Deck 13: Planning for Capital Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

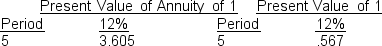

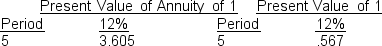

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

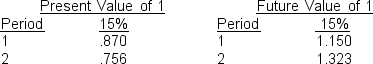

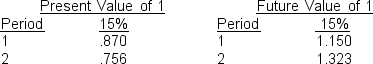

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/80

العب

ملء الشاشة (f)

Deck 13: Planning for Capital Investments

1

The cash payback technique

A)should be used as a final screening tool.

B)can be the only basis for the capital budgeting decision.

C)is relatively easy to calculate and understand.

D)considers the expected profitability of a project.

A)should be used as a final screening tool.

B)can be the only basis for the capital budgeting decision.

C)is relatively easy to calculate and understand.

D)considers the expected profitability of a project.

C

2

A disadvantage of the cash payback technique is that it

A)ignores obsolescence factors.

B)ignores the cost of an investment.

C)is complicated to use.

D)ignores the time value of money.

A)ignores obsolescence factors.

B)ignores the cost of an investment.

C)is complicated to use.

D)ignores the time value of money.

D

3

Capital budgeting is the process

A)used in sell or process further decisions.

B)of determining how many common shares to issue.

C)of making capital expenditure decisions.

D)of eliminating unprofitable product lines.

A)used in sell or process further decisions.

B)of determining how many common shares to issue.

C)of making capital expenditure decisions.

D)of eliminating unprofitable product lines.

C

4

When using the cash payback technique, the payback period is expressed in terms of

A)a percent.

B)dollars.

C)years.

D)months.

A)a percent.

B)dollars.

C)years.

D)months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

5

A company is considering purchasing factory equipment that costs $400,000 and is estimated to have no salvage value at the end of its 5-year useful life.If the equipment is purchased, annual revenues are expected to be $150,000 and annual operating expenses exclusive of depreciation expense are expected to be $25,000.The straight-line method of depreciation would be used.The cash payback period on the equipment is

A)8.89 years.

B)5.0 years.

C)3.2 years.

D)2.67 years.

A)8.89 years.

B)5.0 years.

C)3.2 years.

D)2.67 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

6

The cash payback

A)technique is a quick way to calculate a project's net present value.

B)period is calculated by dividing the annual cash inflow by the cost of the capital investment.

C)method is frequently used as a screening tool but it does not take into consideration the long-term profitability of a project.

D)the longer the payback period the more attractive the investment.

A)technique is a quick way to calculate a project's net present value.

B)period is calculated by dividing the annual cash inflow by the cost of the capital investment.

C)method is frequently used as a screening tool but it does not take into consideration the long-term profitability of a project.

D)the longer the payback period the more attractive the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following describes the capital budgeting evaluation process?

A)The capital budget committee submits its proposals to the officers of the company who choose which projects will be forwarded to the shareholders for ultimate approval.

B)The officers of the company submit their proposals to the capital budget committee who choose which projects will be forwarded to the shareholders for ultimate approval.

C)The officers of the company submit their proposals to the capital budget committee who choose which projects will be forwarded to the board of directors for ultimate approval.

D)The capital budget committee submits its proposal to the officers of the company who choose which projects will be forwarded to the board of directors for ultimate approval.

A)The capital budget committee submits its proposals to the officers of the company who choose which projects will be forwarded to the shareholders for ultimate approval.

B)The officers of the company submit their proposals to the capital budget committee who choose which projects will be forwarded to the shareholders for ultimate approval.

C)The officers of the company submit their proposals to the capital budget committee who choose which projects will be forwarded to the board of directors for ultimate approval.

D)The capital budget committee submits its proposal to the officers of the company who choose which projects will be forwarded to the board of directors for ultimate approval.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

8

The capital budget for the year is approved by a company's

A)board of directors.

B)capital budgeting committee.

C)officers.

D)shareholders.

A)board of directors.

B)capital budgeting committee.

C)officers.

D)shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

9

The cost of capital is a weighted average of the rates paid on borrowed funds, as well as on funds provided by investors in the company's shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following represents a cash outflow?

A)overhaul of equipment

B)increased cash received from customers

C)reduced cash flows for operating costs

D)salvage value of equipment when project is completed

A)overhaul of equipment

B)increased cash received from customers

C)reduced cash flows for operating costs

D)salvage value of equipment when project is completed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

11

Bark Company is considering buying a machine for $120,000 with an estimated life of ten years and no salvage value.The straight-line method of depreciation will be used.The machine is expected to generate net income of $8,000 each year.The cash payback period on this investment is

A)15 years.

B)10 years.

C)6 years.

D)3 years.

A)15 years.

B)10 years.

C)6 years.

D)3 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

12

The cash payback period is calculated by dividing the cost of the capital investment by the

A)annual net income.

B)net annual cash inflow.

C)present value of the cash inflow.

D)present value of the net income.

A)annual net income.

B)net annual cash inflow.

C)present value of the cash inflow.

D)present value of the net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

13

If an asset costs $60,000 and is expected to have a $5,000 salvage value at the end of its nine-year life, and generates annual net cash inflows of $10,000 each year, the cash payback period is

A)6.5 years.

B)6 years.

C)5.5 years.

D)9 years.

A)6.5 years.

B)6 years.

C)5.5 years.

D)9 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

14

The capital budgeting decision depends in part on the

A)availability of funds.

B)relationships among proposed projects.

C)risk associated with a particular project.

D)all of these.

A)availability of funds.

B)relationships among proposed projects.

C)risk associated with a particular project.

D)all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

15

The capital budgeting committee ultimately approves the capital expenditure budget for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a payback period for a project is greater than its expected useful life, the

A)project will always be profitable.

B)entire initial investment will not be recovered.

C)project would only be acceptable if the company's cost of capital was low.

D)project's return will always exceed the company's cost of capital.

A)project will always be profitable.

B)entire initial investment will not be recovered.

C)project would only be acceptable if the company's cost of capital was low.

D)project's return will always exceed the company's cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following represents a cash inflow?

A)the initial investment

B)sale of old equipment

C)repairs and maintenance

D)increased operating costs

A)the initial investment

B)sale of old equipment

C)repairs and maintenance

D)increased operating costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

18

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below: The cash payback period for Project Soup is

A)13.5 years.

B)5 years.

C)3.9 years.

D)3 years.

A)13.5 years.

B)5 years.

C)3.9 years.

D)3 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

19

The internal rate of return (or interest yield)is a rate that will cause the present value of the proposed capital expenditure to equal the present value of the expected annual cash inflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

20

The profitability index allows comparison of the relative desirability of projects that require differing initial investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

21

When using the net present value method

A)a net present value of zero indicates that the project would be acceptable.

B)the expected cash flows from a project must be an equal amount each year.

C)net cashflows are discounted to their future value.

D)a proposal is only acceptable when the rate of return on the investment exceeds the required rate of return.

A)a net present value of zero indicates that the project would be acceptable.

B)the expected cash flows from a project must be an equal amount each year.

C)net cashflows are discounted to their future value.

D)a proposal is only acceptable when the rate of return on the investment exceeds the required rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a company's required rate of return is 10% and, in using the net present value method, a project's net present value is zero, this indicates that the

A)project's rate of return exceeds 10%.

B)project's rate of return is less than the minimum rate required.

C)project earns a rate of return of 10%.

D)project earns a rate of return of 0%.

A)project's rate of return exceeds 10%.

B)project's rate of return is less than the minimum rate required.

C)project earns a rate of return of 10%.

D)project earns a rate of return of 0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

23

Capital budgeting relies on cash inflows and outflows as preferred inputs for calculations because

A)managers prefer to use cash figures rather than accounting figures.

B)GAAP does not apply to capital budgeting decisions.

C)projects require cash paid out and firms want to know when cash will be returned.

D)cash figures are easier to calculate than accounting figures.

A)managers prefer to use cash figures rather than accounting figures.

B)GAAP does not apply to capital budgeting decisions.

C)projects require cash paid out and firms want to know when cash will be returned.

D)cash figures are easier to calculate than accounting figures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

24

When the annual cash flows from an investment are unequal, the appropriate table to use is in the calculation of net present value is the

A)future value of 1 table.

B)future value of annuity table.

C)present value of 1 table.

D)present value of annuity table.

A)future value of 1 table.

B)future value of annuity table.

C)present value of 1 table.

D)present value of annuity table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

25

The cash payback method is useful because

A)it gives a broad indication when outlays will be recovered by the firm.

B)it gives a specific date as to when outlays will be recovered by the firm.

C)it avoids using complicated accounting data in capital budgeting decisions.

D)it is easy to communicate the relation between cash received and ultimate profitability of a project to everyone in the organization.

A)it gives a broad indication when outlays will be recovered by the firm.

B)it gives a specific date as to when outlays will be recovered by the firm.

C)it avoids using complicated accounting data in capital budgeting decisions.

D)it is easy to communicate the relation between cash received and ultimate profitability of a project to everyone in the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

26

The higher the risk element in a project, the

A)more attractive the investment.

B)higher the net present value.

C)higher the cost of capital.

D)higher the discount rate.

A)more attractive the investment.

B)higher the net present value.

C)higher the cost of capital.

D)higher the discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

27

Doris Co.is considering purchasing a new machine which will cost $200,000, but which will decrease costs each year by $50,000.The useful life of the machine is 10 years.The machine would be depreciated straight-line with no residual value over its useful life at the rate of $20,000/year.The payback period is

A)5.0 years.

B)4.5 years.

C)4.0 years.

D)10.0 years.

A)5.0 years.

B)4.5 years.

C)4.0 years.

D)10.0 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

28

The rate that a company must pay to obtain funds from creditors and shareholders s known as the

A)hurdle rate.

B)cost of capital.

C)cutoff rate.

D)all of these.

A)hurdle rate.

B)cost of capital.

C)cutoff rate.

D)all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following assumptions is made in order to simplify the net present value method?

A)All cash flows come at the end of the year.

B)All cash flows are immediately reinvested at the best rate available at the time.

C)All cash flows come at the beginning of the year.

D)All cash flows are not reinvested.

A)All cash flows come at the end of the year.

B)All cash flows are immediately reinvested at the best rate available at the time.

C)All cash flows come at the beginning of the year.

D)All cash flows are not reinvested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the following information for questions

A company projects an increase in net income of $40,000 each year for the next five years if it invests $500,000 in new equipment.The equipment has a five-year life and an estimated salvage value of $50,000.The company uses the straight-line method of depreciation.

What is the cash payback period?

A)12.5 years

B)5.56 years

C)3.85 years

D)3.57 years

A company projects an increase in net income of $40,000 each year for the next five years if it invests $500,000 in new equipment.The equipment has a five-year life and an estimated salvage value of $50,000.The company uses the straight-line method of depreciation.

What is the cash payback period?

A)12.5 years

B)5.56 years

C)3.85 years

D)3.57 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

31

When evaluating a project, companies should always use

A)the Bank of Canada rate of interest.

B)the rate that is currently charged at its bank.

C)the current corporate borrowing rate.

D)the corporate borrowing rate adjusted for any perceived risk of the project.

A)the Bank of Canada rate of interest.

B)the rate that is currently charged at its bank.

C)the current corporate borrowing rate.

D)the corporate borrowing rate adjusted for any perceived risk of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the following information for questions

A company projects an increase in net income of $40,000 each year for the next five years if it invests $500,000 in new equipment.The equipment has a five-year life and an estimated salvage value of $50,000.The company uses the straight-line method of depreciation.

What is the net annual cash flow?

A)$40,000

B)$90,000

C)$130,000

D)$140,000

A company projects an increase in net income of $40,000 each year for the next five years if it invests $500,000 in new equipment.The equipment has a five-year life and an estimated salvage value of $50,000.The company uses the straight-line method of depreciation.

What is the net annual cash flow?

A)$40,000

B)$90,000

C)$130,000

D)$140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

33

The major difficulty of the cash payback method is

A)it includes salvage values at the end of a project.

B)it ignores net income in its calculation.

C)it ignores the overall cash flow of the project.

D)it ignores the overall profitability of the project.

A)it includes salvage values at the end of a project.

B)it ignores net income in its calculation.

C)it ignores the overall cash flow of the project.

D)it ignores the overall profitability of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would not be considered as an input into a capital budgeting decision?

A)scrap value of equipment sold at the end of a project

B)labour savings as a result of mechanization of a process

C)cost outlays many years after the project has started

D)amortization on a straight-line basis

A)scrap value of equipment sold at the end of a project

B)labour savings as a result of mechanization of a process

C)cost outlays many years after the project has started

D)amortization on a straight-line basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

35

Vault Company wants to purchase an asset with a 3-year useful life, which is expected to produce cash inflows of $10,000 each year for two years, and $15,000 in year 3.Vault has a 14% cost of capital, and uses the following factors.What is the present value of these future cash flows?

A)$30,800

B)$30,400

C)$26,550

D)$17,750

A)$30,800

B)$30,400

C)$26,550

D)$17,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

36

Mystery Co.is considering purchasing a new piece of equipment that will cost $600,000.The equipment has an estimated useful life of 8 years and no salvage value.The equipment will produce cash inflows of $215,000 per year and net income of $90,000 per year.Mystery requires a 10% rate of return.What is the payback period for this equipment?

A)8.0 years

B)3.75 years

C)2.79 years

D)6.67 years

A)8.0 years

B)3.75 years

C)2.79 years

D)6.67 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

37

Cleaners, Inc.is considering purchasing equipment costing $30,000 with a 6-year useful life.The equipment will provide cost savings of $7,300 and will be depreciated straight-line over its useful life with no salvage value.Cleaners, Inc.requires a 10% rate of return.What is the approximate net present value of this investment?

A)$13,800

B)$1,792

C)$886

D)$2,748

A)$13,800

B)$1,792

C)$886

D)$2,748

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

38

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below: The company requires a 10% rate of return on all new investments.

The net present value for Project Nuts is

A)$618,410.

B)$182,912.

C)$100,000.

D)$18,410.

The net present value for Project Nuts is

A)$618,410.

B)$182,912.

C)$100,000.

D)$18,410.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

39

Tammy Co.is considering purchasing a machine that will produce annual savings of $22,000 at the end of the year.Tammy requires a 12% rate of return and the asset has a 5-year useful life.What is the maximum Tammy would be willing to pay for this machine?

A)$43,386

B)$79,310

C)$110,000

D)$62,370

A)$43,386

B)$79,310

C)$110,000

D)$62,370

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

40

The discount rate is referred to by all of the following alternative names except the

A)maximum return rate.

B)cutoff rate.

C)hurdle rate.

D)required rate of return.

A)maximum return rate.

B)cutoff rate.

C)hurdle rate.

D)required rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

41

To avoid rejecting projects that actually should be accepted, 1. intangible benefits should be ignared.

2. conservative estimates of the intangible benefits' value should be incorporated into the NPV calculation.

3. calculate net present value ignaring intangible benefits and then, if the NPV is negative, estimate whether the intangible benefits are worth at least the amount of the negative NPV.

A)1

B)2

C)3

D)both 2 and 3 are correct.

2. conservative estimates of the intangible benefits' value should be incorporated into the NPV calculation.

3. calculate net present value ignaring intangible benefits and then, if the NPV is negative, estimate whether the intangible benefits are worth at least the amount of the negative NPV.

A)1

B)2

C)3

D)both 2 and 3 are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

42

All of the following statements about intangible benefits in capital budgeting are correct except that they

A)include increased quality and employee loyalty.

B)are difficult to quantify.

C)are often ignored in capital budgeting decisions.

D)cannot be incorporated into the NPV calculation.

A)include increased quality and employee loyalty.

B)are difficult to quantify.

C)are often ignored in capital budgeting decisions.

D)cannot be incorporated into the NPV calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

43

A post-audit

A)should be performed as an evaluation of an organization's investment projects before their completion.

B)creates an incentive for managers to make lower estimates, since managers know that their results will be evaluated.

C)is an evaluation of how well a project's actual performance matches the projections made when the project was proposed.

D)provides an informal mechanism for deciding whether existing projects should be supported or terminated.

A)should be performed as an evaluation of an organization's investment projects before their completion.

B)creates an incentive for managers to make lower estimates, since managers know that their results will be evaluated.

C)is an evaluation of how well a project's actual performance matches the projections made when the project was proposed.

D)provides an informal mechanism for deciding whether existing projects should be supported or terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

44

Using the profitability index method, the present value of cash inflows for Project Flower is $88,000 and the present value of cash inflows of Project Plant is $48,000.If Project Flower and Project Plant require initial investments of $90,000 and $40,000, respectively, and have the same useful life, the project that should be accepted is

A)Project Flower.

B)Project Plant.

C)Either project may be accepted.

D)Neither project should be accepted.

A)Project Flower.

B)Project Plant.

C)Either project may be accepted.

D)Neither project should be accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

45

The profitability index is calculated by dividing the

A)total cash flows by the initial investment.

B)present value of cash flows by the initial investment.

C)initial investment by the total cash flows.

D)initial investment by the present value of cash flows.

A)total cash flows by the initial investment.

B)present value of cash flows by the initial investment.

C)initial investment by the total cash flows.

D)initial investment by the present value of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following information is available for a potential investment for Panda Company: The potential investment's profitability index is

A)4.00.

B)2.85.

C)2.50.

D)1.45.

A)4.00.

B)2.85.

C)2.50.

D)1.45.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

47

The major difference between the net present value method and the annual rate of return method in evaluating a capital project is

A)the ARR method is easier for accountants to justify than the NPV method.

B)the NPV method is easier for managers to justify than the ARR method.

C)the ARR method focuses on overall profitability of a project.

D)the NPV method focuses on the overall profitability of a project.

A)the ARR method is easier for accountants to justify than the NPV method.

B)the NPV method is easier for managers to justify than the ARR method.

C)the ARR method focuses on overall profitability of a project.

D)the NPV method focuses on the overall profitability of a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

48

An approach that uses a number of outcome estimates to get a sense of the variability among potential returns is

A)the discounted cash flow technique.

B)the net present value method.

C)risk analysis.

D)sensitivity analysis.

A)the discounted cash flow technique.

B)the net present value method.

C)risk analysis.

D)sensitivity analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

49

In evaluating high-tech projects

A)only tangible benefits should be considered.

B)only intangible benefits should be considered.

C)both tangible and intangible benefits should be considered.

D)neither tangible nor intangible benefits should be considered.

A)only tangible benefits should be considered.

B)only intangible benefits should be considered.

C)both tangible and intangible benefits should be considered.

D)neither tangible nor intangible benefits should be considered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

50

Peanut Co.is planning on investing in a new 2-year project, Project Jelly.Project Jelly is expected to produce cash flows of $100,000 and $120,000 in year 1 and year 2, respectively.Peanut requires an internal rate of return of 15%.What is the maximum amount that Peanut should invest immediately in Project Jelly?

A)$191.400

B)$177,720

C)$220,000

D)$273,760

A)$191.400

B)$177,720

C)$220,000

D)$273,760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

51

Intangible benefits in capital budgeting would include all of the following except increased

A)product quality.

B)employee loyalty.

C)salvage value.

D)product safety.

A)product quality.

B)employee loyalty.

C)salvage value.

D)product safety.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

52

If a company's required rate of return is 9%, and in using the profitability index method, a project's index is greater than 1, this indicates that the project's rate of return is

A)equal to 9%.

B)greater than 9%.

C)less than 9%.

D)unacceptable for investment purposes.

A)equal to 9%.

B)greater than 9%.

C)less than 9%.

D)unacceptable for investment purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is false?

A)By ignoring intangible benefits, capital budgeting techniques might incorrectly eliminate projects that could be beneficial to the company.

B)To avoid accepting projects that actually should be rejected, a company should ignore intangible benefits in calculating net present value.

C)One way of incorporating intangible benefits into the capital budgeting decision is to project conservative estimates of the value of the intangible benefits and include them in the NPV calculation.

D)Intangible benefits include increased quality, improved safety or greater employment loyalty.

A)By ignoring intangible benefits, capital budgeting techniques might incorrectly eliminate projects that could be beneficial to the company.

B)To avoid accepting projects that actually should be rejected, a company should ignore intangible benefits in calculating net present value.

C)One way of incorporating intangible benefits into the capital budgeting decision is to project conservative estimates of the value of the intangible benefits and include them in the NPV calculation.

D)Intangible benefits include increased quality, improved safety or greater employment loyalty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

54

Intangible benefits in capital budgeting

A)should be ignored because they are difficult to determine.

B)include increased quality or employee loyalty.

C)are not considered because they are usually not relevant to the decision.

D)have a rate of return in excess of the company's cost of capital.

A)should be ignored because they are difficult to determine.

B)include increased quality or employee loyalty.

C)are not considered because they are usually not relevant to the decision.

D)have a rate of return in excess of the company's cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

55

The profitability index

A)does not take into account the discounted cash flows.

B)is calculated by dividing total cash flows by the initial investment.

C)allows comparison of the relative desirability of projects that require differing initial investments.

D)will never be greater than 1.

A)does not take into account the discounted cash flows.

B)is calculated by dividing total cash flows by the initial investment.

C)allows comparison of the relative desirability of projects that require differing initial investments.

D)will never be greater than 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

56

The capital budgeting method that allows comparison of the relative desirability of projects that require differing initial investments is the

A)cash payback method.

B)internal rate of return method.

C)net present value method.

D)profitability index.

A)cash payback method.

B)internal rate of return method.

C)net present value method.

D)profitability index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

57

The capital budgeting method that takes into account both the size of the original investment and the discounted cash flows is the

A)cash payback method.

B)internal rate of return method.

C)net present value method.

D)profitability index.

A)cash payback method.

B)internal rate of return method.

C)net present value method.

D)profitability index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

58

Sensitivity analysis on a potential project

A)is only useful to perform when there are firm calculations on the project available.

B)is useful to perform when uncertainty exists and calculations are based on estimates.

C)is designed to ensure that management is aware of all possible outcomes of the project.

D)is designed to provide an escape-hatch for management should the project not succeed.

A)is only useful to perform when there are firm calculations on the project available.

B)is useful to perform when uncertainty exists and calculations are based on estimates.

C)is designed to ensure that management is aware of all possible outcomes of the project.

D)is designed to provide an escape-hatch for management should the project not succeed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

59

A thorough evaluation of how well a project's actual performance matches the projections made when the project was proposed is called a

A)pre-audit.

B)post-audit.

C)risk analysis.

D)sensitivity analysis.

A)pre-audit.

B)post-audit.

C)risk analysis.

D)sensitivity analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

60

Using a number of outcome estimates to get a sense of the variability among potential returns is

A)financial analysis.

B)post-audit analysis.

C)sensitivity analysis.

D)outcome analysis.

A)financial analysis.

B)post-audit analysis.

C)sensitivity analysis.

D)outcome analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is the main disadvantage of the annual rate of return method?

A)It is only valid for investments with a one year time perspective.

B)It incorporates depreciation into the calculations, which increases the uncertainty of the calculations associated with estimating the life and salvage value of the investment.

C)No consideration is given as to when the cash inflows occur.

D)It does not consider the time value of money.

A)It is only valid for investments with a one year time perspective.

B)It incorporates depreciation into the calculations, which increases the uncertainty of the calculations associated with estimating the life and salvage value of the investment.

C)No consideration is given as to when the cash inflows occur.

D)It does not consider the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

62

In using the internal rate of return method

A)management can ignore the cost of capital for the project.

B)management must understand its own required rate of return for projects.

C)the net present value method can be ignored in assessing the project.

D)both the net present value and Cash Payback methods can be ignored in assessing the project.

A)management can ignore the cost of capital for the project.

B)management must understand its own required rate of return for projects.

C)the net present value method can be ignored in assessing the project.

D)both the net present value and Cash Payback methods can be ignored in assessing the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

63

Cleaners, Inc.is considering purchasing equipment costing $30,000 with a 6-year useful life.The equipment will provide cost savings of $7,300 and will be depreciated straight-line over its useful life with no salvage value.Cleaners, Inc.requires a 10% rate of return.What is the approximate internal rate of return for this investment?

A)9%

B)10%

C)11%

D)12%

A)9%

B)10%

C)11%

D)12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

64

A capital budgeting method that takes into consideration the time value of money is the

A)annual rate of return method.

B)return on shareholders' equity method.

C)cash payback technique.

D)internal rate of return method.

A)annual rate of return method.

B)return on shareholders' equity method.

C)cash payback technique.

D)internal rate of return method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

65

The annual rate of return method is also referred to as

A)simple rate of return method.

B)accounting rate of return method.

C)unadjusted rate of return method.

D)all of the above

A)simple rate of return method.

B)accounting rate of return method.

C)unadjusted rate of return method.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

66

A post-audit should be performed using

A)a different evaluation technique than that used in making the original decision.

B)the same evaluation technique used in making the original decision.

C)estimated amounts instead of actual figures.

D)an independent advisor.

A)a different evaluation technique than that used in making the original decision.

B)the same evaluation technique used in making the original decision.

C)estimated amounts instead of actual figures.

D)an independent advisor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

67

The internal rate of return method

A)is, like the NPV method, a discounted cash flow technique.

B)will reject a project when the internal rate of return is greater than or equal to the required rate of return.

C)finds the rate that results in a positive net present value.

D)does not recognize the time value of money.

A)is, like the NPV method, a discounted cash flow technique.

B)will reject a project when the internal rate of return is greater than or equal to the required rate of return.

C)finds the rate that results in a positive net present value.

D)does not recognize the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

68

Using the annual rate of return method,

A)a project is acceptable if its rate of return is greater than management's minimum rate of return.

B)requires dividing a project's annual cash inflows by the economic life of the project.

C)is advantageous as it considers the time value of money.

D)is advantageous as it relies on accrual accounting numbers rather than actual cash flows.

A)a project is acceptable if its rate of return is greater than management's minimum rate of return.

B)requires dividing a project's annual cash inflows by the economic life of the project.

C)is advantageous as it considers the time value of money.

D)is advantageous as it relies on accrual accounting numbers rather than actual cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

69

An intangible benefit of a project would best be described as

A)goodwill will be increased on the balance sheet as a result of the project.

B)the company's bankers may offer a lower rate of interest for certain projects.

C)the company's presence in its market is enhanced by the project which may result in additional sales of the company's other product lines.

D)the company may be allowed deferred income tax payment terms as a result of the project.

A)goodwill will be increased on the balance sheet as a result of the project.

B)the company's bankers may offer a lower rate of interest for certain projects.

C)the company's presence in its market is enhanced by the project which may result in additional sales of the company's other product lines.

D)the company may be allowed deferred income tax payment terms as a result of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

70

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below:

The company requires a 10% rate of return on all new investments.

The annual rate of return for Project Soup is

A)13.3%.

B)20%.

C)33.3%.

D)30%.

The company requires a 10% rate of return on all new investments.

The annual rate of return for Project Soup is

A)13.3%.

B)20%.

C)33.3%.

D)30%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

71

A company is considering purchasing factory equipment that costs $400,000 and is estimated to have no salvage value at the end of its 5-year useful life.If the equipment is purchased, annual revenues are expected to be $150,000 and annual operating expenses exclusive of depreciation expense are expected to be $25,000.The straight-line method of depreciation would be used.If the equipment is purchased, the annual rate of return expected on this equipment is

A)37.5%.

B)31.25%.

C)22.5%.

D)6.25%.

A)37.5%.

B)31.25%.

C)22.5%.

D)6.25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

72

Cleaners, Inc.is considering purchasing equipment costing $30,000 with a 6-year useful life.The equipment will provide cost savings of $7,300 and will be amortized using the straight-line method over its useful life with no salvage value.Cleaners, Inc.requires a 10% rate of return.What is the approximate profitability index associated with this equipment?

A)1.23

B)1.03

C)1.06

D)73

A)1.23

B)1.03

C)1.06

D)73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

73

When accepting large capital projects, a company should

A)pay strict attention to what the numbers indicate and accept or reject a project accordingly.

B)pay close attention to trends in the marketplace before accepting or rejecting a project.

C)assess the numbers on the project and then go with management's best judgment.

D)assess the numbers on the project then review the intangible benefits before accepting or rejecting a project.

A)pay strict attention to what the numbers indicate and accept or reject a project accordingly.

B)pay close attention to trends in the marketplace before accepting or rejecting a project.

C)assess the numbers on the project and then go with management's best judgment.

D)assess the numbers on the project then review the intangible benefits before accepting or rejecting a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

74

Post-audits of capital projects

A)are usually foolproof.

B)are done using different evaluation techniques than were used in making the original capital budgeting decision.

C)provide a formal mechanism by which the company can determine whether existing projects should be supported or terminated.

D)all of these.

A)are usually foolproof.

B)are done using different evaluation techniques than were used in making the original capital budgeting decision.

C)provide a formal mechanism by which the company can determine whether existing projects should be supported or terminated.

D)all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

75

The capital budgeting technique that finds the interest yield of the potential investment is the

A)annual rate of return method.

B)internal rate of return method.

C)net present value method.

D)profitability index method.

A)annual rate of return method.

B)internal rate of return method.

C)net present value method.

D)profitability index method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

76

The internal rate of return is the interest rate that results in a

A)positive NPV.

B)negative NPV.

C)zero NPV.

D)positive or negative NPV.

A)positive NPV.

B)negative NPV.

C)zero NPV.

D)positive or negative NPV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

77

In using the internal rate of return method, the internal rate of return factor was 4.0 and the equal annual cash inflows were $16,000.The initial investment in the project must have been

A)$8,000.

B)$16,000.

C)$64,000.

D)$32,000.

A)$8,000.

B)$16,000.

C)$64,000.

D)$32,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

78

The annual rate of return method is based on

A)accounting data.

B)the time value of money data.

C)market values.

D)cash flow data.

A)accounting data.

B)the time value of money data.

C)market values.

D)cash flow data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

79

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below:

The company requires a 10% rate of return on all new investments.

The internal rate of return for Project Nuts is approximately

A)10%.

B)11%.

C)12%.

D)9%.

The company requires a 10% rate of return on all new investments.

The internal rate of return for Project Nuts is approximately

A)10%.

B)11%.

C)12%.

D)9%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

80

A company projects an increase in net income of $40,000 each year for the next five years if it invests $500,000 in new equipment.The equipment has a five-year life and an estimated salvage value of $50,000.The company uses the straight-line method of depreciation.What is the annual rate of return?

A)8%

B)14.5%

C)18%

D)26.7%

A)8%

B)14.5%

C)18%

D)26.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck