Deck 12: Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

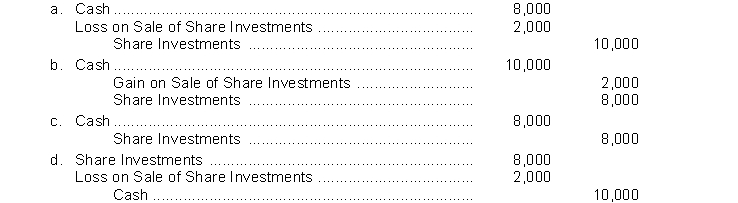

سؤال

سؤال

سؤال

سؤال

سؤال

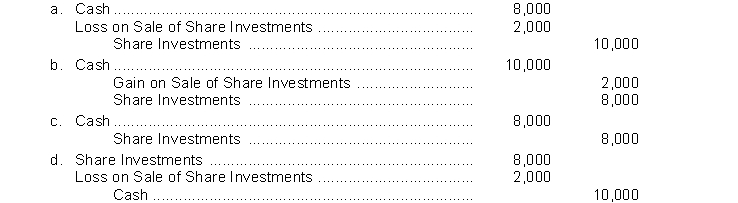

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/227

العب

ملء الشاشة (f)

Deck 12: Investments

1

Under the equity method, the investment in ordinary shares is initially recorded at cost, and the Share Investments account is adjusted annually.

True

2

The valuation of non-trading securities is similar to the procedures followed for trading securities, except that changes in fair value are not recognized in current income.

True

3

Under the equity method, the investment account is increased by the investor's share of the associate's dividends.

False

4

Under the equity method, the receipt of dividends from the investee company results in an increase in the Share Investments account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

5

If an investor owns 30% of the ordinary shares of a corporation, it is generally presumed that the investor cannot exert significant influence over the financial and operating activities of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

6

Consolidated financial statements are prepared in place of the financial statements for the parent and subsidiary companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Share Investments account is debited at acquisition under both the equity method and cost method of accounting for investments in ordinary shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company that owns more than 50% of the ordinary shares of another entity is known as the parent company and usually prepares consolidates financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

9

The cost of debt investments includes brokerage fees and accrued interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

10

A reason some companies purchase investments is because they generate a significant portion of their earnings from investment income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

11

When an investor has significant influence but not control over an investee, the investee is referred to as an associate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

12

Corporations purchase investments in debt or share securities generally for one of two reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

13

When debt investments, are sold, the gain or loss is the difference between the net proceeds from the sale and the fair value of the bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

14

Dividends received on share investments of less than 20% should be credited to the Share Investments account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

15

Consolidated financial statements should be prepared only when a subsidiary company has a controlling interest in the parent company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

16

The accounting for short-term debt investments and for long-term debt investments is similar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

17

Consolidated financial statements are appropriate when an investor controls an investee by ownership of more than 50% of the investee's ordinary shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

18

Debt investments are investments in government and corporation bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under the equity method, the investor records its share of the associate's net income in the year in which it is earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

20

If an investor owns between 20% and 50% of an investee's ordinary shares, it is presumed that the investor has significant influence on the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

21

A decline in the fair value of a trading security is recorded by debiting an unrealized loss account and crediting the Fair Value Adjustment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

22

Unrealized gains and losses on non-trading securities are reported as a separate component of equity on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

23

Held-for-collection securities are debt securities that the investor has the intent and ability to hold to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

24

An investment is readily marketable if it is management's intent to sell the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

25

Because they are highly liquid, short-term investments are included as part of cash in the current assets section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

26

Companies generally report long-term assets in a separate section immediately above current assets on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

27

An unrealized gain or loss on trading securities is reported as a separate component of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

28

When a parent company acquires a wholly owned subsidiary for an amount in excess of the book value of the net assets acquired, the excess is always allocated to goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

29

Consolidated financial statements present a condensed version of the financial statements so investors will not experience information overload.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

30

Companies close the Fair Value Adjustment-Trading account at the end of each reporting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

31

One of the reasons a corporation may purchase investments is that it has excess cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

32

The unrealized gain or loss on non-trading securities is reported in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

33

Non-trading securities should always be reported at fair value and classified as current assets on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

34

"Intent to convert" does not include an investment used as a resource that will be used whenever the need for cash arises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

35

A consolidated income statement will reflect only revenue and expense transactions between the consolidated entity and parties outside the affiliated group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

36

If the fair value of a non-trading security exceeds its cost, the security should be written up to fair value and a realized gain should be recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

37

When recording bond interest, Interest Receivable is reported as a fixed asset in the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

38

Non-trading securities are securities bought and held primarily for sale in the near term to generate income on short-term price differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under the cost method, the investment is recorded at cost and revenue is recognized only when cash dividends are received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

40

To be classified as a short-term investment, the investment must be readily marketable and intended to be converted into cash within the next year or operating cycle, whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

41

In accounting for debt investments, entries are made for each of the following except the

A) acquisition.

B) interest revenue.

C) amortization of any discount or premium.

D) sale.

A) acquisition.

B) interest revenue.

C) amortization of any discount or premium.

D) sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

42

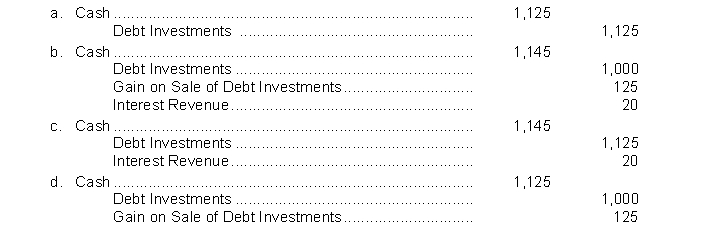

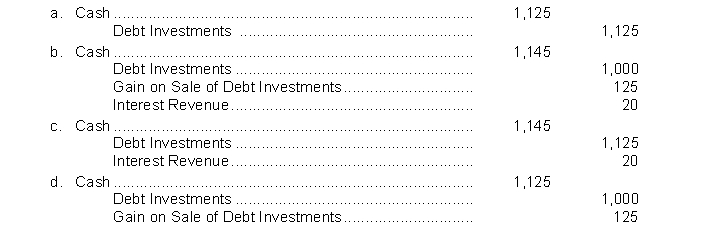

On January 1, Barone Company purchased as a short-term investment a $1,000, 8% bond for $1,000. The bond pays interest on January 1 and July 1. The bond is sold on October 1 for $1,125 plus accrued interest. Interest has not been accrued since the last interest payment date. What is the entry to record the cash proceeds at the time the bond is sold?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

43

Barr Company acquires 50, 10%, 5 year, €1,000 Community bonds on January 1, 2014 for €50,000. Assume Community pays interest on January 1 and July 1, and the July 1 entry was done correctly. The journal entry at December 31, 2014 would include a credit to

A) Interest Receivable for €2,500.

B) Interest Revenue for €5,000.

C) Interest Expense for €2,500.

D) Interest Revenue for €2,500.

A) Interest Receivable for €2,500.

B) Interest Revenue for €5,000.

C) Interest Expense for €2,500.

D) Interest Revenue for €2,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

44

The cost of debt investments includes each of the following except

A) brokerage fees.

B) commissions.

C) accrued interest.

D) the price paid.

A) brokerage fees.

B) commissions.

C) accrued interest.

D) the price paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

45

Winrow Co. purchased 30, 6% Johnston Company bonds for $30,000 cash. Interest is payable semiannually on July 1 and January 1. The entry to record the December 31 interest accrual would include a

A) debit to Interest Receivable for $900.

B) debit to Interest Revenue for $900.

C) credit to Interest Revenue for $1,800.

D) debit to Debt Investments for $900.

A) debit to Interest Receivable for $900.

B) debit to Interest Revenue for $900.

C) credit to Interest Revenue for $1,800.

D) debit to Debt Investments for $900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

46

Winrow Co. purchased 30, 6% Johnston Company bonds for $30,000 cash. Interest is payable semiannually on July 1 and January 1. The entry to record the July 1 semiannual interest payment would include a

A) debit to Interest Receivable for $900.

B) credit to Interest Revenue for $900.

C) credit to Interest Revenue for $1,800.

D) credit to Debt Investments for $900.

A) debit to Interest Receivable for $900.

B) credit to Interest Revenue for $900.

C) credit to Interest Revenue for $1,800.

D) credit to Debt Investments for $900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

47

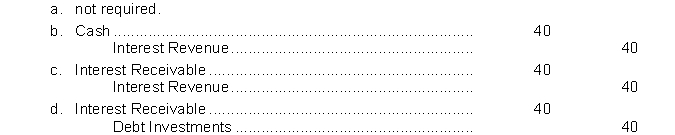

On January 1, 2014, Milton Company purchased at face value, a $1,000, 8% bond that pays interest on January 1 and July 1. Milton Company has a calendar year end. The entry for the receipt of interest on January 1, 2015 is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

48

Barr Company acquires 50, 10%, 5 year, €1,000 Community bonds on January 1, 2014 for €50,000. If Barr sells all of its Community bonds for €49,000, what gain or loss is recognized?

A) Gain of €6,000

B) Loss of €1,000

C) Gain of €1,000

D) Loss of €6,000

A) Gain of €6,000

B) Loss of €1,000

C) Gain of €1,000

D) Loss of €6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

49

If a short-term debt investment is sold, the Investment account is

A) credited for the market value of the bonds at the sale date.

B) credited for the cost of the bonds at the sale date.

C) credited for the fair value of the bonds at the sale date.

D) debited for the cost of the bonds at the sale date.

A) credited for the market value of the bonds at the sale date.

B) credited for the cost of the bonds at the sale date.

C) credited for the fair value of the bonds at the sale date.

D) debited for the cost of the bonds at the sale date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

50

A typical investment to house excess cash until needed is

A) shares of companies in a related industry.

B) debt securities.

C) low-risk, highly liquid securities.

D) share securities.

A) shares of companies in a related industry.

B) debt securities.

C) low-risk, highly liquid securities.

D) share securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

51

Corporations invest in other companies for all of the following reasons except to

A) house excess cash until needed.

B) generate earnings.

C) meet strategic goals.

D) increase trading of the other companies' shares.

A) house excess cash until needed.

B) generate earnings.

C) meet strategic goals.

D) increase trading of the other companies' shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

52

Corporations invest excess cash for short periods of time in each of the following except

A) equity securities.

B) highly liquid securities.

C) low-risk securities.

D) government securities.

A) equity securities.

B) highly liquid securities.

C) low-risk securities.

D) government securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is not a true statement regarding short-term debt investments?

A) The securities usually pay interest.

B) Investments are frequently government or corporate bonds.

C) This type of investment must be currently traded in the securities market.

D) Debt investments are recorded at the price paid less brokerage fees.

A) The securities usually pay interest.

B) Investments are frequently government or corporate bonds.

C) This type of investment must be currently traded in the securities market.

D) Debt investments are recorded at the price paid less brokerage fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

54

A company may purchase a noncontrolling interest in another firm in a related industry

A) to house excess cash until needed.

B) to generate earnings.

C) for strategic reasons.

D) for speculative reasons.

A) to house excess cash until needed.

B) to generate earnings.

C) for strategic reasons.

D) for speculative reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

55

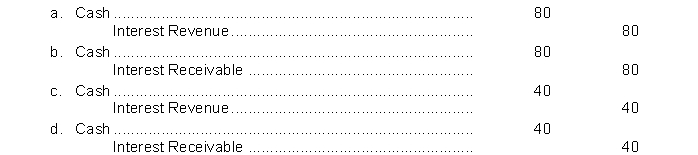

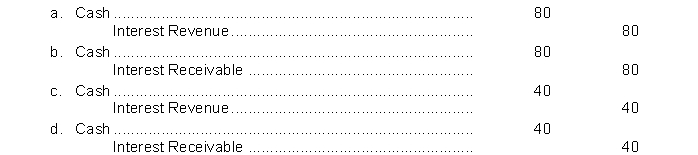

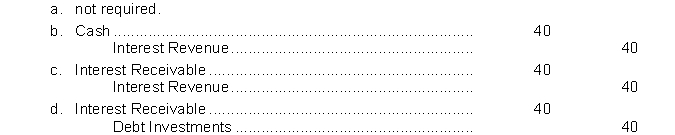

On January 1, 2014, Milton Company purchased at face value, a $1,000,8% bond that pays interest on January 1 and July 1. Milton Company has a calendar year end. The adjusting entry on December 31, 2014, is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

56

Barr Company acquires 50, 10%, 5 year, €1,000 Community bonds on January 1, 2014 for €50,000. The journal entry to record this investment includes a debit to

A) Debt Investments for €55,000.

B) Debt Investments for €50,000.

C) Cash for €50,000.

D) Share Investments for €50,000.

A) Debt Investments for €55,000.

B) Debt Investments for €50,000.

C) Cash for €50,000.

D) Share Investments for €50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

57

Tolan Co. purchased 60, 6% Irick Company bonds for $60,000 cash. Interest is payable semiannually on July 1 and January 1. If 30 of the securities are sold on May 1 for $31,000 plus accrued interest, the entry would include a credit to Gain on Sale of Debt Investments for

A) $2,000.

B) $1,200.

C) $2,200.

D) $1,000.

A) $2,000.

B) $1,200.

C) $2,200.

D) $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not a true statement about the accounting for debt investments?

A) At acquisition, investments are recorded at cost.

B) The cost includes any brokerage fees.

C) Debt investments include investments in government and corporation bonds.

D) The cost includes any accrued interest.

A) At acquisition, investments are recorded at cost.

B) The cost includes any brokerage fees.

C) Debt investments include investments in government and corporation bonds.

D) The cost includes any accrued interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

59

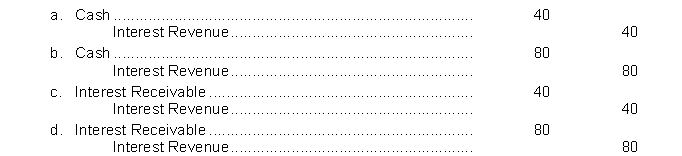

On January 1, 2014, Milton Company purchased at face value, a $1,000, 8% bond that pays interest on January 1 and July 1. Milton Company has a calendar year end. The entry for the receipt of interest on July 1, 2014, is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

60

Pension funds and mutual funds regularly invest in debt and share securities to

A) generate earnings.

B) house excess cash until needed.

C) meet strategic goals.

D) control the company in which they invest.

A) generate earnings.

B) house excess cash until needed.

C) meet strategic goals.

D) control the company in which they invest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

61

On January 1, 2014, Bregeut Company, a calendar year corporation, purchased 900 of the $1,000 face value, 9% bonds of Clariant Incorporated, for CHF900,000. The bonds, which mature on January 1, 2019, pay interest semiannually on July 1 and January 1. The December 31, 2014 adjusting entry for the bonds on Bregeut's books will include

A) a credit to Interest Expense for CHF3,300.

B) a debit to Cash for CHF81,000.

C) a credit to Interest Receivable for CHF40,500.

D) a credit to Interest Revenue for CHF40,500.

A) a credit to Interest Expense for CHF3,300.

B) a debit to Cash for CHF81,000.

C) a credit to Interest Receivable for CHF40,500.

D) a credit to Interest Revenue for CHF40,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

62

On January 1, 2014, Bregeut Company, a calendar year corporation, purchased 900 of the $1,000 face value, 9% bonds of Clariant Incorporated, for CHF900,000. The bonds, which mature on January 1, 2019, pay interest semiannually on July 1 and January 1. The entry on Bregeut's books to record the acquisition will include

A) a credit to Bonds Payable for CHF900,000.

B) a debit to Interest Receivable for CHF81,000.

C) a credit to Interest Revenue for CHF40,500.

D) a debit to Debt Investments for CHF900,000.

A) a credit to Bonds Payable for CHF900,000.

B) a debit to Interest Receivable for CHF81,000.

C) a credit to Interest Revenue for CHF40,500.

D) a debit to Debt Investments for CHF900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

63

Huang Company owns 15,000 of the 50,000 outstanding ordinary shares of Xi Inc. The balance in the investment account at January 1, 2014 was ¥500,000,000. During 2014, Xi earned ¥800,000,000 and paid cash dividends of ¥640,000,000. The balance in the Investment in Xi account reported on Huang's December 31, 2014 statement of financial position should be

A) ¥740,000,000.

B) ¥660,000,000.

C) ¥548,000,000.

D) ¥500,000,000.

A) ¥740,000,000.

B) ¥660,000,000.

C) ¥548,000,000.

D) ¥500,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

64

At December 31, 2013, EI Greco Company has an investment in 2,000 of the €1,000 8% bonds of Dublin Company with a carrying value of €2,000,000. The bonds, which mature on January 1, 2018, pay interest semiannually on July 1 and January 1. After collecting the interest on January 1, 2014, EI Greco sells the bonds for €2,220,000. EI Greco will recognize

A) an unrealized loss of €160,000.

B) a gain on the sale of debt investments for €220,000.

C) interest revenue of €160,000.

D) a loss on the sale of debt investments of €220,000.

A) an unrealized loss of €160,000.

B) a gain on the sale of debt investments for €220,000.

C) interest revenue of €160,000.

D) a loss on the sale of debt investments of €220,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

65

Huang Company owns 15,000 of the 50,000 outstanding ordinary shares of Xi Inc. The balance in the investment account at January 1, 2014 was ¥500,000,000. During 2014, Xi earned ¥800,000,000 and paid cash dividends of ¥640,000,000. Huang should report investment revenue for 2014 of

A) ¥240,000,000.

B) ¥192,000,000.

C) ¥48,000,000.

D) ¥0.

A) ¥240,000,000.

B) ¥192,000,000.

C) ¥48,000,000.

D) ¥0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

66

On January 1, 2014, Garner Corporation purchased 30% of the ordinary shares outstanding of Landon Corporation for $200,000. During 2014, Landon Corporation reported net income of $80,000 and paid cash dividends of $40,000. The balance of the Share Investments-Landon account on the books of Garner Corporation at December 31, 2014 is

A) $200,000.

B) $240,000.

C) $280,000.

D) $212,000.

A) $200,000.

B) $240,000.

C) $280,000.

D) $212,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

67

Stine Co. purchased 80, 6% Kolaw Company bonds for $80,000 cash. Interest is payable semiannually on July 1 and January 1. If 40 of the securities are sold on March 1 for $42,000 plus accured interest the entry would include a credit to Gain on Sale of Debt Investments for

A) $1,200.

B) $800.

C) $2,800.

D) $2,000.

A) $1,200.

B) $800.

C) $2,800.

D) $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

68

Nance Company owns 40% interest in the shares of Finley Corporation. During the year, Finley pays $25,000 in dividends, and reports $100,000 in net income. Nance Company's investment in Finley will increase by

A) $25,000.

B) $40,000.

C) $32,000.

D) $30,000.

A) $25,000.

B) $40,000.

C) $32,000.

D) $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

69

Desmond Corporation owns 3,500 of the 10,000 outstanding ordinary shares of Wetmore Corporation. During 2014, Wetmore earned £2,400,000 and paid cash dividends of £800,000. How much investment revenue should Desmond report in 2014?

A) £800,000.

B) £840,000.

C) £560,000.

D) £2,400,000.

A) £800,000.

B) £840,000.

C) £560,000.

D) £2,400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

70

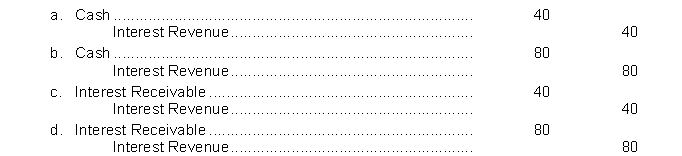

On January 1, Winston Company purchased as an investment a $1,000, 5% bond for $1,000. The bond pays interest on January 1 and July 1. What is the entry to record the interest accrual on December 31?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

71

Osaka Co. acquired a 10% interest in Chen Corp. on December 31, 2013 for HK$3,780,000. During 2014, Chen had net income of HK$2,400,000 and paid cash dividends of HK$600,000. Osaka's 2014 income statement will report

A) dividend income of HK$60,000.

B) investment income of HK$180,000.

C) investment income of HK$240,000.

D) cannot be determined from the information given.

A) dividend income of HK$60,000.

B) investment income of HK$180,000.

C) investment income of HK$240,000.

D) cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

72

Nagen Company had these transactions pertaining to share investments: Feb. 1 Purchased 2,000 shares of Horton Company (10%) for ₤34,000 cash.

June 1 Received cash dividends of ₤2 per share on Horton shares.

Oct) 1 Sold 800 Horton shares for ₤.15,600.

The entry to record the sale of the shares would include a

A) debit to Cash for ₤13,600.

B) credit to Gain on Sale of Share Investments for ₤3,600.

C) debit to Share Investments for ₤13,600.

D) credit to Gain on Sale of Share Investments for ₤2,000.

June 1 Received cash dividends of ₤2 per share on Horton shares.

Oct) 1 Sold 800 Horton shares for ₤.15,600.

The entry to record the sale of the shares would include a

A) debit to Cash for ₤13,600.

B) credit to Gain on Sale of Share Investments for ₤3,600.

C) debit to Share Investments for ₤13,600.

D) credit to Gain on Sale of Share Investments for ₤2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

73

Elston Corporation sells 100 ordinary shares being held as an investment. The shares were acquired six months ago at a cost of $30 a share. Elston sold the shares for $40 a share. The entry to record the sale is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

74

On January 1, Burkett Company purchased as an investment a $1,000, 6% bond for $1,000. The bond pays interest on January 1 and July 1. What is the entry to record the interest accrual on December 31?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

75

Mouns Company owns 40% interest in the shares of Darian Corporation. During the year, Darian pays $20,000 in dividends to Mouns, and reports $100,000 in net income. Mouns Company's investment in Darian will increase Mouns' net income by

A) $20,000.

B) $40,000.

C) $32,000.

D) $8,000.

A) $20,000.

B) $40,000.

C) $32,000.

D) $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

76

Nagen Company had these transactions pertaining to share investments: Feb. 1 Purchased 2,000 shares of Horton Company (10%) for ₤34,000 cash.

June 1 Received cash dividends of ₤2 per share on Horton shares.

Oct) 1 Sold 800 Horton shares for ₤15,600.

The entry to record the receipt of the dividends on June 1 would include a

A) debit to Share Investments for ₤4,000.

B) credit to Dividend Revenue for ₤4,000.

C) debit to Dividend Revenue for ₤4,000.

D) credit to Share Investments for ₤4,000.

June 1 Received cash dividends of ₤2 per share on Horton shares.

Oct) 1 Sold 800 Horton shares for ₤15,600.

The entry to record the receipt of the dividends on June 1 would include a

A) debit to Share Investments for ₤4,000.

B) credit to Dividend Revenue for ₤4,000.

C) debit to Dividend Revenue for ₤4,000.

D) credit to Share Investments for ₤4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

77

On January 1, 2014, Bregeut Company, a calendar year corporation, purchased 900 of the $1,000 face value, 9% bonds of Clariant Incorporated, for CHF900,000. The bonds, which mature on January 1, 2019, pay interest semiannually on July 1 and January 1. On July, 2014, Bregeut will make an entry to

A) amortize bond premium .

B) accrue interest expense.

C) recognize interest revenue.

D) adjust the investment to fair value.

A) amortize bond premium .

B) accrue interest expense.

C) recognize interest revenue.

D) adjust the investment to fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

78

Greene Corporation sells 200 ordinary shares being held as an investment. The shares were acquired six months ago at a cost of $50 a share. Greene sold the shares for $40 a share. The entry to record the sale is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

79

Desmond Corporation owns 3,500 of the 10,000 outstanding ordinary shares of Wetmore Corporation. During 2014, Wetmore earned £2,400,000 and paid cash dividends of £800,000. What balance should Desmond report on its December 31, 2014 statement of financial position for the investment account if the beginning of the year balance in the account was £3,200,000?

A) £4,040,000.

B) £3,200,000.

C) £3,760,000.

D) £4,800,000.

A) £4,040,000.

B) £3,200,000.

C) £3,760,000.

D) £4,800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck

80

Nagen Company had these transactions pertaining to share investments: Feb. 1 Purchased 2,000 shares of Horton Company (10%) for ₤34,000 cash.

June 1 Received cash dividends of ₤2 per share on Horton shares.

Oct) 1 Sold 800 Horton shares for ₤15,600.

The entry to record the purchase of the Horton shares would include a

A) credit to Share Investments for ₤34,000.

B) credit to Cash for ₤30,000.

C) debit to Share Investments for ₤34,000.

D) debit to Investment Revenue for ₤4,000

June 1 Received cash dividends of ₤2 per share on Horton shares.

Oct) 1 Sold 800 Horton shares for ₤15,600.

The entry to record the purchase of the Horton shares would include a

A) credit to Share Investments for ₤34,000.

B) credit to Cash for ₤30,000.

C) debit to Share Investments for ₤34,000.

D) debit to Investment Revenue for ₤4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 227 في هذه المجموعة.

فتح الحزمة

k this deck