Deck 14: Partnerships and Limited Liability Entities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/114

العب

ملء الشاشة (f)

Deck 14: Partnerships and Limited Liability Entities

1

Section 721 provides that, in general, no gain or loss is recognized by the partnership or the partner on contribution of appreciated or depreciated property to a partnership in exchange for an interest in the partnership.

True

2

Laura is a real estate developer and owns property that is treated as inventory (not a capital asset) in her business.She contributes a parcel of this land (basis of $15,000) to a partnership, also to be held as inventory.The fair market value of the property is $12,000 at the contribution date.After three years, the partnership sells the land for $10,000.The partnership will recognize a $5,000 ordinary loss on sale of the property.

True

3

Section 721 provides that no gain or loss is recognized on a contribution of property to a partnership in exchange for an interest in the partnership.An exception might apply if the taxpayer receives a cash distribution from the partnership soon after the property contribution is made.

True

4

A partnership is an association formed by two or more taxpayers (which may be any type of entity) to carry on a trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

5

Ken and Lars formed the equal KL Partnership during the current year, with Ken contributing $100,000 in cash and Lars contributing land (basis of $60,000, fair market value of $40,000) and equipment (basis of $0, fair market value of $60,000).Lars recognizes a $40,000 gain on the contribution and his basis in his partnership interest is $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

6

The primary purpose of the partnership agreement is to document the various tax elections made by the partners regarding depreciation methods, treatment of research and experimental costs, calculation of the § 199 deduction, and the § 754 election.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

7

MNO Partnership has three equal partners.Moon, Inc.and Neptune, Inc.each have fiscal years ending March 31.Omega uses the calendar year.MNO's taxable year end must be determined using the least aggregate deferral method, and is December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

8

The taxable income of a partnership flows through to the partners, who report the income on their tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

9

An example of the "aggregate concept" underlying partnership taxation is the fact that the partners (rather than the partnership) pay tax on partnership income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

10

If the partnership properly makes an election for treatment of a specific tax item, the partner is bound by that treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

11

PaulCo, DavidCo, and Sean form a partnership with cash contributions of $80,000, $50,000 and $30,000, respectively, and agree to share profits and losses in the ratio of their original cash contributions.PaulCo uses a January 31 fiscal year-end, while DavidCo and Sean use a November 30 and December 31 year-end, respectively.The partnership must use the least aggregate deferral method to determine its year end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

12

Morgan and Kristen formed an equal partnership on August 1 of the current year.Morgan contributed $60,000 cash and land with a basis of $18,000 and a fair market value of $40,000.Kristen contributed equipment with a basis of $42,000 and a value of $100,000.Kristen and Morgan each have a basis of $100,000 in their partnership interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

13

The "inside basis" is defined as a partner's basis in the partnership interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

14

JLK Partnership incurred $6,000 of organizational costs and $50,000 of startup costs in 2016.JKL may deduct $5,000 each of organizational and startup costs, and the remaining costs ($1,000 of organizational costs and $45,000 of startup costs) may be amortized over 60 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a limited liability company, all members are protected from all debts of the partnership unless they personally guaranteed the debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

16

George received a fully-vested 10% interest in partnership capital and a 20% interest in future partnership profits in exchange for services rendered to the GHP, LLC (not a publicly-traded partnership interest).The future profits of the partnership are subject to normal operating risks.George will report ordinary income equal to the fair market value of the profits interest, but the capital interest will not be currently taxed to him.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

17

Seven years ago, Paul purchased residential rental estate that he has been depreciating as MACRS property over 27.5 years.This year, when his adjusted basis in the property was $250,000, Paul transferred the property to the newly formed PLA LLC in exchange for a one-third interest in the LLC.PLA incurred $10,000 of transfer taxes and fees related to the property.PLA must treat the $260,000 basis in the property, fees, and expenses, as new MACRS property depreciable over 27.5 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

18

A partnership must provide any information to the partners that the partners would need to calculate deductions not permitted at the partnership level, such as for oil and gas depletion or the corporate dividends received deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

19

Syndication costs arise when partnership interests are being marketed to investors.These costs cannot be amortized or deducted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

20

The partnership reports each partner's share of income to the partner on a Form 1099-MISC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

21

The sum of the partners' ending basis amounts on all Schedules K-1 equals the partners' ending capital account balance shown on the partnership's Schedule L.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following entity owners cannot participate in management of the entity?

A)A general partner in a general partnership.

B)A member of a limited liability company.

C)A partner in a limited liability partnership.

D)A limited partner in a limited partnership.

E)None of the above.

A)A general partner in a general partnership.

B)A member of a limited liability company.

C)A partner in a limited liability partnership.

D)A limited partner in a limited partnership.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

23

Tim, Al, and Pat contributed assets to form the equal TAP Partnership.Tim contributed cash of $40,000 and land with a basis of $80,000 (fair market value of $60,000).Al contributed cash of $60,000 and land with a basis of $50,000 (fair market value of $40,000).Pat contributed cash of $60,000 and a fully depreciated property ($0 basis) valued at $40,000.Which of the following tax treatments is not correct?

A)Tim's basis in his partnership interest is $120,000.

B)Al realizes and recognizes a loss of $10,000.

C)Pat realizes a gain of $40,000 but recognizes $0 gain.

D)TAP has a basis of $80,000, $50,000, and $0 in the land and property (excluding cash) contributed by Tim, Al, and Pat, respectively.

E)All of these statements are correct.

A)Tim's basis in his partnership interest is $120,000.

B)Al realizes and recognizes a loss of $10,000.

C)Pat realizes a gain of $40,000 but recognizes $0 gain.

D)TAP has a basis of $80,000, $50,000, and $0 in the land and property (excluding cash) contributed by Tim, Al, and Pat, respectively.

E)All of these statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

24

William is a general partner in the WST partnership.During the current year, he receives a guaranteed payment of $10,000 for services he provides to the partnership, and his distributive share of partnership income is $30,000.William is required to pay self-employment tax on the $10,000 guaranteed payment, but not on his distributive share of partnership income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

25

Tara and Robert formed the TR Partnership four years ago.Because they decided the company needed some expertise in multimedia presentations, they offered Katie a 1/3 interest in partnership capital if she would come to work for the partnership.On July 1 of the current year, the unrestricted partnership interest (fair market value of $25,000) was transferred to Katie.How should Katie treat the receipt of the partnership interest in the current year?

A)Nontaxable.

B)$25,000 ordinary income.

C)$25,000 short-term capital gain.

D)$25,000 long-term capital gain.

A)Nontaxable.

B)$25,000 ordinary income.

C)$25,000 short-term capital gain.

D)$25,000 long-term capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is a correct definition of a concept related to partnership taxation?

A)The aggregate concept treats partners and partnerships as separate units and gives the partnership its own tax "personality."

B)A partner's capital sharing ratio is defined as the percent of partnership assets (capital) that would be allocated to the partner upon liquidation of the partnership.

C)The partnership's outside basis is defined as the sum of each partner's capital account balance.

D)A special allocation is defined as an amount that could differently affect the tax liabilities of two or more partners.

A)The aggregate concept treats partners and partnerships as separate units and gives the partnership its own tax "personality."

B)A partner's capital sharing ratio is defined as the percent of partnership assets (capital) that would be allocated to the partner upon liquidation of the partnership.

C)The partnership's outside basis is defined as the sum of each partner's capital account balance.

D)A special allocation is defined as an amount that could differently affect the tax liabilities of two or more partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following statements regarding partnership taxation is incorrect?

A)A partnership is a tax paying entity for Federal income tax purposes.

B)Partnership income is comprised of ordinary partnership income or loss and separately stated items.

C)A partnership is required to file a return with the IRS.

D)A partner's profit-sharing percent may differ from the partner's loss-sharing percent.

E)All of these statements are correct.

A)A partnership is a tax paying entity for Federal income tax purposes.

B)Partnership income is comprised of ordinary partnership income or loss and separately stated items.

C)A partnership is required to file a return with the IRS.

D)A partner's profit-sharing percent may differ from the partner's loss-sharing percent.

E)All of these statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

28

The amount of a partnership's income and loss from operating activities is combined with separately stated income and expenses to determine the partnership's equivalent of "taxable income." This amount is reconciled to book income on the partnership's Schedule M-1 or Schedule M-3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

29

One of the disadvantages of the partnership form is that the partner's share of the partnership's taxable income is taxed to the partner, whether it is distributed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

30

Ashley purchased her partnership interest from Lindsey on the first day of the current year for $40,000 cash.She received a $10,000 cash distribution from the partnership during the year, and her share of partnership income is $15,000.Her share of partnership liabilities on the last day of the partnership year is $20,000.Ashley's outside basis for her partnership interest at the end of the year is $45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

31

The JPM Partnership is a US-based manufacturing company.JPM calculates the domestic production activities deduction (§ 199) and deducts that amount on its Form 1065.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

32

On January 1 of the current year, Anna and Jason form an equal partnership.Anna contributes $50,000 cash and a parcel of land (adjusted basis of $100,000; fair market value of $150,000) in exchange for her interest in the partnership.Jason contributes property (adjusted basis of $180,000; fair market value of $200,000) in exchange for his partnership interest.Which of the following statements is true concerning the income tax results of this partnership formation?

A)Jason recognizes a $20,000 gain on his property transfer.

B)Jason has a $200,000 tax basis for his partnership interest.

C)Anna has a $150,000 tax basis for her partnership interest.

D)The partnership has a $150,000 adjusted basis in the land contributed by Anna.

A)Jason recognizes a $20,000 gain on his property transfer.

B)Jason has a $200,000 tax basis for his partnership interest.

C)Anna has a $150,000 tax basis for her partnership interest.

D)The partnership has a $150,000 adjusted basis in the land contributed by Anna.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

33

Blaine contributes property valued at $50,000 (basis of $40,000) in exchange for a 25% interest in the BIKE Partnership.If the property is later sold for $70,000, gain of $15,000 will be allocated to Blaine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

34

Harry's basis in his partnership interest was $10,000 at the beginning of the tax year.For the year, his share of the partnership's loss was $8,000, and he also received a distribution of $4,000.Harry can deduct an $8,000 loss, and he recognizes a gain of $2,000 on the distribution of cash in excess of his remaining basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

35

Items that are not required to be shown on the partners' Schedules K-1 include AMT adjustments and preferences and taxes paid to foreign countries, as AMT and the foreign tax credit are calculated by the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

36

Maria owns a 60% interest in the KLM Partnership.Four years ago her father gave her a parcel of land.The gift basis of the land to Maria is $60,000.In the current year, Maria had still not figured out how to use the land for her own personal or business use; consequently, she sold the land to the partnership for $50,000.The partnership immediately started using the land as a parking lot for its employees.Maria may recognize her $10,000 loss on the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

37

If a partnership allocates losses to the partners, the partners must first apply the passive loss limitations, then the basis limitation, and finally the at-risk limitations.If all three hurdles are met, the partner may deduct the loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

38

Emma's basis in her BBDE LLC interest is $60,000 at the beginning of the tax year.Her allocable share of LLC items are as follows: $20,000 of ordinary income, $2,000 tax-exempt interest income, and a $6,000 long-term capital gain.In addition, the LLC distributed $12,000 of cash to Emma during the year.Assuming the LLC had no liabilities at the beginning or the end of the year, Emma's ending basis in her LLC interest is $76,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

39

A partnership will take a carryover basis in an asset it acquires when:

A)The partnership acquires the asset through a § 1031 like-kind exchange.

B)A partner owning 25% of partnership capital and profits sells the asset to the partnership.

C)The partnership leases the asset from a partner on a one-year lease.

D)The partnership acquires the asset from a partner as a contribution to partnership capital under § 721(a).

A)The partnership acquires the asset through a § 1031 like-kind exchange.

B)A partner owning 25% of partnership capital and profits sells the asset to the partnership.

C)The partnership leases the asset from a partner on a one-year lease.

D)The partnership acquires the asset from a partner as a contribution to partnership capital under § 721(a).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

40

Partners' capital accounts should be determined using the same method on Form 1065 Schedule L, Form 1065 Schedule M-2, and the Schedules K-1 prepared for the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

41

Mark and Addison formed a partnership.Mark received a 25% interest in partnership capital and profits in exchange for land with a basis of $40,000 and a fair market value of $60,000.Addison received a 75% interest in partnership capital and profits in exchange for $180,000 of cash.Three years after the contribution date, the land contributed by Mark is sold by the partnership to a third party for $76,000.How much taxable gain will Mark recognize from the sale?

A)$0

B)$9,000

C)$24,000

D)$36,000

A)$0

B)$9,000

C)$24,000

D)$36,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

42

Stephanie is a calendar year cash basis taxpayer.She owns a 50% profit and loss interest in a cash basis partnership with a September 30 year-end.The partnership's operating income (after deducting guaranteed payments) was $120,000 ($10,000 per month) and $144,000 ($12,000 per month), respectively, for the partnership tax years ended September 30, 2016 and 2017.The partnership paid guaranteed payments to Stephanie of $2,000 and $3,000 per month during the fiscal years ended September 30, 2016 and 2017.How much will Stephanie's adjusted gross income be increased by these partnership items for her tax year ended December 31, 2016?

A)$60,000

B)$72,000

C)$84,000

D)$90,000

E)$108,000

A)$60,000

B)$72,000

C)$84,000

D)$90,000

E)$108,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

43

ABC LLC reported the following items on the LLC's Schedule K: ordinary income, $100,000; interest income, $3,000; long-term capital loss, ($4,000); charitable contributions, $1,000; post-1986 depreciation adjustment, $10,000; and cash distributions to partners, $50,000.How much will ABC show as net income (loss) on its Analysis of Income (Loss)?

A)$68,000

B)$78,000

C)$95,000

D)$98,000

E)$102,000

A)$68,000

B)$78,000

C)$95,000

D)$98,000

E)$102,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

44

Rebecca is a limited partner in the RST Partnership, which is not publicly traded.Her allocable share of RST's passive ordinary losses from a nonrealty activity for the current year is ($60,000).Rebecca has a $40,000 adjusted basis (outside basis) for her interest in RST (before deduction of any of the passive losses).Her amount "at risk" is $30,000 (before deduction of any of the passive losses).She also has $25,000 of passive income from other sources.How much of her ($60,000) allocable loss can Rebecca deduct on her current year's tax return?

A)$25,000

B)$30,000

C)$40,000

D)$60,000

E)None of the above

A)$25,000

B)$30,000

C)$40,000

D)$60,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

45

Molly is a 30% partner in the MAP Partnership.During the current tax year, the partnership reported ordinary income of $200,000 before payment of guaranteed payments and distributions to partners.The partnership made an ordinary cash distribution of $20,000 to Molly, and paid guaranteed payments to partners Molly, Amber, and Pat of $20,000 each ($60,000 total guaranteed payments).How much will Molly's adjusted gross income increase as a result of the above items?

A)$42,000

B)$60,000

C)$62,000

D)$80,000

A)$42,000

B)$60,000

C)$62,000

D)$80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which one of the following is not shown on the partnership's Schedule K on Page 4 of Form 1065?

A)The partnership's self-employment income.

B)The partnership's separately stated income and deductions.

C)The partnership's tax preference and adjustment items.

D)The partnership's net operating loss carryforward.

A)The partnership's self-employment income.

B)The partnership's separately stated income and deductions.

C)The partnership's tax preference and adjustment items.

D)The partnership's net operating loss carryforward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is an election or calculation made by the partner rather than the partnership?

A)Calculation of a § 199 deduction amount.

B)Whether to capitalize, amortize, or expense research and experimental costs.

C)The partnership's overall accounting method.

D)Whether to claim a § 179 deduction related to property acquired by the partnership.

E)All of the above elections are made by the partnership.

A)Calculation of a § 199 deduction amount.

B)Whether to capitalize, amortize, or expense research and experimental costs.

C)The partnership's overall accounting method.

D)Whether to claim a § 179 deduction related to property acquired by the partnership.

E)All of the above elections are made by the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

48

Kristie is a 30% partner in the KKM Partnership.During the current year, KKM reported gross receipts of $280,000 and a charitable contribution of $30,000.The partnership paid office expenses of $80,000.In addition, KKM distributed $20,000 each to partners Kaylyn and Megan, and the partnership paid partner Kaylyn $20,000 for administrative services.Kristie reports the following income from KKM during the current tax year:

A)$54,000 ordinary income; $9,000 charitable contribution.

B)$60,000 ordinary income; $9,000 charitable contribution.

C)$36,000 ordinary income.

D)$54,000 ordinary income.

A)$54,000 ordinary income; $9,000 charitable contribution.

B)$60,000 ordinary income; $9,000 charitable contribution.

C)$36,000 ordinary income.

D)$54,000 ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is always correct regarding assets acquired by a newly formed partnership? If a partner contributes:

A)Depreciable property: the partnership treats the property as newly acquired depreciable property, and may claim a § 179 deduction.

B)Unrealized (cash-basis) receivables: the partnership will report a capital gain when the receivable is collected.

C)Inventory (in the partner's hands): the partnership reports ordinary income if the property is held as a capital asset and sold within five years of the contribution date.

D)Land valued at less than its basis: the partnership reports a § 1231 loss if the property is sold at a loss.

A)Depreciable property: the partnership treats the property as newly acquired depreciable property, and may claim a § 179 deduction.

B)Unrealized (cash-basis) receivables: the partnership will report a capital gain when the receivable is collected.

C)Inventory (in the partner's hands): the partnership reports ordinary income if the property is held as a capital asset and sold within five years of the contribution date.

D)Land valued at less than its basis: the partnership reports a § 1231 loss if the property is sold at a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

50

Misty and John formed the MJ Partnership.Misty contributed $50,000 of cash in exchange for her 50% interest in the partnership capital and profits.During the first year of partnership operations, the following events occurred: the partnership had a net taxable income of $20,000; Misty received a distribution of $12,000 cash from the partnership; and Misty had a 50% share in the partnership's $60,000 of recourse liabilities on the last day of the partnership year.Misty's adjusted basis for her partnership interest at year end is:

A)$48,000.

B)$60,000.

C)$78,000.

D)$88,000.

E)$90,000.

A)$48,000.

B)$60,000.

C)$78,000.

D)$88,000.

E)$90,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

51

On a partnership's Form 1065, which of the following statements is not true?

A)The partnership reconciles its net "taxable" (equivalent) income to book income on Schedule M-1 or M-3.

B)The partnership balance sheet on Schedule L is generally presented on a financial (book) basis.

C)All partnership income and expense items are reported on Form 1065, page 1.

D)The partnership's equivalent of taxable income is reported in the "Analysis of Income (Loss)."

A)The partnership reconciles its net "taxable" (equivalent) income to book income on Schedule M-1 or M-3.

B)The partnership balance sheet on Schedule L is generally presented on a financial (book) basis.

C)All partnership income and expense items are reported on Form 1065, page 1.

D)The partnership's equivalent of taxable income is reported in the "Analysis of Income (Loss)."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

52

At the beginning of the year, Heather's "tax basis" capital account balance in the HEP Partnership was $85,000.During the tax year, Heather contributed property with a basis of $6,000 and a fair market value of $10,000.Her share of the partnership's ordinary income and separately stated income and deduction items was $40,000.At the end of the year, the partnership distributed $15,000 of cash to Heather.In addition, the partnership allocated $12,000 of recourse debt and $10,000 of nonrecourse debt to Heather.What is Heather's ending capital account balance determined using the "tax basis" method?

A)$116,000

B)$120,000

C)$126,000

D)$128,000

E)$138,000

A)$116,000

B)$120,000

C)$126,000

D)$128,000

E)$138,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is correct regarding the manner in which partnership liabilities are reflected in the partners' bases in their partnership interests?

A)Nonrecourse debt is allocated to the partners according to their loss-sharing ratios.

B)Recourse debt is allocated to the partners to the extent of the partnership's liabilities in excess of basis in the property.

C)An increase in partnership debts results in a decrease in the partners' bases in the partnership interest.

D)A decrease in partnership debt is treated as a distribution from the partnership to the partner and reduces the partner's basis in the partnership interest.

E)Partnership debt is not reflected in the partners' bases in their partnership interests.

A)Nonrecourse debt is allocated to the partners according to their loss-sharing ratios.

B)Recourse debt is allocated to the partners to the extent of the partnership's liabilities in excess of basis in the property.

C)An increase in partnership debts results in a decrease in the partners' bases in the partnership interest.

D)A decrease in partnership debt is treated as a distribution from the partnership to the partner and reduces the partner's basis in the partnership interest.

E)Partnership debt is not reflected in the partners' bases in their partnership interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

54

Binita contributed property with a basis of $40,000 and a value of $50,000 to the BE Partnership in exchange for a 20% interest in partnership capital and profits.During the first year of partnership operations, BE had net taxable income of $30,000 and tax-exempt interest income of $10,000.The partnership distributed $10,000 cash to Binita.Binita's adjusted basis (outside basis) for her partnership interest at year-end is:

A)$36,000.

B)$38,000.

C)$60,000.

D)$70,000.

A)$36,000.

B)$38,000.

C)$60,000.

D)$70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

55

TEC Partners was formed during the current tax year.It incurred $10,000 of organizational expenses, $80,000 of startup expenses, and $5,000 of transfer taxes to retitle property contributed by a partner.The property had been held as MACRS property for ten years by the contributing partner, and had an adjusted basis to the partner of $300,000 and fair market value of $400,000.Which of the following statements is correct regarding these items?

A)TEC treats the contributed property as a new MACRS asset placed in service on the date the property title is transferred.

B)TEC must amortize the $10,000 of organizational expenses over 180 months.

C)TEC's deducts the first $5,000 of startup expenses and amortizes the remainder over 180 months.

D)TEC must capitalize the transfer tax and treat it as a new asset placed in service on the date the property is contributed.

E)None of the above statements are true.

A)TEC treats the contributed property as a new MACRS asset placed in service on the date the property title is transferred.

B)TEC must amortize the $10,000 of organizational expenses over 180 months.

C)TEC's deducts the first $5,000 of startup expenses and amortizes the remainder over 180 months.

D)TEC must capitalize the transfer tax and treat it as a new asset placed in service on the date the property is contributed.

E)None of the above statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

56

Allison is a 40% partner in the BAM Partnership.At the beginning of the tax year, Allison's basis in the partnership interest was $100,000, including her share of partnership liabilities.During the current year, BAM reported an ordinary loss of $60,000 (before the following payments to the partners).In addition, BAM made an ordinary distribution of $8,000 to Allison and paid partner Brian a $20,000 consulting fee.At the end of the year, Allison's share of partnership liabilities decreased by $10,000.Assuming loss limitation rules do not apply, Allison's basis in the partnership interest at the end of the year is:

A)$2,000.

B)$50,000.

C)$58,000.

D)$70,000.

A)$2,000.

B)$50,000.

C)$58,000.

D)$70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following would be currently taxable as ordinary income to the service partner if received in exchange for services performed for the partnership? (In all cases, assume the interest is not sold within two years after the time it is granted to the service partner.)

A)A 10% interest in the capital of the partnership that will vest in 3 years.

B)A 20% interest in the future profits of the partnership received in exchange for future services to be performed for the partnership.

C)A 25% interest in the capital of the partnership where there are no restrictions on transferability of the interest.

D)All of the above.

A)A 10% interest in the capital of the partnership that will vest in 3 years.

B)A 20% interest in the future profits of the partnership received in exchange for future services to be performed for the partnership.

C)A 25% interest in the capital of the partnership where there are no restrictions on transferability of the interest.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

58

Ryan is a 25% partner in the ROCC Partnership.At the beginning of the tax year, Ryan's basis in the partnership interest was $90,000, including his share of partnership liabilities.During the current year, ROCC reported net ordinary income of $100,000.In addition, ROCC distributed $10,000 to each of the partners ($40,000 total).At the end of the year, Ryan's share of partnership liabilities increased by $10,000.Ryan's basis in the partnership interest at the end of the year is:

A)$90,000.

B)$100,000.

C)$115,000.

D)$125,000.

A)$90,000.

B)$100,000.

C)$115,000.

D)$125,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

59

Brooke and John formed a partnership.Brooke received a 40% interest in partnership capital and profits in exchange for contributing land (basis of $30,000 and fair market value of $120,000).John received a 60% interest in partnership capital and profits in exchange for contributing $180,000 of cash.Three years after the contribution date, the land contributed by Brooke is sold by the partnership to a third party for $150,000.How much taxable gain will Brooke recognize from the sale?

A)$102,000

B)$90,000

C)$48,000

D)$36,000

E)$0

A)$102,000

B)$90,000

C)$48,000

D)$36,000

E)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which one of the following allocations is most likely to meet the "substantial" test in the "substantial economic effect" rules? (Assume all the "economic effect" tests are met.)

A)The ROY LLC specially allocates $20,000 of income each year to partner Red with no offsetting loss allocations in other years.

B)The YGB LLC specially allocates $30,000 of ordinary income this year to partner Green with an offsetting allocation of loss in that same amount next year.

C)The BPV LLC specially allocates $10,000 of capital gains to Violet and $10,000 of interest income to Purple because Purple is in a lower tax bracket.

D)The PIR LLC specially allocates $60,000 of income to Indigo with no offsetting allocations.Indigo has expiring net operating losses.

A)The ROY LLC specially allocates $20,000 of income each year to partner Red with no offsetting loss allocations in other years.

B)The YGB LLC specially allocates $30,000 of ordinary income this year to partner Green with an offsetting allocation of loss in that same amount next year.

C)The BPV LLC specially allocates $10,000 of capital gains to Violet and $10,000 of interest income to Purple because Purple is in a lower tax bracket.

D)The PIR LLC specially allocates $60,000 of income to Indigo with no offsetting allocations.Indigo has expiring net operating losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

61

During the current year, MAC Partnership reported the following items of receipts and expenditures: $600,000 sales, $80,000 utilities and rent, $200,000 salaries to employees, $20,000 guaranteed payment to partner Antonio, investment interest income of $4,000, a charitable contribution of $8,000, and a distribution of $30,000 to partner Carl.Antonio is a 25% general partner.Based on this information, what items will be reflected on Antonio's Schedule K-1?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

62

Jeordie and Kendis created the JK Partnership by contributing $100,000 each.The $200,000 cash was used by the partnership to acquire a depreciable asset.The partnership agreement provides that the partners' capital accounts will be maintained in accordance with Reg.§ 1.704-1(b) (the "economic effect" Regulations) and that any partner with a deficit capital account will be required to restore that capital account when the partner's interest is liquidated.The partnership agreement provides that MACRS will be allocated 20% to Jeordie and 80% to Kendis.All other items of partnership income, gain, loss, deduction, and credit will be allocated equally between the partners.In the first year, MACRS is $40,000 and no other operating transactions occur.The property is sold at the end of the year for $160,000 and the partnership is liquidated immediately thereafter.

To satisfy the economic effect test, how much of the $160,000 cash (from the sale) is allocated each to Jeordie and Kendis?

To satisfy the economic effect test, how much of the $160,000 cash (from the sale) is allocated each to Jeordie and Kendis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

63

At the beginning of the tax year, Zach's basis for his partnership interest and his amount at risk in the partnership was $30,000.His share of partnership items for the year consisted of tax-exempt interest income of $2,000 and an ordinary loss of $44,000.He also received a distribution from the partnership of $20,000 cash during the year.For the tax year, Zach will report:

A)A nontaxable distribution of $20,000, an ordinary loss of $10,000, and a suspended loss carryforward of $34,000.

B)An ordinary loss of $32,000, a suspended loss carryforward of $12,000, and a taxable distribution of $20,000.

C)A nontaxable distribution of $20,000, an ordinary loss of $12,000, and a suspended loss carryforward of $32,000.

D)An ordinary loss of $44,000 and a nontaxable distribution of $20,000.

A)A nontaxable distribution of $20,000, an ordinary loss of $10,000, and a suspended loss carryforward of $34,000.

B)An ordinary loss of $32,000, a suspended loss carryforward of $12,000, and a taxable distribution of $20,000.

C)A nontaxable distribution of $20,000, an ordinary loss of $12,000, and a suspended loss carryforward of $32,000.

D)An ordinary loss of $44,000 and a nontaxable distribution of $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which one of the following is a true statement regarding the allocation of partnership debt among the partners for purposes of calculating basis?

A)No debt is allocated to LLC members because they are not liable for entity debts.

B)Nonrecourse debt is not allocated to general partners unless they personally guarantee the debt.

C)In a limited partnership, debt is only allocated to general partners.

D)In a limited liability partnership, debt is allocated among the managing partners, but not the partners with "limited liability."

E)For basis purposes, partnership debt is allocated among the partners even if no partner is personally liable for the debt.

A)No debt is allocated to LLC members because they are not liable for entity debts.

B)Nonrecourse debt is not allocated to general partners unless they personally guarantee the debt.

C)In a limited partnership, debt is only allocated to general partners.

D)In a limited liability partnership, debt is allocated among the managing partners, but not the partners with "limited liability."

E)For basis purposes, partnership debt is allocated among the partners even if no partner is personally liable for the debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

65

Sarah contributed fully depreciated ($0 basis) property valued at $50,000 to the RSTU Partnership in exchange for a 25% interest in partnership capital and profits.During the first year of partnership operations, RSTU had net taxable income of $200,000 and tax-exempt income of $4,000.The partnership distributed $10,000 cash to Sarah.Her share of partnership recourse liabilities on the last day of the partnership year was $20,000.What is Sarah's adjusted basis (outside basis) for her partnership interest at the end of the tax year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

66

Cassandra is a 10% limited partner in C&C, Ltd.Her basis in the interest is $60,000 before loss allocations, including her $30,000 share of the partnership's nonrecourse debt.(This debt is not qualified nonrecourse financing.) Cassandra is also a 10% limited partner in MNOP, in which her basis is $30,000.Cassandra is allocated an $80,000 loss from C&C, and $20,000 of income from MNOP.How much of the loss from C&C may Cassandra deduct? Under what Code provisions are the remaining losses suspended?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

67

On the formation of a partnership, when might a "disguised sale" occur? How can this treatment be avoided?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

68

Katherine invested $80,000 this year to purchase a 30% interest in the KLM Partnership.The partnership reported $200,000 of net income from operations, a $2,000 short-term capital loss, and a $10,000 charitable contribution.In addition, the partnership distributed $20,000 to Katherine and $10,000 each to partners Lauren and Missy.Assuming the partnership has no beginning or ending liabilities, what is Katherine's basis in her partnership interest at the end of the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

69

The LN partnership reported the following items of income and deduction during the current tax year: revenues, $300,000; cost of goods sold, $180,000; tax-exempt interest income, $2,000; salaries to employees, $80,000; and long-term capital gain, $10,000.In addition, the partnership distributed $20,000 of cash to 50% partner Nina and $10,000 of cash to 50% partner Len.What is Nina's share of ordinary partnership income and separately stated items?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

70

Samuel is the managing general partner of STU, in which he owns a 25% interest.For the year, STU reported ordinary income of $400,000 (after deducting all guaranteed payments).In addition, the LLC reported interest income of $12,000.Samuel received a guaranteed payment of $120,000 for services he performed for STU.How much income from self-employment did Samuel earn from STU?

A)$100,000

B)$120,000

C)$220,000

D)$223,000

A)$100,000

B)$120,000

C)$220,000

D)$223,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

71

In the current year, Derek formed an equal partnership with Cody.Derek contributed land with an adjusted basis of $110,000 and a fair market value of $200,000.Derek also contributed $50,000 cash to the partnership.Cody contributed land with an adjusted basis of $80,000 and a fair market value of $230,000.The land contributed by Derek was encumbered by a $60,000 nonrecourse debt.The land contributed by Cody was encumbered by $40,000 of nonrecourse debt.Assume the partners share debt equally.Immediately after the formation, what is the basis of Cody's partnership interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

72

Paul sells one parcel of land (basis of $100,000) for its fair market value of $160,000 to a partnership in which he owns a 60% capital interest.Paul held the land for investment purposes.The partnership is in the real estate development business, and will build residential housing (for sale to customers) on the land (the land is inventory to the partnership).Paul will recognize:

A)$0 gain or loss.

B)$36,000 ordinary income.

C)$36,000 capital gain.

D)$60,000 ordinary income.

E)$60,000 capital gain.

A)$0 gain or loss.

B)$36,000 ordinary income.

C)$36,000 capital gain.

D)$60,000 ordinary income.

E)$60,000 capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

73

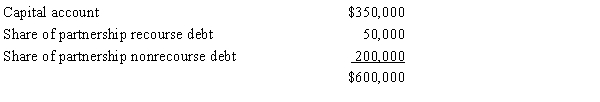

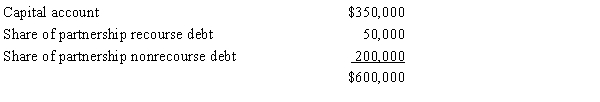

The MOP Partnership is involved in construction activities.Patricia has an adjusted basis for her partnership interest on January 1 of the current year of $600,000, consisting of the following.

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia.Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits, capital, and losses, and is an active ("material") participant in the partnership, how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss? How would your answer change if MOP were an LLC and Patricia had not personally guaranteed any of the debt?

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia.Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits, capital, and losses, and is an active ("material") participant in the partnership, how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss? How would your answer change if MOP were an LLC and Patricia had not personally guaranteed any of the debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

74

What are "syndication costs" and how are they treated for tax purposes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

75

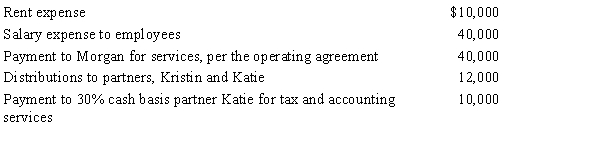

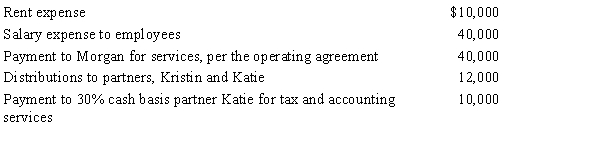

Morgan is a 50% managing member in the calendar year, cash basis MKK LLC.The LLC received $150,000 income from services and paid the following other amounts.

How much will Morgan's adjusted gross income increase as a result of the above items? What amount will be included in Morgan's self-employment tax calculation?

How much will Morgan's adjusted gross income increase as a result of the above items? What amount will be included in Morgan's self-employment tax calculation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

76

Carli contributes land to the newly formed CD Partnership in exchange for a 30% interest.The land has an adjusted basis and fair market value of $300,000 and is subject to a liability of $100,000, which the partnership assumes.None of this liability is repaid at year-end.At the end of the year, the partnership has trade accounts payable of $20,000.Assume all liabilities are allocated proportionately to the partners.Total partnership income for the year is $400,000.What is Carli's basis in her partnership interest at the end of the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

77

Your client owns a parcel of land that has depreciated in value.He wants to know if there is a way he can contribute the property to his partnership, have the partnership sell the property, and convert the existing capital loss into an ordinary loss.He also wants to know if part of the loss would be allocated to his other partners.What is your reaction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

78

Sharon and Sue are equal partners in the S&S Partnership.On January 1 of the current year, each partner's adjusted basis in S&S was $80,000 (including each partner's $20,000 share of the partnership's $40,000 of liabilities).During the current year, S&S repaid $30,000 of the debt and borrowed $20,000 for which Sharon and Sue are equally liable.In the current year ended December 31, S&S also sustained a net operating loss of $40,000 and earned $10,000 of interest income from investments.If liabilities are shared equally by the partners, on January 1 of the next year how much is each partner's basis in her interest in S&S?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is not a correct statement regarding the advantage of the partnership entity form over the C corporation form?

A)A partnership typically has easier administrative and filing requirements than does a C corporation.

B)Partnership income is subject to a single level of taxation; corporate income is double taxed.

C)Partnerships may specially allocate income and expenses among the partners, provided the substantial economic effect requirements are met; corporate dividends must be proportionate to shareholdings.

D)Partners in a general partnership have less personal liability for entity claims than shareholders of a C corporation.

E)All of the above are advantages of partnership taxation.

A)A partnership typically has easier administrative and filing requirements than does a C corporation.

B)Partnership income is subject to a single level of taxation; corporate income is double taxed.

C)Partnerships may specially allocate income and expenses among the partners, provided the substantial economic effect requirements are met; corporate dividends must be proportionate to shareholdings.

D)Partners in a general partnership have less personal liability for entity claims than shareholders of a C corporation.

E)All of the above are advantages of partnership taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which one of the following is not an item that should be documented in the partnership (or LLC operating) agreement?

A)Allocations of cash flows.

B)Allocations of profits and losses.

C)Liquidating distributions.

D)Partners' rights in managing the partnership.

E)All of the above should be documented.

A)Allocations of cash flows.

B)Allocations of profits and losses.

C)Liquidating distributions.

D)Partners' rights in managing the partnership.

E)All of the above should be documented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck