Deck 21: Accounting Changes and Error Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/44

العب

ملء الشاشة (f)

Deck 21: Accounting Changes and Error Analysis

1

Which type of accounting change may be accounted for in current and future periods only?

A)change in accounting estimate

B)change in inventory costing method

C)change in accounting policy

D)correction of an error

A)change in accounting estimate

B)change in inventory costing method

C)change in accounting policy

D)correction of an error

A

2

A publicly accountable enterprise changes from straight-line depreciation to double declining balance.Management feels that this will result in equally reliable and more relevant information; thus it will be treated as a change in accounting policy.The entry to record this change should include a

A)debit to Accumulated Depreciation.

B)credit to Other Comprehensive Income.

C)credit to Deferred Tax Asset.

D)debit to Deferred Tax Liability.

A)debit to Accumulated Depreciation.

B)credit to Other Comprehensive Income.

C)credit to Deferred Tax Asset.

D)debit to Deferred Tax Liability.

D

3

The underlying principle of the retrospective application method is to

A)apply changes currently and in the future.

B)present all comparative periods as if the new accounting policy had always been used.

C)make assumptions about what management's intent was in prior years.

D)disclose all mistakes made in the past.

A)apply changes currently and in the future.

B)present all comparative periods as if the new accounting policy had always been used.

C)make assumptions about what management's intent was in prior years.

D)disclose all mistakes made in the past.

B

4

Retrospective application is required for all

A)errors and non-mandated policy changes.

B)changes in estimates and non-mandated policy changes.

C)errors and changes in estimates.

D)changes in estimates.

A)errors and non-mandated policy changes.

B)changes in estimates and non-mandated policy changes.

C)errors and changes in estimates.

D)changes in estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is NOT considered to be an accounting change?

A)change in accounting estimate

B)change in the composition of the board of directors

C)change in accounting policy

D)correction of a prior period error

A)change in accounting estimate

B)change in the composition of the board of directors

C)change in accounting policy

D)correction of a prior period error

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statements is correct?

A)Changes in accounting policy are always handled in the current or prospective period.

B)Prior year statements should always be restated for changes in accounting estimates.

C)A change from the deferral and amortization method to the immediate recognition method of accounting for defined benefit pension plans should be treated as a change in accounting policy.

D)Correction of prior period error should be presented as an adjustment on the current income statement.

A)Changes in accounting policy are always handled in the current or prospective period.

B)Prior year statements should always be restated for changes in accounting estimates.

C)A change from the deferral and amortization method to the immediate recognition method of accounting for defined benefit pension plans should be treated as a change in accounting policy.

D)Correction of prior period error should be presented as an adjustment on the current income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is NOT considered to be an accounting error?

A)changing from the cash basis to the accrual basis

B)expensing the cost of a new machine

C)changing depreciation methods from declining balance to straight line

D)failing to accrue wages payable at year end

A)changing from the cash basis to the accrual basis

B)expensing the cost of a new machine

C)changing depreciation methods from declining balance to straight line

D)failing to accrue wages payable at year end

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is NOT considered to be a change in accounting policy?

A)changing from weighted average to FIFO for valuing inventories

B)initial adoption of a new accounting standard

C)reclassifying items on the financial statements of prior periods to make the statements more comparable

D)changing from the cost basis to the fair value model for measuring investments

A)changing from weighted average to FIFO for valuing inventories

B)initial adoption of a new accounting standard

C)reclassifying items on the financial statements of prior periods to make the statements more comparable

D)changing from the cost basis to the fair value model for measuring investments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

9

When a company decides to switch from deferring development costs to expensing them immediately, this change should probably be treated as a

A)change in accounting policy.

B)change in accounting estimate.

C)prior period adjustment.

D)correction of an error.

A)change in accounting policy.

B)change in accounting estimate.

C)prior period adjustment.

D)correction of an error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

10

For accounting changes, which of the following is NOT allowed?

A)To use retrospective application for an accounting policy change without restatement, if restatement is impractical.

B)To net accounting errors for disclosure purposes.

C)To use prospective application for an accounting policy change, if allowed in the transition policy.

D)To use prospective application for a change in estimate.

A)To use retrospective application for an accounting policy change without restatement, if restatement is impractical.

B)To net accounting errors for disclosure purposes.

C)To use prospective application for an accounting policy change, if allowed in the transition policy.

D)To use prospective application for a change in estimate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

11

Stockton Ltd.changed its inventory system from FIFO to average cost.What type of accounting change does this represent?

A)A change in accounting estimate for which the financial statements for the prior periods included for comparative purposes do not need to be restated.

B)A change in accounting policy for which the financial statements for prior periods included for comparative purposes do not need to be restated.

C)A change in accounting policy for which the financial statements for prior periods included for comparative purposes should be restated.

D)A change in accounting estimate for which the financial statements for prior periods included for comparative purposes should be restated.

A)A change in accounting estimate for which the financial statements for the prior periods included for comparative purposes do not need to be restated.

B)A change in accounting policy for which the financial statements for prior periods included for comparative purposes do not need to be restated.

C)A change in accounting policy for which the financial statements for prior periods included for comparative purposes should be restated.

D)A change in accounting estimate for which the financial statements for prior periods included for comparative purposes should be restated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

12

An example of a correction of an error in previously issued financial statements is a change

A)from the FIFO method of inventory valuation to the average cost method.

B)in the service life of plant assets, based on changes in the economic environment.

C)from the cash basis of accounting to the accrual basis of accounting.

D)in the tax assessment related to a prior period.

A)from the FIFO method of inventory valuation to the average cost method.

B)in the service life of plant assets, based on changes in the economic environment.

C)from the cash basis of accounting to the accrual basis of accounting.

D)in the tax assessment related to a prior period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

13

When an entity is first transitioning to IFRS, any adjustments required to bring GAAP measures in line with IFRS

A)are recognized directly in other comprehensive income.

B)are recognized directly in retained earnings.

C)must be accounted for by prospective application.

D)are ignored.

A)are recognized directly in other comprehensive income.

B)are recognized directly in retained earnings.

C)must be accounted for by prospective application.

D)are ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

14

One condition required by IFRS is that a voluntary change in accounting policy must result in information that is

A)more reliable than before.

B)more reliable, but equally as relevant as before.

C)both more reliable and more relevant.

D)more relevant, but equally as reliable as before.

A)more reliable than before.

B)more reliable, but equally as relevant as before.

C)both more reliable and more relevant.

D)more relevant, but equally as reliable as before.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is (are)the proper time period(s)to record the effects of a change in accounting estimate?

A)retrospectively only

B)current period and prospectively

C)current period and retrospectively

D)current period only

A)retrospectively only

B)current period and prospectively

C)current period and retrospectively

D)current period only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is NOT considered a change in accounting policy?

A)change in depreciation method

B)change from FIFO to weighted average cost

C)initial adoption of a new accounting standard

D)change in accounting for a defined benefit pension plan from deferral and amortization to immediate recognition

A)change in depreciation method

B)change from FIFO to weighted average cost

C)initial adoption of a new accounting standard

D)change in accounting for a defined benefit pension plan from deferral and amortization to immediate recognition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

17

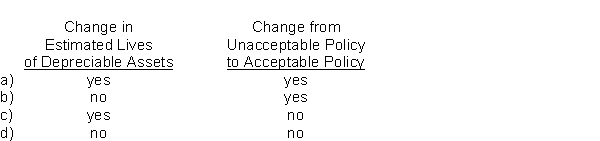

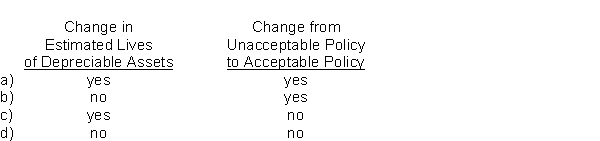

Which of the following should be given retrospective treatment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

18

Accounting for a retrospective change requires

A)reissuing all prior financial statements affected by the change.

B)adjusting the ending balance of retained earnings for the current year.

C)reporting the "catch-up" adjustment on the current income statement.

D)adjusting the opening balance of each affected component of equity for the current year.

A)reissuing all prior financial statements affected by the change.

B)adjusting the ending balance of retained earnings for the current year.

C)reporting the "catch-up" adjustment on the current income statement.

D)adjusting the opening balance of each affected component of equity for the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under IFRS, which of the following disclosures is NOT required for the correction of an accounting error?

A)the amount of the correction made to each affected financial statement item for each prior period presented

B)the nature of the error

C)who was responsible for the error

D)the effect of the correction on both basic and diluted earnings per share for each prior period presented

A)the amount of the correction made to each affected financial statement item for each prior period presented

B)the nature of the error

C)who was responsible for the error

D)the effect of the correction on both basic and diluted earnings per share for each prior period presented

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following alternative accounting methods is(are)allowed by ASPE and IFRS for reporting accounting changes?

A)prospective and retrospective

B)current and retrospective

C)current and prospective

D)retrospective only

A)prospective and retrospective

B)current and retrospective

C)current and prospective

D)retrospective only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use the following information for questions.

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors: An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

What is the total net effect of the errors on the amount of Cheyenne's working capital at December 31, 2017?

A)Working capital overstated by $1,000

B)Working capital overstated by $300

C)Working capital understated by $900

D)Working capital understated by $2,400

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.What is the total net effect of the errors on the amount of Cheyenne's working capital at December 31, 2017?

A)Working capital overstated by $1,000

B)Working capital overstated by $300

C)Working capital understated by $900

D)Working capital understated by $2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

22

Use the following information for questions.

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors: An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

What is the total net effect of the errors on Cheyenne's 2017 net income?

A)Net income understated by $2,900

B)Net income overstated by $1,500

C)Net income overstated by $2,600

D)Net income overstated by $3,000

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.What is the total net effect of the errors on Cheyenne's 2017 net income?

A)Net income understated by $2,900

B)Net income overstated by $1,500

C)Net income overstated by $2,600

D)Net income overstated by $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the following information for questions.

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors: An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

What is the total effect of the errors on the balance of Cheyenne's retained earnings at December 31, 2017?

A)Retained earnings understated by $2,000

B)Retained earnings understated by $900

C)Retained earnings understated by $500

D)Retained earnings overstated by $700

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.What is the total effect of the errors on the balance of Cheyenne's retained earnings at December 31, 2017?

A)Retained earnings understated by $2,000

B)Retained earnings understated by $900

C)Retained earnings understated by $500

D)Retained earnings overstated by $700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

24

On January 1, 2015, Reno Inc.purchased a machine for $150,000.The machine has an estimated five year life, and no residual value.Double declining balance depreciation has been used for financial statement reporting and CCA for income tax reporting.Effective January 1, 2018, Reno decided to change to straight-line depreciation for this machine, and treated the change as a change in accounting policy.For calendar 2018, Reno's pre-tax income before depreciation on this asset is $125,000.Their income tax rate has been 30% for many years.What net income should Reno report for calendar 2018?

A)$95,000

B)$85,820

C)$66,500

D)$45,500

A)$95,000

B)$85,820

C)$66,500

D)$45,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

25

On January 1, 2013, Plover Ltd.purchased a machine for $330,000 and depreciated it using the straight-line method with an estimated useful life of eight years with no residual value.On January 1, 2016, Plover determined that the machine had a useful life of only six years from the date of acquisition, but will have a residual value of $30,000.An accounting change was made in 2016 to reflect these additional facts.At December 31, 2017, the accumulated depreciation for this machine should have a balance of

A)$182,500.

B)$187,500.

C)$241,250.

D)$250,000.

A)$182,500.

B)$187,500.

C)$241,250.

D)$250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

26

On January 1, 2017, Chickadee Corp.changed its inventory costing from FIFO to average cost for financial statement and income tax purposes, to make their reporting as reliable and more relevant.The change resulted in a $400,000 increase in the beginning inventory at January 1, 2017.Assume a 30% income tax rate.The cumulative effect of this accounting change should be reported by Chickadee in its 2017

A)Retained earnings statement as a $280,000 addition to the beginning balance.

B)Income statement as $280,000 other comprehensive income.

C)Retained earnings statement as a $400,000 addition to the beginning balance.

D)Income statement as a $400,000 cumulative effect of accounting change.

A)Retained earnings statement as a $280,000 addition to the beginning balance.

B)Income statement as $280,000 other comprehensive income.

C)Retained earnings statement as a $400,000 addition to the beginning balance.

D)Income statement as a $400,000 cumulative effect of accounting change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

27

Caspar Corp.began operations on January 1, 2016, and uses FIFO to cost its inventory.Management is contemplating a change to the average cost method and is interested in determining what effect such a change will have on pre-tax income.Accordingly, the following information has been developed:  Based upon the above information, a change to the average cost method in 2017 would result in pre-tax income for 2017 of

Based upon the above information, a change to the average cost method in 2017 would result in pre-tax income for 2017 of

A)$395,000.

B)$430,000.

C)$470,000.

D)$490,000.

Based upon the above information, a change to the average cost method in 2017 would result in pre-tax income for 2017 of

Based upon the above information, a change to the average cost method in 2017 would result in pre-tax income for 2017 ofA)$395,000.

B)$430,000.

C)$470,000.

D)$490,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

28

On January 1, 2017, Robin Ltd.changed its inventory valuation method from weighted-average cost to FIFO for financial statement and income tax purposes, to make their reporting as reliable and more relevant.The change resulted in a $600,000 increase in the beginning inventory at January 1, 2017.Assume a 25% income tax rate.The cumulative effect of this accounting change reported for the year ended December 31, 2017 is

A)$0.

B)$150,000.

C)$450,000.

D)$600,000.

A)$0.

B)$150,000.

C)$450,000.

D)$600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

29

On January 1, 2014, Wren Corp.purchased a patent for $238,000.The patent is being amortized straight-line with no residual value over its remaining legal life of 15 years.At the beginning of 2017, however, Wren determined that the economic benefits of the patent would not last longer than ten years from the date of acquisition.What amount should be reported in the statement of financial position for the patent, net of accumulated amortization, at December 31, 2017?

A)$142,800

B)$163,200

C)$168,000

D)$174,550

A)$142,800

B)$163,200

C)$168,000

D)$174,550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

30

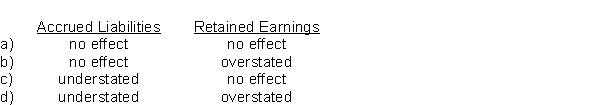

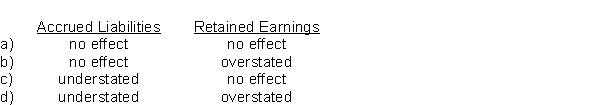

On December 31, 2017, the bookkeeper at Thrush Corp.did not record special insurance costs that had been incurred (but not yet paid), related to a building that Thrush Corp.is constructing.What is the effect of the omission on accrued liabilities and retained earnings in the December 31, 2017 statement of financial position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

31

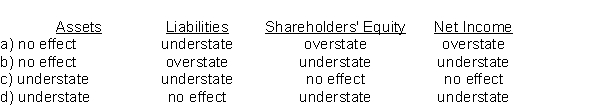

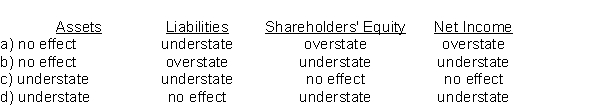

A company using a perpetual inventory system neglected to record a purchase of merchandise on account at year end.This merchandise was also omitted from the year-end physical count.How will these errors affect assets, liabilities, and shareholders' equity at year end and net income for the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the following information for questions.

Minor Corp.purchased a machine on January 1, 2014, for $600,000.The machine is being depreciated on a straight-line basis, using an estimated useful life of six years and no residual value.On January 1, 2017, Minor determined, as a result of additional information, that the machine had an estimated useful life of eight years from the date of acquisition with no residual value.An accounting change was made in 2017 to reflect this additional information.

Assuming that the direct effects of this change are limited to the effect on depreciation and the related tax provision, and that the income tax rate for all years since the machine was purchased was 30%, what should be reported in the income statement for calendar 2017 as the cumulative effect on prior years of changing the estimated useful life of the machine?

A)$0

B)$40,000

C)$60,000

D)$210,000

Minor Corp.purchased a machine on January 1, 2014, for $600,000.The machine is being depreciated on a straight-line basis, using an estimated useful life of six years and no residual value.On January 1, 2017, Minor determined, as a result of additional information, that the machine had an estimated useful life of eight years from the date of acquisition with no residual value.An accounting change was made in 2017 to reflect this additional information.

Assuming that the direct effects of this change are limited to the effect on depreciation and the related tax provision, and that the income tax rate for all years since the machine was purchased was 30%, what should be reported in the income statement for calendar 2017 as the cumulative effect on prior years of changing the estimated useful life of the machine?

A)$0

B)$40,000

C)$60,000

D)$210,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the following information for questions.

Minor Corp.purchased a machine on January 1, 2014, for $600,000.The machine is being depreciated on a straight-line basis, using an estimated useful life of six years and no residual value.On January 1, 2017, Minor determined, as a result of additional information, that the machine had an estimated useful life of eight years from the date of acquisition with no residual value.An accounting change was made in 2017 to reflect this additional information.

What is the amount of depreciation expense on this machine that should be reported in Minor's income statement for calendar 2017?

A)$150,000

B)$120,000

C)$75,000

D)$60,000

Minor Corp.purchased a machine on January 1, 2014, for $600,000.The machine is being depreciated on a straight-line basis, using an estimated useful life of six years and no residual value.On January 1, 2017, Minor determined, as a result of additional information, that the machine had an estimated useful life of eight years from the date of acquisition with no residual value.An accounting change was made in 2017 to reflect this additional information.

What is the amount of depreciation expense on this machine that should be reported in Minor's income statement for calendar 2017?

A)$150,000

B)$120,000

C)$75,000

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

34

The service life of a building that has been depreciated for 30 years of an originally estimated 50-year life (no residual value)has been revised to an estimated remaining life of 10 years.Based on this information, the accountant should

A)continue to depreciate the building over the original 50-year life.

B)depreciate the remaining book value over the remaining life of the asset.

C)adjust accumulated depreciation to its appropriate balance through net income, based on a 40-year life, and then depreciate the adjusted book value as though the estimated life had always been 40 years.

D)adjust accumulated depreciation to its appropriate balance through retained earnings, based on a 40-year life, and then depreciate the adjusted book value as though the estimated life had always been 40 years.

A)continue to depreciate the building over the original 50-year life.

B)depreciate the remaining book value over the remaining life of the asset.

C)adjust accumulated depreciation to its appropriate balance through net income, based on a 40-year life, and then depreciate the adjusted book value as though the estimated life had always been 40 years.

D)adjust accumulated depreciation to its appropriate balance through retained earnings, based on a 40-year life, and then depreciate the adjusted book value as though the estimated life had always been 40 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the following information for questions.

On January 2, 2015, Beaver Corp.purchased machinery for $135,000.The entire cost was incorrectly recorded as an expense.The machinery has a nine-year life and a $9,000 residual value.Beaver uses straight-line depreciation for all its plant assets.The error was not discovered until May 1, 2017, and the appropriate corrections were made.Ignore income tax considerations.

Beaver's income statement for the year ended December 31, 2017 should show the cumulative effect of this error of

A)$0.

B)$93,000.

C)$107,000.

D)$121,000.

On January 2, 2015, Beaver Corp.purchased machinery for $135,000.The entire cost was incorrectly recorded as an expense.The machinery has a nine-year life and a $9,000 residual value.Beaver uses straight-line depreciation for all its plant assets.The error was not discovered until May 1, 2017, and the appropriate corrections were made.Ignore income tax considerations.

Beaver's income statement for the year ended December 31, 2017 should show the cumulative effect of this error of

A)$0.

B)$93,000.

C)$107,000.

D)$121,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

36

MissTake Corp.is a small private corporation that does not prepare comparative statements.At the end of their 2017 fiscal year, it was discovered that the 2016 depreciation expense on their computer equipment had been incorrectly debited to maintenance expense.How should MissTake deal with this situation?

A)Prepare an adjusting entry to debit depreciation expense and credit maintenance expense.

B)Prepare an adjusting entry to debit retained earnings and credit maintenance expense.

C)Restate their 2016 financial statements.

D)Ignore it.

A)Prepare an adjusting entry to debit depreciation expense and credit maintenance expense.

B)Prepare an adjusting entry to debit retained earnings and credit maintenance expense.

C)Restate their 2016 financial statements.

D)Ignore it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

37

Counterbalancing errors do NOT include

A)errors that correct themselves in two years.

B)errors that correct themselves in three or more years.

C)an understatement of ending inventory.

D)an overstatement of unearned revenue.

A)errors that correct themselves in two years.

B)errors that correct themselves in three or more years.

C)an understatement of ending inventory.

D)an overstatement of unearned revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following information for questions.

On January 2, 2015, Beaver Corp.purchased machinery for $135,000.The entire cost was incorrectly recorded as an expense.The machinery has a nine-year life and a $9,000 residual value.Beaver uses straight-line depreciation for all its plant assets.The error was not discovered until May 1, 2017, and the appropriate corrections were made.Ignore income tax considerations.

Before the corrections were made, retained earnings was understated by

A)$135,000.

B)$121,000.

C)$107,000.

D)$93,000.

On January 2, 2015, Beaver Corp.purchased machinery for $135,000.The entire cost was incorrectly recorded as an expense.The machinery has a nine-year life and a $9,000 residual value.Beaver uses straight-line depreciation for all its plant assets.The error was not discovered until May 1, 2017, and the appropriate corrections were made.Ignore income tax considerations.

Before the corrections were made, retained earnings was understated by

A)$135,000.

B)$121,000.

C)$107,000.

D)$93,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

39

On January 1, 2014, Detroit Ltd.bought machinery for $500,000.They used straight-line depreciation for this machinery, over an estimated useful life of ten years, with no residual value.At the beginning of 2017, Detroit decided the estimated useful life of this machinery was only eight years (from the date of acquisition), still with no residual value.For calendar 2017, the depreciation expense for this machinery is

A)$50,000.

B)$62,500.

C)$70,000.

D)$100,000.

A)$50,000.

B)$62,500.

C)$70,000.

D)$100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

40

On January 1, 2015, Missoula Corporation bought machinery for $800,000.They used double declining balance depreciation for this asset, with an estimated life of eight years, and an estimated $200,000 residual value.At the beginning of 2018, Missoula decided to change to the straight-line method of depreciation for this equipment, and treated the change as a change in estimate.For calendar 2018, the depreciation expense for this machinery is

A)$100,000.

B)$ 92,500.

C)$ 75,050.

D)$ 27,500.

A)$100,000.

B)$ 92,500.

C)$ 75,050.

D)$ 27,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

41

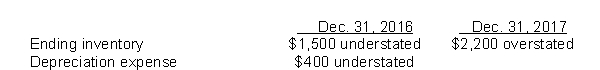

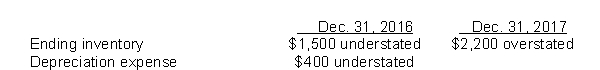

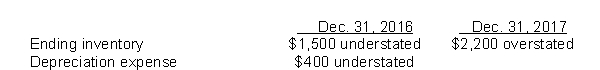

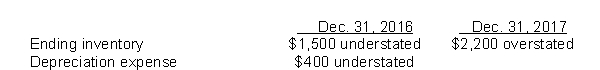

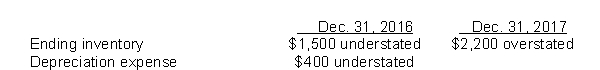

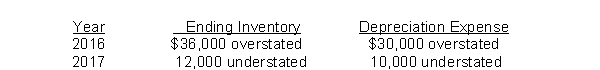

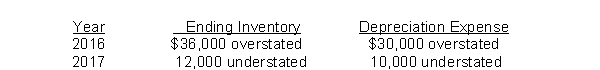

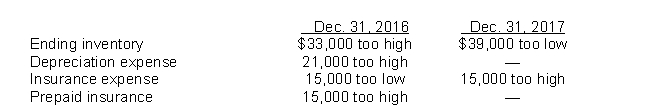

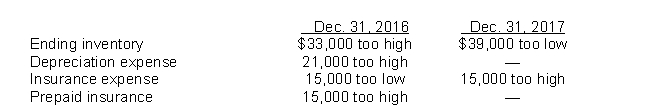

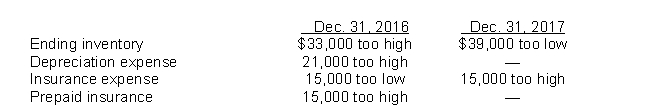

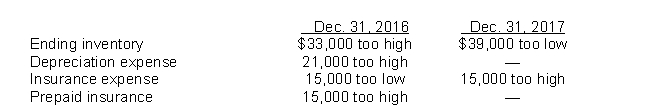

Eagle Corp.is a calendar-year corporation whose financial statements for 2016 and 2017 included errors as follows:  Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2016 or December 31, 2017.Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2018?

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2016 or December 31, 2017.Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2018?

A)$32,000 increase

B)$8,000 increase

C)$4,000 decrease

D)$2,000 increase

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2016 or December 31, 2017.Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2018?

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2016 or December 31, 2017.Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2018?A)$32,000 increase

B)$8,000 increase

C)$4,000 decrease

D)$2,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

42

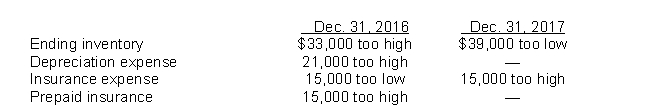

Use the following information for questions.

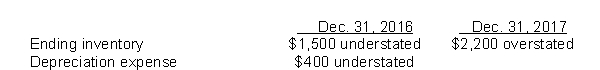

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors: In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

The total effect of the errors on Fairfax's retained earnings at December 31, 2017 is that the balance is understated by

A)$82,200.

B)$67,200.

C)$46,200.

D)$34,200.

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.The total effect of the errors on Fairfax's retained earnings at December 31, 2017 is that the balance is understated by

A)$82,200.

B)$67,200.

C)$46,200.

D)$34,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

43

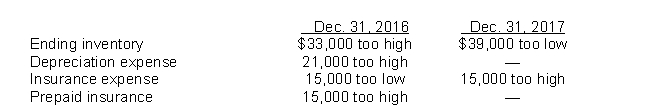

Use the following information for questions.

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors: In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

The total effect of the errors on Fairfax's working capital at December 31, 2017 is that working capital is understated by

A)$100,200.

B)$79,200.

C)$46,200.

D)$31,200.

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.The total effect of the errors on Fairfax's working capital at December 31, 2017 is that working capital is understated by

A)$100,200.

B)$79,200.

C)$46,200.

D)$31,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following information for questions.

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors: In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

The total effect of the errors on Fairfax's 2017 net income is

A)understated by $94,200.

B)understated by $61,200.

C)overstated by $28,800.

D)overstated by $49,800.

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.The total effect of the errors on Fairfax's 2017 net income is

A)understated by $94,200.

B)understated by $61,200.

C)overstated by $28,800.

D)overstated by $49,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck