Deck 25: Capital Investment Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

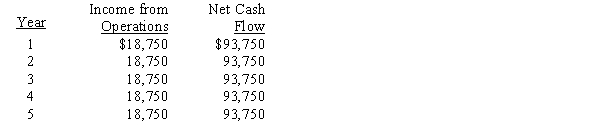

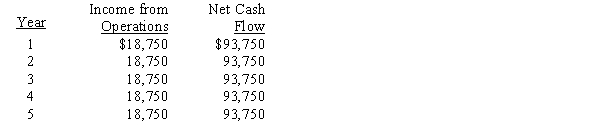

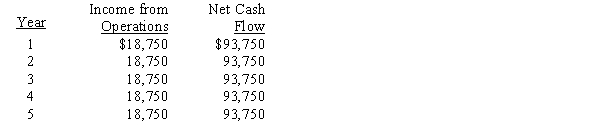

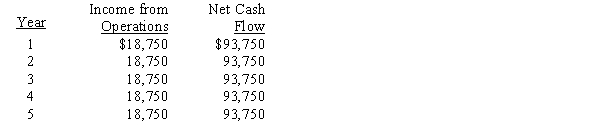

سؤال

سؤال

سؤال

سؤال

سؤال

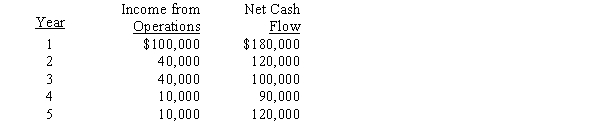

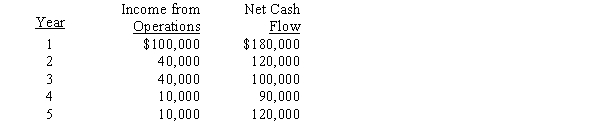

سؤال

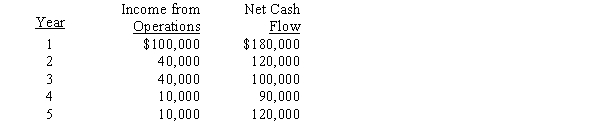

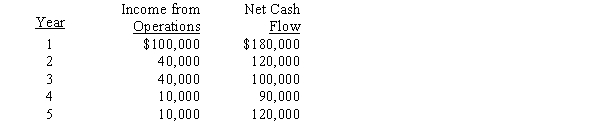

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/189

العب

ملء الشاشة (f)

Deck 25: Capital Investment Analysis

1

The excess of the cash flowing in from revenues over the cash flowing out for expenses is termed net discounted cash flow.

False

2

Average rate of return equals estimated average annual income divided by average investment.

True

3

Methods that ignore present value in capital investment analysis include the net present value method.

False

4

The cash payback method of capital investment analysis is one of the methods referred to as a present value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

5

The method of analyzing capital investment proposals in which the estimated average annual income is divided by the average investment is the average rate of return method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

6

Only managers are encouraged to submit capital investment proposals because they know the processes and are able to match investments with long-term goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

7

The anticipated purchase of a fixed asset for $400,000, with a useful life of five years and no residual value, is expected to yield total net income of $200,000 for the five years. The expected average rate of return on investment is 25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

8

The anticipated purchase of a fixed asset for $400,000, with a useful life of five years and no residual value, is expected to yield total net income of $300,000 for the five years. The expected average rate of return is 37.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

9

The anticipated purchase of a fixed asset for $400,000, with a useful life of five years and no residual value, is expected to yield total net income of $300,000 for the five years. The expected average rate of return is 30%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

10

The methods of evaluating capital investment proposals can be grouped into two general categories that can be referred to as

(1) methods that ignore present value and

(2) present value methods.

(1) methods that ignore present value and

(2) present value methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

11

The average rate of return method of capital investment analysis gives consideration to the present value of future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

12

Care must be taken involving capital investment decisions, since normally a long-term commitment of funds is involved and operations could be affected for many years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

13

Methods that ignore present value in capital investment analysis include the internal rate of return method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

14

The process by which management plans, evaluates, and controls long-term investment decisions involving fixed assets is called capital investment analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

15

Methods that ignore present value in capital investment analysis include the average rate of return method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

16

The excess of the cash flowing in from revenues over the cash flowing out for expenses is termed net cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

17

Average rate of return equals average investment divided by estimated average annual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

18

The methods of evaluating capital investment proposals can be grouped into two general categories that can be referred to as

(1) average rate of return and

(2) cash payback methods.

(1) average rate of return and

(2) cash payback methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

19

The anticipated purchase of a fixed asset for $400,000, with a useful life of five years and no residual value, is expected to yield total net income of $200,000 for the five years. The expected average rate of return on investment is 50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

20

Methods that ignore present value in capital investment analysis include the cash payback method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a proposed expenditure of $70,000 for a fixed asset with a four-year life has an annual expected net cash flow and net income of $32,000 and $12,000, respectively, the cash payback period is 2.5 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a proposed expenditure of $80,000 for a fixed asset with a four-year life has an annual expected net cash flow and net income of $32,000 and $12,000, respectively, the cash payback period is four years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

23

The time expected to pass before the net cash flows from an investment would return its initial cost is called the amortization period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

24

The cash payback method can be used only when net cash inflows are the same for each period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

25

For Years 1-5, a proposed expenditure of $500,000 for a fixed asset with a five-year life has expected net income of $40,000, $35,000, $25,000, $25,000, and $25,000, respectively, and net cash flows of $90,000, $85,000, $75,000, $75,000, and $75,000, respectively. The cash payback period is five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

26

The computations involved in the net present value method of analyzing capital investment proposals are less involved than those for the average rate of return method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

27

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate net cash flows per year of $6,000. The average rate of return for the machine is 50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

28

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate net cash flows per year of $6,000. The payback period for the machine is four years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

29

A company is considering the purchase of a new machine for $48,000. Management expects that the machine can produce sales of $16,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling $8,000 per year plus depreciation of $4,000 per year. All revenues and expenses except depreciation are on a cash basis. The payback period for the machine is six years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

30

A company is considering the purchase of a new piece of equipment for $90,000. Predicted annual net cash inflows from the investment are $36,000

(Year 1), $30,000

(Year 2), $18,000

(Year 3), $12,000

(Year 4), and $6,000

(Year 5). The average income from operations over the five-year life is $20,400. The payback period is 3.5 years.

(Year 1), $30,000

(Year 2), $18,000

(Year 3), $12,000

(Year 4), and $6,000

(Year 5). The average income from operations over the five-year life is $20,400. The payback period is 3.5 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

31

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate net cash flows per year of $6,000. The payback period for the machine is 12 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

32

The average rate of return is a measure of profitability computed by dividing the average annual cash inflows from an asset by the average amount invested in the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

33

For Years 1-5, a proposed expenditure of $250,000 for a fixed asset with a five-year life has expected net income of $40,000, $35,000, $25,000, $25,000, and $25,000, respectively, and net cash flows of $90,000, $85,000, $75,000, $75,000, and $75,000, respectively. The cash payback period is three years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

34

The expected period of time that will elapse between the date of a capital investment and the complete recovery in cash of the amount invested is called the discount period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

35

The expected period of time that will elapse between the date of a capital investment and the complete recovery in cash of the amount invested is called the cash payback period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

36

The average rate of return method of analyzing capital budgeting decisions measures the average rate of return from using the asset over its entire life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

37

A company is considering the purchase of a new machine for $48,000. Management expects that the machine can produce sales of $16,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling $8,000 per year plus depreciation of $4,000 per year. All revenues and expenses except depreciation are on a cash basis. The payback period for the machine is 12 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company is considering purchasing a machine for $21,000. The machine will generate income from operations of $2,000; annual net cash flows from the machine will be $3,500. The payback period for the new machine is 10.5 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

39

A company is considering purchasing a machine for $21,000. The machine will generate income from operations of $2,000; annual net cash flows from the machine will be $3,500. The payback period for the new machine is six years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

40

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate net cash flows per year of $6,000. The average rate of return for the machine is 16.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

41

A qualitative characteristic that may impact capital investment analysis is manufacturing productivity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

42

A qualitative characteristic that may impact capital investment analysis is employee morale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

43

The process by which management allocates available investment funds among competing capital investment proposals is termed present value analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

44

A present value index can be used to rank competing capital investment proposals when the net present value method is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

45

In calculating the net present value of an investment in equipment, the required investment and its residual value should be subtracted from the present value of all future cash inflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

46

If in evaluating a proposal by use of the net present value method there is an excess of the present value of future cash inflows over the amount to be invested, the rate of return on the proposal is less than the rate used in the analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

47

A qualitative characteristic that may impact capital investment analysis is market opportunities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

48

The computations involved in the net present value method of analyzing capital investment proposals are more involved than those for the average rate of return method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

49

In net present value analysis for a proposed capital investment, the expected future net cash flows are reduced to their present values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

50

Net present value and the payback period are examples of discounted cash flow methods used in capital budgeting decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

51

A qualitative characteristic that may impact capital investment analysis is the impact of investment proposals on product quality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

52

The process by which management allocates available investment funds among competing capital investment proposals is termed capital rationing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

53

The internal rate of return method of analyzing capital investment proposals uses present value concepts to compute a rate of return expected from the proposals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

54

In calculating the present value of an investment in equipment, the present value of the residual value should be added to the cash inflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

55

If in evaluating a proposal by use of the net present value method there is an excess of the present value of future cash inflows over the amount to be invested, the rate of return on the proposal exceeds the rate used in the analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

56

A series of equal cash flows at fixed intervals is termed an annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

57

In net present value analysis for a proposed capital investment, the expected future net cash flows are averaged and then reduced to their present values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

58

If in evaluating a proposal by use of the net present value method there is a deficiency of the present value of future cash inflows over the amount to be invested, the proposal should be rejected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

59

If in evaluating a proposal by use of the net present value method there is a deficiency of the present value of future cash inflows over the amount to be invested, the proposal should be accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

60

A qualitative characteristic that may impact capital investment analysis is manufacturing flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

61

The primary advantages of the average rate of return method are its ease of computation and the fact that

A) it is especially useful to managers whose primary concern is liquidity

B) there is less possibility of loss from changes in economic conditions and obsolescence when the commitment is short term

C) it emphasizes the amount of income earned over the life of the proposal

D) rankings of proposals are necessary

A) it is especially useful to managers whose primary concern is liquidity

B) there is less possibility of loss from changes in economic conditions and obsolescence when the commitment is short term

C) it emphasizes the amount of income earned over the life of the proposal

D) rankings of proposals are necessary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

62

The process by which management plans, evaluates, and controls long-term investment decisions involving fixed assets is called

A) absorption cost analysis

B) variable cost analysis

C) capital investment analysis

D) cost-volume-profit analysis

A) absorption cost analysis

B) variable cost analysis

C) capital investment analysis

D) cost-volume-profit analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

63

The amount of the estimated average income for a proposed investment of $90,000 in a fixed asset, giving effect to depreciation (straight-line method), with a useful life of four years, no residual value, and an expected total income yield of $25,300, is

A) $12,650

B) $25,300

C) $6,325

D) $45,000

A) $12,650

B) $25,300

C) $6,325

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

64

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

The average rate of return for this investment is

A) 5%

B) 10%

C) 25%

D) 15%

The average rate of return for this investment is

A) 5%

B) 10%

C) 25%

D) 15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

65

The expected average rate of return for a proposed investment of $6,000,000 in a fixed asset, using straight-line depreciation, with a useful life of 20 years, no residual value, and an expected total net income of $12,000,000 over the 20 years is

A) 20%

B) 10%

C) 40%

D) 5%

A) 20%

B) 10%

C) 40%

D) 5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following are two methods of analyzing capital investment proposals that both ignore present value?

A) internal rate of return and average rate of return

B) net present value and average rate of return

C) internal rate of return and net present value

D) average rate of return and cash payback method

A) internal rate of return and average rate of return

B) net present value and average rate of return

C) internal rate of return and net present value

D) average rate of return and cash payback method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

67

Decisions to install new equipment, replace old equipment, and purchase or construct a new building are examples of

A) sales mix analysis

B) variable cost analysis

C) capital investment analysis

D) variable cost analysis

A) sales mix analysis

B) variable cost analysis

C) capital investment analysis

D) variable cost analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

68

Hayden Company is considering the acquisition of a machine that costs $675,000. The machine is expected to have a useful life of six years, a negligible residual value, an annual net cash flow of $150,000, and annual operating income of $87,500. What is the estimated cash payback period for the machine?

A) 3.5 years

B) 4 years

C) 4.5 years

D) 5 years

A) 3.5 years

B) 4 years

C) 4.5 years

D) 5 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

69

An anticipated purchase of equipment for $490,000 with a useful life of eight years and no residual value is expected to yield the following annual net incomes and net cash flows:? What is the cash payback period?

A) 5 years

B) 4 years

C) 6 years

D) 3 years

A) 5 years

B) 4 years

C) 6 years

D) 3 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

70

The management of Nebraska Corporation is considering the purchase of a new machine costing $490,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for Years 1 through 5 are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability:

The cash payback period for this investment is

A) 5 years

B) 4 years

C) 2 years

D) 3 years

The cash payback period for this investment is

A) 5 years

B) 4 years

C) 2 years

D) 3 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following are present value methods of analyzing capital investment proposals?

A) internal rate of return and average rate of return

B) average rate of return and net present value

C) net present value and internal rate of return

D) net present value and payback

A) internal rate of return and average rate of return

B) average rate of return and net present value

C) net present value and internal rate of return

D) net present value and payback

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

72

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

The cash payback period for this investment is

A) 4 years

B) 5 years

C) 20 years

D) 3 years

The cash payback period for this investment is

A) 4 years

B) 5 years

C) 20 years

D) 3 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

73

The expected average rate of return for a proposed investment of $800,000 in a fixed asset with a useful life of four years, straight-line depreciation, no residual value, and an expected total net income of $360,000 for the four years is

A) 45%

B) 22.5%

C) 11.3%

D) 5.5%

A) 45%

B) 22.5%

C) 11.3%

D) 5.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

74

The management of Nebraska Corporation is considering the purchase of a new machine costing $490,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for Years 1 through 5 are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability:

The average rate of return for this investment is

A) 18%

B) 16%

C) 58%

D) 10%

The average rate of return for this investment is

A) 18%

B) 16%

C) 58%

D) 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which method of evaluating capital investment proposals uses the concept of present value to compute a rate of return?

A) average rate of return

B) accounting rate of return

C) cash payback period

D) internal rate of return

A) average rate of return

B) accounting rate of return

C) cash payback period

D) internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

76

The amount of the average investment for a proposed investment of $120,000 in a fixed asset with a useful life of four years, straight-line depreciation, no residual value, and an expected total net income of $21,600 for the four years is

A) $30,000

B) $21,600

C) $5,400

D) $60,000

A) $30,000

B) $21,600

C) $5,400

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is a present value method of analyzing capital investment proposals?

A) average rate of return

B) cash payback method

C) accounting rate of return

D) net present value

A) average rate of return

B) cash payback method

C) accounting rate of return

D) net present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

78

The methods of evaluating capital investment proposals can be separated into two general groups-present value methods and

A) past value methods

B) straight-line methods

C) reducing value methods

D) methods that ignore present value

A) past value methods

B) straight-line methods

C) reducing value methods

D) methods that ignore present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is a method of analyzing capital investment proposals that ignores present value?

A) internal rate of return

B) net present value

C) discounted cash flow

D) average rate of return

A) internal rate of return

B) net present value

C) discounted cash flow

D) average rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

80

The method of analyzing capital investment proposals that divides the estimated average annual income by the average investment is the

A) cash payback method

B) net present value method

C) internal rate of return method

D) average rate of return method

A) cash payback method

B) net present value method

C) internal rate of return method

D) average rate of return method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck