Deck 10: Reporting and Interpreting Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

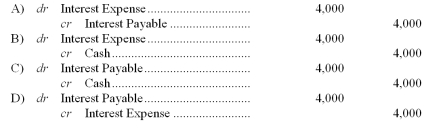

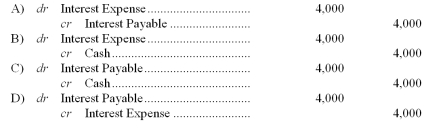

سؤال

سؤال

سؤال

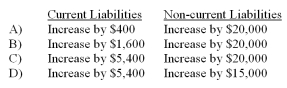

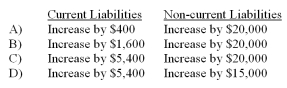

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/133

العب

ملء الشاشة (f)

Deck 10: Reporting and Interpreting Liabilities

1

Operating cycles are generally longer than a year.

False

2

Publicly issued debt certificates are also known as bonds.

True

3

If the market rate equals the stated interest rate, a bond will sell at face value.

True

4

Contingent liabilities arise from past transactions or events but also depend on future events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

5

The quick ratio is similar to the current ratio because it is also used to evaluate the ability to pay current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

6

The method of bond amortization that results in varying amounts of amortization each period is the straight-line amortization method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

7

A company's current liabilities are the total amount it currently owes at a single point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

8

At the date of maturity, the carrying value of a bond should always be equal to the face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

9

When bonds are retired, the balance in the bonds payable account is equal to the issuance price of the bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

10

Callable bonds can be converted to stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

11

Unearned revenue is recorded as an asset until the revenue has been earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

12

When a company issues bonds that include no periodic interest payments, the bonds are called zero-coupon bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

13

Sales taxes are charged to all customers in states that have a sales tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

14

The issuance price of a bond does not depend on the method used to amortize the bond discount or premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

15

The face value of bonds is also the maturity value of the bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

16

The net amount of a bond liability that appears on the balance sheet is equal to the face value of the bond plus any related discount or minus any related premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

17

The times interest earned ratio shows the amount of interest earned for each dollar of interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

18

The net amount of a bond payable on the balance sheet is the call price of the bond plus any related discount or minus any related premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

19

The entry to record a bond retirement at maturity usually involves no gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

20

Bonds allow a company to borrow a lot of money from a lot of different people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

21

A contingent liability is recorded by making an appropriate journal entry if the likelihood of a loss is remote.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

22

FICA payments consist of Social Security taxes and Medicare taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

23

Payroll taxes are contingent liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

24

In October, you borrow $50,000 in order to buy new equipment. The loan is repayable in five years, at 8% annual interest. Semiannual interest payments are due each March and September. Assuming no other long-term debt, what is the initial balance in the long-term debt account?

A) $54,000

B) $50,000

C) $46,000

D) $52,000

A) $54,000

B) $50,000

C) $46,000

D) $52,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

25

How many of the following statements regarding amortization of discounts or premiums are true? Under straight-line amortization, when a bond is sold at a premium, the annual premium amortization is the total premium divided by the number of years until bond maturity.

When a bond is sold at a discount, interest expense recorded using the effective-interest method is less than the

Interest paid on the bond.

The effective-interest method of amortization is considered to be conceptually superior to straight -line

Amortization.

When a bond premium is amortized using the effective-interest method, the promised interest payment is less

Than the interest expense, so the bond liability will increase as a result of the contra-liability account decreasing.

A) One

B) Two

C) Three

D) Four

When a bond is sold at a discount, interest expense recorded using the effective-interest method is less than the

Interest paid on the bond.

The effective-interest method of amortization is considered to be conceptually superior to straight -line

Amortization.

When a bond premium is amortized using the effective-interest method, the promised interest payment is less

Than the interest expense, so the bond liability will increase as a result of the contra-liability account decreasing.

A) One

B) Two

C) Three

D) Four

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

26

Current liabilities are due:

A) but not receivable for more than one year or the current operating cycle, whichever is longer.

B) but not payable for more than one year or the current operating cylce, whichever is longer.

C) and receivable within the current operating cycle or one year, whichever is longer.

D) and payable within the current operating cycle or one year, whichever is longer.

A) but not receivable for more than one year or the current operating cycle, whichever is longer.

B) but not payable for more than one year or the current operating cylce, whichever is longer.

C) and receivable within the current operating cycle or one year, whichever is longer.

D) and payable within the current operating cycle or one year, whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

27

The gross pay for all employees is debited to Wages Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

28

A typical balance sheet provides no information regarding which of the following questions?

A) To whom does the company owe money?

B) For what does the company owe money?

C) How much does the company owe?

D) What proportion of the company's debts will be paid in the short-term?

A) To whom does the company owe money?

B) For what does the company owe money?

C) How much does the company owe?

D) What proportion of the company's debts will be paid in the short-term?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements regarding loan terminology is true?

A) Loan covenants are the collateral provided by a borrower to a lender as security on a loan.

B) secured loan means that the borrower has a pre-approved line of credit backing the debt.

C) loan covenant allows the lender to revise loan terms if a borrower's financial condition deteriorates significantly.

D) All companies are able to establish lines of credit which will allow them to borrow money as needed, up to a

A) Loan covenants are the collateral provided by a borrower to a lender as security on a loan.

B) secured loan means that the borrower has a pre-approved line of credit backing the debt.

C) loan covenant allows the lender to revise loan terms if a borrower's financial condition deteriorates significantly.

D) All companies are able to establish lines of credit which will allow them to borrow money as needed, up to a

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

30

An entertainment company received $6 million in cash for advance season ticket sales. Prior to the beginning of the season, these sales should be recorded as a credit to unearned season ticket revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

31

Bonds that are backed by a company's assets are called secured bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following statements regarding payroll liabilities is true?

A) Accrued payroll includes such liabilities as retirement and health benefits not yet paid.

B) Only employees are required to pay FICA taxes.

C) Both employers and employees are required to pay unemployment taxes.

D) Accrued payroll liabilities do not include any voluntary deductions by employees for charitable contributions or union dues.

A) Accrued payroll includes such liabilities as retirement and health benefits not yet paid.

B) Only employees are required to pay FICA taxes.

C) Both employers and employees are required to pay unemployment taxes.

D) Accrued payroll liabilities do not include any voluntary deductions by employees for charitable contributions or union dues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

33

When the times interest earned ratio declines, the likelihood of default on liabilities increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

34

Bonds that are not backed by collateral are called debenture bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

35

How many of the following statements are true? Liquidity refers to a company's ability to pay current obligations or debts.

A company is always considered a serious credit risk if its quick ratio is below one.

All other things equal, the existence of a line of credit enhances the ability of a company to meet its short-term obligations.

Liquid assets include all current assets.

A) One

B) Two

C) Three

D) Four

A company is always considered a serious credit risk if its quick ratio is below one.

All other things equal, the existence of a line of credit enhances the ability of a company to meet its short-term obligations.

Liquid assets include all current assets.

A) One

B) Two

C) Three

D) Four

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements regarding bonds payable net of a discount or premium is NOT true?

A) If a company records a discount or premium with the bonds payable in a single account called Bonds Payable, Net, it can use the simplified effective interest method of amortization.

B) When bonds payable are accounted for net of a discount, the initial amount recorded in the Bonds Payable, Net account is the issue price of the bond.

C) When bonds are accounted for net of a premium, the balance in the Bonds Payable, Net account will increase as the bond approaches the maturity date.

D) If a company issued bonds at their face value, the balance of Bonds Payable, Net account will always be

A) If a company records a discount or premium with the bonds payable in a single account called Bonds Payable, Net, it can use the simplified effective interest method of amortization.

B) When bonds payable are accounted for net of a discount, the initial amount recorded in the Bonds Payable, Net account is the issue price of the bond.

C) When bonds are accounted for net of a premium, the balance in the Bonds Payable, Net account will increase as the bond approaches the maturity date.

D) If a company issued bonds at their face value, the balance of Bonds Payable, Net account will always be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is NOT true regarding the quick ratio?

A) If a company has more current assets than liquid assets, the current ratio will be larger than the quick ratio.

B) A high quick ratio suggests a high ability to pay current liabilities.

C) Liquid assets include cash and cash equivalents, short-term investments, and net accounts receivable.

D) A quick ratio greater than 1 implies a company could not pay all of its current liabilities.

A) If a company has more current assets than liquid assets, the current ratio will be larger than the quick ratio.

B) A high quick ratio suggests a high ability to pay current liabilities.

C) Liquid assets include cash and cash equivalents, short-term investments, and net accounts receivable.

D) A quick ratio greater than 1 implies a company could not pay all of its current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements regarding bond discounts or premiums is true?

A) discount on a bond reduces the amount that the issuer has to repay to the lenders.

B) premium on a bond increases the interest expense of the loan to the issuer.

C) premium on a bond increases the amount that the issuer has to repay to the lenders.

D) discount on a bond increases the interest expense of the loan to the issuer.

A) discount on a bond reduces the amount that the issuer has to repay to the lenders.

B) premium on a bond increases the interest expense of the loan to the issuer.

C) premium on a bond increases the amount that the issuer has to repay to the lenders.

D) discount on a bond increases the interest expense of the loan to the issuer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements regarding bond terminology is true?

A) The face value of a bond is what it is currently worth in the market.

B) The stated interest rate is expressed as an annual interest rate even if the bonds pay semiannual interest payments.

C) The stated rate of interest always presents the amount that investors are willing to pay for the bond on the issue date.

D) The carrying value of the bond is always equal to the face value of the bond.

A) The face value of a bond is what it is currently worth in the market.

B) The stated interest rate is expressed as an annual interest rate even if the bonds pay semiannual interest payments.

C) The stated rate of interest always presents the amount that investors are willing to pay for the bond on the issue date.

D) The carrying value of the bond is always equal to the face value of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

40

The threshold for recording contingent liabilities under IFRS is lower than that under GAAP.

considered to be more likely than not to occur; whereas, GAAP states that an estimated loss is recorded if it is

probable.

considered to be more likely than not to occur; whereas, GAAP states that an estimated loss is recorded if it is

probable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

41

A company receives $95 for merchandise sold to a consumer, of which $5 is for sales tax. The $5 of sales tax:

A) increases sales revenue.

B) increases current liabilities.

C) increases selling expenses.

D) is not recorded.

A) increases sales revenue.

B) increases current liabilities.

C) increases selling expenses.

D) is not recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

42

What adjusting entry should Backyard make on June 30 before preparing its annual financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

43

During one pay period, your company distributes $130,500 to employees as net pay. The income tax withholdings were $19,000 and the FICA withholdings were $5,000. The total compensation expense to the company for this pay period, excluding any unemployment taxes, was:

A) $149,500.

B) $130,500.

C) $154,500.

D) $159,500.

A) $149,500.

B) $130,500.

C) $154,500.

D) $159,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

44

If the market rate of interest is 6%, a $10,000, 10-year bond with a stated annual interest rate of 8% would be issued at an amount:

A) less than face value.

B) equal to the face value.

C) greater than face value.

D) equal to the face value minus a discount.

A) less than face value.

B) equal to the face value.

C) greater than face value.

D) equal to the face value minus a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

45

At the beginning of the quarter, your company borrows $20,000 by signing a four-year promissory note that states an annual interest rate of 8% plus principal repayments of $5,000 each year. Interest is paid at the end of the second and fourth quarters, whereas principal payments are due at the end of each year. How does this new promissory note affect the current and non-current liability amounts reported on the balance sheet at the end of the first quarter?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

46

IBM is planning to issue $1,000 bonds with a stated interest rate of 7% and a maturity date of July 15, 2022. If interest rates rise in the economy so that similar financial investments pay 9%, IBM will:

A) not be able to issue the bonds because no one will buy them.

B) receive a higher issue price to compensate buyers for the lower stated interest rate.

C) have to accept a lower issue price to attract buyers.

D) have to reprint the bond certificates to change the stated interest rate to 9%.

A) not be able to issue the bonds because no one will buy them.

B) receive a higher issue price to compensate buyers for the lower stated interest rate.

C) have to accept a lower issue price to attract buyers.

D) have to reprint the bond certificates to change the stated interest rate to 9%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

47

A corporate bond with a face value of $1,000 is issued at 107. This means that the bond actually sold for:

A) $107 dollars, and the stated interest rate was higher than the market interest rate.

B) $1,070 dollars, and the stated interest rate was higher than the market interest rate.

C) $107 dollars, and the stated interest rate was lower than the market interest rate.

D) $1,070 dollars, and the stated interest rate was lower than the market interest rate.

A) $107 dollars, and the stated interest rate was higher than the market interest rate.

B) $1,070 dollars, and the stated interest rate was higher than the market interest rate.

C) $107 dollars, and the stated interest rate was lower than the market interest rate.

D) $1,070 dollars, and the stated interest rate was lower than the market interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

48

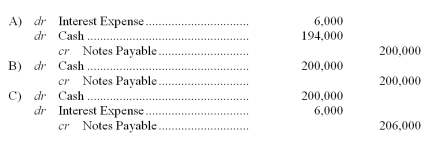

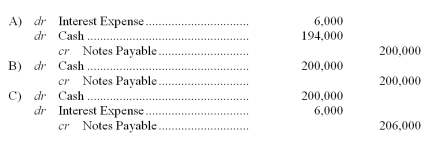

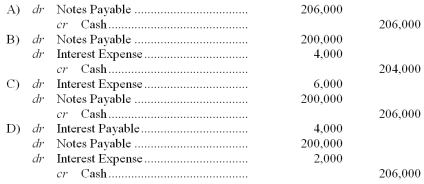

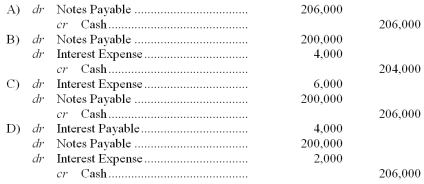

On January 1, which of the following journal entries will be made by Backyard to record the proceeds and issue of the note?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

49

IBM is planning to issue $1,000 bonds with a stated interest rate of 7% and a maturity date of July 15, 2022. If interest rates fall in the economy so that similar financial investments pay 5%, IBM will:.

A) not be able to issue the bonds because no one will buy them.

B) receive a higher issue price as buyers compete for the bonds.

C) have to accept a lower issue price to attract buyers.

D) have to reprint the bond certificates to change stated interest rate to 5%.

A) not be able to issue the bonds because no one will buy them.

B) receive a higher issue price as buyers compete for the bonds.

C) have to accept a lower issue price to attract buyers.

D) have to reprint the bond certificates to change stated interest rate to 5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

50

A company typically records the amount owed to suppliers for goods or services when:

A) they are ordered.

B) a verbal commitment to buy has first been made.

C) they are paid for.

D) the goods or services are received.

A) they are ordered.

B) a verbal commitment to buy has first been made.

C) they are paid for.

D) the goods or services are received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

51

The three key pieces of information that are stated on a bond certificate are:

A) the interest payment, the face value of the bond, and the credit rating of the company.

B) the market interest rate, the price of the bond, and the maturity date.

C) the stated interest rate, the face value of the bond, and the maturity date.

D) the interest payment, the issue price of the bond, and the credit rating of the company.

A) the interest payment, the face value of the bond, and the credit rating of the company.

B) the market interest rate, the price of the bond, and the maturity date.

C) the stated interest rate, the face value of the bond, and the maturity date.

D) the interest payment, the issue price of the bond, and the credit rating of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

52

A company has liquid assets of $600,000 and current liabilities of $500,000. What is the effect on the quick ratio if the company records an accrual adjustment for salaries of $100,000 and pays accounts payable in the amount of $50,000?

A) The quick ratio will not change as a result of either of these transactions.

B) The accrual adjustment will cause the quick ratio to decrease and the payment of accounts payable will not affect the quick ratio.

C) The accrual adjustment will cause the quick ratio to increase and the payment of accounts payable will not affect the quick ratio.

D) The accrual adjustment and the payment of accounts payable will both cause the quick ratio to decrease.

A) The quick ratio will not change as a result of either of these transactions.

B) The accrual adjustment will cause the quick ratio to decrease and the payment of accounts payable will not affect the quick ratio.

C) The accrual adjustment will cause the quick ratio to increase and the payment of accounts payable will not affect the quick ratio.

D) The accrual adjustment and the payment of accounts payable will both cause the quick ratio to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

53

On October 1, you borrow $200,000 in order to build a new facility. The loan is for 10 years, at 7% interest, and semiannual interest payments are due each April and October. The journal entry to record the issuance of the promissory note should:

A) debit Notes Payable for $200,000, debit Interest Expense for $14,000, credit Cash for $200,000, and credit Interest Payable for $14,000.

B) debit Accrued Interest for $14,000 and credit Cash for $14,000.

C) debit Cash for $200,000 and credit Notes Payable for $200,000.

D) debit Cash for $200,000, debit Interest Expense for $14,000, credit Notes Payable for $200,000, and credit

A) debit Notes Payable for $200,000, debit Interest Expense for $14,000, credit Cash for $200,000, and credit Interest Payable for $14,000.

B) debit Accrued Interest for $14,000 and credit Cash for $14,000.

C) debit Cash for $200,000 and credit Notes Payable for $200,000.

D) debit Cash for $200,000, debit Interest Expense for $14,000, credit Notes Payable for $200,000, and credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

54

Your company issues $500,000 in bonds at an issue price of 98. The company will record:

A) a debit of $490,000 to cash, a debit of $10,000 to a contra-liability account to reflect the discount, and a credit of $500,000 to bonds payable.

B) a debit of $490,000 to cash, a debit of $10,000 to a contra-asset account to reflect the discount, and a credit of $500,000 to bonds payable.

C) a debit of $500,000 to bonds payable, a credit of $10,000 to a contra-liability account to reflect the discount, and a credit to cash of $490,000.

D) a debit of $490,000 to bonds payable, a debit of $10,000 to a contra-asset account to reflect the discount, and

A) a debit of $490,000 to cash, a debit of $10,000 to a contra-liability account to reflect the discount, and a credit of $500,000 to bonds payable.

B) a debit of $490,000 to cash, a debit of $10,000 to a contra-asset account to reflect the discount, and a credit of $500,000 to bonds payable.

C) a debit of $500,000 to bonds payable, a credit of $10,000 to a contra-liability account to reflect the discount, and a credit to cash of $490,000.

D) a debit of $490,000 to bonds payable, a debit of $10,000 to a contra-asset account to reflect the discount, and

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

55

A company pays $18,000 in interest on notes, consisting of $12,000 interest that accrued during the last accounting period and $6,000 of interest accumulated during this accounting period but not previously recorded on the books. The journal entry for the interest payment should:

A) debit Interest Expense for $18,000 and credit Cash for $18,000.

B) debit Cash for $18,000 and credit Interest Payable for $18,000.

C) debit Interest Expense for $6,000, debit Interest Payable $12,000 and credit Cash for $18,000.

D) debit Interest Payable for $12,000, debit Accrued Interest $6,000 and credit Cash for $18,000.

A) debit Interest Expense for $18,000 and credit Cash for $18,000.

B) debit Cash for $18,000 and credit Interest Payable for $18,000.

C) debit Interest Expense for $6,000, debit Interest Payable $12,000 and credit Cash for $18,000.

D) debit Interest Payable for $12,000, debit Accrued Interest $6,000 and credit Cash for $18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

56

Accrued liabilities could include all of the following except:

A) salaries payable.

B) current portion of long-term debt.

C) income tax payable.

D) interest payable.

A) salaries payable.

B) current portion of long-term debt.

C) income tax payable.

D) interest payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

57

If a company's gross wages are $12,000, and it withholds $1,800 for income taxes and $800 for FICA taxes and other deductions, the journal entry to record the employees' pay should include a:

A) debit to Wages Expense for $9,400.

B) debit to Wages Payable for $9,400.

C) credit to Wages Payable for $12,000.

D) credit to Cash for $9,400.

A) debit to Wages Expense for $9,400.

B) debit to Wages Payable for $9,400.

C) credit to Wages Payable for $12,000.

D) credit to Cash for $9,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

58

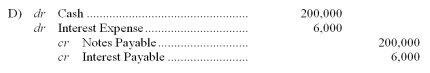

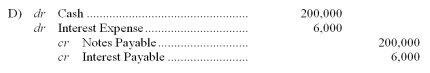

What journal entry will Backyard make when paying off the note and interest at maturity if the company's year-end is June 30? (Hint: Backyard's records were adjusted on June 30).

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

59

A company pays $9,000 in interest on notes consisting of $6,000 of interest that was accrued during the last accounting period and $3,000 of interest that accumulated during this accounting period that has not yet been accrued on the books. The journal entry for the interest payment should:

A) debit Interest Expense $9,000 and credit Cash $9,000.

B) debit Cash $9,000 and credit Interest Payable $9,000.

C) debit Interest Expense $3,000, debit Interest Payable $6,000, and credit Cash $9,000.

D) debit Interest Payable $6,000, debit Accrued Interest $3,000, and credit Cash $9,000.

A) debit Interest Expense $9,000 and credit Cash $9,000.

B) debit Cash $9,000 and credit Interest Payable $9,000.

C) debit Interest Expense $3,000, debit Interest Payable $6,000, and credit Cash $9,000.

D) debit Interest Payable $6,000, debit Accrued Interest $3,000, and credit Cash $9,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

60

On October 1, 2010, you borrow $200,000 at 6% interest and record the promissory note. In April and again in October of the following year, you are required to pay half the annual interest to your creditor. On December 31, 2010, your journal entry for the quarter should:

A) debit Interest Expense for $3,000 and credit Interest Payable for $3,000.

B) debit Cash for $3,000 and credit Accrued Interest for $3,000.

C) debit Interest Expense for $6,000 and credit Cash for $6,000.

D) debit Interest Expense for $6,000 and credit Notes Payable for $6,000.

A) debit Interest Expense for $3,000 and credit Interest Payable for $3,000.

B) debit Cash for $3,000 and credit Accrued Interest for $3,000.

C) debit Interest Expense for $6,000 and credit Cash for $6,000.

D) debit Interest Expense for $6,000 and credit Notes Payable for $6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

61

Your company issued bonds at a discount. Which of the following statements is NOT true?

A) The contra liability account, Discount on Bonds Payable, is amortized each year by shifting part of its balance to interest expense.

B) As the current date approaches the maturity date, the carrying value of the bond approaches the face value of the bond.

C) At the date of issuance, the market interest rate was higher than the stated interest rate.

D) The account used to record the discount is a normal credit balance account.

A) The contra liability account, Discount on Bonds Payable, is amortized each year by shifting part of its balance to interest expense.

B) As the current date approaches the maturity date, the carrying value of the bond approaches the face value of the bond.

C) At the date of issuance, the market interest rate was higher than the stated interest rate.

D) The account used to record the discount is a normal credit balance account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following would help a company improve its quick ratio without necessarily lowering the liability risk to a creditor?

A) Borrowing money on a long-term note just before the end of the accounting period.

B) Shifting resources from long-term assets to short-term assets such as supplies and inventory.

C) Shifting obligations from long-term liabilities to short-term liabilities.

D) Acquiring inventory by issuing a long-term note.

A) Borrowing money on a long-term note just before the end of the accounting period.

B) Shifting resources from long-term assets to short-term assets such as supplies and inventory.

C) Shifting obligations from long-term liabilities to short-term liabilities.

D) Acquiring inventory by issuing a long-term note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company issues $200,000 in long-term bonds and pays off $200,000 in accounts payable. Which of the following statements is true?

A) Both the quick ratio and times interest earned ratio will rise.

B) The quick ratio will fall but the times interest earned ratio will rise.

C) The quick ratio will rise but the times interest earned ratio will fall.

D) Both the quick ratio and times interest earned ratio will fall.

A) Both the quick ratio and times interest earned ratio will rise.

B) The quick ratio will fall but the times interest earned ratio will rise.

C) The quick ratio will rise but the times interest earned ratio will fall.

D) Both the quick ratio and times interest earned ratio will fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

64

Your company sells $50,000 of bonds for an issue price of $48,000. Which of the following statements is correct?

A) The bond sold at a price of 96, implying a discount of $4,000.

B) The bond sold at a price of 48, implying a premium of $2,000.

C) The bond sold at a price of 48, implying a premium of $4,000.

D) The bond sold at a price of 96, implying a discount of $2,000.

A) The bond sold at a price of 96, implying a discount of $4,000.

B) The bond sold at a price of 48, implying a premium of $2,000.

C) The bond sold at a price of 48, implying a premium of $4,000.

D) The bond sold at a price of 96, implying a discount of $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

65

A company has liquid assets of $5 million and net income of $10 million. Current liabilities total $2.5 million, interest expense is $2 million, and income tax expense is $3 million. What is the quick ratio for the company?

A) 0.5

B) 7.5

C) 0.3

D) 2.0

A) 0.5

B) 7.5

C) 0.3

D) 2.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

66

Some bonds mature in installments. If a bond issue contains this feature, they are known as:

A) secured bonds.

B) loan covenant bonds.

C) callable bonds.

D) serial bonds.

A) secured bonds.

B) loan covenant bonds.

C) callable bonds.

D) serial bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

67

Your company sells $50,000 of bonds for an issue price of $52,000. Which of the following statements is correct?

A) The bond sold at a price of 52, implying a premium of $2,000.

B) The bond sold at a price of 104, implying a discount of $2,000.

C) The bond sold at a price of 52, implying a discount of $2,000.

D) The bond sold at a price of 104, implying a premium of $2,000.

A) The bond sold at a price of 52, implying a premium of $2,000.

B) The bond sold at a price of 104, implying a discount of $2,000.

C) The bond sold at a price of 52, implying a discount of $2,000.

D) The bond sold at a price of 104, implying a premium of $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

68

Your company issued bonds at a premium. Which of the following statements is NOT true?

A) The contra account, premium on bonds payable, is amortized each year by shifting part of its balance to interest expense.

B) On the date of issuance, the stated interest rate was greater than the market interest rate.

C) As the current date approaches the maturity date, the carrying value of the bond approaches the face value of the bond.

D) The account used to record the premium has a normal debit balance.

A) The contra account, premium on bonds payable, is amortized each year by shifting part of its balance to interest expense.

B) On the date of issuance, the stated interest rate was greater than the market interest rate.

C) As the current date approaches the maturity date, the carrying value of the bond approaches the face value of the bond.

D) The account used to record the premium has a normal debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

69

A company receives $102,000 when it issues a bond with a face value of $100,000 and a stated interest rate of 7%. Which of the following statements is true?

A) The annual interest expense is $7,000.

B) The market interest rate is 7%.

C) A contra account to bonds payable is not needed.

D) The carrying value of the bonds will be $100,000 at maturity.

A) The annual interest expense is $7,000.

B) The market interest rate is 7%.

C) A contra account to bonds payable is not needed.

D) The carrying value of the bonds will be $100,000 at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

70

Some bonds allow the issuing company to retire the bond with cash at any time. These bonds are known as:

A) convertible bonds.

B) bonds with a loan covenant.

C) callable bonds.

D) senior bonds.

A) convertible bonds.

B) bonds with a loan covenant.

C) callable bonds.

D) senior bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following accounts could have a non-zero balance on a post-closing trial balance?

A) Dividends declared

B) Premium on bonds payable

C) Income tax expense

D) Interest expense

A) Dividends declared

B) Premium on bonds payable

C) Income tax expense

D) Interest expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

72

A company has current assets of $5 million and net income of $10 million. Current liabilities total $2.5 million, interest expense is $2 million, and income tax expense is $3 million. The times interest earned ratio for this company is:

A) 0.5.

B) 7.5.

C) 0.3.

D) 2.0.

A) 0.5.

B) 7.5.

C) 0.3.

D) 2.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

73

A negative times interest earned ratio suggests that the company:

A) is using resources very efficiently.

B) has a serious financial problem.

C) has a very high interest expense.

D) has a high level of sales revenue.

A) is using resources very efficiently.

B) has a serious financial problem.

C) has a very high interest expense.

D) has a high level of sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

74

Because interest rates have fallen, a company retires bonds which had been issued at their face value of $200,000. The company bought the bonds back at 97. This retirement would be recorded with a:

A) debit of $200,000 to Bonds Payable, a credit of $6,000 to Gain on Bonds Retired, and a credit of $194,000 to Cash.

B) debit of $200,000 to Bonds Payable and a credit of $200,000 to Cash.

C) debit of $200,000 to Bonds Payable, a credit of $6,000 to Interest Expense, and a credit of $194,000 to Cash.

D) debit of $194,000 to Bonds Payable and a credit of $194,000 to Cash.

A) debit of $200,000 to Bonds Payable, a credit of $6,000 to Gain on Bonds Retired, and a credit of $194,000 to Cash.

B) debit of $200,000 to Bonds Payable and a credit of $200,000 to Cash.

C) debit of $200,000 to Bonds Payable, a credit of $6,000 to Interest Expense, and a credit of $194,000 to Cash.

D) debit of $194,000 to Bonds Payable and a credit of $194,000 to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is not used to calculate the times interest earned ratio?

A) Net income.

B) Income tax expense.

C) Interest earned on investments.

D) Interest expense.

A) Net income.

B) Income tax expense.

C) Interest earned on investments.

D) Interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

76

You are considering buying a bond from a company that has a quick ratio of 0.45. This means that:

A) the company has 45% of its total assets in the current category.

B) the company does not have the ability to pay off all the debt it owes with all the assets it owns.

C) the company does not have the ability to pay off all the debt that is due in the near future with assets that are available in the near future.

D) stockholders currently own 45% of the company's assets.

A) the company has 45% of its total assets in the current category.

B) the company does not have the ability to pay off all the debt it owes with all the assets it owns.

C) the company does not have the ability to pay off all the debt that is due in the near future with assets that are available in the near future.

D) stockholders currently own 45% of the company's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

77

Arid Company has a quick ratio of 0.90. Which of the following, if it occurred on the last day of the accounting period, would increase Arid's quick ratio?

A) Borrowing with a short-term promissory note.

B) Paying off some accounts payable.

C) Accruing interest payable on its promissory notes.

D) Purchasing inventory on account.

A) Borrowing with a short-term promissory note.

B) Paying off some accounts payable.

C) Accruing interest payable on its promissory notes.

D) Purchasing inventory on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

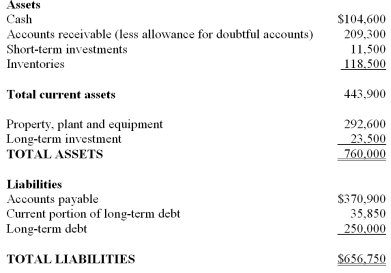

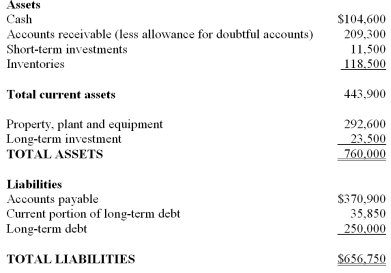

78

A company's total assets and total liabilities at the end of the year are as follows:  The quick ratio for this company is approximately:

The quick ratio for this company is approximately:

A) 1.09.

B) 0.80.

C) 1.16.

D) 0.50.

The quick ratio for this company is approximately:

The quick ratio for this company is approximately:A) 1.09.

B) 0.80.

C) 1.16.

D) 0.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company issues $200,000 in long-term bonds and buys $200,000 in inventory for cash. Which of the following statements is true?

A) The quick ratio will stay the same and the times interest earned ratio will fall.

B) The quick ratio will rise and the times interest earned ratio will rise.

C) The quick ratio will rise but the times interest earned ratio will fall.

D) The quick ratio will rise and the times interest earned ratio will stay the same.

A) The quick ratio will stay the same and the times interest earned ratio will fall.

B) The quick ratio will rise and the times interest earned ratio will rise.

C) The quick ratio will rise but the times interest earned ratio will fall.

D) The quick ratio will rise and the times interest earned ratio will stay the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

80

Some bonds allow the borrower to repay the bond by issuing stock. These bonds are known as:

A) convertible bonds.

B) bonds with a loan covenant.

C) callable bonds.

D) senior bonds.

A) convertible bonds.

B) bonds with a loan covenant.

C) callable bonds.

D) senior bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck