Deck 18: Income Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/55

العب

ملء الشاشة (f)

Deck 18: Income Taxes

1

Interperiod tax allocation causes

A)the income tax expense reported on the income statement to equal the amount of income taxes payable for the current year plus or minus the change in the deferred tax asset or liability balances for the year.

B)the income tax expense reported on the income statement to bear a normal relation to the tax liability.

C)the income tax liability reported on the statement of financial position to bear a normal relation to the income before tax reported on the income statement.

D)the income tax expense reported on the income statement to be presented with the specific revenues causing the tax.

A)the income tax expense reported on the income statement to equal the amount of income taxes payable for the current year plus or minus the change in the deferred tax asset or liability balances for the year.

B)the income tax expense reported on the income statement to bear a normal relation to the tax liability.

C)the income tax liability reported on the statement of financial position to bear a normal relation to the income before tax reported on the income statement.

D)the income tax expense reported on the income statement to be presented with the specific revenues causing the tax.

A

2

The effective tax rate for a period is calculated by dividing

A)total income tax expense by taxable income.

B)total income tax expense by the pre-tax income on the income statement.

C)taxable income by total income tax expense.

D)taxable income by the pre-tax income on the income statement.

A)total income tax expense by taxable income.

B)total income tax expense by the pre-tax income on the income statement.

C)taxable income by total income tax expense.

D)taxable income by the pre-tax income on the income statement.

B

3

If a corporation prepares an adjusting entry to credit the deferred tax asset account, this should represent

A)additional future income taxes payable.

B)a transfer to the deferred tax liability account.

C)the reversal of a deferred tax benefit that originated in a prior year.

D)the reversal of a deferred tax expense that originated in a prior year.

A)additional future income taxes payable.

B)a transfer to the deferred tax liability account.

C)the reversal of a deferred tax benefit that originated in a prior year.

D)the reversal of a deferred tax expense that originated in a prior year.

C

4

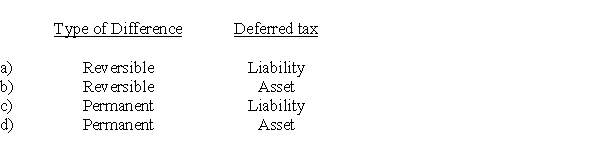

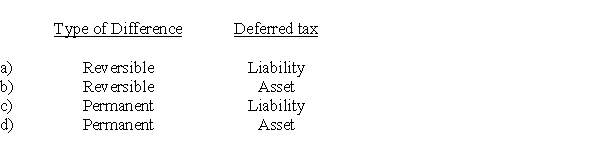

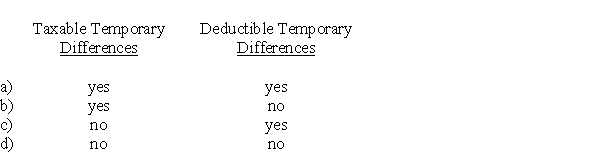

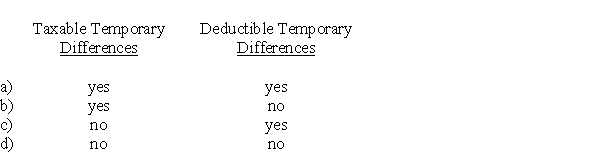

A corporation records an unrealized loss on short-term securities. This would result in what type of difference and in what type of deferred tax account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

5

Total income tax expense for a corporation consists of

A)current tax expense and deferred tax expense.

B)current tax expense only.

C)deferred tax expense only.

D)The deferred tax asset minus any deferred tax liability.

A)current tax expense and deferred tax expense.

B)current tax expense only.

C)deferred tax expense only.

D)The deferred tax asset minus any deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

6

One objective of interperiod tax allocation is to

A)recognize the tax effects in the accounting period when the transactions and events are recognized for financial reporting purposes.

B)recognize a distribution of earnings to the shareholders.

C)reconcile the tax consequences of permanent and reversible differences appearing on the current year's financial statements.

D)adjust income tax expense on the income statement to be in agreement with income taxes payable on the statement of financial position.

A)recognize the tax effects in the accounting period when the transactions and events are recognized for financial reporting purposes.

B)recognize a distribution of earnings to the shareholders.

C)reconcile the tax consequences of permanent and reversible differences appearing on the current year's financial statements.

D)adjust income tax expense on the income statement to be in agreement with income taxes payable on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following will not result in a reversible difference?

A)product warranty liabilities

B)unrealized holding losses

C)instalment sales

D)fines and penalties

A)product warranty liabilities

B)unrealized holding losses

C)instalment sales

D)fines and penalties

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

8

In regard to reconciling income reported on the financial statements to taxable income, which of the following statements is incorrect?

A)All differences between accounting income and taxable income are considered.

B)Only reversible differences are considered.

C)Only those that result in temporary differences are considered when determining deferred tax amounts for the statement of financial position.

D)Permanent differences may be added back to or deducted from accounting income.

A)All differences between accounting income and taxable income are considered.

B)Only reversible differences are considered.

C)Only those that result in temporary differences are considered when determining deferred tax amounts for the statement of financial position.

D)Permanent differences may be added back to or deducted from accounting income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

9

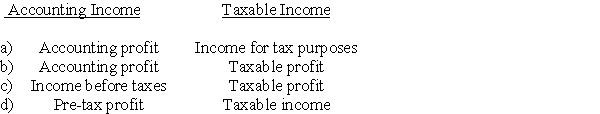

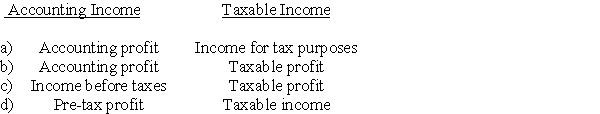

Under IFRS, accounting income and taxable income are referred to as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under IFRS, end of the period adjustments may need to be made to income for all of the following reasons except

A)income taxes must be filed in accordance with the Income Tax Act.

B)IFRS does not provide guidance on allowable deductions for CRA.

C)IFRS does allow for the taxes payable approach.

D)income taxes preparation may also be subject to provincial legislation.

A)income taxes must be filed in accordance with the Income Tax Act.

B)IFRS does not provide guidance on allowable deductions for CRA.

C)IFRS does allow for the taxes payable approach.

D)income taxes preparation may also be subject to provincial legislation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

11

For calculating income tax expense, IFRS requires the use of

A)any method as long as the CRA approves it.

B)the taxes payable method only.

C)the temporary difference approach only.

D)either the taxes payable method or the temporary difference approach.

A)any method as long as the CRA approves it.

B)the taxes payable method only.

C)the temporary difference approach only.

D)either the taxes payable method or the temporary difference approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

12

For calculating income tax expense, ASPE allows the use of

A)any method as long as the CRA approves it.

B)the taxes payable method only.

C)the future income taxes method only.

D)either the taxes payable method or the future income taxes method.

A)any method as long as the CRA approves it.

B)the taxes payable method only.

C)the future income taxes method only.

D)either the taxes payable method or the future income taxes method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

13

Alabama Corp.'s taxable income differed from its accounting income for 2017. An item that would create a permanent difference in accounting and taxable incomes for the corporation would be

A)a balance in the Unearned Rent account at year end.

B)using CCA for tax purposes and straight-line depreciation for book purposes.

C)a payment of the golf club dues for the president's membership.

D)making instalment sales during the year.

A)a balance in the Unearned Rent account at year end.

B)using CCA for tax purposes and straight-line depreciation for book purposes.

C)a payment of the golf club dues for the president's membership.

D)making instalment sales during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

14

The difference between the tax base of an asset or liability and its reported amount on the statement of financial position is called a

A)permanent difference.

B)temporary difference.

C)current difference.

D)future income tax expense.

A)permanent difference.

B)temporary difference.

C)current difference.

D)future income tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

15

A deferred tax asset is the

A)current tax consequence of a taxable temporary difference.

B)current tax consequence of a deductible temporary difference.

C)future tax consequence of a deductible temporary difference.

D)future tax consequence of a taxable temporary difference.

A)current tax consequence of a taxable temporary difference.

B)current tax consequence of a deductible temporary difference.

C)future tax consequence of a deductible temporary difference.

D)future tax consequence of a taxable temporary difference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

16

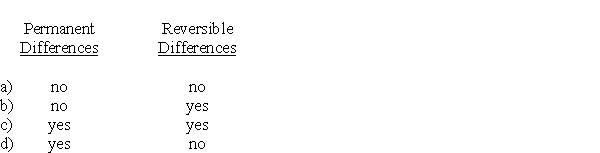

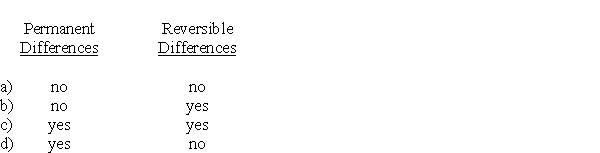

When calculating income tax expense, taxable income of a corporation differs from pre-tax accounting income because of

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

17

Of the various taxation options available to OECD countries, those that had the most negative impact on gross domestic product were

A)property taxes.

B)consumption taxes.

C)corporate taxes.

D)personal income taxes.

A)property taxes.

B)consumption taxes.

C)corporate taxes.

D)personal income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

18

Machinery was acquired at the beginning of the year. Depreciation recorded during the life of the machinery could result in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

19

A deferred tax liability is the

A)current tax consequence of a taxable temporary difference.

B)current tax consequence of a deductible temporary difference.

C)future tax consequence of a deductible temporary difference.

D)future tax consequence of a taxable temporary difference.

A)current tax consequence of a taxable temporary difference.

B)current tax consequence of a deductible temporary difference.

C)future tax consequence of a deductible temporary difference.

D)future tax consequence of a taxable temporary difference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

20

The tax base of a liability is its carrying amount on the statement of financial position

A)reduced by any amount that will be deductible for tax purposes in future periods.

B)increased by any amount that will be deductible for tax purposes in future periods.

C)less any amount that will not be taxable in the future.

D)plus any amount that will not be taxable in the future.

A)reduced by any amount that will be deductible for tax purposes in future periods.

B)increased by any amount that will be deductible for tax purposes in future periods.

C)less any amount that will not be taxable in the future.

D)plus any amount that will not be taxable in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

21

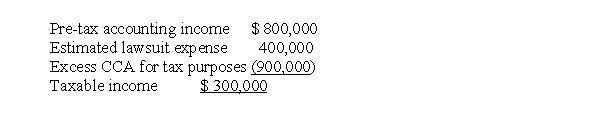

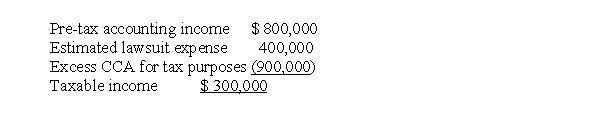

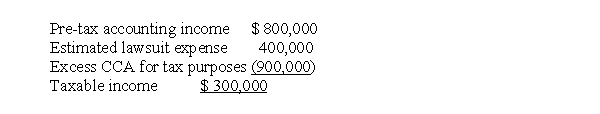

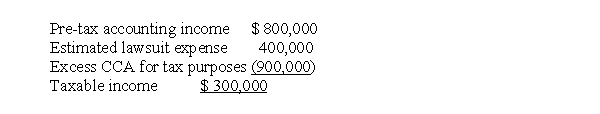

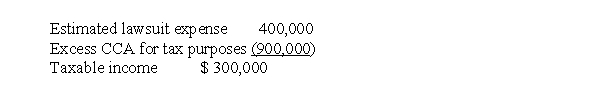

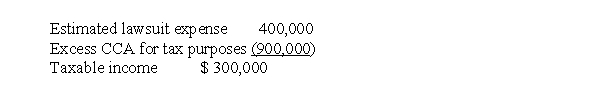

At the end of 2017, its first year of operations, Kali Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

A)$ 0.

B)$ 75,000.

C)$150,000.

D)$200,000.

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable isA)$ 0.

B)$ 75,000.

C)$150,000.

D)$200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

22

The use of a Deferred Tax Asset account is subject to all of the following restrictions, except

A)if the future taxable income is not probable, the deferred tax asset account will be removed.

B)the deferred tax asset account is regularly reviewed.

C)when conditions change a previously unrecognized deferred tax asset account may be recognized.

D)the allowance method for recognizing the deferred tax asset account is the required standard.

A)if the future taxable income is not probable, the deferred tax asset account will be removed.

B)the deferred tax asset account is regularly reviewed.

C)when conditions change a previously unrecognized deferred tax asset account may be recognized.

D)the allowance method for recognizing the deferred tax asset account is the required standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

23

Macintyre Inc. sells household furniture on an instalment basis. Customers make payments in equal monthly instalments over a two-year period, with no down payment required. Macintyre's gross profit on instalment sales is 40% of the selling price.

For book purposes, sales revenue is recognized at the time the sale is made. For income tax purposes, however, the instalment method is used. There are no other accounting and income tax accounting differences, and Macintyre's income tax rate is 30%.

If Macintyre's December 31, 2017, statement of financial position includes a deferred tax liability of $90,000 arising from the difference between accounting and tax treatment of the instalment sales, it should also include instalment accounts receivable of

A)$750,000.

B)$300,000.

C)$225,000.

D)$90,000.

For book purposes, sales revenue is recognized at the time the sale is made. For income tax purposes, however, the instalment method is used. There are no other accounting and income tax accounting differences, and Macintyre's income tax rate is 30%.

If Macintyre's December 31, 2017, statement of financial position includes a deferred tax liability of $90,000 arising from the difference between accounting and tax treatment of the instalment sales, it should also include instalment accounts receivable of

A)$750,000.

B)$300,000.

C)$225,000.

D)$90,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

24

Recognition of tax benefits in a loss year due to a loss carryforward requires

A)the establishment of a deferred tax liability.

B)the establishment of a deferred tax asset.

C)the establishment of an income tax receivable.

D)only a note to the financial statements.

A)the establishment of a deferred tax liability.

B)the establishment of a deferred tax asset.

C)the establishment of an income tax receivable.

D)only a note to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

25

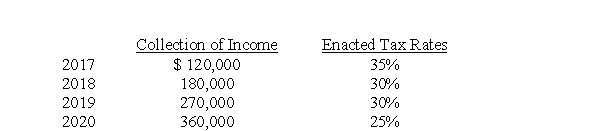

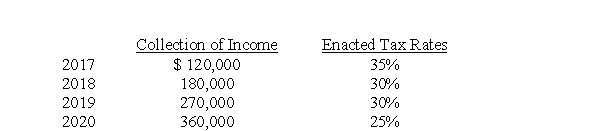

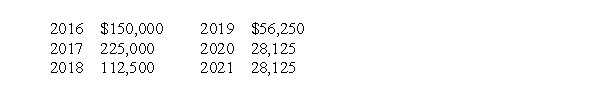

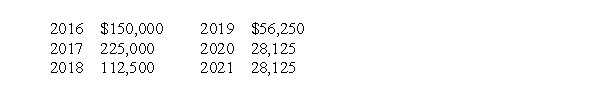

Casey Inc. uses the accrual method of accounting for financial reporting purposes and the instalment method of accounting for income tax purposes. Instalment income of $930,000 will be collected in the following years when the enacted tax rates are:  The instalment income is Casey's only reversible difference. What amount should be included as the deferred tax liability on their December 31, 2017 statement of financial position?

The instalment income is Casey's only reversible difference. What amount should be included as the deferred tax liability on their December 31, 2017 statement of financial position?

A)$225,000

B)$243,000

C)$256,500

D)$315,000

The instalment income is Casey's only reversible difference. What amount should be included as the deferred tax liability on their December 31, 2017 statement of financial position?

The instalment income is Casey's only reversible difference. What amount should be included as the deferred tax liability on their December 31, 2017 statement of financial position?A)$225,000

B)$243,000

C)$256,500

D)$315,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

26

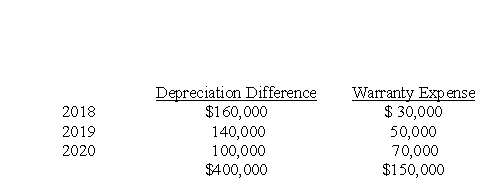

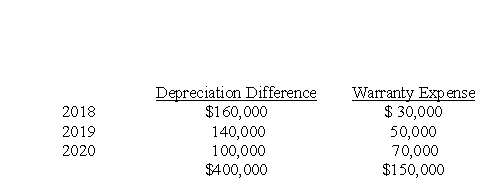

For calendar 2017, Melvin Corp. reported depreciation expense of $800,000 on its income statement, but on its 2017 income tax return, Melvin claimed CCA of $1,200,000. The 2017 income statement also included $150,000 in accrued warranty expense that will be deducted for tax purposes when paid. Melvin's income tax rates are 30% for 2017 and 2015, and 24% for 2018 and 2019. The depreciation difference and warranty expense will reverse over the next three years as follows:  These were Melvin's only reversible differences. At December 31, 2017, Melvin's deferred tax liability should be

These were Melvin's only reversible differences. At December 31, 2017, Melvin's deferred tax liability should be

A)$67,800.

B)$73,200.

C)$75,000.

D)$133,800.

These were Melvin's only reversible differences. At December 31, 2017, Melvin's deferred tax liability should be

These were Melvin's only reversible differences. At December 31, 2017, Melvin's deferred tax liability should beA)$67,800.

B)$73,200.

C)$75,000.

D)$133,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

27

For calendar 2017, Peanuts Corp. prepared the following reconciliation of accounting income to taxable income:  Peanut's income tax rate is 25% for 2017. What amount should the corporation report in its 2017 income statement as current income tax expense?

Peanut's income tax rate is 25% for 2017. What amount should the corporation report in its 2017 income statement as current income tax expense?

A)$ 25,000

B)$112,500

C)$187,500

D)$212,500

Peanut's income tax rate is 25% for 2017. What amount should the corporation report in its 2017 income statement as current income tax expense?

Peanut's income tax rate is 25% for 2017. What amount should the corporation report in its 2017 income statement as current income tax expense?A)$ 25,000

B)$112,500

C)$187,500

D)$212,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

28

Tax rates other than the current tax rate may be used to calculate the future income tax amount on the statement of financial position if

A)it is probable that a future income tax rate change will occur.

B)it appears likely that a future income tax rate will be higher than the current tax rate.

C)the future income tax rates have been enacted or substantively enacted into law.

D)it appears likely that a future income tax rate will be less than the current tax rate.

A)it is probable that a future income tax rate change will occur.

B)it appears likely that a future income tax rate will be higher than the current tax rate.

C)the future income tax rates have been enacted or substantively enacted into law.

D)it appears likely that a future income tax rate will be less than the current tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

29

Taxable income of a corporation

A)differs from accounting income due to differences in intraperiod allocation between the two methods of income determination.

B)differs from accounting income due to differences in interperiod allocation and permanent differences between the two methods of income determination.

C)is based on generally accepted accounting principles.

D)is reported on the corporation's income statement.

A)differs from accounting income due to differences in intraperiod allocation between the two methods of income determination.

B)differs from accounting income due to differences in interperiod allocation and permanent differences between the two methods of income determination.

C)is based on generally accepted accounting principles.

D)is reported on the corporation's income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

30

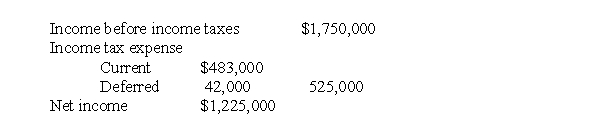

Columbia Corp.'s partial income statement for its first year of operations is as follows:  Columbia uses straight-line depreciation for financial reporting purposes and CCA for tax purposes. The depreciation expense for the year was $700,000. Except for depreciation, there were no other differences between accounting income and taxable income. Assuming a 30% tax rate, what amount was claimed for CCA on the corporation's tax return for the year?

Columbia uses straight-line depreciation for financial reporting purposes and CCA for tax purposes. The depreciation expense for the year was $700,000. Except for depreciation, there were no other differences between accounting income and taxable income. Assuming a 30% tax rate, what amount was claimed for CCA on the corporation's tax return for the year?

A)$560,000

B)$665,000

C)$700,000

D)$840,000

Columbia uses straight-line depreciation for financial reporting purposes and CCA for tax purposes. The depreciation expense for the year was $700,000. Except for depreciation, there were no other differences between accounting income and taxable income. Assuming a 30% tax rate, what amount was claimed for CCA on the corporation's tax return for the year?

Columbia uses straight-line depreciation for financial reporting purposes and CCA for tax purposes. The depreciation expense for the year was $700,000. Except for depreciation, there were no other differences between accounting income and taxable income. Assuming a 30% tax rate, what amount was claimed for CCA on the corporation's tax return for the year?A)$560,000

B)$665,000

C)$700,000

D)$840,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

31

On January 1, 2017, Wings Inc. purchased a machine for $270,000, which will be depreciated $27,000 annually for book purposes. For income tax reporting, the asset is a Class 8 asset with a CCA rate of 20%, subject to the half year rule for 2017. Assume a present and future enacted income tax rate of 30%. What amount should be added to Wings' deferred tax liability for the difference between depreciation and CCA at December 31, 2017?

A)$16,200

B)$9,000

C)$8,100

D)$0

A)$16,200

B)$9,000

C)$8,100

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

32

Using IFRS, IAS 12 guidelines allow for all of the following except

A)the choice of using either the taxes payable method or the future income taxes method.

B)the use of the temporary difference approach.

C)does not use a valuation account.

D)permits the use of a deferred tax asset account to the extent that it is probable.

A)the choice of using either the taxes payable method or the future income taxes method.

B)the use of the temporary difference approach.

C)does not use a valuation account.

D)permits the use of a deferred tax asset account to the extent that it is probable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

33

For calendar 2017, its first year of operations, Snow Corp. reported pre-tax accounting income of $330,000 and taxable income of $600,000. The only reversible difference is accrued warranty costs, which are expected to be paid as follows:  The enacted income tax rates are 35% for 2017, 30% for 2018, 2019 and 2020, and 25% for 2021. The deferred tax asset reported on Snow's December 31, 2017 statement of financial position should be

The enacted income tax rates are 35% for 2017, 30% for 2018, 2019 and 2020, and 25% for 2021. The deferred tax asset reported on Snow's December 31, 2017 statement of financial position should be

A)$54,000.

B)$63,000.

C)$76,500.

D)$94,500.

The enacted income tax rates are 35% for 2017, 30% for 2018, 2019 and 2020, and 25% for 2021. The deferred tax asset reported on Snow's December 31, 2017 statement of financial position should be

The enacted income tax rates are 35% for 2017, 30% for 2018, 2019 and 2020, and 25% for 2021. The deferred tax asset reported on Snow's December 31, 2017 statement of financial position should beA)$54,000.

B)$63,000.

C)$76,500.

D)$94,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

34

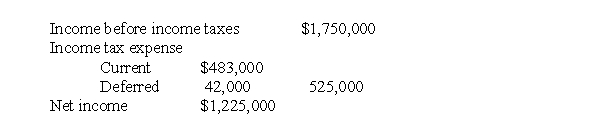

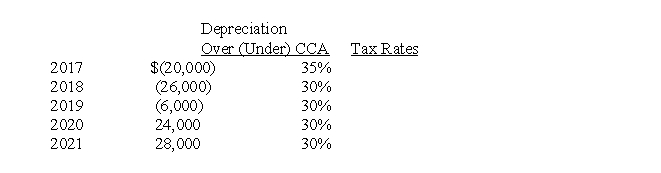

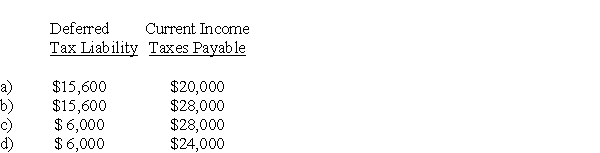

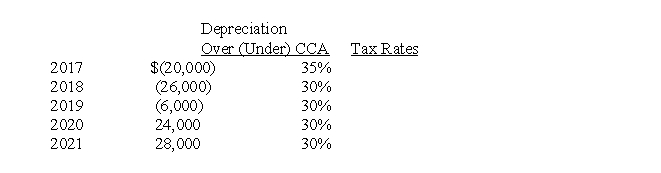

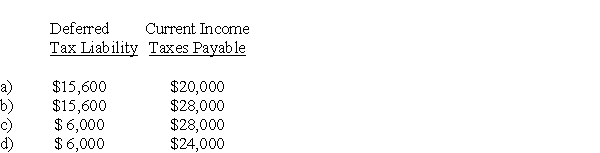

For calendar 2017, its first year of operations, Lion Ltd. reported pre-tax accounting income of $100,000. Lion uses CCA for tax purposes and straight-line depreciation for financial reporting. The differences between depreciation and CCA over the five-year life of their assets, and the enacted tax rates for 2017 to 2021 are as follows:  There are no other reversible differences. On Lion's December 31, 2017 statement of financial position, the deferred tax liability and the current income taxes payable should be

There are no other reversible differences. On Lion's December 31, 2017 statement of financial position, the deferred tax liability and the current income taxes payable should be

There are no other reversible differences. On Lion's December 31, 2017 statement of financial position, the deferred tax liability and the current income taxes payable should be

There are no other reversible differences. On Lion's December 31, 2017 statement of financial position, the deferred tax liability and the current income taxes payable should be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

35

Allocating income tax expense or benefit for the period (both current and deferred)to the income and other statements to reflect transactions that attract income tax is known as

A)intraperiod tax allocation.

B)interperiod tax allocation.

C)current tax allocation.

D)reconcilation approach.

A)intraperiod tax allocation.

B)interperiod tax allocation.

C)current tax allocation.

D)reconcilation approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

36

Under IFRS, how are deferred tax asset and liability accounts presented on the statement of financial position?

A)They must be segregated into current and noncurrent items.

B)They must be shown as noncurrent assets or liabilities.

C)They must be shown as current assets or liabilities.

D)They must be reported as a reduction of the related asset or liability accounts.

A)They must be segregated into current and noncurrent items.

B)They must be shown as noncurrent assets or liabilities.

C)They must be shown as current assets or liabilities.

D)They must be reported as a reduction of the related asset or liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

37

McMurray Inc. incurred an accounting and taxable loss for 2017. The corporation therefore decided to use the carryback provisions as it had been profitable up to this year. How should the amounts related to the carryback be reported in the 2017 financial statements?

A)The reduction of the loss should be reported as an adjustment to retained earnings.

B)The refund claimed should be reported as a future charge and amortized over five years.

C)The refund claimed should be reported as revenue in the current year.

D)The refund claimed should be shown as a reduction of the loss in 2017.

A)The reduction of the loss should be reported as an adjustment to retained earnings.

B)The refund claimed should be reported as a future charge and amortized over five years.

C)The refund claimed should be reported as revenue in the current year.

D)The refund claimed should be shown as a reduction of the loss in 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

38

Recognizing a deferred tax asset for most deductible temporary differences and carryforward of unused tax losses is

A)used under IFRS only.

B)used under ASPE only.

C)used only to the extent that it is probable and the deferred tax asset will be realized.

D)used only for corporate income tax purposes for CRA.

A)used under IFRS only.

B)used under ASPE only.

C)used only to the extent that it is probable and the deferred tax asset will be realized.

D)used only for corporate income tax purposes for CRA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

39

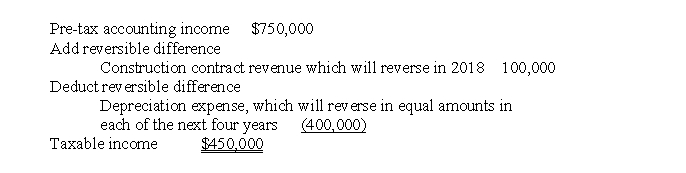

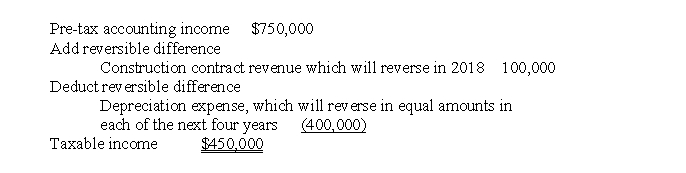

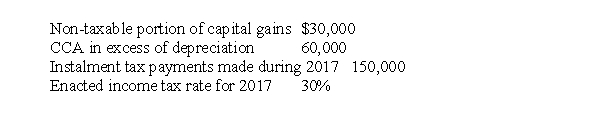

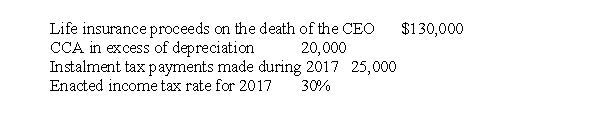

Shierling Corp. reported pre-tax accounting income of $750,000 for calendar 2017. To calculate the income tax liability, the following data were considered:  What amount should Shierling report as its current income tax liability on its December 31, 2017 statement of financial position?

What amount should Shierling report as its current income tax liability on its December 31, 2017 statement of financial position?

A)$198,000

B)$75,000

C)$66,000

D)$48,000

What amount should Shierling report as its current income tax liability on its December 31, 2017 statement of financial position?

What amount should Shierling report as its current income tax liability on its December 31, 2017 statement of financial position?A)$198,000

B)$75,000

C)$66,000

D)$48,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

40

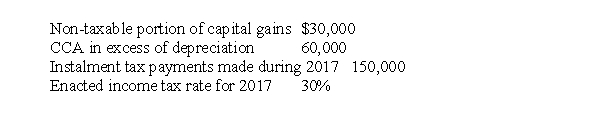

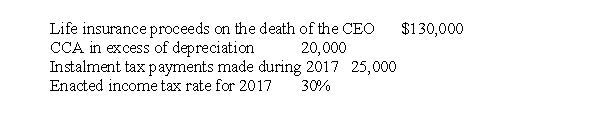

Bare Fashions Corp. reported pre-tax accounting income of $300,000 for calendar 2017. To calculate the income tax liability, the following data were considered:  What amount should Bare Fashion report as its current income tax liability on its December 31, 2017 statement of financial position?

What amount should Bare Fashion report as its current income tax liability on its December 31, 2017 statement of financial position?

A)$20,000

B)$26,000

C)$45,000

D)$51,000

What amount should Bare Fashion report as its current income tax liability on its December 31, 2017 statement of financial position?

What amount should Bare Fashion report as its current income tax liability on its December 31, 2017 statement of financial position?A)$20,000

B)$26,000

C)$45,000

D)$51,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

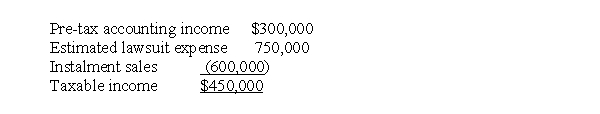

41

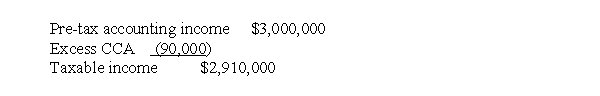

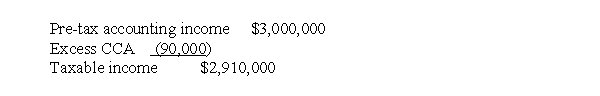

A reconciliation of Quebec Corp.'s pre-tax accounting income with its taxable income for 2017, its first year of operations, is as follows:  The excess CCA will result in equal net taxable amounts in each of the next three years. Enacted tax rates are 40% in 2017, 35% in 2018, and 30% in both 2019 and 2020. The total deferred tax liability to be reported on Quebec's statement of financial position at December 31, 2017 is

The excess CCA will result in equal net taxable amounts in each of the next three years. Enacted tax rates are 40% in 2017, 35% in 2018, and 30% in both 2019 and 2020. The total deferred tax liability to be reported on Quebec's statement of financial position at December 31, 2017 is

A)$36,000.

B)$31,500.

C)$30,000.

D)$28,500.

The excess CCA will result in equal net taxable amounts in each of the next three years. Enacted tax rates are 40% in 2017, 35% in 2018, and 30% in both 2019 and 2020. The total deferred tax liability to be reported on Quebec's statement of financial position at December 31, 2017 is

The excess CCA will result in equal net taxable amounts in each of the next three years. Enacted tax rates are 40% in 2017, 35% in 2018, and 30% in both 2019 and 2020. The total deferred tax liability to be reported on Quebec's statement of financial position at December 31, 2017 isA)$36,000.

B)$31,500.

C)$30,000.

D)$28,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

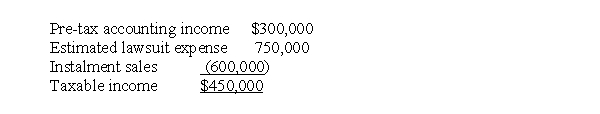

42

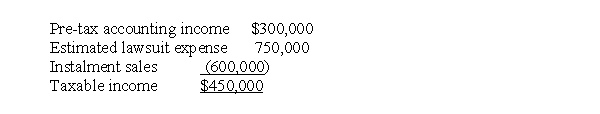

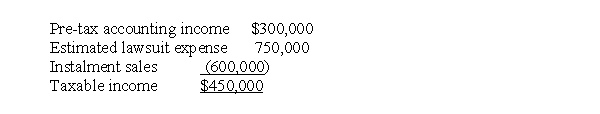

At the end of 2017, its first year of operations, Ontario Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax liability to be recorded is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax liability to be recorded is

A)$180,000.

B)$ 90,000.

C)$ 67,500.

D)$ 45,000.

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax liability to be recorded is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax liability to be recorded isA)$180,000.

B)$ 90,000.

C)$ 67,500.

D)$ 45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

43

At the end of 2017, its first year of operations, Ontario Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The total income tax expense to be reported on the income statement is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The total income tax expense to be reported on the income statement is

A)$90,000.

B)$135,000.

C)$150,000.

D)$300,000.

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The total income tax expense to be reported on the income statement is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The total income tax expense to be reported on the income statement isA)$90,000.

B)$135,000.

C)$150,000.

D)$300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

44

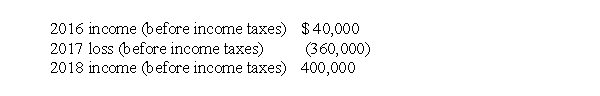

Saucy Inc. reported a taxable and accounting loss of $130,000 for 2017. Its pre-tax accounting income for the last two years was as follows:  The amount that Saucy reports as a net loss for financial reporting purposes in 2017, assuming that it uses the carryback provisions, and that the tax rate is 25% for all years involved, is

The amount that Saucy reports as a net loss for financial reporting purposes in 2017, assuming that it uses the carryback provisions, and that the tax rate is 25% for all years involved, is

A)$0.

B)$97,500.

C)$105,000.

D)$130,000.

The amount that Saucy reports as a net loss for financial reporting purposes in 2017, assuming that it uses the carryback provisions, and that the tax rate is 25% for all years involved, is

The amount that Saucy reports as a net loss for financial reporting purposes in 2017, assuming that it uses the carryback provisions, and that the tax rate is 25% for all years involved, isA)$0.

B)$97,500.

C)$105,000.

D)$130,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

45

In 2017, Savoury Ltd. accrued, for book purposes, estimated losses on disposal of unused plant facilities of $750,000. The facilities were sold in March 2018 and a $750,000 loss was recognized for tax purposes. Also in 2017, Savoury paid $50,000 in premiums for a two-year life insurance policy in which the company was the beneficiary. Assuming that the enacted tax rate is 25% in both 2017 and 2018, and that Savoury$390,000 in income taxes in 2017, the amount reported as the deferred tax asset or liability on Savoury's statement of financial position at December 31, 2017, should be a

A)Cannot be determined from the information given.

B)$175,000 asset.

C)$187,500 liability.

D)$187,500 asset.

A)Cannot be determined from the information given.

B)$175,000 asset.

C)$187,500 liability.

D)$187,500 asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

46

Night Owl Inc. reports a taxable and pre-tax accounting loss of $150,000 for 2017. The corporation's taxable and pre-tax accounting income and tax rates for the last two years were:  The 2017 tax rate is 30%. If Indiana elects to use the carryback provisions, the amount that should be reported as income tax receivable for 2017 is

The 2017 tax rate is 30%. If Indiana elects to use the carryback provisions, the amount that should be reported as income tax receivable for 2017 is

A)$50,000.

B)$45,000.

C)$35,000.

D)$30,000.

The 2017 tax rate is 30%. If Indiana elects to use the carryback provisions, the amount that should be reported as income tax receivable for 2017 is

The 2017 tax rate is 30%. If Indiana elects to use the carryback provisions, the amount that should be reported as income tax receivable for 2017 isA)$50,000.

B)$45,000.

C)$35,000.

D)$30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

47

On January 2, 2016, Brunswick Corp. purchased a depreciable asset for $600,000. The asset has an estimated 4 year life with no residual value. Straight-line depreciation is being used for financial statement purposes but the following CCA amounts will be deducted for tax purposes:  Assuming an income tax rate of 30% for all years, the deferred tax liability that should be reflected on Brunswick's statement of financial position at December 31, 2017, should be

Assuming an income tax rate of 30% for all years, the deferred tax liability that should be reflected on Brunswick's statement of financial position at December 31, 2017, should be

A)$22,500.

B)$33,750.

C)$45,000.

D)$50,625.

Assuming an income tax rate of 30% for all years, the deferred tax liability that should be reflected on Brunswick's statement of financial position at December 31, 2017, should be

Assuming an income tax rate of 30% for all years, the deferred tax liability that should be reflected on Brunswick's statement of financial position at December 31, 2017, should beA)$22,500.

B)$33,750.

C)$45,000.

D)$50,625.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

48

In its 2017 income statement, its first year of operations, Penelope Corp. reported depreciation of $525,000 and interest revenue from a Canadian corporation of $105,000. For 2017 income tax purposes, Maine claimed CCA of $825,000. The difference in depreciation/CCA will reverse in equal amounts over the next three years. Penelope's income tax rates are 35% for 2017, 30% for 2018, and 25% for both 2019 and 2020. What amount should be included as the deferred tax liability on Penelope's December 31, 2017 statement of financial position?

A)$99,000

B)$90,000

C)$80,000

D)$75,000

A)$99,000

B)$90,000

C)$80,000

D)$75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

49

At the end of 2017, its first year of operations, Gaucho Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Gaucho adheres to IFRS requirements. The deferred tax asset to be recorded is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Gaucho adheres to IFRS requirements. The deferred tax asset to be recorded is

A)$200,000.

B)$160,000.

C)$100,000.

D)$ 60,000.

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Gaucho adheres to IFRS requirements. The deferred tax asset to be recorded is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Gaucho adheres to IFRS requirements. The deferred tax asset to be recorded isA)$200,000.

B)$160,000.

C)$100,000.

D)$ 60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

50

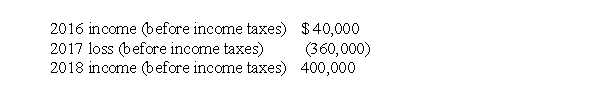

Hopper Corporation reported the following results for its first three years of operations:  There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If Hopper elects to use the carryback provisions, what income (loss)is reported for 2017?

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If Hopper elects to use the carryback provisions, what income (loss)is reported for 2017?

A)$(360,000)

B)$(348,000)

C)$(220,000)

D)$ 0

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If Hopper elects to use the carryback provisions, what income (loss)is reported for 2017?

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If Hopper elects to use the carryback provisions, what income (loss)is reported for 2017?A)$(360,000)

B)$(348,000)

C)$(220,000)

D)$ 0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

51

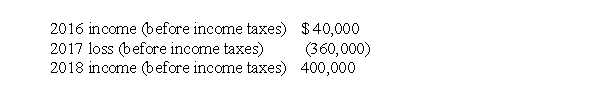

CB Properties Corporation reported the following results for its first three years of operations:  There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If CB Properties elects to use the carryforward provisions and not the carryback provisions, what income (loss)is reported for 2017?

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If CB Properties elects to use the carryforward provisions and not the carryback provisions, what income (loss)is reported for 2017?

A)$ 0

B)$(216,000)

C)$(232,000)

D)$(360,000)

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If CB Properties elects to use the carryforward provisions and not the carryback provisions, what income (loss)is reported for 2017?

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If CB Properties elects to use the carryforward provisions and not the carryback provisions, what income (loss)is reported for 2017?A)$ 0

B)$(216,000)

C)$(232,000)

D)$(360,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

52

On January 1, 2017, Lake Corp., a publicly accountable enterprise, purchased 40% of the common shares of Michigan Inc. and accounts for this investment by the equity method. During 2017, Michigan reported earnings of $900,000 and paid dividends of $300,000. Lake assumes that all of Michigan's undistributed earnings will be distributed as dividends in future periods when the enacted tax rate will be 20%. Lake's current income tax rate is 25%. The increase in Lake's deferred tax liability for this temporary difference is

A)$120,000.

B)$100,000.

C)$ 60,000.

D)$ 48,000.

A)$120,000.

B)$100,000.

C)$ 60,000.

D)$ 48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

53

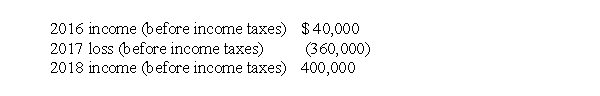

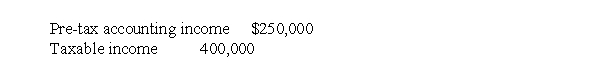

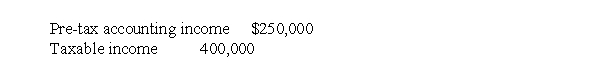

Gretna Corp. reported the following results for calendar 2017, its first year of operations:  The difference between accounting income and taxable income is due to a temporary difference, which will reverse in 2018. Assuming that the enacted tax rates in effect are 30% in 2017 and 25% in 2018, what amount should Gretna record as the deferred tax asset or liability for calendar 2017?

The difference between accounting income and taxable income is due to a temporary difference, which will reverse in 2018. Assuming that the enacted tax rates in effect are 30% in 2017 and 25% in 2018, what amount should Gretna record as the deferred tax asset or liability for calendar 2017?

A)$45,000 deferred tax liability

B)$37,500 deferred tax asset

C)$45,000 deferred tax asset

D)$37,500 deferred tax liability

The difference between accounting income and taxable income is due to a temporary difference, which will reverse in 2018. Assuming that the enacted tax rates in effect are 30% in 2017 and 25% in 2018, what amount should Gretna record as the deferred tax asset or liability for calendar 2017?

The difference between accounting income and taxable income is due to a temporary difference, which will reverse in 2018. Assuming that the enacted tax rates in effect are 30% in 2017 and 25% in 2018, what amount should Gretna record as the deferred tax asset or liability for calendar 2017?A)$45,000 deferred tax liability

B)$37,500 deferred tax asset

C)$45,000 deferred tax asset

D)$37,500 deferred tax liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

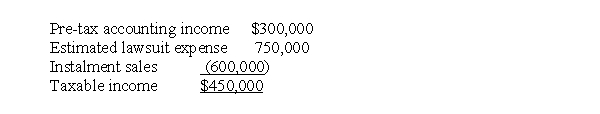

54

At the end of 2017, its first year of operations, Rinaldo Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax asset to be recorded is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax asset to be recorded is

A)$ 0.

B)$45,000.

C)$90,000.

D)$225,000.

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax asset to be recorded is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax asset to be recorded isA)$ 0.

B)$45,000.

C)$90,000.

D)$225,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

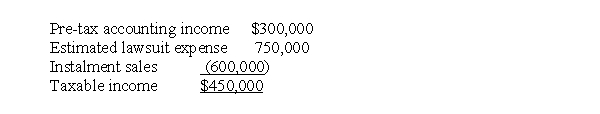

55

At the end of 2017, its first year of operations, Halifax Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Halifax adheres to IFRS requirements. The deferred tax liability to be recorded is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Halifax adheres to IFRS requirements. The deferred tax liability to be recorded is

A)$225,000.

B)$200,000.

C)$100,000.

D)$ 0.

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Halifax adheres to IFRS requirements. The deferred tax liability to be recorded is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Halifax adheres to IFRS requirements. The deferred tax liability to be recorded isA)$225,000.

B)$200,000.

C)$100,000.

D)$ 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck