Deck 12: Reporting and Interpreting the Statement of Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/143

العب

ملء الشاشة (f)

Deck 12: Reporting and Interpreting the Statement of Cash Flows

1

The statement of cash flows explains the difference between the beginning and ending balances of cash and cash equivalents.

True

2

When calculating net cash flow from financing activities using the direct method, a company must convert interest expense to cash paid for interest.

False

3

Significant noncash financing and investing activities are not reported on the statement of cash flows since they do not represent a cash flow.

False

4

Major investing and financing activities that do not involve cash do not have to be reported on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

5

When preparing the operating activities section of the statement of cash flows using the indirect method, an increase in income taxes payable is added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

6

A gain or loss from selling equipment is reported under cash flows from operating activities using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

7

When using the spreadsheet approach for preparing a Statement of Cash Flows using the indirect method, one half of the spreadsheet reflects changes in balance sheet accounts and the other half is used to demonstrate their effect on cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

8

When the cash flows from operating, investing, and financing activities are combined to arrive at the overall net change in cash, a net decrease in cash is subtracted from the beginning cash to calculate the ending cash balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

9

Depreciation expense is not reported on the statement of cash flows when prepared using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

10

In general, the cash flow from operating activities is considered by many to be the most important component of the Statement of Cash Flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

11

A negative cash flow is referred to as a cash outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

12

The reporting of financing activities is identical under the indirect and direct methods for the Statement of Cash Flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

13

Interest and dividends from investments held by a company are reported as cash inflows from investing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

14

Financing activities include receiving cash from issuing debt and receiving cash dividends from investments in stock of other companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cash equivalents are assets that are easily converted to cash regardless of their time to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under the indirect method, changes in current assets are used in determining net cash flows from operating activities and changes in current liabilities are used in determining cash flows from financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a company uses the direct method of calculating net cash flows from operating activities, it must adjust net income for gains or losses when selling property, plant, and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

18

The issuance of a stock dividend is a cash outflow in the financing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

19

When preparing the operating activities section of the statement of cash flows using the indirect method, a decrease in accounts receivable is subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

20

Treasury stock purchases made with cash are cash outflows in the financing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

21

A growing, start-up company may have a cash flow pattern of borrowing cash to offset a cash shortage from the cash flows from operating activities and to purchase additional productive assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements regarding financing activities is NOT true?

A) Cash dividends paid to a company's stockholders are reported as cash outflows from financing activities.

B) When a company issues stock for cash, it reports a cash inflow from financing activities.

C) When a company repurchases stock with cash, it reports a cash outflow for financing activities.

D) When a company repays a loan, it reports a cash outflow from investing activities.

A) Cash dividends paid to a company's stockholders are reported as cash outflows from financing activities.

B) When a company issues stock for cash, it reports a cash inflow from financing activities.

C) When a company repurchases stock with cash, it reports a cash outflow for financing activities.

D) When a company repays a loan, it reports a cash outflow from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the calculation of net cash flows from operating activities starts with net income, the company:

A) is using the net income method.

B) will remove the effects of all noncash items included in the calculation of net income.

C) is using the direct method.

D) will add all noncash items not included in the calculation of net income.

A) is using the net income method.

B) will remove the effects of all noncash items included in the calculation of net income.

C) is using the direct method.

D) will add all noncash items not included in the calculation of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

24

B. Darin Company loaned $3,000,000 at 7% interest to S. Dee Company.

B. Darin Company would report this as an investing activity on the statement of cash flows.

TRUE

B. Darin Company would report this as an investing activity on the statement of cash flows.

TRUE

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements regarding quality of income ratio is NOT true?

A) A quality of income ratio will increase if a company's working capital management allows current assets such as inventory to increase out of control.

B) Variations in the ratio can be seasonal and are the result of sales fluctuations rather than reasons for alarm.

C) The quality of income ratio measures the portion of income that was generated in cash.

D) The quality of income ratio is useful when compared to industry competitors or to prior periods.

A) A quality of income ratio will increase if a company's working capital management allows current assets such as inventory to increase out of control.

B) Variations in the ratio can be seasonal and are the result of sales fluctuations rather than reasons for alarm.

C) The quality of income ratio measures the portion of income that was generated in cash.

D) The quality of income ratio is useful when compared to industry competitors or to prior periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following would be included in cash flows from operating activities?

A) Cash proceeds from sales.

B) Cash received from an issuance of bonds.

C) Dividends paid to stockholders.

D) Cash used for purchases of equipment.

A) Cash proceeds from sales.

B) Cash received from an issuance of bonds.

C) Dividends paid to stockholders.

D) Cash used for purchases of equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a company reports negative net cash flows from operating activities, positive net cash flows from investing activities, and zero net cash flows from financing activities, this suggests that the company is selling its productive assets to cover its operating activities outflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following statements regarding the reporting of operating cash flows using the direct method is true?

A) The Financial Accounting Standards Board (FASB) prefers the direct method of accounting for cash flows from operating activities.

B) The FASB prefers the indirect method of calculating cash flows fro m operations because it gives a more accurate calculation of cash provided by operating activities.

C) The direct method results in a larger amount of cash flow from operating activities than does the indirect method.

D) The direct and indirect methods use different presentations for cash flows from investing and financing activities.

A) The Financial Accounting Standards Board (FASB) prefers the direct method of accounting for cash flows from operating activities.

B) The FASB prefers the indirect method of calculating cash flows fro m operations because it gives a more accurate calculation of cash provided by operating activities.

C) The direct method results in a larger amount of cash flow from operating activities than does the indirect method.

D) The direct and indirect methods use different presentations for cash flows from investing and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a company is to succeed over the long-term, a positive cash flow from operating activities is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements regarding cash flows from investing activities is true?

A) The proceeds from sales of investments are reported as cash inflows from investing activities.

B) Cash flows from investing activities are calculated by making adjustments to net income.

C) Cash paid to acquire long-lived assets is reported as a cash inflow from investing activities.

D) Cash received from issuing a long-term payable is reported as a cash inflow from investing activities.

A) The proceeds from sales of investments are reported as cash inflows from investing activities.

B) Cash flows from investing activities are calculated by making adjustments to net income.

C) Cash paid to acquire long-lived assets is reported as a cash inflow from investing activities.

D) Cash received from issuing a long-term payable is reported as a cash inflow from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

31

Cash flows from investing activities include cash:

A) inflows and outflows reflecting revenues and expenses.

B) outflows from the sale of long-term investments.

C) inflows from the sale of long-term investments.

D) inflows from the sale of a company's own stock to its stockholders.

A) inflows and outflows reflecting revenues and expenses.

B) outflows from the sale of long-term investments.

C) inflows from the sale of long-term investments.

D) inflows from the sale of a company's own stock to its stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

32

Cash and cash equivalents include:

A) assets that have stable long-term value.

B) assets that are short-term, highly liquid, and are purchased within three months of maturity.

C) assets that consistently grow in value over the long run.

D) assets that are expected to be used up within a year.

A) assets that have stable long-term value.

B) assets that are short-term, highly liquid, and are purchased within three months of maturity.

C) assets that consistently grow in value over the long run.

D) assets that are expected to be used up within a year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

33

Suppose a company generally records revenues and expenses before receiving or making cash payments. Which of the following statements is NOT true?

A) If sales are falling, net losses could occur even though the company reports net cash inflows from operating activities.

B) If sales are rising, net profits could occur even though the company reports net cash outflows from operating activities.

C) Net income and cash flows will always agree because even though revenues and expenses can be recorded in different time periods than their related cash flows the differences will cancel out and the results will be the same.

D) When the indirect method is used, net cash flows from operating activities includes adjustments for non-cash expenses such as depreciation which would cause net cash from operating activities to be different from net

A) If sales are falling, net losses could occur even though the company reports net cash inflows from operating activities.

B) If sales are rising, net profits could occur even though the company reports net cash outflows from operating activities.

C) Net income and cash flows will always agree because even though revenues and expenses can be recorded in different time periods than their related cash flows the differences will cancel out and the results will be the same.

D) When the indirect method is used, net cash flows from operating activities includes adjustments for non-cash expenses such as depreciation which would cause net cash from operating activities to be different from net

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would be included in cash flows from investing activities?

A) Cash proceeds from sales.

B) Cash received from an issuance of bonds.

C) Dividends paid to stockholders.

D) Cash used to purchases of equipment.

A) Cash proceeds from sales.

B) Cash received from an issuance of bonds.

C) Dividends paid to stockholders.

D) Cash used to purchases of equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements regarding calculation of cash flows from operating activities under the indirect method is true?

A) When the indirect method is used, changes in current liabilities are subtracted while changes in current assets are added to convert net income to net cash flows from operating activities.

B) When the indirect method is used, depreciation expense is added to net income as a step in the process of calculating net cash flows from operating activities.

C) When the indirect method is used, gains on the sale of property, plant and equipment are added to convert net income to net cash flows from operating activities.

D) When the indirect method is used, changes in long-term liabilities are subtracted to convert net income to net cash flows from operating activities.

A) When the indirect method is used, changes in current liabilities are subtracted while changes in current assets are added to convert net income to net cash flows from operating activities.

B) When the indirect method is used, depreciation expense is added to net income as a step in the process of calculating net cash flows from operating activities.

C) When the indirect method is used, gains on the sale of property, plant and equipment are added to convert net income to net cash flows from operating activities.

D) When the indirect method is used, changes in long-term liabilities are subtracted to convert net income to net cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements regarding the quality of income and fraudulent financial reporting is NOT true?

A) Net income assumes that all revenues are eventually realized as cash inflows and all expenses are realized as cash outflows. The quality of income ratio is a measure of the extent to which this assumption should be considered valid.

B) Fraudulent financial reporting may involve delayed expense recognition.

C) Fraudulent financial reporting is more likely to result in overstatement of net cash flows from operating activities rather than as overstatement of net income.

D) Fraudulent financial reporting may involve aggressive revenue recognition, that is, recognizing revenue before it is earned.

A) Net income assumes that all revenues are eventually realized as cash inflows and all expenses are realized as cash outflows. The quality of income ratio is a measure of the extent to which this assumption should be considered valid.

B) Fraudulent financial reporting may involve delayed expense recognition.

C) Fraudulent financial reporting is more likely to result in overstatement of net cash flows from operating activities rather than as overstatement of net income.

D) Fraudulent financial reporting may involve aggressive revenue recognition, that is, recognizing revenue before it is earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following statements regarding the calculation of cash flows from operating activities under the direct method is true?

A) When the direct method is used, each revenue and expense account on the income statement is individually adjusted to calculate net cash flows from operating activities.

B) Noncash revenues and expenses must be included in net cash flows from operating activities when preparing a Statement of Cash Flows using the direct method.

C) Depreciation is reported as a cash inflow in the cash flows from operating activities when the direct method is used.

D) A loss on the sale of a long-term asset is subtracted in the cash flows from operating activities when the

A) When the direct method is used, each revenue and expense account on the income statement is individually adjusted to calculate net cash flows from operating activities.

B) Noncash revenues and expenses must be included in net cash flows from operating activities when preparing a Statement of Cash Flows using the direct method.

C) Depreciation is reported as a cash inflow in the cash flows from operating activities when the direct method is used.

D) A loss on the sale of a long-term asset is subtracted in the cash flows from operating activities when the

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

38

B. Darin Company loaned $3,000,000 at 7% interest to S. Dee Company. S. Dee Company would report this as an investing activity on the statement of cash flows.

FALSE

FALSE

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following would be included in cash flows from financing activities?

A) Cash proceeds from sales.

B) Cash received from a sale of land.

C) Dividends paid to stockholders.

D) Cash used to purchases of equipment.

A) Cash proceeds from sales.

B) Cash received from a sale of land.

C) Dividends paid to stockholders.

D) Cash used to purchases of equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements regarding the capital acquisitions ratio is true?

A) The capital acquisitions ratio is often calculated as an average over a number of years for better comparison between companies in the same industry.

B) The calculation of the capital acquisit ions ratio uses the cash expenditures for property, plant and equipment that, all else equal, are reported in the financing activities section of the Statement of Cash Flows.

C) A ratio greater than 1.0 indicates that outside financing was needed to replace equipment in the current period.

D) The higher the ratio, the more likely external financing will be needed to fund future expansion.

A) The capital acquisitions ratio is often calculated as an average over a number of years for better comparison between companies in the same industry.

B) The calculation of the capital acquisit ions ratio uses the cash expenditures for property, plant and equipment that, all else equal, are reported in the financing activities section of the Statement of Cash Flows.

C) A ratio greater than 1.0 indicates that outside financing was needed to replace equipment in the current period.

D) The higher the ratio, the more likely external financing will be needed to fund future expansion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

41

When the indirect method is used, if accounts receivable increases during the accounting period, the change in accounts receivable is:

A) added to the change in the cash account.

B) subtracted from net income.

C) added to net income.

D) subtracted from the change in the cash account.

A) added to the change in the cash account.

B) subtracted from net income.

C) added to net income.

D) subtracted from the change in the cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

42

When the indirect method is used, details from which of the following balance sheet accounts are used in calculating both operating and financing cash flows?

A) Bonds payable.

B) Taxes payable.

C) Retained earnings.

D) Contributed capital.

A) Bonds payable.

B) Taxes payable.

C) Retained earnings.

D) Contributed capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume a company uses the indirect method to prepare its statement of cash flows. If inventory decreases and unearned revenue increases during an accounting period, what does the company do with the changes in these accounts to calculate net cash flows from operating activities?

A) Both are added to net income.

B) The change in inventory is added to net income; the change in unearned revenue is subtracted.

C) Both are subtracted from net income.

D) The change in unearned revenue is added to net income; the change in inventory is subtracted.

A) Both are added to net income.

B) The change in inventory is added to net income; the change in unearned revenue is subtracted.

C) Both are subtracted from net income.

D) The change in unearned revenue is added to net income; the change in inventory is subtracted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

44

Cash flows from financing activities:

A) are always negative because the company pays dividends as well as interest and principal on debt.

B) includes all cash inflows and outflows between a company and its stockholders.

C) includes all cash inflows and outflows associated with a company's lending activities.

D) are always positive unless the company is experiencing serious financial trouble.

A) are always negative because the company pays dividends as well as interest and principal on debt.

B) includes all cash inflows and outflows between a company and its stockholders.

C) includes all cash inflows and outflows associated with a company's lending activities.

D) are always positive unless the company is experiencing serious financial trouble.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

45

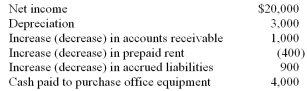

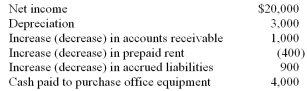

Consider the following information:  The company would report a net cash inflow from operating activities of:

The company would report a net cash inflow from operating activities of:

A) $17,500.

B) $18,500.

C) $21,500.

D) $23,300.

The company would report a net cash inflow from operating activities of:

The company would report a net cash inflow from operating activities of:A) $17,500.

B) $18,500.

C) $21,500.

D) $23,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

46

When a company uses the direct method to determine the net cash flows from operating activities, cash flows from operating activities will:

A) be identical to the amount reported using the indirect method.

B) be larger if there is a net cash inflow and smaller if there is a net cash outflow compared to the amount reported using the indirect method.

C) always be larger than the amount reported using the indirect method.

D) be larger if there is a net cash outflow and smaller if there is a net cash inflow co mpared to the amount reported using the indirect method.

A) be identical to the amount reported using the indirect method.

B) be larger if there is a net cash inflow and smaller if there is a net cash outflow compared to the amount reported using the indirect method.

C) always be larger than the amount reported using the indirect method.

D) be larger if there is a net cash outflow and smaller if there is a net cash inflow co mpared to the amount reported using the indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

47

A change in a company's cash account is equal to the:

A) changes in liabilities, stockholders' equity, and noncash assets.

B) changes in liabilities minus the changes in stockholders' equity and noncash assets.

C) sum of the changes in liabilities, stockholders' equity and noncash assets.

D) change in noncash assets minus the changes in liabilities and stockholders' equity.

A) changes in liabilities, stockholders' equity, and noncash assets.

B) changes in liabilities minus the changes in stockholders' equity and noncash assets.

C) sum of the changes in liabilities, stockholders' equity and noncash assets.

D) change in noncash assets minus the changes in liabilities and stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

48

Depreciation is added back to net income in a statement of cash flows prepared using the indirect method because it:

A) reduces income but not cash.

B) is a cash inflow.

C) is a revenue.

D) is a valuation concept.

A) reduces income but not cash.

B) is a cash inflow.

C) is a revenue.

D) is a valuation concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

49

Assume a company uses the direct method to prepare its statement of cash flows. If the company's inventory and accounts payable both increase during the accounting period, how would these changes affect cash flow calculations?

A) The changes in each account are both added to net income.

B) The change in inventory is subtracted from cost of goods sold and the change in accounts payable is added to cost of goods sold to find the cash paid to suppliers.

C) The changes in each account are both subtracted from net income.

D) The change in inventory is added to cost of goods sold and the change in accounts payable is subtracted from

A) The changes in each account are both added to net income.

B) The change in inventory is subtracted from cost of goods sold and the change in accounts payable is added to cost of goods sold to find the cash paid to suppliers.

C) The changes in each account are both subtracted from net income.

D) The change in inventory is added to cost of goods sold and the change in accounts payable is subtracted from

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

50

Brighton, Inc., uses the indirect method to determine its net cash flows from operating activities. During the course of the year, the company's accounts receivable increased by $10,000 and its accounts payable decreased by $5,000. As a result of these two items, the calculation to determine cash flows from operating activities will be:

A) increased by $5,000.

B) decreased by $5,000.

C) increased by $15,000.

D) decreased by $15,000.

A) increased by $5,000.

B) decreased by $5,000.

C) increased by $15,000.

D) decreased by $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

51

What is the first step in calculating cash flows from operations when the indirect method is used?

A) Find net income on the income statement.

B) Calculate the net change in the cash account.

C) Add the change in accounts receivable to sales revenue.

D) Identify the balance sheet accounts that relate to operating activities.

A) Find net income on the income statement.

B) Calculate the net change in the cash account.

C) Add the change in accounts receivable to sales revenue.

D) Identify the balance sheet accounts that relate to operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

52

When the direct method is used to determine the net cash flow from operating activities, other operating expenses are converted into cash outflows by:

A) adding changes in prepaid expenses and accrued liabilities to other expenses.

B) subtracting increases in prepaid expenses and subtracting decreases in accrued liabilities from other expenses.

C) adding increases in prepaid expenses and adding decreases in accrued liabilities to other expenses.

D) subtracting changes in prepaid expenses and accrued liabilities from other expenses.

A) adding changes in prepaid expenses and accrued liabilities to other expenses.

B) subtracting increases in prepaid expenses and subtracting decreases in accrued liabilities from other expenses.

C) adding increases in prepaid expenses and adding decreases in accrued liabilities to other expenses.

D) subtracting changes in prepaid expenses and accrued liabilities from other expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

53

Assume a company uses the indirect method to prepare its statement of cash flows. If the supplies account decreases and accounts payable increases during an accounting period, what does the company do with the changes in these accounts to calculate net cash flows from operating activities?

A) Both are added to net income.

B) The change in accounts payable is added to net income; the change in supplies is subtracted.

C) Both are subtracted from net income.

D) The change in supplies is added to net income; the change in accounts payable is subtracted.

A) Both are added to net income.

B) The change in accounts payable is added to net income; the change in supplies is subtracted.

C) Both are subtracted from net income.

D) The change in supplies is added to net income; the change in accounts payable is subtracted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume a company uses the direct method to prepare its statement of cash flows. If the company's accounts receivable increase during the accounting period, the change in accounts receivable

Is:

A) added to the change in the cash account to calculate cash collected from customers.

B) subtracted from sales revenue to calculate the cash collected from customers.

C) added to sales revenue to calculate the cash collected from customers.

D) subtracted from the change in the cash account to calculate cash collected from customers.

Is:

A) added to the change in the cash account to calculate cash collected from customers.

B) subtracted from sales revenue to calculate the cash collected from customers.

C) added to sales revenue to calculate the cash collected from customers.

D) subtracted from the change in the cash account to calculate cash collected from customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

55

Almost all U.S. companies have used the indirect method of preparing the statement of cash flows:

A) because most users of the financial statements do not understand the direct method.

B) in spite of the Financial Accounting Standard Board's stated preference for the direct method.

C) because it usually requires less space in the annual report.

D) so that stockholders cannot determine how much cash was spent on executives' salaries.

A) because most users of the financial statements do not understand the direct method.

B) in spite of the Financial Accounting Standard Board's stated preference for the direct method.

C) because it usually requires less space in the annual report.

D) so that stockholders cannot determine how much cash was spent on executives' salaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following journal entries would change the Net Cash Flows from Operating Activities line of the statement of cash flows?

A) Recording bad debts.

B) Recording depreciation.

C) Recording loss on sale of investment.

D) Recording cash paid for interest on long-term note payable.

A) Recording bad debts.

B) Recording depreciation.

C) Recording loss on sale of investment.

D) Recording cash paid for interest on long-term note payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is not needed to prepare a statement of cash flows?

A) Statement of retained earnings.

B) Comparative balance sheet.

C) Additional information on financing and investing activities.

D) Income statement.

A) Statement of retained earnings.

B) Comparative balance sheet.

C) Additional information on financing and investing activities.

D) Income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

58

When the direct method is used to determine the net cash flows from operating activities, which of the following adjustments must be made to interest expense to determine total interest payments?

A) Add all changes in interest payable.

B) Add decreases in interest payable and subtract increases in interest payable.

C) Add increases in interest payable and subtract decreases in interest payable.

D) Subtract all changes in interest payable.

A) Add all changes in interest payable.

B) Add decreases in interest payable and subtract increases in interest payable.

C) Add increases in interest payable and subtract decreases in interest payable.

D) Subtract all changes in interest payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

59

Cinno Company reported net income of $20,000 for the year ended December 31, 2011. During the year, inventories decreased by $7,000, accounts payable decreased by $8,000, depreciation expense was $10,000, and accounts receivable increased by $6,500. Net cash provided by operations in 2011, computed using the indirect method, was:

A) $10,500.

B) $22,500.

C) $38,500.

D) $51,500.

A) $10,500.

B) $22,500.

C) $38,500.

D) $51,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

60

When the indirect method is used, if prepaid expenses decrease during the accounting period, the change in prepaid expenses is:

A) added to the change in the cash account.

B) subtracted from net income.

C) added to net income.

D) subtracted from the change in the cash account.

A) added to the change in the cash account.

B) subtracted from net income.

C) added to net income.

D) subtracted from the change in the cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following represent cash inflows from financing activities?

A) Issuing stock in exchange for another company's stock.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Receiving interest on promissory notes.

A) Issuing stock in exchange for another company's stock.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Receiving interest on promissory notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following are used to determine cash flows from financing activities?

A) Short-term debt, accrued liabilities, contributed capital, and notes payable.

B) Long-term debt, contributed capital, and retained earnings.

C) Short-term debt, accrued liabilities, retained earnings, and bonds payable.

D) Long-term debt, notes payable, interest expense, and bonds payable.

A) Short-term debt, accrued liabilities, contributed capital, and notes payable.

B) Long-term debt, contributed capital, and retained earnings.

C) Short-term debt, accrued liabilities, retained earnings, and bonds payable.

D) Long-term debt, notes payable, interest expense, and bonds payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following statements is true regarding cash flows from financing activities?

A) When companies borrow, cash outflows for financing activities have occurred.

B) When companies receive dividends, cash inflows from financing activities have occurred.

C) When companies repurchase their own stock, cash outflows for financing activities have occurred.

D) When companies pay dividends, cash inflows from financing activities have occurred.

A) When companies borrow, cash outflows for financing activities have occurred.

B) When companies receive dividends, cash inflows from financing activities have occurred.

C) When companies repurchase their own stock, cash outflows for financing activities have occurred.

D) When companies pay dividends, cash inflows from financing activities have occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

64

The company would report net cash inflows (outflows) from investing activities of:

A) $(1,000)

B) $(2,000)

C) $5,000

D) $7,000

A) $(1,000)

B) $(2,000)

C) $5,000

D) $7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

65

When the direct method is used to determine the net cash flows from operating activities, which of the following adjustments must be made to income tax expense to determine total income tax payments?

A) Add all changes in income taxes and income taxes payable.

B) Add decreases in income taxes payable and subtract increases in income taxes payable.

C) Add increases in income taxes payable and subtract decreases in income taxes payable.

D) Subtract all changes in income taxes payable.

A) Add all changes in income taxes and income taxes payable.

B) Add decreases in income taxes payable and subtract increases in income taxes payable.

C) Add increases in income taxes payable and subtract decreases in income taxes payable.

D) Subtract all changes in income taxes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

66

Company X paid Company Y $1.35 million for a new plant. During the same accounting period, Company X experienced the following changes in its balance sheet: Cash decreased by $350,000, Accounts Receivable increased by $321,300, Inventory increased by $275,800, Property, Plant, and Equipment increased by $752,900, and Bonds Payable increased by $1 million. The net cash flow from financing activities is:

A) An inflow of $1.35 million.

B) An outflow of $350,000.

C) An inflow of $1 million.

D) An inflow of $752,900.

A) An inflow of $1.35 million.

B) An outflow of $350,000.

C) An inflow of $1 million.

D) An inflow of $752,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

67

The net cash flow from operating activities is an inflow of $37,042, the net cash flow from investing activities is an outflow of $16,831, and the net cash flow from financing activities is an outflow of $26,397. If the beginning cash account balance is $11,283, what is the ending cash account balance?

A) $5,097

B) ($6,186)

C) $38,759

D) $27,476

A) $5,097

B) ($6,186)

C) $38,759

D) $27,476

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

68

Your company owned equipment with a book value of $120,000 that was sold during this accounting period for $30,500 in cash, and purchased new equipment for cash of $148,000. Your company would record:

A) a debit of $148,000 and a credit of $30,500 to the cash account for a net cash inflow of $117,500.

B) a debit of $148,000 and a credit of $89,500 to the cash account for a net cash inflow of $58,500.

C) a debit of $30,500 and a credit of $148,000 to the cash account for a net cash outflow of $117,500.

D) a debit of $89,500 and a credit of $148,000 to the cash account for a net cash outflow of $58,500.

A) a debit of $148,000 and a credit of $30,500 to the cash account for a net cash inflow of $117,500.

B) a debit of $148,000 and a credit of $89,500 to the cash account for a net cash inflow of $58,500.

C) a debit of $30,500 and a credit of $148,000 to the cash account for a net cash outflow of $117,500.

D) a debit of $89,500 and a credit of $148,000 to the cash account for a net cash outflow of $58,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

69

Two years ago, your company bought $40,000 in bonds from another company. This month, it sold half of those bonds for $20,640 and lent $1,000 to an employee with a promissory note. On the statement of cash flows for this accounting period, your company would report a net cash:

A) outflow of $19,640 from investing activities.

B) inflow of $19,640 from investing activities.

C) cash inflow of $20,640 from investing activities.

D) cash outflow of $20,640 from investing activities.

A) outflow of $19,640 from investing activities.

B) inflow of $19,640 from investing activities.

C) cash inflow of $20,640 from investing activities.

D) cash outflow of $20,640 from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following represent cash outflows from financing activities?

A) Distributing a stock dividend.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Paying interest on promissory notes.

A) Distributing a stock dividend.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Paying interest on promissory notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

71

Free cash flow is a positive cash flow:

A) beyond what is needed to replace current property, plant, and equipment and pay dividends.

B) across all three activity components of the statement of cash flows.

C) beyond what has been allotted for future property, plant, and equipment replacement and expansion.

D) across both financing and investing activities.

A) beyond what is needed to replace current property, plant, and equipment and pay dividends.

B) across all three activity components of the statement of cash flows.

C) beyond what has been allotted for future property, plant, and equipment replacement and expansion.

D) across both financing and investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

72

An outdoor water park in the Midwestern states with a calendar year-end is likely to have:

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operations in the second and third quarters (April - September).

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operations in the fourth and first quarters (October - March).

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operations in the second and third quarters (April - September).

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operations in the fourth and first quarters (October - March).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

73

The company would report net cash inflows (outflows) from financing activities of:

A) $(2,500)

B) $2,000

C) $5,000

D) $6,000

A) $(2,500)

B) $2,000

C) $5,000

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

74

A company issues $1 million of new stock and pays $200,000 in cash dividends during the year. In addition, the company took advantage of falling interest rates to borrow $1.5 million in a new bond issue and paid off existing bonds with a face value of $2 million. The company bought 500 of another company's $1,000 bonds at a $100,000 premium. The net cash flow from financing activities is:

A) An inflow of $500,000.

B) An outflow of $200,000.

C) An outflow of $100,000.

D) An inflow of $300,000.

A) An inflow of $500,000.

B) An outflow of $200,000.

C) An outflow of $100,000.

D) An inflow of $300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

75

Cash transactions relating to the purchase and sale of which types of assets affect a company's cash flows from investing activities?

A) All of a company's assets.

B) All of a company's assets except inventory.

C) All of a company's non-current assets.

D) Only property, plant and equipment.

A) All of a company's assets.

B) All of a company's assets except inventory.

C) All of a company's non-current assets.

D) Only property, plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

76

A toy store with a calendar year-end is likely to have:

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operations in the second and third quarters (April - September).

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operations in the fourth and firstquarters (October - March).

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operations in the second and third quarters (April - September).

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operations in the fourth and firstquarters (October - March).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

77

Buffers, Inc., uses cash when buying and selling all of its investment assets. Which of the following statements regarding cash flows are true? (1). When the investment asset accounts increase, net cash inflows have occurred. (2). When the investment asset accounts increase, net cash outflows have occurred.

(3)) When the investment asset accounts decreased, net cash inflows have occurred. (4). When the investment asset accounts decrease, net cash outflows have occurred.

A) Statements (1) and (3) are true.

B) Statements (2) and (4) are true.

C) Statements (1) and (4) are true.

D) Statements (2) and (3) are true.

(3)) When the investment asset accounts decreased, net cash inflows have occurred. (4). When the investment asset accounts decrease, net cash outflows have occurred.

A) Statements (1) and (3) are true.

B) Statements (2) and (4) are true.

C) Statements (1) and (4) are true.

D) Statements (2) and (3) are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

78

If a company's sales revenue was $171,356 and cash collected from customers was $167,803, which of the following would be consistent with this difference?

A) Accounts receivable could have decreased.

B) Cash payments could have been larger than the expense accounts.

C) Accounts receivable could have increased.

D) Cash payments could have been smaller than the expense accounts.

A) Accounts receivable could have decreased.

B) Cash payments could have been larger than the expense accounts.

C) Accounts receivable could have increased.

D) Cash payments could have been smaller than the expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following would be reported as a cash outflow from investing activities?

A) Donating an old piece of equipment to charity.

B) Repaying the principal of a bond.

C) Buying another company's bonds with cash.

D) Paying for an investment asset by issuing company stock.

A) Donating an old piece of equipment to charity.

B) Repaying the principal of a bond.

C) Buying another company's bonds with cash.

D) Paying for an investment asset by issuing company stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

80

The retained earnings account has a beginning balance of $321,975 and an ending balance of $356,413. Net income is $40,251. Which of the following statements is true?

A) $5,813 would be subtracted when determining cash flows from financing activities.

B) $40,251 would be added when determining cash flows from financing activities.

C) $34,438 would be added when determining cash flows from financing activities.

D) $321,975 would be added when determining cash flow from operating activities.

A) $5,813 would be subtracted when determining cash flows from financing activities.

B) $40,251 would be added when determining cash flows from financing activities.

C) $34,438 would be added when determining cash flows from financing activities.

D) $321,975 would be added when determining cash flow from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck