Deck 12: Reporting and Analyzing Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

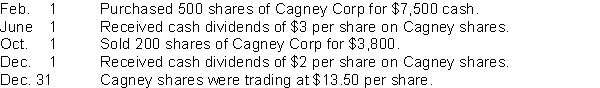

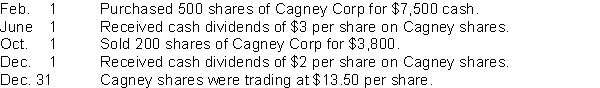

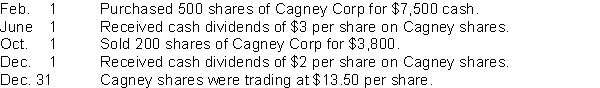

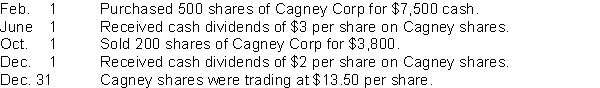

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/112

العب

ملء الشاشة (f)

Deck 12: Reporting and Analyzing Investments

1

Only debt investments can be purchased as strategic investments.

False

2

The cost model is used when the investment is held to earn cash flows but there is no fair value available.

True

3

When investing excess cash for short periods, investors generally invest in debt securities that have both high liquidity and high risk.

False

4

When investing excess cash for short periods of time, corporations generally invest in equity securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

5

Corporations purchase investments in debt or equity securities for the income tax write-off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

6

Equity securities are always classified as long-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

7

Using the fair value model, both unrealized and realized gains and losses would be reported in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under both the fair value model and the amortized cost model, investments are adjusted upwards or downwards to reflect their fair value at year end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

9

Only equity securities can be purchased for the strategic purpose of influencing relationships between companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

10

The degree of influence determines how a strategic investment is classified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

11

At acquisition, non-strategic investments are recorded at their purchase cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

12

Strategic investments are debt or equity securities that are usually purchased to generate investment income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

13

If the fair value through other comprehensive income model is used, then unrealized gains and losses are not used to evaluate management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

14

Non-strategic investments that are held for the purpose of earning capital gains are called trading investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

15

Non-strategic investments can be classified as short or long-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

16

Debt investments are generally low-risk investments the investor does not intend to sell in the near-term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

17

Preferred shares are often purchased as strategic investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

18

No unrealized gains and losses are recorded when using the amortized cost model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

19

Investments accounted for using the fair value through other comprehensive income model are called available-for-sale investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

20

The cost model is used only for equity investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under both IFRS and ASPE, investors can use either the cost model or the equity method for significantly influenced investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

22

Other comprehensive income (loss) increases (decreases) accumulated other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

23

Trading investments are always classified as current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

24

Under the equity method, the investment account is adjusted annually for a portion of associate's net profit and for dividends received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

25

Like profit (loss), other comprehensive income (loss) increases (decreases) retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

26

Dividends received on investments are accounted for in the same way under the fair value model cost and the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

27

The cost model is used to account for equity investments where there is significant influence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

28

At acquisition, the investment account is debited for the cost of the shares under both the cost and equity methods of accounting for strategic investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

29

Valuing available-for-sale securities at fair value could result in unrealized gains and losses that are reported on the statement of comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

30

When the equity method is used to account for an investment in shares, dividends received are accounted for as a reduction in the investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

31

When an investee can be significantly influenced, it is known as an associate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under the equity method, revenue is recognized when profit is earned by the associate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

33

Investments in associates are reported as current assets on the statement of financial position at their fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

34

One source of comprehensive income is created when unrealized gains and losses are recorded for trading investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

35

Using the fair value method of accounting for an equity investment, the journal entry to record the receipt of dividends involves a credit to Dividend Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

36

Unless there is evidence to the contrary, an investor owning at least 20% of the shares of an investee is assumed to have significant influence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

37

Realized gains and losses are always reported in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

38

Under the equity method, the receipt of dividends from the investee results in an increase in the investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

39

Both equity and debt investments are reported as current assets on the statement of financial position at their fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

40

Under the equity method, the receipt of dividends from the investee results in a credit to the Dividend Revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

41

Consolidated financial statements are appropriate when an investor has voting control of the investee's common shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

42

Financial assets have all of the following characteristics except

(a)They include receivables and investments.

(b)They are frequently purchased for investment purposes.

(c)They have a contractual right to receive cash.

(d)They are normally difficult to measure.

(a)They include receivables and investments.

(b)They are frequently purchased for investment purposes.

(c)They have a contractual right to receive cash.

(d)They are normally difficult to measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which one of the following would not be classified as a non-strategic investment?

(a)Money-market securities

(b)Idle cash in a chequing account

(c)Trading investments

(d)Long-term bonds

(a)Money-market securities

(b)Idle cash in a chequing account

(c)Trading investments

(d)Long-term bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

44

Debt investments are all of the following except

(a)low risk.

(b)classified according to maturity.

(c)equity securities.

(d)debt securities.

(a)low risk.

(b)classified according to maturity.

(c)equity securities.

(d)debt securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

45

Premiums and discounts must be amortized on all bond investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

46

Interest revenue is calculated by multiplying the carrying amount of the bond investment by the market rate of interest when the bond was purchased prorated by the portion of the payment period covered during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

47

Trading investments are all of the following except

(a)debt or equity securities.

(b)securities purchased to generate a profit from short-term price fluctuations.

(c)securities held for the purpose of earning capital gains.

(d)strategic investments.

(a)debt or equity securities.

(b)securities purchased to generate a profit from short-term price fluctuations.

(c)securities held for the purpose of earning capital gains.

(d)strategic investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

48

Short-term investments in bonds are accounted for using the fair value model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

49

The amortization of a bond investment is recorded in an Interest Revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

50

All of the following statements concerning strategic investments are true, except

(a)They include trading investments.

(b)They are purchased for the strategic purpose of influencing relationships between companies.

(c)They are generally long-term investments.

(d)They are financial assets.

(a)They include trading investments.

(b)They are purchased for the strategic purpose of influencing relationships between companies.

(c)They are generally long-term investments.

(d)They are financial assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

51

Corporations invest in other companies for all of the following reasons except to

(a)use excess cash until needed.

(b)generate investment revenue.

(c)meet strategic goals.

(d)influence the market value.

(a)use excess cash until needed.

(b)generate investment revenue.

(c)meet strategic goals.

(d)influence the market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

52

If there is a bond premium on a long-term bond investment, the carrying amount of the investment is reduced by the amount of the amortization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

53

When an investment in bonds is made, the investment account is debited for the face value of the bond less any premium or plus any discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

54

When investing excess cash for short periods of time, corporations generally invest in any of the following, except

(a)money-market funds.

(b)bankers' acceptances.

(c)equity securities.

(d)treasury bills.

(a)money-market funds.

(b)bankers' acceptances.

(c)equity securities.

(d)treasury bills.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

55

Realized and unrealized gains and losses are reported in the investing activities of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

56

Debt investments held to earn interest revenue are reported at amortized cost in the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following would never be classified as a long-term investment?

(a)Strategic investments

(b)Trading investments

(c)Investments in associates

(d)Bonds with a ten-year maturity

(a)Strategic investments

(b)Trading investments

(c)Investments in associates

(d)Bonds with a ten-year maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

58

Under both IFRS and ASPE, the investor must use the effective-interest method to amortize bond premium or discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

59

Debt investments include all of the following except

(a)common shares.

(b)guaranteed investment certificates.

(c)treasury bills.

(d)bonds.

(a)common shares.

(b)guaranteed investment certificates.

(c)treasury bills.

(d)bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

60

The amortization of a bond investment is recorded in an Interest Expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is not true about the accounting for trading investments?

(a)They are reported as current assets on the statement of financial position.

(b)Realized gains and losses are reported on the income statement.

(c)They are valued at fair value.

(d)Unrealized gains and losses are reported on the statement of comprehensive income.

(a)They are reported as current assets on the statement of financial position.

(b)Realized gains and losses are reported on the income statement.

(c)They are valued at fair value.

(d)Unrealized gains and losses are reported on the statement of comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements is not true?

(a)Trading investments can be classified as either current or non-current assets on the statement of financial position.

(b)Under the fair value model, both realized and unrealized gains and losses are reported in the income statement.

(c)Under the amortized cost method, no unrealized gains or losses are reported.

(d)Non-strategic investments are purchased to generate investment income.

(a)Trading investments can be classified as either current or non-current assets on the statement of financial position.

(b)Under the fair value model, both realized and unrealized gains and losses are reported in the income statement.

(c)Under the amortized cost method, no unrealized gains or losses are reported.

(d)Non-strategic investments are purchased to generate investment income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

63

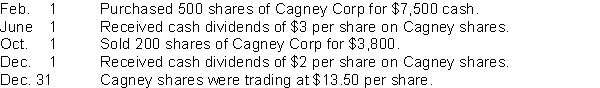

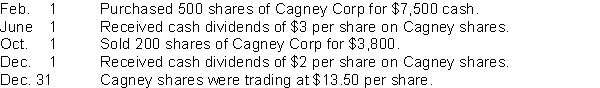

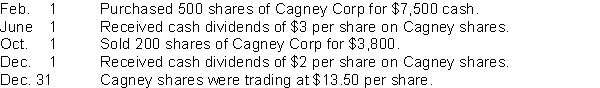

Use the following information to answer questions

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry to record the purchase of the Cagney shares on Feb. 1 would include a

(a)debit to Available-for-Sale Investments.

(b)debit to Trading Investments.

(c)debit to Strategic Investments.

(d)debit to Investment in Associates.

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry to record the purchase of the Cagney shares on Feb. 1 would include a

(a)debit to Available-for-Sale Investments.

(b)debit to Trading Investments.

(c)debit to Strategic Investments.

(d)debit to Investment in Associates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

64

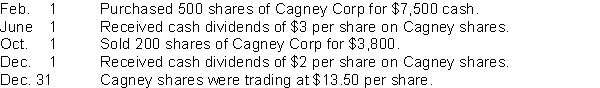

Use the following information to answer questions

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry to record the sale of the shares on Oct. 1 would include a

(a)credit to Trading Investments for $3,800.

(b)credit to Realized Gain for $800.

(c)credit to Unrealized Gain for $800.

(d)debit to Unrealized Gain for $3,800.

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry to record the sale of the shares on Oct. 1 would include a

(a)credit to Trading Investments for $3,800.

(b)credit to Realized Gain for $800.

(c)credit to Unrealized Gain for $800.

(d)debit to Unrealized Gain for $3,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

65

On June 1, 2012, Rouge Corp purchased Noir Corp common shares for $9,300 as a trading investment. Three months later, Rouge sold these shares for $10,000. The entry to record the sale would include a

(a)debit to Cash of $9,300.

(b)credit to Interest Revenue of $700.

(c)credit to Trading Investments of $10,000.

(d)credit to Realized Gain on Trading Investments of $700.

(a)debit to Cash of $9,300.

(b)credit to Interest Revenue of $700.

(c)credit to Trading Investments of $10,000.

(d)credit to Realized Gain on Trading Investments of $700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

66

When an investee can be significantly influenced, it is known as a(n)

(a)subsidiary.

(b)associate.

(c)trading investment.

(d)parent.

(a)subsidiary.

(b)associate.

(c)trading investment.

(d)parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

67

In June, Potter Corp paid $25,000 for 1,000 shares of Weasley Corp, which was classified as a long-term available-for-sale investment. At year-end, the fair value of the investment is $27,500. Potter will report

(a)nothing until the investment is sold.

(b)a $2,500 unrealized gain in its income statement.

(c)a $2,500 realized gain in its income statement.

(d)a $2,500 unrealized gain as other comprehensive income.

(a)nothing until the investment is sold.

(b)a $2,500 unrealized gain in its income statement.

(c)a $2,500 realized gain in its income statement.

(d)a $2,500 unrealized gain as other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following statements is not correct regarding strategic investments?

(a)They are purchased with the purpose of influencing the investee company.

(b)They are generally classified as investments in associates.

(c)They are frequently debt securities.

(d)The degree of influence determines how a strategic investment is classified.

(a)They are purchased with the purpose of influencing the investee company.

(b)They are generally classified as investments in associates.

(c)They are frequently debt securities.

(d)The degree of influence determines how a strategic investment is classified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

69

All of the following investments are generally shown at their fair value except

(a)Short-term debt investments.

(b)Trading investments.

(c)Bond investments intended to be held to maturity.

(d)Shares purchased with the intention of achieving a capital gain on sale.

(a)Short-term debt investments.

(b)Trading investments.

(c)Bond investments intended to be held to maturity.

(d)Shares purchased with the intention of achieving a capital gain on sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

70

On September 15, 2012, Wong Ltd sells 100 common shares of Tong Corp, which were being held as a trading investment. The shares were acquired six months ago at $100 a share. Wong sells the shares for $80 a share. The entry to record the sale is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a company reporting under ASPE decides to use the cost model to account for an investment in common shares, dividends received should be

(a)credited to the investment account.

(b)credited to the Dividend Revenue account.

(c)debited to the investment account.

(d)recorded only when 20% or more of the shares are owned.

(a)credited to the investment account.

(b)credited to the Dividend Revenue account.

(c)debited to the investment account.

(d)recorded only when 20% or more of the shares are owned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

72

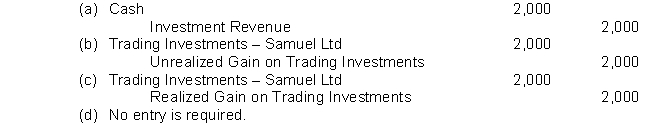

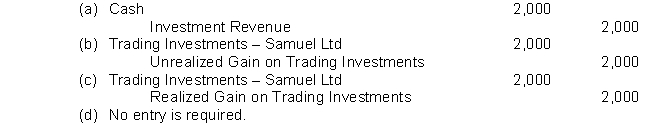

Jaleem Corporation buys 1,000 shares of Samuel Ltd.'s common shares as a trading investment. The shares are purchased for $30 a share. At year-end the shares are trading at $32. The adjusting entry at year-end is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

73

An advantage of using the fair value through other comprehensive income is that

(a)the effect on other comprehensive income is reported in the income statement.

(b)unrealized gains and losses are not used to evaluate management.

(c)unrealized losses must be reversed, but unrealized gains are ignored for that security.

(d)unrealized gains must be reversed, but unrealized losses are ignored for that security.

(a)the effect on other comprehensive income is reported in the income statement.

(b)unrealized gains and losses are not used to evaluate management.

(c)unrealized losses must be reversed, but unrealized gains are ignored for that security.

(d)unrealized gains must be reversed, but unrealized losses are ignored for that security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

74

If a trading investment in bonds is sold one month after its value was adjusted at year-end, the investment account is

(a)debited for the carrying amount of the bonds at the sale date.

(b)credited for the cost of the bonds at the sale date.

(c)credited for the carrying amount of the bonds at the sale date.

(d)debited for the cost of the bonds at the sale date.

(a)debited for the carrying amount of the bonds at the sale date.

(b)credited for the cost of the bonds at the sale date.

(c)credited for the carrying amount of the bonds at the sale date.

(d)debited for the cost of the bonds at the sale date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

75

Under the equity method of accounting for an investment

(a)Dividend Revenue is credited when dividends are received.

(b)an Unrealized Gain account is credited when the investee reports a profit.

(c)the investment account is credited when the investee reports a profit.

(d)the investment account is credited when dividends are received.

(a)Dividend Revenue is credited when dividends are received.

(b)an Unrealized Gain account is credited when the investee reports a profit.

(c)the investment account is credited when the investee reports a profit.

(d)the investment account is credited when dividends are received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

76

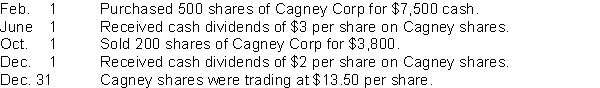

Use the following information to answer questions

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry to record the receipt of the dividends on December 1 would include a

(a)credit to Dividend Revenue for $600.

(b)credit to Trading Investments for $600.

(c)credit to Dividend Revenue of $1,000.

(d)credit to Realized Gain for $1,000.

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry to record the receipt of the dividends on December 1 would include a

(a)credit to Dividend Revenue for $600.

(b)credit to Trading Investments for $600.

(c)credit to Dividend Revenue of $1,000.

(d)credit to Realized Gain for $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

77

On October 1 of last year, Canadian Trader Corp (CTC) purchased 1,000 shares of the Regal Bank for $50,000 as a trading investment. At year end, December 31, the fair value of these shares was $52,000. On February 1 of this year, CTC sold all these shares for $51,000. The realized gain (loss) that CTC will report this year is

(a)a gain of $1,000.

(b)a gain of $2,000.

(c)a loss of $2,000.

(d)a loss of $1,000.

(a)a gain of $1,000.

(b)a gain of $2,000.

(c)a loss of $2,000.

(d)a loss of $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

78

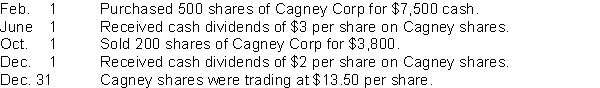

Use the following information to answer questions

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry, if any is required, to record the value of the investment on December 31 would include a debit to

(a)Realized Loss for $450.

(b)Unrealized Loss for $750.

(c)No entry is required.

(d)Unrealized Loss of $450.

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry, if any is required, to record the value of the investment on December 31 would include a debit to

(a)Realized Loss for $450.

(b)Unrealized Loss for $750.

(c)No entry is required.

(d)Unrealized Loss of $450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use the following information to answer questions

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry to record the receipt of the dividends on June 1 would include a

(a)debit to Trading Investments for $1,500.

(b)debit to Dividend Revenue for $1,500.

(c)credit to Dividend Revenue for $1,500.

(d)credit to Strategic Investments for $1,500.

Lacey Inc. reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

The entry to record the receipt of the dividends on June 1 would include a

(a)debit to Trading Investments for $1,500.

(b)debit to Dividend Revenue for $1,500.

(c)credit to Dividend Revenue for $1,500.

(d)credit to Strategic Investments for $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

80

Non-strategic Investments for which fair value cannot be determined are accounted for using the

(a)fair value model.

(b)equity method.

(c)cost model.

(d)amortized cost model.

(a)fair value model.

(b)equity method.

(c)cost model.

(d)amortized cost model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck