Deck 5: Financial Position and Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/78

العب

ملء الشاشة (f)

Deck 5: Financial Position and Cash Flows

1

An enterprise's ability to take effective actions to alter the amounts and timing of cash flows so it can respond to unexpected needs and opportunities is called

A)financial flexibility.

B)liquidity.

C)the quick ratio.

D)solvency.

A)financial flexibility.

B)liquidity.

C)the quick ratio.

D)solvency.

A

2

The statement of financial position is useful for all of the following EXCEPT to

A)compute rates of return.

B)analyze cash inflows and outflows for the period.

C)evaluate capital structure.

D)assess future cash flows.

A)compute rates of return.

B)analyze cash inflows and outflows for the period.

C)evaluate capital structure.

D)assess future cash flows.

B

3

Which of the following is a current asset?

A)trade instalment receivables normally collectible in eighteen months

B)intangible assets

C)investment in associates (significant influence investments)

D)cash designated for the purchase of property, plant and equipment

A)trade instalment receivables normally collectible in eighteen months

B)intangible assets

C)investment in associates (significant influence investments)

D)cash designated for the purchase of property, plant and equipment

A

4

Monetary assets represent

A)only cash.

B)contractual rights to receive cash.

C)equity investments in other companies.

D)cash or claims to future cash flows that are fixed and determinable in amounts and timing.

A)only cash.

B)contractual rights to receive cash.

C)equity investments in other companies.

D)cash or claims to future cash flows that are fixed and determinable in amounts and timing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements about intangible assets is INCORRECT?

A)They are capital assets that have no physical substance.

B)Intangibles with finite lives are amortized but not tested for impairment.

C)Intangibles with infinite lives are not amortized but are tested for impairment.

D)Internally recognized intangibles are never recognized on the statement of financial position.

A)They are capital assets that have no physical substance.

B)Intangibles with finite lives are amortized but not tested for impairment.

C)Intangibles with infinite lives are not amortized but are tested for impairment.

D)Internally recognized intangibles are never recognized on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

6

Equity or debt securities held to finance future construction of additional plants should be classified on a statement of financial position as

A)current assets.

B)property, plant, and equipment.

C)non-current investments.

D)intangible assets.

A)current assets.

B)property, plant, and equipment.

C)non-current investments.

D)intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

7

Non-monetary assets

A)are those for which the cash value is determinable in amount and timing.

B)are often measured at historical cost.

C)are always classified as non-current.

D)will required future cash outflows from the company.

A)are those for which the cash value is determinable in amount and timing.

B)are often measured at historical cost.

C)are always classified as non-current.

D)will required future cash outflows from the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is NOT a limitation of the statement of financial position?

A)Many assets are reported at historical cost.

B)Judgments and estimates are used.

C)Only "hard" numbers are reported.

D)Disclosure of all pertinent information in the notes.

A)Many assets are reported at historical cost.

B)Judgments and estimates are used.

C)Only "hard" numbers are reported.

D)Disclosure of all pertinent information in the notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is a limitation of the balance sheet?

A)Many items that are of financial value are omitted.

B)Judgments and estimates are used.

C)Current fair value is not reported.

D)All of these answer choices are correct.

A)Many items that are of financial value are omitted.

B)Judgments and estimates are used.

C)Current fair value is not reported.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

10

Monetary assets include

A)cash, accounts receivable and inventory.

B)accounts and notes receivable and inventory.

C)cash, accounts and notes receivable.

D)accounts receivable and property, plant and equipment.

A)cash, accounts receivable and inventory.

B)accounts and notes receivable and inventory.

C)cash, accounts and notes receivable.

D)accounts receivable and property, plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

11

The statement of financial position is useful for analyzing all of the following EXCEPT

A)liquidity.

B)solvency.

C)profitability.

D)financial flexibility.

A)liquidity.

B)solvency.

C)profitability.

D)financial flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

12

Non-monetary assets include

A)accounts and notes receivable and inventory.

B)accounts receivable and property, plant and equipment.

C)inventory, property, plant and equipment, and intangibles.

D)accounts receivable and investments.

A)accounts and notes receivable and inventory.

B)accounts receivable and property, plant and equipment.

C)inventory, property, plant and equipment, and intangibles.

D)accounts receivable and investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

13

Generally, as financial flexibility increases, the risk of enterprise or business failure will

A)increase.

B)decrease.

C)stay the same.

D)be eliminated.

A)increase.

B)decrease.

C)stay the same.

D)be eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

14

The basis for classifying assets as current or non-current is conversion to cash within

A)the accounting cycle or one year, whichever is shorter.

B)the accounting cycle or one year, whichever is longer.

C)the operating cycle or one year, whichever is longer.

D)the operating cycle or one year, whichever is shorter.

A)the accounting cycle or one year, whichever is shorter.

B)the accounting cycle or one year, whichever is longer.

C)the operating cycle or one year, whichever is longer.

D)the operating cycle or one year, whichever is shorter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

15

When assessing earnings quality, financial analysts are concerned that management may attempt to manipulate information to make earnings appear better or worse than they really are.Which of the following would NOT suggest poor earnings quality?

A)reduction of the allowance for doubtful accounts

B)consistent application of GAAP

C)significantly higher net income than cash flows from operations

D)reliance on share issuances to offset repeated negative cash flow from operations

A)reduction of the allowance for doubtful accounts

B)consistent application of GAAP

C)significantly higher net income than cash flows from operations

D)reliance on share issuances to offset repeated negative cash flow from operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

16

Financial instruments do NOT include

A)cash.

B)inventory.

C)derivatives.

D)accounts payable.

A)cash.

B)inventory.

C)derivatives.

D)accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

17

The statement of financial position is useful for all of the following EXCEPT

A)assessing a company's risk.

B)evaluating a company's liquidity.

C)evaluating a company's financial flexibility.

D)determining free cash flows.

A)assessing a company's risk.

B)evaluating a company's liquidity.

C)evaluating a company's financial flexibility.

D)determining free cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

18

An enterprise's ability to pay its debts and related interest is called

A)liquidity.

B)financial flexibility.

C)the amount of time expected to pass until an asset is realized.

D)solvency.

A)liquidity.

B)financial flexibility.

C)the amount of time expected to pass until an asset is realized.

D)solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

19

The operating cycle is the time between

A)selling products to customers and the realization of cash.

B)purchase of inventory and selling to customers.

C)manufacture of products and receiving cash from customers.

D)acquisition of assets for processing and the realization in cash or cash equivalents.

A)selling products to customers and the realization of cash.

B)purchase of inventory and selling to customers.

C)manufacture of products and receiving cash from customers.

D)acquisition of assets for processing and the realization in cash or cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following should NOT be considered current assets in the statement of financial position?

A)instalment notes receivable due over eighteen months, in accordance with normal trade practice

B)prepaid taxes, which cover assessments for the current year

C)equity or debt securities purchased with cash available for current operations

D)franchises and copyrights

A)instalment notes receivable due over eighteen months, in accordance with normal trade practice

B)prepaid taxes, which cover assessments for the current year

C)equity or debt securities purchased with cash available for current operations

D)franchises and copyrights

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

21

Significant accounting policies may NOT be

A)selected on the basis of judgment.

B)selected from existing acceptable alternatives.

C)unusual or innovative in application.

D)omitted from financial-statement disclosure.

A)selected on the basis of judgment.

B)selected from existing acceptable alternatives.

C)unusual or innovative in application.

D)omitted from financial-statement disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would NOT appear in the equity section of a statement of financial position?

A)preferred shares

B)accumulated other comprehensive income

C)stock dividend distributable

D)investment in affiliate

A)preferred shares

B)accumulated other comprehensive income

C)stock dividend distributable

D)investment in affiliate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

23

An example of an item which is NOT an element of working capital is

A)accrued interest on notes receivable.

B)goodwill.

C)inventory.

D)short-term investments.

A)accrued interest on notes receivable.

B)goodwill.

C)inventory.

D)short-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following facts concerning depreciable assets should be included in the summary of significant accounting policies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is NOT a method of disclosing additional information in the financial statements?

A)supporting schedules

B)parenthetical explanations

C)cross-reference and contra items

D)press releases

A)supporting schedules

B)parenthetical explanations

C)cross-reference and contra items

D)press releases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following should be EXCLUDED from long-term liabilities?

A)derivatives

B)employee future benefits obligations

C)long-term liabilities maturing within the operating cycle, but will be paid from a sinking fund

D)bonds payable maturing in five years

A)derivatives

B)employee future benefits obligations

C)long-term liabilities maturing within the operating cycle, but will be paid from a sinking fund

D)bonds payable maturing in five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

27

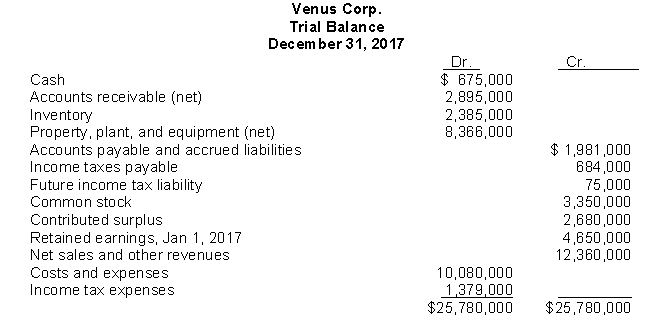

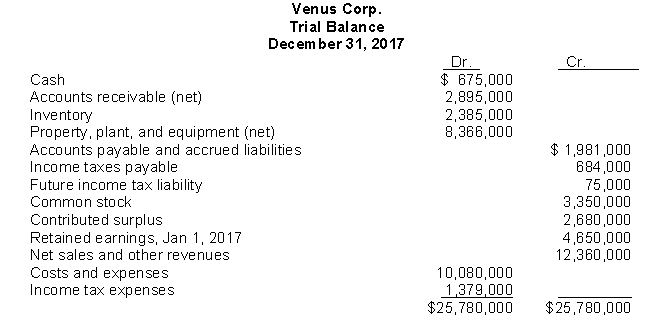

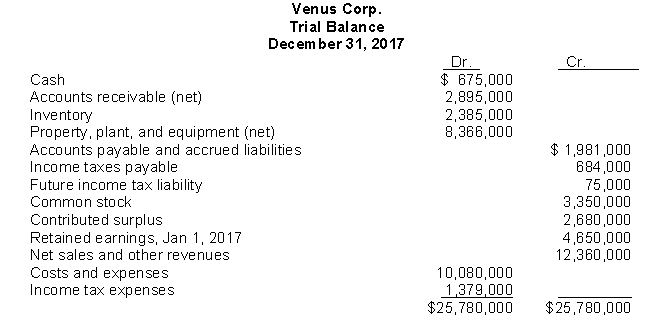

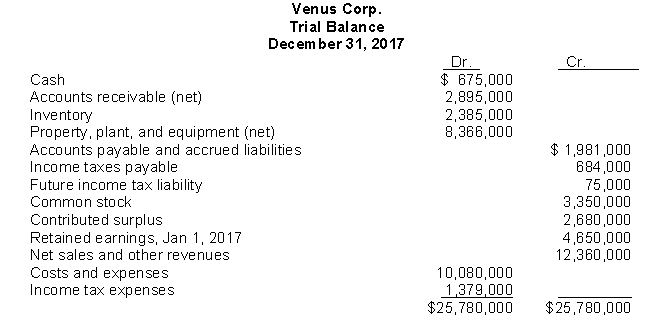

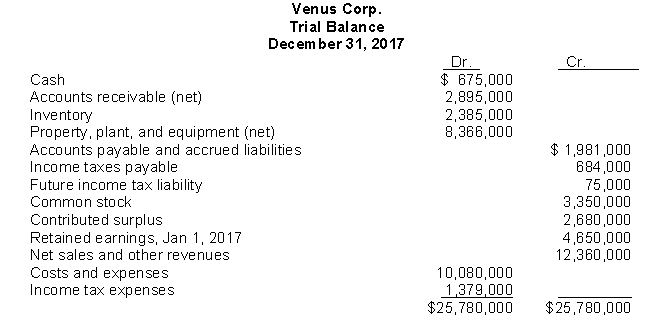

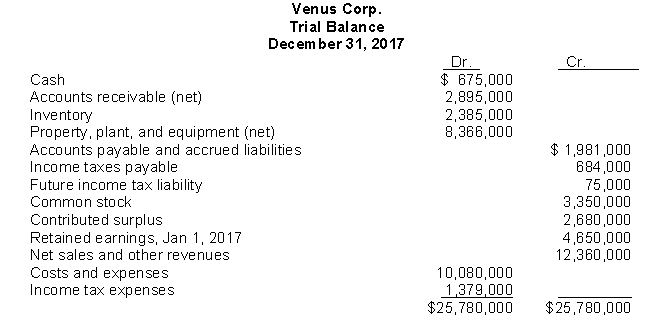

Use the following information for questions.

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment. Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

In Venus's December 31, 2017 statement of financial position, the current liabilities total is

A)$2,435,000.

B)$2,695,000.

C)$2,200,000.

D)$2,114,000.

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

In Venus's December 31, 2017 statement of financial position, the current liabilities total is

A)$2,435,000.

B)$2,695,000.

C)$2,200,000.

D)$2,114,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

28

Receivables are valued based on their ______.

A)fair value

B)estimated amount collectible

C)lower of cost or market value

D)historical cost

A)fair value

B)estimated amount collectible

C)lower of cost or market value

D)historical cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is a contra account?

A)Premium on bonds payable

B)Unearned revenue

C)Patents

D)Accumulated depreciation

A)Premium on bonds payable

B)Unearned revenue

C)Patents

D)Accumulated depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

30

The current assets section of the balance sheet should include

A)machinery.

B)patents.

C)goodwill.

D)inventory.

A)machinery.

B)patents.

C)goodwill.

D)inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following balance sheet classifications would normally require the greatest amount of supplementary disclosure?

A)Current assets

B)Current liabilities

C)Plant assets

D)Long-term liabilities

A)Current assets

B)Current liabilities

C)Plant assets

D)Long-term liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is NOT a current liability?

A)unearned revenue

B)derivatives

C)stock dividends distributable

D)trade accounts payable

A)unearned revenue

B)derivatives

C)stock dividends distributable

D)trade accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

33

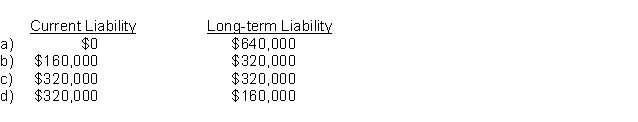

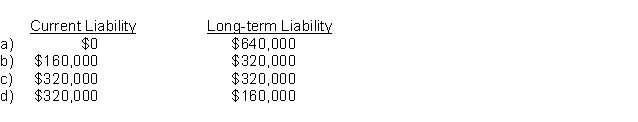

On January 1, 2017, Mars Inc.leased a building to Vulcan Corp.for a ten-year term at an annual rental of $160,000.At inception of the lease, Mars received $640,000, which covered the first two years rent of $320,000 and a security deposit of $320,000.This deposit will not be returned to Vulcan upon expiration of the lease, but will be applied to payment of rent for the last two years of the lease.What portion of the $640,000 should be shown as a current and long-term liability in Mars's December 31, 2017 statement of financial position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

34

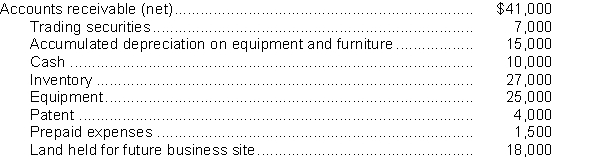

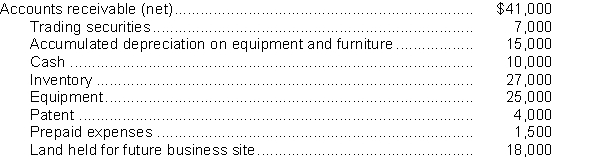

Pluto Corp.'s trial balance included the following account balances at December 31, 2017:  In Pluto's December 31, 2017 statement of financial position, the current assets total is

In Pluto's December 31, 2017 statement of financial position, the current assets total is

A)$104,500.

B)$90,500.

C)$86,500.

D)$73,500.

In Pluto's December 31, 2017 statement of financial position, the current assets total is

In Pluto's December 31, 2017 statement of financial position, the current assets total isA)$104,500.

B)$90,500.

C)$86,500.

D)$73,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

35

The shareholders' equity section is usually divided into which four parts?

A)preferred shares, common shares, retained earnings, contributed surplus

B)preferred shares, common shares, retained earnings, other comprehensive income

C)capital shares, contributed surplus, retained earnings, accumulated other comprehensive income

D)capital shares, appropriated retained earnings, unappropriated retained earnings, contributed surplus

A)preferred shares, common shares, retained earnings, contributed surplus

B)preferred shares, common shares, retained earnings, other comprehensive income

C)capital shares, contributed surplus, retained earnings, accumulated other comprehensive income

D)capital shares, appropriated retained earnings, unappropriated retained earnings, contributed surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

36

Working capital is

A)capital which has been reinvested in the business.

B)cash invested by owners.

C)cash and receivables less current liabilities.

D)current assets less current liabilities.

A)capital which has been reinvested in the business.

B)cash invested by owners.

C)cash and receivables less current liabilities.

D)current assets less current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is NOT a required supplemental disclosure for the balance sheet?

A)Contingencies

B)Financial forecasts

C)Accounting policies

D)Contractual situations

A)Contingencies

B)Financial forecasts

C)Accounting policies

D)Contractual situations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following information for questions.

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment. Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

In Venus's December 31, 2017 statement of financial position, the final retained earnings balance is

A)$5,551,000.

B)$6,132,000.

C)$5,135,000.

D)$6,016,000.

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

In Venus's December 31, 2017 statement of financial position, the final retained earnings balance is

A)$5,551,000.

B)$6,132,000.

C)$5,135,000.

D)$6,016,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements best describes a liability?

A)Any obligation, whether enforceable or not, is a liability.

B)A liability is an enforceable economic burden or obligation.

C)A liability is a legal economic benefit.

D)Deferred income taxes are always shown as liabilities.

A)Any obligation, whether enforceable or not, is a liability.

B)A liability is an enforceable economic burden or obligation.

C)A liability is a legal economic benefit.

D)Deferred income taxes are always shown as liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following information for questions.

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment. Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

In Venus's December 31, 2017 statement of financial position, the current assets total is

A)$5,955,000.

B)$5,595,000.

C)$3,060,000.

D)$4,495,000.

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

In Venus's December 31, 2017 statement of financial position, the current assets total is

A)$5,955,000.

B)$5,595,000.

C)$3,060,000.

D)$4,495,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

41

The statement of cash flows reports all of the following EXCEPT

A)the net change in cash for the period.

B)the cash effects of operations during the period.

C)the free cash flows generated during the period.

D)investing transactions.

A)the net change in cash for the period.

B)the cash effects of operations during the period.

C)the free cash flows generated during the period.

D)investing transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

42

On a statement of cash flows, the enterprise's main revenue-producing activities are disclosed in the

A)operating activities.

B)investing activities.

C)financing activities.

D)both operating and investing activities.

A)operating activities.

B)investing activities.

C)financing activities.

D)both operating and investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

43

A statement of cash flows prepared under the INDIRECT method adds and subtracts certain items to the base number.Decreases in unearned revenues would be shown as

A)a deduction from net income.

B)an addition to net income.

C)a deduction from sales.

D)an addition to sales.

A)a deduction from net income.

B)an addition to net income.

C)a deduction from sales.

D)an addition to sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

44

The financial statement which summarizes operating, investing, and financing activities of an entity for a period of time is the

A)retained earnings statement.

B)income statement.

C)statement of cash flows.

D)statement of financial position.

A)retained earnings statement.

B)income statement.

C)statement of cash flows.

D)statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

45

The current cash debt coverage ratio is often used to assess

A)financial flexibility.

B)solvency.

C)liquidity.

D)profitability.

A)financial flexibility.

B)solvency.

C)liquidity.

D)profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

46

In preparing a statement of cash flows, repurchase of a company's own shares at an amount greater than cost would be classified as a(n)

A)operating activity.

B)extraordinary activity.

C)financing activity.

D)investing activity.

A)operating activity.

B)extraordinary activity.

C)financing activity.

D)investing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

47

A statement of cash flows prepared under the DIRECT method starts with

A)net income.

B)gross profit.

C)cash received from customers.

D)income from operations.

A)net income.

B)gross profit.

C)cash received from customers.

D)income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

48

Making and collecting loans and disposing of property, plant, and equipment are

A)operating activities.

B)investing activities.

C)financing activities.

D)liquidity activities.

A)operating activities.

B)investing activities.

C)financing activities.

D)liquidity activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

49

In a statement of cash flows, proceeds from issuing equity instruments should be classified as cash inflows from

A)lending activities.

B)operating activities.

C)investing activities.

D)financing activities.

A)lending activities.

B)operating activities.

C)investing activities.

D)financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is NOT included in a statement of cash flows prepared under the DIRECT method?

A)cash flows from operating activities

B)gross profit

C)cash paid to suppliers and employees

D)interest paid or received

A)cash flows from operating activities

B)gross profit

C)cash paid to suppliers and employees

D)interest paid or received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

51

In a statement of cash flows, payments to acquire debt instruments of other entities (other than cash equivalents)should be classified as cash outflows for

A)operating activities.

B)investing activities.

C)financing activities.

D)lending activities.

A)operating activities.

B)investing activities.

C)financing activities.

D)lending activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

52

In preparing a statement of cash flows, which of the following transactions would be considered an investing activity?

A)sale of equipment at book value

B)sale of merchandise on credit

C)declaration of a cash dividend

D)issuance of bonds payable at a discount

A)sale of equipment at book value

B)sale of merchandise on credit

C)declaration of a cash dividend

D)issuance of bonds payable at a discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

53

Preparing a statement of cash flows under the INDIRECT method involves all of the following EXCEPT determining the

A)cash provided by operations.

B)cash provided by or used in investing and financing activities.

C)change in cash during the period.

D)cash collections from customers during the period.

A)cash provided by operations.

B)cash provided by or used in investing and financing activities.

C)change in cash during the period.

D)cash collections from customers during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

54

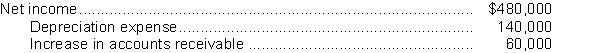

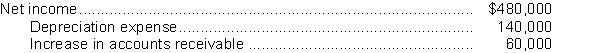

Yule Corporation reports the following information:  Yule should report cash provided by operating activities of

Yule should report cash provided by operating activities of

A)$280,000.

B)$400,000.

C)$560,000.

D)$680,000.

Yule should report cash provided by operating activities of

Yule should report cash provided by operating activities ofA)$280,000.

B)$400,000.

C)$560,000.

D)$680,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

55

In preparing a statement of cash flows under the INDIRECT method, cash flows from operating activities

A)are always equal to accrual accounting income.

B)are calculated as the difference between revenues and expenses.

C)can be calculated by appropriately adding to or deducting from net income those items in the income statement that do not affect cash.

D)can be calculated by appropriately adding to or deducting from net income those items in the income statement that do affect cash.

A)are always equal to accrual accounting income.

B)are calculated as the difference between revenues and expenses.

C)can be calculated by appropriately adding to or deducting from net income those items in the income statement that do not affect cash.

D)can be calculated by appropriately adding to or deducting from net income those items in the income statement that do affect cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

56

In a statement of cash flows, receipts from sales of property, plant, and equipment and other productive assets should be classified as cash inflows from

A)operating activities.

B)financing activities.

C)investing activities.

D)selling activities.

A)operating activities.

B)financing activities.

C)investing activities.

D)selling activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

57

The cash debt coverage ratio is calculated by dividing net cash provided by operating activities by

A)average long-term liabilities.

B)average total liabilities.

C)ending long-term liabilities.

D)ending total liabilities.

A)average long-term liabilities.

B)average total liabilities.

C)ending long-term liabilities.

D)ending total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

58

In a statement of cash flows, interest payments to lenders and other creditors should be classified as cash outflows for

A)operating activities.

B)borrowing activities.

C)lending activities.

D)financing activities.

A)operating activities.

B)borrowing activities.

C)lending activities.

D)financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

59

In a statement of cash flows, payments to acquire debt instruments of other entities (other than cash equivalents)should be classified as cash outflows for

A)operating activities.

B)investing activities.

C)financing activities.

D)lending activities.

A)operating activities.

B)investing activities.

C)financing activities.

D)lending activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

60

A measure of a company's financial flexibility is the

A)cash debt coverage ratio.

B)current cash debt coverage ratio.

C)free cash flow.

D)cash debt coverage ratio and free cash flow.

A)cash debt coverage ratio.

B)current cash debt coverage ratio.

C)free cash flow.

D)cash debt coverage ratio and free cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

61

Financial or capital market risks are related to

A)financing activities only.

B)investing activities only.

C)both financing and investing activities.

D)operating and financing activities.

A)financing activities only.

B)investing activities only.

C)both financing and investing activities.

D)operating and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

62

Significant changes to the presentation of financial statements are currently being developed by the IASB and FASB.Which of the following best describes the focus of these changes?

A)to better highlight the company's assets, liabilities and equity

B)to segregate the company's operating, financing and investing activities

C)to highlight the company's major business and financing activities

D)to increase the number of notes to be attached to financial statements

A)to better highlight the company's assets, liabilities and equity

B)to segregate the company's operating, financing and investing activities

C)to highlight the company's major business and financing activities

D)to increase the number of notes to be attached to financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

63

Net sales divided by average total assets is called

A)inventory turnover.

B)receivables turnover.

C)rate of return on assets.

D)asset turnover.

A)inventory turnover.

B)receivables turnover.

C)rate of return on assets.

D)asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements about IFRS and ASPE accounting and reporting requirements for the statement of financial position is NOT correct?

A)The presentation formats required by IFRS and ASPE for the statement of financial position are similar.

B)One difference between the reporting requirements under IFRS and those of ASPE statement of financial position is that an IFRS balance sheet may list long-term assets first.

C)Both IFRS and ASPE require that cash flow per share information be reported on the statement of financial position.

D)Both IFRS and ASPE require that comparative information be reported.

A)The presentation formats required by IFRS and ASPE for the statement of financial position are similar.

B)One difference between the reporting requirements under IFRS and those of ASPE statement of financial position is that an IFRS balance sheet may list long-term assets first.

C)Both IFRS and ASPE require that cash flow per share information be reported on the statement of financial position.

D)Both IFRS and ASPE require that comparative information be reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

65

The IASB issued an Exposure Draft (ED)in May 2015 entitled "Conceptual Framework for Financial Reporting" including proposed changes to the definitions of assets and liabilities.For most assets and liabilities, applying the new definition

A)yields the same accounting results as the current definition.

B)results in more conservative reporting of assets, and more aggressive reporting of liabilities.

C)results in more aggressive reporting of assets and more conservative reporting of liabilities.

D)results in more conservative reporting of both assets and liabilities.

A)yields the same accounting results as the current definition.

B)results in more conservative reporting of assets, and more aggressive reporting of liabilities.

C)results in more aggressive reporting of assets and more conservative reporting of liabilities.

D)results in more conservative reporting of both assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

66

Ratios that measure the degree of protection for long-term creditors and investors or the ability to meet long-term obligations are called

A)liquidity ratios.

B)activity ratios.

C)solvency ratios.

D)profitability ratios.

A)liquidity ratios.

B)activity ratios.

C)solvency ratios.

D)profitability ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

67

A company that follows IFRS

A)may disclose cash flow per share if it makes a special election to do so.

B)must not disclose cash flow per share.

C)is generally allowed to disclose cash flow per share.

D)only discloses cash flow per share if there are more than two shareholders.

A)may disclose cash flow per share if it makes a special election to do so.

B)must not disclose cash flow per share.

C)is generally allowed to disclose cash flow per share.

D)only discloses cash flow per share if there are more than two shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

68

When current debt is refinanced by the issue date of financial statements, it may generally be presented as non-current

A)if the company follows IFRS.

B)under either ASPE or IFRS.

C)if the company follows ASPE.

D)only if the company is a subsidiary.

A)if the company follows IFRS.

B)under either ASPE or IFRS.

C)if the company follows ASPE.

D)only if the company is a subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

69

Free cash flow is calculated as net cash provided by operating activities less

A)capital expenditures.

B)dividends.

C)capital expenditures and dividends.

D)capital expenditures and depreciation.

A)capital expenditures.

B)dividends.

C)capital expenditures and dividends.

D)capital expenditures and depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

70

Under IFRS, current assets are listed in

A)the order of liquidity.

B)the reverse order of liquidity.

C)the ascending order of their balances.

D)the descending order of their balances.

A)the order of liquidity.

B)the reverse order of liquidity.

C)the ascending order of their balances.

D)the descending order of their balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following items would require special disclosure under IFRS?

A)investment property only

B)biological assets and investment property only

C)provisions and biological assets

D)biological assets, investment property and provisions

A)investment property only

B)biological assets and investment property only

C)provisions and biological assets

D)biological assets, investment property and provisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

72

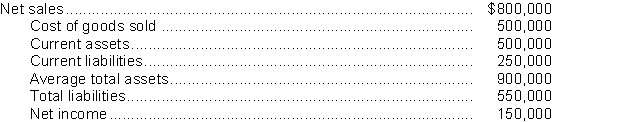

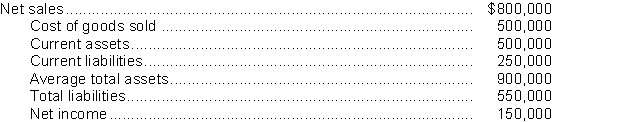

Thrifty's Inc.gives you the following information pertaining to the year 2017:  The rate of return on assets Thrifty's Inc.is

The rate of return on assets Thrifty's Inc.is

A)55.5%.

B)30.0%.

C)18.7%.

D)16.6%.

The rate of return on assets Thrifty's Inc.is

The rate of return on assets Thrifty's Inc.isA)55.5%.

B)30.0%.

C)18.7%.

D)16.6%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

73

Ratios that measure how effectively an entity is using is assets are called

A)liquidity ratios.

B)activity ratios.

C)solvency ratios.

D)profitability ratios.

A)liquidity ratios.

B)activity ratios.

C)solvency ratios.

D)profitability ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

74

Free cash flow is calculated as net cash provided by operating activities less

A)capital expenditures.

B)dividends.

C)capital expenditures and dividends.

D)capital expenditures and depreciation.

A)capital expenditures.

B)dividends.

C)capital expenditures and dividends.

D)capital expenditures and depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

75

Thrifty's Inc.gives you the following information pertaining to the year 2017:  The asset turnover ratio of Thrifty's Inc.is

The asset turnover ratio of Thrifty's Inc.is

A)0.56.

B)0.17.

C)0.89.

D)1.13.

The asset turnover ratio of Thrifty's Inc.is

The asset turnover ratio of Thrifty's Inc.isA)0.56.

B)0.17.

C)0.89.

D)1.13.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

76

One of the benefits of the statement of cash flows is that it helps users evaluate financial flexibility.Which of the following explanations is a description of financial flexibility?

A)the nearness to cash of assets and liabilities

B)the firm's ability to respond and adapt to financial adversity and unexpected needs and opportunities

C)the firm's ability to pay its debts as they mature

D)the firm's ability to invest in a number of projects with different objectives and costs

A)the nearness to cash of assets and liabilities

B)the firm's ability to respond and adapt to financial adversity and unexpected needs and opportunities

C)the firm's ability to pay its debts as they mature

D)the firm's ability to invest in a number of projects with different objectives and costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

77

A company that follows ASPE

A)must not disclose cash flow per share.

B)may disclose cash flow per share.

C)may disclose cash flow per share if it makes a special election to do so.

D)must disclose cash flow per share.

A)must not disclose cash flow per share.

B)may disclose cash flow per share.

C)may disclose cash flow per share if it makes a special election to do so.

D)must disclose cash flow per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Exposure Draft (ED)called the "Disclosure Initiative-Proposed Amendments to IAS7" proposes

A)replacement of IAS 7: Statement of Cash flows.

B)amendments that would provide additional information about investing activities.

C)amendments that would provide additional information about financing activities.

D)amendments that would provide additional information about operating activities.

A)replacement of IAS 7: Statement of Cash flows.

B)amendments that would provide additional information about investing activities.

C)amendments that would provide additional information about financing activities.

D)amendments that would provide additional information about operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck