Deck 11: Cost-Volume-Profit Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/129

العب

ملء الشاشة (f)

Deck 11: Cost-Volume-Profit Analysis

1

Fixed costs are costs that vary in total dollar amount as the level of activity changes.

False

2

A mixed cost has characteristics of both a variable cost and a fixed cost.

True

3

Monthly rent on a factory building is an example of a fixed cost.

True

4

A rental cost of $40,000 plus $0.50 per machine hour of use is an example of a mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

5

Total fixed costs remain constant as the level of activity changes within the relevant range.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

6

Cost behavior refers to the manner in which a cost changes as a related activity changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

7

Variable costs are costs that vary on a per-unit basis as the level of manufacturing activity changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

8

The variable cost per unit remains constant with changes in the level of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

9

Variable costs are costs that vary in total in direct proportion to changes in the activity level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

10

A production supervisor's salary that does not vary with the number of units produced is an example of a fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

11

Direct materials cost is an example of a fixed cost of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

12

The relevant range is useful for analyzing cost behavior for management decision-making purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

13

The graph of the variable costs when plotted against the activity level appears as a line parallel to horizontal axis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

14

Variable cost per unit remains the same regardless of activity level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

15

The fixed cost per unit varies with changes in the level of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

16

Direct materials and direct labor costs are examples of variable costs of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

17

Rental charges of $60,000 per year plus $2 for each machine hour over 15,000 hours is an example of a fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

18

Activities that cause costs to change are called activity bases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

19

The range of activity over which changes in cost are of interest to management is called the relevant range.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

20

Variable costs are costs that remain constant in total with changes in the activity level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

21

The point in operations at which revenues and expenses are exactly equal is called the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

22

If direct materials cost per unit decreases, the break-even point will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

23

If direct materials cost per unit decreases, the amount of sales necessary to earn a desired amount of profit will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

24

A change in fixed costs as a result of increase in yearly insurance premium will decrease the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

25

If sales total $2,000,000, fixed costs total $600,000, and variable costs are 60% of the sales, the contribution margin ratio is 40%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

26

If fixed costs are $300,000 and variable costs are 70% of break-even sales, profit is zero when sales revenue is $1,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

27

Variable costs as a percentage of sales is equal to 100% minus the contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

28

For purpose of analysis, mixed costs can generally be separated into their variable and fixed components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

29

If fixed costs are $220,000 and the unit contribution margin is $25, the sales necessary to earn an operating income of $30,000 are 10,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

30

If fixed costs are $850,000 and the unit contribution margin is $50, profit is zero when 15,000 units are sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

31

The unit contribution margin is the dollars available from each unit of sales to cover fixed cost and provide operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

32

If direct materials cost per unit increases, the break-even point will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

33

The break-even point (in units) is calculated by dividing the total estimated fixed costs by the net sales of a period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

34

If employees accept a wage contract that decreases the unit contribution margin, the break-even point will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

35

Break-even analysis is a type of cost-volume-profit analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

36

If sales total $5,000,000, fixed costs total $400,000, and variable costs are 2,750,000, the contribution margin ratio is 45%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

37

The contribution margin ratio is the same as the variable cost ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

38

If sales total $1,000,000, fixed costs total $200,000, and variable costs are 55% of the sales, the contribution margin ratio is 55%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

39

A change in fixed costs as a result of increase in the property tax rates will increase the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

40

The ratio that indicates the percentage of each sales dollar available to cover the fixed costs and to provide operating income is termed as contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following activity bases would be the most appropriate for food costs of a hospital?

A) Number of cooks scheduled to work

B) Number of x-rays taken

C) Number of patients who are admitted in the hospital

D) Number of scheduled surgeries

A) Number of cooks scheduled to work

B) Number of x-rays taken

C) Number of patients who are admitted in the hospital

D) Number of scheduled surgeries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

42

Only a single line, which represents the difference between total sales revenues and total costs, is plotted on the profit-volume graph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

43

If a business sells four products, it is not possible to estimate the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

44

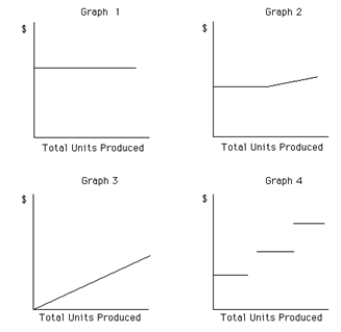

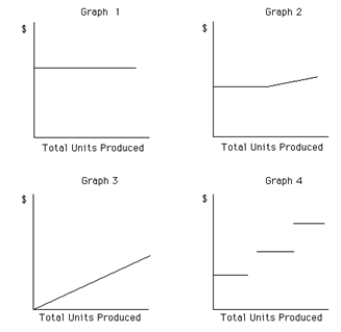

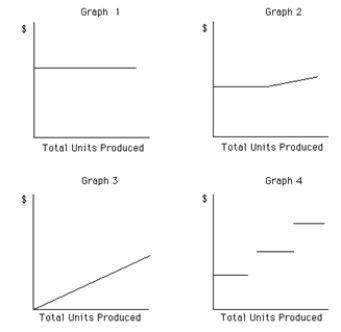

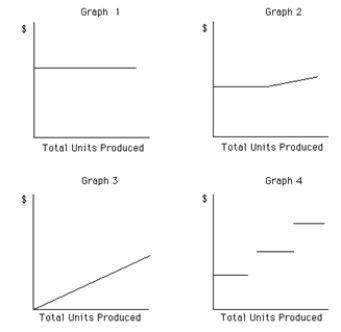

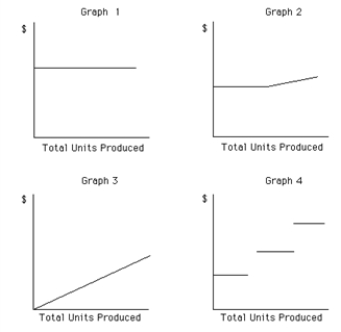

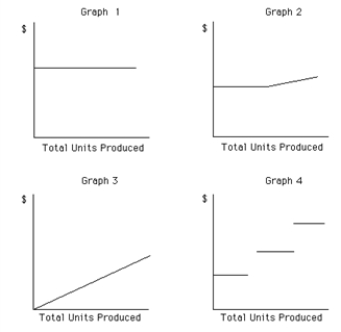

Which of the following graphs illustrates the behavior of a total fixed cost within the specified relevant range?

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

45

DeGiaimo Co.has an operating leverage of 5.If next year's sales are expected to increase by 10%, then the company's operating income will increase by 50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

46

Costs that remain constant on a per-unit level as the level of activity changes are called:

A) fixed costs.

B) mixed costs.

C) opportunity costs.

D) variable costs.

A) fixed costs.

B) mixed costs.

C) opportunity costs.

D) variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

47

If the volume of sales is $4,000,000 and sales at the break-even point amount to $3,200,000, the margin of safety will be 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

48

Even if a business sells six products, it is possible to estimate the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

49

Cost-volume-profit analysis can be presented in both graphically and equation form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

50

If the volume of sales is $6,000,000 and sales at the break-even point amount to $5,000,000, the margin of safety will be 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

51

If fixed costs are $450,000 and the unit contribution margin is $50, the sales necessary to earn an operating income of $30,000 are 14,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following costs is an example of a fixed cost?

A) Direct labor cost

B) Insurance cost

C) Commission paid

D) Capital stock

A) Direct labor cost

B) Insurance cost

C) Commission paid

D) Capital stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

53

Cost behavior refers to the manner in which:

A) a cost changes as the related activity changes.

B) a cost is allocated to products.

C) a cost is used in setting selling prices.

D) a cost is estimated.

A) a cost changes as the related activity changes.

B) a cost is allocated to products.

C) a cost is used in setting selling prices.

D) a cost is estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

54

If the volume of sales is $6,000,000 and sales at the break-even point amount to $4,800,000, the margin of safety will be 25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

55

Only a single line, which represents the difference between total sales revenues and total costs, is plotted on the cost-volume-profit graph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

56

If a business sells two products, it is not possible to estimate the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is true of a variable cost?

A) Total variable cost remains constant with changes in the number of goods sold.

B) Unit variable cost decreases with an increase in production.

C) Unit variable cost remains constant with changes in production.

D) Total variable cost decreases with an increase in the number of goods sold.

A) Total variable cost remains constant with changes in the number of goods sold.

B) Unit variable cost decreases with an increase in production.

C) Unit variable cost remains constant with changes in production.

D) Total variable cost decreases with an increase in the number of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

58

A low operating leverage is normal for highly automated industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

59

If the unit selling price is $50, the volume of sales is $450,000, sales at the break-even point amount to $375,000, and the maximum possible sales are $550,000, the margin of safety will be 2,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

60

If the unit selling price is $40, the volume of sales is $3,000,000, sales at the break-even point amount to $2,500,000, and the maximum possible sales are $3,300,000, the margin of safety will be 12,500 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

61

Based on the following information, calculate fixed costs per month using the high-low method. ?

A) $12,000

B) $11,000

C) $10,000

D) $9,000

A) $12,000

B) $11,000

C) $10,000

D) $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

62

Under direct costing, only _____ manufacturing costs are included in the product cost.

A) variable

B) fixed

C) capitalized

D) notional

A) variable

B) fixed

C) capitalized

D) notional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is true about the changes in fixed cost?

A) An increase in production will result in an increase in per unit fixed cost.

B) A decrease in fixed cost will result in an increase in variable cost.

C) An increase in production will result in a decrease in per unit fixed cost.

D) A decrease in production will result in an increase in total fixed cost.

A) An increase in production will result in an increase in per unit fixed cost.

B) A decrease in fixed cost will result in an increase in variable cost.

C) An increase in production will result in a decrease in per unit fixed cost.

D) A decrease in production will result in an increase in total fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

64

The graph of a variable cost per unit when plotted against its related activity base appears as a:

A) circle.

B) rectangle.

C) straight line.

D) curved line.

A) circle.

B) rectangle.

C) straight line.

D) curved line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following graphs illustrates the nature of a mixed cost?

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

66

Tucker Co.manufactures office furniture.During the most productive month of the year, 3,600 desks were manufactured at a total cost of $192,000.In its slowest month, the company made 1,200 desks at a cost of $72,000.Using the high-low method of cost estimation, total fixed costs per month are:

A) $120,000.

B) $12,000.

C) $72,000.

D) $11,600.

A) $120,000.

B) $12,000.

C) $72,000.

D) $11,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

67

Knowing how costs behave to change in the level of activity is useful to management for all the following reasons except for:

A) predicting customer demand.

B) predicting profits as sales and production volumes change.

C) estimating costs.

D) changing an existing product production.

A) predicting customer demand.

B) predicting profits as sales and production volumes change.

C) estimating costs.

D) changing an existing product production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following statements is true if the number of units produced decreases?

A) The total variable cost remains constant.

B) The total variable cost decreases.

C) The variable cost per unit decreases.

D) The variable cost per unit increases.

A) The total variable cost remains constant.

B) The total variable cost decreases.

C) The variable cost per unit decreases.

D) The variable cost per unit increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

69

ABC Co.manufactures pens.During the most productive month of the year, 3,650 pens were manufactured at a total cost of $84,550.During its slowest month, the company made 1,250 pens at a cost of $46,150.Calculate the total fixed cost using the high-low method of cost estimation.

A) $25,650

B) $28,300

C) $26,150

D) $27,800

A) $25,650

B) $28,300

C) $26,150

D) $27,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is an example of a mixed cost?

A) Depreciation on factory machinery

B) Direct material cost

C) Maintenance expense

D) Property tax

A) Depreciation on factory machinery

B) Direct material cost

C) Maintenance expense

D) Property tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

71

_____ per unit increases or decreases in inverse proportion to its activity level.

A) Variable cost

B) Opportunity cost

C) Contribution cost

D) Fixed cost

A) Variable cost

B) Opportunity cost

C) Contribution cost

D) Fixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

72

Using the high-low method, calculate variable utilities costs per machine hour. ? ?

A) $0.33

B) $0.64

C) $0.50

D) $0.25

A) $0.33

B) $0.64

C) $0.50

D) $0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following activity bases would be the most appropriate for gasoline costs of a delivery service such as UPS?

A) Number of trucks employed

B) Number of miles driven

C) Number of trucks in service

D) Number of packages delivered

A) Number of trucks employed

B) Number of miles driven

C) Number of trucks in service

D) Number of packages delivered

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following graphs illustrates the behavior of a total variable cost?

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

75

The electricity expense in a production plant is an example of a:

A) variable cost.

B) margin cost.

C) fixed cost.

D) distribution cost.

A) variable cost.

B) margin cost.

C) fixed cost.

D) distribution cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

76

The following information is given for the maintenance department of Goldenrod Co.Calculate the variable costs per unit using the high-low method. ?

A) $0.17

B) $0.11

C) $0.25

D) $0.08

A) $0.17

B) $0.11

C) $0.25

D) $0.08

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

77

The systematic examination of the relationships among selling prices, volume of sales and production, costs, expenses, and profits is termed as:

A) contribution margin analysis.

B) cost-volume-profit analysis.

C) budgetary analysis.

D) gross profit analysis.

A) contribution margin analysis.

B) cost-volume-profit analysis.

C) budgetary analysis.

D) gross profit analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

78

For the purpose of analysis, mixed costs are generally:

A) classified as fixed costs.

B) classified as variable costs.

C) classified as period costs.

D) separated into their variable and fixed cost components.

A) classified as fixed costs.

B) classified as variable costs.

C) classified as period costs.

D) separated into their variable and fixed cost components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following statements is true regarding fixed and variable costs?

A) Both costs are constant when considered on a per-unit basis.

B) Both costs are constant when considered on a total basis.

C) Fixed costs are fixed in total, and variable costs are fixed per unit.

D) Variable costs are fixed in total, and fixed costs vary in total.

A) Both costs are constant when considered on a per-unit basis.

B) Both costs are constant when considered on a total basis.

C) Fixed costs are fixed in total, and variable costs are fixed per unit.

D) Variable costs are fixed in total, and fixed costs vary in total.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is an example of a cost that varies in proportion to changes in the activity base?

A) Depreciation on machinery

B) Packaging cost

C) Factory rent

D) Insurance cost

A) Depreciation on machinery

B) Packaging cost

C) Factory rent

D) Insurance cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck