Deck 12: Intangible Assets and Goodwill

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/72

العب

ملء الشاشة (f)

Deck 12: Intangible Assets and Goodwill

1

Which of the following is NOT generally true of intangible assets and goodwill?

A)Many major public companies have significant amounts of intangible assets and goodwill listed on their balance sheets.

B)The major assets of today's information and service providers are likely to be tangible.

C)The major assets of today's information and service providers are likely to be intangible.

D)Since identifying and measuring intangibles and goodwill is often difficult, they are not always reported on the balance sheet.

A)Many major public companies have significant amounts of intangible assets and goodwill listed on their balance sheets.

B)The major assets of today's information and service providers are likely to be tangible.

C)The major assets of today's information and service providers are likely to be intangible.

D)Since identifying and measuring intangibles and goodwill is often difficult, they are not always reported on the balance sheet.

B

2

The cost of a patent should be amortized over its

A)legal life.

B)legal life or useful life, whichever is shorter.

C)legal life or useful life, whichever is longer.

D)Patents are indefinite-life intangibles, therefore not amortized.

A)legal life.

B)legal life or useful life, whichever is shorter.

C)legal life or useful life, whichever is longer.

D)Patents are indefinite-life intangibles, therefore not amortized.

B

3

An "indefinite life" for an intangible asset means that

A)the asset will last forever.

B)unlimited amortization may be recorded for the asset.

C)amortization is only recorded if future economic benefits can be determined.

D)there appears to be no foreseeable limit to how long the asset will generate positive future cash flows.

A)the asset will last forever.

B)unlimited amortization may be recorded for the asset.

C)amortization is only recorded if future economic benefits can be determined.

D)there appears to be no foreseeable limit to how long the asset will generate positive future cash flows.

D

4

A change in the amortization rate for an intangible asset should be accounted for as a

A)change in accounting principle.

B)change in reporting entity.

C)correction of an error.

D)change in accounting estimate.

A)change in accounting principle.

B)change in reporting entity.

C)correction of an error.

D)change in accounting estimate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

5

The reason that the revaluation model is NOT widely used for measuring intangible assets after initial recognition is that

A)it is not allowed under IFRS.

B)the cost method is easier to use.

C)it can be applied only to intangible assets with a fair value determined in an active market.

D)it requires an extensive internal investigation to determine fair value.

A)it is not allowed under IFRS.

B)the cost method is easier to use.

C)it can be applied only to intangible assets with a fair value determined in an active market.

D)it requires an extensive internal investigation to determine fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

6

When determining whether an internally developed intangible asset should be recognized, the process of generating the intangible is usually broken down into the

A)research and financing elements.

B)acquisition and disposal stages.

C)exploitation and disposal stages.

D)research and development phases.

A)research and financing elements.

B)acquisition and disposal stages.

C)exploitation and disposal stages.

D)research and development phases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

7

Development costs may be capitalized if

A)the resulting product or service is technically feasible.

B)the entity has sufficient resources to complete the project.

C)all of these (all of these criteria, in addition to others, must be met in order for development costs to be capitalized).

D)the entity intends to use or sell the resulting product or service.

A)the resulting product or service is technically feasible.

B)the entity has sufficient resources to complete the project.

C)all of these (all of these criteria, in addition to others, must be met in order for development costs to be capitalized).

D)the entity intends to use or sell the resulting product or service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is INCORRECT about the measurement of purchased intangible assets?

A)Purchased intangible assets are measured at cost, which is their fair value at acquisition.

B)Cost includes the acquisition cost and all expenditures necessary to make the intangible asset ready for its intended use.

C)If an intangible asset is acquired due to a government grant, the asset is not recognized in the accounting records as there is no cost to the entity receiving the intangible asset.

D)The cost of the intangible received in a nonmonetary exchange is the fair value of the consideration given or the fair value of the intangible received, whichever is more clearly evident.

A)Purchased intangible assets are measured at cost, which is their fair value at acquisition.

B)Cost includes the acquisition cost and all expenditures necessary to make the intangible asset ready for its intended use.

C)If an intangible asset is acquired due to a government grant, the asset is not recognized in the accounting records as there is no cost to the entity receiving the intangible asset.

D)The cost of the intangible received in a nonmonetary exchange is the fair value of the consideration given or the fair value of the intangible received, whichever is more clearly evident.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following best describes goodwill?

A)internal value generated by way of a brand image

B)the excess of fair value transferred to acquire a business over fair value amounts assigned to identifiable assets

C)internal value generated by way of a company's charitable activities and philanthropic acts

D)a company's intentions to impact the community and environment in a favourable way

A)internal value generated by way of a brand image

B)the excess of fair value transferred to acquire a business over fair value amounts assigned to identifiable assets

C)internal value generated by way of a company's charitable activities and philanthropic acts

D)a company's intentions to impact the community and environment in a favourable way

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

10

The three main characteristics of intangible assets are

A)identifiability, non-physical existence, and nonmonetary nature.

B)identifiability, physical existence, and separability.

C)separability, identifiability, and nonmonetary nature.

D)physical Existence, nonmonetary nature, and identifiability.

A)identifiability, non-physical existence, and nonmonetary nature.

B)identifiability, physical existence, and separability.

C)separability, identifiability, and nonmonetary nature.

D)physical Existence, nonmonetary nature, and identifiability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following research and development related costs should be capitalized and amortized over current and future periods?

A)research and development general laboratory building which can be put to alternative uses in the future

B)inventory used for a specific research project

C)administrative salaries allocated to research and development

D)research findings purchased from another company to aid a particular research project currently in process

A)research and development general laboratory building which can be put to alternative uses in the future

B)inventory used for a specific research project

C)administrative salaries allocated to research and development

D)research findings purchased from another company to aid a particular research project currently in process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

12

If the pattern in which an intangible asset's benefits will be used up CANNOT be determined, the amortization method most likely to be used is

A)straight-line.

B)capital cost allowance.

C)units of production.

D)double declining-balance.

A)straight-line.

B)capital cost allowance.

C)units of production.

D)double declining-balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is NOT a factor to be considered in determining a limited-life intangible asset's useful life?

A)the expected useful life of any related asset

B)the effects of obsolescence

C)all of these are correct

D)any legal provisions that may limit the useful life

A)the expected useful life of any related asset

B)the effects of obsolescence

C)all of these are correct

D)any legal provisions that may limit the useful life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

14

The proper accounting for the costs incurred in creating computer software products that are to be sold, leased, or otherwise marketed to external parties, is to

A)capitalize all costs until the software is sold to external parties.

B)charge research and development expense when incurred until technological feasibility has been established for the product.

C)charge research and development expense only if the computer software has alternative future uses.

D)capitalize all costs as incurred until a detailed program design or working model is created.

A)capitalize all costs until the software is sold to external parties.

B)charge research and development expense when incurred until technological feasibility has been established for the product.

C)charge research and development expense only if the computer software has alternative future uses.

D)capitalize all costs as incurred until a detailed program design or working model is created.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

15

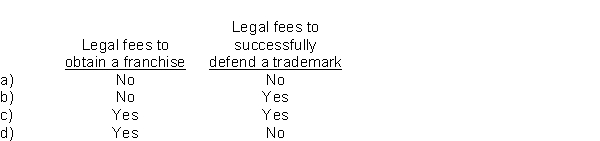

Which of the following legal fees should be capitalized?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is an example of a limited-life intangible asset?

A)patent

B)trade name

C)goodwill

D)trademark

A)patent

B)trade name

C)goodwill

D)trademark

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a company constructs a laboratory building to be used as a research and development facility, the cost of the laboratory building is matched against earnings as

A)amortization deducted as part of research and development costs.

B)research and development expense in the period(s)of construction.

C)amortization or immediate write-off, depending on company policy.

D)an expense at such time as productive research and development has been obtained from the facility.

A)amortization deducted as part of research and development costs.

B)research and development expense in the period(s)of construction.

C)amortization or immediate write-off, depending on company policy.

D)an expense at such time as productive research and development has been obtained from the facility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

18

Intangible assets that have a finite life are amortized over a period NOT to exceed

A)intangible assets are not amortized.

B)0 years.

C)their useful life.

D)the legal life.

A)intangible assets are not amortized.

B)0 years.

C)their useful life.

D)the legal life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under IFRS, which of the following statements best describes the accounting for intangible assets after acquisition?

A)They may be accounted for under either the cost model or the revaluation model.

B)They should be accounted for under the cost model.

C)They should be accounted for under the revaluation model if an active market exists for the asset.

D)They should always be accounted for under the revaluation model.

A)They may be accounted for under either the cost model or the revaluation model.

B)They should be accounted for under the cost model.

C)They should be accounted for under the revaluation model if an active market exists for the asset.

D)They should always be accounted for under the revaluation model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under ASPE, which of the following statements best describes the accounting for intangible assets after acquisition?

A)They may be accounted for under the cost model or the revaluation model.

B)They should be accounted for under the cost model.

C)They should be accounted for under the revaluation model.

D)They must be amortized over a very short period, usually less than five years.

A)They may be accounted for under the cost model or the revaluation model.

B)They should be accounted for under the cost model.

C)They should be accounted for under the revaluation model.

D)They must be amortized over a very short period, usually less than five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

21

Goodwill may be

A)capitalized only when purchased.

B)capitalized either when purchased or created internally.

C)capitalized only when created internally.

D)written off directly to retained earnings.

A)capitalized only when purchased.

B)capitalized either when purchased or created internally.

C)capitalized only when created internally.

D)written off directly to retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

22

A copyright is an example of a(n)

A)customer-related intangible asset.

B)marketing-related intangible asset.

C)contract-based intangible asset.

D)artistic-related intangible asset.

A)customer-related intangible asset.

B)marketing-related intangible asset.

C)contract-based intangible asset.

D)artistic-related intangible asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

23

An impairment of an identifiable intangible asset arises when its carrying amount exceeds the

A)present value of the expected future net cash flows.

B)expected future economic benefits.

C)asset's cost.

D)asset's fair value.

A)present value of the expected future net cash flows.

B)expected future economic benefits.

C)asset's cost.

D)asset's fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is correct regarding the rational entity impairment model?

A)For limited-life intangibles, IFRS requires that the rational entity impairment model be applied.

B)For limited-life intangibles, ASPE requires that the rational entity impairment model be applied.

C)For indefinite-life intangibles, ASPE requires that the rational entity impairment model be applied.

D)Neither ASPE nor IFRS allow the use of the rational entity impairment model.

A)For limited-life intangibles, IFRS requires that the rational entity impairment model be applied.

B)For limited-life intangibles, ASPE requires that the rational entity impairment model be applied.

C)For indefinite-life intangibles, ASPE requires that the rational entity impairment model be applied.

D)Neither ASPE nor IFRS allow the use of the rational entity impairment model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is the impairment test for indefinite-life intangibles?

A)recoverability test and then fair value test

B)fair value test and then recoverability test

C)recoverability test

D)fair value test

A)recoverability test and then fair value test

B)fair value test and then recoverability test

C)recoverability test

D)fair value test

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

26

Similar to impairment models and standards that apply to long-lived tangible assets, the rational entity impairment model applies also to

A)limited-life intangible assets for organizations using IFRS.

B)indefinite-life intangible assets for organizations using ASPE.

C)indefinite-life intangible asset for organizations using IFRS.

D)limited-life intangible assets for organizations using ASPE.

A)limited-life intangible assets for organizations using IFRS.

B)indefinite-life intangible assets for organizations using ASPE.

C)indefinite-life intangible asset for organizations using IFRS.

D)limited-life intangible assets for organizations using ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

27

Under IFRS, to determine if there is an impairment loss, compare the

A)fair value of the identifiable assets to the book value of the assets.

B)fair value of the reporting unit to the carrying value of the reporting unit.

C)imputed current fair value of goodwill with the carrying value of goodwill.

D)carrying amount of the CGU with the recoverable amount.

A)fair value of the identifiable assets to the book value of the assets.

B)fair value of the reporting unit to the carrying value of the reporting unit.

C)imputed current fair value of goodwill with the carrying value of goodwill.

D)carrying amount of the CGU with the recoverable amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

28

Internally generated goodwill

A)is not possible.

B)may be capitalized or expensed.

C)is not capitalized.

D)is capitalized but not amortized.

A)is not possible.

B)may be capitalized or expensed.

C)is not capitalized.

D)is capitalized but not amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

29

This year, Level Ground Ltd.went to court and successfully defended its trade-marked product, "Hot Gum," from infringement by a competitor.Legal costs of this defence should be charged to

A)Trademarks and amortized over the legal life of the trademark.

B)Trademarks and amortized over the same period of time as the "Hot Gum" trademark.

C)Legal Expense and amortized over five years or less.

D)Legal Expense of the period.

A)Trademarks and amortized over the legal life of the trademark.

B)Trademarks and amortized over the same period of time as the "Hot Gum" trademark.

C)Legal Expense and amortized over five years or less.

D)Legal Expense of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

30

Negative goodwill arises when

A)the book value of identifiable net assets acquired exceeds the purchase price.

B)the fair value of identifiable net assets acquired exceeds the purchase price.

C)the fair value of identifiable net assets acquired is less than the purchase price.

D)the fair value of identifiable net assets acquired exceeds the book value.

A)the book value of identifiable net assets acquired exceeds the purchase price.

B)the fair value of identifiable net assets acquired exceeds the purchase price.

C)the fair value of identifiable net assets acquired is less than the purchase price.

D)the fair value of identifiable net assets acquired exceeds the book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

31

A patent is an example of a(n)

A)technology-based intangible asset.

B)marketing-related intangible asset.

C)contract-based intangible asset.

D)artistic-related intangible asset.

A)technology-based intangible asset.

B)marketing-related intangible asset.

C)contract-based intangible asset.

D)artistic-related intangible asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

32

Purchased goodwill should be

A)expensed as soon as possible against retained earnings.

B)expensed as soon as possible to other comprehensive income.

C)amortized over the period benefited, but not more than 40 years.

D)not expensed or amortized, but rather reduced only if impairment occurs.

A)expensed as soon as possible against retained earnings.

B)expensed as soon as possible to other comprehensive income.

C)amortized over the period benefited, but not more than 40 years.

D)not expensed or amortized, but rather reduced only if impairment occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

33

Goodwill is the excess of purchase price of the acquired enterprise over

A)fair value of the tangible net assets acquired.

B)book value of the identifiable net assets acquired.

C)book value of the tangible net assets acquired.

D)fair value of the identifiable net assets acquired.

A)fair value of the tangible net assets acquired.

B)book value of the identifiable net assets acquired.

C)book value of the tangible net assets acquired.

D)fair value of the identifiable net assets acquired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

34

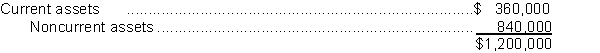

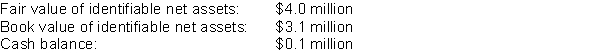

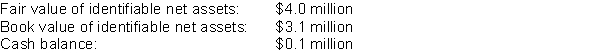

During 2017, Spokane Ltd.purchased the net assets of Tacoma Corp.for $635,000.On the date of the transaction, Tacoma reported $200,000 in liabilities.As well, the fair value of Tacoma's assets were:  How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

A)The difference should be credited to retained earnings.

B)The difference should be recognized as a gain in net income.

C)The noncurrent assets should be reduced appropriately.

D)The difference should be prorated between the current and the noncurrent assets.

How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?A)The difference should be credited to retained earnings.

B)The difference should be recognized as a gain in net income.

C)The noncurrent assets should be reduced appropriately.

D)The difference should be prorated between the current and the noncurrent assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

35

All of the following are specifically identifiable intangible assets EXCEPT

A)patents.

B)trademarks.

C)goodwill.

D)copyrights.

A)patents.

B)trademarks.

C)goodwill.

D)copyrights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

36

If a trademark is developed by the enterprise itself, the costs should be

A)capitalized but not amortized.

B)capitalized only if future benefits are reasonably assured.

C)capitalized, but only from the point in time when all six capitalization criteria are met in the development phase.

D)capitalized as soon as the development phase starts.

A)capitalized but not amortized.

B)capitalized only if future benefits are reasonably assured.

C)capitalized, but only from the point in time when all six capitalization criteria are met in the development phase.

D)capitalized as soon as the development phase starts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

37

If the fair value of the net assets acquired in a business combination is greater than the purchase price, the difference is called

A)organizational costs.

B)contributed surplus.

C)purchased goodwill.

D)negative goodwill or bargain purchase.

A)organizational costs.

B)contributed surplus.

C)purchased goodwill.

D)negative goodwill or bargain purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

38

The cost of purchasing patent rights for a product that might otherwise have seriously competed with one of the purchaser's patented products should be

A)expensed in the current period.

B)amortized over the legal life of the purchased patent.

C)added to factory overhead and allocated to production of the purchaser's product.

D)amortized over the remaining estimated life of the original patent covering the product whose market would have been impaired by competition from the newly patented product.

A)expensed in the current period.

B)amortized over the legal life of the purchased patent.

C)added to factory overhead and allocated to production of the purchaser's product.

D)amortized over the remaining estimated life of the original patent covering the product whose market would have been impaired by competition from the newly patented product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

39

A franchise or licence with a limited life is

A)amortized over the lesser of its legal or useful life.

B)expensed.

C)not amortized.

D)always amortized over its legal life.

A)amortized over the lesser of its legal or useful life.

B)expensed.

C)not amortized.

D)always amortized over its legal life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

40

Under ASPE, to determine if there is an impairment loss, compare the

A)fair value of the identifiable assets to the book value of the assets.

B)fair value of the reporting unit to the carrying value of the reporting unit.

C)imputed current fair value of the assets with the carrying value of the assets.

D)imputed carrying value of the assets with the fair value of the assets.

A)fair value of the identifiable assets to the book value of the assets.

B)fair value of the reporting unit to the carrying value of the reporting unit.

C)imputed current fair value of the assets with the carrying value of the assets.

D)imputed carrying value of the assets with the fair value of the assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

41

On January 2, 2017, Silver Corp.bought a trademark from Lake Inc.for $150,000.An independent research company estimated that the remaining useful life of the trademark was 30 years.At this time, the trademark's net book value in Lake's records was $210,000.Because the trademark had a demonstrated limited life beyond 20 years, Silver decided to amortize the trademark over the maximum period, straight-line with no residual.In Silver's (calendar)2017 income statement, what amount should be reported as amortization expense for this trademark?

A)$7,500

B)$7,000

C)$6,000

D)$5,000

A)$7,500

B)$7,000

C)$6,000

D)$5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

42

Regarding trends in intangible asset reporting, which of the following statements is NOT true?

A)Intangible assets, along with goodwill, have been decreasing as a proportion of companies' reported assets.

B)The most common types of intangible assets reported are broadcast rights, publishing rights, trademarks, patents, licences, customer lists, non-competition agreement, franchises and purchased R&D.

C)Intangibles are an important contributor to entity performance and financial position.

D)Intangible assets, along with goodwill, have been increasing as a proportion of companies' reported assets.

A)Intangible assets, along with goodwill, have been decreasing as a proportion of companies' reported assets.

B)The most common types of intangible assets reported are broadcast rights, publishing rights, trademarks, patents, licences, customer lists, non-competition agreement, franchises and purchased R&D.

C)Intangibles are an important contributor to entity performance and financial position.

D)Intangible assets, along with goodwill, have been increasing as a proportion of companies' reported assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

43

Under IFRS, which of the following statements best describes when goodwill should be tested for impairment?

A)Goodwill should be tested for impairment when events or changes in circumstance indicate that impairment may have occurred.

B)Goodwill should be tested annually for impairment regardless of the circumstances.

C)Goodwill should be tested for impairment annually and whenever events or changes in circumstance indicate that impairment may have occurred.

D)Goodwill should only be tested for impairment when the company follows a policy to amortize its goodwill.

A)Goodwill should be tested for impairment when events or changes in circumstance indicate that impairment may have occurred.

B)Goodwill should be tested annually for impairment regardless of the circumstances.

C)Goodwill should be tested for impairment annually and whenever events or changes in circumstance indicate that impairment may have occurred.

D)Goodwill should only be tested for impairment when the company follows a policy to amortize its goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements best describes when previously recognized goodwill impairment may be reversed?

A)Reversals are permitted under both ASPE and IFRS.

B)Reversals are permitted under ASPE but not IFRS.

C)Reversals are permitted under IFRS but not ASPE.

D)Reversals are not permitted under either IFRS or ASPE.

A)Reversals are permitted under both ASPE and IFRS.

B)Reversals are permitted under ASPE but not IFRS.

C)Reversals are permitted under IFRS but not ASPE.

D)Reversals are not permitted under either IFRS or ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

45

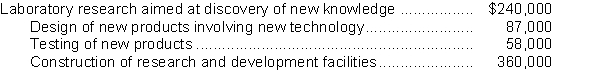

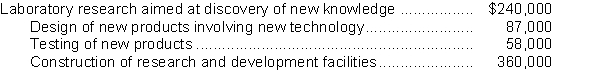

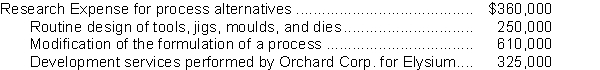

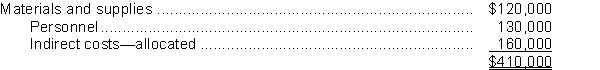

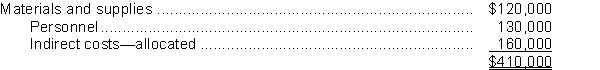

Sandoval Inc.incurred the following costs during the year ended December 31, 2017:  Assuming the 6 specific conditions have been demonstrated, the total amount to be classified as development costs (either deferred or capitalized)in 2017 is

Assuming the 6 specific conditions have been demonstrated, the total amount to be classified as development costs (either deferred or capitalized)in 2017 is

A)$145,000.

B)$240,000.

C)$327,000.

D)$600,000.

Assuming the 6 specific conditions have been demonstrated, the total amount to be classified as development costs (either deferred or capitalized)in 2017 is

Assuming the 6 specific conditions have been demonstrated, the total amount to be classified as development costs (either deferred or capitalized)in 2017 isA)$145,000.

B)$240,000.

C)$327,000.

D)$600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

46

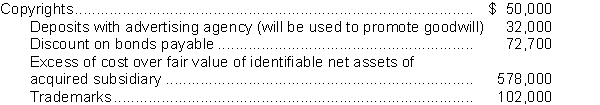

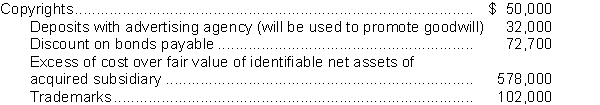

At December 31, 2017, Walker Corp.'s general ledger includes the following account balances:  In the preparation of Walker's balance sheet as of December 31, 20172017, what should be reported as total intangible assets?

In the preparation of Walker's balance sheet as of December 31, 20172017, what should be reported as total intangible assets?

A)$152,000

B)$730,000

C)$762,000

D)$802,700

In the preparation of Walker's balance sheet as of December 31, 20172017, what should be reported as total intangible assets?

In the preparation of Walker's balance sheet as of December 31, 20172017, what should be reported as total intangible assets?A)$152,000

B)$730,000

C)$762,000

D)$802,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

47

Goodwill was purchased when a business was acquired.When it is determined that the goodwill is impaired, the credit is usually made to

A)the Goodwill account.

B)an Accumulated Impairment Loss account.

C)a Deferred Credit account.

D)a Shareholders' Equity account.

A)the Goodwill account.

B)an Accumulated Impairment Loss account.

C)a Deferred Credit account.

D)a Shareholders' Equity account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

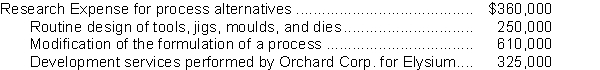

48

During 2017, Elysium Inc.incurred the following costs:  Assuming the 6 specific conditions have been demonstrated, in 2017, Elysium Corp.would report development costs of

Assuming the 6 specific conditions have been demonstrated, in 2017, Elysium Corp.would report development costs of

A)$1,545,000.

B)$1,295,000.

C)$935,000.

D)$610,000.

Assuming the 6 specific conditions have been demonstrated, in 2017, Elysium Corp.would report development costs of

Assuming the 6 specific conditions have been demonstrated, in 2017, Elysium Corp.would report development costs ofA)$1,545,000.

B)$1,295,000.

C)$935,000.

D)$610,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

49

The steps involved in testing goodwill for impairment using ASPE do NOT include

A)comparing the current implied fair value of goodwill with its carrying amount.

B)comparing the fair value of the reporting unit against its carrying amount including goodwill.

C)all of these (all of these steps are involved in testing goodwill for impairment using ASPE).

D)calculating the implied current fair value of goodwill.

A)comparing the current implied fair value of goodwill with its carrying amount.

B)comparing the fair value of the reporting unit against its carrying amount including goodwill.

C)all of these (all of these steps are involved in testing goodwill for impairment using ASPE).

D)calculating the implied current fair value of goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following explains the rationale for using "normalized" earnings under the excess-earnings valuation approach?

A)Historic asset values are the best reflection of the assets' value in use.

B)The company's future earnings should always be higher than the past earnings.

C)The past often provides useful information about the future; past earnings are a good starting point.

D)Normalized earnings are not used under the excess-earnings valuation approach.

A)Historic asset values are the best reflection of the assets' value in use.

B)The company's future earnings should always be higher than the past earnings.

C)The past often provides useful information about the future; past earnings are a good starting point.

D)Normalized earnings are not used under the excess-earnings valuation approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

51

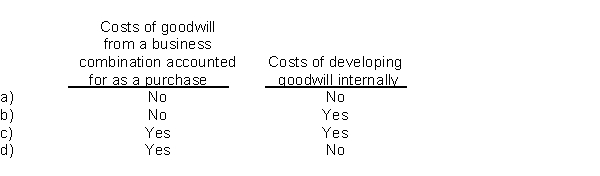

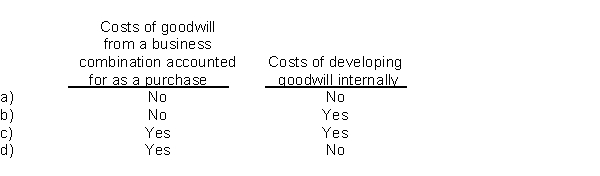

Which of the following costs of goodwill should be capitalized?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

52

Mardaloop Inc.is developing a new process which it plans to sell.During 2016, 2017, the company had capitalized $1.5 million and $0.3 million respectively.An additional $0.4 million was spent in 2018.During 2018 it became apparent that, due to a lack of financial resources, the company would not be able to complete the project.

The total amount of capitalized costs relating to this project at the end of 2018 is

A)nil.

B)$1.8 million.

C)$2.2 million.

D)$1.5 million.

The total amount of capitalized costs relating to this project at the end of 2018 is

A)nil.

B)$1.8 million.

C)$2.2 million.

D)$1.5 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

53

Mindy Corporation acquired all outstanding shares of Lahiri Ltd.For $4.2 million.Selected information relating to Lahiri was as follows:  Mindy will recognize goodwill of

Mindy will recognize goodwill of

A)$0.2 million.

B)$1.1 million.

C)$4.1 million.

D)$3.0 million.

Mindy will recognize goodwill of

Mindy will recognize goodwill ofA)$0.2 million.

B)$1.1 million.

C)$4.1 million.

D)$3.0 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

54

On January 1, 2013, Wellington Corp.purchased a trademark for $400,000, which had an estimated useful life of 16 years.In January 2017, Wellington paid $60,000 for legal fees in a successful defence of the trademark.The amortization expense for this asset for calendar 2017, should be

A)$30,000.

B)$28,750.

C)$25,000.

D)$0.

A)$30,000.

B)$28,750.

C)$25,000.

D)$0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is NOT true of the earnings normalization process?

A)Accounting policies applied should be consistent with those of the purchaser.

B)Future earnings should be based on the net assets' current fair values.

C)Amounts that are not expected to recur should be adjusted out of our calculations.

D)All of these statements are true of the earnings normalization process.

A)Accounting policies applied should be consistent with those of the purchaser.

B)Future earnings should be based on the net assets' current fair values.

C)Amounts that are not expected to recur should be adjusted out of our calculations.

D)All of these statements are true of the earnings normalization process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

56

On January 1, 2017, Muhlenberg Corp.bought a trademark from Glasgow Corp.for $160,000.An independent consultant retained by Muhlenberg estimated that the remaining useful life is 50 years.The trademark's carrying value on Yarmouth's books was $61,000.Muhlenberg decided to write off the trademark over the maximum period allowed.How much should be amortized for the year ended December 31, 2017?

A)$1,220

B)$3,200

C)$4,000

D)$8,000

A)$1,220

B)$3,200

C)$4,000

D)$8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

57

The significant difference between market capitalization and book value of companies like Apple Inc.holding sizeable knowledge assets or intellectual capital is an example of

A)the tradeoff between timeliness and accuracy.

B)the tradeoff between relevance and reliability.

C)the tradeoff between cost and fair value reporting.

D)the decreasing emphasis on representational faithfulness.

A)the tradeoff between timeliness and accuracy.

B)the tradeoff between relevance and reliability.

C)the tradeoff between cost and fair value reporting.

D)the decreasing emphasis on representational faithfulness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

58

In 2017, Yupukari Corporation incurred research costs as follows:  These costs relate to a product that Yupukari expects to market in 2018.It is estimated that these costs will be recouped by December 31, 2020.How much of these costs could be capitalized in 2017?

These costs relate to a product that Yupukari expects to market in 2018.It is estimated that these costs will be recouped by December 31, 2020.How much of these costs could be capitalized in 2017?

A)$410,000

B)$250,000

C)$160,000

D)$0

These costs relate to a product that Yupukari expects to market in 2018.It is estimated that these costs will be recouped by December 31, 2020.How much of these costs could be capitalized in 2017?

These costs relate to a product that Yupukari expects to market in 2018.It is estimated that these costs will be recouped by December 31, 2020.How much of these costs could be capitalized in 2017?A)$410,000

B)$250,000

C)$160,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is NOT a method of calculating goodwill?

A)excess-earnings approach

B)total earnings approach

C)discounted free cash flow method

D)undiscounted free cash flow method

A)excess-earnings approach

B)total earnings approach

C)discounted free cash flow method

D)undiscounted free cash flow method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

60

Under ASPE, which of the following statements best describes when goodwill should be tested for impairment?

A)Goodwill should be tested for impairment when events or changes in circumstances indicate that impairment may have occurred.

B)Goodwill should be tested annually for impairment regardless of the circumstances.

C)Goodwill should be tested for impairment annually and whenever events or changes in circumstance indicate that impairment may have occurred.

D)Goodwill should only be tested for impairment when the company follows a policy to amortize its goodwill.

A)Goodwill should be tested for impairment when events or changes in circumstances indicate that impairment may have occurred.

B)Goodwill should be tested annually for impairment regardless of the circumstances.

C)Goodwill should be tested for impairment annually and whenever events or changes in circumstance indicate that impairment may have occurred.

D)Goodwill should only be tested for impairment when the company follows a policy to amortize its goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

61

In January, 2012, Tillicum Corp.purchased a patent for a new consumer product for $900,000.At the time of purchase, the patent was valid for fifteen years.Due to the competitive nature of the product, however, the patent was estimated to have a useful life of only ten years.During 2017, the product was permanently removed from the market because of a potential health hazard.What amount should Tillicum recognize as an impairment loss for calendar 2017, assuming amortization has been recorded annually using the straight-line method with no residual value?

A)$600,000

B)$450,000

C)$90,000

D)$60,000

A)$600,000

B)$450,000

C)$90,000

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

62

The owners of Dallas Electronics Store are contemplating selling the business.The cumulative earnings for the past 5 years totalled $900,000, including a gain on discontinued operations of $30,000.The annual earnings based on an average rate of return on investment for this industry would have been $138,000.If excess earnings are to be capitalized at 15%, then implied goodwill should be

A)$210,000.

B)$280,000.

C)$240,000.

D)$870,000.

A)$210,000.

B)$280,000.

C)$240,000.

D)$870,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

63

On September 2017, Princes Corporation acquired Royal Mile Incorporated for a cash payment of $864,300.At the time of the purchase, Royal Mile's statement of financial position showed assets of $890,600, liabilities of $469,700, and owners' equity of $420,900.The fair value of Royal Mile's assets is estimated to be $1,162,900.Assume that Princes Corporation is a public company and that the goodwill was allocated entirely to one cash-generating unit (GU).Two years later, the CGU's carrying amount is $3,530,300, the value in use is $3,458,200, and the fair value less costs to sell is $3,058,200.

Goodwill is

A)not impaired.

B)impaired by $72,100.

C)impaired by $472,100.

D)Not enough information is provided to assess impairment.

Goodwill is

A)not impaired.

B)impaired by $72,100.

C)impaired by $472,100.

D)Not enough information is provided to assess impairment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

64

On January 2, 2014, Albion Corp.purchased a patent for a new consumer product for $45,000.At the time of purchase, the patent was valid for fifteen years.Due to the competitive nature of the product, however, the patent was estimated to have a useful life of only ten years.During 2017, the product was permanently removed from the market because of a potential health hazard.What amount should Albion recognize as an impairment loss for calendar 2017, assuming amortization has been recorded annually using the straight-line method with no residual value?

A)$4,500

B)$27,000

C)$31,500

D)$36,000

A)$4,500

B)$27,000

C)$31,500

D)$36,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

65

On May 5, 2017, Miami Corp.exchanged 5,000 of its common shares for a copyright owned by Lauderdale Ltd.At this date, Miami's common shares were quoted at $28 per share, and the copyright had a carrying value of $130,000 on Lauderdale's books.Miami should record the copyright at

A)$110,000.

B)$120,000.

C)$130,000.

D)$140,000.

A)$110,000.

B)$120,000.

C)$130,000.

D)$140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

66

On June 30, 2017, Carter Ltd.exchanged 3,000 Butte Corp.common shares for a patent owned by Texas Corp.The Butte shares were acquired in 2015 for $160,000.At the exchange date, Butte common shares have a fair value of $90 per share, and the patent had a carrying value of $320,000 on Texas's books.Carter should record the patent at

A)$320,000.

B)$270,000.

C)$180,000.

D)$160,000.

A)$320,000.

B)$270,000.

C)$180,000.

D)$160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

67

Use the following information for questions.

Casper Corp.is planning to acquire a controlling interest in the outstanding shares of Frosty Inc.for $9.2 million in cash.

Assuming the fair value of Frosty's net assets is $12.5 million, and Casper acquires a 75% share, goodwill can be calculated as

A)$375,000.

B)$175,000 negative.

C)$175,000.

D)$ 0.

Casper Corp.is planning to acquire a controlling interest in the outstanding shares of Frosty Inc.for $9.2 million in cash.

Assuming the fair value of Frosty's net assets is $12.5 million, and Casper acquires a 75% share, goodwill can be calculated as

A)$375,000.

B)$175,000 negative.

C)$175,000.

D)$ 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

68

Grand Trunk Corp.incurred $160,000 of basic research and $50,000 of development costs to develop a product for which a patent was granted on January 2, 2012.Legal fees and other costs associated with registration of the patent totalled $60,000.On March 31, 2017, Grand Trunk paid $90,000 for legal fees in a successful defence of the patent.The total amount capitalized for the patent through March 31, 2017 should be

A)$360,000.

B)$270,000.

C)$200,000.

D)$150,000.

A)$360,000.

B)$270,000.

C)$200,000.

D)$150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

69

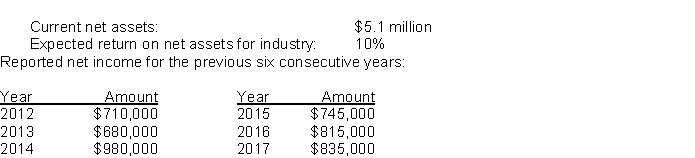

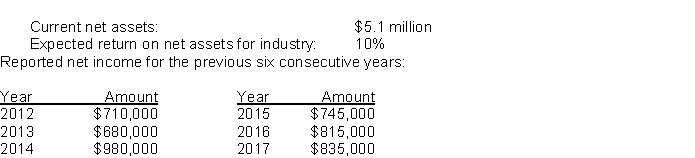

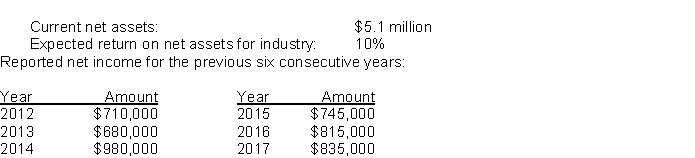

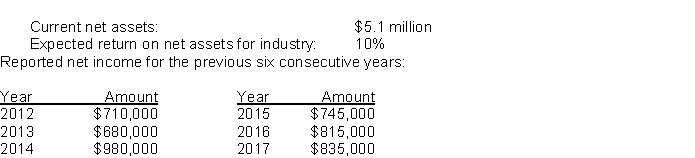

Use the following information for questions.

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Net income for 2014 included a $200,000 gain from the sale of a discontinued operation.

Net income for 2014 included a $200,000 gain from the sale of a discontinued operation.

Assuming that excess earnings are expected to continue for 8 years, and ignoring the time value of money, estimated goodwill is

A)$2,273,000.

B)$2,006,667.

C)$1,854,333.

D)$1,531,733.

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following:

Net income for 2014 included a $200,000 gain from the sale of a discontinued operation.

Net income for 2014 included a $200,000 gain from the sale of a discontinued operation.Assuming that excess earnings are expected to continue for 8 years, and ignoring the time value of money, estimated goodwill is

A)$2,273,000.

B)$2,006,667.

C)$1,854,333.

D)$1,531,733.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

70

Frosty Corp.'s average annual net income is $75,000 above the average for Frosty's industry.Casper is interested in purchased Frosty.Assuming Casper estimates goodwill by capitalizing excess earnings at 14%, the estimated goodwill (to the nearest dollar)is

A)$1,050,000.

B)$954,333.

C)$535,714.

D)$ 0.

A)$1,050,000.

B)$954,333.

C)$535,714.

D)$ 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the following information for questions.

Casper Corp.is planning to acquire a controlling interest in the outstanding shares of Frosty Inc.for $9.2 million in cash.

Assuming the fair value of Frosty's net assets is $10.2 million, and Casper acquires a 75% share, goodwill can be calculated as

A)$1,550,000.

B)$1,243,000.

C)$1,000,000.

D)$750,000.

Casper Corp.is planning to acquire a controlling interest in the outstanding shares of Frosty Inc.for $9.2 million in cash.

Assuming the fair value of Frosty's net assets is $10.2 million, and Casper acquires a 75% share, goodwill can be calculated as

A)$1,550,000.

B)$1,243,000.

C)$1,000,000.

D)$750,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the following information for questions.

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Net income for 2014 included a $200,000 gain from the sale of a discontinued operation.

Net income for 2014 included a $200,000 gain from the sale of a discontinued operation.

Estimated goodwill by capitalizing average excess earnings at 14% is

A)$2,029,762.

B)$1,791,667.

C)$1,654,331.

D)$ 760,833.

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following:

Net income for 2014 included a $200,000 gain from the sale of a discontinued operation.

Net income for 2014 included a $200,000 gain from the sale of a discontinued operation.Estimated goodwill by capitalizing average excess earnings at 14% is

A)$2,029,762.

B)$1,791,667.

C)$1,654,331.

D)$ 760,833.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck