Deck 24: Analysis of Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

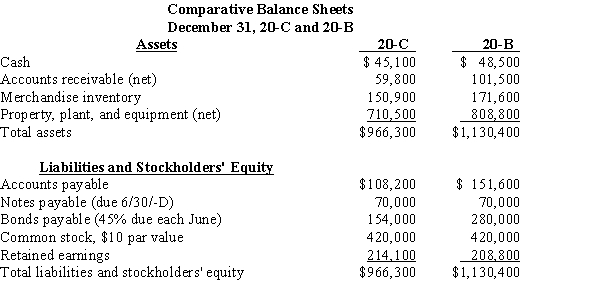

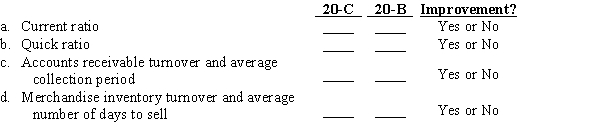

سؤال

سؤال

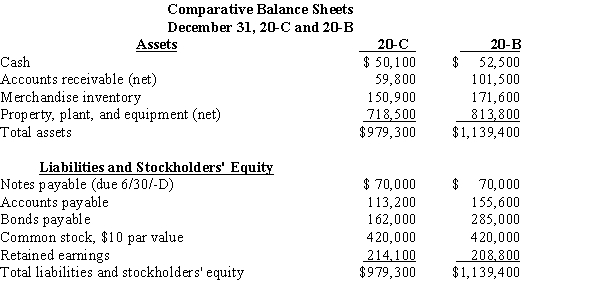

سؤال

سؤال

سؤال

سؤال

سؤال

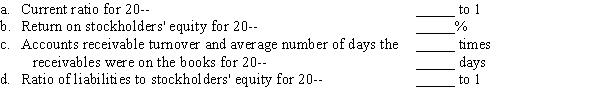

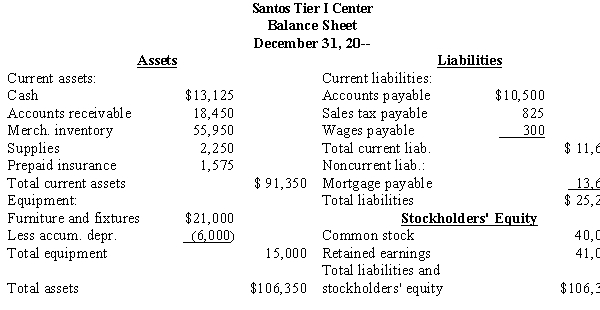

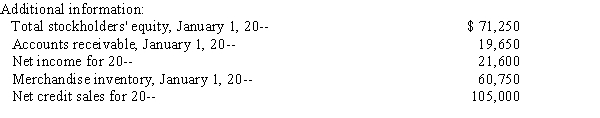

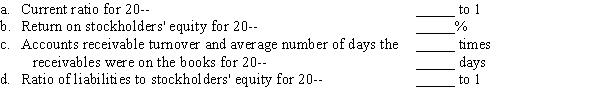

سؤال

سؤال

سؤال

سؤال

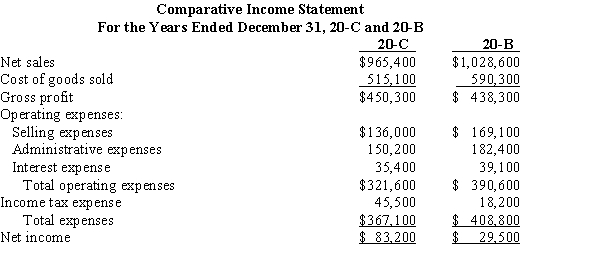

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/101

العب

ملء الشاشة (f)

Deck 24: Analysis of Financial Statements

1

Working capital is the excess of a company's current assets over current liabilities.

True

2

Merchandise inventory turnover measures the relationship between sales and inventory.

True

3

Leverage measures are intended to indicate the extent to which a firm is being financed by debt and the ability of the firm to meet its debt obligations.

True

4

The debt-to-equity ratio is calculated by dividing the net income for the year by the average stockholders' equity for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

5

Retention of a major portion of business earnings is a desirable way to finance corporate growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

6

Profitability measures are intended to indicate the extent to which an entity is being financed by debt and the ability of the entity to meet its debt obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

7

The current ratio and the quick or acid-test ratio may be too high for the overall good of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

8

Profitability measures focus on relationships between key income statement and balance sheet accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

9

The current ratio is calculated by dividing total current assets by total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

10

Asset turnover ratio measures how effectively a company uses assets to generate sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

11

As a general rule, a current ratio of 0.5 to 1 or better is satisfactory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

12

In calculating the percentage of change (for a comparative financial statement), the amount for the year prior serves as the base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

13

Quick assets include cash, temporary investments, and receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

14

Issuing additional common stock is not a desirable means to finance business growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

15

The quick or acid-test ratio is calculated by dividing current assets by current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

16

The return on total assets is calculated by dividing the net income for the year by the average total assets during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

17

Vertical analysis of income statements automatically provides the cost of goods sold ratio and the gross profit ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

18

Book value per share of common stock is the measure of ownership equity represented by each share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

19

From the standpoint of the individual stockholder, one of the most important measures of profitability of the firm is the earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

20

When there are preferred shares outstanding, the calculation of book value per share of common stock must first take into consideration the claims or equity of the preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

21

Merchandise inventory turnover is calculated by dividing cost of goods sold by the average merchandise inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

22

The ratio of earnings before interest and taxes to the interest requirement is called the times interest earned ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

23

The times interest earned ratio tells a creditor the firm's ability to pay interest on debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

24

Information not reported in the financial statements is also important in evaluating the financial health of a firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

25

A period of two consecutive years is sufficient to establish a long-term trend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

26

Profitability measures are intended to indicate an entity's ability to earn income by operating efficiently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

27

The various methods of financial statement analysis need to be used cautiously, with an awareness of the limitations of accounting data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

28

The gross profit ratio is computed by subtracting cost of goods sold from net sales and dividing by net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

29

The accounts receivable turnover measures how promptly receivables are collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

30

The financial statements of a business are intended to supply information to several interested parties such as: management, present and potential owners, creditors, employees and their unions, governmental agencies, and sometimes the general public.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

31

Liquidity measures are intended to indicate an entity's ability to pay long-term debts as they come due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

32

If a corporation has only common stock outstanding, book value per share can be determined by dividing the total stockholders' equity by the number of shares outstanding at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

33

A comparison of the amounts for the same item in the financial statements of two or more periods is called horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

34

The ratio of liabilities to stockholders' equity is a measure of the extent of leverage, or proportion of borrowed capital, with which a business operates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

35

An expression of the amount of each item in a statement as a percentage of some designated total for comparative purposes is called vertical analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

36

Vertical analysis reports the amount of each item in a statement as a percentage of a designated total.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

37

Comparisons across companies are difficult due to the possible use of different accounting techniques.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

38

The cause of changes in key ratios must be investigated before drawing conclusions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

39

Accounts receivable turnover is calculated by dividing (gross) sales by the average (gross) amount of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

40

The debt-to-equity ratio measures the extent of leverage, or proportion of borrowed capital, with which a business operates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

41

Total liabilities divided by total stockholders' equity is the calculation for the

A) current ratio.

B) ratio of liabilities to stockholders' equity.

C) return on equity ratio.

D) times interest earned ratio.

A) current ratio.

B) ratio of liabilities to stockholders' equity.

C) return on equity ratio.

D) times interest earned ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

42

Dividing quick assets by total current liabilities is the calculation for the

A) current ratio.

B) return on investment.

C) quick or acid-test ratio.

D) ratio of liabilities to owner's equity.

A) current ratio.

B) return on investment.

C) quick or acid-test ratio.

D) ratio of liabilities to owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

43

A company has net sales on account of $1,750,000. Net accounts receivable at the beginning of the year are $147,000 and net accounts receivable at the end of the year are $153,000. The accounts receivable turnover is

A) 11.9.

B) 11.7.

C) 11.4.

D) 1.0.

A) 11.9.

B) 11.7.

C) 11.4.

D) 1.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

44

The liabilities of a company at the end of the year are $500,000 and the total stockholders' equity at the end of the year is $1,500,000. The ratio of liabilities to stockholders' equity is

A) 0.50 to 1.

B) 0.33 to 1.

C) 0.67 to 1.

D) 3 to 1.

A) 0.50 to 1.

B) 0.33 to 1.

C) 0.67 to 1.

D) 3 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

45

Merchandise inventory turnover measures the relationship between

A) assets and current liabilities.

B) merchandise inventory and current liabilities.

C) expenses and merchandise inventory.

D) cost of goods sold and merchandise inventory.

A) assets and current liabilities.

B) merchandise inventory and current liabilities.

C) expenses and merchandise inventory.

D) cost of goods sold and merchandise inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

46

The net income for the year ended was $720,000; total assets at the beginning of the year was $2,100,000; and total assets at the end of the was $2,300,000. The return on total assets would be

A) 1.1%.

B) 3.1%.

C) 11.2%.

D) 32.7%.

A) 1.1%.

B) 3.1%.

C) 11.2%.

D) 32.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company has cash, $80,000; temporary investments, $20,000; net receivables, $60,000; and inventory, $450,000. Current liabilities are $200,000. The quick or acid-test ratio is

A) 0.54 to 1.

B) 0.80 to 1.

C) 2.25 to 1.

D) 3.05 to 1.

A) 0.54 to 1.

B) 0.80 to 1.

C) 2.25 to 1.

D) 3.05 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

48

The cost of goods sold for a company for the year was $1,900,000. Merchandise inventory at the beginning of the year was $125,000 and merchandise inventory at the end of the year was $133,000. The merchandise inventory turnover for the year was

A) 0.1.

B) 14.7.

C) 33.8.

D) 65.5.

A) 0.1.

B) 14.7.

C) 33.8.

D) 65.5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

49

A company has cash, $85,000; temporary investments, $30,000; net receivables, $60,000; and inventory, $350,000. Current liabilities are $300,000. The current ratio is

A) 0.58 to 1.

B) 0.74 to 1.

C) 1.75 to 1.

D) 1.86 to 1.

A) 0.58 to 1.

B) 0.74 to 1.

C) 1.75 to 1.

D) 1.86 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

50

Dividing the net income for the year by the average assets for the year is the calculation for the

A) return on assets.

B) earnings per share.

C) book value per share.

D) quick or acid-test ratio.

A) return on assets.

B) earnings per share.

C) book value per share.

D) quick or acid-test ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

51

A comparison of the amounts for the same item in financial statements of two or more periods is called

A) vertical analysis.

B) competitive analysis.

C) earnings per share.

D) horizontal analysis.

A) vertical analysis.

B) competitive analysis.

C) earnings per share.

D) horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

52

The net income of a company is $175,000. The average book value of the company's assets is $1,300,000. The return on total assets would be

A) 20.00%.

B) 7.43%.

C) 600.00%.

D) 13.46%.

A) 20.00%.

B) 7.43%.

C) 600.00%.

D) 13.46%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

53

Dividing cost of goods sold by the average of merchandise inventory is the calculation for the

A) accounts receivable turnover.

B) working capital turnover.

C) merchandise inventory turnover.

D) plant and equipment turnover.

A) accounts receivable turnover.

B) working capital turnover.

C) merchandise inventory turnover.

D) plant and equipment turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

54

A company has net sales on account of $1,200,000. Net accounts receivable at the beginning of the year are $500,000 and net accounts receivable at the end of the year are $700,000. The average number of days that the accounts receivables were on the books was

A) 8.7 days.

B) 182.5 days.

C) 304.0 days.

D) 439.8 days.

A) 8.7 days.

B) 182.5 days.

C) 304.0 days.

D) 439.8 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

55

Dividing net sales on account by the average amount of net accounts receivable is the calculation for the

A) accounts receivable turnover.

B) working capital turnover.

C) merchandise inventory turnover.

D) plant and equipment turnover.

A) accounts receivable turnover.

B) working capital turnover.

C) merchandise inventory turnover.

D) plant and equipment turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

56

The net sales for a company were $3,600,000; gross profit was $600,000; and net income was $260,000. The net income to net sales ratio would be

A) 7.22%.

B) 16.67%.

C) 23.89%.

D) 43.33%.

A) 7.22%.

B) 16.67%.

C) 23.89%.

D) 43.33%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

57

Dividing the total stockholders' equity by the average number of shares outstanding at the end of the year (if only common stock is outstanding) is the calculation for

A) book value per share.

B) earnings per share.

C) return on equity.

D) the times interest earned ratio.

A) book value per share.

B) earnings per share.

C) return on equity.

D) the times interest earned ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

58

The cost of goods sold for a company for the year was $1,600,000. Merchandise inventory at the beginning of the year was $195,000 and merchandise inventory at the end of the year was $205,000. The average number of days that the inventory was held during the year was

A) 8.0 days.

B) 25.0 days.

C) 39.6 days.

D) 45.6 days.

A) 8.0 days.

B) 25.0 days.

C) 39.6 days.

D) 45.6 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

59

An expression of the amount of each item in a statement as a percentage of some designated total for comparative purposes is called

A) vertical analysis.

B) return on total assets.

C) earnings per share.

D) horizontal analysis.

A) vertical analysis.

B) return on total assets.

C) earnings per share.

D) horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

60

Leverage is

A) the ability to earn a satisfactory return on the investments in the business.

B) the proportion of debt to stockholders' equity.

C) the ability to pay current debts when they come due.

D) also called profit margin.

A) the ability to earn a satisfactory return on the investments in the business.

B) the proportion of debt to stockholders' equity.

C) the ability to pay current debts when they come due.

D) also called profit margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

61

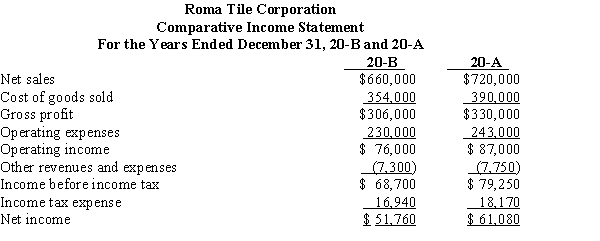

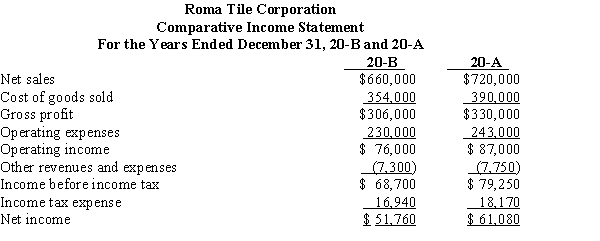

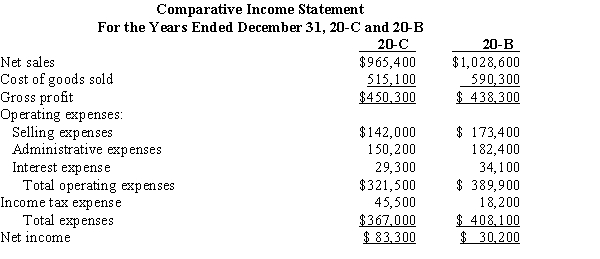

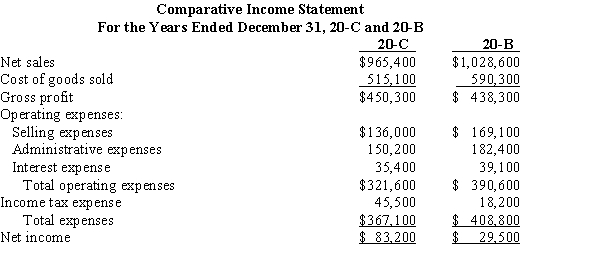

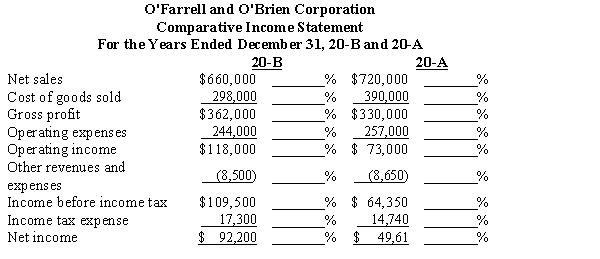

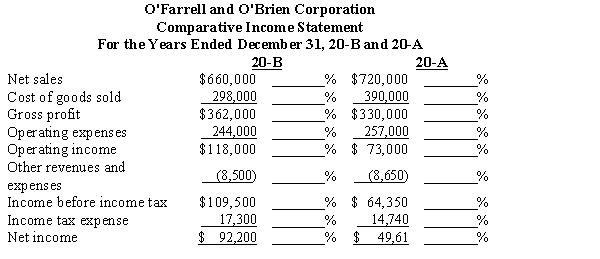

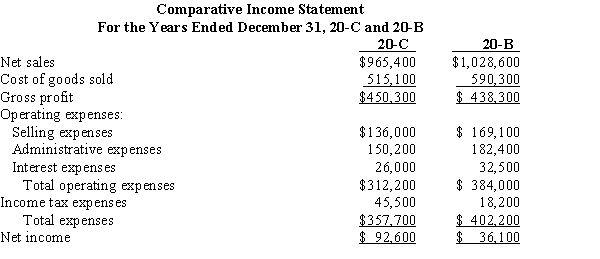

Consider the following:  Required:

Required:

Prepare a horizontal comparative income statement.

Required:

Required:Prepare a horizontal comparative income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

62

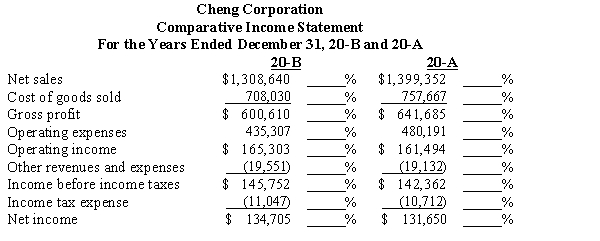

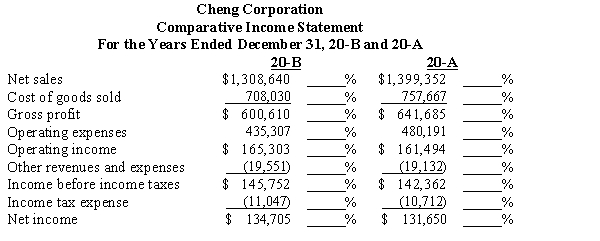

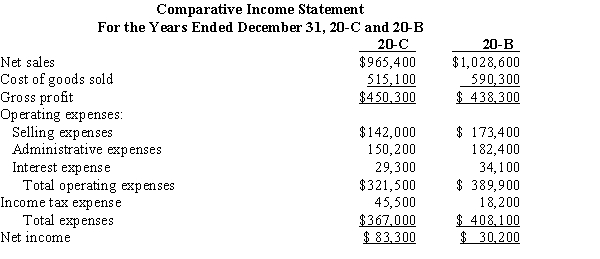

Perform a vertical analysis of the following comparative income statements for Cheng Corporation. Use net sales as the comparative base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

63

Match the terms with the definitions.a.accounts receivable turnover

b.book value per share

c.working capital

d.current ratio (working capital ratio)

e.earnings per share

f.gross profit ratio

g.vertical analysis

h.times interest earned ratio

i.leverage measures

j.return on common stockholders' equity

k.quick ratio (acid-test ratio)

l.profitability

m.operating expense ratio

The ratio of common stockholders' equity to the number of common shares outstanding at the end of the year.

b.book value per share

c.working capital

d.current ratio (working capital ratio)

e.earnings per share

f.gross profit ratio

g.vertical analysis

h.times interest earned ratio

i.leverage measures

j.return on common stockholders' equity

k.quick ratio (acid-test ratio)

l.profitability

m.operating expense ratio

The ratio of common stockholders' equity to the number of common shares outstanding at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

64

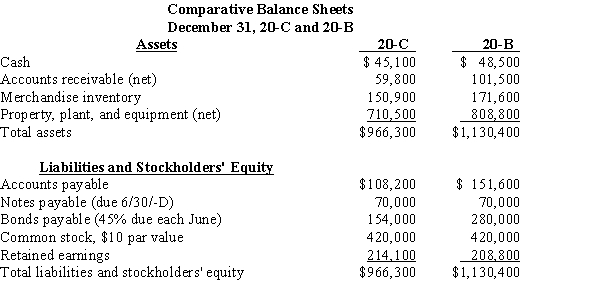

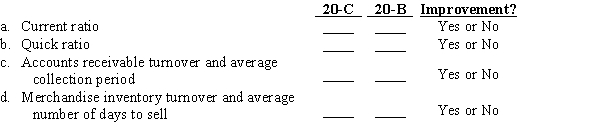

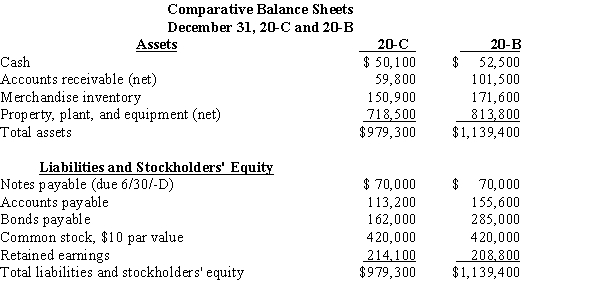

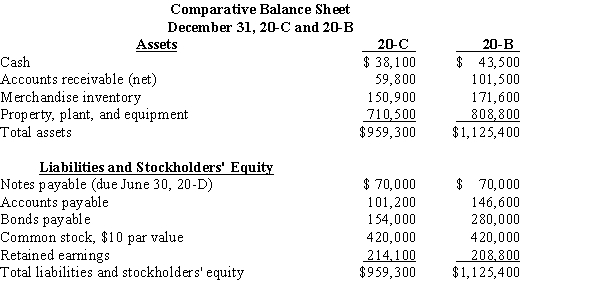

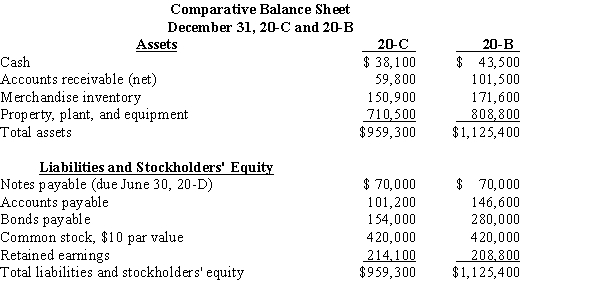

Use the following comparative income statements and balance sheets to complete the required ratio analysis.

Additional information:

Additional information:

All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $153,100; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding, 42,000. Required:

Required:

Prepare a liquidity analysis by calculating for 20-B and 20-C the (a) current ratio, (b) quick ratio, (c) accounts receivable turnover, and (d) merchandise inventory turnover. Indicate whether there has been an improvement or not from 20-B to 20-C. Round all answers to two decimal places.

Additional information:

Additional information:All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $153,100; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding, 42,000.

Required:

Required:Prepare a liquidity analysis by calculating for 20-B and 20-C the (a) current ratio, (b) quick ratio, (c) accounts receivable turnover, and (d) merchandise inventory turnover. Indicate whether there has been an improvement or not from 20-B to 20-C. Round all answers to two decimal places.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

65

Dividing the net income for the year by the average number of common shares outstanding during the year (if only common stock is outstanding) is the calculation for the

A) return on stockholders' equity.

B) return on assets.

C) earnings per share.

D) book value per share.

A) return on stockholders' equity.

B) return on assets.

C) earnings per share.

D) book value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

66

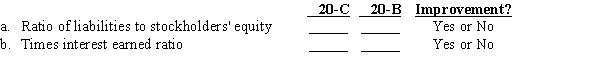

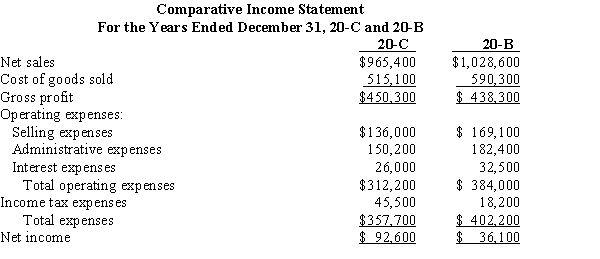

Use the following comparative income statements and balance sheets to complete the required ratio analysis:

Additional information:

Additional information:

All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $139,200; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding, 42,000. Required:

Required:

Analyze for 20-B and 20-C the extent to which this corporation is being financed by debt using the (a) ratio of liabilities to stockholders' equity, and analyze its ability to meet its debt obligation using the (b) times interest earned ratio. Indicate whether there has been an improvement or not from 20-B to 20-C. Round all answers to two decimal places.

Additional information:

Additional information:All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $139,200; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding, 42,000.

Required:

Required:Analyze for 20-B and 20-C the extent to which this corporation is being financed by debt using the (a) ratio of liabilities to stockholders' equity, and analyze its ability to meet its debt obligation using the (b) times interest earned ratio. Indicate whether there has been an improvement or not from 20-B to 20-C. Round all answers to two decimal places.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

67

Book value per share of common stock is calculated by dividing the

A) number of common shares outstanding at year end by the common stockholders' equity.

B) net income available to common stockholders by the average number of common shares outstanding.

C) common stockholders' equity by the number of common shares outstanding at year end.

D) total liabilities by the total stockholders' equity.

A) number of common shares outstanding at year end by the common stockholders' equity.

B) net income available to common stockholders by the average number of common shares outstanding.

C) common stockholders' equity by the number of common shares outstanding at year end.

D) total liabilities by the total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

68

Consider the following:

Required:

Required:

Prepare a vertical comparative income statement basing percentages on net sales for each year.

Required:

Required:Prepare a vertical comparative income statement basing percentages on net sales for each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

69

Match the terms with the definitions.a.accounts receivable turnover

b.book value per share

c.working capital

d.current ratio (working capital ratio)

e.earnings per share

f.gross profit ratio

g.vertical analysis

h.times interest earned ratio

i.leverage measures

j.return on common stockholders' equity

k.quick ratio (acid-test ratio)

l.profitability

m.operating expense ratio

The ratio of current assets to current liabilities.

b.book value per share

c.working capital

d.current ratio (working capital ratio)

e.earnings per share

f.gross profit ratio

g.vertical analysis

h.times interest earned ratio

i.leverage measures

j.return on common stockholders' equity

k.quick ratio (acid-test ratio)

l.profitability

m.operating expense ratio

The ratio of current assets to current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

70

Match the terms with the definitions.a.accounts receivable turnover

b.book value per share

c.working capital

d.current ratio (working capital ratio)

e.earnings per share

f.gross profit ratio

g.vertical analysis

h.times interest earned ratio

i.leverage measures

j.return on common stockholders' equity

k.quick ratio (acid-test ratio)

l.profitability

m.operating expense ratio

The ratio of gross profit to net sales.

b.book value per share

c.working capital

d.current ratio (working capital ratio)

e.earnings per share

f.gross profit ratio

g.vertical analysis

h.times interest earned ratio

i.leverage measures

j.return on common stockholders' equity

k.quick ratio (acid-test ratio)

l.profitability

m.operating expense ratio

The ratio of gross profit to net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

71

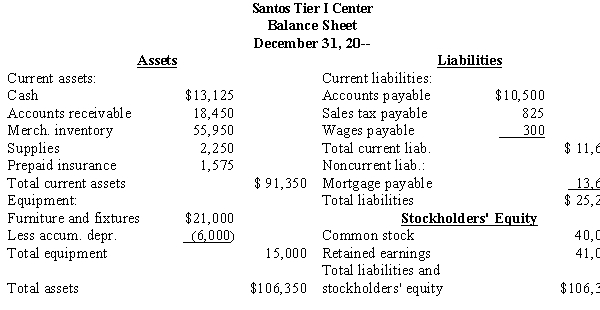

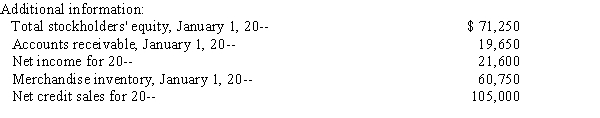

Consider the following:

Required:

Required:

You have been provided with the balance sheet for Santos Tier I Center. Calculate the following ratios and round answers to two decimal places.

Required:

Required:You have been provided with the balance sheet for Santos Tier I Center. Calculate the following ratios and round answers to two decimal places.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

72

A company has 6,000 shares of common stock outstanding and the total common stockholders' equity is $1,500,000. The book value per share of common stock is

A) $.004.

B) $2.50.

C) $4.00.

D) $250.00.

A) $.004.

B) $2.50.

C) $4.00.

D) $250.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

73

The net income for the year ended was $300,000. Common stockholders' equity at the beginning of the year was $1,400,000 and $1,600,000 at the end of the year. The return on common stockholders' equity would be

A) 18.75%.

B) 20.00%.

C) 21.43%.

D) 87.50%.

A) 18.75%.

B) 20.00%.

C) 21.43%.

D) 87.50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

74

A corporation has 2,000 shares of $50 par, 10% preferred stock, and 6,000 shares of common stock outstanding. The net income for the year is $250,000. The earnings per share of common stock would be

A) $10.83.

B) $31.25.

C) $40.00.

D) $41.67.

A) $10.83.

B) $31.25.

C) $40.00.

D) $41.67.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

75

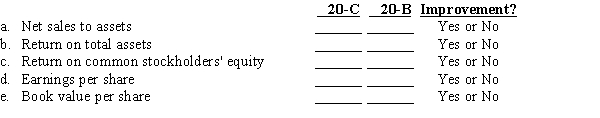

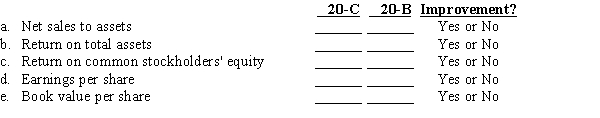

Use the comparative income statements and balance sheets below to complete the required ratio analysis.

Additional information:

Additional information:

All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $139,200; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding 42,000. Prepare a profitability analysis by calculating for 20-B and 20-C the (a) net sales to assets, (b) return on total assets, (c) return on common stockholders' equity, (d) earnings per share, and (e) book value per share. Indicate whether there has been an improvement or not from 20-B to 20-C. Round to two decimal places.

Prepare a profitability analysis by calculating for 20-B and 20-C the (a) net sales to assets, (b) return on total assets, (c) return on common stockholders' equity, (d) earnings per share, and (e) book value per share. Indicate whether there has been an improvement or not from 20-B to 20-C. Round to two decimal places.

Additional information:

Additional information:All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $139,200; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding 42,000.

Prepare a profitability analysis by calculating for 20-B and 20-C the (a) net sales to assets, (b) return on total assets, (c) return on common stockholders' equity, (d) earnings per share, and (e) book value per share. Indicate whether there has been an improvement or not from 20-B to 20-C. Round to two decimal places.

Prepare a profitability analysis by calculating for 20-B and 20-C the (a) net sales to assets, (b) return on total assets, (c) return on common stockholders' equity, (d) earnings per share, and (e) book value per share. Indicate whether there has been an improvement or not from 20-B to 20-C. Round to two decimal places.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

76

Net income divided by average common stockholders' equity is the calculation for the

A) ratio of net sales to assets.

B) return on total assets.

C) return on common stockholders' equity.

D) earnings per share.

A) ratio of net sales to assets.

B) return on total assets.

C) return on common stockholders' equity.

D) earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

77

Match the terms with the definitions.a.accounts receivable turnover

b.book value per share

c.working capital

d.current ratio (working capital ratio)

e.earnings per share

f.gross profit ratio

g.vertical analysis

h.times interest earned ratio

i.leverage measures

j.return on common stockholders' equity

k.quick ratio (acid-test ratio)

l.profitability

m.operating expense ratio

The excess of a company's current assets over current liabilities.

b.book value per share

c.working capital

d.current ratio (working capital ratio)

e.earnings per share

f.gross profit ratio

g.vertical analysis

h.times interest earned ratio

i.leverage measures

j.return on common stockholders' equity

k.quick ratio (acid-test ratio)

l.profitability

m.operating expense ratio

The excess of a company's current assets over current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

78

Dividing quick assets by current liabilities is the calculation for the

A) current ratio.

B) return on investment.

C) acid-test ratio.

D) ratio of liabilities to stockholders' equity.

A) current ratio.

B) return on investment.

C) acid-test ratio.

D) ratio of liabilities to stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

79

The net income of a company for the year just ended is $230,000. Income tax is $80,500 and interest expense is $20,000. The number of times interest was earned would be

A) 0.05.

B) 10.5.

C) 11.5.

D) 16.5.

A) 0.05.

B) 10.5.

C) 11.5.

D) 16.5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

80

The net income for a company was $315,000 last year and is $270,000 this year. The percent of increase or decrease was

A) 16.7%.

B) 14.3%.

C) 26.4%.

D) 86.0%.

A) 16.7%.

B) 14.3%.

C) 26.4%.

D) 86.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck