Deck 9: Reporting and Analyzing Long-Lived Assets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/150

العب

ملء الشاشة (f)

Deck 9: Reporting and Analyzing Long-Lived Assets

1

All property, plant, and equipment must be depreciated for accounting purposes.

False

2

While depreciation is a required expense on the financial statements, Capital Cost Allowance is an optional deduction for tax purposes.

True

3

The carrying amount of property, plant, and equipment is always equal to its fair value.

False

4

Land improvements are generally debited to the Land account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

5

Canada Revenue Agency requires a company to use the same depreciation method on its income tax return that is used in preparing financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

6

The depreciable amount of property, plant, and equipment is its original cost minus the depreciation for the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

7

When purchasing land, the costs for clearing, draining, filling, and grading should be charged to a Land Improvements account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

8

Using the units-of-production method of depreciation for equipment will generally result in more depreciation expense being recorded over the life of the asset than if the straight-line method had been used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

9

If land is purchased with a building on it that is to be demolished, proceeds from any salvaged materials are reported as Other Revenue in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under a finance lease, both the leased asset and the related lease obligation are shown on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under an operating lease, both the leased asset and the related lease obligation are shown on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

12

When purchasing a delivery truck, the cost of painting the company logo on the side should be debited to Delivery Truck account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

13

Asset retirement costs are added to the cost of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

14

Using the diminishing-balance method results in higher expense in the early years, and therefore lower profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Accumulated Depreciation account represents a cash fund available to replace property, plant, and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

16

Carrying amount is used in determining the amount that the diminishing-balance rate is applied to.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

17

In calculating depreciation, cost, useful life, and residual value are all based on estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

18

Recording depreciation on equipment affects both the statement of financial position and the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

19

Leasehold improvements are depreciated over the remaining life of the lease or the useful life of the improvements, whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under IFRS, companies must account for their property, plant, and equipment using the revaluation model, where depreciable assets are revalued upward to their fair values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the proceeds from the sale of equipment exceed its carrying amount, a gain on disposal is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

22

An intangible asset must be identifiable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

23

Normally, businesses only dispose of property, plant, and equipment by either sale or exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

24

When a company has a piece of property, plant, or equipment which has different components that depreciate at different rates, the total cost should be allocated to each component and each component should be depreciated separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

25

The cost of a finite intangible asset is not amortized, but the asset is tested for impairment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

26

When an impairment loss is recorded, the offsetting credit is recorded in accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a trademark is developed internally, it cannot be recognized as an intangible asset on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

28

A change in the estimated residual value of property, plant, and equipment requires a restatement of prior years' depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

29

An item of property, plant, and equipment is considered to be impaired if its carrying amount exceeds its recoverable amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

30

The carrying amount of an asset is the original cost less anticipated residual value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

31

A loss on disposal results if the cash proceeds received from the asset sale are less than the asset's carrying amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

32

When an entire business is purchased, goodwill is the excess of cost over the carrying amount of the net identifiable assets acquired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a building is sold at a gain, the gain on disposal should be reported in the non-operating section of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

34

All research costs should be capitalized when incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

35

When a change in estimate is made, there is no correction of previously recorded depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

36

Intangible assets involve rights, privileges, and/or competitive advantages that result from ownership of identifiable assets that do not possess physical substance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

37

When an asset is retired, a gain or loss must be recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

38

A tangible asset must be fully depreciated before it can be removed from the books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

39

If an acquired franchise or licence is for an indefinite time period, then the cost of the asset should not be amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

40

The cost of a patent should be amortized over its legal life or useful life, whichever is shorter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following should not be classified as property, plant and equipment?

(a)Building used as a factory

(b)Land used in ordinary business operations

(c)A truck held for resale by an automobile dealership

(d)Land improvements, such as parking lots and fences

(a)Building used as a factory

(b)Land used in ordinary business operations

(c)A truck held for resale by an automobile dealership

(d)Land improvements, such as parking lots and fences

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

42

Depreciation expense and impairment losses are presented in the operating section of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

43

Mercy General Hospital installs a new parking lot. The paving cost $25,000 and the lights to illuminate the new parking lot cost $13,000. Which of the following statements is true with respect to these expenditures?

(a)$25,000 should be debited to Land.

(b)$13,000 should be debited to Lighting Expense.

(c)$38,000 should be debited to Land.

(d)$38,000 should be debited to Land Improvements.

(a)$25,000 should be debited to Land.

(b)$13,000 should be debited to Lighting Expense.

(c)$38,000 should be debited to Land.

(d)$38,000 should be debited to Land Improvements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

44

A characteristic of property, plant, and equipment is that it is

(a)intangible.

(b)used in the operations of a business.

(c)held for sale in the ordinary course of the business.

(d)not currently used in the business but held for future use.

(a)intangible.

(b)used in the operations of a business.

(c)held for sale in the ordinary course of the business.

(d)not currently used in the business but held for future use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is not true for an operating expenditure?

(a)It is recorded with a debit to a statement of financial position account.

(b)It benefits the current period only.

(c)It is incurred to maintain an asset in its normal operating condition.

(d)It often recurs.

(a)It is recorded with a debit to a statement of financial position account.

(b)It benefits the current period only.

(c)It is incurred to maintain an asset in its normal operating condition.

(d)It often recurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following would not be included in the Equipment account?

(a)Installation costs

(b)Freight costs

(c)Cost of trial runs

(d)Electricity used by the machine

(a)Installation costs

(b)Freight costs

(c)Cost of trial runs

(d)Electricity used by the machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

47

Amortizing an intangible asset over too long a period will understate annual amortization expense and also understate net profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which one of the following items is not considered to be a part of the cost of a truck purchased for business use?

(a)Insurance during transit

(b)Truck licence

(c)Freight charges incurred when acquiring the truck

(d)Cost of lettering on the side of the truck

(a)Insurance during transit

(b)Truck licence

(c)Freight charges incurred when acquiring the truck

(d)Cost of lettering on the side of the truck

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

49

Land improvements should be depreciated over the useful life of the

(a)land.

(b)buildings on the land.

(c)land or land improvements, whichever is longer.

(d)land improvements.

(a)land.

(b)buildings on the land.

(c)land or land improvements, whichever is longer.

(d)land improvements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

50

Profit margin can be determined by multiplying the asset turnover by the return on assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

51

Impairment losses on goodwill are never reversed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

52

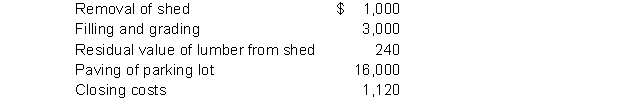

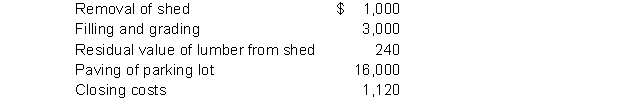

Cordelia Corp acquires land for $120,000 cash. Additional costs are as follows:  Cordelia will record the cost of the land as

Cordelia will record the cost of the land as

(a)$120,000.

(b)$124,120.

(c)$124,880.

(d)$140,880.

Cordelia will record the cost of the land as

Cordelia will record the cost of the land as(a)$120,000.

(b)$124,120.

(c)$124,880.

(d)$140,880.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following assets does not decline in service potential over the course of its useful life?

(a)Office equipment

(b)Furnishings

(c)Land

(d)Computers

(a)Office equipment

(b)Furnishings

(c)Land

(d)Computers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

54

The asset turnover indicates how efficiently a company uses its assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

55

A company purchased land for $120,000 cash; $7,000 was spent to demolish an old building on the land before construction of a new building could start; and $1,500 was received for material salvaged from the old building. The cost of the land would be recorded at

(a)$120,000.

(b)$125,500.

(c)$127,000.

(d)$128,500.

(a)$120,000.

(b)$125,500.

(c)$127,000.

(d)$128,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Land account would include all of the following costs except

(a)drainage costs.

(b)the cost of building a parking lot.

(c)title fees.

(d)the cost of tearing down a building.

(a)drainage costs.

(b)the cost of building a parking lot.

(c)title fees.

(d)the cost of tearing down a building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

57

The cost of land does not include

(a)closing costs.

(b)annual property taxes.

(c)removal costs of an old building.

(d)title fees.

(a)closing costs.

(b)annual property taxes.

(c)removal costs of an old building.

(d)title fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

58

The asset turnover ratio is calculated as net sales divided by ending total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

59

The cash flows from the purchase and sale of long-lived assets are reported in the operating activities section of the cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

60

Pippen Clinic Ltd. purchases land for $287,500 cash. The title and legal fees totalled $1,200. The clinic has the land graded for $30,000. What amount does Pippen Clinic record as the cost for the land?

(a)$287,500.

(b)$288,700.

(c)$317,500.

(d)$318,700.

(a)$287,500.

(b)$288,700.

(c)$317,500.

(d)$318,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

61

The carrying amount of an asset is equal to the

(a)asset's fair value less its historical cost.

(b)"blue-book" amount relied on by secondary markets.

(c)replacement cost of the asset.

(d)asset's cost less accumulated depreciation.

(a)asset's fair value less its historical cost.

(b)"blue-book" amount relied on by secondary markets.

(c)replacement cost of the asset.

(d)asset's cost less accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is not a consideration when calculating depreciation?

(a)the method of payment for the asset

(b)the cost of the asset

(c)the useful life of the asset

(d)the residual value of the asset

(a)the method of payment for the asset

(b)the cost of the asset

(c)the useful life of the asset

(d)the residual value of the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

63

Aye Corp purchases a remote site building for computer operations. The building will be suitable for operations after some necessary expenditures. The wiring must be replaced to handle the computer specifications. The roof is leaking and must be replaced. All rooms must be repainted and re-carpeted and there will also be some updating of the plumbing needed. Which of the following statements is true?

(a)The cost of the building will not include the repainting and re-carpeting costs.

(b)The cost of the building will include the cost of replacing the roof.

(c)The cost of the building is the purchase price of the building, while the additional expenditures are all capitalized as Building Improvements.

(d)The wiring replacement will be part of the computer costs, not the building cost.

(a)The cost of the building will not include the repainting and re-carpeting costs.

(b)The cost of the building will include the cost of replacing the roof.

(c)The cost of the building is the purchase price of the building, while the additional expenditures are all capitalized as Building Improvements.

(d)The wiring replacement will be part of the computer costs, not the building cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

64

Equipment was purchased for $25,000. Freight charges amounted to $700 and there was a cost of $3,000 for building a foundation and installing the equipment. It is estimated that the equipment will have a $1,600 residual value at the end of its 5-year useful life. Using the straight-line method, annual depreciation expense will be

(a)$4,540.

(b)$4,680.

(c)$5,420.

(d)$5,740.

(a)$4,540.

(b)$4,680.

(c)$5,420.

(d)$5,740.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

65

Interest may be included in the acquisition cost of property, plant, and equipment

(a)during the construction period of a building.

(b)if equipment is purchased on credit.

(c)if acquisition of an existing plant is financed by a mortgage.

(d)under no circumstances.

(a)during the construction period of a building.

(b)if equipment is purchased on credit.

(c)if acquisition of an existing plant is financed by a mortgage.

(d)under no circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

66

Dallas Corporation purchases a new delivery truck for $35,000. The company logo is painted on the side of the truck for $1,800. The truck licence is $160. Annual insurance is $1,700. At what amount does Dallas record the cost of the new truck?

(a)$35,000

(b)$35,160

(c)$36,800

(d)$36,860

(a)$35,000

(b)$35,160

(c)$36,800

(d)$36,860

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

67

In calculating depreciation, residual value is

(a)the fair value of the asset on the date of acquisition.

(b)subtracted from accumulated depreciation to determine the asset's depreciable cost.

(c)an estimate of the asset's value at the end of its useful life.

(d)ignored in all the depreciation methods.

(a)the fair value of the asset on the date of acquisition.

(b)subtracted from accumulated depreciation to determine the asset's depreciable cost.

(c)an estimate of the asset's value at the end of its useful life.

(d)ignored in all the depreciation methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is not an advantage of an operating lease?

(a)Reduced risk of obsolescence

(b)100-percent financing

(c)Income tax advantages

(d)Accelerated depreciation

(a)Reduced risk of obsolescence

(b)100-percent financing

(c)Income tax advantages

(d)Accelerated depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

69

Depreciation is a process of

(a)determining the asset's fair value.

(b)asset valuation.

(c)cost allocation.

(d)determining the asset's residual value.

(a)determining the asset's fair value.

(b)asset valuation.

(c)cost allocation.

(d)determining the asset's residual value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is included in the cost of constructing a building?

(a)Cost of paving a parking lot

(b)Cost of repairing vandalism damage during construction

(c)Interest incurred during construction

(d)Cost of removing the demolished building that existed on the land when it was purchased

(a)Cost of paving a parking lot

(b)Cost of repairing vandalism damage during construction

(c)Interest incurred during construction

(d)Cost of removing the demolished building that existed on the land when it was purchased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

71

The cost of a depreciable long-lived asset is expensed

(a)when it is paid for.

(b)as the asset benefits the company.

(c)in the period in which it is acquired.

(d)in the period in which it is disposed of.

(a)when it is paid for.

(b)as the asset benefits the company.

(c)in the period in which it is acquired.

(d)in the period in which it is disposed of.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

72

The balance in the Accumulated Depreciation account represents the

(a)cash fund to be used to replace assets.

(b)amount to be deducted from the cost of the asset to arrive at its fair value.

(c)amount charged to depreciation expense in the current period.

(d)amount charged to depreciation expense since the acquisition of the asset.

(a)cash fund to be used to replace assets.

(b)amount to be deducted from the cost of the asset to arrive at its fair value.

(c)amount charged to depreciation expense in the current period.

(d)amount charged to depreciation expense since the acquisition of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is not an acceptable method of depreciation for financial statement purposes in Canada?

(a)Straight-line

(b)Increasing-balance

(c)Diminishing-balance

(d)Units-of-Production

(a)Straight-line

(b)Increasing-balance

(c)Diminishing-balance

(d)Units-of-Production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

74

Equipment with a cost of $160,000, an estimated residual value of $10,000, and an estimated life of 4 years, was purchased on April 1, 2012. If the straight-line method is used, the depreciation expense for calendar 2012 is

(a)$40,000.

(b)$37,500.

(c)$30,000.

(d)$28,125.

(a)$40,000.

(b)$37,500.

(c)$30,000.

(d)$28,125.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

75

The difference between a depreciable asset's cost and its residual value is called

(a)the annual depreciation.

(b)accumulated depreciation.

(c)the depreciable amount.

(d)the revaluation amount.

(a)the annual depreciation.

(b)accumulated depreciation.

(c)the depreciable amount.

(d)the revaluation amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

76

When estimating the useful life of an asset, accountants do not consider

(a)the cost to replace the asset at the end of its useful life.

(b)vulnerability to obsolescence.

(c)expected repairs and maintenance.

(d)the intended use of the asset.

(a)the cost to replace the asset at the end of its useful life.

(b)vulnerability to obsolescence.

(c)expected repairs and maintenance.

(d)the intended use of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

77

A truck was purchased for $40,000 and it was estimated to have a $4,000 residual value. Using the straight-line method, monthly depreciation expense of $600 was recorded. Therefore, the annual depreciation rate as a percent is

(a)2%.

(b)17%.

(c)18%.

(d)20%.

(a)2%.

(b)17%.

(c)18%.

(d)20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which statement is correct regarding the use of the cost model and the revaluation model?

(a)The cost model is not allowed under IFRS.

(b)The revaluation model is the only model allowed under IFRS.

(c)The cost model is the only model allowed under ASPE.

(d)Either the cost model or the revaluation model can be under ASPE.

(a)The cost model is not allowed under IFRS.

(b)The revaluation model is the only model allowed under IFRS.

(c)The cost model is the only model allowed under ASPE.

(d)Either the cost model or the revaluation model can be under ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

79

The expected costs to retire an asset are called

(a)off-balance sheet financing.

(b)expected retirement costs.

(c)disposal costs.

(d)asset retirement costs.

(a)off-balance sheet financing.

(b)expected retirement costs.

(c)disposal costs.

(d)asset retirement costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

80

Equipment was purchased for $20,000. It is estimated that the equipment will have a $3,000 residual value at the end of its 5-year useful life. Using the straight-line method, annual depreciation expense will be

(a)$3,400.

(b)$4,000.

(c)$4,600.

(d)$5,000.

(a)$3,400.

(b)$4,000.

(c)$4,600.

(d)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck