Deck 7: Incremental Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/79

العب

ملء الشاشة (f)

Deck 7: Incremental Analysis

1

Costs that are relevant for future decision making in a manufacturing environment include

A)only variable manufacturing costs.

B)only fixed manufacturing costs.

C)all manufacturing costs.

D)only future costs that impact on the alternatives presented.

A)only variable manufacturing costs.

B)only fixed manufacturing costs.

C)all manufacturing costs.

D)only future costs that impact on the alternatives presented.

D

2

Which of the following statements about making decisions is correct?

A)Only relevant financial information should be considered.

B)All information should be considered in the final decision.

C)Management should consider both relevant financial and non-financial information.

D)Management accountants should provide the information, but they should not make recommendations.It is up to the managers to make decisions.

A)Only relevant financial information should be considered.

B)All information should be considered in the final decision.

C)Management should consider both relevant financial and non-financial information.

D)Management accountants should provide the information, but they should not make recommendations.It is up to the managers to make decisions.

C

3

What is a sunk cost?

A)A significant cost that has the potential to "sink" the organization.

B)A cost that has already occurred, but still must be considered in the decision process.

C)A cost that has already occurred and therefore is not relevant in the decision process.

D)A cost that cannot be changed.

A)A significant cost that has the potential to "sink" the organization.

B)A cost that has already occurred, but still must be considered in the decision process.

C)A cost that has already occurred and therefore is not relevant in the decision process.

D)A cost that cannot be changed.

C

4

Which of the following statements about incremental analysis is true?

A)It cannot be used if more than two alternatives are available.

B)It considers only cost factors, not revenue.

C)Its focus is on the past activities.

D)It only considers factors that are different for each alternative, and only those factors that will occur in the future.

A)It cannot be used if more than two alternatives are available.

B)It considers only cost factors, not revenue.

C)Its focus is on the past activities.

D)It only considers factors that are different for each alternative, and only those factors that will occur in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which one of the following is a true statement about incremental analysis?

A)It is another name for capital budgeting.

B)It is the same as CVP analysis.

C)It is used primarily for long-term planning.

D)It focuses on decisions that involve a choice among alternative courses of action.

A)It is another name for capital budgeting.

B)It is the same as CVP analysis.

C)It is used primarily for long-term planning.

D)It focuses on decisions that involve a choice among alternative courses of action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the process of evaluating financial data that changes under alternative courses of action called?

A)incremental analysis

B)decision-making analysis

C)contribution margin analysis

D)cost-benefit analysis

A)incremental analysis

B)decision-making analysis

C)contribution margin analysis

D)cost-benefit analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

7

For which of the following decisions is incremental analysis not appropriate?

A)elimination of an unprofitable segment

B)determining cost behaviour

C)a make-or-buy decision

D)an allocation of limited resource decision

A)elimination of an unprofitable segment

B)determining cost behaviour

C)a make-or-buy decision

D)an allocation of limited resource decision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

8

Decision making

A)involves reviewing the results of a decision once the decision has been made.

B)using incremental analysis focuses on the amounts which are the same among alternatives.

C)involves management considering only financial information because accounting is presented in a financial context.

D)always follows the same pattern, because decisions vary significantly in their scope, urgency, and importance.

A)involves reviewing the results of a decision once the decision has been made.

B)using incremental analysis focuses on the amounts which are the same among alternatives.

C)involves management considering only financial information because accounting is presented in a financial context.

D)always follows the same pattern, because decisions vary significantly in their scope, urgency, and importance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is a true statement about costs in incremental analysis?

A)Variable costs are always relevant.

B)Fixed costs are never relevant.

C)Fixed costs are always relevant.

D)Both variable and fixed costs can be relevant.

A)Variable costs are always relevant.

B)Fixed costs are never relevant.

C)Fixed costs are always relevant.

D)Both variable and fixed costs can be relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

10

Specik, Inc.is considering the following alternatives: Which of the following are relevant in choosing between the alternatives?

A)variable costs

B)revenues

C)fixed costs

D)variable costs and fixed costs

A)variable costs

B)revenues

C)fixed costs

D)variable costs and fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which steps do accountants mostly contribute to in the decision-making process?

A)Identifying the problem and then assigning responsibility.

B)Determining and evaluating possible courses of action and then reviewing the results of the decision.

C)Determining and evaluating possible courses of action, and then making a decision.

D)Making a decision and then reviewing the results of that decision.

A)Identifying the problem and then assigning responsibility.

B)Determining and evaluating possible courses of action and then reviewing the results of the decision.

C)Determining and evaluating possible courses of action, and then making a decision.

D)Making a decision and then reviewing the results of that decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which statement is true about relevant costs in incremental analysis?

A)All costs are relevant if they change between alternatives.

B)Only fixed costs are relevant.

C)Only variable costs are relevant.

D)Relevant costs should be ignored.

A)All costs are relevant if they change between alternatives.

B)Only fixed costs are relevant.

C)Only variable costs are relevant.

D)Relevant costs should be ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which one of the following is an alternative name for incremental analysis?

A)managerial analysis

B)cost analysis

C)contribution margin analysis

D)differential analysis

A)managerial analysis

B)cost analysis

C)contribution margin analysis

D)differential analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

14

For which of the following is incremental analysis appropriate?

A)acceptance of a special order and a make-or-buy decision

B)a retain or replace equipment decision and CVP analysis

C)a sell or process further decision and allocation of indirect costs

D)elimination of an unprofitable segment and allocation of indirect costs

A)acceptance of a special order and a make-or-buy decision

B)a retain or replace equipment decision and CVP analysis

C)a sell or process further decision and allocation of indirect costs

D)elimination of an unprofitable segment and allocation of indirect costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

15

Who prepares relevant revenue and cost data for the decision-making process?

A)department heads

B)the controller

C)management accountants

D)factory supervisors

A)department heads

B)the controller

C)management accountants

D)factory supervisors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements is true?

A)All variable costs are relevant costs.

B)Only those variable costs that differ between alternatives are relevant costs.

C)Fixed costs are never relevant costs.

D)All fixed costs are relevant costs as they impact on overall unit costs.

A)All variable costs are relevant costs.

B)Only those variable costs that differ between alternatives are relevant costs.

C)Fixed costs are never relevant costs.

D)All fixed costs are relevant costs as they impact on overall unit costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which one of the following is non-financial information that management might evaluate in making a decision?

A)opportunity costs of a decision

B)contribution margin

C)the effect on profit of a decision

D)the corporate profile in the community

A)opportunity costs of a decision

B)contribution margin

C)the effect on profit of a decision

D)the corporate profile in the community

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which one of the following stages of the management decision-making process is properly sequenced?

A)Evaluate possible courses of action; make decision.

B)Review the actual impact of the decision; determine possible courses of action.

C)Assign responsibility for the decision; identify the problem.

D)Make a decision; assign responsibility.

A)Evaluate possible courses of action; make decision.

B)Review the actual impact of the decision; determine possible courses of action.

C)Assign responsibility for the decision; identify the problem.

D)Make a decision; assign responsibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is false?

A)Incremental analysis identifies the probable effects of management decisions on future earnings.

B)In incremental analysis, total fixed costs will always remain constant under alternative courses of action.

C)The process used to identify the financial data that change under alternative courses of action is called incremental analysis.

D)Incremental costs are always relevant.

A)Incremental analysis identifies the probable effects of management decisions on future earnings.

B)In incremental analysis, total fixed costs will always remain constant under alternative courses of action.

C)The process used to identify the financial data that change under alternative courses of action is called incremental analysis.

D)Incremental costs are always relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following describes one aspect of incremental analysis?

A)Both costs and revenues that stay the same between alternate courses of action will be analyzed.

B)Both costs and revenues that differ between alternate courses of action will be analyzed.

C)All costs and revenues, regardless if they stay the same or differ between alternate courses of action, will be analyzed.

D)Only costs relating to the decisions at hand are analyzed.

A)Both costs and revenues that stay the same between alternate courses of action will be analyzed.

B)Both costs and revenues that differ between alternate courses of action will be analyzed.

C)All costs and revenues, regardless if they stay the same or differ between alternate courses of action, will be analyzed.

D)Only costs relating to the decisions at hand are analyzed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

21

A factory is operating at less than 100% capacity.Potential additional business will not use up the remainder of the plant capacity.Given the following list of costs, which one should be ignored in a decision to produce additional units of product?

A)variable selling expenses

B)fixed factory overhead

C)direct labour

D)contribution margin of additional units

A)variable selling expenses

B)fixed factory overhead

C)direct labour

D)contribution margin of additional units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

22

When making a decision to accept a special order, management must consider

A)the impact that additional manufacturing time will have on unit costs of its current products.

B)whether the purchaser will accept additional high costs of a special order.

C)whether a lower price will convince the purchaser to become a regular customer.

D)whether capacity exists to meet the demand of the order.

A)the impact that additional manufacturing time will have on unit costs of its current products.

B)whether the purchaser will accept additional high costs of a special order.

C)whether a lower price will convince the purchaser to become a regular customer.

D)whether capacity exists to meet the demand of the order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

23

It costs Lannon Fields $14 of variable costs and $6 of allocated fixed costs to produce an industrial trash can that sells for $30.A buyer in Mexico offers to purchase 3,000 units at $18 each.Lannon has excess capacity and can handle the additional production.What effect will acceptance of the offer have on net income?

A)decrease $4,000

B)increase $4,000

C)increase $54,000

D)increase $12,000

A)decrease $4,000

B)increase $4,000

C)increase $54,000

D)increase $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

24

Canosta, Inc.determined it must expand its capacity to accept a special order.Which situation is likely?

A)Unit variable costs will increase.

B)Fixed costs will not be relevant.

C)Both variable and fixed costs will be relevant.

D)The company should accept the order.

A)Unit variable costs will increase.

B)Fixed costs will not be relevant.

C)Both variable and fixed costs will be relevant.

D)The company should accept the order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

25

When a company does not have sufficient capacity to fill an order for less than the current selling price, what additional factor must be taken into consideration?

A)The decision process is the same whether there is sufficient capacity or not.

B)How will the lack of capacity affect the quality of the product?

C)Can resources be transferred from producing product to sell at the current price to producing product at the special price?

D)opportunity costs

A)The decision process is the same whether there is sufficient capacity or not.

B)How will the lack of capacity affect the quality of the product?

C)Can resources be transferred from producing product to sell at the current price to producing product at the special price?

D)opportunity costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

26

Max Company uses 10,000 units of Part A in producing its products.A supplier offers to make Part A for $7.Max Company has relevant costs of $8 a unit to manufacture Part A.If there is excess capacity, the opportunity cost of buying Part A from the supplier is

A)$0.

B)$10,000.

C)$70,000.

D)$80,000.

A)$0.

B)$10,000.

C)$70,000.

D)$80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

27

Seran Company has contacted Truckel Inc.with an offer to sell it 5,000 of the wickets for $18.00 each.If Truckel makes the wickets, variable costs are $11 per unit.Fixed costs are $12 per unit however $5 per unit is avoidable.Should Truckel make or buy the wickets? What are the savings of this choice?

A)Buy; savings = $25,000

B)Buy; savings = $10,000

C)Make; savings = $20,000

D)Make; savings = $10,000

A)Buy; savings = $25,000

B)Buy; savings = $10,000

C)Make; savings = $20,000

D)Make; savings = $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

28

Eminen Music produces 60,000 blank CDs on which to record music.The CDs have the following costs:

-Eminem could avoid $4,000 in fixed overhead costs if it acquires the CDs externally.If cost minimization is the major consideration and the company would prefer to buy the 60,000 units externally, what is the maximum external price that Eminem would expect to pay for the units?

A)$32,000

B)$29,000

C)$36,000

D)$33,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

29

What is the nature of an opportunity cost?

A)It is always variable.

B)It is a potential benefit.

C)It is included as part of cost of goods sold.

D)It is a sunk cost.

A)It is always variable.

B)It is a potential benefit.

C)It is included as part of cost of goods sold.

D)It is a sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

30

Excess capacity decisions for management involve

A)decreasing sales prices to stimulate demand.

B)accepting special orders.

C)outsourcing some products to specialist manufacturers.

D)mixing production to reduce variable costs.

A)decreasing sales prices to stimulate demand.

B)accepting special orders.

C)outsourcing some products to specialist manufacturers.

D)mixing production to reduce variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

31

When management has excess capacity available to it in the short run, which of the following would be the best path to follow?

A)Consider ways to reduce its fixed costs.

B)Consider accepting special orders.

C)Consider outsourcing certain products.

D)Consider mixing its product offerings in a new way.

A)Consider ways to reduce its fixed costs.

B)Consider accepting special orders.

C)Consider outsourcing certain products.

D)Consider mixing its product offerings in a new way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

32

Argus Company anticipates that other sales will be affected by the acceptance of a special order.What should the company do?

A)Reject the order.

B)Consider the opportunity cost of lost sales in the incremental analysis.

C)Accept the order.

D)Accept the order if the plant is below capacity.

A)Reject the order.

B)Consider the opportunity cost of lost sales in the incremental analysis.

C)Accept the order.

D)Accept the order if the plant is below capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

33

A company is within plant capacity.It is contemplating whether a special order should be accepted.The order will not impact regular sales.If the company accepts a special order, what will occur?

A)Incremental costs will not be affected.

B)Net income will increase if the special sales price per unit exceeds the unit variable costs.

C)There are no incremental revenues.

D)Both fixed and variable costs will increase.

A)Incremental costs will not be affected.

B)Net income will increase if the special sales price per unit exceeds the unit variable costs.

C)There are no incremental revenues.

D)Both fixed and variable costs will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which statement is true of an opportunity cost?

A)It is the cost of a special order option.

B)It reduces the possibility of accepting a particular course of action.

C)It is the potential benefit as a result of following an alternative course of action.

D)It is a variable cost.

A)It is the cost of a special order option.

B)It reduces the possibility of accepting a particular course of action.

C)It is the potential benefit as a result of following an alternative course of action.

D)It is a variable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

35

Truckel, Inc.currently manufactures a wicket as its main product.The costs per unit are as follows: The fixed overhead is an allocated common cost.How much is the relevant cost of the wicket?

A)$24.00

B)$14.00

C)$11.00

D)$19.00

A)$24.00

B)$14.00

C)$11.00

D)$19.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

36

M&H Ltd.has sufficient capacity to fill an order at a special price below its usual price.The special price exceeds its variable costs.What non-financial factors should also be considered in the decision?

A)Is there the potential for additional sales to the customer in the future?

B)How will existing customers respond if they find out about the special price?

C)If there is the potential for additional sales to the customer in the future, can a higher price be charged?

D)all of the above

A)Is there the potential for additional sales to the customer in the future?

B)How will existing customers respond if they find out about the special price?

C)If there is the potential for additional sales to the customer in the future, can a higher price be charged?

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

37

Eminen Music produces 60,000 blank CDs on which to record music.The CDs have the following costs:

-None of Eminem's fixed overhead costs can be reduced, but another product could be made that would increase profit contribution by $4,000 if the CDs were acquired externally.If cost minimization is the major consideration and the company would prefer to buy the CDs, what is the maximum external price that Eminem would be willing to accept to acquire the 60,000 units externally?

A)$36,000

B)$32,000

C)$33,000

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

38

Seville Company manufactures a product with a unit variable cost of $42 and a unit sales price of $75.Fixed manufacturing costs were $80,000 when 10,000 units were produced and sold, equating to $8 per unit.The company has a one-time opportunity to sell an additional 1,500 units at $55 each in an international market which would not affect its present sales.The company has sufficient capacity to produce the additional units.How much is the relevant income effect of accepting the special order?

A)$63,000

B)$7,500

C)$50,000

D)$19,500

A)$63,000

B)$7,500

C)$50,000

D)$19,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

39

The cost to produce Part A was $5 per unit in 2019.During 2020, it has increased to $8 per unit.In 2020, Supplier Company has offered to supply Part A for $6 per unit.For the make-or-buy decision,

A)incremental revenues are $1 per unit.

B)incremental costs are $3 per unit.

C)net relevant costs are $3 per unit.

D)differential costs are $2 per unit.

A)incremental revenues are $1 per unit.

B)incremental costs are $3 per unit.

C)net relevant costs are $3 per unit.

D)differential costs are $2 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

40

It costs Fortune Company $12 of variable and $5 of fixed costs to produce one bathroom scale which normally sells for $35.A foreign wholesaler offers to purchase 1,000 scales at $16 each.Fortune would incur special shipping costs of $2 per scale if the order were accepted.Fortune has sufficient unused capacity to produce the 1,000 scales.If the special order is accepted, what will be the effect on net income?

A)$2,000 increase

B)$2,000 decrease

C)$3,000 decrease

D)$15,000 increase

A)$2,000 increase

B)$2,000 decrease

C)$3,000 decrease

D)$15,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

41

In which situations should opportunity costs be considered?

A)decision making that involves alternative uses

B)forecasting sales

C)financial accounting

D)break-even analysis

A)decision making that involves alternative uses

B)forecasting sales

C)financial accounting

D)break-even analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

42

PH Toy Company is unsure of whether to sell its product assembled or unassembled.The unit cost of the unassembled product is $30 and PH Toy Company would sell it for $65.The cost to assemble the product is estimated at $21 per unit and PH Toy Company believes the market would support a price of $85 on the assembled unit.What decision should PH Toy make?

A)Sell before assembly; the company will be better off by $1 per unit.

B)Sell before assembly; the company will be better off by $20 per unit.

C)Process further; the company will be better off by $29 per unit.

D)Process further; the company will be better off by $14 per unit.

A)Sell before assembly; the company will be better off by $1 per unit.

B)Sell before assembly; the company will be better off by $20 per unit.

C)Process further; the company will be better off by $29 per unit.

D)Process further; the company will be better off by $14 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

43

During 2019, it cost Westa, Inc.$12 per unit to produce Part T5.During 2020, it has increased to $14 per unit.In 2020, Southside Company has offered to provide Part T5 for $9 per unit to Westa.As it pertains to the make-or-buy decision, which statement is true?

A)Differential costs are $5 per unit.

B)Incremental costs are $3 per unit.

C)Net relevant costs are $3 per unit.

D)Incremental revenues are $2 per unit.

A)Differential costs are $5 per unit.

B)Incremental costs are $3 per unit.

C)Net relevant costs are $3 per unit.

D)Incremental revenues are $2 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which decision will involve no incremental revenues?

A)make-or-buy decision

B)Drop a product line.

C)Accept a special order.

D)additional processing decision

A)make-or-buy decision

B)Drop a product line.

C)Accept a special order.

D)additional processing decision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

45

Litto Fray's produces corn chips.The cost of one batch is below: An outside supplier has offered to produce the corn chips for $26 per batch.How much will Litto Fray save if it accepts the offer?

A)$2.00 per batch

B)$17.00 per batch

C)$31.00 per batch

D)$6.00 per batch

A)$2.00 per batch

B)$17.00 per batch

C)$31.00 per batch

D)$6.00 per batch

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

46

In a sell or process further decision,

A)management should process further as long as the incremental revenues from additional processing are greater than the incremental costs.

B)the basic decision rule is: process further if the total processing costs exceeds the incremental revenue.

C)it is better to process further rather than sell now if the sales price increases.

D)the allocation of joint product costs is important and relevant.

A)management should process further as long as the incremental revenues from additional processing are greater than the incremental costs.

B)the basic decision rule is: process further if the total processing costs exceeds the incremental revenue.

C)it is better to process further rather than sell now if the sales price increases.

D)the allocation of joint product costs is important and relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

47

Walton, Inc.is unsure of whether to sell its product assembled or unassembled.The unit cost of the unassembled product is $16, while the cost of assembling each unit is estimated at $17.Unassembled units can be sold for $55, while assembled units could be sold for $71 per unit.What decision should Walton make?

A)Sell before assembly; the company will save $1 per unit.

B)Sell before assembly; the company will save $15 per unit.

C)Process further; the company will save $1 per unit.

D)Process further; the company will save $16 per unit.

A)Sell before assembly; the company will save $1 per unit.

B)Sell before assembly; the company will save $15 per unit.

C)Process further; the company will save $1 per unit.

D)Process further; the company will save $16 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

48

Peters, Inc.produces chocolate chip cookies.Costs for producing one batch appear below: An outside supplier has offered to produce the cookies for $14 per batch.If Peters decides to buy instead of make the cookies, what is the maximum price it would pay?

A)$16.00

B)$12.00

C)$13.60

D)$14.40

A)$16.00

B)$12.00

C)$13.60

D)$14.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

49

A company has a process that results in 1,000 kilograms of Product X that can be sold for $10 per kilogram.An alternative would be to process Product X further at a cost of $2,000 and then sell it for $13 per kilogram.Should management sell Product X now or should Product X be processed further and then sold?

A)Process further; the company will be better off by $1,000.

B)Sell now; the company will be better off by $1,000.

C)Process further; the company will be better off by $3,000.

D)Sell now; the company will be better off by $10,000.

A)Process further; the company will be better off by $1,000.

B)Sell now; the company will be better off by $1,000.

C)Process further; the company will be better off by $3,000.

D)Sell now; the company will be better off by $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

50

What non-financial factors should be considered when making a decision about buying rather than making a component of a company's product?

A)Is the quality of the purchased component acceptable?

B)Will the outside supplier increase prices significantly in the future?

C)Will the supplier deliver on time?

D)all of the above

A)Is the quality of the purchased component acceptable?

B)Will the outside supplier increase prices significantly in the future?

C)Will the supplier deliver on time?

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the following information for questions

Hermantic, Inc.can produce 100 units of a component part with the following costs:

-If Hermantic, Inc.purchases the units externally for $80,000, by what amount will its total costs change? Fixed costs are not avoidable if they purchase externally.

A)an increase of $80,000

B)an increase of $5,000

C)an increase of $17,000

D)a decrease of $22,000

Hermantic, Inc.can produce 100 units of a component part with the following costs:

-If Hermantic, Inc.purchases the units externally for $80,000, by what amount will its total costs change? Fixed costs are not avoidable if they purchase externally.

A)an increase of $80,000

B)an increase of $5,000

C)an increase of $17,000

D)a decrease of $22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

52

Harrison Company determines that an opportunity cost of an alternate course of action is relevant to a make-or-buy decision.Which statement is true of the opportunity cost?

A)should be added to the "buy" costs

B)should be subtracted from the "make" costs

C)should be added to the "make" costs

D)should be ignored if it does not involve a cash outlay

A)should be added to the "buy" costs

B)should be subtracted from the "make" costs

C)should be added to the "make" costs

D)should be ignored if it does not involve a cash outlay

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

53

Chapman Company manufactures widgets.Embree Company has approached Chapman with a proposal to sell the company widgets at a price of $60,000 for 100,000 units.Chapman is currently making these components in its own factory.The following costs are associated with this part of the process when 100,000 units are produced: The manufacturing overhead consists of $12,000 of costs that will be eliminated if the components are no longer produced by Chapman.From Chapman's point of view, how much is the incremental cost or savings if the widgets are bought instead of made?

A)$15,000 incremental savings

B)$3,000 incremental cost

C)$3,000 incremental savings

D)$15,000 incremental cost

A)$15,000 incremental savings

B)$3,000 incremental cost

C)$3,000 incremental savings

D)$15,000 incremental cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

54

Rosen, Inc.has 10,000 obsolete calculators, which are carried in inventory at a cost of $20,000.If the calculators are scrapped, they can be sold for $1.10 each (for parts).If they are repackaged, at a cost of $15,000, they could be sold to toy stores for $2.50 per unit.What alternative should be chosen, and why?

A)Scrap; profit is $1,000 greater.

B)Repackage; revenue is $5,000 greater than cost.

C)Scrap; incremental loss is $9,000.

D)Repackage; receive profit of $10,000.

A)Scrap; profit is $1,000 greater.

B)Repackage; revenue is $5,000 greater than cost.

C)Scrap; incremental loss is $9,000.

D)Repackage; receive profit of $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which one of the following does not affect a make-or-buy decision?

A)variable manufacturing costs

B)opportunity cost

C)incremental revenue

D)direct labour

A)variable manufacturing costs

B)opportunity cost

C)incremental revenue

D)direct labour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

56

Wishnell Toys can make 5,000 toy robots with the following costs: The company can purchase the 5,000 robots externally for $145,000.The avoidable fixed costs are $15,000 if the units are purchased externally.What is the cost savings if the company makes the robots?

A)$18,000

B)$15,000

C)$5,000

D)$3,000

A)$18,000

B)$15,000

C)$5,000

D)$3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

57

Galley Industries can produce 500 units of a necessary component part with the following costs: If Galley Industries purchases the component externally, $3,000 of the fixed costs can be avoided.Below what external price for the 500 units would Galley choose to buy instead of make?

A)$95,000

B)$165,000

C)$155,000

D)$158,000

A)$95,000

B)$165,000

C)$155,000

D)$158,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

58

Meow Cat Toys utilizes Lincoln Fabrics by purchasing the fabric to cover toy mice for its mouse toy division.As it pertains to Lincoln Fabrics, what decision situation does this create?

A)make-or-buy

B)sell or process further

C)relevant costing

D)budgeting

A)make-or-buy

B)sell or process further

C)relevant costing

D)budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which statement is true concerning the decision rule on whether to make or buy?

A)The company should buy if the cost of buying is less than the cost of producing.

B)The company should buy if the incremental revenue exceeds the incremental costs.

C)The company should buy as long as total revenue exceeds present revenues.

D)The company should buy assuming no additional fixed costs are incurred.

A)The company should buy if the cost of buying is less than the cost of producing.

B)The company should buy if the incremental revenue exceeds the incremental costs.

C)The company should buy as long as total revenue exceeds present revenues.

D)The company should buy assuming no additional fixed costs are incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use the following information for questions

Hermantic, Inc.can produce 100 units of a component part with the following costs:

-If Hermantic, Inc.can purchase the component externally for $88,000 and only $8,000 of the fixed costs can be avoided, what is the correct "make-or-buy decision"?

A)Make and save $1,000.

B)Buy and save $1,000.

C)Make and save $5,000.

D)Buy and save $13,000.

Hermantic, Inc.can produce 100 units of a component part with the following costs:

-If Hermantic, Inc.can purchase the component externally for $88,000 and only $8,000 of the fixed costs can be avoided, what is the correct "make-or-buy decision"?

A)Make and save $1,000.

B)Buy and save $1,000.

C)Make and save $5,000.

D)Buy and save $13,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

61

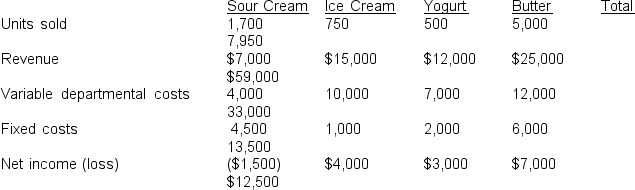

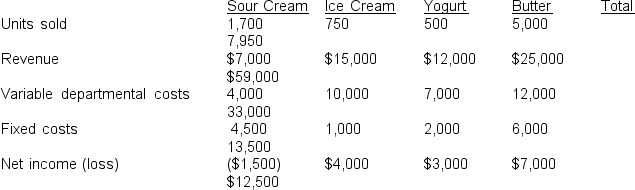

Serene Dairy has four product lines: sour cream, ice cream, yogurt, and butter.The total costs of producing the milk base for the products is $53,000 which has been allocated based on litres of milk base used by each product.Results of July follow:  How much are total joint costs of the products?

How much are total joint costs of the products?

A)$33,000

B)$13,500

C)$53,000

D)$12,500

How much are total joint costs of the products?

How much are total joint costs of the products?A)$33,000

B)$13,500

C)$53,000

D)$12,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

62

In a decision concerning replacing equipment

A)with new equipment, the book value of the old equipment can be considered an opportunity cost.

B)or keeping it, the salvage value of the old equipment is a sunk cost in incremental analysis.

C)with new equipment, old equipment which is not fully depreciated should always be replaced.

D)any trade-in allowance or cash disposal value of existing assets is relevant to the decision to retain or replace equipment.

A)with new equipment, the book value of the old equipment can be considered an opportunity cost.

B)or keeping it, the salvage value of the old equipment is a sunk cost in incremental analysis.

C)with new equipment, old equipment which is not fully depreciated should always be replaced.

D)any trade-in allowance or cash disposal value of existing assets is relevant to the decision to retain or replace equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

63

The main purpose of allocating joint costs to products is to

A)assist management in setting prices for its products.

B)assist in the annual budgetary processes.

C)assist in determining the cost of the products involved.

D)assist in determining which products should be added or dropped.

A)assist management in setting prices for its products.

B)assist in the annual budgetary processes.

C)assist in determining the cost of the products involved.

D)assist in determining which products should be added or dropped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

64

Costs that are common to two or more products are considered to be

A)joint costs.

B)split-off costs.

C)allocated costs.

D)shared fixed costs.

A)joint costs.

B)split-off costs.

C)allocated costs.

D)shared fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

65

A company decided to replace an old machine with a new machine.Which of the following is considered a relevant cost?

A)the book value of the old equipment

B)depreciation expense on the old equipment

C)the loss on the disposal of the old equipment

D)the current disposal price of the old equipment

A)the book value of the old equipment

B)depreciation expense on the old equipment

C)the loss on the disposal of the old equipment

D)the current disposal price of the old equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

66

EKP purchased a raw material in bulk for $10,000.It then spent an additional $500 to package the product into smaller quantities which it can sell for $12,000.Recently, a situation has arisen in which EKP can add an additional ingredient to the individual packages and sell them for $14,000.The cost of adding the additional ingredient is $1,700.Which amounts are relevant to the decision?

A)$10,000 + $500, $12,000 and $14,000

B)$10,000 + $500, $1,700 and $14,000

C)$12,000, $1,700 and $14,000

D)$10,000, $500, $12,000, $14,000 and $1,700

A)$10,000 + $500, $12,000 and $14,000

B)$10,000 + $500, $1,700 and $14,000

C)$12,000, $1,700 and $14,000

D)$10,000, $500, $12,000, $14,000 and $1,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

67

What role does a trade-in allowance on old equipment play in a decision to retain or replace equipment?

A)It is relevant since it increases the cost of the new equipment.

B)It is not relevant since it reduces the cost of the old equipment.

C)It is not relevant to the decision since it does not impact the cost of the new equipment.

D)It is relevant since it reduces the cost of the new equipment.

A)It is relevant since it increases the cost of the new equipment.

B)It is not relevant since it reduces the cost of the old equipment.

C)It is not relevant to the decision since it does not impact the cost of the new equipment.

D)It is relevant since it reduces the cost of the new equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

68

The most important thing to consider when deciding to replace or keep equipment is

A)salvage value of the current equipment.

B)the estimated number of years remaining on the books.

C)the expected variable costs of the new equipment.

D)whether book value is higher than replacement value.

A)salvage value of the current equipment.

B)the estimated number of years remaining on the books.

C)the expected variable costs of the new equipment.

D)whether book value is higher than replacement value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

69

Corn Crunchers has three product lines.Its only unprofitable line is Corn Nuts, the results of which appear below for 2020:

If this product line is eliminated, 30% of the fixed expenses can be eliminated. How much are the relevant costs in the decision to eliminate this product line?

A)$54,000

B)$410,000

C)$335,000

D)$284,000

If this product line is eliminated, 30% of the fixed expenses can be eliminated. How much are the relevant costs in the decision to eliminate this product line?

A)$54,000

B)$410,000

C)$335,000

D)$284,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

70

A company is considering replacing old equipment with new equipment.Which of the following is a relevant cost for incremental analysis?

A)total accumulated depreciation of the old equipment

B)cost of the old equipment

C)annual operating cost of the new equipment

D)book value of the old equipment

A)total accumulated depreciation of the old equipment

B)cost of the old equipment

C)annual operating cost of the new equipment

D)book value of the old equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

71

A company should

A)eliminate any segment in which the contribution margin is less than the fixed costs that are unavoidable.

B)eliminate an unprofitable product line as it will always increase the total profits of a company.

C)eliminate an unprofitable product as fixed expenses allocated to the eliminated segment will likely be eliminated.

D)identify the relevant costs in deciding whether to eliminate an unprofitable segment.

A)eliminate any segment in which the contribution margin is less than the fixed costs that are unavoidable.

B)eliminate an unprofitable product line as it will always increase the total profits of a company.

C)eliminate an unprofitable product as fixed expenses allocated to the eliminated segment will likely be eliminated.

D)identify the relevant costs in deciding whether to eliminate an unprofitable segment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

72

What is the nature of a sell or process further decision?

A)It is an incremental revenue decision.

B)It is an incremental cost decision.

C)It is both an incremental revenue and incremental cost decision.

D)It is neither incremental revenue nor incremental cost.

A)It is an incremental revenue decision.

B)It is an incremental cost decision.

C)It is both an incremental revenue and incremental cost decision.

D)It is neither incremental revenue nor incremental cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

73

Market Makeup produces face cream.Each bottle of face cream costs $10 to produce and can be sold for $13.The bottles can be sold as is, or processed further into sunscreen at a cost of $14 each.Market Makeup could sell the sunscreen bottles for $23 each.What should Market Makeup do?

A)Face cream must be further processed because its profit is $9 each.

B)Face cream must not be further processed because costs increase more than revenue.

C)Face cream must not be further processed because it decreases profit by $1 each.

D)Face cream must be further processed because it increases profit by $3 each.

A)Face cream must be further processed because its profit is $9 each.

B)Face cream must not be further processed because costs increase more than revenue.

C)Face cream must not be further processed because it decreases profit by $1 each.

D)Face cream must be further processed because it increases profit by $3 each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

74

Costs that are common to one or more products are called

A)split-off costs.

B)sunk costs.

C)joint costs.

D)incremental costs.

A)split-off costs.

B)sunk costs.

C)joint costs.

D)incremental costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

75

Coggin Company gathered the following data about the three products that it produces:

Which of the products should be processed further?

A)Product A

B)Product B

C)Product C

D)all three products

Which of the products should be processed further?

A)Product A

B)Product B

C)Product C

D)all three products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following is relevant information in a decision whether old equipment presently being used should be replaced by new equipment?

A)the cost of the old equipment

B)the salvage value of the old equipment

C)the book value of the old equipment

D)the accumulated depreciation of the old equipment

A)the cost of the old equipment

B)the salvage value of the old equipment

C)the book value of the old equipment

D)the accumulated depreciation of the old equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

77

Namov Company has old inventory on hand that cost $12,000.Its scrap value is $16,000.The inventory could be sold for $38,000 if manufactured further at an additional cost of $12,000.What should Namov do?

A)Sell the inventory for $16,000 scrap value.

B)Dispose of the inventory to avoid any further decline in value.

C)Hold the inventory at its $12,000 cost.

D)Manufacture further and sell it for $38,000.

A)Sell the inventory for $16,000 scrap value.

B)Dispose of the inventory to avoid any further decline in value.

C)Hold the inventory at its $12,000 cost.

D)Manufacture further and sell it for $38,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

78

A company is deciding whether or not to replace some old equipment with new equipment.Which of the following is not considered in the incremental analysis?

A)annual operating cost of the new equipment

B)annual operating cost of the old equipment

C)net cost of the new equipment

D)book value of the old equipment

A)annual operating cost of the new equipment

B)annual operating cost of the old equipment

C)net cost of the new equipment

D)book value of the old equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

79

What is the salvage value of old equipment considered to be?

A)a relevant cost

B)a non-incremental cost

C)an opportunity cost

D)a cost that is not differential

A)a relevant cost

B)a non-incremental cost

C)an opportunity cost

D)a cost that is not differential

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck