Deck 9: The Valuation of Stock Private

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/36

العب

ملء الشاشة (f)

Deck 9: The Valuation of Stock Private

1

The dividend-growth valuation model employs current dividends, future dividend growth, and the required return.

True

2

High P/E stocks should be preferred because they pay larger dividends.

False

3

A higher beta decreases the required rate of return.

False

4

A P/E ratio depends on1. the firm's dividends2. the price of the stock3. the firm's per share earnings

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

5

If the required rate of return is 10 percent and thestock pays a fixed $5 dividend, its value is

A) $100

B) $75

C) $50

D) $25

A) $100

B) $75

C) $50

D) $25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

6

The expected return depends on future dividends and future price appreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

7

The dividend growth model requires that dividends grow annually at the same rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

8

According to the dividend growth model, the valuation of common stock depends on1. the firm's dividends2. investors' required rate of return3. the prior year's dividends

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

9

The risk adjusted required rate of return includes1. the firm's earnings2. the firm's beta coefficient3. the treasury bill rate (i.e., the risk free rate)

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

10

Value investors tend to prefer stocks with low price to sales and price to book ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

11

The efficient market hypothesis suggests that thecurrent prices of stocks reflect what the investment community believes the stocks are worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

12

The dividend growth model includes both the currentand past years' dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

13

The PEG ratio multiplies a stock's earnings, price, and growth rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

14

According to the efficient market hypothesis, purchasing companies with high cash flow should produce superior investment results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

15

An increase in the risk free rate will tend to decrease stock prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the anticipated return exceeds the required rateof return, the investor should buy the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

17

A stock's price will tend to fall if1. the firm's beta declines2. the firm's beta increases3. the risk free rate declines4. the risk free rate increases

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

18

The required return includes the risk free rate and a risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

19

According to the efficient market hypothesis, purchasing low P/S stocks should produce superior investment results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

20

According to the efficient market hypothesis, purchasing high P/E stock should not produce superiorinvestment results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the ratio of price to book exceeds 1.0,

A) the stock is overvalued

B) the firm's assets are understated

C) the price of the stock is greater than the accounting value of the firm

D) the accounting value of the firm is greater than the market value of the firm

PROBLEMS

A) the stock is overvalued

B) the firm's assets are understated

C) the price of the stock is greater than the accounting value of the firm

D) the accounting value of the firm is greater than the market value of the firm

PROBLEMS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

22

If you purchase TrisCorp stock at $71 a share and the firm pays a $5.20 dividend which is expected to grow at 7.5 percent, what is the implied annual rate of return on the investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

23

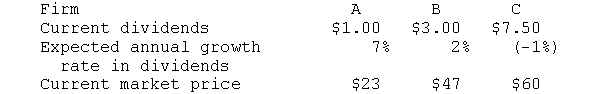

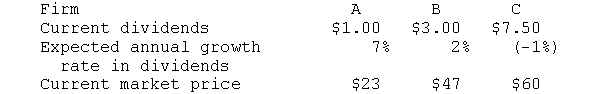

As an investor you have a required rate of return of 14 percent for investments in risky stocks. You have analyzed three risky firms and must decide which (if any) to purchase. Your information is

a. What is your valuation of each stock using the dividend-growth model? Which (if any) should you buy?

b. If you bought Stock A, what is your implied rate of return?

c. If your required rate of return were 10 percent, what should be the price necessary to induce you to buy Stock A?

a. What is your valuation of each stock using the dividend-growth model? Which (if any) should you buy?

b. If you bought Stock A, what is your implied rate of return?

c. If your required rate of return were 10 percent, what should be the price necessary to induce you to buy Stock A?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

24

Use of P/E ratios will not produce superiorinvestment results according to the

A) weak form of the efficient market hypothesis

B) semi?strong form of the efficient market hypothesis

C) strong form of the efficient market hypothesis

D) all forms of the efficient market hypothesis

A) weak form of the efficient market hypothesis

B) semi?strong form of the efficient market hypothesis

C) strong form of the efficient market hypothesis

D) all forms of the efficient market hypothesis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

25

The use of price to book ratios to select stockssuggests that

A) high price to book stocks are undervalued

B) low price to book stocks are overvalued

C) a stock should be purchased if it is selling near its historic high price to book ratio

D) a stock should be purchased if it is selling near its historic low price to book ratio

A) high price to book stocks are undervalued

B) low price to book stocks are overvalued

C) a stock should be purchased if it is selling near its historic high price to book ratio

D) a stock should be purchased if it is selling near its historic low price to book ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

26

The risk free rate of return is 8 percent; the expected rate of return on the market is 12 percent. Stock X has a beta coefficient of 1.3, an earnings and dividend growth rate of 7 percent, and a current dividend of $2.40. If the stock is selling for $35, what should you do

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

27

Your broker recommends that you purchase XYZ Inc. at $60. The stock pays a $2.40 dividend which (like its per share earnings) is expected to grow annually at 8 percent. If you want to earn 12 percent on your funds, is this a good buy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

28

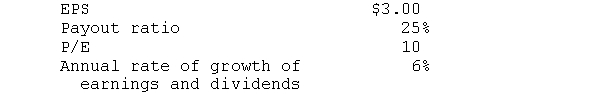

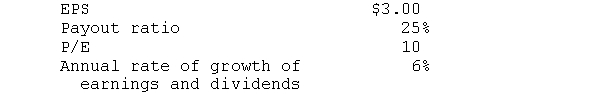

You know the following concerning a common stock:  If you want to earn 10 percent, should you buy this stock What is the maximum price you should be willing to pay for the stock

If you want to earn 10 percent, should you buy this stock What is the maximum price you should be willing to pay for the stock

If you want to earn 10 percent, should you buy this stock What is the maximum price you should be willing to pay for the stock

If you want to earn 10 percent, should you buy this stock What is the maximum price you should be willing to pay for the stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

29

Investors may use P/E and price/sales ratios tovalue stocks. If this analysis is used, which of thefollowing is desirable

A) a high P/E and a low price/sales ratio

B) a high P/E and a high price/sales ratio

C) a low P/E and a low price/sales ratio

D) a low P/E and a high price/sales ratio

A) a high P/E and a low price/sales ratio

B) a high P/E and a high price/sales ratio

C) a low P/E and a low price/sales ratio

D) a low P/E and a high price/sales ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

30

A low price to sales ratio suggests

A) the firm is generating cash

B) the firm has no earnings

C) the stock valuation is too high

D) the stock may be undervalued

A) the firm is generating cash

B) the firm has no earnings

C) the stock valuation is too high

D) the stock may be undervalued

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

31

Two stocks each pay a $1 dividend that is growing annually at 8 percent. Stock A has a beta of 1.3; stock B's beta is 0.8.

a. Which stock is more volatile?

b. If treasury bills yield 6 percent and you expect the market to rise by 12 percent, what is your risk?adjusted required rate of return?

c. Using the dividend?growth model, what is the maximum amount you would be willing to pay for each stock?

d. Why are your valuations different?

a. Which stock is more volatile?

b. If treasury bills yield 6 percent and you expect the market to rise by 12 percent, what is your risk?adjusted required rate of return?

c. Using the dividend?growth model, what is the maximum amount you would be willing to pay for each stock?

d. Why are your valuations different?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

32

If the financial markets were not efficient,

A) all investors would profit

B) prices indicate the proper valuation of securities

C) prices would adjust rapidly

D) an investor may consistently outperform the market

A) all investors would profit

B) prices indicate the proper valuation of securities

C) prices would adjust rapidly

D) an investor may consistently outperform the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

33

Higher required returns

A) decrease stock prices

B) are required by the efficient market hypothesis

C) increase dividends

D) are associated with higher dividends

A) decrease stock prices

B) are required by the efficient market hypothesis

C) increase dividends

D) are associated with higher dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

34

The price to sales ratio may be a preferredanalytical tool if

A) the firm is not generating cash

B) the firm is not generating earnings

C) the P/E ratio is too high

D) the dividend-growth model suggests the stock is undervalued

A) the firm is not generating cash

B) the firm is not generating earnings

C) the P/E ratio is too high

D) the dividend-growth model suggests the stock is undervalued

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

35

The use of P/E ratios to select stocks suggests that

A) high P/E stocks should be purchased

B) low P/E ratio stocks are overvalued

C) a stock should be purchased if it is selling near its historic low P/E

D) a stock should be purchased if it is selling near its historic high P/E

A) high P/E stocks should be purchased

B) low P/E ratio stocks are overvalued

C) a stock should be purchased if it is selling near its historic low P/E

D) a stock should be purchased if it is selling near its historic high P/E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

36

Presently, Stock A pays a dividend of $2.00 a share, and you expect the dividend to grow rapidly for the next four years at 20 percent. Thus the dividend payments will be  After this initial period of super growth, the rate of increase in the dividend should decline to 8 percent. If you want to earn 12 percent on investments in common stock, what is the maximum you should pay for this stock SOLUTIONS TO PROBLEMS

After this initial period of super growth, the rate of increase in the dividend should decline to 8 percent. If you want to earn 12 percent on investments in common stock, what is the maximum you should pay for this stock SOLUTIONS TO PROBLEMS

After this initial period of super growth, the rate of increase in the dividend should decline to 8 percent. If you want to earn 12 percent on investments in common stock, what is the maximum you should pay for this stock SOLUTIONS TO PROBLEMS

After this initial period of super growth, the rate of increase in the dividend should decline to 8 percent. If you want to earn 12 percent on investments in common stock, what is the maximum you should pay for this stock SOLUTIONS TO PROBLEMS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck