Deck 2: Nalyzing Transaction and Their Effect on Financial Statement

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

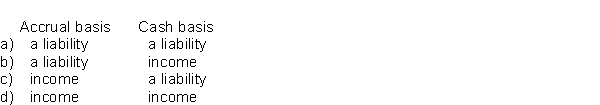

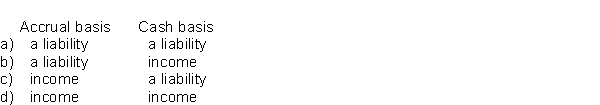

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/53

العب

ملء الشاشة (f)

Deck 2: Nalyzing Transaction and Their Effect on Financial Statement

1

Information has predictive value if it provides feedback to users on their previous assessments of the company.

False

2

Dividends are an expense of doing business.

False

3

The objective of both IFRS and ASPE is to allow financial reporting that is useful to the financial statement users.

True

4

Information is considered to be material if it would impact the decisions of a financial statement user.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

5

Straight-line depreciation = (cost + residual value) ÷ estimated useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

6

The return on assets = net income ÷ average total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

7

Public companies are prohibited from being cross listed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

8

Relevance, faithful representation and cost constraint are examples of the fundamental qualitative characteristics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

9

Accumulated depreciation is deducted when calculating net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Classified Statement of Financial Position distinguishes between current and non current assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

11

A significant limitation of the template method is the lack of specific retained earnings and dividends declared accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

12

The sales of merchandise on credit will cause the retained earnings and long term liabilities accounts to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

13

The template method can only be used by large companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

14

The issuance of common shares with a value of $9,000 to purchase land will increase the common share account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

15

The purchase of equipment costing $19,500 for $1,500 down and the balance on account will increase both sides of the Statement of Financial Position Statement of Financial Position equation by $18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

16

All public companies must follow IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

17

The purchase of a three-year insurance policy should be reflected on the Statement of Financial Position under current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

18

Revenue recognition criteria are necessary to determine when to recognize revenue when using both accrual and cash accounting methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

19

NBV of an asset is the cost of the asset that has already been expensed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

20

A declaration of dividends results in an increase in liabilities and a decrease in shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

21

A piece of equipment was recently purchased for $10,600 on June 30. It is estimated that it will last for 10 years and have a residual value of $400. The depreciation expense to be recognized in the year of acquisition, assuming a December year-end, would be

A) $1,020.00.

B) $510.00.

C) $318.75.

D) $637.50.

A) $1,020.00.

B) $510.00.

C) $318.75.

D) $637.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

22

Cost of goods sold should be matched up with the revenue generated on each year's Statement of Income because of the

A) revenue recognition criteria.

B) cash basis of accounting.

C) actual basis of accounting.

D) accrual basis of accounting.

A) revenue recognition criteria.

B) cash basis of accounting.

C) actual basis of accounting.

D) accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

23

A company sold available for resale inventory for cash. What is the effect of this sale?

A) increase in revenue, increase in COGS, decrease in inventory

B) increase in revenue, decrease in COGS, increase in inventory

C) increase in revenue, increase in COGS, increase in inventory

D) increase in revenue, decrease in COGS, decrease in inventory

A) increase in revenue, increase in COGS, decrease in inventory

B) increase in revenue, decrease in COGS, increase in inventory

C) increase in revenue, increase in COGS, increase in inventory

D) increase in revenue, decrease in COGS, decrease in inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

24

Use the following information for questions 27-28.

During a recent week, Emmy's Consulting received $25,000 cash from clients for services performed with a total value of $75,000. The balance is to be received within 30 days.

The effect on the Statement of Financial Position equation for this transaction would be

A) + $25,000 cash = - $50,000 accounts payable + $75,000 retained earnings.

B) + $25,000 cash - $50,000 accounts receivable = $75,000 retained earnings.

C) + $25,000 cash + $50,000 accounts receivable = + $75,000 retained earnings.

D) + $25,000 cash = + $25,000 retained earnings.

During a recent week, Emmy's Consulting received $25,000 cash from clients for services performed with a total value of $75,000. The balance is to be received within 30 days.

The effect on the Statement of Financial Position equation for this transaction would be

A) + $25,000 cash = - $50,000 accounts payable + $75,000 retained earnings.

B) + $25,000 cash - $50,000 accounts receivable = $75,000 retained earnings.

C) + $25,000 cash + $50,000 accounts receivable = + $75,000 retained earnings.

D) + $25,000 cash = + $25,000 retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

25

The profit margin ratio = sales ÷ net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following enhancing characteristics is achieved if a third party, with sufficient understanding, would arrive at a similar result to that used by the company?

A) comparability

B) understandability

C) timeliness

D) verifiability

A) comparability

B) understandability

C) timeliness

D) verifiability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

27

A new company signed a lease for office space during their first month of business. At that time they paid a total of $12,000 for first and last months' rent. At the end of the first month, the effect on the financial statements would be

A) $12,000 rent expense.

B) $6,000 rent expense and $6,000 prepaid rent on the Statement of Financial Position.

C) $12,000 prepaid rent on the Statement of Financial Position.

D) Nothing recorded because the company has not made any sales yet.

A) $12,000 rent expense.

B) $6,000 rent expense and $6,000 prepaid rent on the Statement of Financial Position.

C) $12,000 prepaid rent on the Statement of Financial Position.

D) Nothing recorded because the company has not made any sales yet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

28

On July 1, 2017 Albacore Company paid $5,200 for a 1-year insurance policy. To record this transaction Albacore Company should

A) decrease cash and increase insurance expense.

B) decrease cash and increase prepaid insurance.

C) increase accounts payable and increase insurance expense.

D) increase cash and increase prepaid insurance.

A) decrease cash and increase insurance expense.

B) decrease cash and increase prepaid insurance.

C) increase accounts payable and increase insurance expense.

D) increase cash and increase prepaid insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a vehicle was purchased for $6,500 and has a residual value of $500, the annual depreciation expense will be $1,000 if the estimated useful life is

A) 6 years.

B) 6.5 years.

C) 7 years.

D) 13 years.

A) 6 years.

B) 6.5 years.

C) 7 years.

D) 13 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

30

The asset that results when a customer buys goods or services on credit is

A) Accounts receivable.

B) Accounts payable.

C) Notes receivable.

D) Cash.

A) Accounts receivable.

B) Accounts payable.

C) Notes receivable.

D) Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

31

How is cash invested by shareholders in exchange for shares initially recorded in the accounting records?

A) as an increase in retained earnings, and an increase in cash

B) as an increase in long-term investments, and a decrease in cash

C) as an increase in common shares, and a decrease in cash

D) as an increase in common shares, and an increase in cash

A) as an increase in retained earnings, and an increase in cash

B) as an increase in long-term investments, and a decrease in cash

C) as an increase in common shares, and a decrease in cash

D) as an increase in common shares, and an increase in cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

32

On Oct. 1, 2017 Bonita, Inc. signed a 1-year $75,000 note payable from First National Bank. The loan plus 6% interest is to be repaid on Sept. 30, 2018. Bonita's year-end is December 31. In its 2017 financial statements Bonita will record interest expense of

A) $375.

B) $1,125.

C) $4,500.

D) $75,000.

A) $375.

B) $1,125.

C) $4,500.

D) $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

33

Information that has been determined based on the best information available using the correct process and with an adequate explanation provided is an example of which fundamental characteristic?

A) neutral

B) free from bias

C) timeliness

D) verifiability

A) neutral

B) free from bias

C) timeliness

D) verifiability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

34

All of the following are examples of enhancing qualitative characteristics EXCEPT

A) verifiability.

B) understandability.

C) neutrality.

D) timeliness.

A) verifiability.

B) understandability.

C) neutrality.

D) timeliness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

35

The following costs are initially expressed as assets but are then reclassified as expenses when they are used up, EXCEPT for the following:

A) inventory.

B) prepaid insurance.

C) prepaid rent.

D) short term investments.

A) inventory.

B) prepaid insurance.

C) prepaid rent.

D) short term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company paid $22,000 for goods it had purchased last month for resale. What is the effect of the payment?

A) a decrease in inventory

B) a decrease in accounts payable

C) an increase in cost of goods sold

D) an increase in inventory

A) a decrease in inventory

B) a decrease in accounts payable

C) an increase in cost of goods sold

D) an increase in inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

37

The asset that results from the payment of expenses in advance is

A) Accounts receivable.

B) Short term investments.

C) Inventory.

D) Prepaids.

A) Accounts receivable.

B) Short term investments.

C) Inventory.

D) Prepaids.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

38

When $10,000 of inventory is purchased with a six-month note payable bearing 4% interest, the inventory has a total cost of

A) $10,400.

B) $10,000.

C) $10,200.

D) $9,800.

A) $10,400.

B) $10,000.

C) $10,200.

D) $9,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

39

A company received a $6,500 deposit from a customer for goods to be delivered the following month. Under the accrual and cash basis of accounting respectively, the deposit would be recorded as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following information for questions 27-28.

During a recent week, Emmy's Consulting received $25,000 cash from clients for services performed with a total value of $75,000. The balance is to be received within 30 days.

The effect of this transaction in the accounting records would be

A) + $75,000 revenue = + $25,000 cash + $50,000 accounts receivable.

B) + $50,000 net income = + $50,000 assets.

C) + $25,000 revenue = + $25,000 cash.

D) + $75,000 revenue = + $75,000 accounts receivable.

During a recent week, Emmy's Consulting received $25,000 cash from clients for services performed with a total value of $75,000. The balance is to be received within 30 days.

The effect of this transaction in the accounting records would be

A) + $75,000 revenue = + $25,000 cash + $50,000 accounts receivable.

B) + $50,000 net income = + $50,000 assets.

C) + $25,000 revenue = + $25,000 cash.

D) + $75,000 revenue = + $75,000 accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following transactions would decrease the cash from operating activities?

A) the payment of dividends

B) the sale of goods on account

C) the purchase of goods on account

D) the payment of wages

A) the payment of dividends

B) the sale of goods on account

C) the purchase of goods on account

D) the payment of wages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following assets is NEVER expensed on the Statement of Income?

A) land

B) building

C) inventory

D) equipment

A) land

B) building

C) inventory

D) equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

43

How are goods purchased for sale at a later date recorded in the financial statements?

A) as inventory

B) as prepaid expenses

C) as cost of goods sold

D) as operating expenses

A) as inventory

B) as prepaid expenses

C) as cost of goods sold

D) as operating expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following would be the most useful in determining if a company has sufficient resources to continue operations in the short-term?

A) the profit margin ratio

B) the return on assets ratio

C) the cash from operating activities

D) the cash from financing activities

A) the profit margin ratio

B) the return on assets ratio

C) the cash from operating activities

D) the cash from financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

45

When the board of directors declares a $500 dividend, which of the following would be included in recording the transaction?

A) increase in Retained Earnings, increase in Dividends Declared

B) decrease in Cash, decrease in Dividends Payable

C) increase in Dividends Declared, increase in Dividends Payable

D) decrease in Dividends Payable, increase in Cash

A) increase in Retained Earnings, increase in Dividends Declared

B) decrease in Cash, decrease in Dividends Payable

C) increase in Dividends Declared, increase in Dividends Payable

D) decrease in Dividends Payable, increase in Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

46

The purchase of land for a combination of cash and issuance of shares would require which of the following?

A) increase in Land, increase in Common shares, increase in Cash

B) increase in Cash, decrease in Common shares, decrease in Land

C) increase in Land, increase in Common shares

D) increase in Land, increase in Common shares, decrease in Cash

A) increase in Land, increase in Common shares, increase in Cash

B) increase in Cash, decrease in Common shares, decrease in Land

C) increase in Land, increase in Common shares

D) increase in Land, increase in Common shares, decrease in Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following will NOT appear on the Statement of Income?

A) depreciation

B) interest

C) cost of goods sold

D) dividends

A) depreciation

B) interest

C) cost of goods sold

D) dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the company had a loan outstanding, which of the following would be used to record accrued interest at the end of the accounting period?

A) increase Interest Expense, decrease Cash

B) increase Interest Expense, increase Interest Payable

C) decrease Interest Payable, increase Interest Income

D) decrease Interest Payable, decrease Cash

A) increase Interest Expense, decrease Cash

B) increase Interest Expense, increase Interest Payable

C) decrease Interest Payable, increase Interest Income

D) decrease Interest Payable, decrease Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following would be the effect of a transaction to expense prepaid rent for the period?

A) increase Prepaid Rent, decrease Rent Expense

B) increase Rent Expense, decrease Cash

C) increase Prepaid Rent, decrease Cash

D) increase Rent Expense, decrease Prepaid Rent

A) increase Prepaid Rent, decrease Rent Expense

B) increase Rent Expense, decrease Cash

C) increase Prepaid Rent, decrease Cash

D) increase Rent Expense, decrease Prepaid Rent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

50

The accounting basis that attempts to measure performance in the period in which it occurred is the

A) approval basis.

B) cash basis.

C) matching basis.

D) accrual basis.

A) approval basis.

B) cash basis.

C) matching basis.

D) accrual basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

51

The sale of merchandise to a customer partly for cash and partly on account would require which of the following?

A) increase in Accounts receivable, increase in Cash, increase in Sales revenue

B) increase in Cash, decrease in Accounts payable, increase in Sales revenue

C) increase in Cash, increase in Sales revenue

D) decrease in Accounts payable, increase in Accounts receivable, increase in Sales revenue

A) increase in Accounts receivable, increase in Cash, increase in Sales revenue

B) increase in Cash, decrease in Accounts payable, increase in Sales revenue

C) increase in Cash, increase in Sales revenue

D) decrease in Accounts payable, increase in Accounts receivable, increase in Sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following expenses has NO effect on the cash flow of a firm?

A) salaries expense

B) interest expense

C) depreciation expense

D) cost of goods sold

A) salaries expense

B) interest expense

C) depreciation expense

D) cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

53

If dividends are declared and paid in the same accounting period, what is the net effect on the accounting equation?

A) a decrease in retained earnings and an increase in expenses

B) a decrease in cash and an increase expenses

C) a decrease in cash and an increase in retained earnings

D) a decrease in cash and a decrease in retained earnings

A) a decrease in retained earnings and an increase in expenses

B) a decrease in cash and an increase expenses

C) a decrease in cash and an increase in retained earnings

D) a decrease in cash and a decrease in retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck