Deck 31: Mergers

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/73

العب

ملء الشاشة (f)

Deck 31: Mergers

1

Market for corporate control includes the following:

I. Mergers

II. Spin-offs and divestitures

III. Leveraged buyouts (LBOs)

IV. Privatizations

A) I only

B) I and II only

C) I, II, and III only

D) I, II, III, and IV

I. Mergers

II. Spin-offs and divestitures

III. Leveraged buyouts (LBOs)

IV. Privatizations

A) I only

B) I and II only

C) I, II, and III only

D) I, II, III, and IV

I, II, III, and IV

2

Google's acquisition of Double Click is an example of:

I. Horizontal merger

II. Vertical merger

III. Conglomerate merger

IV. Cross-border merger

A) I only

B) II only

C) III only

D) I and IV only

I. Horizontal merger

II. Vertical merger

III. Conglomerate merger

IV. Cross-border merger

A) I only

B) II only

C) III only

D) I and IV only

II only

3

Firm A has a value of $100 million, and B has a value of $70 million. Merging the two would allow a cost savings with a present value of $20 million. Firm A purchases B for $75 million. What is the cost of this merger?

A) $30 million

B) $20 million

C) $5 million

D) $10 million

A) $30 million

B) $20 million

C) $5 million

D) $10 million

$5 million

4

Many mergers that appear to make economic sense fail because managers are unable to handle the complex task of integrating two firms with different:

I. production processes II) accounting methods

III. corporate cultures

A) I only

B) I and II only

C) III only

D) I, II and III

I. production processes II) accounting methods

III. corporate cultures

A) I only

B) I and II only

C) III only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

5

The following reasons are good motives for mergers except:

I. Economies of scale

II. Complementary resources

III. Diversification

IV. Eliminating Inefficiencies

A) I only

B) II only

C) III only

D) I, II, and IV only

I. Economies of scale

II. Complementary resources

III. Diversification

IV. Eliminating Inefficiencies

A) I only

B) II only

C) III only

D) I, II, and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

6

The following are good reasons for mergers:

I. Economies of scale

II. Economics of vertical integration

III. Complementary resources

IV. Surplus funds

V. Eliminating inefficiencies

VI. Industry consolidation

A) I only

B) I, II, and III only

C) I, III, IV, and V only

D) I, II, III, IV, V, and VI

I. Economies of scale

II. Economics of vertical integration

III. Complementary resources

IV. Surplus funds

V. Eliminating inefficiencies

VI. Industry consolidation

A) I only

B) I, II, and III only

C) I, III, IV, and V only

D) I, II, III, IV, V, and VI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

7

Tele Atlas acquisition of Tom Tom is an example of:

I. Horizontal merger

II. Vertical merger

III. Conglomerate merger

A) I only

B) II only

C) III only

D) None of the given ones

I. Horizontal merger

II. Vertical merger

III. Conglomerate merger

A) I only

B) II only

C) III only

D) None of the given ones

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

8

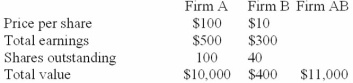

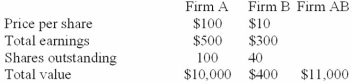

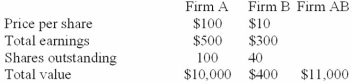

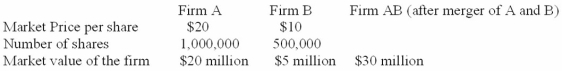

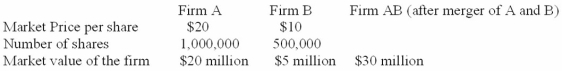

The following data on a merger is given:  Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger assuming that cash is used in the acquisition?

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger assuming that cash is used in the acquisition?

A) $6

B) $7

C) $8

D) $5

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger assuming that cash is used in the acquisition?

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger assuming that cash is used in the acquisition?A) $6

B) $7

C) $8

D) $5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

9

The BP and Amoco merger is an example of:

I. Cross-border merger

II. Horizontal merger

III. Economies of scale

A) I only

B) I and II only

C) I, II, and III only

D) III only

I. Cross-border merger

II. Horizontal merger

III. Economies of scale

A) I only

B) I and II only

C) I, II, and III only

D) III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

10

The following are dubious reasons for mergers:

I. to diversify

II. increasing the earnings per share (EPS)

III. lower financing costs

IV. industry consolidation

A) I only

B) II and IV only

C) III and IV only

D) I, II, and III only

I. to diversify

II. increasing the earnings per share (EPS)

III. lower financing costs

IV. industry consolidation

A) I only

B) II and IV only

C) III and IV only

D) I, II, and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

11

Bank of America and Merrill Lynch merger is an example of:

I. Horizontal merger

II. Vertical merger

III. Conglomerate merger

IV. Cross-border merger

A) I only

B) II only

C) III only

D) III and IV only

I. Horizontal merger

II. Vertical merger

III. Conglomerate merger

IV. Cross-border merger

A) I only

B) II only

C) III only

D) III and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

12

The merger of Pfizer and Wyeth is an example of:

I. Horizontal merger

II. Cross-border merger

III. Conglomerate merger

IV. Vertical merger

A) I only

B) II only

C) III only

D) I and III only

I. Horizontal merger

II. Cross-border merger

III. Conglomerate merger

IV. Vertical merger

A) I only

B) II only

C) III only

D) I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

13

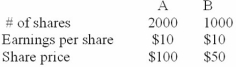

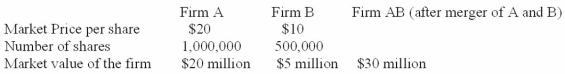

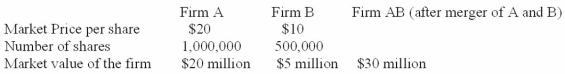

Companies A and B are valued as follows:  Company A now acquires B by offering one (new) share of A for every two shares of B (that is, after the merger, there are 2500 shares of A outstanding). If investors are aware that there are no economic gains from the merger, what is the price-earnings ratio of A's stock after the merger?

Company A now acquires B by offering one (new) share of A for every two shares of B (that is, after the merger, there are 2500 shares of A outstanding). If investors are aware that there are no economic gains from the merger, what is the price-earnings ratio of A's stock after the merger?

A) 7.5

B) 8.3

C) 10.0

D) 5.0

Company A now acquires B by offering one (new) share of A for every two shares of B (that is, after the merger, there are 2500 shares of A outstanding). If investors are aware that there are no economic gains from the merger, what is the price-earnings ratio of A's stock after the merger?

Company A now acquires B by offering one (new) share of A for every two shares of B (that is, after the merger, there are 2500 shares of A outstanding). If investors are aware that there are no economic gains from the merger, what is the price-earnings ratio of A's stock after the merger?A) 7.5

B) 8.3

C) 10.0

D) 5.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

14

Firm A has a value of $150 million, and B has a value of $100 million. Merging the two would allow a cost savings with a present value of $40 million. Firm A purchases B for $120 million. What is the gain from this merger?

A) $20 million

B) $40 million

C) $100 million

D) $80 million

A) $20 million

B) $40 million

C) $100 million

D) $80 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

15

Firm A has a value of $100 million, and B has a value of $60 million. Merging the two would allow a cost savings with a present value of $20 million. Firm A purchases B for $65 million. How much do firm A's shareholders gain from this merger?

A) $30 million

B) $20 million

C) $15 million

D) $5 million

A) $30 million

B) $20 million

C) $15 million

D) $5 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

16

Firm A has a value of $200 million, and B has a value of $120 million. Merging the two would allow a cost savings with a present value of $30 million. Firm A purchases B for $130 million. How much do firm A's shareholders gain from this merger?

A) $30 million

B) $20 million

C) $15 million

D) $10 million

A) $30 million

B) $20 million

C) $15 million

D) $10 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

17

The following data on a merger is given:  Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the post merger P/E ratio assuming cash is used in the acquisition.

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the post merger P/E ratio assuming cash is used in the acquisition.

A) 12.75

B) 6.25

C) 13.75

D) None of the above

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the post merger P/E ratio assuming cash is used in the acquisition.

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the post merger P/E ratio assuming cash is used in the acquisition.A) 12.75

B) 6.25

C) 13.75

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

18

Live Nation acquisition of Ticketmaster is an example of:

I. Cross-border merger

II. Horizontal merger

III. Conglomerate merger

IV. Vertical merger

A) I and II only

B) I and III only

C) III only

D) IV only

I. Cross-border merger

II. Horizontal merger

III. Conglomerate merger

IV. Vertical merger

A) I and II only

B) I and III only

C) III only

D) IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

19

Roche acquisition of Genentech is an example of:

I. Horizontal merger

II. Conglomerate merger

III. Cross-border merger

IV. Vertical merger

A) I only

B) II only

C) I and III only

D) IV only

I. Horizontal merger

II. Conglomerate merger

III. Cross-border merger

IV. Vertical merger

A) I only

B) II only

C) I and III only

D) IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

20

The following are good reasons for mergers:

I. Surplus funds

II. Eliminating inefficiencies

III. Complementary resources

IV. Increasing earnings per share (EPS)

A) I only

B) I and II only

C) I, II, and III only

D) IV only

I. Surplus funds

II. Eliminating inefficiencies

III. Complementary resources

IV. Increasing earnings per share (EPS)

A) I only

B) I and II only

C) I, II, and III only

D) IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

21

Firm A is planning to acquire Firm B. If Firm A prefers to make cash offer for the merger it indicates that:

A) Firm A's managers are optimistic about the post merger value of A

B) Firm A's managers are pessimistic about the post merger value of A

C) Firm A's managers are neutral about the post merger value of A

D) None of the above

A) Firm A's managers are optimistic about the post merger value of A

B) Firm A's managers are pessimistic about the post merger value of A

C) Firm A's managers are neutral about the post merger value of A

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is not a major item of US antitrust legislation? I) Garn-St. Germain Act

II) Clayton Act

III) Hart-Scott-Rodino Act

A) I only

B) II only

C) III only

D) II and III only

II) Clayton Act

III) Hart-Scott-Rodino Act

A) I only

B) II only

C) III only

D) II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

23

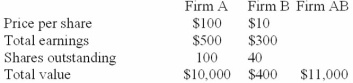

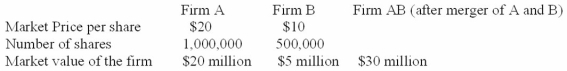

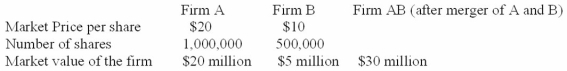

Given the following data:  If Firm A offers 250,000 shares for B's shareholders, calculate the true cost of merger:

If Firm A offers 250,000 shares for B's shareholders, calculate the true cost of merger:

A) $2 million

B) $3 million

C) $1 million

D) none of the above

If Firm A offers 250,000 shares for B's shareholders, calculate the true cost of merger:

If Firm A offers 250,000 shares for B's shareholders, calculate the true cost of merger:A) $2 million

B) $3 million

C) $1 million

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

24

Antitrust law can be enforced by the federal government by:

I. a civil suit brought by the Justice Department

II. a proceedings initiated by the Federal Trade Commission (FTC)

III. a proceedings initiated by the Securities and Exchange Commission (SEC)

A) I only

B) I and II only

C) I, II and III

D) II only

I. a civil suit brought by the Justice Department

II. a proceedings initiated by the Federal Trade Commission (FTC)

III. a proceedings initiated by the Securities and Exchange Commission (SEC)

A) I only

B) I and II only

C) I, II and III

D) II only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

25

The main difference in a tax-free versus taxable acquisition to the shareholders is that:

I. In a tax-free acquisition shares are only exchanged, while in a taxable transaction the shares are considered sold and realized capital gains or losses are taxed

II. In a tax-free acquisition a capital gain and loss are realized and then new shares issued, while in a taxable transaction the assets are revalued, taxed on any capital gains and losses and then shares exchanged

III. In a tax-free acquisition the shareholders simply take the cash and depart, while in a taxable transaction the shareholders must stay with the new entity

A) I only

B) II only

C) III only

D) I and III only

I. In a tax-free acquisition shares are only exchanged, while in a taxable transaction the shares are considered sold and realized capital gains or losses are taxed

II. In a tax-free acquisition a capital gain and loss are realized and then new shares issued, while in a taxable transaction the assets are revalued, taxed on any capital gains and losses and then shares exchanged

III. In a tax-free acquisition the shareholders simply take the cash and depart, while in a taxable transaction the shareholders must stay with the new entity

A) I only

B) II only

C) III only

D) I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

26

Given the following data:  If Firm A intends to pay $7 million cash for B, calculate the cost of this merger:

If Firm A intends to pay $7 million cash for B, calculate the cost of this merger:

A) $2 million

B) $3 million

C) $1 million

D) none of the above cost = 7 - 5 = 2

If Firm A intends to pay $7 million cash for B, calculate the cost of this merger:

If Firm A intends to pay $7 million cash for B, calculate the cost of this merger:A) $2 million

B) $3 million

C) $1 million

D) none of the above cost = 7 - 5 = 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose that the market price of Company A is $50 per share and that of Company B is

$20) If A offers half a share of common stock for each share of B, the ratio of exchange of market prices would be:

A) 0.8

B) 1.25

C) 0.4

D) none of the above ratio = 25/20 = 1.25

$20) If A offers half a share of common stock for each share of B, the ratio of exchange of market prices would be:

A) 0.8

B) 1.25

C) 0.4

D) none of the above ratio = 25/20 = 1.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

28

The DOC Corporation with a book value of $20 million and a market value of $30 million has merged with the CIC Corporation with a book value of $6 million and a market value of

$8 million at a price of $9 million. If the transaction is a purchase will there be any goodwill, and if so, what is the amount of goodwill?

A) No goodwill; 0

B) Yes goodwill; 3

C) Yes goodwill; 1

D) Cannot be calculated with the information given

$8 million at a price of $9 million. If the transaction is a purchase will there be any goodwill, and if so, what is the amount of goodwill?

A) No goodwill; 0

B) Yes goodwill; 3

C) Yes goodwill; 1

D) Cannot be calculated with the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

29

Following an acquisition, the acquiring firm's balance sheet shows an asset labeled

"goodwill." What form of merger accounting is being used?

A) Consolidation

B) Aggregation

C) Purchase

D) None of the above

"goodwill." What form of merger accounting is being used?

A) Consolidation

B) Aggregation

C) Purchase

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

30

The following mergers have been blocked on antitrust grounds except:

A) Reynolds and Alcoa

B) Kroger and WinnDixie

C) Office Depot and Staples

D) AOL and Time Warner

A) Reynolds and Alcoa

B) Kroger and WinnDixie

C) Office Depot and Staples

D) AOL and Time Warner

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following factors influence the choice between merger and an acquisition of stock?

I. Shareholders are dealt with directly to bypass target management and board of directors

II. In a tender offer, usually some minority shareholders do not tender stopping complete firm absorption

III. Target management may be unfriendly and resist an offer. Resistance usually makes the stock price higher

A) I only

B) II only

C) III only

D) I, II, and III

I. Shareholders are dealt with directly to bypass target management and board of directors

II. In a tender offer, usually some minority shareholders do not tender stopping complete firm absorption

III. Target management may be unfriendly and resist an offer. Resistance usually makes the stock price higher

A) I only

B) II only

C) III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

32

Given the following data:

If Firm A offers 250,000 shares for B's shareholders, calculate the apparent cost of merger

A) $2 million

B) $3 million

C) $1 million

D) none of the above

If Firm A offers 250,000 shares for B's shareholders, calculate the apparent cost of merger

A) $2 million

B) $3 million

C) $1 million

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

33

The following are industries in which large mergers have been blocked on antitrust grounds are:

I. aerospace II) aluminum

III. telecoms

IV. supermarkets

V. video rentals

VI. office equipment

A) I, II and III only

B) I, II, III and IV only

C) I, II, III, IV and V only

D) I, II, III, IV, V and VI

I. aerospace II) aluminum

III. telecoms

IV. supermarkets

V. video rentals

VI. office equipment

A) I, II and III only

B) I, II, III and IV only

C) I, II, III, IV and V only

D) I, II, III, IV, V and VI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

34

If firms A is acquiring firm B and Bs shareholders are given the fraction "x" of the combined firm, then the cost of this merger is:

A) Cost = (PVAB) - (x) PVB

B) Cost = (x) PVAB - PVB

C) Cost = PVAB - (x) PVA

D) Cost = (x) PVAB - (x) PVB

A) Cost = (PVAB) - (x) PVB

B) Cost = (x) PVAB - PVB

C) Cost = PVAB - (x) PVA

D) Cost = (x) PVAB - (x) PVB

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

35

If an acquisition is made using cash payment then the acquisition is:

A) taxable

B) viewed as exchanging of shares and is not taxed

C) a tax-free transaction as no capital gains or losses are recognized

D) none of the above

A) taxable

B) viewed as exchanging of shares and is not taxed

C) a tax-free transaction as no capital gains or losses are recognized

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

36

Accounting changes by the Financial Accounting Standards Board (FASB) in the US:

A) eliminated the "purchase method," allowing only the "pooling-of-interests" method for mergers and acquisitions

B) eliminated the "pooling-of-interests" method, allowing only the "purchase method" for mergers and acquisitions

C) allow for both the "purchase method" and the "pooling-of-interests" method for mergers and acquisitions

D) none of the above

A) eliminated the "purchase method," allowing only the "pooling-of-interests" method for mergers and acquisitions

B) eliminated the "pooling-of-interests" method, allowing only the "purchase method" for mergers and acquisitions

C) allow for both the "purchase method" and the "pooling-of-interests" method for mergers and acquisitions

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

37

The acquisition of stock has the advantage of:

A) No shareholder meeting to vote is necessary

B) Minority shareholders may exist

C) Opening the bidding to others

D) All of the above

E) None of the above

A) No shareholder meeting to vote is necessary

B) Minority shareholders may exist

C) Opening the bidding to others

D) All of the above

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

38

What are the tax consequences of a taxable merger?

A) Selling shareholders can defer any capital gain until they sell their shares in the merged company

B) Depreciation tax shield is unchanged by merger

C) Selling shareholders must recognize any capital gain

D) Depreciable value of assets will remain unchanged

A) Selling shareholders can defer any capital gain until they sell their shares in the merged company

B) Depreciation tax shield is unchanged by merger

C) Selling shareholders must recognize any capital gain

D) Depreciable value of assets will remain unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

39

The PEN Corporation with a book value of $20 million and a market value of $30 million has merged with the CNC Corporation with a book value of $6 million and a market value of

$8 million at a price of $9 million. If the transaction is a purchase then the total assets on the books of the new company will be:

A) $38 million

B) $39 million

C) $29 million

D) $26 million

$8 million at a price of $9 million. If the transaction is a purchase then the total assets on the books of the new company will be:

A) $38 million

B) $39 million

C) $29 million

D) $26 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

40

When a merger of two firms is achieved by one firm automatically assuming all the assets and all the liabilities of the other firm; such a merger requires:

A) no shareholder meeting to vote is necessary.

B) the approval of at least 50% of the stockholders (or as specified by corporate charters or state laws) of each firm.

C) that the management of the two firms be tossed out.

D) none of the above.

A) no shareholder meeting to vote is necessary.

B) the approval of at least 50% of the stockholders (or as specified by corporate charters or state laws) of each firm.

C) that the management of the two firms be tossed out.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

41

The following are methods available to change the management of a firm

I. a successful proxy contest in which a group of shareholders vote in a new board of directors who then pick a new management team.

II. a takeover of one firm by another firm.

III. a leveraged buyout of the firm by a private group of investors.

A) I only

B) II and III only

C) I, II and III

D) I and III only

I. a successful proxy contest in which a group of shareholders vote in a new board of directors who then pick a new management team.

II. a takeover of one firm by another firm.

III. a leveraged buyout of the firm by a private group of investors.

A) I only

B) II and III only

C) I, II and III

D) I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

42

It appears that target companies capture most of the gains in hostile takeovers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

43

A dissident group solicits votes in an attempt to replace existing management. This is called a:

A) Proxy fight

B) Shareholder derivative action

C) Tender offer

D) Management freeze-out

A) Proxy fight

B) Shareholder derivative action

C) Tender offer

D) Management freeze-out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

44

Gain from mergers is defined as: Gain = PVAB - (PVA + PVB).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

45

Compensation paid to top management in the event of a takeover is called a:

A) Poison pill

B) Golden parachute

C) Self-tender

D) Buyout

A) Poison pill

B) Golden parachute

C) Self-tender

D) Buyout

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

46

As a defensive maneuver, a firm issues deep-discount bonds that are redeemable at par in the event of an unfriendly takeover. These bonds are an example of:

A) Greenmail

B) A "scorched earth" policy

C) Crown jewels

D) A poison put

A) Greenmail

B) A "scorched earth" policy

C) Crown jewels

D) A poison put

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

47

A vertical merger is one in which the buyer expands forward in the direction of the ultimate consumer or backward toward the source of raw material.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

48

A modification of the corporate charter that requires 80% shareholder approval for takeover is called a(n):

A) Repurchase standstill provision

B) Exclusionary self-tender

C) Super majority amendment

D) Tender offer

A) Repurchase standstill provision

B) Exclusionary self-tender

C) Super majority amendment

D) Tender offer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

49

An example of a shark-repellent charter amendment is:

I. Supermajority

II. Waiting period

III. Restricted voting rights

IV. Staggered board

A) I only

B) II only

C) I and II only

D) I, II, III, and IV

I. Supermajority

II. Waiting period

III. Restricted voting rights

IV. Staggered board

A) I only

B) II only

C) I and II only

D) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

50

The easiest task for the managers is the integration of the two firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

51

Two companies should consider a merger if they have complementary resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

52

If Firm A acquires Firm B for cash, then the cost of the merger is equal to the cash payment minus B's value as a separate entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

53

The following are pre-offer defenses: litigation, asset structuring and liability structuring.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

54

A conglomerate merger is one in which a buyer buys a closely related firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

55

Takeover defenses are designed to benefit

A) Stockholders

B) Workers

C) Creditors

D) Managers

A) Stockholders

B) Workers

C) Creditors

D) Managers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

56

The would-be acquirer making a tender offer directly to shareholders is another form of proxy fight.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

57

A poison pill protects the rights of shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

58

A poison pill defense is implemented by

A) Giving stock away

B) Selling firm assets

C) Issuing rights at a cheap price

D) Adding seats to the board of directors

A) Giving stock away

B) Selling firm assets

C) Issuing rights at a cheap price

D) Adding seats to the board of directors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

59

In the purchase method of merger accounting a new asset category called goodwill is created.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

60

Diversification is a very sensible reason for two companies to merge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

61

Name the agencies that have successfully blocked mergers on antitrust (anti-monopoly)

grounds.

grounds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

62

Briefly discuss different forms of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

63

Briefly explain the term "economies of scale."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

64

Briefly discuss takeover defenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

65

Discuss the difficulties associated with a typical merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

66

Who gains most in mergers?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

67

Explain the central tenet of the Clayton Act of 1914.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

68

Who are anti-takeover defenses designed to protect?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

69

Briefly explain what is meant by "the Cost of acquiring" in the context of a merger?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

70

Supermajorities give shareholders more control over the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

71

Briefly explain some of the good motives for mergers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

72

Briefly explain the different types of mergers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

73

Briefly explain what is meant by economic gain from merger?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck