Deck 13: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/168

العب

ملء الشاشة (f)

Deck 13: Financial Statement Analysis

1

Which of the following considerations is most important for a stockholder when evaluating whether to purchase stock in a company?

A)Will earnings per share be distributed to stockholders?

B)Will the company earn a fair return on the amount invested by the stockholders?

C)Will the key ratios be reported on the balance sheet?

D)Will cash flows from operations exceed the amount of net income for the period?

A)Will earnings per share be distributed to stockholders?

B)Will the company earn a fair return on the amount invested by the stockholders?

C)Will the key ratios be reported on the balance sheet?

D)Will cash flows from operations exceed the amount of net income for the period?

B

2

Trend analysis is analysis

A)of dollar changes and percentage changes over several years.

B)in which all items are presented as a percentage of one selected item on a financial statement.

C)in which a statistic is calculated for the relationship between two items on a single financial statement or for two items on different financial statements.

D)of all ratios that increased or decreased over past accounting periods.

A)of dollar changes and percentage changes over several years.

B)in which all items are presented as a percentage of one selected item on a financial statement.

C)in which a statistic is calculated for the relationship between two items on a single financial statement or for two items on different financial statements.

D)of all ratios that increased or decreased over past accounting periods.

A

3

Which of the following statements is true regarding valuation amounts on the balance sheet?

A)Stockholders' equity reflects the amount the stockholders would receive upon liquidation.

B)Assets are recorded at current cost.

C)Stockholders' equity reflects the current market value of the stock

D)There are a variety of assumptions used in determining amounts reported on the balance sheet.

A)Stockholders' equity reflects the amount the stockholders would receive upon liquidation.

B)Assets are recorded at current cost.

C)Stockholders' equity reflects the current market value of the stock

D)There are a variety of assumptions used in determining amounts reported on the balance sheet.

D

4

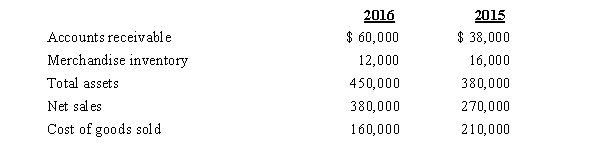

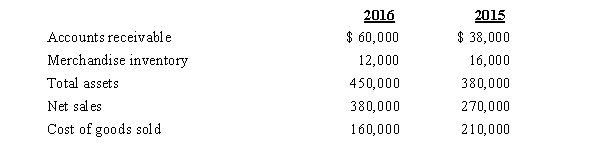

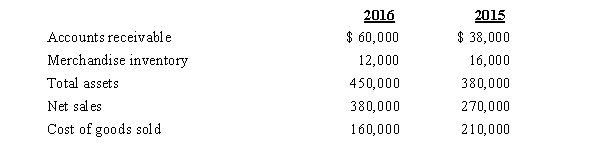

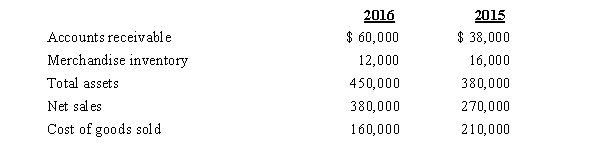

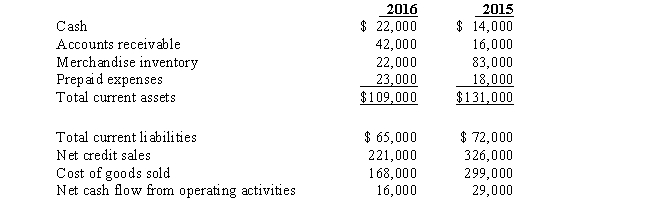

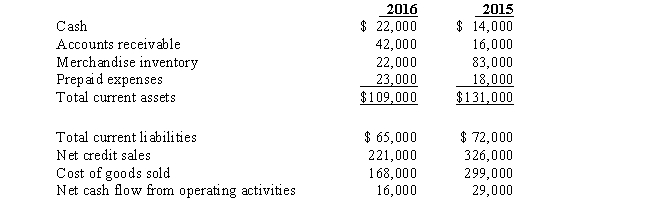

Sunshine Farm Supply

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following would result from a horizontal analysis of its balance sheet?

A)Accounts receivable increased $22,000 or 57.9% during 2016.

B)Accounts receivable is five times larger than Merchandise inventory in 2016.

C)Accounts receivable is 13.3% of total assets for 2016.

D)Merchandise inventory is 2.7% of total assets for 2016.

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following would result from a horizontal analysis of its balance sheet?

A)Accounts receivable increased $22,000 or 57.9% during 2016.

B)Accounts receivable is five times larger than Merchandise inventory in 2016.

C)Accounts receivable is 13.3% of total assets for 2016.

D)Merchandise inventory is 2.7% of total assets for 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

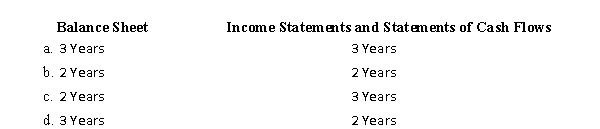

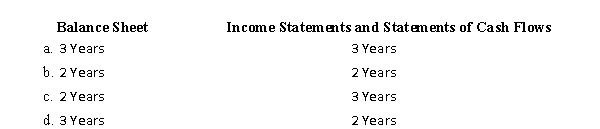

5

What is the minimum number of years for which publicly traded companies must include the following statements in their annual report filed with the SEC?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

6

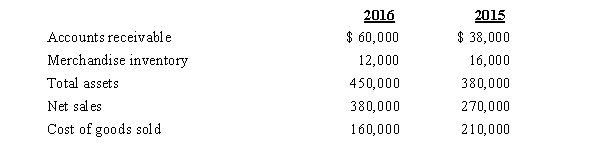

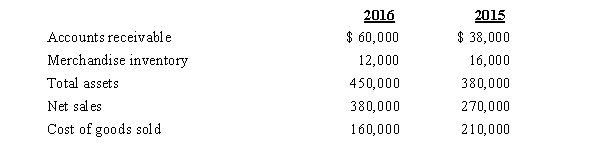

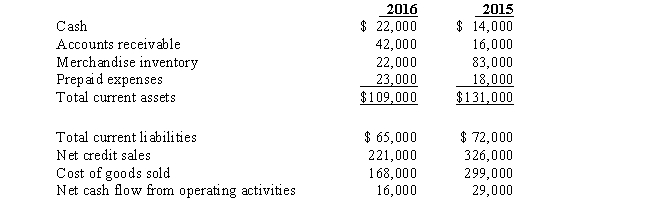

Sunshine Farm Supply

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following would not result from a vertical analysis of its balance sheet?

A)Accounts receivable increased $22,000 or 36.7% during 2016.

B)Accounts receivable is five times larger than Merchandise inventory in 2016.

C)Accounts receivable is 13.3% of total assets for 2016.

D)Merchandise inventory is 2.7% of total assets for 2016.

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following would not result from a vertical analysis of its balance sheet?

A)Accounts receivable increased $22,000 or 36.7% during 2016.

B)Accounts receivable is five times larger than Merchandise inventory in 2016.

C)Accounts receivable is 13.3% of total assets for 2016.

D)Merchandise inventory is 2.7% of total assets for 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

7

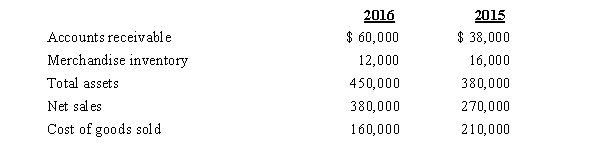

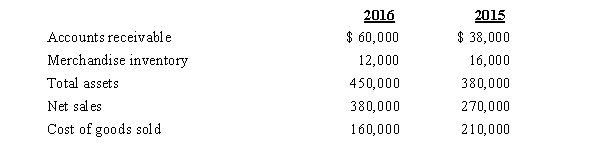

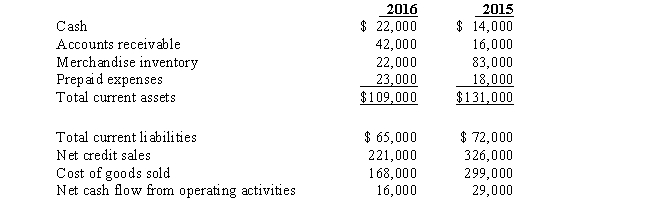

Sunshine Farm Supply

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following would result from a horizontal analysis of its income statement?

A)Cost of goods sold is 45.5% of net sales for 2016.

B)Gross profit is 42.1% of net sales for 2016.

C)Cost of goods sold decreased $50,000 or 23.8% during 2016.

D)Accounts receivable total 13.3% of total assets for 2016.

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following would result from a horizontal analysis of its income statement?

A)Cost of goods sold is 45.5% of net sales for 2016.

B)Gross profit is 42.1% of net sales for 2016.

C)Cost of goods sold decreased $50,000 or 23.8% during 2016.

D)Accounts receivable total 13.3% of total assets for 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a vertical analysis of the income statement, the 100% amount is

A)Net income

B)Gross profit

C)Operating income

D)Net sales

A)Net income

B)Gross profit

C)Operating income

D)Net sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is least useful in evaluating a company's financial statements?

A)Comparison with government economic data for the economy as a whole

B)Comparison with other companies in the same industry

C)Comparison of the company's current period data with accounting data from 5 years ago

D)Comparison of the company's current period data with that of the last year

A)Comparison with government economic data for the economy as a whole

B)Comparison with other companies in the same industry

C)Comparison of the company's current period data with accounting data from 5 years ago

D)Comparison of the company's current period data with that of the last year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

10

Horizontal analysis is analysis

A)of dollar changes and percentage changes over two or more years.

B)in which all items are presented as a percentage of one selected item on a financial statement.

C)in which a statistic is calculated for the relationship between two items on a single financial statement or for two items on different financial statements

D)of all ratios that increased or decreased over past accounting periods.

A)of dollar changes and percentage changes over two or more years.

B)in which all items are presented as a percentage of one selected item on a financial statement.

C)in which a statistic is calculated for the relationship between two items on a single financial statement or for two items on different financial statements

D)of all ratios that increased or decreased over past accounting periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is the most serious limitation to financial statement analysis of publicly traded companies?

A)Some companies do not use GAAP.

B)Inflation can distort comparisons between years.

C)Some companies report nonoperating items such as extraordinary gains and losses, while others do not.

D)Different industries use different account names.

A)Some companies do not use GAAP.

B)Inflation can distort comparisons between years.

C)Some companies report nonoperating items such as extraordinary gains and losses, while others do not.

D)Different industries use different account names.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

12

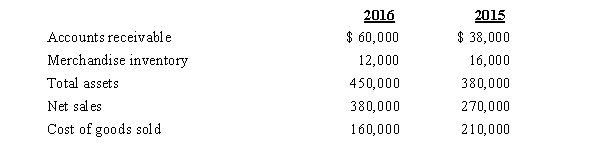

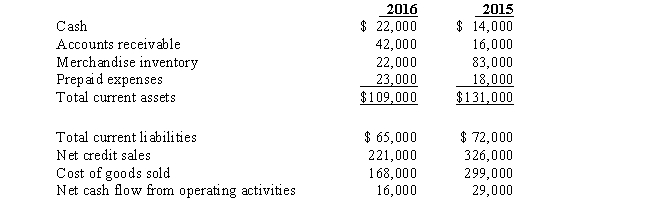

Sunshine Farm Supply

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following would result from a vertical analysis of its income statement?

A)Accounts receivable increased $22,000 or 57.9% during 2016.

B)Gross profit is 57.9% of net sales for 2016.

C)Cost of goods sold increased $50,000 or 23.8% during 2016.

D)Net sales increased $110,000 or 28.9% during 2016.

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following would result from a vertical analysis of its income statement?

A)Accounts receivable increased $22,000 or 57.9% during 2016.

B)Gross profit is 57.9% of net sales for 2016.

C)Cost of goods sold increased $50,000 or 23.8% during 2016.

D)Net sales increased $110,000 or 28.9% during 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

13

The calculations for some profitability ratios are the same as the calculations for common-size analysis of the income statement.Which of the following profitability ratios would also be determined through a common-size analysis of the income statement?

A)gross profit ratio

B)debt-to-equity ratio

C)acid-test ratio

D)earnings per share

A)gross profit ratio

B)debt-to-equity ratio

C)acid-test ratio

D)earnings per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

14

The dollar change and percentage change in the accounts receivable account from 2013 to 2014 is calculated for Allison Corporation.This is an example of

A)horizontal analysis

B)vertical analysis

C)profitability analysis

D)solvency assessment

A)horizontal analysis

B)vertical analysis

C)profitability analysis

D)solvency assessment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

15

A financial analyst is comparing two companies.Which of the following would cause major problems in the evaluation process?

A)One company has a fiscal year that ends on October 31, while the other company has a fiscal year that ends on August 31.

B)One company reported nonoperating activities, while the other company did not.

C)The companies operate in different industries.

D)Inflation has been low for the past several years.

A)One company has a fiscal year that ends on October 31, while the other company has a fiscal year that ends on August 31.

B)One company reported nonoperating activities, while the other company did not.

C)The companies operate in different industries.

D)Inflation has been low for the past several years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

16

A banker is analyzing a company which operates in the petroleum industry.Which of the following might be a major consideration in determining whether the company should receive a loan?

A)The petroleum industry suffers from political pressures concerning the selling price of its products.

B)Inflation has been high for several years in a row.

C)All companies in the petroleum industry use the same accounting principles.

D)The company has a large amount of interest payments related to many outstanding loans.

A)The petroleum industry suffers from political pressures concerning the selling price of its products.

B)Inflation has been high for several years in a row.

C)All companies in the petroleum industry use the same accounting principles.

D)The company has a large amount of interest payments related to many outstanding loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements is true regarding vertical analysis?

A)Common-size financial statements can be used to compare businesses of different sizes.

B)Vertical analysis can only be used with balance sheet accounts.

C)Vertical analysis can only be used with income statement accounts.

D)Vertical analysis can only be used with retained earnings accounts.

A)Common-size financial statements can be used to compare businesses of different sizes.

B)Vertical analysis can only be used with balance sheet accounts.

C)Vertical analysis can only be used with income statement accounts.

D)Vertical analysis can only be used with retained earnings accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

18

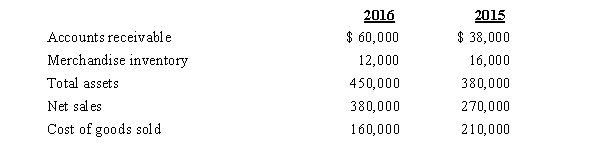

Sunshine Farm Supply

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following results would be found through a vertical analysis of the balance sheet or the income statement of Sunshine Farm Supply?

A)Accounts receivable increased $22,000 during 2016.

B)Total assets increased $70,000 during 2016.

C)Cost of goods sold increased $50,000 or 23.8% during 2016.

D)Gross profit is 57.9% of net sales for 2016.

Following are selected data from the financial statements of Sunshine Farm Supply:

Refer to the data for Sunshine Farm Supply.

Which of the following results would be found through a vertical analysis of the balance sheet or the income statement of Sunshine Farm Supply?

A)Accounts receivable increased $22,000 during 2016.

B)Total assets increased $70,000 during 2016.

C)Cost of goods sold increased $50,000 or 23.8% during 2016.

D)Gross profit is 57.9% of net sales for 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

19

To review the current market price of the stock, one should review the

A)balance sheet.

B)income statement.

C)statement of cash flows.

D)none of these; it is not on the financial statements.

A)balance sheet.

B)income statement.

C)statement of cash flows.

D)none of these; it is not on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

20

Starship Inc.'s gross profit ratio increased from 36.5% in 2015 to 48.6% in 2016.What is the trend in this change?

A)An upward trend

B)A downward trend

C)It depends on whether net sales increased or decreased during the period

D)Trends cannot be determined without the dollar amount of the increase provided

A)An upward trend

B)A downward trend

C)It depends on whether net sales increased or decreased during the period

D)Trends cannot be determined without the dollar amount of the increase provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

21

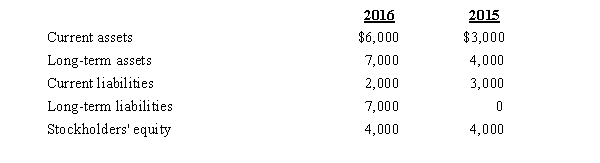

Pinecrest Company

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

Competitors in Pinecrest Company's industry have an average inventory turnover of 20.8 times.Its inventory turnover for 2016

A)indicates that the company has too little inventory on hand at the end of 2016.

B)indicates that the company is pricing its products too low.

C)is equal to the number of days' sales in the company's inventory.

D)indicates that the market may be reacting to problems in the sales department by reducing demand for the company's products.

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

Competitors in Pinecrest Company's industry have an average inventory turnover of 20.8 times.Its inventory turnover for 2016

A)indicates that the company has too little inventory on hand at the end of 2016.

B)indicates that the company is pricing its products too low.

C)is equal to the number of days' sales in the company's inventory.

D)indicates that the market may be reacting to problems in the sales department by reducing demand for the company's products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is a measure of the time that it takes to convert current assets into cash?

A)accounts receivable turnover ratio

B)cash to cash operating cycle

C)number of days' sales in inventory

D)working capital

A)accounts receivable turnover ratio

B)cash to cash operating cycle

C)number of days' sales in inventory

D)working capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is a total dollar measure of liquidity?

A)accounts receivable turnover ratio

B)cash to cash operating cycle

C)number of days' sales in inventory

D)working capital

A)accounts receivable turnover ratio

B)cash to cash operating cycle

C)number of days' sales in inventory

D)working capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is considered a liquidity analysis tool?

A)gross profit ratio

B)acid-test ratio

C)dividend yield ratio

D)return on assets ratio

A)gross profit ratio

B)acid-test ratio

C)dividend yield ratio

D)return on assets ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

25

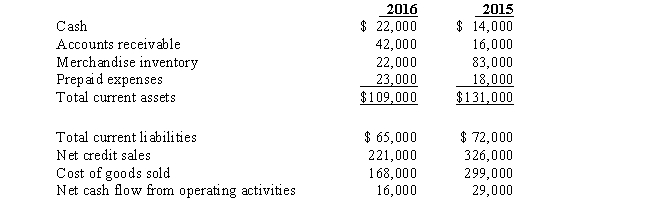

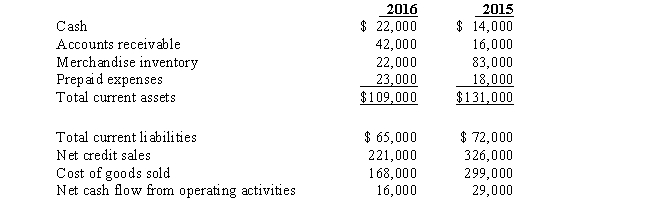

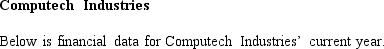

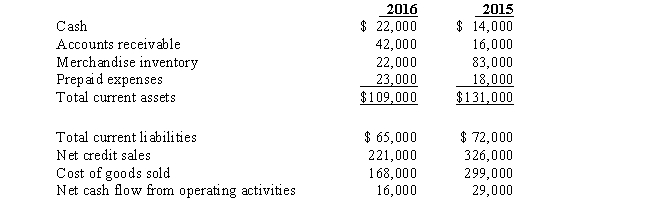

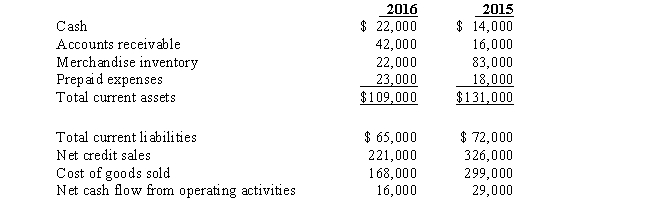

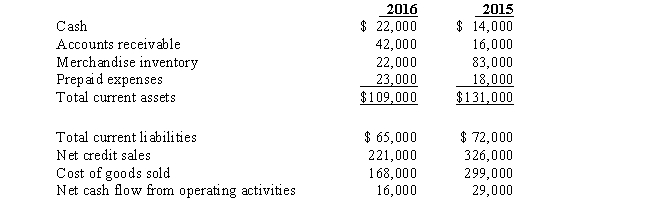

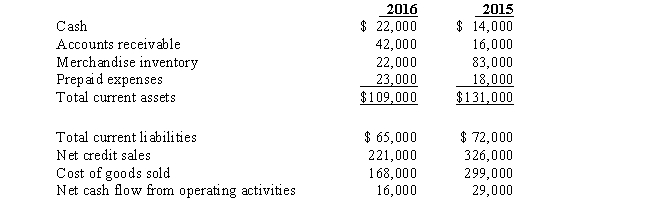

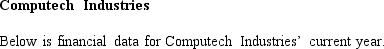

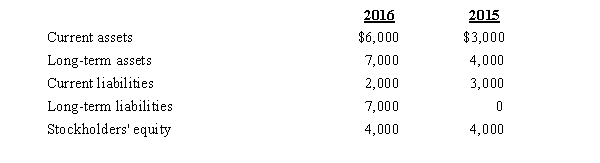

Refer to the data for Computech Industries.

Based on this information, what is the accounts receivable turnover for the current period?

A)10.0 times

B)12.5 times

C)11.1 times

D)14.3 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following ratios is least useful in evaluating a company's ability to pay its current debts as they become due?

A)current ratio

B)debt-to-equity ratio

C)debt service coverage ratio

D)acid-test ratio

A)current ratio

B)debt-to-equity ratio

C)debt service coverage ratio

D)acid-test ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

27

If Crab Shack Company has a current ratio of 2.5 and current assets of $195,000, the amount of working capital is:

A)$117,000

B)$330,000

C)$380,000

D)$78,000

A)$117,000

B)$330,000

C)$380,000

D)$78,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

28

You want to know whether selling and administrative expenses were reasonable for the past year, based on the level of sales.The best analysis for obtaining this information is:

A)trend analysis

B)vertical analysis

C)horizontal analysis

D)liquidity analysis

A)trend analysis

B)vertical analysis

C)horizontal analysis

D)liquidity analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

29

Pinecrest Company

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

Competitors in Pinecrest Company's industry have an average accounts receivable turnover of 10.8 times.Pinecrest reported accounts receivable at December 31, 2016 of $42,000 and has normal credit terms requiring payment within 30 days.Pinecrest's accounts receivable turnover for 2016 is:

A)probably indicating that the company probably has stricter credit terms and policies than the industry as a whole, which may repel potential buyers.

B)of no value to bankers and other creditors.

C)less efficient in its collection policies in 2016 than the industry as a whole.

D)less than the industry, which means that its customers are paying on their accounts in a more timely manner than are customers reflected by the industry average.

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

Competitors in Pinecrest Company's industry have an average accounts receivable turnover of 10.8 times.Pinecrest reported accounts receivable at December 31, 2016 of $42,000 and has normal credit terms requiring payment within 30 days.Pinecrest's accounts receivable turnover for 2016 is:

A)probably indicating that the company probably has stricter credit terms and policies than the industry as a whole, which may repel potential buyers.

B)of no value to bankers and other creditors.

C)less efficient in its collection policies in 2016 than the industry as a whole.

D)less than the industry, which means that its customers are paying on their accounts in a more timely manner than are customers reflected by the industry average.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

30

In a vertical analysis of the balance sheet, the 100% amount is

A)Current assets

B)Working capital

C)Total assets

D)Total stockholders' equity

A)Current assets

B)Working capital

C)Total assets

D)Total stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

31

If Mussel Company has working capital of $540,000 and a current ratio of 3 to 1, the amount of current assets is:

A)$540,000

B)$810,000

C)$270,000

D)$405,000

A)$540,000

B)$810,000

C)$270,000

D)$405,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

32

Liquidity analysis is required

A)in order to evaluate the profitability over past accounting periods.

B)to assess the nearness to cash of a company's assets and liabilities.

C)to be reported in the financial statements for all companies publicly traded.

D)when a company reports nonrecurring items in its financial statements.

A)in order to evaluate the profitability over past accounting periods.

B)to assess the nearness to cash of a company's assets and liabilities.

C)to be reported in the financial statements for all companies publicly traded.

D)when a company reports nonrecurring items in its financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

33

Pinecrest Company

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

Which of the following statements is true?

A)The current ratio increased from 2015 to 2016.

B)The acid-test ratio decreased from 2015 to 2016.

C)The amount of working capital decreased from 2015 to 2016.

D)Assuming extreme conditions do not exist, the company appears to be in a worse position to pay its current debts at the end of 2016 compared to 2015.

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

Which of the following statements is true?

A)The current ratio increased from 2015 to 2016.

B)The acid-test ratio decreased from 2015 to 2016.

C)The amount of working capital decreased from 2015 to 2016.

D)Assuming extreme conditions do not exist, the company appears to be in a worse position to pay its current debts at the end of 2016 compared to 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

34

Refer to the data for Computech Industries.

Based on this information, what is Computech's number of days' sales in receivables assuming a 360 day year)?

A)32.4 days

B)36.0 days

C)28.8 days

D)25.2 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

35

Pinecrest Company

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

Which of the following statements is true?

A)Net income must be at least $36,000 for 2016.

B)Net income must be less than $36,000 for 2016.

C)Cash flows from operating activities is twice as large as net income for 2016.

D)The amount of net income for 2016 cannot be determined based on the data provided.

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

Which of the following statements is true?

A)Net income must be at least $36,000 for 2016.

B)Net income must be less than $36,000 for 2016.

C)Cash flows from operating activities is twice as large as net income for 2016.

D)The amount of net income for 2016 cannot be determined based on the data provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

36

Pinecrest Company

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

The amount of working capital at the end of 2016 is

A)$ 36,000

B)$ 44,000

C)$ 99,000

D)$174,000

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

The amount of working capital at the end of 2016 is

A)$ 36,000

B)$ 44,000

C)$ 99,000

D)$174,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

37

Refer to the data for Computech Industries.

Based on this information, what is Computech's number of days' sales in inventory assuming a 360 day year)?

A)132 days

B)216 days

C)1,091 days

D)120 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

38

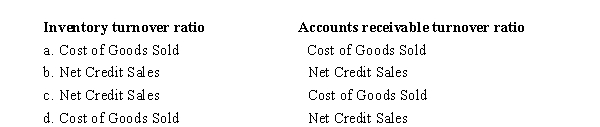

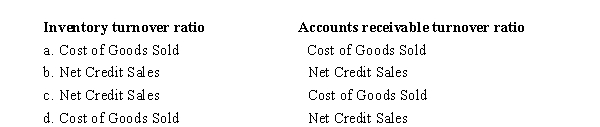

What numerators are used in the computation of the following ratios?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

39

Pinecrest Company

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

The current ratio for 2016 is

A)0.60 to 1

B)0.99 to 1

C)1.34 to 1

D)1.68 to 1

Use the selected data from Pinecrest Company's financial statements to answer the following question.

Refer to the data for Pinecrest Company.

The current ratio for 2016 is

A)0.60 to 1

B)0.99 to 1

C)1.34 to 1

D)1.68 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

40

Refer to the data for Computech Industries.

Based on this information, what is Computech's inventory turnover ratio for the current period?

A)1.67 times

B)2.73 times

C)0.33 times

D)3.00 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

41

Most companies

A)are not concerned with the management of working capital because cash flows are good.

B)strive for a balance between current assets and current liabilities.

C)try to maintain protection from the creditors by keeping only a small amount of cash available.

D)agree that working capital of $3,000,000 is sufficient for business operations.

A)are not concerned with the management of working capital because cash flows are good.

B)strive for a balance between current assets and current liabilities.

C)try to maintain protection from the creditors by keeping only a small amount of cash available.

D)agree that working capital of $3,000,000 is sufficient for business operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

42

The acid-test ratio differs from the current ratio in that it

A)represents the amount of cash on hand instead of the amount of working capital.

B)excludes inventories and accounts receivable from the numerator of the fraction because of obsolescence and possible nonpayment.

C)is a stricter test of a company's ability to pay its current debts as they are due.

D)signals the need to liquidate marketable securities when it drops below 5 to 1.

A)represents the amount of cash on hand instead of the amount of working capital.

B)excludes inventories and accounts receivable from the numerator of the fraction because of obsolescence and possible nonpayment.

C)is a stricter test of a company's ability to pay its current debts as they are due.

D)signals the need to liquidate marketable securities when it drops below 5 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following formulas gives the inventory turnover ratio?

A)Net credit sales/Average inventory

B)Average inventory/Net credit sales

C)Cost of goods sold/Average inventory

D)Average inventory/Cost of goods sold

A)Net credit sales/Average inventory

B)Average inventory/Net credit sales

C)Cost of goods sold/Average inventory

D)Average inventory/Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is an example of liquidity analysis?

A)Bonds payable are divided by total liabilities and stockholders' equity.

B)Net income is divided by total assets.

C)Net income is divided by the number of shares of stock outstanding

D)Current assets are divided by current liabilities.

A)Bonds payable are divided by total liabilities and stockholders' equity.

B)Net income is divided by total assets.

C)Net income is divided by the number of shares of stock outstanding

D)Current assets are divided by current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

45

The net assets of a company are equal to

A)current assets less current liabilities.

B)total assets less current assets.

C)long-term assets less accumulated depreciation.

D)the stockholders' equity.

A)current assets less current liabilities.

B)total assets less current assets.

C)long-term assets less accumulated depreciation.

D)the stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following will decrease working capital?

A)collection of accounts receivable

B)purchase of a new computer with cash

C)payment of salaries payable

D)purchase of merchandise on credit

A)collection of accounts receivable

B)purchase of a new computer with cash

C)payment of salaries payable

D)purchase of merchandise on credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

47

Moonbeam Gift Shop's inventory turned over six times during the year.Similar gift shops have an inventory turnover equal to twelve times per year.What explains Moonbeam's state of inventory management?

A)Moonbeam sold too much inventory during the year.

B)Moonbeam needs to increase sales and decrease the amount of inventory on hand.

C)Moonbeam is performing twice as well as its competitors.

D)Moonbeam should increase the amount of goods on hand to accommodate the additional inventory demand.

A)Moonbeam sold too much inventory during the year.

B)Moonbeam needs to increase sales and decrease the amount of inventory on hand.

C)Moonbeam is performing twice as well as its competitors.

D)Moonbeam should increase the amount of goods on hand to accommodate the additional inventory demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following generally indicates a positive change?

A)Earnings per share decreases

B)The debt service coverage decreases

C)The acid-test ratio decreases

D)The number of days' sales in inventory decreases

A)Earnings per share decreases

B)The debt service coverage decreases

C)The acid-test ratio decreases

D)The number of days' sales in inventory decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

49

The cash-to-cash operating cycle is the number of days' sales in

A)receivables and working capital.

B)receivables and plant assets.

C)inventory and receivables.

D)inventory and plant assets.

A)receivables and working capital.

B)receivables and plant assets.

C)inventory and receivables.

D)inventory and plant assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

50

Turnover ratios differ from the current and quick ratios in that they

A)are based on working capital instead of cash.

B)are based on a point of time instead of a period of time.

C)are activity ratios.

D)measure the profitability of a company instead of its liquidity.

A)are based on working capital instead of cash.

B)are based on a point of time instead of a period of time.

C)are activity ratios.

D)measure the profitability of a company instead of its liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

51

Sandy Shores, Inc.reported the following amounts in its financial statements:  From 2015 to 2016, the company's management of inventory is

From 2015 to 2016, the company's management of inventory is

A)declining, because the number of days' sales in inventory is getting larger.

B)increasing, because the number of days' sales in inventory is getting larger.

C)declining, because the number of days' sales in inventory is getting smaller.

D)increasing, because the number of days' sales in inventory is getting smaller.

From 2015 to 2016, the company's management of inventory is

From 2015 to 2016, the company's management of inventory isA)declining, because the number of days' sales in inventory is getting larger.

B)increasing, because the number of days' sales in inventory is getting larger.

C)declining, because the number of days' sales in inventory is getting smaller.

D)increasing, because the number of days' sales in inventory is getting smaller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is true regarding the relationship of the current ratio to the quick ratio?

A)The current ratio is based on a more conservative measure of liquidity.

B)Both focus on the relationship between part or all of the firm's current assets and all of its current liabilities.

C)Both focus on the relationship between all of the firm's current assets and part or all of its current liabilities.

D)For a company in the service industry, the current ratio and quick ratio will be significantly different.

A)The current ratio is based on a more conservative measure of liquidity.

B)Both focus on the relationship between part or all of the firm's current assets and all of its current liabilities.

C)Both focus on the relationship between all of the firm's current assets and part or all of its current liabilities.

D)For a company in the service industry, the current ratio and quick ratio will be significantly different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

53

Seashell Company is considered "very liquid" for the year ended December 31, 2016.This means that Seashell

A)has a small quick ratio.

B)must decrease its liquidity in order to appear favorable to stockholders.

C)should sell plant assets in order to remain in business.

D)is able to pay its current debts using its current assets.

A)has a small quick ratio.

B)must decrease its liquidity in order to appear favorable to stockholders.

C)should sell plant assets in order to remain in business.

D)is able to pay its current debts using its current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is generally considered desirable?

A)A large decrease in accounts receivable turnover ratio

B)A decrease in the number of days' sales in receivables

C)An increase in sales along with a larger decrease in the gross profit ratio

D)A decrease in the cash flow from operations to current liabilities ratio

A)A large decrease in accounts receivable turnover ratio

B)A decrease in the number of days' sales in receivables

C)An increase in sales along with a larger decrease in the gross profit ratio

D)A decrease in the cash flow from operations to current liabilities ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

55

Assume the current ratio for Horizon Surf Supplies is 2 to 1.If the company purchased supplies on credit, the effect of this transaction is to:

A)increase the current ratio

B)decrease the current ratio

C)have no effect on the current ratio

D)decrease cash

A)increase the current ratio

B)decrease the current ratio

C)have no effect on the current ratio

D)decrease cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

56

The current and quick ratios have two limitations.These ratios

A)emphasize the ineffectiveness of analysts' calculations, and focus on liquid assets at a point in time instead of a period of time.

B)focus on cash instead of working capital, and they represent a point in time instead of covering a period of time.

C)focus on working capital instead of cash, and they represent a point in time instead of covering a period of time.

D)are ignored by most creditors, and focus on working capital instead of cash.

A)emphasize the ineffectiveness of analysts' calculations, and focus on liquid assets at a point in time instead of a period of time.

B)focus on cash instead of working capital, and they represent a point in time instead of covering a period of time.

C)focus on working capital instead of cash, and they represent a point in time instead of covering a period of time.

D)are ignored by most creditors, and focus on working capital instead of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

57

If the current ratio is 3 to 1 and the working capital is $100,000, then the current assets are

A)$150,000

B)$200,000

C)$300,000

D)$450,000

A)$150,000

B)$200,000

C)$300,000

D)$450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

58

The current ratio

A)is generally smaller than the quick ratio.

B)decreases when a company becomes more liquid.

C)increases when a company allows more customers to charge on account instead of collecting cash.

D)is larger when a company is more liquid.

A)is generally smaller than the quick ratio.

B)decreases when a company becomes more liquid.

C)increases when a company allows more customers to charge on account instead of collecting cash.

D)is larger when a company is more liquid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following ratios is used to analyze a company's liquidity?

A)Return on assets ratio

B)Inventory turnover ratio

C)Earnings per share

D)Asset turnover ratio

A)Return on assets ratio

B)Inventory turnover ratio

C)Earnings per share

D)Asset turnover ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

60

The operating cycle of a manufacturer is the length of time between the

A)purchase of raw materials and the sale of the goods.

B)sale of the goods and the collection of any outstanding receivables from the sale of the product.

C)purchase of raw materials and collection of any outstanding receivables from the sale of the product.

D)purchase of raw materials and the production of goods.

A)purchase of raw materials and the sale of the goods.

B)sale of the goods and the collection of any outstanding receivables from the sale of the product.

C)purchase of raw materials and collection of any outstanding receivables from the sale of the product.

D)purchase of raw materials and the production of goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

61

Solvency and liquidity differ in a company's ability

A)to show a profit.

B)to remain in business over a long or short period of time.

C)to collect cash from customers during the short- or long-term.

D)to increase gross profit percentages over long or short periods of time.

A)to show a profit.

B)to remain in business over a long or short period of time.

C)to collect cash from customers during the short- or long-term.

D)to increase gross profit percentages over long or short periods of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following solvency ratios is the best measure to determine the degree to which a company relies on outsiders for funds?

A)Debt-to-equity ratio

B)Times interest earned ratio

C)Debt service coverage ratio

D)Cash flow from operations to capital expenditures ratio

A)Debt-to-equity ratio

B)Times interest earned ratio

C)Debt service coverage ratio

D)Cash flow from operations to capital expenditures ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following solvency ratios is the best measure of a company's ability to pay interest and maturing principal amounts on its long-term debt?

A)Debt-to-equity ratio

B)Times interest earned ratio

C)Debt service coverage ratio

D)Earnings per share

A)Debt-to-equity ratio

B)Times interest earned ratio

C)Debt service coverage ratio

D)Earnings per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following ratios is the best measure in analyzing a company's ability to pay interest on long-term debt and to repay the long-term debt over several years?

A)Debt-to-equity ratio

B)Times interest earned ratio

C)Debt service coverage ratio

D)Acid-test ratio

A)Debt-to-equity ratio

B)Times interest earned ratio

C)Debt service coverage ratio

D)Acid-test ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which profitability ratio requires the use of earnings per share and the current market price?

A)Return on common stockholders' equity

B)Dividend payout ratio

C)Dividend yield ratio

D)Price/earnings ratio

A)Return on common stockholders' equity

B)Dividend payout ratio

C)Dividend yield ratio

D)Price/earnings ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

66

Santana Company issued additional shares of common stock.The effect of the transaction is

A)the earnings per share increased

B)the debt-to-equity ratio increased

C)the earnings per share decreased

D)the asset turnover ratio decreased

A)the earnings per share increased

B)the debt-to-equity ratio increased

C)the earnings per share decreased

D)the asset turnover ratio decreased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

67

Auto Industries Company reported the following on its income statement:  If the income statement also shows interest expense equal to $80,000, what is the company's times interest earned ratio?

If the income statement also shows interest expense equal to $80,000, what is the company's times interest earned ratio?

A)5 times

B)8 times

C)5.25 times

D)6.25 times

If the income statement also shows interest expense equal to $80,000, what is the company's times interest earned ratio?

If the income statement also shows interest expense equal to $80,000, what is the company's times interest earned ratio?A)5 times

B)8 times

C)5.25 times

D)6.25 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is considered a profitability ratio?

A)Earnings per share

B)Debt-to-equity ratio

C)Acid-test ratio

D)Inventory turnover ratio

A)Earnings per share

B)Debt-to-equity ratio

C)Acid-test ratio

D)Inventory turnover ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

69

The cash flow from operations to capital expenditures ratio measures a company's ability to

A)use operations to finance its acquisitions of productive assets.

B)use cash flows from capital expenditure transactions to maintain working capital.

C)increase its capital expenditures as a result of profitable operations.

D)pay its current bills from profits made using productive assets.

A)use operations to finance its acquisitions of productive assets.

B)use cash flows from capital expenditure transactions to maintain working capital.

C)increase its capital expenditures as a result of profitable operations.

D)pay its current bills from profits made using productive assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

70

A non-business entity would be particularly concerned about its

A)earnings per share

B)price/earnings ratio

C)liquidity

D)income tax rate

A)earnings per share

B)price/earnings ratio

C)liquidity

D)income tax rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

71

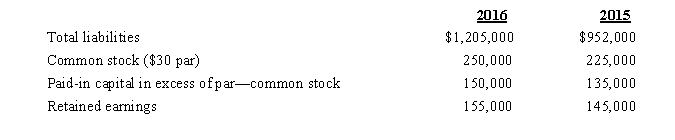

The following items appear on the balance sheet of The Piano Company at the end of 2016 and 2015:  Between 2015 and 2016

Between 2015 and 2016

A)The Piano Company's debt-to-equity ratio and current ratio both increased.

B)The Piano Company's debt-to-equity ratio and current ratio both decreased.

C)The Piano Company's debt-to-equity ratio increased and its debt-to-total assets ratio decreased.

D)The Piano Company's debt-to-equity ratio decreased and its debt-to-total assets ratio increased.

Between 2015 and 2016

Between 2015 and 2016A)The Piano Company's debt-to-equity ratio and current ratio both increased.

B)The Piano Company's debt-to-equity ratio and current ratio both decreased.

C)The Piano Company's debt-to-equity ratio increased and its debt-to-total assets ratio decreased.

D)The Piano Company's debt-to-equity ratio decreased and its debt-to-total assets ratio increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

72

Aleve Company purchased inventory on credit.The effect of this transaction is that the

A)earnings per share decreased

B)working capital increased

C)debt-to-equity ratio increased

D)earnings per share increased

A)earnings per share decreased

B)working capital increased

C)debt-to-equity ratio increased

D)earnings per share increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

73

Back Company sold merchandise on credit.Its gross profit ratio is 23%.The effect of this transaction is that the

A)earnings per share decreased

B)current ratio was unchanged

C)debt-to-equity ratio increased

D)earnings per share increased

A)earnings per share decreased

B)current ratio was unchanged

C)debt-to-equity ratio increased

D)earnings per share increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

74

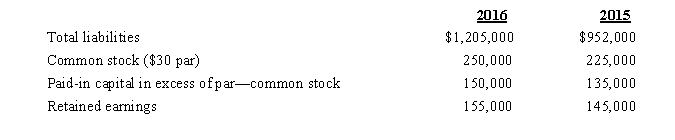

Below are selected data from the financial statements of Moriarty Company.  The debt-to-equity ratio for 2016 is

The debt-to-equity ratio for 2016 is

A)increasing, which should be a major cause of concern for Moriarty Company.

B)increasing, which should be a good sign in investors' eyes.

C)decreasing, which should be a major cause of concern for Moriarty Company.

D)decreasing, which should be a good sign in investors' eyes.

The debt-to-equity ratio for 2016 is

The debt-to-equity ratio for 2016 isA)increasing, which should be a major cause of concern for Moriarty Company.

B)increasing, which should be a good sign in investors' eyes.

C)decreasing, which should be a major cause of concern for Moriarty Company.

D)decreasing, which should be a good sign in investors' eyes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

75

Crimson Company declared and paid $1,000,000 in dividends to the common stockholders.The effect of this transaction is that the

A)earnings per share decreased

B)current ratio increased

C)debt-to-equity ratio increased

D)earnings per share increased

A)earnings per share decreased

B)current ratio increased

C)debt-to-equity ratio increased

D)earnings per share increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

76

Treetop Company paid off a $100,000 two-year note payable.The effect of this transaction is that the

A)earnings per share increased

B)current ratio decreased

C)debt-to-equity ratio increased

D)debt-to-equity ratio decreased

A)earnings per share increased

B)current ratio decreased

C)debt-to-equity ratio increased

D)debt-to-equity ratio decreased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

77

Return ratios are measures of the relationship between the

A)income earned and the investment made in the company by the various groups.

B)revenue earned and the total equity of a company.

C)total equity of a company and its cash flows for the period.

D)profitability and liquidity aspects of a company.

A)income earned and the investment made in the company by the various groups.

B)revenue earned and the total equity of a company.

C)total equity of a company and its cash flows for the period.

D)profitability and liquidity aspects of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which profitability ratio requires the use of earnings per share in its calculation?

A)Price/earnings ratio

B)Return on common stockholders' equity

C)Dividend yield ratio

D)Profit margin

A)Price/earnings ratio

B)Return on common stockholders' equity

C)Dividend yield ratio

D)Profit margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

79

A solvency measure that focuses specifically on the extent to which a company relies on outsiders for funds is:

A)cash flow from operations to capital expenditures ratio

B)debt service coverage ratio

C)times interest earned ratio

D)debt-to-equity ratio

A)cash flow from operations to capital expenditures ratio

B)debt service coverage ratio

C)times interest earned ratio

D)debt-to-equity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

80

In considering equity and debt financing, which of the following statements is true?

A)Compared to equity financing, debt is a more expensive source of funding.

B)Interest and dividends payments are required to be made by the issuing corporation.

C)In general, the higher the proportion of total debt-to-equity ratio, the greater the likelihood the firm will have difficulty in meeting its obligations in some future period.

D)Most firms prefer to have no debt and rely on equity financing.

A)Compared to equity financing, debt is a more expensive source of funding.

B)Interest and dividends payments are required to be made by the issuing corporation.

C)In general, the higher the proportion of total debt-to-equity ratio, the greater the likelihood the firm will have difficulty in meeting its obligations in some future period.

D)Most firms prefer to have no debt and rely on equity financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck