution of a partnership

A) implies that the business operations will halt.

B) occurs when there is any change in the members of the partnership.

C) implies that the business cannot continue with a new group of partners.

D) implies that the business cannot form a different ownership structure.

A) implies that the business operations will halt.

B) occurs when there is any change in the members of the partnership.

C) implies that the business cannot continue with a new group of partners.

D) implies that the business cannot form a different ownership structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

54

Delisa invests office equipment with a fair market value of $70,000, delivery equipment with a fair market value of $89,000, and cash of $54,000. She owes $68,000, represented by a note on the delivery equipment. If Delisa's office equipment cost $80,000 and has accumulated depreciation of $30,000, the amount at which the asset should be entered on the books of the new partnership would be

A) $50,000.

B) $70,000.

C) $80,000.

D) $89,000.

A) $50,000.

B) $70,000.

C) $80,000.

D) $89,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

55

After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Ryan, $40,000; O'Malley, $60,000; Sullivan, $45,000. Partners share profits and losses as follows: Ryan, 20%; O'Malley, 30%; and Sullivan, 50%. If Sullivan retired and withdrew $40,000 in settlement of his/her equity and settlements are allocated according to capital interests, the amount entered in Ryan's capital account would be a

A) $2,000 credit.

B) $2,000 debit.

C) $3,000 credit.

D) $3,000 debit.

A) $2,000 credit.

B) $2,000 debit.

C) $3,000 credit.

D) $3,000 debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

56

If two or more sole proprietors combine their businesses to form a partnership, the basis for the opening entries for the investments of such partners is based upon their respective

A) balance sheet.

B) income statement.

C) statement of owner's equity.

D) cash flow statement.

A) balance sheet.

B) income statement.

C) statement of owner's equity.

D) cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

57

After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Golden, $30,000; Chavez, $40,000; McGinnis, $55,000. If McGinnis retired and withdrew $50,000 in settlement of his/her equity, the amount entered in McGinnis's capital account would be a

A) $5,000 credit.

B) $50,000 credit.

C) $55,000 debit.

D) $55,000 credit.

A) $5,000 credit.

B) $50,000 credit.

C) $55,000 debit.

D) $55,000 credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

58

"Mutual agency" means that

A) a partnership has a limited life.

B) any partner can bind the other partners to a contract.

C) each partner is personally liable for all debts.

D) partnerships are not subject to federal income taxes.

A) a partnership has a limited life.

B) any partner can bind the other partners to a contract.

C) each partner is personally liable for all debts.

D) partnerships are not subject to federal income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

59

The allocation of net income and its impact on partners' equity balances should be disclosed on the

A) income statement.

B) balance sheet.

C) statement of partners' equity.

D) work sheet.

A) income statement.

B) balance sheet.

C) statement of partners' equity.

D) work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

60

"Limited life" means

A) a partnership may be dissolved as the result of any change in the ownership.

B) a partnership may be dissolved if the location of the business is changed.

C) a partnership is limited to the amount of net income it can earn.

D) a partnership is limited in the amount of debt it is liable for in the course of the business.

A) a partnership may be dissolved as the result of any change in the ownership.

B) a partnership may be dissolved if the location of the business is changed.

C) a partnership is limited to the amount of net income it can earn.

D) a partnership is limited in the amount of debt it is liable for in the course of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

61

Yon Haggerdorf and Sue Lee, who have ending capital balances of $80,000 and $60,000, respectively, agree to admit two new partners to their business on April 1, 20--. Carlos Sanchez will buy 1/4 of Haggerdorf's equity interest for $20,000 and 1/3 of Lee's equity interest for $25,000 directly from the partners. Carmen Della will invest $30,000 in the business for which she is to receive a $30,000 equity interest.

Required:

a.

Prepare general journal entries showing the above transactions admitting Sanchez and Della to the partnership.

b.

Calculate the ending capital balances for all four partners after the above transactions.

Required:

a.

Prepare general journal entries showing the above transactions admitting Sanchez and Della to the partnership.

b.

Calculate the ending capital balances for all four partners after the above transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

62

Match the terms with the definitions.a.dissolution

b.liquidation

c.partnership

d.partnership agreement

The form of organization in which two or more individuals engage in an enterprise as co-owners.

b.liquidation

c.partnership

d.partnership agreement

The form of organization in which two or more individuals engage in an enterprise as co-owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

63

Match the terms with the definitions.a.dissolution

b.liquidation

c.partnership

d.partnership agreement

Dissolving of the partnership resulting from any change in the members of the partnership.

b.liquidation

c.partnership

d.partnership agreement

Dissolving of the partnership resulting from any change in the members of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

64

Soo Yung and Saul Gazza agree to admit Millie Hillsberg into their partnership. The balance sheet of Hillsberg's business as of September 30 is shown below:  Yung, Gazza, and Hillsberg agree that the amounts reported on Hillsberg's balance sheet are reasonable approximations of market value. Yung and Gazza agree to purchase all business assets, except cash, and all business liabilities were assumed, in exchange for a $55,000 interest in their partnership.

Yung, Gazza, and Hillsberg agree that the amounts reported on Hillsberg's balance sheet are reasonable approximations of market value. Yung and Gazza agree to purchase all business assets, except cash, and all business liabilities were assumed, in exchange for a $55,000 interest in their partnership.

Required:

Prepare the journal entry showing Hillsberg's investment in the partnership of Yung and Gazza, as of October 1, 20--.

Yung, Gazza, and Hillsberg agree that the amounts reported on Hillsberg's balance sheet are reasonable approximations of market value. Yung and Gazza agree to purchase all business assets, except cash, and all business liabilities were assumed, in exchange for a $55,000 interest in their partnership.

Yung, Gazza, and Hillsberg agree that the amounts reported on Hillsberg's balance sheet are reasonable approximations of market value. Yung and Gazza agree to purchase all business assets, except cash, and all business liabilities were assumed, in exchange for a $55,000 interest in their partnership.Required:

Prepare the journal entry showing Hillsberg's investment in the partnership of Yung and Gazza, as of October 1, 20--.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

65

Steve and Heather decided to form a partnership on April 1. Steve invested $60,000 and Heather invested $40,000. Net income for the fiscal year ended March 31 was $110,000. Each partner is to receive 10% on their original investment. Steve and Heather are to receive a salary allowance of $35,000 and $45,000, respectively. The remainder is to be divided as follows: 70% to Steve and 30% to Heather. Determine the amount of net income that Steve and Heather would have received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

66

All assets held by a partnership are

A) co-owned by all partners.

B) owned by the partner(s) who purchased the assets.

C) owned by the partners based on the percentage of their investment in the business.

D) owned by the partnership.

A) co-owned by all partners.

B) owned by the partner(s) who purchased the assets.

C) owned by the partners based on the percentage of their investment in the business.

D) owned by the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

67

Match the terms with the definitions.a.dissolution

b.liquidation

c.partnership

d.partnership agreement

A process of selling the assets, paying the liabilities, and distributing the remaining cash or other assets to the partners.

b.liquidation

c.partnership

d.partnership agreement

A process of selling the assets, paying the liabilities, and distributing the remaining cash or other assets to the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

68

After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Yang, $20,000; Wolfe, $30,000; Stamatis, $45,000. Partners share profits and losses as follows: Yang, 20%; Wolfe, 30%; and Stamatis, 50%. If Yang purchased Stamatis's interest in the partnership for $40,000 cash, the amount entered in Yang's capital account is a

A) $5,000 debit.

B) $40,000 debit.

C) $40,000 credit.

D) $45,000 credit.

A) $5,000 debit.

B) $40,000 debit.

C) $40,000 credit.

D) $45,000 credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

69

Kate DeLeo and Joe Desmond decided to form a partnership on January 1. DeLeo invested $50,000 and Desmond invested $30,000. On December 31, the end of the fiscal year, a net income of $100,000 was earneD.Required:

Determine the amount of net income that DeLeo and Desmond would receive under each of the following independent assumptions:

a.

There is no agreement concerning the distribution of net income.

b.

Each partner is to receive 10% on their original investment, and the remainder divided equally.

c.

DeLeo and Desmond are to receive a salary allowance of $35,000 and $45,000 respectively, and the remainder divided equally.

d.

Each partner is to receive 10% on their original investment, DeLeo and Desmond are to receive a salary allowance of $30,000 and $40,000 respectively, and the remainder divided as follows: 60% to DeLeo and 40% to Desmond.

Determine the amount of net income that DeLeo and Desmond would receive under each of the following independent assumptions:

a.

There is no agreement concerning the distribution of net income.

b.

Each partner is to receive 10% on their original investment, and the remainder divided equally.

c.

DeLeo and Desmond are to receive a salary allowance of $35,000 and $45,000 respectively, and the remainder divided equally.

d.

Each partner is to receive 10% on their original investment, DeLeo and Desmond are to receive a salary allowance of $30,000 and $40,000 respectively, and the remainder divided as follows: 60% to DeLeo and 40% to Desmond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

70

J. O'Keefe and J. Kisha combined for a 50/50 partnership in 1980 and continued to do business successfully for many years. In January 2011, J. Kimley offered to contribute a sizable amount of working capital and was accepted as a partner in the business. J. O'Keefe and J. Kisha each own 40% of the business and J. Kimley 20% of the business partnership. Profits and losses are to be shared according to these percentages. Due to the lagging economy and a sudden loss of profits, all three agree to liquidate the business and enjoy a gain on the sale of their major asset, which was purchased in 1981. This should be distributed

A) 50% to J. O'Keefe; 50% to J. Kisha.

B) 40% to J. O'Keefe; 40% to J. Kisha; 20% to J. Kimley.

C) equally among the three partners at the time of the sale.

D) 100% into the partnership dissolution revenue account.

A) 50% to J. O'Keefe; 50% to J. Kisha.

B) 40% to J. O'Keefe; 40% to J. Kisha; 20% to J. Kimley.

C) equally among the three partners at the time of the sale.

D) 100% into the partnership dissolution revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

71

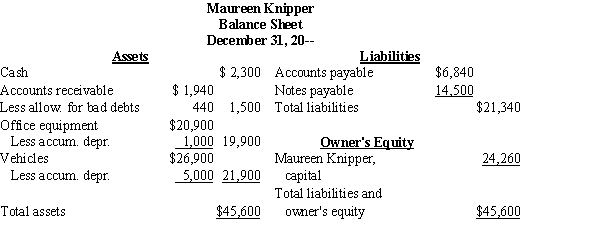

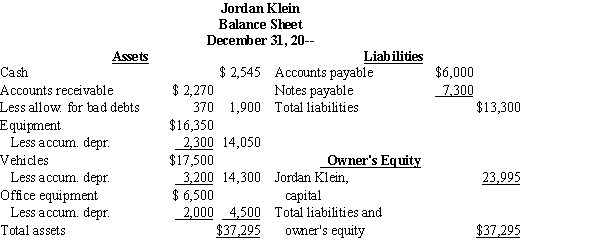

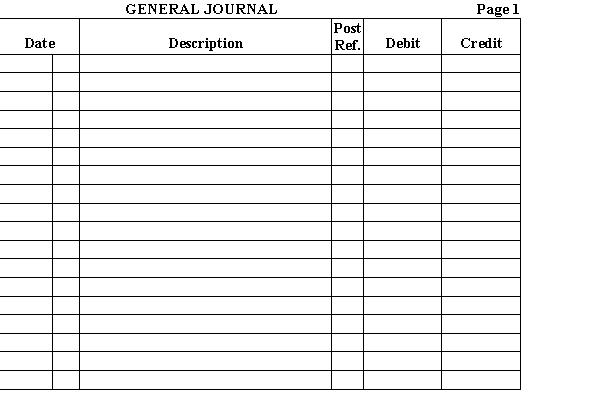

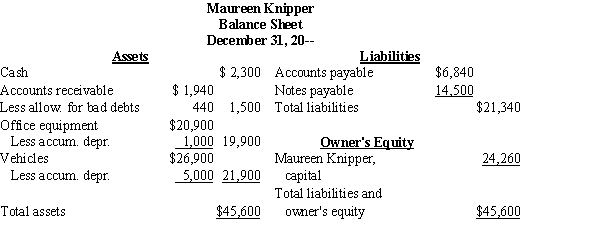

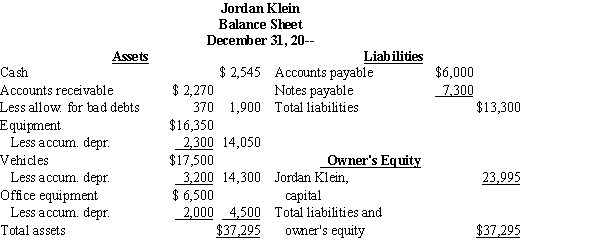

Maureen Knipper and Jordan Klein have been sole proprietors of separate animal relocation businesses for several years. On January 1, 20--, they form a partnership called K & K Animal Kingdom. The following balance sheets provided for each business serve as the basis for the partnership:

Knipper and Klein agree that the information provided on the balance sheets represents market values, except for the assets listed below for which appraisals of current market values were obtained.

Required:

Prepare the opening journal entries for the formation of K & K Animal Kingdom.

Knipper and Klein agree that the information provided on the balance sheets represents market values, except for the assets listed below for which appraisals of current market values were obtained.

Required:

Prepare the opening journal entries for the formation of K & K Animal Kingdom.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

72

After several years of operation, the partnership of Raimondo, Rodriguez, and Rosenfeld is being liquidated. After making closing entries on September 30, 20--, the following accounts remain open:  The noncash assets are sold for $275,000. Profits and losses are shared equally.

The noncash assets are sold for $275,000. Profits and losses are shared equally.

Required:

Prepare journal entries for the following transactions:

a.

The sale of the noncash assets on October 1.

b.

Payment of the liabilities on October 15.

c.

Division of the remaining cash on October 20.

The noncash assets are sold for $275,000. Profits and losses are shared equally.

The noncash assets are sold for $275,000. Profits and losses are shared equally.Required:

Prepare journal entries for the following transactions:

a.

The sale of the noncash assets on October 1.

b.

Payment of the liabilities on October 15.

c.

Division of the remaining cash on October 20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

73

Match the terms with the definitions.a.dissolution

b.liquidation

c.partnership

d.partnership agreement

A written agreement containing the various provisions for operating a partnership.

b.liquidation

c.partnership

d.partnership agreement

A written agreement containing the various provisions for operating a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is an incorrect step in the process of liquidation?

A) sell the assets

B) allocate gains or losses to partners

C) close all accounts payable

D) pay any liabilities

A) sell the assets

B) allocate gains or losses to partners

C) close all accounts payable

D) pay any liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

75

Kristin Anastra and Jesse Turnbull agreed on September 1 to go into business as partners. According to the agreement, Anastra is to contribute $80,000 cash and Turnbull is to contribute $75,000 casH.Required:

Provide a separate journal entry for the investment of each partner.

Provide a separate journal entry for the investment of each partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

76

After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Peluso, $20,000; Odin, $30,000; Nazaro, $45,000. Partners share profits and losses as follows: Peluso, 20%; Odin, 30%; and Nazaro, 50%. If Peluso purchased Nazaro's interest in the partnership for $40,000 cash, the amount entered in Nazaro's capital account is a

A) $5,000 debit.

B) $40,000 debit.

C) $40,000 credit.

D) $45,000 debit.

A) $5,000 debit.

B) $40,000 debit.

C) $40,000 credit.

D) $45,000 debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

77

When a partnership is liquidated, the assets are sold and the cash realized is applied first to the

A) partners' equity accounts.

B) claims of creditors.

C) partner with the largest investment in the partnership.

D) partners according to their ownership interest as indicated by their capital account.

A) partners' equity accounts.

B) claims of creditors.

C) partner with the largest investment in the partnership.

D) partners according to their ownership interest as indicated by their capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck