Deck 10: Long-Term Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

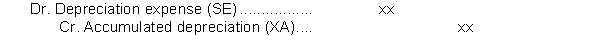

سؤال

سؤال

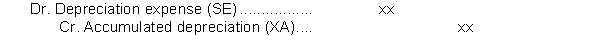

سؤال

سؤال

سؤال

سؤال

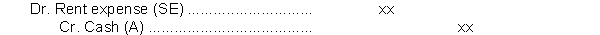

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/76

العب

ملء الشاشة (f)

Deck 10: Long-Term Liabilities

1

Companies must always accrue interest between the last loan payment date and the company's reporting date.

False

2

Companies are NOT required to disclose the details of their long-term loans in the notes to the financial statements.

True

3

The operating lease classification is considered the "default" classification.

False

4

The carrying value of a bond issued at a discount decreases over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

5

Restrictions placed on a company by the lender are also known as covenants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

6

Under a finance lease the liability is recorded as "obligation under finance lease".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

7

Non-financial covenants may include a requirement to have an annual audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

8

Off-balance sheet financing occurs only for finance leases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

9

There is an inverse relationship between the discount rate and the selling price of a bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

10

Debentures can be either senior or subordinated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

11

A finance lease allows a firm to report more expenses over the life of a lease than an operating lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

12

All bond covenants are recorded in an agreement called a debenture agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

13

Benefits that are NOT contingent upon an employee's continued employment are called vested benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

14

At the end of a finance lease the lessee will NEVER have the option to purchase the asset at less than the fair market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

15

A lease that runs eight years on an asset with a 12-year useful life may qualify as an operating lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

16

Post-employment benefits other than pensions are expensed on an accrual basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

17

An investment banker is usually hired to assist a company in issuing debt securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

18

A public offering is open to all investors including institutions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

19

Bank loan covenants only pertain to financial data such as ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

20

The interest rate paid on the bond is known as the effective rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

21

A defined benefit plan is similar to a defined contribution plan in that only employers contribute to the plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a bond is trading at 98 the

A) the interest expense is greater than the interest payment.

B) the interest expense is less than the interest payment.

C) the interest expense is equal to the interest payment.

D) the interest expense can not be determined.

A) the interest expense is greater than the interest payment.

B) the interest expense is less than the interest payment.

C) the interest expense is equal to the interest payment.

D) the interest expense can not be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

23

How would the Depreciation of a bond discount affect each of the following? Bond's Net Bond's

Carrying Value Interest Expense

A) increase decrease

B) increase increase

C) decrease increase

D) decrease decrease

Carrying Value Interest Expense

A) increase decrease

B) increase increase

C) decrease increase

D) decrease decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

24

Temporary differences between accounting and taxable income will eventually offset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

25

The proceeds from the sale of a bond are equal to

A) the face value of the bond.

B) the face value of the bond plus the present value of the interest to be paid.

C) the maturity value of the bond plus the interest to be paid.

D) the present value of the principal and interest to be paid.

A) the face value of the bond.

B) the face value of the bond plus the present value of the interest to be paid.

C) the maturity value of the bond plus the interest to be paid.

D) the present value of the principal and interest to be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

26

An actuary is only necessary when there is a dispute between contributions made and benefits expected to be received for a defined benefit plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a bond is trading at 103 the

A) the interest expense is greater than the interest payment.

B) the interest expense is less than the interest payment.

C) the interest expense is equal to the interest payment.

D) the interest expense can not be determined.

A) the interest expense is greater than the interest payment.

B) the interest expense is less than the interest payment.

C) the interest expense is equal to the interest payment.

D) the interest expense can not be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

28

A temporary difference is a difference between tax and accounting income that will not reverse in a future period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

29

Hybrid pension plans are also known as target benefit plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

30

A bond issue is a form of

A) equity financing.

B) debt financing.

C) collateral financing.

D) financing similar to an instalment loan.

A) equity financing.

B) debt financing.

C) collateral financing.

D) financing similar to an instalment loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

31

Pension funds are described as underfunded if the value of the pensions fund assets is less than the present value of the future pension obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

32

If a bond is issued at a discount, the coupon rate is

A) equal to the effective rate.

B) less than the effective rate.

C) greater than the effective rate.

D) not needed to determine the bond's sale price.

A) equal to the effective rate.

B) less than the effective rate.

C) greater than the effective rate.

D) not needed to determine the bond's sale price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

33

The two kinds of pension plans that are commonly used by employers are: defined obligation plans and defined contribution plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

34

All of the following are used to determine the bond premium or the bond discount EXCEPT for

A) market rate.

B) yield rate.

C) coupon rate.

D) capital rate.

A) market rate.

B) yield rate.

C) coupon rate.

D) capital rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

35

The calculation of future taxes is based on the temporary differences between book income and tax income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

36

Deferred income taxes represent amounts due to Canada Revenue Agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

37

The distinction between senior and subordinated debt is associated with

A) general debenture bonds.

B) mortgage bonds.

C) collateral trust bonds.

D) commercial bonds.

A) general debenture bonds.

B) mortgage bonds.

C) collateral trust bonds.

D) commercial bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

38

Restrictions placed on a company in their bond indenture agreement are known as

A) collateral.

B) bond indenture.

C) bond covenants.

D) agreements.

A) collateral.

B) bond indenture.

C) bond covenants.

D) agreements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

39

A deferred tax asset can be recognized when lower income taxes will expected in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a bond is issued at a premium, the coupon rate is

A) equal to the effective rate.

B) less than the effective rate.

C) greater than the effective rate.

D) not needed to determine the bond's sale price.

A) equal to the effective rate.

B) less than the effective rate.

C) greater than the effective rate.

D) not needed to determine the bond's sale price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is a reason a lessee would enter into an operating lease instead of buying an asset?

A) The risk of loss from obsolescence is reduced.

B) The company's ability to borrow increases due to larger assets.

C) The company can claim capital cost allowance.

D) The company benefits from the appreciation in value of the asset.

A) The risk of loss from obsolescence is reduced.

B) The company's ability to borrow increases due to larger assets.

C) The company can claim capital cost allowance.

D) The company benefits from the appreciation in value of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

42

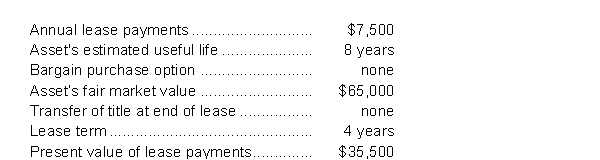

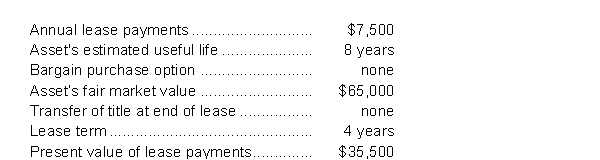

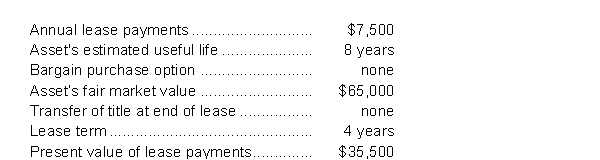

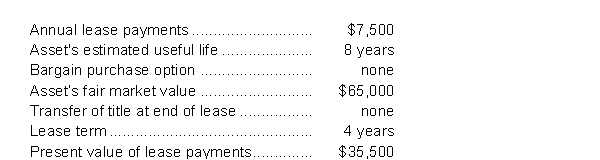

Use the following information to answer question

Canin Cranes Co. leased an asset under the following terms:

The lease should be classified by Canin Cranes Co. as a(n)

A) operating lease.

B) commercial lease.

C) leveraged lease.

D) finance lease.

Canin Cranes Co. leased an asset under the following terms:

The lease should be classified by Canin Cranes Co. as a(n)

A) operating lease.

B) commercial lease.

C) leveraged lease.

D) finance lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

43

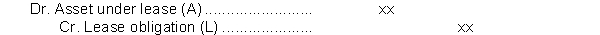

If a company made the following entry  what type of lease do they have?

what type of lease do they have?

A) capital lease

B) finance lease

C) operating lease

D) sales-type lease

what type of lease do they have?

what type of lease do they have?A) capital lease

B) finance lease

C) operating lease

D) sales-type lease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

44

DRM Corporation leased a piece of machinery and correctly classified and recorded it as a finance lease. At the date of signing, January 1, 2017, the asset and lease obligation were recorded for $42,000. The first lease payment of $8,200 was due December 31, 2017 and the interest rate they used in their calculations was 7%. The lease term was 10 years. Which of the following best describes what would be reported on AFC's Statement of Income for the year ending December 31, 2017?

A) $8,200 Lease Expense

B) $8,200 Lease Expense, $4,200 Depreciation Expense

C) $2,940 Interest Expense, $1,260 Depreciation Expense

D) $2,940 Interest Expense, $4,200 Depreciation Expense

A) $8,200 Lease Expense

B) $8,200 Lease Expense, $4,200 Depreciation Expense

C) $2,940 Interest Expense, $1,260 Depreciation Expense

D) $2,940 Interest Expense, $4,200 Depreciation Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

45

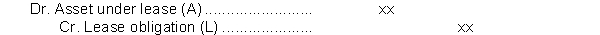

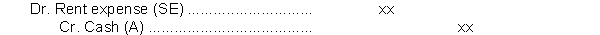

If the lessee makes the following entry  what type of lease do they have?

what type of lease do they have?

A) commercial lease

B) finance lease

C) operating lease

D) sales-type lease

what type of lease do they have?

what type of lease do they have?A) commercial lease

B) finance lease

C) operating lease

D) sales-type lease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

46

From the lessee's point of view, which type of lease means that its debt to equity ratio will not be affected?

A) operating lease

B) sales-type lease

C) leveraged lease

D) finance lease

A) operating lease

B) sales-type lease

C) leveraged lease

D) finance lease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

47

An operating lease will be reflected on the Statement of Financial Position of the lessee as

A) a current liability.

B) a non-current liability.

C) a non-current liability and a fixed asset.

D) nothing; it is not reflected on the Statement of Financial Position.

A) a current liability.

B) a non-current liability.

C) a non-current liability and a fixed asset.

D) nothing; it is not reflected on the Statement of Financial Position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

48

If a bond sells at a premium, the depreciation of the premium will

A) have no effect on periodic expense.

B) decrease periodic expense.

C) increase periodic interest expense.

D) make periodic interest expense equal to the periodic interest payment.

A) have no effect on periodic expense.

B) decrease periodic expense.

C) increase periodic interest expense.

D) make periodic interest expense equal to the periodic interest payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

49

If a company made the following journal entry  what type of lease do they have?

what type of lease do they have?

A) capital lease

B) finance lease

C) operating lease

D) sales-type lease

what type of lease do they have?

what type of lease do they have?A) capital lease

B) finance lease

C) operating lease

D) sales-type lease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is NOT a criterion for classifying a lease as a finance lease, from the lessee's point of view?

A) The lease payments are more frequent than annually.

B) Title to the lease passes to the lessee at the end of the lease.

C) The lease term is for a major portion of the asset's economic life.

D) Present value of the minimum lease payments is equal to substantially all of the FV of the asset.

A) The lease payments are more frequent than annually.

B) Title to the lease passes to the lessee at the end of the lease.

C) The lease term is for a major portion of the asset's economic life.

D) Present value of the minimum lease payments is equal to substantially all of the FV of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

51

Tough Tracks Inc. has leased an excavator for a 5-year period. The excavator has an estimated useful life of 15 years and a current market value of $125,000. At the end of the lease Tough Tracks can buy the asset for its market value at that time. How should Tough Tracks account for the lease?

A) as a finance lease because the market value of the asset is known

B) as a finance lease because they will own the asset at the end of the lease

C) as an operating lease because they might not purchase the asset at the end of the lease

D) as an operating lease because the lease is only for one-third of the estimated useful life

A) as a finance lease because the market value of the asset is known

B) as a finance lease because they will own the asset at the end of the lease

C) as an operating lease because they might not purchase the asset at the end of the lease

D) as an operating lease because the lease is only for one-third of the estimated useful life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following statements about defined benefit pension plans is true?

A) The expense is equal to the contribution amounts in a period.

B) The contributions to the fund are equal to the benefits paid in a period.

C) The expense is equal to the present value of the future benefit obligations incurred that period.

D) The amount of benefits the employee will receive depends on the performance of the pension plan.

A) The expense is equal to the contribution amounts in a period.

B) The contributions to the fund are equal to the benefits paid in a period.

C) The expense is equal to the present value of the future benefit obligations incurred that period.

D) The amount of benefits the employee will receive depends on the performance of the pension plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

53

If the assets in the pension fund exceed the present value of future pension obligations, the pension fund is described as

A) fully funded.

B) underfunded.

C) partially funded

D) overfunded.

A) fully funded.

B) underfunded.

C) partially funded

D) overfunded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

54

A pension plan that pays employees benefits upon retirement based on how well the investments in the pension plan perform is called a

A) defined contribution plan.

B) defined performance plan.

C) defined benefit plan.

D) defined investment plan.

A) defined contribution plan.

B) defined performance plan.

C) defined benefit plan.

D) defined investment plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

55

The entry made when cash is set aside to pay for future pension benefits is called a(n)

A) funding entry.

B) adjusting entry.

C) accrual entry.

D) reclassification entry.

A) funding entry.

B) adjusting entry.

C) accrual entry.

D) reclassification entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

56

Vested benefits in a pension plan

A) belong to an employee even if they leave the firm.

B) are paid to an employee if they leave the firm.

C) revert to the company if an employee leaves the firm.

D) are paid to an employee in the year of vesting.

A) belong to an employee even if they leave the firm.

B) are paid to an employee if they leave the firm.

C) revert to the company if an employee leaves the firm.

D) are paid to an employee in the year of vesting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements concerning pensions is correct?

A) Defined benefit plans offer a retiree more security than defined contribution plans.

B) The accounting for a defined contribution plan is more complex than for a defined benefit plan.

C) Pension funding must always equal the pension expense.

D) The employee will forfeit vested pension contributions if he/she is terminated.

A) Defined benefit plans offer a retiree more security than defined contribution plans.

B) The accounting for a defined contribution plan is more complex than for a defined benefit plan.

C) Pension funding must always equal the pension expense.

D) The employee will forfeit vested pension contributions if he/she is terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following information to answer question

Canin Cranes Co. leased an asset under the following terms:

Assume Canin Cranes decides to account for the lease as a finance lease. The lessee's entry to record the leased asset and lease acquired would include a

A) debit to asset under lease for $35,500.

B) debit to asset under lease for $40,000.

C) credit to obligation under finance lease for $7,500.

D) credit to lease payable for $7,500.

Canin Cranes Co. leased an asset under the following terms:

Assume Canin Cranes decides to account for the lease as a finance lease. The lessee's entry to record the leased asset and lease acquired would include a

A) debit to asset under lease for $35,500.

B) debit to asset under lease for $40,000.

C) credit to obligation under finance lease for $7,500.

D) credit to lease payable for $7,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

59

From the lessee's perspective, a finance lease results in all of the following EXCEPT

A) recognition of an asset on the Statement of Financial Position.

B) recognition of a liability on the Statement of Financial Position.

C) recognition of interest expense on the Statement of Income.

D) recognition of rent expense on the Statement of Income.

A) recognition of an asset on the Statement of Financial Position.

B) recognition of a liability on the Statement of Financial Position.

C) recognition of interest expense on the Statement of Income.

D) recognition of rent expense on the Statement of Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

60

From the lessee's point of view, a lease qualifies as a finance lease if it contains which one of the following?

A) The lease term is for a major part of the asset's economic life.

B) Title to the lease remains with the lessor.

C) The lease does not contain a bargain purchase option.

D) The present value of the minimum lease payments represents all of the asset's fair market value.

A) The lease term is for a major part of the asset's economic life.

B) Title to the lease remains with the lessor.

C) The lease does not contain a bargain purchase option.

D) The present value of the minimum lease payments represents all of the asset's fair market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

61

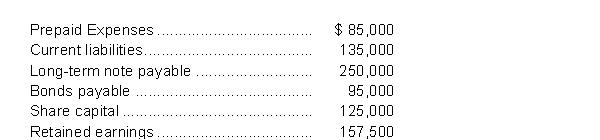

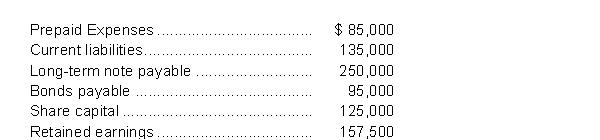

Wahi Limited reported the following items on their Statement of Financial Position:  The debt to equity ratio for Wahi is closest to

The debt to equity ratio for Wahi is closest to

A) 2.0.

B) 1.7.

C) 1.22.

D) 0.88.

The debt to equity ratio for Wahi is closest to

The debt to equity ratio for Wahi is closest toA) 2.0.

B) 1.7.

C) 1.22.

D) 0.88.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

62

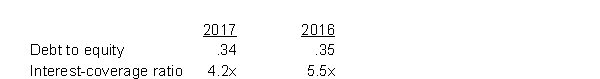

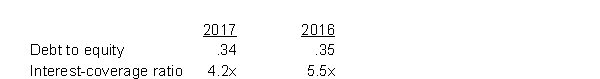

The debt to equity ratio and interest coverage ratio for Lopez Corporation for the last two years are as follows:  Which of the following conclusions could be made about Lopez Corporation?

Which of the following conclusions could be made about Lopez Corporation?

A) The company is less able to pay its interest costs in 2017.

B) The company is better able to pay its interest costs in 2017.

C) The company has more debt outstanding in 2017.

D) The company is less risky in 2017.

Which of the following conclusions could be made about Lopez Corporation?

Which of the following conclusions could be made about Lopez Corporation?A) The company is less able to pay its interest costs in 2017.

B) The company is better able to pay its interest costs in 2017.

C) The company has more debt outstanding in 2017.

D) The company is less risky in 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

63

How should a contingent liability that has a likely chance of occurring and can be reasonably estimated be disclosed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

64

The journal entry to record income taxes owing is

A) Dr. Income Taxes Receivable, Cr. Income Tax Revenue.

B) Dr. Income Tax Expense, Cr. CRA Payable.

C) Dr. Income Tax Expense, Cr. Deferred Tax Liability.

D) Dr. Income Tax Payable, Cr. Cash.

A) Dr. Income Taxes Receivable, Cr. Income Tax Revenue.

B) Dr. Income Tax Expense, Cr. CRA Payable.

C) Dr. Income Tax Expense, Cr. Deferred Tax Liability.

D) Dr. Income Tax Payable, Cr. Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

65

When the occurrence of a liability is dependent on the outcome of some future event, the liability is referred to as a(n)

A) contingent liability.

B) commitment.

C) accrued liability.

D) accounts payable.

A) contingent liability.

B) commitment.

C) accrued liability.

D) accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

66

A debt to equity ratio of 50% indicates that

A) half of the company's assets are financed through equity.

B) 50% of the company's interest expense comes from long-term debt financing.

C) the company is close to bankruptcy.

D) the company spends 50% of its operating earnings on interest.

A) half of the company's assets are financed through equity.

B) 50% of the company's interest expense comes from long-term debt financing.

C) the company is close to bankruptcy.

D) the company spends 50% of its operating earnings on interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

67

How should a contingent liability that has an unlikely chance of occurring and is insignificant in size be disclosed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following contingent losses would require footnote disclosure only?

A) a likely loss with an amount that can be reasonably estimated

B) a likely loss of a known amount

C) an unlikely loss

D) a likely loss with an amount that cannot be reasonably estimated

A) a likely loss with an amount that can be reasonably estimated

B) a likely loss of a known amount

C) an unlikely loss

D) a likely loss with an amount that cannot be reasonably estimated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

69

In which of the following situations would a contingent loss be recognized?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

70

How should a contingent liability that has a likely chance of occurring but the amount of the loss cannot be reasonably estimated be disclosed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

71

All of the following transactions lead to temporary timing differences EXCEPT

A) the use of straight-line depreciation of accounting purposes.

B) the use of estimated warranty costs for calculating warranty expense.

C) the recognition of dividend income for dividends received from another Canadian company.

D) all of the above lead to temporary timing differences.

A) the use of straight-line depreciation of accounting purposes.

B) the use of estimated warranty costs for calculating warranty expense.

C) the recognition of dividend income for dividends received from another Canadian company.

D) all of the above lead to temporary timing differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

72

A pension plan that pays employees benefits upon retirement based on their length of service and salary is called a

A) defined contribution plan.

B) defined service plan

C) defined benefit plan.

D) defined performance plan.

A) defined contribution plan.

B) defined service plan

C) defined benefit plan.

D) defined performance plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following would best describe a contingent liability?

A) An obligation to transfer services instead of cash to settle a liability

B) an obligation where the costs will be covered by insurance

C) an obligation with a high degree of uncertainty about the amount or timing of the payment

D) an obligation with a low degree of uncertainty about the amount or timing of the payment

A) An obligation to transfer services instead of cash to settle a liability

B) an obligation where the costs will be covered by insurance

C) an obligation with a high degree of uncertainty about the amount or timing of the payment

D) an obligation with a low degree of uncertainty about the amount or timing of the payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

74

A deferred income tax asset is created when the difference will result in

A) higher income taxes in the future.

B) no income taxes in the future.

C) lower income taxes in the future.

D) none of the above.

A) higher income taxes in the future.

B) no income taxes in the future.

C) lower income taxes in the future.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

75

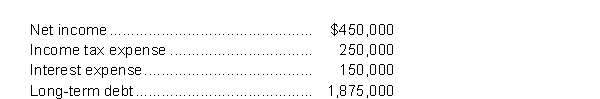

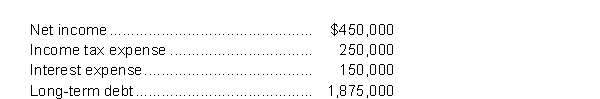

The following information is from the financial statements of Duff Inc.:  The interest coverage ratio for Duff would be closest to

The interest coverage ratio for Duff would be closest to

A) 3 times.

B) 4.7 times.

C) 5.7 times.

D) 8 times.

The interest coverage ratio for Duff would be closest to

The interest coverage ratio for Duff would be closest toA) 3 times.

B) 4.7 times.

C) 5.7 times.

D) 8 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

76

The interest coverage ratio is calculated as

A) (net income - taxes - interest) ÷ interest

B) (net income + taxes - interest) ÷ interest

C) (net income + interest) ÷ interest

D) (net income + taxes + interest) ÷ interest

A) (net income - taxes - interest) ÷ interest

B) (net income + taxes - interest) ÷ interest

C) (net income + interest) ÷ interest

D) (net income + taxes + interest) ÷ interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck