Deck 6: Process Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/114

العب

ملء الشاشة (f)

Deck 6: Process Costing

1

In a process costing system, normal spoilage is allocated to good units produced.

True

2

In the weighted average method, cost per equivalent unit is often calculated separately for materials costs and conversion costs.

True

3

In FIFO costing, the costs of units in beginning work in process are merged with current period costs to calculate the cost per equivalent unit.

False

4

In a process costing system with multiple production departments, costs from the first department's ending work in process are transferred to the second department's finished goods before going into the second department's work in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

5

Managers can calculate costs per equivalent unit using the weighted average or the FIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

6

In a process costing system, direct materials are added during every production process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

7

Process costing is simplified when a company uses just-in-time inventory methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

8

Conversion costs refer to the cost of direct labour and production overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

9

Process costing information is useful for measuring and monitoring production processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

10

Conversion costs must be incurred uniformly throughout the production process to calculate equivalent units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

11

In the weighted average method, costs from beginning work in process are averaged with costs incurred during the current period and then allocated to units completed and ending work in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

12

Equivalent units measure the resources used in partially completed units relative to the resources needed to complete the units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

13

Spoilage costs from an unusual natural disaster would be allocated to good units produced in a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

14

When an organization uses a long-term procurement contract, direct labour costs are normally stable over long periods of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

15

When using the weighted average method to calculate cost per equivalent unit, the cost is calculated as current period costs / equivalent units for total work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

16

All spoilage in a process costing system is considered abnormal spoilage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

17

In calculating the cost per equivalent unit using FIFO costing, the appropriate formula is current period costs / equivalent units for work performed this period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

18

Conversion costs may be separated into direct labour and overhead when it is relatively easy to track direct labour, and the use of labour occurs in a different pattern than the use of overhead resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

19

Equivalent units are calculated for work in process and finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

20

Managers can only use FIFO process costing if it is reflected in the physical flow of units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

21

Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the weighted average method, the cost of the ending work in process inventory for July was:

A) $18,480

B) $18,540

C) $18,330

D) $18,390

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the weighted average method, the cost of the ending work in process inventory for July was:

A) $18,480

B) $18,540

C) $18,330

D) $18,390

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

22

On September 1, Kelita Company had 20,000 units in process, which were 30% completed. Materials are added at the beginning of the process. During the month 160,000 units were started and 170,000 completed. Ending work in process was 50% complete. By what amount would the equivalent units of materials differ if weighted average were used instead of FIFO?

A) 20,000 more

B) -0-

C) 6,000 more

D) 14,000 less

A) 20,000 more

B) -0-

C) 6,000 more

D) 14,000 less

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assume there were 6,000 units in beginning work in process, 60% complete. 20,000 units were completed during the month. Ending work in process is 40% complete, which is equivalent to 3,200 units for conversion costs. Materials are added at the beginning of the process. The FIFO method is used.

The number of units started this month is:

A) 20,000 units

B) 22,000 units

C) 28,000 units

D) 15,280 units

The number of units started this month is:

A) 20,000 units

B) 22,000 units

C) 28,000 units

D) 15,280 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

24

Salmon Manufacturing Company uses a process costing system. Direct materials are added at the beginning of the process. During January, Department Q had a beginning inventory of 2,000 units, 25% complete for conversion costs. During the month 14,000 units were started and there were 1,000 units in ending inventory, 60% complete for conversion costs.

Using FIFO process costing, the equivalent units for direct materials for the month were:

A) 13,600

B) 14,000

C) 16,000

D) 15,600

Using FIFO process costing, the equivalent units for direct materials for the month were:

A) 13,600

B) 14,000

C) 16,000

D) 15,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

25

Perry Company started 6,000 units during the month of March. 600 units were in the beginning work in process inventory and 400 units in the ending work in process inventory. Units completed and transferred out during March will be:

A) 6,000

B) 6,400

C) 6,200

D) 5,400

A) 6,000

B) 6,400

C) 6,200

D) 5,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

26

Gholson, Inc. employs a process costing system in which direct materials are added at the beginning of the process. Direct material costs from the prior period for beginning work in process are $1,250. The current period's direct material costs total $31,500. The company began the period with 500 units, 70% complete, started 10,500 units, and finished the period with 1,000 units, 40% complete.

Using a FIFO system, the direct material cost per equivalent unit is:

A) $3.00

B) $2.98

C) $3.20

D) $2.55

Using a FIFO system, the direct material cost per equivalent unit is:

A) $3.00

B) $2.98

C) $3.20

D) $2.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

27

Salmon Manufacturing Company uses a process costing system. Direct materials are added at the beginning of the process. During January, Department Q had a beginning inventory of 2,000 units, 25% complete for conversion costs. During the month 14,000 units were started and there were 1,000 units in ending inventory, 60% complete for conversion costs.

Using weighted average process costing, the equivalent units for direct material for the month were:

A) 13,600

B) 14,000

C) 16,000

D) 15,600

Using weighted average process costing, the equivalent units for direct material for the month were:

A) 13,600

B) 14,000

C) 16,000

D) 15,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

28

Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the FIFO method, the number of equivalent units of conversion costs was:

A) 14,400

B) 14,550

C) 14,850

D) 14,700

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the FIFO method, the number of equivalent units of conversion costs was:

A) 14,400

B) 14,550

C) 14,850

D) 14,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

29

Assume that ending work in process is 8,000 units, 20% complete, and that 20,000 units were completed and transferred out. The beginning work in process was 75% complete. Materials are added when the process is 50% complete, and the cost of materials added during the month was $61,500. Using the weighted average method, materials are allocated at $4.00 per equivalent unit. The cost of material included in the beginning work in process from last month was:

A) $18,500

B) $20,000

C) $34,500

D) None of the above

A) $18,500

B) $20,000

C) $34,500

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

30

Standard cost equivalent units are calculated the same way as FIFO equivalent units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

31

Gholson, Inc. employs a process costing system in which direct materials are added at the beginning of the process. Direct material costs from the prior period for beginning work in process are $1,250. The current period's direct material costs total $31,500. The company began the period with 500 units, 70% complete, started 10,500 units, and finished the period with 1,000 units, 40% complete.

Using the weighted average method, the direct material cost per equivalent unit for the period is:

A) $3.00

B) $2.98

C) $3.20

D) $2.55

Using the weighted average method, the direct material cost per equivalent unit for the period is:

A) $3.00

B) $2.98

C) $3.20

D) $2.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

32

Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the FIFO method, the cost of goods completed and transferred out during July was:

A) $225,150

B) $225,060

C) $213,300

D) $213,000

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the FIFO method, the cost of goods completed and transferred out during July was:

A) $225,150

B) $225,060

C) $213,300

D) $213,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

33

When standard costs are used as benchmarks, they are compared to actual costs using either weighted average or FIFO costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

34

Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the weighted average method, the number of equivalent units of material was:

A) 15,750

B) 14,250

C) 15,000

D) 13,500

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the weighted average method, the number of equivalent units of material was:

A) 15,750

B) 14,250

C) 15,000

D) 13,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

35

Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities: On July 1: Beginning inventories units, complete

Direct materials cost

Conversion costs

During July: units started

Direct materials added

Conversion costs added

On July 31: Ending inventories units, complete Using the weighted average method, the cost of the goods completed and transferred out was:

A) $225,150

B) $225,060

C) $213,300

D) $213,000

Direct materials cost

Conversion costs

During July: units started

Direct materials added

Conversion costs added

On July 31: Ending inventories units, complete Using the weighted average method, the cost of the goods completed and transferred out was:

A) $225,150

B) $225,060

C) $213,300

D) $213,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

36

Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the FIFO method, the number of units started and completed in July was:

A) 14,250

B) 15,000

C) 13,500

D) 15,750

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the FIFO method, the number of units started and completed in July was:

A) 14,250

B) 15,000

C) 13,500

D) 15,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

37

Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the FIFO method, the cost per equivalent unit for materials used during July was:

A) $9.90

B) $9.80

C) $11.11

D) $10.00

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the FIFO method, the cost per equivalent unit for materials used during July was:

A) $9.90

B) $9.80

C) $11.11

D) $10.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

38

Assume there were 6,000 units in beginning work in process, 60% complete. 20,000 units were completed during the month. Ending work in process is 40% complete, which is equivalent to 3,200 units for conversion costs. Materials are added at the beginning of the process. The FIFO method is used.

The number of equivalent units of conversion costs is:

A) 23,200

B) 17,680

C) 19,600

D) 21,280

The number of equivalent units of conversion costs is:

A) 23,200

B) 17,680

C) 19,600

D) 21,280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

39

Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the weighted average method, the cost per equivalent unit for conversion costs was:

A) $5.80

B) $5.90

C) $6.00

D) $6.10

On July 1: Beginning inventories = 750 units, 60% complete

Direct materials cost = $5,925

Conversion costs = $4,095

During July: 15,000 units started

Direct materials added = $150,000

Conversion costs added = $83,520

On July 31: Ending inventories = 1,500 units, 40% complete

Using the weighted average method, the cost per equivalent unit for conversion costs was:

A) $5.80

B) $5.90

C) $6.00

D) $6.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

40

Salmon Manufacturing Company uses a process costing system. Direct materials are added at the beginning of the process. During January, Department Q had a beginning inventory of 2,000 units, 25% complete for conversion costs. During the month 14,000 units were started and there were 1,000 units in ending inventory, 60% complete for conversion costs.

Using weighted average process costing, the equivalent units for conversion costs for the month were:

A) 14,100

B) 14,000

C) 16,000

D) 15,600

Using weighted average process costing, the equivalent units for conversion costs for the month were:

A) 14,100

B) 14,000

C) 16,000

D) 15,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

41

Assume a company's beginning work in process consists of 20,000 units, 40% complete. Materials are added at the beginning of the process. During the month, 90,000 units are transferred in. The ending work in process consists of 10,000 units, 50% complete.

Using the FIFO method, the equivalent units of production are:

Using the FIFO method, the equivalent units of production are:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

42

When using weighted average process costing:

A) The costs attached to beginning work in process are kept separate from all other costs

B) The current period costs will be added to the beginning work in process costs

C) Units in the ending inventory are not considered in making equivalent unit computations

D) Completed units are transferred out in two separate blocks

A) The costs attached to beginning work in process are kept separate from all other costs

B) The current period costs will be added to the beginning work in process costs

C) Units in the ending inventory are not considered in making equivalent unit computations

D) Completed units are transferred out in two separate blocks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

43

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: Beginning inventories units, complete

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the weighted average method, the cost of the units transferred out was:

A) $53,570

B) $44,710

C) $52,261

D) $66,219

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the weighted average method, the cost of the units transferred out was:

A) $53,570

B) $44,710

C) $52,261

D) $66,219

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

44

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: Beginning inventories units, complete

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the weighted average method, the total transferred-in costs for the month were:

A) $38,040

B) $40,600

C) $30,800

D) $33,360

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the weighted average method, the total transferred-in costs for the month were:

A) $38,040

B) $40,600

C) $30,800

D) $33,360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

45

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: Beginning inventories units, complete

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the weighted average method, the cost per equivalent unit for materials was:

A) $5.00

B) $4.14

C) $6.04

D) $4.44

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the weighted average method, the cost per equivalent unit for materials was:

A) $5.00

B) $4.14

C) $6.04

D) $4.44

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

46

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: Beginning inventories units, complete

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the weighted average method, the cost of the ending work in process inventory was:

A) $13,958

B) $13,944

C) $12,663

D) $12,649

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the weighted average method, the cost of the ending work in process inventory was:

A) $13,958

B) $13,944

C) $12,663

D) $12,649

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

47

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally:

On May 1: Beginning inventories = 250 units, 40% complete

Direct materials costs = $1,250

Conversion costs = $1,356

Transferred-in costs = $2,560

During May: Direct materials costs incurred = $6,000

Conversion costs incurred = $17,013

On May 31: Ending Inventories = 350 units, 20% complete

Using the weighted average method, the number of equivalent units for conversion costs was:

A) 1,070

B) 1,020

C) 1,170

D) 1,380

On May 1: Beginning inventories = 250 units, 40% complete

Direct materials costs = $1,250

Conversion costs = $1,356

Transferred-in costs = $2,560

During May: Direct materials costs incurred = $6,000

Conversion costs incurred = $17,013

On May 31: Ending Inventories = 350 units, 20% complete

Using the weighted average method, the number of equivalent units for conversion costs was:

A) 1,070

B) 1,020

C) 1,170

D) 1,380

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

48

Because the weighted average and FIFO methods treat beginning inventory differently, if a firm has beginning inventory in a process costing system and the FIFO method is used, it will:

A) Always have a higher number of equivalent units of production for conversion costs than weighted the average method

B) Always have a lower number of equivalent units of production for conversion costs than the weighted average method

C) Always have a higher cost per equivalent unit than the weighted average method for materials

D) Always have a lower cost per equivalent unit than the weighted average method for conversion costs

A) Always have a higher number of equivalent units of production for conversion costs than weighted the average method

B) Always have a lower number of equivalent units of production for conversion costs than the weighted average method

C) Always have a higher cost per equivalent unit than the weighted average method for materials

D) Always have a lower cost per equivalent unit than the weighted average method for conversion costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

49

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: Beginning inventories units, complete

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the FIFO method, units transferred in and completed were:

A) 1,200

B) 1,100

C) 850

D) 1,450

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the FIFO method, units transferred in and completed were:

A) 1,200

B) 1,100

C) 850

D) 1,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

50

A costing system that determines an average cost for all units of product in a particular time period is:

A) Job costing system

B) Batch costing system

C) Process costing system

D) Direct costing system

A) Job costing system

B) Batch costing system

C) Process costing system

D) Direct costing system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

51

Equivalent whole units of production:

A) Are the number of whole units produced in a batch

B) Include the number of units started and completed during the period

C) Compare the number of units that should have been completed with that actually produced

D) Consist of all units completed this period

A) Are the number of whole units produced in a batch

B) Include the number of units started and completed during the period

C) Compare the number of units that should have been completed with that actually produced

D) Consist of all units completed this period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

52

Materials are added at the beginning of the process. The beginning work in process is 30% complete. If the ending work in process is zero, the total equivalent units for direct materials for the period using FIFO are equal to:

A) The units in beginning work in process

B) The units started this period

C) The units started plus 70% of the units in beginning work in process

D) The units started and completed plus the beginning work in process

A) The units in beginning work in process

B) The units started this period

C) The units started plus 70% of the units in beginning work in process

D) The units started and completed plus the beginning work in process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

53

Production costs during the current period are kept separate from that of the previous period in the:

A) FIFO method

B) Job costing method

C) Just-in-time method

D) Weighted average method

A) FIFO method

B) Job costing method

C) Just-in-time method

D) Weighted average method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which type of company would most likely use a process costing system?

A) Chemical producer

B) Custom furniture maker

C) Printer

D) Ship builder

A) Chemical producer

B) Custom furniture maker

C) Printer

D) Ship builder

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

55

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally:

On May 1: Beginning inventories = 250 units, 40% complete

Direct materials costs = $1,250

Conversion costs = $1,356

Transferred-in costs = $2,560

During May: Direct materials costs incurred = $6,000

Conversion costs incurred = $17,013

On May 31: Ending Inventories = 350 units, 20% complete

Using the FIFO method, the equivalent units of material were:

A) 1,200

B) 1,100

C) 850

D) 1,450

On May 1: Beginning inventories = 250 units, 40% complete

Direct materials costs = $1,250

Conversion costs = $1,356

Transferred-in costs = $2,560

During May: Direct materials costs incurred = $6,000

Conversion costs incurred = $17,013

On May 31: Ending Inventories = 350 units, 20% complete

Using the FIFO method, the equivalent units of material were:

A) 1,200

B) 1,100

C) 850

D) 1,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

56

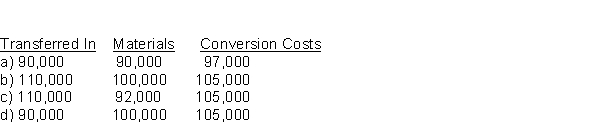

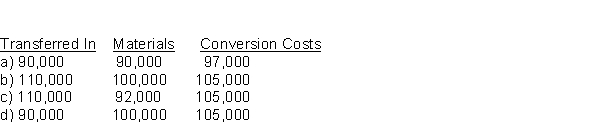

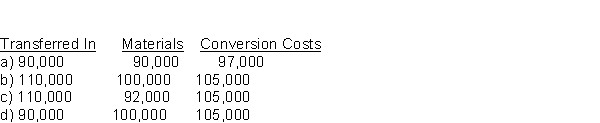

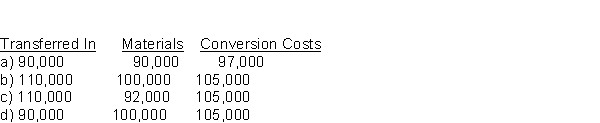

Assume a company's beginning work in process consists of 20,000 units, 40% complete. Materials are added at the beginning of the process. During the month, 90,000 units are transferred in. The ending work in process consists of 10,000 units, 50% complete.

Using the weighted average method, the equivalent units of production for the month are:

Transferred In Materials Conversion Costs

A) 110,000 100,000 65,000

B) 90,000 100,000 97,000

C) 110,000 110,000 105,000

D) 105,000 60,000 100,000

Using the weighted average method, the equivalent units of production for the month are:

Transferred In Materials Conversion Costs

A) 110,000 100,000 65,000

B) 90,000 100,000 97,000

C) 110,000 110,000 105,000

D) 105,000 60,000 100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

57

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally:

On May 1: Beginning inventories = 250 units, 40% complete

Direct materials costs = $1,250

Conversion costs = $1,356

Transferred-in costs = $2,560

During May: Direct materials costs incurred = $6,000

Conversion costs incurred = $17,013

On May 31: Ending Inventories = 350 units, 20% complete

Using the FIFO method, the cost of the ending work in process was:

A) $2,863

B) $7,113

C) $12,649

D) $13,958

On May 1: Beginning inventories = 250 units, 40% complete

Direct materials costs = $1,250

Conversion costs = $1,356

Transferred-in costs = $2,560

During May: Direct materials costs incurred = $6,000

Conversion costs incurred = $17,013

On May 31: Ending Inventories = 350 units, 20% complete

Using the FIFO method, the cost of the ending work in process was:

A) $2,863

B) $7,113

C) $12,649

D) $13,958

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

58

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: Beginning inventories units, complete

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the FIFO method, the cost per equivalent unit for transferred-in units was:

A) $28.00

B) $31.70

C) $26.23

D) $33.87

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the FIFO method, the cost per equivalent unit for transferred-in units was:

A) $28.00

B) $31.70

C) $26.23

D) $33.87

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

59

Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: Beginning inventories units, complete

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the FIFO method, the cost of the beginning work in process units transferred out was:

A) $2,385

B) $15,476

C) $7,551

D) $6,756

Direct materials costs

Conversion costs

Transferred-in costs

During May: Direct materials costs incurred Conversion costs incurred

On May 31: Ending Inventories units, complete Using the FIFO method, the cost of the beginning work in process units transferred out was:

A) $2,385

B) $15,476

C) $7,551

D) $6,756

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

60

In a process costing system, transferred-in costs:

A) Are computed for all production but not reported in the cost of process costing report

B) Usually do not include any indirect costs

C) Are the costs recorded in preceding departments

D) Are the costs of the completed units

A) Are computed for all production but not reported in the cost of process costing report

B) Usually do not include any indirect costs

C) Are the costs recorded in preceding departments

D) Are the costs of the completed units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

61

Xeno, Inc. operates a process costing system and uses the FIFO method. Beginning work in process consists of 1,000 units, 30% complete. Ending work in process is 15% complete, and direct materials are added at the 20% point. The equivalent units of production for materials are 14,000 and for conversion costs are 18,000.

The number of units started this month was:

A) 15,000

B) 18,000

C) 36,000

D) 37,000

The number of units started this month was:

A) 15,000

B) 18,000

C) 36,000

D) 37,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

62

Miramar, Inc. uses a weighted-average process costing system which recognizes normal spoilage as 5% of good output. During the current period, 14,000 units were started and 10,000 units completed. Materials are added at the beginning of the process, conversion costs occur uniformly, and the inspection point is at the 70% point. Beginning work in process was 6,000 units, 40% complete, and ending work in process 9,000 units, 80% complete. The cost per equivalent unit for material was $1.00 and for conversion costs $3.00.

The total costs in work in process during the period were:

A) $31,995

B) $70,600

C) $73,700

D) Cannot be determined

The total costs in work in process during the period were:

A) $31,995

B) $70,600

C) $73,700

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

63

Assume there were 6,000 units in beginning work in process, 60% complete. 20,000 units were completed during the month. Ending work in process is 40% complete, which is equivalent to 3,200 units for conversion costs. Materials are added at the beginning of the process. The standard cost method is used.

The number of equivalent units of conversion costs is:

A) 23,200

B) 17,680

C) 19,600

D) 21,280

The number of equivalent units of conversion costs is:

A) 23,200

B) 17,680

C) 19,600

D) 21,280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

64

Tong, Inc. is a manufacturing company that uses a process costing system. All direct material is added at the start of the process, and spoilage is discovered at the end. During the first period of operations 15,000 units of material were placed into production at a cost of $20 each (ignore conversion costs for this process). Ending work in process was 2,000 units, good units completed totalled 11,000 units, and normal spoilage is 15% of the units surviving inspection. Inspection takes place after the units are completed.

The unit cost assigned to the normal spoilage is:

A) $-0-

B) $22.61

C) $20.00

D) $24.00

The unit cost assigned to the normal spoilage is:

A) $-0-

B) $22.61

C) $20.00

D) $24.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

65

Macey Company uses a weighted-average process costing system. Beginning inventory consists of 6,000 units, 40% complete. Units started are 14,000, completed are 10,000, and ending inventories are 9,000 units, 70% complete. Normal spoilage is 5% of the units inspected. Direct material is added at the 75% point and spoilage inspection occurs at the 80% point. The cost per equivalent unit for materials was $1.00 and $3.00 for conversion costs.

The number of equivalent units of material was:

A) 20,000

B) 18,000

C) 18,200

D) 11,000

The number of equivalent units of material was:

A) 20,000

B) 18,000

C) 18,200

D) 11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

66

Xeno, Inc. operates a process costing system and uses the FIFO method. Beginning work in process consists of 1,000 units, 30% complete. Ending work in process is 15% complete, and direct materials are added at the 20% point. The equivalent units of production for materials are 14,000 and for conversion costs are 18,000.

The number of units in ending work in process was:

A) 37,000

B) 14,000

C) 18,000

D) 22,000

The number of units in ending work in process was:

A) 37,000

B) 14,000

C) 18,000

D) 22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

67

Miramar, Inc. uses a weighted-average process costing system which recognizes normal spoilage as 5% of good output. During the current period, 14,000 units were started and 10,000 units completed. Materials are added at the beginning of the process, conversion costs occur uniformly, and the inspection point is at the 70% point. Beginning work in process was 6,000 units, 40% complete, and ending work in process 9,000 units, 80% complete. The cost per equivalent unit for material was $1.00 and for conversion costs $3.00.

The cost of abnormal spoilage was:

A) $200

B) $1,550

C) $155

D) $2,000

The cost of abnormal spoilage was:

A) $200

B) $1,550

C) $155

D) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

68

Tong, Inc. is a manufacturing company that uses a process costing system. All direct material is added at the start of the process, and spoilage is discovered at the end. During the first period of operations 15,000 units of material were placed into production at a cost of $20 each (ignore conversion costs for this process). Ending work in process was 2,000 units, good units completed totalled 11,000 units, and normal spoilage is 15% of the units surviving inspection. Inspection takes place after the units are completed.

The unit cost assigned to the abnormal spoilage is:

A) $-0-

B) $22.61

C) $20.00

D) $24.00

The unit cost assigned to the abnormal spoilage is:

A) $-0-

B) $22.61

C) $20.00

D) $24.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

69

Miramar, Inc. uses a weighted-average process costing system which recognizes normal spoilage as 5% of good output. During the current period, 14,000 units were started and 10,000 units completed. Materials are added at the beginning of the process, conversion costs occur uniformly, and the inspection point is at the 70% point. Beginning work in process was 6,000 units, 40% complete, and ending work in process 9,000 units, 80% complete. The cost per equivalent unit for material was $1.00 and for conversion costs $3.00.

The cost of ending work in process was:

A) $31,995

B) $30,600

C) $31,334

D) $31,547

The cost of ending work in process was:

A) $31,995

B) $30,600

C) $31,334

D) $31,547

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

70

Assume that conversion costs are $122,100 for the month, and the equivalent unit cost for conversion is $5.50. The ending work in process is 80% complete, and the beginning work in process consisted of 2,000 units, 40% complete. The company completed 17,000 units. What is the number of whole units in the ending work in process under the FIFO method?

A) 6,000 units

B) 6,500 units

C) 7,500 units

D) 5,200 units

A) 6,000 units

B) 6,500 units

C) 7,500 units

D) 5,200 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

71

Miramar, Inc. uses a weighted-average process costing system which recognizes normal spoilage as 5% of good output. During the current period, 14,000 units were started and 10,000 units completed. Materials are added at the beginning of the process, conversion costs occur uniformly, and the inspection point is at the 70% point. Beginning work in process was 6,000 units, 40% complete, and ending work in process 9,000 units, 80% complete. The cost per equivalent unit for material was $1.00 and for conversion costs $3.00.

The cost of goods completed was:

A) $42,945

B) $40,000

C) $40,816

D) $41,053

The cost of goods completed was:

A) $42,945

B) $40,000

C) $40,816

D) $41,053

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

72

Miramar, Inc. uses a weighted-average process costing system which recognizes normal spoilage as 5% of good output. During the current period, 14,000 units were started and 10,000 units completed. Materials are added at the beginning of the process, conversion costs occur uniformly, and the inspection point is at the 70% point. Beginning work in process was 6,000 units, 40% complete, and ending work in process 9,000 units, 80% complete. The cost per equivalent unit for material was $1.00 and for conversion costs $3.00.

The number of equivalent units of conversion costs was:

A) 17,200

B) 19,700

C) 20,000

D) 17,900

The number of equivalent units of conversion costs was:

A) 17,200

B) 19,700

C) 20,000

D) 17,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

73

Assume a company's beginning work in process consists of 20,000 units, 40% complete. Materials are added at the beginning of the process. During the month, 90,000 units are transferred in. The ending work in process consists of 10,000 units, 50% complete. Under the standard cost method, the equivalent units of production are:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

74

Tong, Inc. is a manufacturing company that uses a process costing system. All direct material is added at the start of the process, and spoilage is discovered at the end. During the first period of operations 15,000 units of material were placed into production at a cost of $20 each (ignore conversion costs for this process). Ending work in process was 2,000 units, good units completed totalled 11,000 units, and normal spoilage is 15% of the units surviving inspection. Inspection takes place after the units are completed.

The unit cost assigned to the ending work in process inventory is:

A) $-0-

B) $22.61

C) $20.00

D) $24.00

The unit cost assigned to the ending work in process inventory is:

A) $-0-

B) $22.61

C) $20.00

D) $24.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

75

Macey Company uses a weighted-average process costing system. Beginning inventory consists of 6,000 units, 40% complete. Units started are 14,000, completed are 10,000, and ending inventories are 9,000 units, 70% complete. Normal spoilage is 5% of the units inspected. Direct material is added at the 75% point and spoilage inspection occurs at the 80% point. The cost per equivalent unit for materials was $1.00 and $3.00 for conversion costs.

The cost of the units completed was:

A) $40,000

B) $42,200

C) $41,760

D) $41,870

The cost of the units completed was:

A) $40,000

B) $42,200

C) $41,760

D) $41,870

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

76

Miramar, Inc. uses a weighted-average process costing system which recognizes normal spoilage as 5% of good output. During the current period, 14,000 units were started and 10,000 units completed. Materials are added at the beginning of the process, conversion costs occur uniformly, and the inspection point is at the 70% point. Beginning work in process was 6,000 units, 40% complete, and ending work in process 9,000 units, 80% complete. The cost per equivalent unit for material was $1.00 and for conversion costs $3.00.

The number of units in abnormal spoilage was:

A) 500

B) 50

C) -0-

D) 550

The number of units in abnormal spoilage was:

A) 500

B) 50

C) -0-

D) 550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

77

Macey Company uses a weighted-average process costing system. Beginning inventory consists of 6,000 units, 40% complete. Units started are 14,000, completed are 10,000, and ending inventories are 9,000 units, 70% complete. Normal spoilage is 5% of the units inspected. Direct material is added at the 75% point and spoilage inspection occurs at the 80% point. The cost per equivalent unit for materials was $1.00 and $3.00 for conversion costs.

The loss from abnormal spoilage was:

A) $1,530

B) $1,800

C) $1,440

D) $1,080

The loss from abnormal spoilage was:

A) $1,530

B) $1,800

C) $1,440

D) $1,080

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

78

Assume there were 6,000 units in beginning work in process, 60% complete. 20,000 units were completed during the month. Ending work in process is 40% complete, which is equivalent to 3,200 units for conversion costs. Materials are added at the beginning of the process. The standard cost method is used.

The number of units started this month is:

A) 20,000 units

B) 22,000 units

C) 28,000 units

D) 15,280 units

The number of units started this month is:

A) 20,000 units

B) 22,000 units

C) 28,000 units

D) 15,280 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

79

Assume there were 6,000 units in beginning work in process, 60% complete. 20,000 units were completed during the month. Ending work in process is 40% complete, which is equivalent to 3,200 units for conversion costs. Materials are added at the beginning of the process. The standard cost method is used.

Assume the total conversion costs for the month are $78,400. What amount of conversion costs are attached to units in ending work in process inventory?

A) $8.960

B) $12,800

C) $10,814

D) None of the above

Assume the total conversion costs for the month are $78,400. What amount of conversion costs are attached to units in ending work in process inventory?

A) $8.960

B) $12,800

C) $10,814

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

80

Tong, Inc. is a manufacturing company that uses a process costing system. All direct material is added at the start of the process, and spoilage is discovered at the end. During the first period of operations 15,000 units of material were placed into production at a cost of $20 each (ignore conversion costs for this process). Ending work in process was 2,000 units, good units completed totalled 11,000 units, and normal spoilage is 15% of the units surviving inspection. Inspection takes place after the units are completed.

The unit cost assigned to the good units completed is:

A) $-0-

B) $20.00

C) $24.00

D) $23.55

The unit cost assigned to the good units completed is:

A) $-0-

B) $20.00

C) $24.00

D) $23.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck