Deck 5: Deductions for and From AGI

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/130

العب

ملء الشاشة (f)

Deck 5: Deductions for and From AGI

1

Ellen supports her family as a self-employed attorney. She reports $90,000 of income on her Schedule C and pays $8,000 for health insurance for her family, $2,500 for dental insurance, $4,000 for health insurance for her 23-year-old daughter who is no longer a dependent, and $3,000 for disability insurance for herself. What is Ellen's self-employed health insurance deduction?

A)$8,000

B)$10,500

C)$12,000

D)$14,500

E)$13,500

A)$8,000

B)$10,500

C)$12,000

D)$14,500

E)$13,500

D

2

In 2019, all taxpayers may make a deductible or nondeductible contribution to an IRA.

False

3

What percentage of medical insurance payments can self-employed taxpayers deduct for adjusted gross income on their 2019 tax returns, assuming their self-employment income exceeds their medical insurance payments?

A)60 percent

B)70 percent

C)50 percent

D)90 percent

E)100 percent

A)60 percent

B)70 percent

C)50 percent

D)90 percent

E)100 percent

E

4

Jim lives in California. What is Jim's deadline for making a contribution to traditional IRA or a Roth IRA for 2019?

A)April 15, 2019

B)December 31, 2019

C)April 15, 2020

D)October 15, 2020

A)April 15, 2019

B)December 31, 2019

C)April 15, 2020

D)October 15, 2020

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

5

A taxpayer must make contributions to a regular or Roth IRA prior to the end of the year in order to claim the deduction for that year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

6

Over the years, Monica contributed $15,000 to a Roth IRA opened 10 years ago. The IRA has a current value of $37,500. She is 54 years old and takes a distribution of $25,000. How much of the distribution will be taxable to Monica?

A)$0

B)$10,000

C)$15,000

D)$25,000

E)$37,500

A)$0

B)$10,000

C)$15,000

D)$25,000

E)$37,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

7

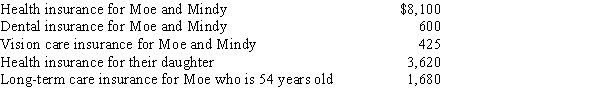

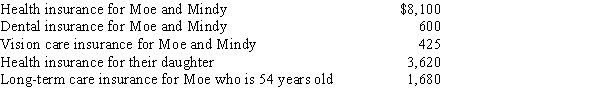

Moe has a law practice and earns $322,000 which he reports on his Schedule C. His wife, Mindy, works part-time at Wal-Mart and earns $8,300. Mindy does not receive any medical benefits through Wal-Mart. Their 29-year-old daughter, Michelle, who is not a dependent, is working toward earning her Master's degree.

Moe and Mindy pay the following amounts: How much may Moe and Mindy claim on their tax return as a self-employed health insurance deduction?

How much may Moe and Mindy claim on their tax return as a self-employed health insurance deduction?

Moe and Mindy pay the following amounts:

How much may Moe and Mindy claim on their tax return as a self-employed health insurance deduction?

How much may Moe and Mindy claim on their tax return as a self-employed health insurance deduction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

8

A taxpayer who is under 50 years of age and not an active participant in a retirement plan may make a contribution of up to $6,000 to an IRA, subject to the earned income limitation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is true about the self-employed health insurance deduction?

A)Dental insurance is not part of the allowable deduction.

B)Medical insurance is allowed as a deduction, subject to a dollar limitation.

C)Life insurance is allowed as a deduction.

D)Long-term care insurance is allowed as a deduction, subject to a dollar limitation.

E)The cost of insurance for dependent children is not allowed.

A)Dental insurance is not part of the allowable deduction.

B)Medical insurance is allowed as a deduction, subject to a dollar limitation.

C)Life insurance is allowed as a deduction.

D)Long-term care insurance is allowed as a deduction, subject to a dollar limitation.

E)The cost of insurance for dependent children is not allowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

10

If a taxpayer receives an early distribution from an IRA due to disability, he or she will not be subject to a penalty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

11

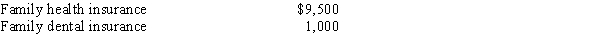

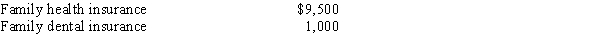

Mike and Rose are married and file jointly. Mike earns $45,000 from wages and Rose reports $450 on her Schedule C as an artist. Since Mike's work does not offer health insurance, Rose pays the following health insurance premiums from her business account:  How much can Mike and Rose deduct as self-employed health insurance?

How much can Mike and Rose deduct as self-employed health insurance?

How much can Mike and Rose deduct as self-employed health insurance?

How much can Mike and Rose deduct as self-employed health insurance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following statements is false about health savings accounts (HSAs)?

A)HSAs must be paired with qualifying high-deductible health insurance.

B)Taxpayers qualifying for Medicare do not qualify to make HSA contributions.

C)Distributions from HSAs which are not used for medical expenses are generally subject to a 20 percent penalty and income taxes.

D)Distributions from HSAs which are used for qualifying medical expenses are not subject to tax or penalty.

E)Deductible contributions to HSAs are unlimited.

A)HSAs must be paired with qualifying high-deductible health insurance.

B)Taxpayers qualifying for Medicare do not qualify to make HSA contributions.

C)Distributions from HSAs which are not used for medical expenses are generally subject to a 20 percent penalty and income taxes.

D)Distributions from HSAs which are used for qualifying medical expenses are not subject to tax or penalty.

E)Deductible contributions to HSAs are unlimited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

13

Earnings on nondeductible IRA contributions are allowed to accumulate tax-free until they are withdrawn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

14

Subject to the annual dollar limitation and the earned income limitation, deductible IRA contributions are allowed for all taxpayers who do not participate in a qualified retirement plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

15

Miki, who is single and 57 years old, has a qualifying high-deductible insurance plan. She had the following transactions with her HSA during the year:

a. How much may Miki claim as a deduction for adjusted gross income?

b. What is the amount that Miki must report on her federal income tax return as income from her HSA?

c. How much is subject to a penalty? What is the penalty percentage?

a. How much may Miki claim as a deduction for adjusted gross income?

b. What is the amount that Miki must report on her federal income tax return as income from her HSA?

c. How much is subject to a penalty? What is the penalty percentage?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements is true about health savings accounts (HSAs)?

A)There is no restriction on the kind of health insurance taxpayers must carry in order to qualify for an HSA.

B)Contributions to HSAs are not deductible for adjusted gross income (AGI), but are treated as an itemized deduction.

C)Individuals taking distributions from HSAs which are not for medical expenses are subject to a 50 percent penalty.

D)Distributions from HSAs are tax and penalty free when used for qualified medical expenses.

E)Taxpayers may take tax and penalty free distributions from HSAs to purchase automobiles after age 65.

A)There is no restriction on the kind of health insurance taxpayers must carry in order to qualify for an HSA.

B)Contributions to HSAs are not deductible for adjusted gross income (AGI), but are treated as an itemized deduction.

C)Individuals taking distributions from HSAs which are not for medical expenses are subject to a 50 percent penalty.

D)Distributions from HSAs are tax and penalty free when used for qualified medical expenses.

E)Taxpayers may take tax and penalty free distributions from HSAs to purchase automobiles after age 65.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

17

Since a contribution to an IRA is a voluntary action, a taxpayer may withdraw amounts from an IRA at any time without penalty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

18

What is the amount of the deductible HSA for each of the following taxpayers?

a. Amelia and Albert, both age 43, have a qualifying high-deductible insurance plan. They contribute $5,700 to a family HSA.

b. Betsy, who is single, 72 years old and covered by Medicare, wants to contribute the maximum amount to an HSA.

c. Carlo has health insurance through his employer which has low deductible amounts. He is 34 years old and is married. Carlo wants to contribute the maximum to an HSA.

d. Diane is 57 years old. She has a qualifying high-deductible insurance plan. She has contributed $5,350 to her HSA.

a. Amelia and Albert, both age 43, have a qualifying high-deductible insurance plan. They contribute $5,700 to a family HSA.

b. Betsy, who is single, 72 years old and covered by Medicare, wants to contribute the maximum amount to an HSA.

c. Carlo has health insurance through his employer which has low deductible amounts. He is 34 years old and is married. Carlo wants to contribute the maximum to an HSA.

d. Diane is 57 years old. She has a qualifying high-deductible insurance plan. She has contributed $5,350 to her HSA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

19

A 42-year-old single taxpayer earning a salary of $138,000 a year can make which of the following IRA contributions if he is not covered by a plan at work?

A)$6,000 to either a traditional IRA, a Roth IRA, or a nondeductible IRA

B)$7,000 to either a traditional IRA, a Roth IRA, or a nondeductible IRA

C)$6,000 to a Roth IRA only

D)$6,000 to either a traditional IRA or a nondeductible IRA, but no contribution is allowed to a Roth IRA

A)$6,000 to either a traditional IRA, a Roth IRA, or a nondeductible IRA

B)$7,000 to either a traditional IRA, a Roth IRA, or a nondeductible IRA

C)$6,000 to a Roth IRA only

D)$6,000 to either a traditional IRA or a nondeductible IRA, but no contribution is allowed to a Roth IRA

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

20

In some cases, a taxpayer may deduct an otherwise allowable contribution to an IRA, even though the contribution is made after the close of the tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

21

John is a single 40-year-old landscape architect earning $125,000 a year and is not covered by a pension plan at work. How much can he put into a Traditional IRA in 2019?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

22

Steven is 27 years old and has a total AGI of $110,000 in 2019. He contracts pneumonia in 2019 and incurs a medical bill that totals $7,500. He withdraws $7,500 from his traditional IRA to pay the bill. Which of the following is true?

A)He is not subject to penalties on the IRA withdrawal because it was for medical expenses.

B)He is not subject to penalties on the IRA withdrawal because he was disabled by pneumonia for 2 weeks.

C)He is subject to penalties on the IRA withdrawal because a person may not take a withdrawal from a traditional IRA until they are 59½ years old no matter what.

D)He is subject to penalties on the IRA withdrawal because the withdrawal did not cover a portion of medical bills that exceeded 10 percent of his AGI.

E)None of these is correct

A)He is not subject to penalties on the IRA withdrawal because it was for medical expenses.

B)He is not subject to penalties on the IRA withdrawal because he was disabled by pneumonia for 2 weeks.

C)He is subject to penalties on the IRA withdrawal because a person may not take a withdrawal from a traditional IRA until they are 59½ years old no matter what.

D)He is subject to penalties on the IRA withdrawal because the withdrawal did not cover a portion of medical bills that exceeded 10 percent of his AGI.

E)None of these is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

23

Contributions by a self-employed individual to a SEP plan for 2019 are limited to the lesser of a percent of net earned income or:

A)$19,000

B)$0

C)$55,000

D)$56,000

E)None of these is correct

A)$19,000

B)$0

C)$55,000

D)$56,000

E)None of these is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

24

Donald, a 40-year-old married taxpayer, has a salary of $55,000 and interest income of $6,000. He is an active participant in his employer's pension plan. What is the maximum amount Donald can contribute to a Roth IRA in 2019?

A)$550

B)$610

C)$1,220

D)$3,000

E)$6,000

A)$550

B)$610

C)$1,220

D)$3,000

E)$6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

25

Jody is a physician (not covered by a retirement plan) with a salary of $40,000 from the hospital where she is employed. She supports her husband, Andre, who sells art work and has no earned income. Both are in their twenties. What is the maximum total amount that Jody and Andre may contribute to their IRAs and deduct for the 2019 tax year?

A)$5,500

B)$6,000

C)$12,000

D)$11,000

E)None of these

A)$5,500

B)$6,000

C)$12,000

D)$11,000

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is correct?

A)Contributions to SEP plans by self-employed taxpayers are generally limited to the lesser of 15 percent of their net earned income (before the SEP deduction) or $45,000.

B)The contribution limits for SEPs are the lesser of 25 percent of net self-employment income after the deduction for the contribution to the SEP or $56,000 for a self-employed taxpayer.

C)Employees may elect to make annual contributions to 401(k) plans up to the lesser of 15 percent of their net earned income (before the 401(k) deduction) or $55,000.

D)The contribution limits for SEPs are a maximum of $19,000 ($25,000 for taxpayers 50 or older).

A)Contributions to SEP plans by self-employed taxpayers are generally limited to the lesser of 15 percent of their net earned income (before the SEP deduction) or $45,000.

B)The contribution limits for SEPs are the lesser of 25 percent of net self-employment income after the deduction for the contribution to the SEP or $56,000 for a self-employed taxpayer.

C)Employees may elect to make annual contributions to 401(k) plans up to the lesser of 15 percent of their net earned income (before the 401(k) deduction) or $55,000.

D)The contribution limits for SEPs are a maximum of $19,000 ($25,000 for taxpayers 50 or older).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is the maximum amount a 55-year-old taxpayer and a 48-year-old spouse can put into a Traditional or Roth IRA for 2019, assuming they earn $85,000 in total and are not participants in pension plans?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a Section 401(k) plan allows an employee to choose between a direct payment of compensation in cash or a contribution to the retirement plan, the plan is not a "qualified" plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

29

Debbie is 63 years old and retired in 2017. She receives Social Security payments of $12,000 a year and interest income of $30,000. She wishes to put the maximum allowed into an IRA. How much can she contribute to her IRA?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

30

In 2019, the adjusted gross income (AGI) limitation on medical expenses is 15 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

31

What is the maximum amount a 30-year-old taxpayer and a 35-year-old spouse can put into a Traditional or Roth IRA for 2019, assuming they earn $50,000 in total and are not covered by pension plans?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under the SEP plan provisions, deductible contributions to a qualified retirement plan on behalf of an employee whose net earned income is $20,000 are limited to:

A)$1,500

B)$2,000

C)$4,000

D)$5,000

E)None of these is correct

A)$1,500

B)$2,000

C)$4,000

D)$5,000

E)None of these is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is the difference between the tax treatment of contributions and distributions from a traditional IRA and a Roth IRA?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

34

If an employer makes a contribution to a qualified retirement plan on behalf of an employee, the amount is currently deductible by the employer, and the employee must include the amount in gross income at the time the contribution is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

35

Barrett is a 45-year-old political commentator who has self-employed net earned income of $170,000 in 2019. What is the maximum amount he can deduct for contributions to his simplified employee pension (SEP) for the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

36

Jeremy, age 38, has $25,000 in a traditional IRA account and is considering taking the money out to buy himself a new car. What will be the tax consequences to Jeremy if he withdraws the $25,000 from his IRA in 2019 for this purpose? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following taxpayers qualifies for the maximum traditional individual retirement account deduction for 2019?

A)Married taxpayers, neither of whom is covered by a qualified retirement plan, with total adjusted gross income, all earned, of $85,000

B)A single taxpayer, who is covered by a qualified retirement plan, with adjusted gross income of $80,000

C)A single taxpayer, who is not covered by a qualified retirement plan, with no earned income but with unearned income of $12,000

D)Married taxpayers, only one of whom is covered by a qualified retirement plan, with total adjusted gross income of $200,000

E)None of these

A)Married taxpayers, neither of whom is covered by a qualified retirement plan, with total adjusted gross income, all earned, of $85,000

B)A single taxpayer, who is covered by a qualified retirement plan, with adjusted gross income of $80,000

C)A single taxpayer, who is not covered by a qualified retirement plan, with no earned income but with unearned income of $12,000

D)Married taxpayers, only one of whom is covered by a qualified retirement plan, with total adjusted gross income of $200,000

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

38

Christine is a self-employed graphics artist who has net earned income of $160,000 from her business. Christine has a defined contribution SEP Plan and plans to contribute the amount that provides the maximum deduction allowable. How much can Christine contribute?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

39

Ben is a 19-year-old single software inventor earning $200,000 a year and is not covered by a pension plan at work. How much can he put into a Roth IRA in 2019?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is not an exception to the 10% early withdrawal penalty of a traditional IRA:

A)Paying the costs of higher education, including tuition, fees, books, and room and board for a dependent child

B)Withdrawing up to $30,000 of first-time home-buying expenses

C)Using the withdrawals for medical expenses in excess of 10 percent of their AGI, for persons younger than 59½ years old

D)Over 59½ years old

A)Paying the costs of higher education, including tuition, fees, books, and room and board for a dependent child

B)Withdrawing up to $30,000 of first-time home-buying expenses

C)Using the withdrawals for medical expenses in excess of 10 percent of their AGI, for persons younger than 59½ years old

D)Over 59½ years old

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

41

For 2019, Betsy and Bob, ages 62 and 68, respectively, are married taxpayers who file a joint tax return with AGI of $50,000. During the year they incurred the following expenses: In addition, their insurance company reimbursed them $3,100 for the above expenses.

Using the format below, calculate Betsy and Bob's deduction for medical and dental expenses for 2019.

Using the format below, calculate Betsy and Bob's deduction for medical and dental expenses for 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

42

The amount of a special assessment charged to residents for the installation of sidewalks on their street is not deductible on Schedule A as property taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

43

In 2019, David, age 65, had adjusted gross income of $32,000. During the year he paid the following medical expenses:

What amount can David deduct as medical expenses (after the adjusted gross income limitation) in calculating his itemized deductions for 2019?

A)$0

B)$900

C)$1,700

D)$4,100

E)None of these is correct

What amount can David deduct as medical expenses (after the adjusted gross income limitation) in calculating his itemized deductions for 2019?

A)$0

B)$900

C)$1,700

D)$4,100

E)None of these is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not an itemized deduction?

A)Medical expenses

B)IRA contribution deduction

C)Personal property taxes

D)Home mortgage interest

E)All of these are itemized deductions

A)Medical expenses

B)IRA contribution deduction

C)Personal property taxes

D)Home mortgage interest

E)All of these are itemized deductions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

45

The cost of a chiropractor's services qualifies as a medical deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

46

Jon, age 45, had adjusted gross income of $26,000 in 2019. During the year, he incurred and paid the following medical expenses: Jon received $900 in 2019 as a reimbursement for a portion of the doctors' fees. If Jon were to itemize his deductions, what would be his allowable medical expense deduction after the adjusted gross income limitation is taken into account?

A)$0

B)$275

C)$3,775

D)$2,875

E)None of these is correct

A)$0

B)$275

C)$3,775

D)$2,875

E)None of these is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is not deductible as a medical expense on Schedule A?

A)Payments to a nurse

B)Payments for marriage counseling

C)Payments for dentures

D)Payments for psychiatric care

E)All of these are deductible as medical expenses

A)Payments to a nurse

B)Payments for marriage counseling

C)Payments for dentures

D)Payments for psychiatric care

E)All of these are deductible as medical expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

48

Roberto, age 50, has AGI of $110,000 for 2019. He has medical expenses of $13,200. How much of the medical expenses can Roberto deduct on his Schedule A for 2019?

A)$0

B)$4,950

C)$11,000

D)$2,200

E)$13,200

A)$0

B)$4,950

C)$11,000

D)$2,200

E)$13,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

49

Randy is advised by his physician to install an elevator in his residence, since he is afflicted with heart disease. The cost of installing the elevator is $10,000 and it has an estimated useful life of 10 years. He installs the elevator in January of the current year, and it increases the value of his residence by $8,000. Disregarding the limitation based on adjusted gross income, how much of the cost of the elevator may Randy take into account in determining his medical expense deduction for the current year?

A)$0

B)$1,000

C)$2,000

D)$10,000

E)None of these is correct

A)$0

B)$1,000

C)$2,000

D)$10,000

E)None of these is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

50

During the current year, Mary paid the following expenses: ? What is the total amount of medical expenses (before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Mary's current year income tax return?

A)$700

B)$1,190

C)$1,450

D)$1,580

E)None of these is correct

A)$700

B)$1,190

C)$1,450

D)$1,580

E)None of these is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

51

If real property is sold during the year, the property taxes must be allocated between the buyer and seller based on the number of days the property was held by each party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

52

The 2019 standard mileage rate for taxpayer use of a personal auto for transportation for medical care is $.19 per mile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

53

Jake developed serious health problems and had his bathroom remodeled so it is wheelchair-accessible and had a handicapped shower installed, based on a written prescription by his doctor. The cost of the remodel is $15,000 and is deemed to add no value to his house by a real estate appraiser. How is the cost of the remodel treated on Jake's tax return?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

54

Premiums paid for life insurance policies are deductible as medical expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

55

During 2019, Sarah, age 29, had adjusted gross income of $12,000 and paid the following amounts for medical expenses: In 2019, Sarah drove 125 miles for medical transportation in her personal automobile, and she uses the standard mileage allowance. Her insurance company reimbursed Sarah $300 during the year for the above medical expenses. Using the schedule below, calculate the amount of Sarah's deduction for medical and dental expenses for the 2019 tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

56

The cost of over-the-counter aspirin and decongestants is a deductible medical expense even though they are nonprescription drugs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

57

Glenda heard from a friend that prescription drugs were considerably cheaper overseas and purchases her regular prescription over the Internet from a foreign company for $500. Though technically illegal, Glenda saves quite a bit and is pretty sure "everyone is doing it." Glenda can include the $500 cost of the prescription as a deductible medical expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not considered a deductible medical expense?

A)A face lift

B)Eye exams

C)Prescription drugs

D)Medical insurance

A)A face lift

B)Eye exams

C)Prescription drugs

D)Medical insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

59

If a taxpayer installs special equipment in their home for medical reasons, some or all of the cost can be included as a deductible medical expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

60

Lodging for a trip associated with medical care associated with a licensed hospital is not deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

61

Frank is a resident of a state that imposes a tax on income. The following information pertaining to Frank's state income taxes is available:

What amount should Frank use as state and local income taxes in calculating itemized deductions for his 2019 Federal tax return, assuming he deducts state and local income taxes?

A)$3,500

B)$3,700

C)$4,100

D)$4,200

E)None of these

What amount should Frank use as state and local income taxes in calculating itemized deductions for his 2019 Federal tax return, assuming he deducts state and local income taxes?

A)$3,500

B)$3,700

C)$4,100

D)$4,200

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following taxes is not deductible as an itemized deduction?

A)Property tax on second residence

B)Sales tax in a state with no income tax

C)Federal income tax

D)State income tax

A)Property tax on second residence

B)Sales tax in a state with no income tax

C)Federal income tax

D)State income tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

63

To calculate the amount of state and local income taxes which may be deducted as an itemized deduction, state income taxes paid during the year must be reduced by state income tax refunds received during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

64

Stan, a single taxpayer, has $1,700 of state income taxes withheld from his wages in the current year. In the current year, he also received a $320 refund on his prior year state income tax. Stan did not itemize last year but he intends to do so this year. Stan used the sales tax estimate tables and determined his sales tax deduction amount is $1,600. What amount should Stan deduct for state taxes?

A)$0

B)$1,380

C)$1,600

D)$1,700

E)None of the above

A)$0

B)$1,380

C)$1,600

D)$1,700

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is not deductible as an itemized deduction?

A)State income taxes

B)Personal property taxes

C)Charitable contributions

D)Local income taxes

E)All of these may be deductible as itemized deductions

A)State income taxes

B)Personal property taxes

C)Charitable contributions

D)Local income taxes

E)All of these may be deductible as itemized deductions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

66

During the current year, George, a salaried taxpayer, paid the following taxes which were not incurred in connection with a trade or business: What amount can George claim for the current year as an itemized deduction for the taxes paid, assuming he deducts state and local income taxes?

A)$1,100

B)$1,150

C)$1,400

D)$2,000

E)None of these

A)$1,100

B)$1,150

C)$1,400

D)$2,000

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which one of the following is not tax deductible?

A)Real estate taxes

B)Property taxes

C)Local income taxes

D)State income taxes

E)All of these are tax deductible

A)Real estate taxes

B)Property taxes

C)Local income taxes

D)State income taxes

E)All of these are tax deductible

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

68

Meade paid $5,000 of state income taxes in 2019. The total actual sales taxes paid during 2019 was $4,500, which did not include $3,000 for the sales taxes paid in 2019 on Meade's new boat. How should Meade treat the taxes paid in his 2019 tax return?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

69

Weber resides in a state that imposes a tax on income. The following information relating to Weber's state income taxes is available:

What amount should Weber use as state and local income taxes in calculating itemized deductions for his 2019 Federal income tax return?

A)$2,700

B)$3,000

C)$3,500

D)$3,800

E)None of these

What amount should Weber use as state and local income taxes in calculating itemized deductions for his 2019 Federal income tax return?

A)$2,700

B)$3,000

C)$3,500

D)$3,800

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

70

Harvey itemized deductions on his 2018 income tax return and was able to deduct all state and local income taxes paid. Harvey plans to itemize deductions again in 2019 and the following information is available regarding state and local income taxes: Assuming he deducts state and local income taxes, the above information should be reported by Harvey in his 2019 tax return as:

A)Itemized deduction for state and local income taxes of $12,500, and income from state and local tax refund of $200

B)Itemized deduction for state and local income taxes of $12,300

C)Itemized deduction for state and local income taxes of $12,800

D)Itemized deduction for state and local income taxes of $10,000 and income from state and local tax refund of $500

E)None of these

A)Itemized deduction for state and local income taxes of $12,500, and income from state and local tax refund of $200

B)Itemized deduction for state and local income taxes of $12,300

C)Itemized deduction for state and local income taxes of $12,800

D)Itemized deduction for state and local income taxes of $10,000 and income from state and local tax refund of $500

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

71

Newt is a single taxpayer living in Hollywood, California, with adjusted gross income for the 2019 tax year of $43,050. Newt's employer withheld $3,700 in state income tax from his salary. In April of 2019, he paid $300 in additional state taxes for his prior year's return. The real estate taxes on his home are $1,800 for 2019 and his personal property tax based on the value of his automobile is $75. Also, he paid $210 for state gasoline taxes for the year. The IRS estimate of general sales tax for Newt is $1,250 for 2019.

How much should Newt deduct on Schedule A of Form 1040 of his 2019 tax return for taxes paid?

How much should Newt deduct on Schedule A of Form 1040 of his 2019 tax return for taxes paid?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

72

Foreign income taxes paid are deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

73

Brittany determined that she paid $450 in gasoline excise taxes during the year when she bought gas for her commute to and from work. Brittany's gas excise taxes are deductible as an itemized deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

74

During the current year, Mr. and Mrs. West paid the following taxes: What amount can the Wests deduct as property taxes in calculating itemized deductions for the current year?

A)$0

B)$1,900

C)$2,300

D)$2,900

E)None of these

A)$0

B)$1,900

C)$2,300

D)$2,900

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

75

Taxpayers are permitted an itemized deduction for the lesser of state income taxes paid or state sales taxes paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

76

Margo has $2,200 withheld from her wages for state income taxes during 2019. In March of 2019, she paid $400 in additional taxes for her 2018 state tax return. Her state income tax liability for 2019 is $2,700 and she pays the additional $500 when she files her 2019 state tax return in April of 2020. What amount should Margo deduct as an itemized deduction for state income taxes on her 2019 federal income tax return, assuming she deducts state and local income taxes?

A)$2,100

B)$2,500

C)$2,600

D)$3,100

E)None of these

A)$2,100

B)$2,500

C)$2,600

D)$3,100

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

77

State sales taxes can be deducted in lieu of state income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

78

In 2019, state income taxes or state and local sales taxes, whichever is larger, may be deducted as an itemized deduction on Schedule A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

79

In 2019, the itemized deduction for taxes is limited to 10% of adjusted gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

80

During the current year, Seth, a self-employed individual, paid the following taxes: What amount can Seth claim as an itemized deduction for taxes paid during the current year?

A)$10,100

B)$11,400

C)$9,500

D)$10,000

E)None of these

A)$10,100

B)$11,400

C)$9,500

D)$10,000

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck