Deck 25: Appendix

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/89

العب

ملء الشاشة (f)

Deck 25: Appendix

1

In considering interim financial reporting, how did the Accounting Principles Board conclude that such reporting should be viewed?

A) As a "special" type of reporting that need not follow generally accepted accounting principles.

B) As useful only if activity is evenly spread throughout the year so that estimates are unnecessary.

C) As reporting for a basic accounting period.

D) As reporting for an integral part of an annual period.

A) As a "special" type of reporting that need not follow generally accepted accounting principles.

B) As useful only if activity is evenly spread throughout the year so that estimates are unnecessary.

C) As reporting for a basic accounting period.

D) As reporting for an integral part of an annual period.

D

2

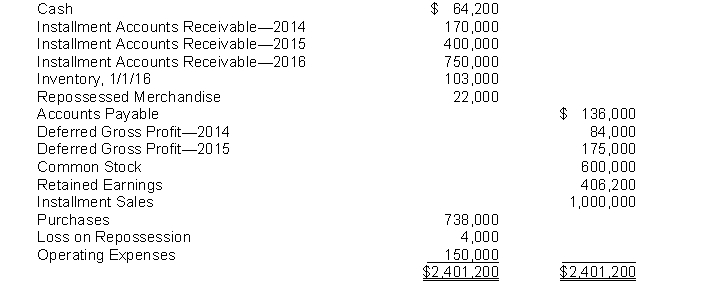

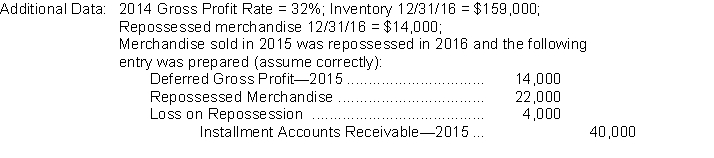

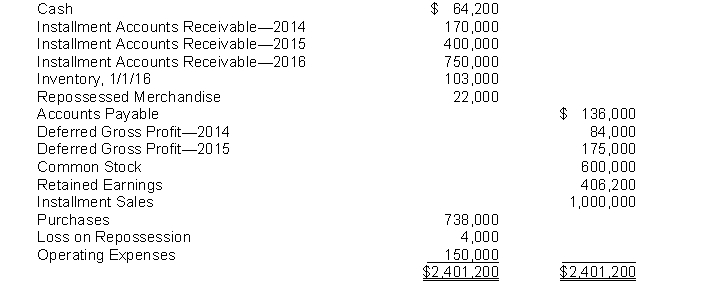

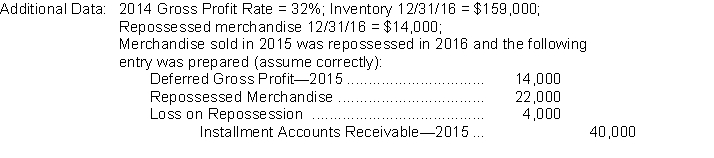

Installment Sales Method.Garber, Inc. accounts for all sales of its merchandise on the installment basis. Following is the unadjusted trial balance at 12/31/16:

Instructions

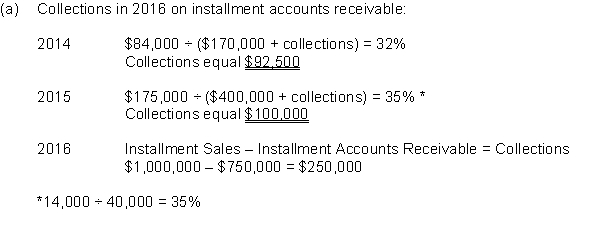

(a) Determine collections during 2016 on Installment A/R for each of the years 2014, 2015, and 2016.

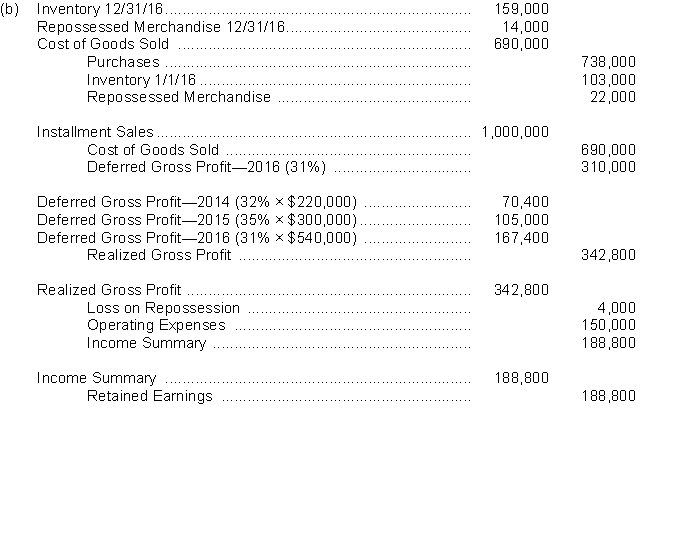

(b) Without prejudice to your answer in Part

(a), assume that total collections on Installment Accounts Receivable during 2016 were $1,060,000; $220,000 from 2014, $300,000 from 2015, and $540,000 from 2016. Prepare all necessary adjusting and closing entries at 12/31/16.

Instructions

(a) Determine collections during 2016 on Installment A/R for each of the years 2014, 2015, and 2016.

(b) Without prejudice to your answer in Part

(a), assume that total collections on Installment Accounts Receivable during 2016 were $1,060,000; $220,000 from 2014, $300,000 from 2015, and $540,000 from 2016. Prepare all necessary adjusting and closing entries at 12/31/16.

3

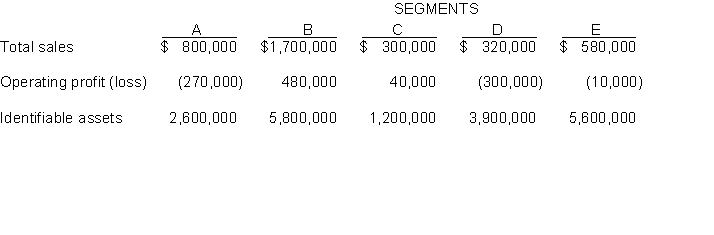

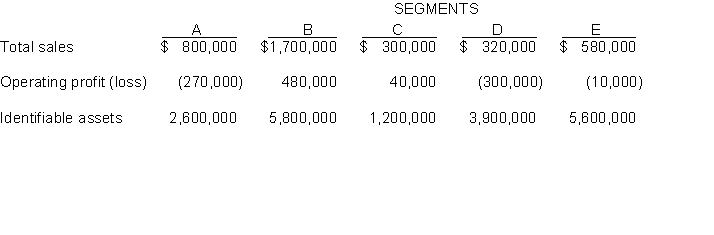

Segment Reporting.Baden Company is a diversified company which has developed the following information about its five segments:

InstructionsIdentify which segments are significant enough to warrant disclosure in accordance with FASB No. 131, "Reporting Disaggregated Information about a Business Enterprise," by applying the following quantitative tests:

a. Revenue test

b. Operating profit or loss test

c. Identifiable assets test

InstructionsIdentify which segments are significant enough to warrant disclosure in accordance with FASB No. 131, "Reporting Disaggregated Information about a Business Enterprise," by applying the following quantitative tests:

a. Revenue test

b. Operating profit or loss test

c. Identifiable assets test

a. Revenue test - a segment is reportable if its total sales are $370,000 or more

(10% × $3,700,000). Segments A, B, and E satisfy the revenue test.

b. Operating profit or loss test - a segment's absolute profit or loss must be $58,000 or more [10% of the absolute greater of $520,000 or ($580,000)]. Segments A, B, and D satisfy the operating profit or loss test.

c. Identifiable assets test - a segment's identifiable assets must be $1,910,000 or more (10% × $19,100,000). Segments B, D, and E satisfy the identifiable test.

Segments A, B, D, and E are identified as significant and therefore reportable because they passed at least one of the significance tests.

(10% × $3,700,000). Segments A, B, and E satisfy the revenue test.

b. Operating profit or loss test - a segment's absolute profit or loss must be $58,000 or more [10% of the absolute greater of $520,000 or ($580,000)]. Segments A, B, and D satisfy the operating profit or loss test.

c. Identifiable assets test - a segment's identifiable assets must be $1,910,000 or more (10% × $19,100,000). Segments B, D, and E satisfy the identifiable test.

Segments A, B, D, and E are identified as significant and therefore reportable because they passed at least one of the significance tests.

4

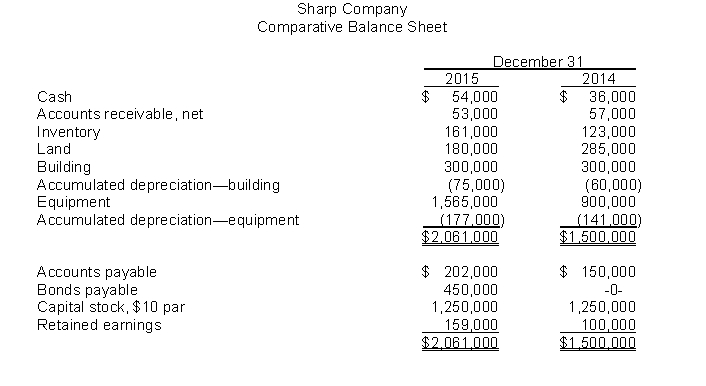

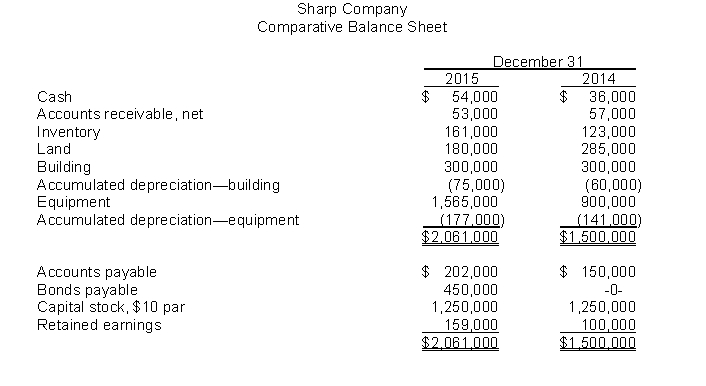

Statement of Cash Flows.  Additional Data:

Additional Data:

1. Net income for the year amounted to $109,000.

2. Cash dividends were paid amounting to 4% of par value.

3. Land was sold for $120,000."

4. Sharp sold equipment, which cost $225,000 and had accumulated depreciation of $90,000, for $115,000.

InstructionsPrepare a statement of cash flows using the indirect method."

Additional Data:

Additional Data:1. Net income for the year amounted to $109,000.

2. Cash dividends were paid amounting to 4% of par value.

3. Land was sold for $120,000."

4. Sharp sold equipment, which cost $225,000 and had accumulated depreciation of $90,000, for $115,000.

InstructionsPrepare a statement of cash flows using the indirect method."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

5

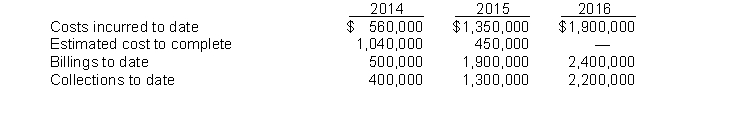

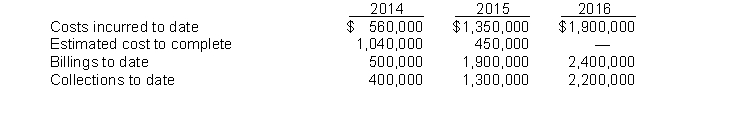

Long-Term Contracts.Edwards Company contracted on 4/1/14 to construct a building for $2,400,000. The project was completed in 2016. Additional data follow:

Instructions

(a) Calculate the income recognized by Edwards under the percentage-of-completion method of accounting in each of the years 2014, 2015, and 2016.

(b) Prepare all necessary entries for the year 2015.

(c) Present the balance sheet disclosures at December 31, 2015. Proper headings or subheadings must be indicated.

Instructions

(a) Calculate the income recognized by Edwards under the percentage-of-completion method of accounting in each of the years 2014, 2015, and 2016.

(b) Prepare all necessary entries for the year 2015.

(c) Present the balance sheet disclosures at December 31, 2015. Proper headings or subheadings must be indicated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

6

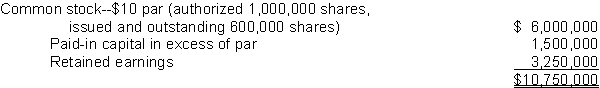

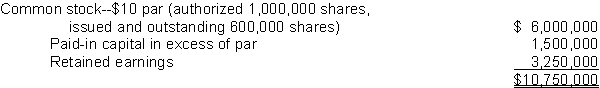

Treasury StockThe stockholders' equity section of Carey Co.'s balance sheet at December 31, 2014, was as follows:

InstructionsPrepare journal entries (1, 2, and 4) and show proper disclosure (3) to reflect the following treasury stock transactions showing how each is accounted for under the cost method. (Show computations.)

InstructionsPrepare journal entries (1, 2, and 4) and show proper disclosure (3) to reflect the following treasury stock transactions showing how each is accounted for under the cost method. (Show computations.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

7

The net income for the year ended December 31, 2015, for Tax Consultants INC. was $990,000. Additional information is as follows: Based on the information given above, what should be the net cash provided by operating activities in the statement of cash flows for the year ended December 31, 2015?

A) $1,326,000.

B) $1,416,000.

C) $1,461,000.

D) $1,506,000.

A) $1,326,000.

B) $1,416,000.

C) $1,461,000.

D) $1,506,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

8

Information from Collins Company's balance sheet is as follows:

What is the acid-test (quick) ratio?

A) 1.03 to 1

B) 1.37 to 1

C) 1.40 to 1

D) 2.50 to 1

What is the acid-test (quick) ratio?

A) 1.03 to 1

B) 1.37 to 1

C) 1.40 to 1

D) 2.50 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

9

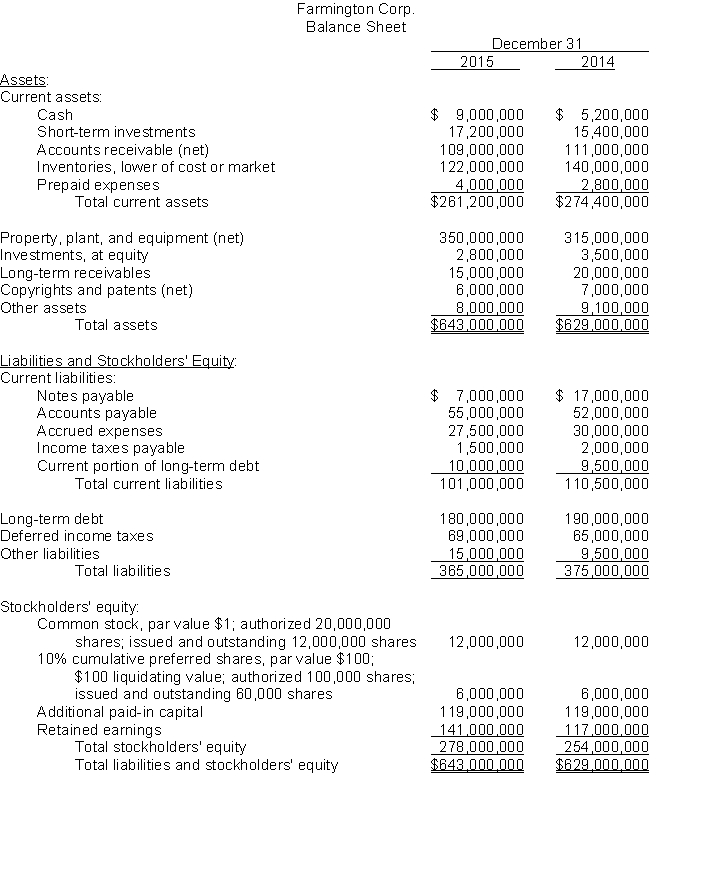

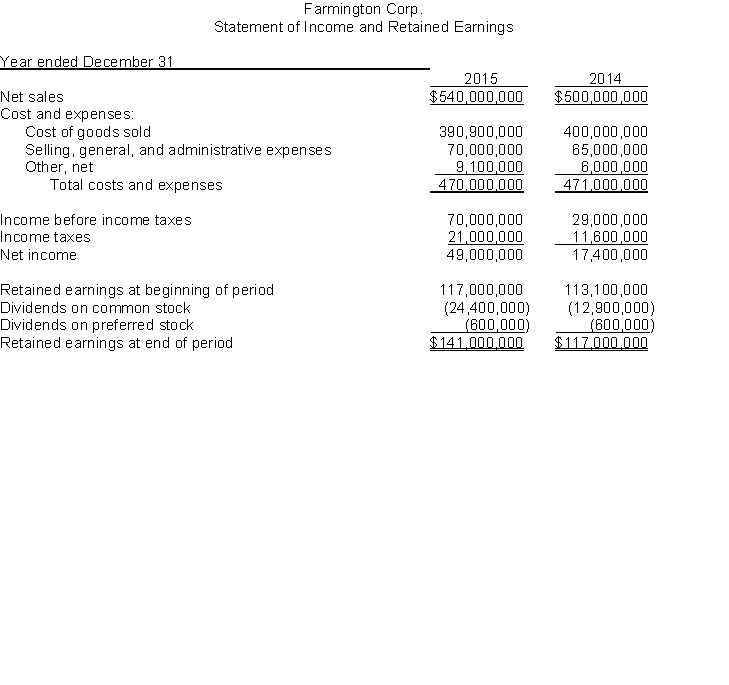

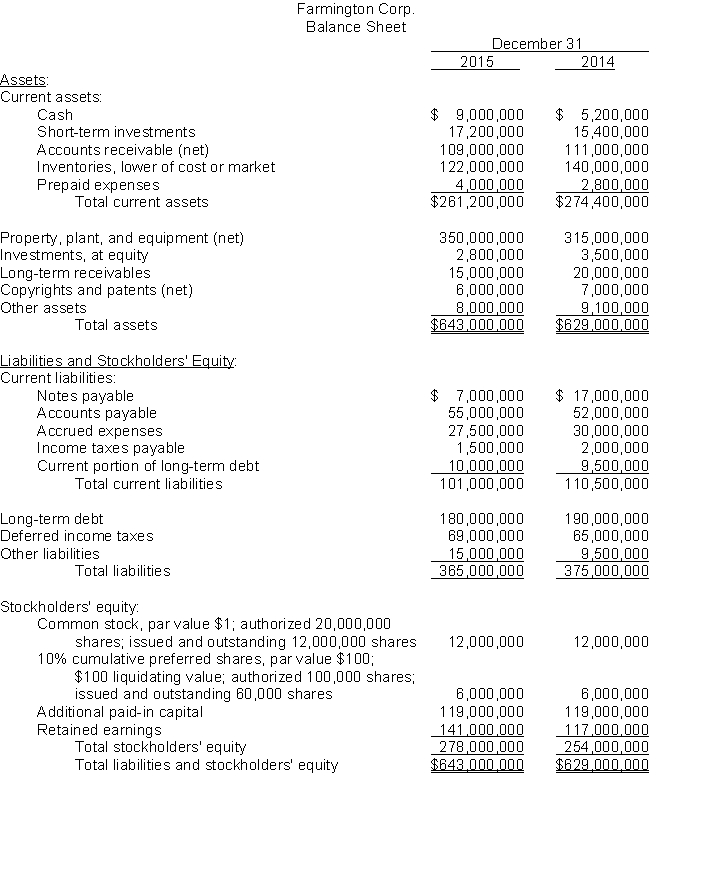

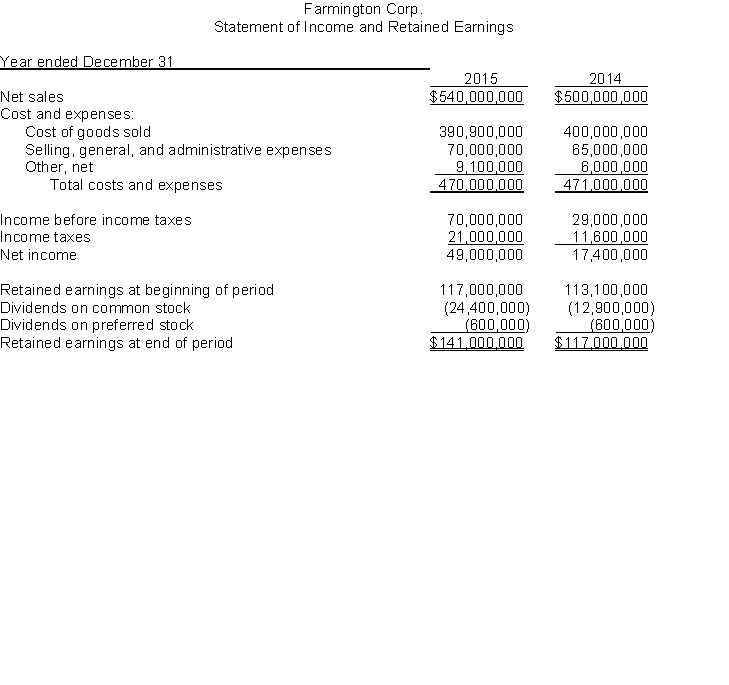

Analysis of Financial Statements.The market value of Farmington Corp.'s common shares was quoted at $54 per share at December 31, 2015, and 2014. Planetarium 's balance sheet at December 31, 2015, and 2014, and statement of income and retained earnings for the years then ended are presented below:

InstructionsBased on the above information, compute the following (for the year 2015 only): (Show supporting computations in good form.)

(a) Current ratio.

(b) Acid-test (quick) ratio.

(c) Receivables turnover.(d) Inventory turnover.(e) Book value per share of common stock.(f) Earnings per share on common stock.(g) Price-earnings ratio on common stock.(h) Payout ratio on common stock.

InstructionsBased on the above information, compute the following (for the year 2015 only): (Show supporting computations in good form.)

(a) Current ratio.

(b) Acid-test (quick) ratio.

(c) Receivables turnover.(d) Inventory turnover.(e) Book value per share of common stock.(f) Earnings per share on common stock.(g) Price-earnings ratio on common stock.(h) Payout ratio on common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

10

On January 7, 2013, Yoder Corporation acquired machinery at a cost of $2,100,000. Yoder adopted the sum-of-the-years'-digits method of depreciation for this machine and had been recording depreciation over an estimated life of five years, with no residual value. At the beginning of 2015, a decision was made to change to the straight-line method of depreciation for this machine. Assuming a 30% tax rate, the cumulative effect of this accounting change, net of tax, is

A) $0

B) $280,000

C) $294,000

D) $420,000

A) $0

B) $280,000

C) $294,000

D) $420,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

11

Deferred Income Taxes.In 2015, the initial year of its existence, Dexter Company's accountant, in preparing both the income statement and the tax return, developed the following list of items causing differences between accounting and taxable income:1. The company sells its merchandise on an installment contract basis. In 2015, Dexter elected, for tax purposes, to report the gross profit from these sales in the years the receivables are collected. However, for financial statement purposes, the company recognized all the gross profit in 2015. These procedures created a $500,000 difference between book and taxable incomes. The future collection of the installment contracts receivables are expected to result in taxable amounts of $250,000 in each of the next two years. (Note: the company treats installment contracts receivable as a current asset on its balance sheet.)2. The company has also chosen to depreciate all of its depreciable assets on an accelerated basis for tax purposes but on a straight-line basis for accounting purposes. These procedures resulted in $60,000 excess depreciation for tax purposes over accounting depreciation. The temporary difference due to excess tax depreciation will reverse equally over the three year period from 2016-2018.3. Dexter leased some of its property to Baker Company on July 1, 2015. The lease was to expire on July 1, 2017 and the monthly rentals were to be $60,000. Baker, however, paid the first year's rent in advance and Dexter reported this entire amount on its tax return. These procedures resulted in a $360,000 difference between book and taxable incomes. (Note: this lease was an operating lease and Dexter classified the unearned rent as a current liability on its balance sheet.)4. Dexter owns $200,000 of bonds issued by the State of Oregon upon which 5% interest is paid annually. In 2015, Dexter showed $10,000 of income from the bonds on its income statement but did not show any of this amount on its tax return. (Note: these bonds are classified as long-term investments on Dexter's balance sheet.)"5. In 2015, Dexter insured the lives of its chief executives. The premiums paid amounted to $12,000 and this amount was shown as an expense on the income statement. However, this amount was not deducted on the tax return. The company is the beneficiary.

InstructionsAssuming that the income statement of Dexter Company showed ""Income before income taxes"" of $1,500,000; that the enacted tax rates are 30% for all years; and that no other differences between book and taxable incomes existed, except for those mentioned above:

(a) Compute the income taxes payable.

(b) Prepare a schedule of future taxable and (deductible) amounts at the end of 2015.

(c) Prepare a schedule of deferred tax (asset) and liability at the end of 2015.(d) Compute the net deferred tax expense (benefit) for 2015.(e) Make the journal entry recording income tax expense, income taxes payable, and deferred income taxes for 2015.(f) Indicate how income tax expense and any deferred income taxes should be disclosed on the financial statements under generally accepted accounting principles. Show the amounts for these items and indicate specifically where they would be disclosed."

InstructionsAssuming that the income statement of Dexter Company showed ""Income before income taxes"" of $1,500,000; that the enacted tax rates are 30% for all years; and that no other differences between book and taxable incomes existed, except for those mentioned above:

(a) Compute the income taxes payable.

(b) Prepare a schedule of future taxable and (deductible) amounts at the end of 2015.

(c) Prepare a schedule of deferred tax (asset) and liability at the end of 2015.(d) Compute the net deferred tax expense (benefit) for 2015.(e) Make the journal entry recording income tax expense, income taxes payable, and deferred income taxes for 2015.(f) Indicate how income tax expense and any deferred income taxes should be disclosed on the financial statements under generally accepted accounting principles. Show the amounts for these items and indicate specifically where they would be disclosed."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

12

Worthington Company purchased a machine on January 1, 2012, for $6,400,000. At the date of acquisition, the machine had an estimated useful life of six years with no salvage. The machine is being depreciated on a straight-line basis. On January 1, 2015, Worthington determined, as a result of additional information, that the machine had an estimated useful life of eight years from the date of acquisition with no salvage. An accounting change was made to reflect this additional information. What amount of depreciation expense should be reported in Worthington's income statement for the year ended December 31, 2015?

A) $1,066,667

B) $800,000

C) $640,000

D) $400,000

A) $1,066,667

B) $800,000

C) $640,000

D) $400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

13

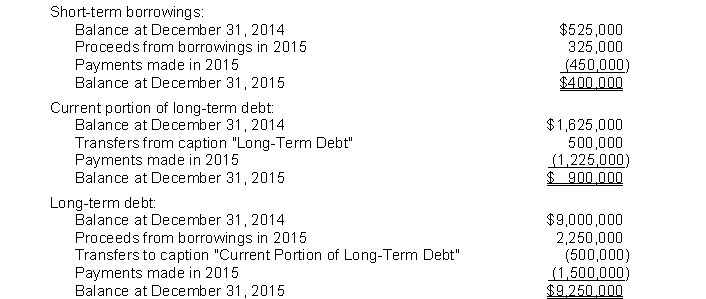

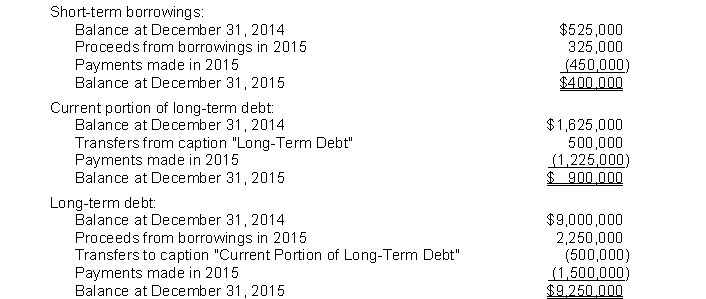

Information concerning the debt of Cole Company is as follows:  In preparing a statement of cash flows for the year ended December 31, 2015, for Cole Company, cash flows from financing activities would reflectOutflow

In preparing a statement of cash flows for the year ended December 31, 2015, for Cole Company, cash flows from financing activities would reflectOutflow

A) $2,000,000

B) $2,250,000

C) $2,575,000

D) $3,175,000

In preparing a statement of cash flows for the year ended December 31, 2015, for Cole Company, cash flows from financing activities would reflectOutflow

In preparing a statement of cash flows for the year ended December 31, 2015, for Cole Company, cash flows from financing activities would reflectOutflowA) $2,000,000

B) $2,250,000

C) $2,575,000

D) $3,175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following transactions would be considered a financing activity in preparing a statement of cash flows?

A) Amortizing a discount on bonds payable

B) Recording net income from operations

C) Selling common stock

D) Purchasing inventory

A) Amortizing a discount on bonds payable

B) Recording net income from operations

C) Selling common stock

D) Purchasing inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

15

The calculation of the number of times interest is earned involves dividing

A) net income by annual interest expense.

B) net income plus income taxes by annual interest expense.

C) net income plus income taxes and interest expense by annual interest expense.

D) none of these answers are correct.

A) net income by annual interest expense.

B) net income plus income taxes by annual interest expense.

C) net income plus income taxes and interest expense by annual interest expense.

D) none of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

16

Fargo, Inc. disclosed the following information as of and for the year ended December 31, 2015: Fargo's receivables turnover is

A) 7.4 to 1.

B) 8.0 to 1.

C) 12.0 to 1.

D) 13.0 to 1.

A) 7.4 to 1.

B) 8.0 to 1.

C) 12.0 to 1.

D) 13.0 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

17

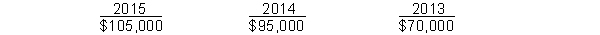

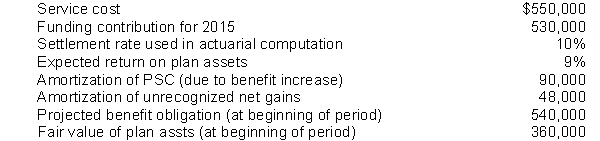

Accounting Changes, Error Corrections, and Prior Period Adjustments.Molina Company's reported net incomes for 2015 and the previous two years are presentedbelow.  2015's net income was properly determined after giving effect to the following accounting changes, error corrections, etc. which took place during the year. The incomes for 2013 and 2014 do not take these items into account and are stated at the amounts determined in those years. Ignore income taxes.

2015's net income was properly determined after giving effect to the following accounting changes, error corrections, etc. which took place during the year. The incomes for 2013 and 2014 do not take these items into account and are stated at the amounts determined in those years. Ignore income taxes.

Instructions

(a) For each of the six accounting changes, errors, or prior period adjustment situations described below, prepare the journal entry or entries Molina Company should record during 2015. If no entry is required, write "none."(b) After recording the situation in part

(a) above, prepare the year-end adjusting entry for December 31, 2015. If no entry, write "none.""1. Early in 2015, Molina determined that equipment purchased in January, 2013 at a cost of $1,075,000, with an estimated life of 5 years and salvage value of $75,000 is now estimated to continue in use until December 31, 2019 and will have a $25,000 salvage value. Molina recorded its 2015 depreciation at the end of 2015.

(a)(b)""2. Molina determined that it had understated its depreciation by $20,000 in 2014 owing to the fact that an adjusting entry did not get recorded.

(a)(b)""3. Molina bought a truck January 1, 2012 for $60,000 with a $6,000 estimated salvage value and a six-year life. The company debited an expense account and credited cash on the purchase date. The truck is expected to be traded at the end of 2017. Molina uses straight-line depreciation for its trucks.

(a)(b)""4. During 2015, Molina changed from the straight-line method of depreciating its cement plant to the double-declining-balance method. The following calculations present depreciation on both bases. (Ignore income taxes.) The 2015 amount applies double-declining balance to the 1/1/15 carrying amount after straight-line was used.

(a)(b)""5. Molina, in reviewing its provision for uncollectibles during 2015, has determined that 1/2 of 1% is the appropriate amount of bad debt expense to be charged to operations. The company had used 1% as its rate in 2014 and 2013 when the expense had been $20,000 and $14,000, respectively. The company would have recorded $60,000 of bad debt expense on December 31, 2015 under the old rate.

(a)(b)""6. During 2015, Molina decided to change from the LIFO method of valuing inventories to average cost. The net incomes involved under each method were as follows: Assume no difference between LIFO and average cost inventory values in years prior to 2013.

Assume no difference between LIFO and average cost inventory values in years prior to 2013.

(a)(b)"

2015's net income was properly determined after giving effect to the following accounting changes, error corrections, etc. which took place during the year. The incomes for 2013 and 2014 do not take these items into account and are stated at the amounts determined in those years. Ignore income taxes.

2015's net income was properly determined after giving effect to the following accounting changes, error corrections, etc. which took place during the year. The incomes for 2013 and 2014 do not take these items into account and are stated at the amounts determined in those years. Ignore income taxes.Instructions

(a) For each of the six accounting changes, errors, or prior period adjustment situations described below, prepare the journal entry or entries Molina Company should record during 2015. If no entry is required, write "none."(b) After recording the situation in part

(a) above, prepare the year-end adjusting entry for December 31, 2015. If no entry, write "none.""1. Early in 2015, Molina determined that equipment purchased in January, 2013 at a cost of $1,075,000, with an estimated life of 5 years and salvage value of $75,000 is now estimated to continue in use until December 31, 2019 and will have a $25,000 salvage value. Molina recorded its 2015 depreciation at the end of 2015.

(a)(b)""2. Molina determined that it had understated its depreciation by $20,000 in 2014 owing to the fact that an adjusting entry did not get recorded.

(a)(b)""3. Molina bought a truck January 1, 2012 for $60,000 with a $6,000 estimated salvage value and a six-year life. The company debited an expense account and credited cash on the purchase date. The truck is expected to be traded at the end of 2017. Molina uses straight-line depreciation for its trucks.

(a)(b)""4. During 2015, Molina changed from the straight-line method of depreciating its cement plant to the double-declining-balance method. The following calculations present depreciation on both bases. (Ignore income taxes.) The 2015 amount applies double-declining balance to the 1/1/15 carrying amount after straight-line was used.

(a)(b)""5. Molina, in reviewing its provision for uncollectibles during 2015, has determined that 1/2 of 1% is the appropriate amount of bad debt expense to be charged to operations. The company had used 1% as its rate in 2014 and 2013 when the expense had been $20,000 and $14,000, respectively. The company would have recorded $60,000 of bad debt expense on December 31, 2015 under the old rate.

(a)(b)""6. During 2015, Molina decided to change from the LIFO method of valuing inventories to average cost. The net incomes involved under each method were as follows:

Assume no difference between LIFO and average cost inventory values in years prior to 2013.

Assume no difference between LIFO and average cost inventory values in years prior to 2013.(a)(b)"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

18

Leases.On January 1, 2015, Foley Company (as lessor) entered into a noncancelable lease agreement with Pinkley Company for machinery which was carried on the accounting records of Foley at $6,795,000 and had a market value of $7,200,000. Minimum lease payments under the lease agreement which expires on December 31, 2024, total $10,650,000. Payments of $1,065,000 are due each January 1. The first payment was made on January 1, 2015 when the lease agreement was finalized. The interest rate of 10% which was stipulated in the lease agreement is the implicit rate set by the lessor. The effective interest method of amortization is being used. Pinkley expects the machine to have a ten-year life with no salvage value, and be depreciated on a straight-line basis. Collectibility of the rentals is reasonably predictable, and there are no important uncertainties surrounding the costs yet to be incurred by the lessor.

Instructions

(a) From the lessee's viewpoint, what kind of lease is the above agreement? From the lessor's viewpoint, what kind of lease is the above agreement?

(b) What should be the income before income taxes derived by Foley from the lease for the year ended December 31, 2015?

(c) Ignoring income taxes, what should be the expenses incurred by Pinkley from this lease for the year ended December 31, 2015?(d) What journal entries should be recorded by Pinkley Company on January 1, 2015?(e) What journal entries should be recorded by Foley Company on January 1, 2015?

Instructions

(a) From the lessee's viewpoint, what kind of lease is the above agreement? From the lessor's viewpoint, what kind of lease is the above agreement?

(b) What should be the income before income taxes derived by Foley from the lease for the year ended December 31, 2015?

(c) Ignoring income taxes, what should be the expenses incurred by Pinkley from this lease for the year ended December 31, 2015?(d) What journal entries should be recorded by Pinkley Company on January 1, 2015?(e) What journal entries should be recorded by Foley Company on January 1, 2015?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following items represents a potential use of cash?

A) Patent amortization

B) Sale of plant assets at a loss

C) Net loss from operations

D) Declaration of a stock dividend

A) Patent amortization

B) Sale of plant assets at a loss

C) Net loss from operations

D) Declaration of a stock dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

20

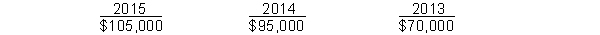

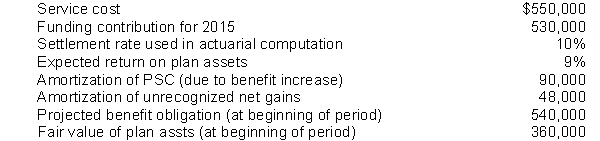

Pensions.Presented below is information related to Stage Department Stores, Inc. pension plan for 2015.

Instructions

(a) Compute the amount of pension expense to be reported for 2015. (Show computations.)(b) Prepare the journal entry to record pension expense and the employer's contribution for 2015.

Instructions

(a) Compute the amount of pension expense to be reported for 2015. (Show computations.)(b) Prepare the journal entry to record pension expense and the employer's contribution for 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

21

Problem D-VII -Available-for-Sale Equity InvestmentsOn January 2, 2014, Norwin Company purchased 2,000 shares of Oslo Company common stock for $60,000. The stock has a par value of $10 and is part of the total stock outstanding of 20,000 shares of Oslo Company. Norwin Company intends the stock to be available for sale. Total stockholders' equity of Oslo Company on January 2, 2014 was $600,000.

InstructionsPrepare necessary journal entries on the books of Norwin Company for the following transactions. If no entry is required, write "none" in the space provided. (Round all calculations to the nearest cent.)

(a) January 2, 2014: Norwin purchases the shares described above.

(b) December 31, 2014: Norwin receives a $.75 per share dividend from Oslo, and Oslo announces a net income for 2014 of $250,000.

(c) December 31, 2014: According to The Wall Street Journal, Oslo common is selling for $27 per share. Norwin's management views this decline as being only temporary in nature. Oslo's common is Norwin's only available-for-sale security.(d) February 15, 2015: Norwin sells 1,000 of the shares purchased on January 2, 2014 at $32 per share.

InstructionsPrepare necessary journal entries on the books of Norwin Company for the following transactions. If no entry is required, write "none" in the space provided. (Round all calculations to the nearest cent.)

(a) January 2, 2014: Norwin purchases the shares described above.

(b) December 31, 2014: Norwin receives a $.75 per share dividend from Oslo, and Oslo announces a net income for 2014 of $250,000.

(c) December 31, 2014: According to The Wall Street Journal, Oslo common is selling for $27 per share. Norwin's management views this decline as being only temporary in nature. Oslo's common is Norwin's only available-for-sale security.(d) February 15, 2015: Norwin sells 1,000 of the shares purchased on January 2, 2014 at $32 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

22

Use the following data to answer questions 5 through 9:

Davis Company purchased a new piece of equipment on July 1, 2014 at a cost of $1,800,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $150,000. The current year end is 12/31/15. Davis records depreciation to the nearest month.

What is sum-of-the-years'-digits depreciation for 2015?

A) $439,998.

B) $495,000.

C) $540,000.

D) $550,000.

Davis Company purchased a new piece of equipment on July 1, 2014 at a cost of $1,800,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $150,000. The current year end is 12/31/15. Davis records depreciation to the nearest month.

What is sum-of-the-years'-digits depreciation for 2015?

A) $439,998.

B) $495,000.

C) $540,000.

D) $550,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

23

The par (or stated value) of the stock is unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

24

On June 30, 2015 the firm sold 10,000 of the reacquired shares for $17 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

25

On January 4, 2015, having idle cash, Carey Co. repurchased 25,000 shares of its out-standing stock for $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

26

Retained earnings in the amount of the distribution are transferred to capital stock, in some instances in an amount in excess of that required by the laws of the state of incorporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

27

In accordance with GAAP, the maximum period over which a patent can be amortized is

A) 20 years.

B) 28 years.

C) 40 years.

D) 50 years.

A) 20 years.

B) 28 years.

C) 40 years.

D) 50 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

28

Purchased goodwill represents

A) excess of price paid over fair value of net assets obtained in a combination.

B) excess of price paid over the book value of the net assets obtained in a combination.

C) the difference in the aggregate amount of the market prices of the stock of the combining companies.

D) a tangible asset.

A) excess of price paid over fair value of net assets obtained in a combination.

B) excess of price paid over the book value of the net assets obtained in a combination.

C) the difference in the aggregate amount of the market prices of the stock of the combining companies.

D) a tangible asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

29

Problem D-III — Stock Dividends and Stock Splits

Stock dividends and stock splits are common forms of corporate stock distribution to stockholders.

Consider each of the numbered statements. You are to decide whether it:

-Subsequent per-share earnings, if any, are decreased.

A)Applies to both stock dividends and stock splits.

B)Applies to neither.

C)Applies to stock splits only.

D)Applies to stock dividends only.

E)Applies to stock splits effected in the form of a dividend only.

F)Applies to both stock splits effected in the form of a dividend and a stock dividend.

(In each instance, the issuing company has only one class of stock.)

Instructions

Print next to the number of each statement below, the single capital letter of the description which applies to the statement.

Stock dividends and stock splits are common forms of corporate stock distribution to stockholders.

Consider each of the numbered statements. You are to decide whether it:

-Subsequent per-share earnings, if any, are decreased.

A)Applies to both stock dividends and stock splits.

B)Applies to neither.

C)Applies to stock splits only.

D)Applies to stock dividends only.

E)Applies to stock splits effected in the form of a dividend only.

F)Applies to both stock splits effected in the form of a dividend and a stock dividend.

(In each instance, the issuing company has only one class of stock.)

Instructions

Print next to the number of each statement below, the single capital letter of the description which applies to the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

30

On March 4, Carey sold 5,000 of these reacquired shares at $24 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

31

Earnings Per Share ComputationsJones, Inc. has net income (30% tax rate) of $1,400,000 for 2015, and an average number of shares outstanding during the year of 500,000 shares. The corporation issued $2,000,000 par value of 10-year, 9% convertible bonds on January 1, 2013 at a $180,000 discount. The convertible bonds are convertible into 70,000 shares of common stock. Assume the company uses the straight-line method for amortizing bond discount.

InstructionsCompute the earnings per share data, excluding any notes if required.

InstructionsCompute the earnings per share data, excluding any notes if required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

32

Problem D-III — Stock Dividends and Stock Splits

Stock dividends and stock splits are common forms of corporate stock distribution to stockholders.

Consider each of the numbered statements. You are to decide whether it:

-The retained earnings available for dividends are increased.

A)Applies to both stock dividends and stock splits.

B)Applies to neither.

C)Applies to stock splits only.

D)Applies to stock dividends only.

E)Applies to stock splits effected in the form of a dividend only.

F)Applies to both stock splits effected in the form of a dividend and a stock dividend.

(In each instance, the issuing company has only one class of stock.)

Instructions

Print next to the number of each statement below, the single capital letter of the description which applies to the statement.

Stock dividends and stock splits are common forms of corporate stock distribution to stockholders.

Consider each of the numbered statements. You are to decide whether it:

-The retained earnings available for dividends are increased.

A)Applies to both stock dividends and stock splits.

B)Applies to neither.

C)Applies to stock splits only.

D)Applies to stock dividends only.

E)Applies to stock splits effected in the form of a dividend only.

F)Applies to both stock splits effected in the form of a dividend and a stock dividend.

(In each instance, the issuing company has only one class of stock.)

Instructions

Print next to the number of each statement below, the single capital letter of the description which applies to the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

33

Show the proper disclosures in the stockholders' equity section of the balance sheet issued at the end of the first quarter, March 31, 2015. Assume net income of $100,000 during the first quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

34

Earnings Per Share ConceptsIndicate which of the following securities would be included in the computation of "basic earnings per share," and which would be included in the computation of "diluted earnings per share." Place a "B" before those which affect only basic EPS, a "D" before those which affect only diluted EPS, a "BD" before those which affect both basic and diluted EPS, and an "N" before those securities which do not affect EPS computations. Assume that, where applicable, the appropriate securities are dilutive.1. Warrants to purchase additional common shares.2. Common stock.3. Nonconvertible debenture bonds.4. Convertible, noncumulative preferred stock.5. Cumulative, nonconvertible preferred stock.6. Convertible bonds.7. Executive stock options.8. Notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

35

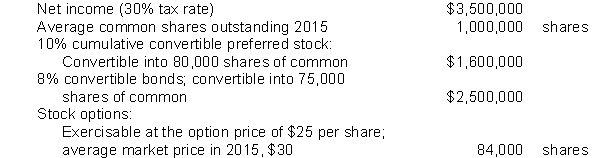

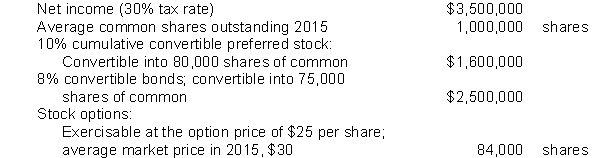

Basic and Diluted Earnings Per ShareAssume that the following data relate to Rosen, Inc. for the year 2015:

InstructionsCompute

(a) basic earnings per share, and (b) diluted earnings per share.

InstructionsCompute

(a) basic earnings per share, and (b) diluted earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

36

When the sum-of-the-years'-digits method is used, depreciation expense for a given asset will

A) decline by a constant amount each year.

B) be the same each year.

C) decrease rapidly and then slowly over the life of the asset.

D) vary from year to year in relation to changes in output.

A) decline by a constant amount each year.

B) be the same each year.

C) decrease rapidly and then slowly over the life of the asset.

D) vary from year to year in relation to changes in output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following data to answer questions 5 through 9:

Davis Company purchased a new piece of equipment on July 1, 2014 at a cost of $1,800,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $150,000. The current year end is 12/31/15. Davis records depreciation to the nearest month.

What is straight-line depreciation for 2015?

A) $165,000.

B) $180,000.

C) $330,000.

D) $360,000.

Davis Company purchased a new piece of equipment on July 1, 2014 at a cost of $1,800,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $150,000. The current year end is 12/31/15. Davis records depreciation to the nearest month.

What is straight-line depreciation for 2015?

A) $165,000.

B) $180,000.

C) $330,000.

D) $360,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

38

Trading SecuritiesThe information below relates to Milton Company's trading securities in 2014 and 2015.(a) Prepare the journal entries for the following transactions.January 1, 2014 Purchased $400,000 par value of GLF Company bonds at 97 plus accrued interest. The bonds pay interest annually at 9% each December 31. Broker's commission was $4,000.September 1, 2014 Sold $200,000 par value of GLF Company bonds at 94 plus accrued interest. Broker's commission, taxes, and fees were $2,000.September 5, 2014 Purchased 5,000 shares of Hayes, Inc. common stock for $30 per share. The broker's commission on the purchase amounted to $2,000.December 31, 2014 Make the appropriate entry for the GLF Company bonds.December 31, 2014 The market prices of the trading securities at December 31 were: Hayes, Inc. common stock, $31 per share; and GLF Company bonds, 99. Make the appropriate entry.July 1, 2015 Milton sold 1/2 of the Hayes, Inc. common stock at $33 per share. Broker's commissions, taxes, and fees were $1,000.December 1, 2015 Milton purchased 600 shares of Ramirez, Inc. common stock at $45 per share. Broker's commission was $500.December 31, 2015 Make the appropriate entry for the GLF Company bonds.December 31, 2015 The market prices of the trading securities at December 31 were: Hayes, Inc. common stock, $34 per share; GLF Company bonds, 98; and Ramirez, Inc. common stock, $47 per share. Make the appropriate entry.(b) Present the financial statement disclosure (balance sheet and income statement) of Milton Company's transactions in trading securities for each of the years 2014 and 2015. Appropriate financial statement subheadings must be disclosed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

39

Perry Corporation acquired land, buildings, and equipment from a bankrupt company at a lump-sum price of $550,000. At the time of acquisition Perry paid $20,000 to have the assets appraised. The appraisal disclosed the following values: What cost should be assigned to the land, buildings, and equipment, respectively?

A) $320,000, $256,000, and $64,000.

B) $275,000, $220,000, and $55,000.

C) $285,000, $228,000, and $57,000.

D) $190,000, $190,000, and $190,000.

A) $320,000, $256,000, and $64,000.

B) $275,000, $220,000, and $55,000.

C) $285,000, $228,000, and $57,000.

D) $190,000, $190,000, and $190,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

40

Problem D-III — Stock Dividends and Stock Splits

Stock dividends and stock splits are common forms of corporate stock distribution to stockholders.

Consider each of the numbered statements. You are to decide whether it:

-There is no change in the total stockholders' equity of the issuing corporation.

A)Applies to both stock dividends and stock splits.

B)Applies to neither.

C)Applies to stock splits only.

D)Applies to stock dividends only.

E)Applies to stock splits effected in the form of a dividend only.

F)Applies to both stock splits effected in the form of a dividend and a stock dividend.

(In each instance, the issuing company has only one class of stock.)

Instructions

Print next to the number of each statement below, the single capital letter of the description which applies to the statement.

Stock dividends and stock splits are common forms of corporate stock distribution to stockholders.

Consider each of the numbered statements. You are to decide whether it:

-There is no change in the total stockholders' equity of the issuing corporation.

A)Applies to both stock dividends and stock splits.

B)Applies to neither.

C)Applies to stock splits only.

D)Applies to stock dividends only.

E)Applies to stock splits effected in the form of a dividend only.

F)Applies to both stock splits effected in the form of a dividend and a stock dividend.

(In each instance, the issuing company has only one class of stock.)

Instructions

Print next to the number of each statement below, the single capital letter of the description which applies to the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

A replacement, which extended the life but did not increase the quality of units produced by the asset, cost $15,000.

A) Asset(s) only.

B) Accumulated amortization, or depletion or depreciation only.

C) Expense only.

D) Asset(s) and expense.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

A replacement, which extended the life but did not increase the quality of units produced by the asset, cost $15,000.

A) Asset(s) only.

B) Accumulated amortization, or depletion or depreciation only.

C) Expense only.

D) Asset(s) and expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Given the assumptions in 15 above, at what amount will Brown record Machine A?

A) $540,000.

B) $737,100.

C) $621,000.

D) $656,100.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Given the assumptions in 15 above, at what amount will Brown record Machine A?

A) $540,000.

B) $737,100.

C) $621,000.

D) $656,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

As generally used in accounting, what is depreciation?

A) It is a process of asset valuation for balance sheet purposes.

B) It applies only to long-lived intangible assets.

C) It is used to indicate a decline in market value of a long-lived asset.

D) It is an accounting process which allocates long-lived asset cost to accounting periods.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

As generally used in accounting, what is depreciation?

A) It is a process of asset valuation for balance sheet purposes.

B) It applies only to long-lived intangible assets.

C) It is used to indicate a decline in market value of a long-lived asset.

D) It is an accounting process which allocates long-lived asset cost to accounting periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Long-Term Debt."1. On March 31, 2011, Hanson Corporation sold $9,000,000 of its 8%, 10-year bonds for $8,653,500 including accrued interest. The bonds were dated January 1, 2011. Interest is paid semiannually on January 1 and July 1. On April 1, 2015, Hanson purchased 1/2 of the bonds on the open market at 99 plus accrued interest and canceled them. Hanson uses the straight-line method for amortization of bond premiums and discounts.(a) What was the amount of the gain or loss on retirement of the bonds?(b) Prepare the journal entry needed at April 1, 2015 to record retirement of the bonds. Assume that interest and premium or discount amortization have been recorded through January 1, 2015. Record interest and amortization on only the bonds retired.(c) Prepare the journal entry needed at July 1, 2015 to record interest and premium or discount amortization.""2. On January 1 of the current year, Feller Corporation issued $5,000,000 of 10% debenture bonds on a basis to yield 9%, receiving $5,224,300. Interest is payable annually on December 31 and the bonds mature in 6 years. The effective-interest method is used.(a) What is the interest expense for the first year?(b) What is the interest expense for the second year?""3. On October 1, 2014, Noller Company issued $6,000,000 par value, 10%, 10-year bonds dated July 1, 2014, with interest payable semiannually on January 1 and July 1. The bonds are issued at $6,813,000 (to yield 8%) plus accrued interest. The effective interest method is used.(a) Prepare the journal entry at the date the bonds are issued.(b) Prepare the adjusting entry at December 31, 2014, the end of the fiscal year.(c) Prepare the entry for the interest payment on January 1, 2015."

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Long-Term Debt."1. On March 31, 2011, Hanson Corporation sold $9,000,000 of its 8%, 10-year bonds for $8,653,500 including accrued interest. The bonds were dated January 1, 2011. Interest is paid semiannually on January 1 and July 1. On April 1, 2015, Hanson purchased 1/2 of the bonds on the open market at 99 plus accrued interest and canceled them. Hanson uses the straight-line method for amortization of bond premiums and discounts.(a) What was the amount of the gain or loss on retirement of the bonds?(b) Prepare the journal entry needed at April 1, 2015 to record retirement of the bonds. Assume that interest and premium or discount amortization have been recorded through January 1, 2015. Record interest and amortization on only the bonds retired.(c) Prepare the journal entry needed at July 1, 2015 to record interest and premium or discount amortization.""2. On January 1 of the current year, Feller Corporation issued $5,000,000 of 10% debenture bonds on a basis to yield 9%, receiving $5,224,300. Interest is payable annually on December 31 and the bonds mature in 6 years. The effective-interest method is used.(a) What is the interest expense for the first year?(b) What is the interest expense for the second year?""3. On October 1, 2014, Noller Company issued $6,000,000 par value, 10%, 10-year bonds dated July 1, 2014, with interest payable semiannually on January 1 and July 1. The bonds are issued at $6,813,000 (to yield 8%) plus accrued interest. The effective interest method is used.(a) Prepare the journal entry at the date the bonds are issued.(b) Prepare the adjusting entry at December 31, 2014, the end of the fiscal year.(c) Prepare the entry for the interest payment on January 1, 2015."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Given the assumption in 12 above except that the fair values of Machines A and B are $504,000 and $675,000, respectively, at what amount will Brown record Machine A?

A) $656,100.

B) $756,000.

C) $675,000.

D) $737,100.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Given the assumption in 12 above except that the fair values of Machines A and B are $504,000 and $675,000, respectively, at what amount will Brown record Machine A?

A) $656,100.

B) $756,000.

C) $675,000.

D) $737,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Jim Dolan and Matt Stine, maintenance repairmen, spent five days in unloading and setting up a new $30,000 precision machine in the plant. Their wages earned in this five-day period totaled $800.

A) Asset(s) only.

B) Accumulated amortization, depletion, or depreciation only.

C) Expense only.

D) Asset(s) and expense.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Jim Dolan and Matt Stine, maintenance repairmen, spent five days in unloading and setting up a new $30,000 precision machine in the plant. Their wages earned in this five-day period totaled $800.

A) Asset(s) only.

B) Accumulated amortization, depletion, or depreciation only.

C) Expense only.

D) Asset(s) and expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the following data to answer questions 5 through 9:

Davis Company purchased a new piece of equipment on July 1, 2014 at a cost of $1,800,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $150,000. The current year end is 12/31/15. Davis records depreciation to the nearest month.

If Davis expensed the total cost of the equipment at 7/1/14, what was the effect on 2014 and 2015 income before taxes, assuming Davis uses straight-line depreciation?

A) $1,470,000 understated and $330,000 overstated.

B) $1,620,000 understated and $180,000 overstated.

C) $1,635,000 understated and $330,000 overstated.

D) $1,800,000 understated and $180,000 overstated.

Davis Company purchased a new piece of equipment on July 1, 2014 at a cost of $1,800,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $150,000. The current year end is 12/31/15. Davis records depreciation to the nearest month.

If Davis expensed the total cost of the equipment at 7/1/14, what was the effect on 2014 and 2015 income before taxes, assuming Davis uses straight-line depreciation?

A) $1,470,000 understated and $330,000 overstated.

B) $1,620,000 understated and $180,000 overstated.

C) $1,635,000 understated and $330,000 overstated.

D) $1,800,000 understated and $180,000 overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Given the assumptions in 15 above except that the selling prices and fair market values of A and B are $756,000 and $675,000, respectively, at what amount will Brown record Machine A?

A) $656,100.

B) $607,500.

C) $756,000.

D) $675,000.

For the following two questions, indicate the nature of the account or accounts to be debited when recording each transaction.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Given the assumptions in 15 above except that the selling prices and fair market values of A and B are $756,000 and $675,000, respectively, at what amount will Brown record Machine A?

A) $656,100.

B) $607,500.

C) $756,000.

D) $675,000.

For the following two questions, indicate the nature of the account or accounts to be debited when recording each transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Assume that instead of dealers, both Sawyer and Brown are machine manufacturers and use the machines in production. Assume the exchange lacks commercial substance. At what amount will Brown record Machine A?

A) $540,000.

B) $621,000.

C) $729,000.

D) $810,000.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Assume that instead of dealers, both Sawyer and Brown are machine manufacturers and use the machines in production. Assume the exchange lacks commercial substance. At what amount will Brown record Machine A?

A) $540,000.

B) $621,000.

C) $729,000.

D) $810,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the following data to answer questions 5 through 9:

Davis Company purchased a new piece of equipment on July 1, 2014 at a cost of $1,800,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $150,000. The current year end is 12/31/15. Davis records depreciation to the nearest month.

If, at the end of 2016, Davis Company decides the equipment still has five more years of life beyond 12/31/16, with a salvage value of $150,000, what is straight-line depreciation for 2016? (Assume straight-line used in all years.)

A) $180,000.

B) $192,500.

C) $217,500.

D) $330,000.

Davis Company purchased a new piece of equipment on July 1, 2014 at a cost of $1,800,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $150,000. The current year end is 12/31/15. Davis records depreciation to the nearest month.

If, at the end of 2016, Davis Company decides the equipment still has five more years of life beyond 12/31/16, with a salvage value of $150,000, what is straight-line depreciation for 2016? (Assume straight-line used in all years.)

A) $180,000.

B) $192,500.

C) $217,500.

D) $330,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Property, plant, and equipment is usually presented in the balance sheet at

A) replacement cost less accumulated depreciation.

B) historical cost less salvage value.

C) original cost less accumulated depreciation.

D) acquisition cost less net book value thereof.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Property, plant, and equipment is usually presented in the balance sheet at

A) replacement cost less accumulated depreciation.

B) historical cost less salvage value.

C) original cost less accumulated depreciation.

D) acquisition cost less net book value thereof.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Assignment of Costs.Match the following cost items with these appropriate accounts:1. Interest cost incurred during building construction.2. Back taxes on purchased plot of land to be used for building site.3. Assessment by city for drainage system.4. Building permits.5. Landscaping shrubs planted after building has been constructed.6. Demolition costs of building on land bought for plant site.7. Interest cost incurred after completion of building construction.8. Recording fees for land.9. Architect's fees.10. Grading and filling building site.11. Parking lots.12. Fences.

a. Land

b. Buildings

c. Land Improvements

d. Other

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Assignment of Costs.Match the following cost items with these appropriate accounts:1. Interest cost incurred during building construction.2. Back taxes on purchased plot of land to be used for building site.3. Assessment by city for drainage system.4. Building permits.5. Landscaping shrubs planted after building has been constructed.6. Demolition costs of building on land bought for plant site.7. Interest cost incurred after completion of building construction.8. Recording fees for land.9. Architect's fees.10. Grading and filling building site.11. Parking lots.12. Fences.

a. Land

b. Buildings

c. Land Improvements

d. Other

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Exchange of Assets.Assume that the following cases are independent and rely on the following data. Make entries on the books of both companies. "1. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance.Jensen Co.'s Books: Merton Co.'s Books:""2. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance.Jensen Co.'s Books: Merton Co.'s Books:Assume that the following cases are independent and rely on the following data. Make entries on the books of both companies.

"1. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance.Jensen Co.'s Books: Merton Co.'s Books:""2. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance.Jensen Co.'s Books: Merton Co.'s Books:Assume that the following cases are independent and rely on the following data. Make entries on the books of both companies.  ""3. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance.Jensen Co.'s Books: Merton Co.'s Books:""4. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance.Jensen Co.'s Books: Merton Co.'s Books:"

""3. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance.Jensen Co.'s Books: Merton Co.'s Books:""4. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance.Jensen Co.'s Books: Merton Co.'s Books:"

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.

Exchange of Assets.Assume that the following cases are independent and rely on the following data. Make entries on the books of both companies.

"1. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance.Jensen Co.'s Books: Merton Co.'s Books:""2. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance.Jensen Co.'s Books: Merton Co.'s Books:Assume that the following cases are independent and rely on the following data. Make entries on the books of both companies.

"1. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance.Jensen Co.'s Books: Merton Co.'s Books:""2. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance.Jensen Co.'s Books: Merton Co.'s Books:Assume that the following cases are independent and rely on the following data. Make entries on the books of both companies.  ""3. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance.Jensen Co.'s Books: Merton Co.'s Books:""4. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance.Jensen Co.'s Books: Merton Co.'s Books:"

""3. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance.Jensen Co.'s Books: Merton Co.'s Books:""4. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance.Jensen Co.'s Books: Merton Co.'s Books:"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the following data for questions 10 through 17. Each question is independent of the other questions.

Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/14 for $540,000. On 12/31/14 such machines have a selling price and fair value of $621,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

Brown Corporation has a machine (Machine B) that it acquired on 1/1/14 for $729,000. On 12/31/14 such machines have a selling price and fair value of $540,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method.

On 12/31/14 Brown gave Machine B plus $81,000 cash to Sawyer in return for

Machine A.