Deck 5: Job Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/133

العب

ملء الشاشة (f)

Deck 5: Job Costing

1

A "job" refers to a group of individual overhead costs that are accumulated for a particular purpose.

False

2

Direct material and direct labour costs are typically traced to individual jobs in a job costing system.

True

3

Overhead is typically allocated to jobs in a job costing system, rather than being traced directly.

True

4

Both actual costing and normal costing systems use the actual quantity of the allocation base to assign overhead costs to jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

5

Identifying a cost driver is the first step in allocating overhead in a job costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

6

One of the primary differences between actual and normal costing systems is their treatment of direct material and direct labour costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

7

Information from job costing systems is subject to uncertainties and implementing a job costing system requires judgment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

8

Overhead allocation is the process of tracing costs to products or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

9

In actual costing systems, overhead is allocated using the following formula: actual allocation base volume / actual allocation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

10

In a job costing system, costs flow out of work-in-process into finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

11

Allocated overhead generally does not accurately measure a job's overhead resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

12

Because overhead costs are allocated in a job costing system they can be considered "variable" for the purpose of decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

13

Job costing can be used in both manufacturing and service organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

14

A separate cost allocation base must be chosen for each job in a job costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

15

When goods are customized, all costs are easily traced to individual cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

16

Direct costs are subject to less uncertainty than indirect costs in a job costing system, but managers still exercise judgment regarding direct cost tracing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

17

Actual costing and normal costing are two different names for the same overhead allocation system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

18

In a job costing system, costs are very accurate because jobs are customized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

19

In normal costing systems, overhead is allocated using the following formula: normal allocation base volume / normal allocation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

20

The first step in overhead allocation is to identify the cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

21

Spoilage is typically identified as part of the overhead allocation process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

22

Smith Fabricating uses job costing and applies overhead using a normal costing system and uses direct labour cost as the allocation base. This period's estimated overhead cost is $100,000 and estimated direct labour cost of $50,000 and 2,500 direct labour hours.

What is the overhead allocation rate?

A) 200%

B) 50%

C) 30%

D) 60%

What is the overhead allocation rate?

A) 200%

B) 50%

C) 30%

D) 60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

23

Quality initiatives have both quantitative and qualitative benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

24

Bhavik's Accounting Services uses job costing and applies overhead using a normal costing system using professional labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated professional labour cost is $800,000 and estimated direct labour hours are 8,000. This period actual overhead cost was $426,400, actual direct labour cost was $820,000, and actual direct labour hours were 8,200.

What is the total cost for Client 58?

A) $1,300

B) $1,200

C) $1,720

D) $1,700

What is the total cost for Client 58?

A) $1,300

B) $1,200

C) $1,720

D) $1,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

25

Potential loss of reputation and market share are opportunity costs of spoilage and rework.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

26

Accounting processes influence manager behaviour in many organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

27

Kelita's Kar Kare Kompany had the following cost and inventory data for the month:

Costs incurred for the month:

Assume that the total production costs incurred for the month were $15,000. What was the cost of jobs completed?

A) $14,550

B) $19,050

C) $15,000

D) $15,450

Costs incurred for the month:

Assume that the total production costs incurred for the month were $15,000. What was the cost of jobs completed?

A) $14,550

B) $19,050

C) $15,000

D) $15,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

28

Scrap can be sold, discarded, or used in other creative ways.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Soap Company uses job costing and applies overhead using a normal costing system using direct labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labour cost is $500,000 and estimated direct labour hours are 25,000. This period's actual overhead cost was $420,000, actual direct labour cost was $390,000, and actual direct labour hours were 20,000.

What is the total manufacturing cost of Job 400?

A) $1,200

B) $1,000

C) $1,320

D) $1,640

What is the total manufacturing cost of Job 400?

A) $1,200

B) $1,000

C) $1,320

D) $1,640

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

30

Reworked units can always be sold at the regular market price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

31

Sparkle Company uses job costing and applies overhead using an actual costing system using direct labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labour cost is $500,000 and estimated direct labour hours are 25,000. This period's actual overhead cost was $420,000, actual direct labour cost was $390,000, and actual direct labour hours were 20,000.

What is the total manufacturing cost of Job 402?

A) $1,100

B) $1,772

C) $1,320

D) $1,640

What is the total manufacturing cost of Job 402?

A) $1,100

B) $1,772

C) $1,320

D) $1,640

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

32

Although they may be significant in amount, quality costs are often measured imprecisely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

33

Bhavik's Accounting Services uses job costing and applies overhead using a normal costing system using professional labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated professional labour cost is $800,000 and estimated direct labour hours are 8,000. This period actual overhead cost was $426,400, actual direct labour cost was $820,000, and actual direct labour hours were 8,200.

What is the overhead allocation rate?

A) $60/hour

B) $55/hour

C) $52/hour

D) $50/hour

What is the overhead allocation rate?

A) $60/hour

B) $55/hour

C) $52/hour

D) $50/hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

34

Spoilage, rework, and scrap are irrelevant in job costing systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

35

Only spoiled goods are reworked.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

36

Kelita's Kar Kare Kompany had the following cost and inventory data for the month:

Costs incurred for the month:

Inventories:

What were the direct costs of production incurred during the month?

A) $12,000

B) $11,700

C) $10,200

D) $10,500

Costs incurred for the month:

Inventories:

What were the direct costs of production incurred during the month?

A) $12,000

B) $11,700

C) $10,200

D) $10,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

37

Smith Fabricating uses job costing and applies overhead using a normal costing system and uses direct labour cost as the allocation base. This period's estimated overhead cost is $100,000 and estimated direct labour cost of $50,000 and 2,500 direct labour hours.

What is the total manufacturing cost of Job 201?

A) $550

B) $950

C) $850

D) $1,500

What is the total manufacturing cost of Job 201?

A) $550

B) $950

C) $850

D) $1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

38

The Soap Company uses job costing and applies overhead using a normal costing system using direct labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labour cost is $500,000 and estimated direct labour hours are 25,000. This period's actual overhead cost was $420,000, actual direct labour cost was $390,000, and actual direct labour hours were 20,000.

What is the overhead allocation rate?

A) $21/hour

B) $10/hour

C) $16/hour

D) $18/hour

What is the overhead allocation rate?

A) $21/hour

B) $10/hour

C) $16/hour

D) $18/hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

39

Kelita's Kar Kare Kompany had the following cost and inventory data for the month:

Costs incurred for the month:

Inventories:

What were the direct materials available for the month?

A) $4,500

B) $6,000

C) $6,300

D) $7,800

Costs incurred for the month:

Inventories:

What were the direct materials available for the month?

A) $4,500

B) $6,000

C) $6,300

D) $7,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

40

Sparkle Company uses job costing and applies overhead using an actual costing system using direct labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labour cost is $500,000 and estimated direct labour hours are 25,000. This period's actual overhead cost was $420,000, actual direct labour cost was $390,000, and actual direct labour hours were 20,000.

What is the overhead allocation rate?

A) $21/hour

B) $10/hour

C) $16/hour

D) $18/hour

What is the overhead allocation rate?

A) $21/hour

B) $10/hour

C) $16/hour

D) $18/hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which costing system does not include over- or underapplied overhead?

A) Actual costing system

B) Normal costing system

C) Process costing system

D) Activity-based costing system

A) Actual costing system

B) Normal costing system

C) Process costing system

D) Activity-based costing system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

42

Kelita's Kar Kare Kompany had the following cost and inventory data for the month:

Costs incurred for the month:

Assume that total production costs incurred for the month were $15,000. What was the cost of goods sold?

A) $13,800

B) $15,300

C) $19,800

D) $20,550

Costs incurred for the month:

Assume that total production costs incurred for the month were $15,000. What was the cost of goods sold?

A) $13,800

B) $15,300

C) $19,800

D) $20,550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

43

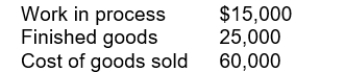

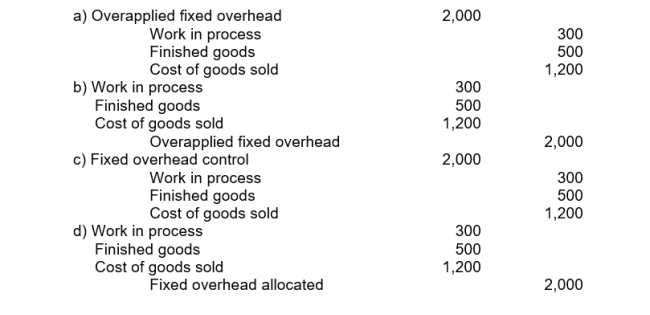

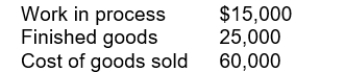

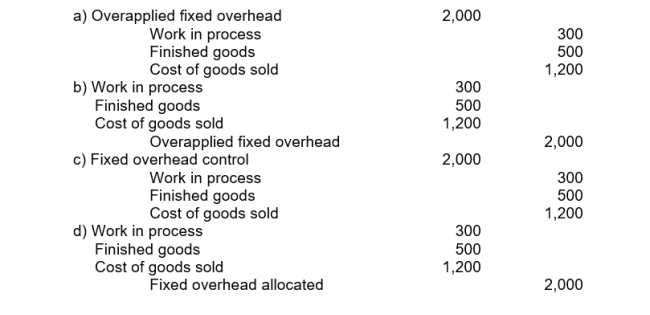

Assume there is $2,000 of overapplied fixed overhead, which is to be prorated. Current balances of selected accounts are:  The adjusting journal entry is:

The adjusting journal entry is:

The adjusting journal entry is:

The adjusting journal entry is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

44

When overhead is underapplied:

A) Cost of goods sold is understated

B) Work in process inventory is overstated

C) Gross profit is understated

D) Finished goods inventory is overstated

A) Cost of goods sold is understated

B) Work in process inventory is overstated

C) Gross profit is understated

D) Finished goods inventory is overstated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

45

Allen, Inc. has budgeted $120,000 in variable overhead and $72,000 in fixed overhead for the current month. 8,000 custom units were expected to be produced using 60,000 machine hours. During the month, Allen actually used 68,096 machine hours and produced 8,960 units. Actual overhead costs were: $132,000 variable and $73,600 fixed.

Assume Allen uses an actual costing system. The amount of over- or underapplied overhead for the current month is:

A) $9,440 overapplied

B) $12,307 overapplied

C) $0

D) $13,600 overapplied

Assume Allen uses an actual costing system. The amount of over- or underapplied overhead for the current month is:

A) $9,440 overapplied

B) $12,307 overapplied

C) $0

D) $13,600 overapplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

46

A firm had the following balances at the end of the period: It was determined that the overapplied overhead should be treated as immaterial. After any adjustments for overapplied overhead are made, the balance of work in process would be:

A) $320

B) $400

C) $480

D) $534

A) $320

B) $400

C) $480

D) $534

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

47

Kelita's Kar Company projects the following costs: If overhead is allocated on the basis of direct labour hours and 25,000 direct labour hours are budgeted for next year, the estimated overhead allocation rate will be

A) $13.40 per direct labour hours

B) $14.60 per direct labour hours

C) $12.40 per direct labour hours

D) $33.40 per direct labour hours

A) $13.40 per direct labour hours

B) $14.60 per direct labour hours

C) $12.40 per direct labour hours

D) $33.40 per direct labour hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

48

Following are the budgeted costs for a manufacturing plant producing custom products: The company uses a normal costing system and overhead is allocated on the basis of direct labour cost. If actual direct labour cost was $7,500, the overhead allocated was:

A) $29,160

B) $20,688

C) $30,375

D) $48,813

A) $29,160

B) $20,688

C) $30,375

D) $48,813

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

49

Collins Company uses a job costing system and allocates overhead using an estimated overhead allocation rate based on direct labour hours. Information for 2017 is as follows: The amount of over- or underapplied overhead for 2017 was:

A) $1,500 underapplied

B) $3,000 underapplied

C) $1,500 overapplied

D) $34,800 overapplied

A) $1,500 underapplied

B) $3,000 underapplied

C) $1,500 overapplied

D) $34,800 overapplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

50

Assume that variable overhead is overapplied by $200 and fixed overhead is underapplied by $100. If these variances are considered immaterial, the effect on cost of goods sold is:

A) $300 increase

B) $100 increase

C) $300 decrease

D) $100 decrease

A) $300 increase

B) $100 increase

C) $300 decrease

D) $100 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

51

The denominator in an overhead allocation rate for normal costing is:

A) Actual overhead costs

B) Estimated activity level

C) Estimated overhead costs

D) Actual activity level

A) Actual overhead costs

B) Estimated activity level

C) Estimated overhead costs

D) Actual activity level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

52

Collins Company uses a job costing system and allocates overhead using an estimated overhead allocation rate based on direct labour hours. Information for 2017 is as follows: The overhead allocated to work in process during 2017 before the year-end adjustment was:

A) $199,800

B) $165,000

C) $166,500

D) $198,000

A) $199,800

B) $165,000

C) $166,500

D) $198,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

53

A costing system that charges jobs with actual direct costs and uses an estimated overhead allocation rate is called a(n):

A) Actual costing system

B) Normal costing system

C) Process costing system

D) Activity-based costing system

A) Actual costing system

B) Normal costing system

C) Process costing system

D) Activity-based costing system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

54

Allen, Inc. has budgeted $120,000 in variable overhead and $72,000 in fixed overhead for the current month. 8,000 custom units were expected to be produced using 60,000 machine hours. During the month, Allen actually used 68,096 machine hours and produced 8,960 units. Actual overhead costs were: $132,000 variable and $73,600 fixed.

Assume Allen uses a normal costing system. The variable overhead allocated would be:

A) $136,192

B) $132,000

C) $134,400

D) $120,000

Assume Allen uses a normal costing system. The variable overhead allocated would be:

A) $136,192

B) $132,000

C) $134,400

D) $120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

55

For which of the following products would a job costing system be appropriate?

A) Brewery, where each brand is produced in a separate batch process

B) Jewellery store that manufactures and sells handcrafted jewellery

C) Cement kiln, where a single identical type of cement product is manufactured

D) Chemical plant, where each polymer is produced in a separate continuous process

A) Brewery, where each brand is produced in a separate batch process

B) Jewellery store that manufactures and sells handcrafted jewellery

C) Cement kiln, where a single identical type of cement product is manufactured

D) Chemical plant, where each polymer is produced in a separate continuous process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

56

Collins Company uses a job costing system and allocates overhead using an estimated overhead allocation rate based on direct labour hours. Information for 2017 is as follows: The estimated overhead allocation rate for 2017 was:

A) $2.75

B) $3.30

C) $3.33

D) $2.76

A) $2.75

B) $3.30

C) $3.33

D) $2.76

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

57

For which costing system is overhead allocated on the basis of the actual direct labour hours worked?

A) Normal costing system

B) Process costing system

C) Activity-based costing system

D) None of these costing systems

A) Normal costing system

B) Process costing system

C) Activity-based costing system

D) None of these costing systems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

58

In an actual costing system, the overhead allocation rate is calculated as:

A) Actual overhead cost + actual quantity of allocation base

B) Actual overhead cost / actual quantity of allocation base

C) Actual quantity of allocation base / actual overhead cost

D) Actual overhead cost / standard quantity of allocation base

A) Actual overhead cost + actual quantity of allocation base

B) Actual overhead cost / actual quantity of allocation base

C) Actual quantity of allocation base / actual overhead cost

D) Actual overhead cost / standard quantity of allocation base

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

59

In a normal costing system, which of the following costs are traced to each job?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

60

Normal costing overhead rates are developed at the beginning of each period based on the:

A) Actual overhead costs of the previous period

B) Actual activity level of the previous period

C) Direct labour hours at maximum capacity

D) Expected activity level of the coming period

A) Actual overhead costs of the previous period

B) Actual activity level of the previous period

C) Direct labour hours at maximum capacity

D) Expected activity level of the coming period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following statements regarding the uses and limitations of job costing is true?

A) Overhead is allocated to match revenues and costs

B) Most overhead costs are relevant for short-term decisions

C) Managers frequently assume variable overhead costs are fixed

D) Overhead costs are not relevant for most short-term decisions

A) Overhead is allocated to match revenues and costs

B) Most overhead costs are relevant for short-term decisions

C) Managers frequently assume variable overhead costs are fixed

D) Overhead costs are not relevant for most short-term decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

62

The cost of normal spoilage arising from a production process common to several jobs is:

A) Written off as a period expense

B) Charged to overhead for the jobs with the greatest total cost

C) Charged to overhead for the jobs with the least total cost

D) Charged to overhead and allocated with other overhead costs to all jobs

A) Written off as a period expense

B) Charged to overhead for the jobs with the greatest total cost

C) Charged to overhead for the jobs with the least total cost

D) Charged to overhead and allocated with other overhead costs to all jobs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

63

Managers reconcile actual and allocated overhead when they use this job costing system:

A) Actual

B) Normal

C) Relevant

D) Product

A) Actual

B) Normal

C) Relevant

D) Product

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

64

How is spoilage typically identified?

A) Through analysis at the account level

B) Through an inspection process

C) By regression analysis

D) By using a scatter plot

A) Through analysis at the account level

B) Through an inspection process

C) By regression analysis

D) By using a scatter plot

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

65

An out-of-control manufacturing process is most likely to produce:

A) Normal spoilage

B) Abnormal spoilage

C) Finished goods

D) Research and development expense

A) Normal spoilage

B) Abnormal spoilage

C) Finished goods

D) Research and development expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

66

Rework costs are:

A) Always tracked

B) Never tracked

C) Sometimes tracked

D) Deferred until the cash cycle is complete

A) Always tracked

B) Never tracked

C) Sometimes tracked

D) Deferred until the cash cycle is complete

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

67

Spoiled units that are repaired and sold as if they were originally produced correctly are called:

A) Rework

B) Scrap

C) Normal spoilage

D) Abnormal spoilage

A) Rework

B) Scrap

C) Normal spoilage

D) Abnormal spoilage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

68

In a normal costing system, the overhead allocation rate is calculated as

A) Estimated overhead cost / estimated quantity of allocation base

B) Estimated overhead cost / actual quantity of allocation base

C) Actual overhead cost / actual quantity of allocation base

D) Actual overhead cost / estimated quantity of allocation base

A) Estimated overhead cost / estimated quantity of allocation base

B) Estimated overhead cost / actual quantity of allocation base

C) Actual overhead cost / actual quantity of allocation base

D) Actual overhead cost / estimated quantity of allocation base

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

69

Jerry and Damien are partners in a house-painting business. Which of the following costs is subject to the least uncertainty for a specific painting job?

A) Cost of supervisory labour

B) Amortization on company vehicle

C) Cost of fuel used to drive to a specific job site

D) All of the preceding costs involve uncertainty

A) Cost of supervisory labour

B) Amortization on company vehicle

C) Cost of fuel used to drive to a specific job site

D) All of the preceding costs involve uncertainty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following statements regarding overhead allocation is true?

A) Actual job costs are almost always higher than estimated job costs

B) Actual job costs are almost always lower than estimated job costs

C) Actual job costs are almost always the same as estimated job costs

D) Actual job costs are almost always different from estimated job costs

A) Actual job costs are almost always higher than estimated job costs

B) Actual job costs are almost always lower than estimated job costs

C) Actual job costs are almost always the same as estimated job costs

D) Actual job costs are almost always different from estimated job costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

71

Managers use judgment in job costing systems to decide:

A) Whether to use any source documents

B) Which direct costs to trace to a job

C) Which indirect costs to trace to a job

D) Which fixed costs to trace to a job

A) Whether to use any source documents

B) Which direct costs to trace to a job

C) Which indirect costs to trace to a job

D) Which fixed costs to trace to a job

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

72

Abnormal spoilage is recorded in a Loss from Abnormal Spoilage account so that managers can:

A) Monitor abnormal spoilage problems

B) Hide them on the income statement

C) Minimize income taxes

D) Decide later which jobs to assign it to

A) Monitor abnormal spoilage problems

B) Hide them on the income statement

C) Minimize income taxes

D) Decide later which jobs to assign it to

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

73

In a normal costing system, an immaterial amount of overapplied overhead is allocated 100% to:

A) Work in process

B) Finished goods

C) Retained earnings

D) Cost of goods sold

A) Work in process

B) Finished goods

C) Retained earnings

D) Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

74

With respect to the uses and limitations of job costing information, accountants' responsibilities include:

A) Eliminating uncertainty

B) Educating managers about appropriate information use

C) Eliminating biases

D) Classifying fixed costs as variable whenever possible

A) Eliminating uncertainty

B) Educating managers about appropriate information use

C) Eliminating biases

D) Classifying fixed costs as variable whenever possible

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

75

Bits of direct material left over from normal manufacturing processes are called:

A) Scrap

B) Normal spoilage

C) Abnormal spoilage

D) Rework

A) Scrap

B) Normal spoilage

C) Abnormal spoilage

D) Rework

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following statements regarding the uses and limitations of job costing is true?

A) Job costs are measured accurately

B) The total job cost of an individual unit is an incremental cost, that is, it does not include average costs of any type

C) Developing information within job costing systems requires judgment

D) Job costing systems are not subject to uncertainties

A) Job costs are measured accurately

B) The total job cost of an individual unit is an incremental cost, that is, it does not include average costs of any type

C) Developing information within job costing systems requires judgment

D) Job costing systems are not subject to uncertainties

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

77

Job costing information can be used to:

I) Report inventory and cost of goods sold on financial statements

II) Estimate average costs for future jobs

III) Report the costs of marketing for a product

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

I) Report inventory and cost of goods sold on financial statements

II) Estimate average costs for future jobs

III) Report the costs of marketing for a product

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

78

If the cost of rework is tracked, it is recorded in the accounting system in the same manner as:

A) A period cost

B) Spoilage

C) Scrap

D) A deferred asset

A) A period cost

B) Spoilage

C) Scrap

D) A deferred asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

79

Units of product that are unacceptable and are either discarded or sold at a reduced price are called:

A) Scrap

B) Rework

C) Spoilage

D) Work in process

A) Scrap

B) Rework

C) Spoilage

D) Work in process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

80

Managers use estimates in job costing systems to:

I) Establish a bid for a job

II) Decide whether to accept a job

III) Monitor actual operations

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

I) Establish a bid for a job

II) Decide whether to accept a job

III) Monitor actual operations

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck