Deck 3: Reporting Operating Results on the Income Statement

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/137

العب

ملء الشاشة (f)

Deck 3: Reporting Operating Results on the Income Statement

1

When a business receives a payment on account from a customer, the total assets of the business are unchanged.

True

2

Costs that benefit future periods are reported as assets.

True

3

Dividing up the continuing life of a company into shorter periods is called the time period assumption.

True

4

Unearned Revenue is an alternative name for the stockholders' equity account typically known as Retained

Earnings.

Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

5

All revenues come from selling the company's goods or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

6

If revenues are not growing faster than expenses, then Net Income will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

7

Revenue and Expense accounts are subcategories of Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

8

Unearned Revenue is a liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

9

The period of time from buying goods and services to collecting cash from customers is called the operating cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

10

GAAP does not allow cash basis accounting to be used in external financial reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

11

Net Income on the Income Statement is equal to the amount of cash generated by the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a company decides to record an expenditure made this period as an expense, when it should have been recorded as an asset, net income will be overstated in the current period as a result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

13

In any given industry, companies are entirely consistent in the account titles they use on financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

14

When expenses exceed revenues in a period, stockholders' equity will be increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

15

Unearned Revenue is reported on the Balance Sheet as a liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

16

A company does not need to record the receipt of a bill for utilities used during this year if they will not pay for it until next year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

17

Net Income would be understated by a failure to record collection of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

18

All operating activities increase a company's resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

19

Revenues represent decreases in stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

20

Expenses are the same as expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following would not be associated with an expense?

A) Using supplies.

B) Paying off an account payable.

C) Paying for electricity used by production equipment.

D) Paying wages for production workers.

A) Using supplies.

B) Paying off an account payable.

C) Paying for electricity used by production equipment.

D) Paying wages for production workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following items is not a specific account in a company's chart of accounts?

A) Income Tax Expense.

B) Sales Revenue.

C) Unearned Revenue.

D) Net Income.

A) Income Tax Expense.

B) Sales Revenue.

C) Unearned Revenue.

D) Net Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements regarding revenues and expenses is true?

A) Both revenues and expenses typically have credit balances.

B) Revenues and expenses are considered assets and liabilities, respectively.

C) Revenue is the same as Cash.

D) Expenses decrease the amount of stockholders' equity.

A) Both revenues and expenses typically have credit balances.

B) Revenues and expenses are considered assets and liabilities, respectively.

C) Revenue is the same as Cash.

D) Expenses decrease the amount of stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements regarding cash and accrual accounting is true?

A) If payment is received at the same time a service is produced and sold, there is no difference between how cash and accrual accounting record the transaction.

B) The cash basis of accounting works best when a lengthy delay exists between the timing of cash flows and the underlying business activities to which they relate.

C) If a company receives a bill for rent for the period and decides to delay payment, the rent will not be recorded as an expense according to the accrual model of accounting.

D) The cash basis of accounting would record unearned revenue if a company received a deposit in advance of services to be rendered by the company.

A) If payment is received at the same time a service is produced and sold, there is no difference between how cash and accrual accounting record the transaction.

B) The cash basis of accounting works best when a lengthy delay exists between the timing of cash flows and the underlying business activities to which they relate.

C) If a company receives a bill for rent for the period and decides to delay payment, the rent will not be recorded as an expense according to the accrual model of accounting.

D) The cash basis of accounting would record unearned revenue if a company received a deposit in advance of services to be rendered by the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

25

During June, the Grass is Greener Company mows 100 lawns a week; the company was paid in advance during May by those customers. The company uses the accrual basis of accounting. How will these events affect the company's financial statements?

A) The income statement shows the effects of the transactions in May.

B) The income statement shows the effects of the transactions in June.

C) The balance sheet shows no effect from the transactions in May.

D) The transactions have no effect on the balance sheet.

A) The income statement shows the effects of the transactions in May.

B) The income statement shows the effects of the transactions in June.

C) The balance sheet shows no effect from the transactions in May.

D) The transactions have no effect on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

26

How many of the following statements regarding the revenue recognition and matching principles are true?

According to the revenue principle, a company should not record the revenue from a transaction until it is actually received in cash.

To ensure revenue reporting is consistent over time, a business adopts a revenue recognition policy that defines the time at which they report revenues from providing goods or services to customers.

The matching principle requires that expenses be determined first and then revenues be "matched" to those expenses.

A) None

B) One

C) Two

D) Three

According to the revenue principle, a company should not record the revenue from a transaction until it is actually received in cash.

To ensure revenue reporting is consistent over time, a business adopts a revenue recognition policy that defines the time at which they report revenues from providing goods or services to customers.

The matching principle requires that expenses be determined first and then revenues be "matched" to those expenses.

A) None

B) One

C) Two

D) Three

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

27

How many of the following statements regarding the trial balance are true?

A trial balance is included in the full set of external financial statements, just like an income statement.

If debits equal credits in the unadjusted trial balance, you have made no errors in preparing and posting journal entries.

The balances for each account reported on an unadjusted trial balance are determined by adding the amounts on the "+" side and subtracting the amounts on the "-" side of each ledger or T-account.

A) None

B) One

C) Two

D) Three

A trial balance is included in the full set of external financial statements, just like an income statement.

If debits equal credits in the unadjusted trial balance, you have made no errors in preparing and posting journal entries.

The balances for each account reported on an unadjusted trial balance are determined by adding the amounts on the "+" side and subtracting the amounts on the "-" side of each ledger or T-account.

A) None

B) One

C) Two

D) Three

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

28

Costs are said to have been "capitalized" when:

A) they are financed by the company.

B) they are recorded as assets.

C) the company calculates the worth of the asset based on the revenue generated.

D) they are recorded as expenses

A) they are financed by the company.

B) they are recorded as assets.

C) the company calculates the worth of the asset based on the revenue generated.

D) they are recorded as expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

29

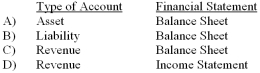

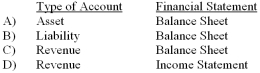

Time Warner is a publishing and communications company, specializing in magazines, cable television operation, television program development, and other telecommunication services. Its financial statements show $37,666 in an account called "Unearned Subscriber Revenue," which represents amounts that customers have paid in advance of receiving magazines, cable television, and internet services. What type of account is this and

On what statement is it reported?

A) Option A

B) Option B

C) Option C

D) Option D

On what statement is it reported?

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

30

During November 2010, Asler Inc., performs consulting services. The client does not pay Asler until January, 2011.

A) Using the accrual basis of accounting, the revenue is reported in January 2011.

B) Using the cash basis of accounting, the revenue is reported in November 2010.

C) Using the accrual basis of accounting, the revenue is reported in November 2010.

D) Using the accrual basis of accounting, the revenue is reported when Asler's expenses are paid.

A) Using the accrual basis of accounting, the revenue is reported in January 2011.

B) Using the cash basis of accounting, the revenue is reported in November 2010.

C) Using the accrual basis of accounting, the revenue is reported in November 2010.

D) Using the accrual basis of accounting, the revenue is reported when Asler's expenses are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

31

During June, the Grass is Greener Company mows 100 lawns a week and is paid in July by those customers. The company uses the accrual basis of accounting. How will these events affect the company's financial statements?

A) The income statement shows the effects of the transactions in June.

B) The income statement shows the effects of the transactions in July.

C) The balance sheet shows no effect from the transactions in June.

D) The transactions have no effect on the balance sheet.

A) The income statement shows the effects of the transactions in June.

B) The income statement shows the effects of the transactions in July.

C) The balance sheet shows no effect from the transactions in June.

D) The transactions have no effect on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

32

Your company bought a 30-second advertisement that aired during the Super Bowl at a cost of $1.2 million. It is legally obligated to pay for the ad but has not yet done so. How does the purchase and use of the ad time affect your company's balance sheet?

A) It increases both assets and liabilities by $1.2 million.

B) It increases assets and decreases stockholders' equity by $1.2 million each.

C) It does not affect the balance sheet.

D) It increases liabilities and decreases stockholders' equity by $1.2 million each.

A) It increases both assets and liabilities by $1.2 million.

B) It increases assets and decreases stockholders' equity by $1.2 million each.

C) It does not affect the balance sheet.

D) It increases liabilities and decreases stockholders' equity by $1.2 million each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is an expense of this period?

A) Costs of items used up this period but paid for next period.

B) Costs of items paid for in this period but used up next period.

C) Cost of land purchased and paid for this period.

D) Repayment of debt from a loan in a prior period.

A) Costs of items used up this period but paid for next period.

B) Costs of items paid for in this period but used up next period.

C) Cost of land purchased and paid for this period.

D) Repayment of debt from a loan in a prior period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

34

How many of the following statements regarding the debit/credit processing of revenues and expenses are true?

Debits reduce expenses.

The total credits recorded in revenue accounts must equal the total debits recorded in expense accounts.

Across all revenue accounts, the total value of all debits must equal the total value of all credits.

A) None

B) One

C) Two

D) Three

Debits reduce expenses.

The total credits recorded in revenue accounts must equal the total debits recorded in expense accounts.

Across all revenue accounts, the total value of all debits must equal the total value of all credits.

A) None

B) One

C) Two

D) Three

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following represents a subtotal rather than an account?

A) Advertising Expense.

B) Service Revenue.

C) Supplies Expense.

D) Total Revenues.

A) Advertising Expense.

B) Service Revenue.

C) Supplies Expense.

D) Total Revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is Melody's Net Income for May using the accrual basis of accounting?

A) $250

B) $300

C) $350

D) $600

A) $250

B) $300

C) $350

D) $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

37

How many of the following statements regarding the accrual and cash basis of accounting are true?

Using the accrual basis of accounting, if payment is received before delivery of a good or service, a liability is recorded at the time the payment is received.

Using the accrual basis of accounting, if payment is received after delivery of a good or service, an asset is recorded at the time the good or service was delivered.

Generally accepted accounting principles require the accrual basis of accounting to be used for external financial reporting purposes.

A) None

B) One

C) Two

D) Three

Using the accrual basis of accounting, if payment is received before delivery of a good or service, a liability is recorded at the time the payment is received.

Using the accrual basis of accounting, if payment is received after delivery of a good or service, an asset is recorded at the time the good or service was delivered.

Generally accepted accounting principles require the accrual basis of accounting to be used for external financial reporting purposes.

A) None

B) One

C) Two

D) Three

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

38

Net Income refers to:

A) The difference between what was earned and the costs incurred during a period.

B) The difference between the cash received and the cash paid out during a period.

C) The difference between what is owned and what is owed at a point in time.

D) The change in the value of the company during a period.

A) The difference between what was earned and the costs incurred during a period.

B) The difference between the cash received and the cash paid out during a period.

C) The difference between what is owned and what is owed at a point in time.

D) The change in the value of the company during a period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Fastbank Motorcycle Service Company (FMSC) wins a $10 million bid to provide the repair service for a recall on a popular brand of motorcycles. No money changes hands. The repairs are expected to take place next quarter. How will these events affect the balance sheet?

A) Accounts Receivable will increase by $10 million this quarter and Inventories will decrease next quart er.

B) Both Accounts Receivable and Accounts Payable will increase by $10 million this quarter.

C) Both Accounts Receivable and Stockholders' Equity will increase by $10 million this quarter.

D) These events will not impact the balance sheet this quarter.

A) Accounts Receivable will increase by $10 million this quarter and Inventories will decrease next quart er.

B) Both Accounts Receivable and Accounts Payable will increase by $10 million this quarter.

C) Both Accounts Receivable and Stockholders' Equity will increase by $10 million this quarter.

D) These events will not impact the balance sheet this quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

40

During April, the Grass is Greener Company buys and pays for a six-month supply of fertilizer in order to receive a bulk discount. The cost of fertilizer is recorded:

A) immediately as an expense.

B) as a liability, which will later be reduced as the fertilizer used.

C) partially as an expense and partially as a liability.

D) as an asset, which will later be reduced as the fertilizer is used.

A) immediately as an expense.

B) as a liability, which will later be reduced as the fertilizer used.

C) partially as an expense and partially as a liability.

D) as an asset, which will later be reduced as the fertilizer is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is true about expenses?

A) Expenses are not reported if they are not paid.

B) Expenses are reported in the period in which they are incurred to generate revenue.

C) Expenses increase stockholders' equity.

D) Expenses are only reported in the period they are paid

A) Expenses are not reported if they are not paid.

B) Expenses are reported in the period in which they are incurred to generate revenue.

C) Expenses increase stockholders' equity.

D) Expenses are only reported in the period they are paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

42

Company A receives $10,000 in advance this month for work to be performed next mo nth. This month, the company should:

A) Debit Cash $10,000 and credit Service Revenue $10,000.

B) Debit Cash $10,000 and credit Unearned Revenue $10,000.

C) Debit Cash $10,000 and credit Accounts Payable $10,000.

D) Debit Accounts Payable $10,000 and credit Cash $10,000.

A) Debit Cash $10,000 and credit Service Revenue $10,000.

B) Debit Cash $10,000 and credit Unearned Revenue $10,000.

C) Debit Cash $10,000 and credit Accounts Payable $10,000.

D) Debit Accounts Payable $10,000 and credit Cash $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

43

Customers paid $8,000 on their accounts. Which accounts are affected by this transaction?

A) Revenue and Retained Earnings increase $8,000.

B) Cash and Revenue increase $8,000. Liabilities and Expense increase $8,000.

C) Cash increases $8,000 and Accounts Receivable decreases $8,000. Revenue and Retained Earnings are unchanged.

D) Cash and Retained Earnings increase $8,000.

A) Revenue and Retained Earnings increase $8,000.

B) Cash and Revenue increase $8,000. Liabilities and Expense increase $8,000.

C) Cash increases $8,000 and Accounts Receivable decreases $8,000. Revenue and Retained Earnings are unchanged.

D) Cash and Retained Earnings increase $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

44

Your company receives advance payment in October for services that are provided during November. Which of the following is true?

A) A liability is recorded in October; in November the liability is reduced and revenue is recorded.

B) Revenue is recorded in October and expenses are recorded in November.

C) An asset is recorded in October; in November, the asset is reduced and revenue is recorded.

D) Revenue and expenses are recorded in October.

A) A liability is recorded in October; in November the liability is reduced and revenue is recorded.

B) Revenue is recorded in October and expenses are recorded in November.

C) An asset is recorded in October; in November, the asset is reduced and revenue is recorded.

D) Revenue and expenses are recorded in October.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

45

If a company is paid in full for services provided this month, how will the basic accounting equation be affected?

A) Liabilities will decrease.

B) Stockholders' equity will increase as revenue is recorded.

C) Liabilities will increase.

D) Assets will decrease.

A) Liabilities will decrease.

B) Stockholders' equity will increase as revenue is recorded.

C) Liabilities will increase.

D) Assets will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

46

In October, your company prepays rent of $7,000 for November and December. Which of the following describes the effects of this transaction in October?

A) Assets decrease $7,000 and liabilities decrease $7,000.

B) Assets increase $7,000 and stockholders' equity increases $7,000.

C) There is no change to total assets, liabilities or stockholders' equity.

D) Liabilities decrease $7,000 and stockholders' equity increases $7,000.

A) Assets decrease $7,000 and liabilities decrease $7,000.

B) Assets increase $7,000 and stockholders' equity increases $7,000.

C) There is no change to total assets, liabilities or stockholders' equity.

D) Liabilities decrease $7,000 and stockholders' equity increases $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

47

Cansing Company collected $5,000 from a customer on account. What journal entry will Cansing record?

A) Debit Cash, credit Accounts Receivable.

B) Debit Cash, credit Revenue.

C) Debit Accounts Receivable, credit Revenue.

D) Debit Accounts Receivable, credit Cash.

A) Debit Cash, credit Accounts Receivable.

B) Debit Cash, credit Revenue.

C) Debit Accounts Receivable, credit Revenue.

D) Debit Accounts Receivable, credit Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following would eventually cause a reduction in retained earnings?

A) Receiving contributions from investors.

B) Earning unearned revenue.

C) Billing customers for services provided.

D) Using up supplies.

A) Receiving contributions from investors.

B) Earning unearned revenue.

C) Billing customers for services provided.

D) Using up supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

49

During March, the Long Life Consulting Company provides $23,000 in consulting services of which $12,000 is immediately paid for and $11,000 is on account.

A) Cash increases $12,000, revenue increases $11,000, and contributed capital increases $23,000.

B) Cash increases $12,000, Accounts Receivable increases $11,000, and revenues increase $23,000.

C) Accounts Receivable increases $11,000, liabilities decrease $12,000, and stockholders' equity decreases $1,000.

D) Revenues increase $12,000, liabilities decrease $12,000, and stockholders' equity is unchanged.

A) Cash increases $12,000, revenue increases $11,000, and contributed capital increases $23,000.

B) Cash increases $12,000, Accounts Receivable increases $11,000, and revenues increase $23,000.

C) Accounts Receivable increases $11,000, liabilities decrease $12,000, and stockholders' equity decreases $1,000.

D) Revenues increase $12,000, liabilities decrease $12,000, and stockholders' equity is unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

50

West Corporation issued a $1,000 gift certificate. What journal entry will West Corporation record?

A) Debit Cash, credit Sales Revenue.

B) Debit Cash, credit Unearned Revenue.

C) Debit Unearned Revenues, credit Cash.

D) Debit Accounts Receivable, credit Cash.

A) Debit Cash, credit Sales Revenue.

B) Debit Cash, credit Unearned Revenue.

C) Debit Unearned Revenues, credit Cash.

D) Debit Accounts Receivable, credit Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is not true concerning requirements of when a company should recognize revenue?

A) When delivery has occurred or services have been provided (rendered).

B) When the price is fixed or determinable.

C) When there is persuasive evidence of an arrangement for customer payment and collection is reasonably assured.

D) When cash has been received for services rendered.

A) When delivery has occurred or services have been provided (rendered).

B) When the price is fixed or determinable.

C) When there is persuasive evidence of an arrangement for customer payment and collection is reasonably assured.

D) When cash has been received for services rendered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is true?

A) Credits increase both assets and liabilities.

B) Credits increase assets and decrease liabilities.

C) Credits increase liabilities and decrease assets.

D) Credits decrease both assets and liabilities.

A) Credits increase both assets and liabilities.

B) Credits increase assets and decrease liabilities.

C) Credits increase liabilities and decrease assets.

D) Credits decrease both assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following would most likely be reported as an asset?

A) Service Revenue.

B) Wages.

C) Prepaid Rent.

D) Unearned Revenue.

A) Service Revenue.

B) Wages.

C) Prepaid Rent.

D) Unearned Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

54

Galvan Corporation (GC) capitalized a $20,000 automobile. Which of the following is true?

A) GC recorded a liability for $20,000.

B) GC recorded an asset for $20,000.

C) GC recorded an expense for $20,000.

D) GC recorded Contributed Capital for $20,000.

A) GC recorded a liability for $20,000.

B) GC recorded an asset for $20,000.

C) GC recorded an expense for $20,000.

D) GC recorded Contributed Capital for $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

55

Your company orders and receives supplies in January, pays for them in February, provides services that use those goods up in March and is paid by customers in April. Using the accrual basis of accounting:

A) expenses are recorded in February and revenues are recorded in April.

B) expenses are recorded in February and revenues are recorded in March.

C) expenses and revenues are recorded in March.

D) expenses are recorded in January and revenues are recorded in April.

A) expenses are recorded in February and revenues are recorded in April.

B) expenses are recorded in February and revenues are recorded in March.

C) expenses and revenues are recorded in March.

D) expenses are recorded in January and revenues are recorded in April.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

56

If a company provides a service and receives payment at the same time:

A) more than one journal entry is needed.

B) Cash will be credited.

C) a revenue account will be increased with a debit.

D) stockholders' equity will increase.

A) more than one journal entry is needed.

B) Cash will be credited.

C) a revenue account will be increased with a debit.

D) stockholders' equity will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

57

When a customer buys services on account, it should be recorded by the company as:

A) a debit to Cash and a credit to Accounts Receivable.

B) a debit to Accounts Receivable and a credit to Revenue.

C) a credit to Unearned Revenue and a debit to Inventory.

D) a debit to Cash and a credit to Accounts Payable.

A) a debit to Cash and a credit to Accounts Receivable.

B) a debit to Accounts Receivable and a credit to Revenue.

C) a credit to Unearned Revenue and a debit to Inventory.

D) a debit to Cash and a credit to Accounts Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is a true statement?

A) Revenue accounts are a subset of assets, and expense accounts are a subset of liabilities.

B) Both revenue accounts and expense accounts are subsets of contributed capital.

C) Both revenue accounts and expense accounts are subsets of retained earnings.

D) Revenue accounts are a subset of cash, and expense accounts are a subset of accounts payable.

A) Revenue accounts are a subset of assets, and expense accounts are a subset of liabilities.

B) Both revenue accounts and expense accounts are subsets of contributed capital.

C) Both revenue accounts and expense accounts are subsets of retained earnings.

D) Revenue accounts are a subset of cash, and expense accounts are a subset of accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

59

A customer purchased $1,500 of services on credit two months ago and has just paid the bill. The receipt of the payment from the customer is recorded as a

A) debit to Cash and a credit to Accounts Receivable.

B) debit to Cash and a credit to Accounts Payable.

C) debit to Expenses and a credit to Revenue.

D) debit to Accounts Receivable and a credit to Retained Earnings.

A) debit to Cash and a credit to Accounts Receivable.

B) debit to Cash and a credit to Accounts Payable.

C) debit to Expenses and a credit to Revenue.

D) debit to Accounts Receivable and a credit to Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

60

Your company received payment last month for a service that you provided this month. How will the business activity of the current month affect the basic accounting equation?

A) Assets will not change; liabilities (Unearned Revenue) will decrease; and stockholders' equity (Service Revenue) will increase.

B) Assets (Cash) will increase, liabilities (Unearned Revenue) will increase, and stockholders' equity will not change.

C) Assets (Cash) will increase, liabilities will not change, and stockholders' equity (Service Revenue) will increase.

D) Assets (Prepaid Expenses) will decrease, liabilities will not change, and stockholders' equity (Service

A) Assets will not change; liabilities (Unearned Revenue) will decrease; and stockholders' equity (Service Revenue) will increase.

B) Assets (Cash) will increase, liabilities (Unearned Revenue) will increase, and stockholders' equity will not change.

C) Assets (Cash) will increase, liabilities will not change, and stockholders' equity (Service Revenue) will increase.

D) Assets (Prepaid Expenses) will decrease, liabilities will not change, and stockholders' equity (Service

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is an example of an error that would cause the trial balance to be out of balance?

A) A journal entry was posted as a debit to Cash for $525 and credited to Accounts Receivable for $552.

B) A journal entry was posted as a debit to Cash and a credit to Sales Revenue when the company received a customer payment on account.

C) A journal entry was posted as a credit to Wages Expense and a debit to Wages Payable.

D) A transaction was not recorded at all.

A) A journal entry was posted as a debit to Cash for $525 and credited to Accounts Receivable for $552.

B) A journal entry was posted as a debit to Cash and a credit to Sales Revenue when the company received a customer payment on account.

C) A journal entry was posted as a credit to Wages Expense and a debit to Wages Payable.

D) A transaction was not recorded at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

62

This month, Grass is Greener Lawn Service pays cash for $4,000 of grass fertilizer to be used two months from now. What journal entry will Grass is Greener record this month?

A) Debit cash for $4,000 and credit supplies expense for $4,000.

B) Debit supplies expense for $4,000 and credit accounts payable for $4,000.

C) Debit supplies for $4,000 and credit cash for $4,000.

D) Debit retained earnings for $4,000 and credit accounts payable for $4,000.

A) Debit cash for $4,000 and credit supplies expense for $4,000.

B) Debit supplies expense for $4,000 and credit accounts payable for $4,000.

C) Debit supplies for $4,000 and credit cash for $4,000.

D) Debit retained earnings for $4,000 and credit accounts payable for $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company's revenue recognition policy:

A) affects the income statement but not the balance sheet.

B) defines when its revenue should be collected.

C) is usually described in the notes to a company's financial statements.

D) states that revenues should not be recorded until payments are received from customers.

A) affects the income statement but not the balance sheet.

B) defines when its revenue should be collected.

C) is usually described in the notes to a company's financial statements.

D) states that revenues should not be recorded until payments are received from customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

64

In January, the Caribbean Dream Resort books and accepts a cash payment for $32,000 for vacation services to be provided during spring break in March. The $32,000 would be recorded during January as a:

A) debit to Cash and a credit to Unearned Revenue.

B) debit to Accounts Payable and a credit to Service Revenue.

C) credit to Accounts Receivable and a credit to Service Revenue.

D) credit to Service Revenue and a debit to Prepaid Expenses.

A) debit to Cash and a credit to Unearned Revenue.

B) debit to Accounts Payable and a credit to Service Revenue.

C) credit to Accounts Receivable and a credit to Service Revenue.

D) credit to Service Revenue and a debit to Prepaid Expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

65

Sparkling Pools provides $1,000 of pool maintenance services during July and collects payment in August. The company performs $1,600 of pool maintenance services during July that were paid for in June. The company accepts an order to perform $500 of pool maintenance services in August and will be paid in the same month. Revenue should be credited for:

A) $1,600 in June, $1,000 in July, and $500 in August.

B) $1,600 in June, $0 in July, and $1,500 in August.

C) $0 in June, $1,600 in July, and $1,500 in August.

D) $0 in June, $2,600 in July, and $500 in August.

A) $1,600 in June, $1,000 in July, and $500 in August.

B) $1,600 in June, $0 in July, and $1,500 in August.

C) $0 in June, $1,600 in July, and $1,500 in August.

D) $0 in June, $2,600 in July, and $500 in August.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

66

In January, the Huntington Beach Resort (HBR) accepts your reservation and receives your $2,000 payment for a week of sun and fun in California during spring break. The $2,000 would be recorded by HBR during January as a debit to:

A) Cash and a credit to Unearned Revenue.

B) Accounts Payable and a credit to Service Revenue.

C) Cash and a credit to Service Revenue.

D) Service Revenue and a credit to Cash.

A) Cash and a credit to Unearned Revenue.

B) Accounts Payable and a credit to Service Revenue.

C) Cash and a credit to Service Revenue.

D) Service Revenue and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

67

Trudy's Café paid employees $50,000 in September for work done that month. What journal entry will Trudy's record in September, assuming Trudy's did not owe any amounts to employees at the end of August?

A) Debit Cash, credit Wages Revenue.

B) Debit Cash, credit Wages Payable.

C) Debit Wages Revenue, credit Cash.

D) Debit Wages Expense, credit Cash.

A) Debit Cash, credit Wages Revenue.

B) Debit Cash, credit Wages Payable.

C) Debit Wages Revenue, credit Cash.

D) Debit Wages Expense, credit Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

68

Austin Insurance (AI) earned $10,000 revenue for services provided. Which of the following is correct?

A) AI would credit Accounts Receivable, regardless of the timing of cash receipts.

B) AI would credit Accounts Receivable, but only if cash has not been received.

C) AI would credit Revenue, regardless of the timing of cash receipts.

D) AI would credit Revenue, but only if cash has been received.

A) AI would credit Accounts Receivable, regardless of the timing of cash receipts.

B) AI would credit Accounts Receivable, but only if cash has not been received.

C) AI would credit Revenue, regardless of the timing of cash receipts.

D) AI would credit Revenue, but only if cash has been received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

69

In September, a customer signed a contract to have his house painted and paid for the job in October. The painting company bought the paint in August on account and paid for it in September. The painting company painted the house in November. According to the revenue and matching principles, the painting company should record:

A) the revenues in November and the expenses in September.

B) the revenues and the expenses in September.

C) the revenues and the expenses in November.

D) the revenues in September and the expenses in August.

A) the revenues in November and the expenses in September.

B) the revenues and the expenses in September.

C) the revenues and the expenses in November.

D) the revenues in September and the expenses in August.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

70

This month, a company performed $517,000 of services and incurred total expenses of $438,000. If the company was paid in cash for all its services and paid cash for all its expenses, these transactions would cau se:

A) revenues to increase $517,000, expenses to increase $438,000, and retained earnings to decrease $79,000.

B) cash to increase $517,000, expenses to increase $438,000, and contributed capital to increase $79,000.

C) revenues to increase $517,000, expenses to increase $438,000, and cash to increase $79,000.

D) revenues to increase $79,000, expenses to increase $438,000, and cash to increase $517,000.

A) revenues to increase $517,000, expenses to increase $438,000, and retained earnings to decrease $79,000.

B) cash to increase $517,000, expenses to increase $438,000, and contributed capital to increase $79,000.

C) revenues to increase $517,000, expenses to increase $438,000, and cash to increase $79,000.

D) revenues to increase $79,000, expenses to increase $438,000, and cash to increase $517,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

71

On October 10, a company paid $12,000 to its suppliers, of which $2,000 was for supplies received on October 10 and $10,000 was for supplies received and recorded during September. The $12,000 payment would be recorded as a:

A) $10,000 debit to Supplies, a $2,000 debit to Accounts Payable, and a $12,000 credit to Cash.

B) $12,000 debit to Supplies and a $12,000 credit to Cash.

C) $12,000 debit to Supplies Expense and a $12,000 credit to Cash.

D) $2,000 debit to Supplies, a $10,000 debit to Accounts Payable, and a $12,000 credit to Cash.

A) $10,000 debit to Supplies, a $2,000 debit to Accounts Payable, and a $12,000 credit to Cash.

B) $12,000 debit to Supplies and a $12,000 credit to Cash.

C) $12,000 debit to Supplies Expense and a $12,000 credit to Cash.

D) $2,000 debit to Supplies, a $10,000 debit to Accounts Payable, and a $12,000 credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

72

An increase in revenue will always:

A) increase stockholders' equity.

B) increase assets.

C) decrease stockholders' equity.

D) decrease assets.

A) increase stockholders' equity.

B) increase assets.

C) decrease stockholders' equity.

D) decrease assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following journal entries would decrease stockholders' equity?

A) Debiting Prepaid Insurance and crediting Cash.

B) Debiting Unearned Revenue and crediting Revenue.

C) Debiting Supplies and crediting Accounts Payable.

D) Debiting Insurance Expense and crediting Cash

A) Debiting Prepaid Insurance and crediting Cash.

B) Debiting Unearned Revenue and crediting Revenue.

C) Debiting Supplies and crediting Accounts Payable.

D) Debiting Insurance Expense and crediting Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

74

On the 15th of the month, a company receives $8,000 in payments from customers. $1,000 is for services performed on that day and the remaining is payment for services performed in the previous month. The $8,000 cash receipt would be recorded as a:

A) debit of $7,000 to Accounts Receivable, debit of $1,000 to Service Revenue, and a credit of $8,000 to Cash.

B) debit of $8,000 to Cash, a credit of $7,000 to Accounts Receivable, and a credit of $1,000 to Service Revenue.

C) debit of $7,000 to Accounts Receivable, a debit of $1,000 to Unearned Revenue, and a credit of $8,000 to Cash.

D) debit of $8,000 to Cash, debit of $1,000 to Service Revenue, and a credit of $7,000 to Accounts Receivable.

A) debit of $7,000 to Accounts Receivable, debit of $1,000 to Service Revenue, and a credit of $8,000 to Cash.

B) debit of $8,000 to Cash, a credit of $7,000 to Accounts Receivable, and a credit of $1,000 to Service Revenue.

C) debit of $7,000 to Accounts Receivable, a debit of $1,000 to Unearned Revenue, and a credit of $8,000 to Cash.

D) debit of $8,000 to Cash, debit of $1,000 to Service Revenue, and a credit of $7,000 to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

75

Sparkling Pools received a bill for $1,200 for running newspaper ads during the last two weeks of July; the bill will be paid on August 1. Advertising expense should be:

A) credited for $1,200 in July.

B) credited for $1,200 in August.

C) debited for $1,200 in July.

D) debited for $1,200 in August.

A) credited for $1,200 in July.

B) credited for $1,200 in August.

C) debited for $1,200 in July.

D) debited for $1,200 in August.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

76

The unadjusted trial balance:

A) is a preliminary financial statement for external and internal users.

B) generally lists account names in alphabetical order.

C) is created to determine that total debits equal total credits.

D) indicates whether or not errors were made in recording transactions.

A) is a preliminary financial statement for external and internal users.

B) generally lists account names in alphabetical order.

C) is created to determine that total debits equal total credits.

D) indicates whether or not errors were made in recording transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which account is least likely to be credited when an expense is recorded?

A) Cash.

B) Accounts Payable.

C) Prepaid Expenses.

D) Accounts Receivable.

A) Cash.

B) Accounts Payable.

C) Prepaid Expenses.

D) Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

78

In January, a company pays for advertising space in the local paper for ads to be run during the months of January, February, and March at $1,500 a month. The payment would be recorded in January as a:

A) debit of $4,500 to Cash, a credit of $1,500 to Advertising Expense, and a credit of $3,000 to Prepaid Advertising.

B) debit of $4,500 to Accounts Payable and a credit of $4,500 to Cash.

C) debit of $4,500 to Accounts Payable and a credit of $4,500 to Stockholders' Equity.

D) debit of $1,500 to Advertising Expense, a debit of $3,000 to Prepaid Advertising, and a credit of $4,500 to

A) debit of $4,500 to Cash, a credit of $1,500 to Advertising Expense, and a credit of $3,000 to Prepaid Advertising.

B) debit of $4,500 to Accounts Payable and a credit of $4,500 to Cash.

C) debit of $4,500 to Accounts Payable and a credit of $4,500 to Stockholders' Equity.

D) debit of $1,500 to Advertising Expense, a debit of $3,000 to Prepaid Advertising, and a credit of $4,500 to

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following groups of accounts contains only those that normally have credit balances?

A) Accounts Payable; Retained Earnings; Service Revenue.

B) Equipment; Cash; Contributed Capital.

C) Notes Payable; Wages Payable; Rent Expense.

D) Accounts receivable, Retained earnings, Cash

A) Accounts Payable; Retained Earnings; Service Revenue.

B) Equipment; Cash; Contributed Capital.

C) Notes Payable; Wages Payable; Rent Expense.

D) Accounts receivable, Retained earnings, Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is not true about the unadjusted trial balance?

A) An unadjusted trial balance may only include a preliminary amount for income tax expense.

B) An unadjusted trial balance might balance even if there is a mistake.

C) An unadjusted trial balance does not yet include end-of-the-accounting period adjustments.

D) An unadjusted trial balance is part of the financial statements issued to external decision makers

A) An unadjusted trial balance may only include a preliminary amount for income tax expense.

B) An unadjusted trial balance might balance even if there is a mistake.

C) An unadjusted trial balance does not yet include end-of-the-accounting period adjustments.

D) An unadjusted trial balance is part of the financial statements issued to external decision makers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck