Deck 19: Accounting for Income Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

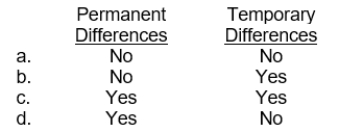

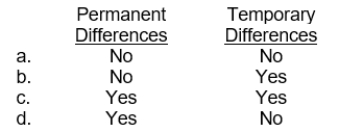

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

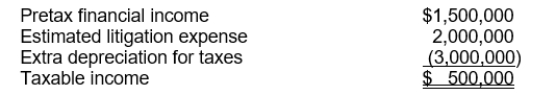

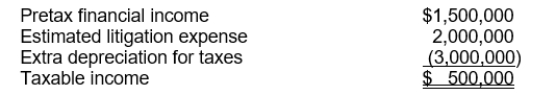

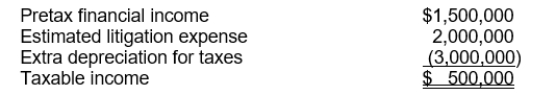

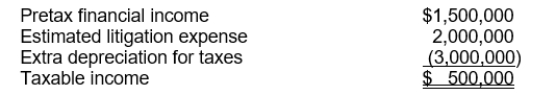

سؤال

سؤال

سؤال

سؤال

سؤال

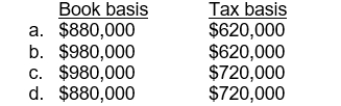

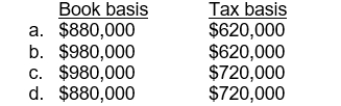

سؤال

سؤال

سؤال

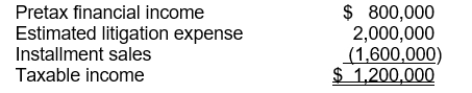

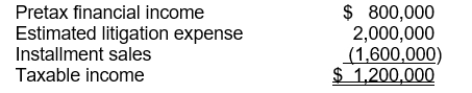

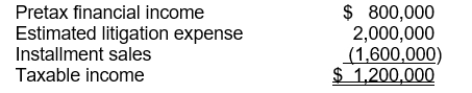

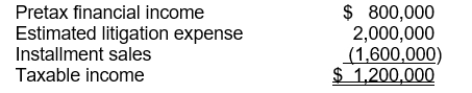

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

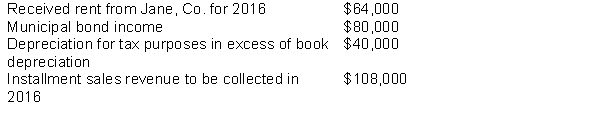

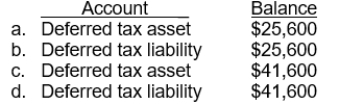

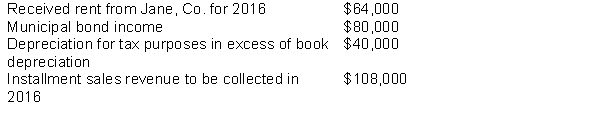

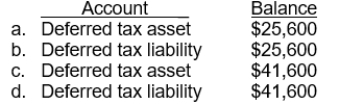

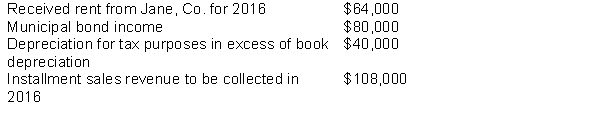

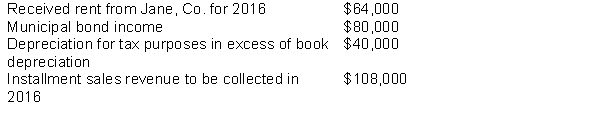

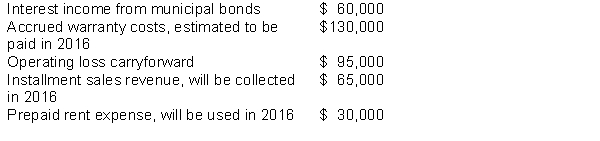

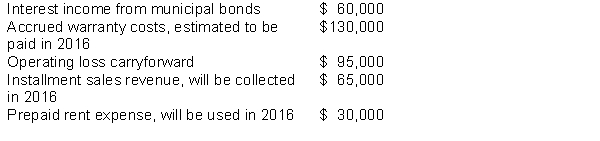

سؤال

سؤال

سؤال

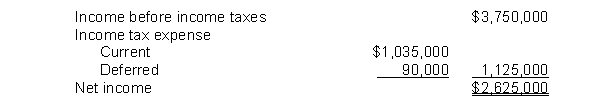

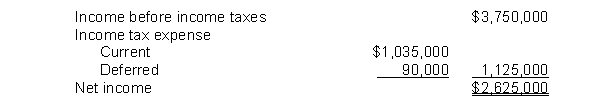

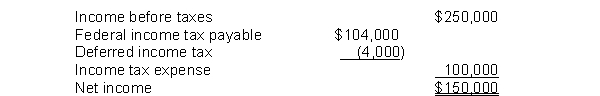

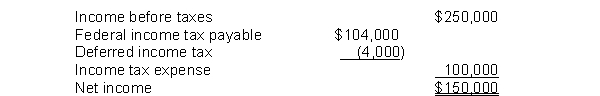

سؤال

سؤال

سؤال

سؤال

سؤال

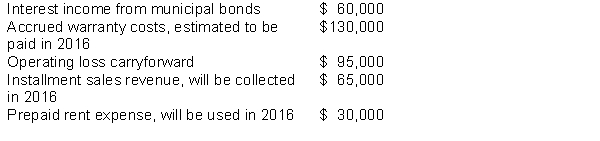

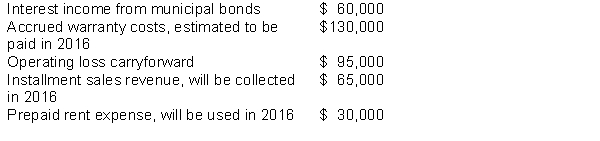

سؤال

سؤال

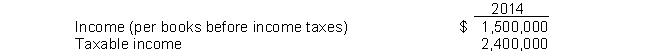

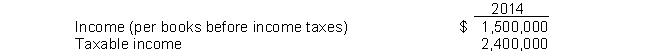

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

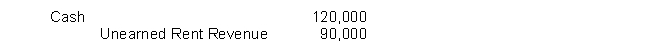

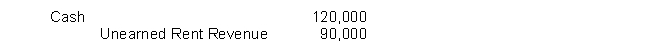

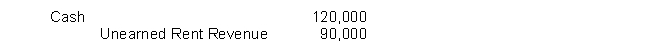

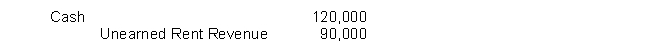

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/127

العب

ملء الشاشة (f)

Deck 19: Accounting for Income Taxes

1

Deferred tax expense is the increase in the deferred tax liability balance from the beginning to the end of the accounting period.

True

2

Companies should classify the balances in the deferred tax accounts on the balance sheet as noncurrent assets and noncurrent liabilities.

False

3

Taxable temporary differences will result in taxable amounts in future years when the related assets are recovered.

True

4

Companies must consider presently enacted changes in the tax rate that become effective in future years when determining the tax rate to apply to existing temporary differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

5

The tax effect of a loss carryforward represents future tax savings and results in the recognition of a deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

6

A deferred tax asset represents the increase in taxes refundable in future years as a result of deductible temporary differences existing at the end of the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

7

A deferred tax liability represents the increase in taxes payable in future years as a result of taxable temporary differences existing at the end of the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

8

A possible source of taxable income that may be available to realize a tax benefit for loss carryforwards is future reversals of existing taxable temporary differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

9

Pretax financial income is the amount used to compute income taxes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

10

Taxable income is a tax accounting term and is also referred to as income before taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

11

A company should add a decrease in a deferred tax liability to income taxes payable in computing income tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

12

Deductible amounts cause taxable income to be greater than pretax financial income in the future as a result of existing temporary differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

13

Permanent differences do not give rise to future taxable or deductible amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

14

Examples of taxable temporary differences are subscriptions received in advance and advance rental receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

15

When a change in the tax rate is enacted, the effect is reported as an adjustment to income tax payable in the period of the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

16

An individual deferred tax asset or liability is classified as current or noncurrent based on the classification of the related asset/liability for financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

17

The FASB believes that the deferred tax method is the most consistent method for accounting for income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

18

A company reduces a deferred tax asset by a valuation allowance if it is probable that it will not realize some portion of the deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

19

Companies should consider both positive and negative evidence to determine whether it needs to record a valuation allowance to reduce a deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the loss carryback approach, companies must apply a current year loss to the most recent year first and then to an earlier year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

21

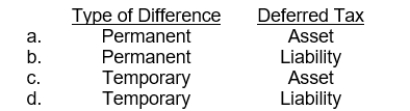

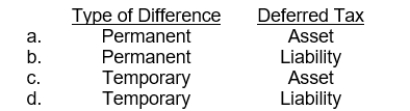

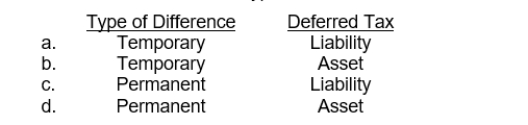

A company uses the equity method to account for an investment for financial reporting purposes. This would result in what type of difference and in what type of deferred income tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

22

Taxable income of a corporation

A) differs from accounting income due to differences in intraperiod allocation between the two methods of income determination.

B) differs from accounting income due to differences in interperiod allocation and permanent differences between the two methods of income determination.

C) is based on generally accepted accounting principles.

D) is reported on the corporation's income statement.

A) differs from accounting income due to differences in intraperiod allocation between the two methods of income determination.

B) differs from accounting income due to differences in interperiod allocation and permanent differences between the two methods of income determination.

C) is based on generally accepted accounting principles.

D) is reported on the corporation's income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

23

A major distinction between temporary and permanent differences is

A) permanent differences are not representative of acceptable accounting practice.

B) temporary differences occur frequently, whereas permanent differences occur only once.

C) once an item is determined to be a temporary difference, it maintains that status; however, a permanent difference can change in status with the passage of time.

D) temporary differences reverse themselves in subsequent accounting periods, whereas permanent differences do not reverse.

A) permanent differences are not representative of acceptable accounting practice.

B) temporary differences occur frequently, whereas permanent differences occur only once.

C) once an item is determined to be a temporary difference, it maintains that status; however, a permanent difference can change in status with the passage of time.

D) temporary differences reverse themselves in subsequent accounting periods, whereas permanent differences do not reverse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

24

26. At the December 31, 2014 balance sheet date, Unruh Corporation reports an accrued receivable for financial reporting purposes but not for tax purposes. When this asset is recovered in 2015, a future taxable amount will occur and

A) pretax financial income will exceed taxable income in 2015.

B) Unruh will record a decrease in a deferred tax liability in 2015.

C) total income tax expense for 2015 will exceed current tax expense for 2015.

D) Unruh will record an increase in a deferred tax asset in 2015.

A) pretax financial income will exceed taxable income in 2015.

B) Unruh will record a decrease in a deferred tax liability in 2015.

C) total income tax expense for 2015 will exceed current tax expense for 2015.

D) Unruh will record an increase in a deferred tax asset in 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

25

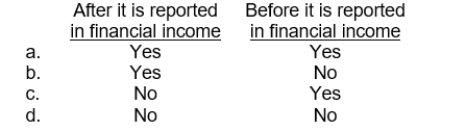

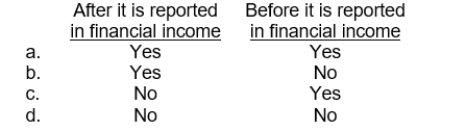

A temporary difference arises when a revenue item is reported for tax purposes in a period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

26

When a change in the tax rate is enacted into law, its effect on existing deferred income tax accounts should be

A) handled retroactively in accordance with the guidance related to changes in accounting principles.

B) considered, but it should only be recorded in the accounts if it reduces a deferred tax liability or increases a deferred tax asset.

C) reported as an adjustment to income tax expense in the period of change.

D) applied to all temporary or permanent differences that arise prior to the date of the enactment of the tax rate change, but not subsequent to the date of the change.

A) handled retroactively in accordance with the guidance related to changes in accounting principles.

B) considered, but it should only be recorded in the accounts if it reduces a deferred tax liability or increases a deferred tax asset.

C) reported as an adjustment to income tax expense in the period of change.

D) applied to all temporary or permanent differences that arise prior to the date of the enactment of the tax rate change, but not subsequent to the date of the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

27

Stuart Corporation's taxable income differed from its accounting income computed for this past year. An item that would create a permanent difference in accounting and taxable incomes for Stuart would be

A) a balance in the Unearned Rent account at year end.

B) using accelerated depreciation for tax purposes and straight-line depreciation for book purposes.

C) a fine resulting from violations of OSHA regulations.

D) making installment sales during the year.

A) a balance in the Unearned Rent account at year end.

B) using accelerated depreciation for tax purposes and straight-line depreciation for book purposes.

C) a fine resulting from violations of OSHA regulations.

D) making installment sales during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following are temporary differences that are normally classified as expenses or losses that are deductible after they are recognized in financial income?

A) Prepaid expenses that are deducted on the tax return in the period paid.

B) Product warranty liabilities.

C) Depreciable property.

D) Fines and expenses resulting from a violation of law.

A) Prepaid expenses that are deducted on the tax return in the period paid.

B) Product warranty liabilities.

C) Depreciable property.

D) Fines and expenses resulting from a violation of law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is a temporary difference classified as a revenue or gain that is taxable after it is recognized in financial income?

A) Subscriptions received in advance.

B) Prepaid royalty received in advance.

C) An installment sale accounted for on the accrual basis for financial reporting purposes and on the installment (cash) basis for tax purposes.

D) Interest received on a municipal obligation.

A) Subscriptions received in advance.

B) Prepaid royalty received in advance.

C) An installment sale accounted for on the accrual basis for financial reporting purposes and on the installment (cash) basis for tax purposes.

D) Interest received on a municipal obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following differences would result in future taxable amounts?

A) Expenses or losses that are tax deductible after they are recognized in financial income.

B) Revenues or gains that are taxable before they are recognized in financial income.

C) Revenues or gains that are recognized in financial income but are never included in taxable income.

D) Expenses or losses that are tax deductible before they are recognized in financial income.

A) Expenses or losses that are tax deductible after they are recognized in financial income.

B) Revenues or gains that are taxable before they are recognized in financial income.

C) Revenues or gains that are recognized in financial income but are never included in taxable income.

D) Expenses or losses that are tax deductible before they are recognized in financial income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

31

Tax rates other than the current tax rate may be used to calculate the deferred income tax amount on the balance sheet if

A) it is probable that a future tax rate change will occur.

B) it appears likely that a future tax rate will be greater than the current tax rate.

C) the future tax rates have been enacted into law.

D) it appears likely that a future tax rate will be less than the current tax rate.

A) it is probable that a future tax rate change will occur.

B) it appears likely that a future tax rate will be greater than the current tax rate.

C) the future tax rates have been enacted into law.

D) it appears likely that a future tax rate will be less than the current tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

32

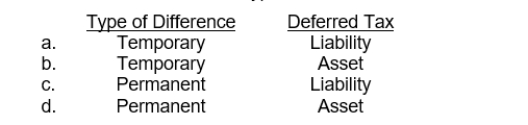

A company records an unrealized loss on short-term securities. This would result in what type of difference and in what type of deferred income tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following will not result in a temporary difference?

A) Product warranty liabilities

B) Advance rental receipts

C) Installment sales

D) All of these will result in a temporary difference.

A) Product warranty liabilities

B) Advance rental receipts

C) Installment sales

D) All of these will result in a temporary difference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is not considered a permanent difference?

A) Interest received on municipal bonds.

B) Fines resulting from violating the law.

C) Premiums paid for life insurance on a company's CEO when the company is the beneficiary.

D) Stock-based compensation expense.

A) Interest received on municipal bonds.

B) Fines resulting from violating the law.

C) Premiums paid for life insurance on a company's CEO when the company is the beneficiary.

D) Stock-based compensation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following temporary differences results in a deferred tax asset in the year the temporary difference originates?

I)Accrual for product warranty liability.

II)Subscriptions received in advance

III)Prepaid insurance expense.

A) I and II only.

B) II only.

C) III only.

D) I and III only.

I)Accrual for product warranty liability.

II)Subscriptions received in advance

III)Prepaid insurance expense.

A) I and II only.

B) II only.

C) III only.

D) I and III only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

36

An example of a permanent difference is

A) proceeds from life insurance on officers.

B) interest expense on money borrowed to invest in municipal bonds.

C) insurance expense for a life insurance policy on officers.

D) All of these answers are correct.

A) proceeds from life insurance on officers.

B) interest expense on money borrowed to invest in municipal bonds.

C) insurance expense for a life insurance policy on officers.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

37

The deferred tax expense is the

A) increase in balance of deferred tax asset minus the increase in balance of deferred tax liability.

B) increase in balance of deferred tax liability minus the increase in balance of deferred tax asset.

C) increase in balance of deferred tax asset plus the increase in balance of deferred tax liability.

D) decrease in balance of deferred tax asset minus the increase in balance of deferred tax liability.

A) increase in balance of deferred tax asset minus the increase in balance of deferred tax liability.

B) increase in balance of deferred tax liability minus the increase in balance of deferred tax asset.

C) increase in balance of deferred tax asset plus the increase in balance of deferred tax liability.

D) decrease in balance of deferred tax asset minus the increase in balance of deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

38

Machinery was acquired at the beginning of the year. Depreciation recorded during the life of the machinery could result in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

39

22 Taxable income of a corporation differs from pretax financial income because of

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

40

Assuming a 40% statutory tax rate applies to all years involved, which of the following situations will give rise to reporting a deferred tax liability on the balance sheet?

I)A revenue is deferred for financial reporting purposes but not for tax purposes.

II)A revenue is deferred for tax purposes but not for financial reporting purposes

III)An expense is deferred for financial reporting purposes but not for tax purposes.IV. An expense is deferred for tax purposes but not for financial reporting purposes.

A) item II only

B) items I and II only

C) items II and III only

D) items I and IV only

I)A revenue is deferred for financial reporting purposes but not for tax purposes.

II)A revenue is deferred for tax purposes but not for financial reporting purposes

III)An expense is deferred for financial reporting purposes but not for tax purposes.IV. An expense is deferred for tax purposes but not for financial reporting purposes.

A) item II only

B) items I and II only

C) items II and III only

D) items I and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

41

Deferred tax amounts that are related to specific assets or liabilities should be classified as current or noncurrent based on

A) their expected reversal dates.

B) their debit or credit balance.

C) the length of time the deferred tax amounts will generate future tax deferral benefits.

D) the classification of the related asset or liability.

A) their expected reversal dates.

B) their debit or credit balance.

C) the length of time the deferred tax amounts will generate future tax deferral benefits.

D) the classification of the related asset or liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

42

Major reasons for disclosure of deferred income tax information is (are)

A) better assessment of quality of earnings.

B) better predictions of future cash flows.

C) predicting future cash flows for operating loss carryforwards.

D) All of these answer choices are correct.

A) better assessment of quality of earnings.

B) better predictions of future cash flows.

C) predicting future cash flows for operating loss carryforwards.

D) All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

43

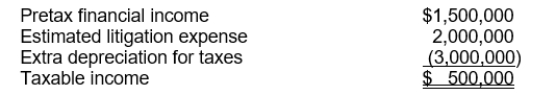

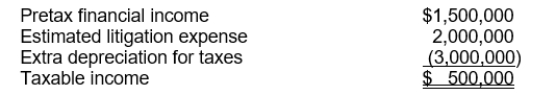

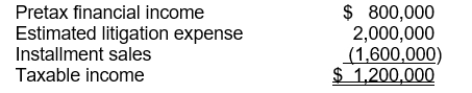

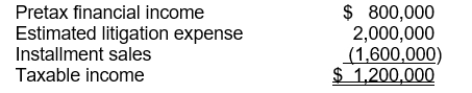

Use the following information for questions 58 through 60.

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The deferred tax asset to be recognized is

A) $150,000 current.

B) $300,000 current.

C) $450,000 current.

D) $600,000 current.

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.The deferred tax asset to be recognized is

A) $150,000 current.

B) $300,000 current.

C) $450,000 current.

D) $600,000 current.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

44

Accounting for income taxes can result in the reporting of deferred taxes as any of the following except

A) a current or long-term asset.

B) a current or long-term liability.

C) a contra-asset account.

D) All of these are acceptable methods of reporting deferred taxes.

A) a current or long-term asset.

B) a current or long-term liability.

C) a contra-asset account.

D) All of these are acceptable methods of reporting deferred taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

45

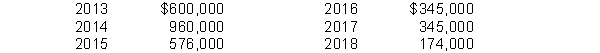

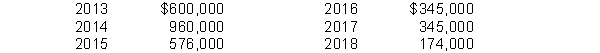

Lehman Corporation purchased a machine on January 2, 2013, for $3,000,000. The machine has an estimated 5-year life with no salvage value. The straight-line method of depreciation is being used for financial statement purposes and the following MACRS amounts will be deducted for tax purposes:  Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's balance sheet at December 31, 2014 be

Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's balance sheet at December 31, 2014 be

Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's balance sheet at December 31, 2014 be

Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's balance sheet at December 31, 2014 be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

46

Recognizing a valuation allowance for a deferred tax asset requires that a company

A) consider all positive and negative information in determining the need for a valuation allowance.

B) consider only the positive information in determining the need for a valuation allowance.

C) take an aggressive approach in its tax planning.

D) pass a recognition threshold, after assuming that it will be audited by taxing authorities.

A) consider all positive and negative information in determining the need for a valuation allowance.

B) consider only the positive information in determining the need for a valuation allowance.

C) take an aggressive approach in its tax planning.

D) pass a recognition threshold, after assuming that it will be audited by taxing authorities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

47

With regard to uncertain tax positions, the FASB requires that companies recognize a tax benefit when

A) it is probable and can be reasonably estimated.

B) there is at least a 51% probability that the uncertain tax position will be approved by the taxing authorities.

C) it is more likely than not that the tax position will be sustained upon audit.

D) Any of the above exist.

A) it is probable and can be reasonably estimated.

B) there is at least a 51% probability that the uncertain tax position will be approved by the taxing authorities.

C) it is more likely than not that the tax position will be sustained upon audit.

D) Any of the above exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the following information for questions 52 and 53.

At the beginning of 2015, Pitman Co. purchased an asset for $1,200,000 with an estimated useful life of 5 years and an estimated salvage value of $100,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 40% for 2015 and all future years.

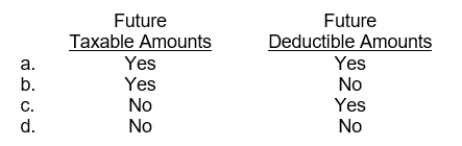

At the end of 2015, what are the book basis and the tax basis of the asset?

At the beginning of 2015, Pitman Co. purchased an asset for $1,200,000 with an estimated useful life of 5 years and an estimated salvage value of $100,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 40% for 2015 and all future years.

At the end of 2015, what are the book basis and the tax basis of the asset?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

49

A deferred tax liability is classified on the balance sheet as either a current or a noncurrent liability. The current amount of a deferred tax liability should generally be

A) the net deferred tax consequences of temporary differences that will result in net taxable amounts during the next year.

B) totally eliminated from the financial statements if the amount is related to a noncurrent asset.

C) based on the classification of the related asset or liability for financial reporting purposes.

D) the total of all deferred tax consequences that are not expected to reverse in the operating period or one year, whichever is greater.

A) the net deferred tax consequences of temporary differences that will result in net taxable amounts during the next year.

B) totally eliminated from the financial statements if the amount is related to a noncurrent asset.

C) based on the classification of the related asset or liability for financial reporting purposes.

D) the total of all deferred tax consequences that are not expected to reverse in the operating period or one year, whichever is greater.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

50

Deferred taxes should be presented on the balance sheet

A) as one net debit or credit amount.

B) in two amounts: one for the net current amount and one for the net noncurrent amount.

C) in two amounts: one for the net debit amount and one for the net credit amount.

D) as reductions of the related asset or liability accounts.

A) as one net debit or credit amount.

B) in two amounts: one for the net current amount and one for the net noncurrent amount.

C) in two amounts: one for the net debit amount and one for the net credit amount.

D) as reductions of the related asset or liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

51

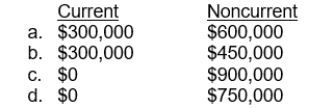

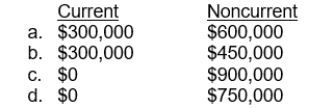

Use the following information for questions 55 through 57.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The deferred tax asset to be recognized is

A) $0.

B) $120,000 current.

C) $600,000 current.

D) $600,000 noncurrent.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.The deferred tax asset to be recognized is

A) $0.

B) $120,000 current.

C) $600,000 current.

D) $600,000 noncurrent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the following information for questions 58 through 60.

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The deferred tax liability to be recognized is

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.The deferred tax liability to be recognized is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

53

Recognition of tax benefits in the loss year due to a loss carryforward requires

A) the establishment of a deferred tax liability.

B) the establishment of a deferred tax asset.

C) the establishment of an income tax refund receivable.

D) only a note to the financial statements.

A) the establishment of a deferred tax liability.

B) the establishment of a deferred tax asset.

C) the establishment of an income tax refund receivable.

D) only a note to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the following information for questions 55 through 57.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The income tax expense is

A) $240,000.

B) $360,000.

C) $400,000.

D) $800,000.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.The income tax expense is

A) $240,000.

B) $360,000.

C) $400,000.

D) $800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the following information for questions 58 through 60.

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

Income taxes payable is

A) $0.

B) $150,000.

C) $300,000.

D) $450,000.

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.Income taxes payable is

A) $0.

B) $150,000.

C) $300,000.

D) $450,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

56

All of the following are procedures for the computation of deferred income taxes except to

A) identify the types and amounts of existing temporary differences.

B) measure the total deferred tax liability for taxable temporary differences.

C) measure the total deferred tax asset for deductible temporary differences and operating loss carrybacks.

D) All of these are procedures in computing deferred income taxes.

A) identify the types and amounts of existing temporary differences.

B) measure the total deferred tax liability for taxable temporary differences.

C) measure the total deferred tax asset for deductible temporary differences and operating loss carrybacks.

D) All of these are procedures in computing deferred income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following information for questions 55 through 57.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The deferred tax liability-current to be recognized is

A) $120,000.

B) $360,000.

C) $240,000.

D) $480,000.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.The deferred tax liability-current to be recognized is

A) $120,000.

B) $360,000.

C) $240,000.

D) $480,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

58

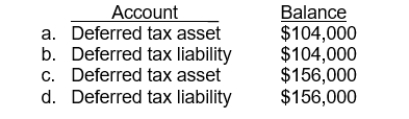

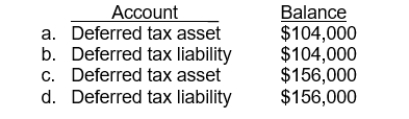

Use the following information for questions 52 and 53.

At the beginning of 2015, Pitman Co. purchased an asset for $1,200,000 with an estimated useful life of 5 years and an estimated salvage value of $100,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 40% for 2015 and all future years.

At the end of 2015, which of the following deferred tax accounts and balances is reported on Pitman's balance sheet?

At the beginning of 2015, Pitman Co. purchased an asset for $1,200,000 with an estimated useful life of 5 years and an estimated salvage value of $100,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 40% for 2015 and all future years.

At the end of 2015, which of the following deferred tax accounts and balances is reported on Pitman's balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

59

Tanner, Inc. incurred a financial and taxable loss for 2015. Tanner therefore decided to use the carryback provisions as it had been profitable up to this year. How should the amounts related to the carryback be reported in the 2015 financial statements?

A) The reduction of the loss should be reported as a prior period adjustment.

B) The refund claimed should be reported as a deferred charge and amortized over five years.

C) The refund claimed should be reported as revenue in the current year.

D) The refund claimed should be shown as a reduction of the loss in 2015.

A) The reduction of the loss should be reported as a prior period adjustment.

B) The refund claimed should be reported as a deferred charge and amortized over five years.

C) The refund claimed should be reported as revenue in the current year.

D) The refund claimed should be shown as a reduction of the loss in 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

60

Uncertain tax positions

I)Are positions for which the tax authorities may disallow a deduction in whole orin part.

II)Include instances in which the tax law is clear and in which the company believesan audit is likely

III)Give rise to tax expense by increasing payables or increasing a deferredtax liability.

A) I, II, and III.

B) I and III only.

C) II only.

D) I only.

I)Are positions for which the tax authorities may disallow a deduction in whole orin part.

II)Include instances in which the tax law is clear and in which the company believesan audit is likely

III)Give rise to tax expense by increasing payables or increasing a deferredtax liability.

A) I, II, and III.

B) I and III only.

C) II only.

D) I only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

61

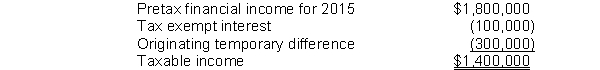

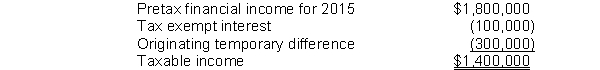

Use the following information for questions 79 and 80.

Rowen, Inc. had pre-tax accounting income of $1,800,000 and a tax rate of 40% in 2015, its first year of operations. During 2015 the company had the following transactions:

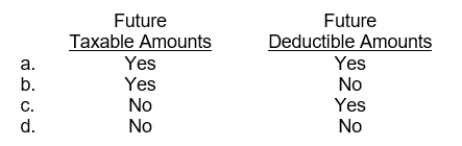

At the end of 2015, which of the following deferred tax accounts and balances is reported on Rowen, Inc.'s balance sheet?

Rowen, Inc. had pre-tax accounting income of $1,800,000 and a tax rate of 40% in 2015, its first year of operations. During 2015 the company had the following transactions:

At the end of 2015, which of the following deferred tax accounts and balances is reported on Rowen, Inc.'s balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

62

In 2014, Krause Company accrued, for financial statement reporting, estimated losses on disposal of unused plant facilities of $2,400,000. The facilities were sold in March 2015 and a $2,400,000 loss was recognized for tax purposes. Also in 2014, Krause paid $100,000 in premiums for a two-year life insurance policy in which the company was the beneficiary. Assuming that the enacted tax rate is 30% in both 2014 and 2015, and that Krause paid $780,000 in income taxes in 2014, the amount reported as net deferred income taxes on Krause's balance sheet at December 31, 2014, should be a

A) $680,000 asset.

B) $360,000 asset.

C) $360,000 liability.

D) $720,000 asset.

A) $680,000 asset.

B) $360,000 asset.

C) $360,000 liability.

D) $720,000 asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use the following information for questions 66 and 67.

Mitchell Corporation prepared the following reconciliation for its first year of operations: The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 35%.

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 35%.

In Mitchell's 2015 income statement, what amount should be reported for total income tax expense?

A) $345,000

B) $315,000

C) $315,000

D) $227,500

Mitchell Corporation prepared the following reconciliation for its first year of operations:

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 35%.

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 35%.In Mitchell's 2015 income statement, what amount should be reported for total income tax expense?

A) $345,000

B) $315,000

C) $315,000

D) $227,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

64

Eckert Corporation's partial income statement after its first year of operations is as follows:  Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $2,400,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $2,400,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

A) $2,100,000

B) $1,125,000

C) $2,400,000

D) $2,700,000

Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $2,400,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $2,400,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?A) $2,100,000

B) $1,125,000

C) $2,400,000

D) $2,700,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the following information for questions 79 and 80.

Rowen, Inc. had pre-tax accounting income of $1,800,000 and a tax rate of 40% in 2015, its first year of operations. During 2015 the company had the following transactions:

For 2015, what is the amount of income taxes payable for Rowen, Inc?

A) $603,200

B) $654,400

C) $686,400

D) $772,800

Rowen, Inc. had pre-tax accounting income of $1,800,000 and a tax rate of 40% in 2015, its first year of operations. During 2015 the company had the following transactions:

For 2015, what is the amount of income taxes payable for Rowen, Inc?

A) $603,200

B) $654,400

C) $686,400

D) $772,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

66

Watson Corporation prepared the following reconciliation for its first year of operations:  The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 28%. What amount should be reported in its 2015 income statement as the current portion of its provision for income taxes?

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 28%. What amount should be reported in its 2015 income statement as the current portion of its provision for income taxes?

A) $392,000

B) $560,000

C) $504,000

D) $720,000

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 28%. What amount should be reported in its 2015 income statement as the current portion of its provision for income taxes?

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 28%. What amount should be reported in its 2015 income statement as the current portion of its provision for income taxes?A) $392,000

B) $560,000

C) $504,000

D) $720,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

67

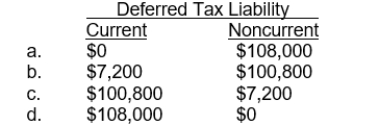

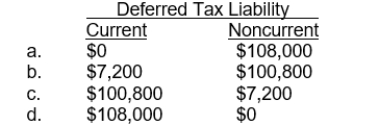

Use the following information for questions 70 through 72.

Lyons Company deducts insurance expense of $126,000 for tax purposes in 2014, but the expense is not yet recognized for accounting purposes. In 2015, 2016, and 2017, no insurance expense will be deducted for tax purposes, but $42,000 of insurance expense will be reported for accounting purposes in each of these years. Lyons Company has a tax rate of 40% and income taxes payable of $108,000 at the end of 2014. There were no deferred taxes at the beginning of 2014.

What is the amount of the deferred tax liability at the end of 2014?

A) $50,400

B) $43,200

C) $18,000

D) $0

Lyons Company deducts insurance expense of $126,000 for tax purposes in 2014, but the expense is not yet recognized for accounting purposes. In 2015, 2016, and 2017, no insurance expense will be deducted for tax purposes, but $42,000 of insurance expense will be reported for accounting purposes in each of these years. Lyons Company has a tax rate of 40% and income taxes payable of $108,000 at the end of 2014. There were no deferred taxes at the beginning of 2014.

What is the amount of the deferred tax liability at the end of 2014?

A) $50,400

B) $43,200

C) $18,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

68

Ewing Company sells household furniture. Customers who purchase furniture on the installment basis make payments in equal monthly installments over a two-year period, with no down payment required. Ewing's gross profit on installment sales equals 40% of the selling price of the furniture.For financial accounting purposes, sales revenue is recognized at the time the sale is made. For income tax purposes, however, the installment method is used. There are no other book and income tax accounting differences, and Ewing's income tax rate is 30%.If Ewing's December 31, 2015, balance sheet includes a deferred tax liability of $600,000 arising from the difference between book and tax treatment of the installment sales, it should also include installment accounts receivable of

A) $5,000,000.

B) $2,000,000.

C) $1,500,000.

D) $450,000.

A) $5,000,000.

B) $2,000,000.

C) $1,500,000.

D) $450,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

69

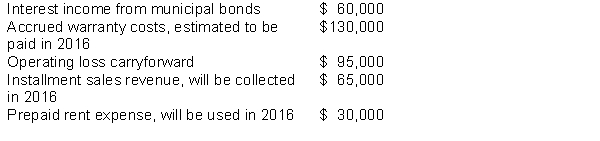

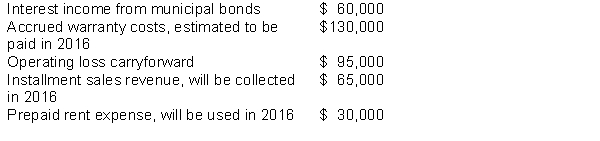

Use the following information for questions 76-78.

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

The ending balance in Elephant, Inc's deferred tax liability at December 31, 2015 is

A) $23,000

B) $38,000

C) $26,000

D) $78,000

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

The ending balance in Elephant, Inc's deferred tax liability at December 31, 2015 is

A) $23,000

B) $38,000

C) $26,000

D) $78,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

70

Ferguson Company has the following cumulative taxable temporary differences:  The tax rate enacted for 2015 is 40%, while the tax rate enacted for future years is 30%. Taxable income for 2015 is $4,800,000 and there are no permanent differences. Ferguson's pretax financial income for 2015 is

The tax rate enacted for 2015 is 40%, while the tax rate enacted for future years is 30%. Taxable income for 2015 is $4,800,000 and there are no permanent differences. Ferguson's pretax financial income for 2015 is

A) $7,500,000.

B) $5,580,000.

C) $4,020,000.

D) $2,100,000.

The tax rate enacted for 2015 is 40%, while the tax rate enacted for future years is 30%. Taxable income for 2015 is $4,800,000 and there are no permanent differences. Ferguson's pretax financial income for 2015 is

The tax rate enacted for 2015 is 40%, while the tax rate enacted for future years is 30%. Taxable income for 2015 is $4,800,000 and there are no permanent differences. Ferguson's pretax financial income for 2015 isA) $7,500,000.

B) $5,580,000.

C) $4,020,000.

D) $2,100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

71

Cross Company reported the following results for the year ended December 31, 2014, its first year of operations:  The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2015. What should Cross record as a net deferred tax asset or liability for the year ended December 31, 2014, assuming that the enacted tax rates in effect are 40% in 2014 and 35% in 2015?

The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2015. What should Cross record as a net deferred tax asset or liability for the year ended December 31, 2014, assuming that the enacted tax rates in effect are 40% in 2014 and 35% in 2015?

A) $360,000 deferred tax liability

B) $315,000 deferred tax asset

C) $360,000 deferred tax asset

D) $315,000 deferred tax liability

The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2015. What should Cross record as a net deferred tax asset or liability for the year ended December 31, 2014, assuming that the enacted tax rates in effect are 40% in 2014 and 35% in 2015?

The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2015. What should Cross record as a net deferred tax asset or liability for the year ended December 31, 2014, assuming that the enacted tax rates in effect are 40% in 2014 and 35% in 2015?A) $360,000 deferred tax liability

B) $315,000 deferred tax asset

C) $360,000 deferred tax asset

D) $315,000 deferred tax liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

72

Horner Corporation has a deferred tax asset at December 31, 2015 of $160,000 due to the recognition of potential tax benefits of an operating loss carryforward. The enacted tax rates are as follows: 40% for 2012-2014; 35% for 2015; and 30% for 2016 and thereafter. Assuming that management expects that only 50% of the related benefits will actually be realized, a valuation account should be established in the amount of:

A) $80,000

B) $32,000

C) $28,000

D) $24,000

A) $80,000

B) $32,000

C) $28,000

D) $24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the following information for questions 70 through 72.

Lyons Company deducts insurance expense of $126,000 for tax purposes in 2014, but the expense is not yet recognized for accounting purposes. In 2015, 2016, and 2017, no insurance expense will be deducted for tax purposes, but $42,000 of insurance expense will be reported for accounting purposes in each of these years. Lyons Company has a tax rate of 40% and income taxes payable of $108,000 at the end of 2014. There were no deferred taxes at the beginning of 2014.

Assuming that income taxes payable for 2015 is $144,000, the income tax expense for 2015 would be what amount?

A) $194,400

B) $160,800

C) $144,000

D) $127,200

Lyons Company deducts insurance expense of $126,000 for tax purposes in 2014, but the expense is not yet recognized for accounting purposes. In 2015, 2016, and 2017, no insurance expense will be deducted for tax purposes, but $42,000 of insurance expense will be reported for accounting purposes in each of these years. Lyons Company has a tax rate of 40% and income taxes payable of $108,000 at the end of 2014. There were no deferred taxes at the beginning of 2014.

Assuming that income taxes payable for 2015 is $144,000, the income tax expense for 2015 would be what amount?

A) $194,400

B) $160,800

C) $144,000

D) $127,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use the following information for questions 76-78.

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

Which of the following is required to adjust Elephant, Inc.'s deferred tax asset to its correct balance at December 31, 2015?

A) A credit of $52,000

B) A credit of $38,000

C) A debit of $38,000

D) A debit of $42,000

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

Which of the following is required to adjust Elephant, Inc.'s deferred tax asset to its correct balance at December 31, 2015?

A) A credit of $52,000

B) A credit of $38,000

C) A debit of $38,000

D) A debit of $42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the following information for questions 76-78.

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

What is Elephant, Inc.'s taxable income for 2015?

A) $ 750,000

B) $ 630,000

C) $ 870,000

D) $1,130,000

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

What is Elephant, Inc.'s taxable income for 2015?

A) $ 750,000

B) $ 630,000

C) $ 870,000

D) $1,130,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use the following information for questions 70 through 72.

Lyons Company deducts insurance expense of $126,000 for tax purposes in 2014, but the expense is not yet recognized for accounting purposes. In 2015, 2016, and 2017, no insurance expense will be deducted for tax purposes, but $42,000 of insurance expense will be reported for accounting purposes in each of these years. Lyons Company has a tax rate of 40% and income taxes payable of $108,000 at the end of 2014. There were no deferred taxes at the beginning of 2014.

What is the amount of income tax expense for 2014?

A) $158,400

B) $151,200

C) $126,000

D) $108,000

Lyons Company deducts insurance expense of $126,000 for tax purposes in 2014, but the expense is not yet recognized for accounting purposes. In 2015, 2016, and 2017, no insurance expense will be deducted for tax purposes, but $42,000 of insurance expense will be reported for accounting purposes in each of these years. Lyons Company has a tax rate of 40% and income taxes payable of $108,000 at the end of 2014. There were no deferred taxes at the beginning of 2014.

What is the amount of income tax expense for 2014?

A) $158,400

B) $151,200

C) $126,000

D) $108,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

77

The following information is available for Kessler Company after its first year of operations:  Kessler estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was $85,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?

Kessler estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was $85,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?

A) $95,000

B) $100,000

C) $85,000

D) $75,000

Kessler estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was $85,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?

Kessler estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was $85,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?A) $95,000

B) $100,000

C) $85,000

D) $75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

78

Use the following information for questions 73 and 74.

Kraft Company made the following journal entry in late 2014 for rent on property it leases to Danford Corporation. The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

Assuming the income taxes payable at the end of 2015 is $204,000, what amount of income tax expense would Kraft Company record for 2015?

A) $162,000

B) $183,000

C) $225,000

D) $246,000

Kraft Company made the following journal entry in late 2014 for rent on property it leases to Danford Corporation.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.Assuming the income taxes payable at the end of 2015 is $204,000, what amount of income tax expense would Kraft Company record for 2015?

A) $162,000

B) $183,000

C) $225,000

D) $246,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use the following information for questions 66 and 67.

Mitchell Corporation prepared the following reconciliation for its first year of operations: The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 35%.

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 35%.

What amount should be reported in its 2015 income statement as the deferred portion of income tax expense?

A) $70,000 debit

B) $87,500 debit

C) $70,000 credit

D) $87,500 credit

Mitchell Corporation prepared the following reconciliation for its first year of operations:

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 35%.

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2015 is 35%.What amount should be reported in its 2015 income statement as the deferred portion of income tax expense?

A) $70,000 debit

B) $87,500 debit

C) $70,000 credit

D) $87,500 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use the following information for questions 73 and 74.

Kraft Company made the following journal entry in late 2014 for rent on property it leases to Danford Corporation. The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

What amount of income tax expense should Kraft Company report at the end of 2014?

A) $106,000

B) $142,000

C) $163,000

D) $226,000

Kraft Company made the following journal entry in late 2014 for rent on property it leases to Danford Corporation.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.What amount of income tax expense should Kraft Company report at the end of 2014?

A) $106,000

B) $142,000

C) $163,000

D) $226,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck