Deck 3: Cost Flows and Cost Terminology

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/71

العب

ملء الشاشة (f)

Deck 3: Cost Flows and Cost Terminology

1

The cost flows in merchandising firms resemble the flows for service firms.

True

2

To comply with GAAP, an income statement must separate direct and indirect costs.

False

3

Unlike service firms, merchandising firms maintain an inventory of goods that they buy and sell.

True

4

As with service firms, period costs appear below the line for gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

5

It frequently is vital to modify accounting reports and use non-financial data to estimate the controllable costs and benefits of a decision option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

6

The terms cost of goods sold and costs of goods manufactured are used interchangeably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

7

Period costs are all costs that are not product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

8

The cost of purchasing goods from suppliers does not include the cost of transportation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

9

Product costs are often referred to as inventoriable costs because these are the costs that firms attach to inventories of work in process and finished goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

10

The cost of providing services might include depreciation on equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

11

Once the production process is completed, firms transfer finished work physically from work-in-process inventory to raw materials inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

12

GAAP provides considerable flexibility regarding reporting formats.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

13

Product costs always appear "below the line" for gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

14

For financial reporting purposes, merchandising firms expense the cost of items when they purchase them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

15

Period costs are added to gross margin to arrive at profit before taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

16

Service firms are distinguished from other firms in that the products service firms offer are not tangible or storable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

17

The total of all the indirect manufacturing inputs are sometimes referred to as manufacturing allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

18

The GAAP income statement combines controllable with non-controllable costs and fixed costs with variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

19

Period costs contain controllable, but not non-controllable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

20

The sum of labor and overhead is referred to as conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

21

The income statement for a service firm distinguishes between which of the following costs?

A)Cost of goods manufactured and conversion costs.

B)Costs of providing services and product costs.

C)Cost of providing service and selling and administrative costs.

D)Selling and administrative costs and period costs.

E)None of the above.

A)Cost of goods manufactured and conversion costs.

B)Costs of providing services and product costs.

C)Cost of providing service and selling and administrative costs.

D)Selling and administrative costs and period costs.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

22

The matching principle in GAAP requires that we separate:

A)Conversion costs and overhead.

B)Product costs and period costs.

C)Selling and administrative costs.

D)Controllable and non-controllable costs.

E)None of the above.

A)Conversion costs and overhead.

B)Product costs and period costs.

C)Selling and administrative costs.

D)Controllable and non-controllable costs.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

23

C & C Power Lines is a subcontractor that works on public utilities.Which of the following is a key characteristic that makes it distinctively a service company?

A)It does not maintain inventories.

B)Its products are tangible.

C)Its product costs appear below the line in computing gross margin.

D)All of its costs are period costs.

A)It does not maintain inventories.

B)Its products are tangible.

C)Its product costs appear below the line in computing gross margin.

D)All of its costs are period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is not an example of a service firm?

A)Delta Airlines.

B)Blankenship and Hobbs, Attorneys.

C)First State Bank.

D)Hilton Hotels.

E)All of the above are service firms.

A)Delta Airlines.

B)Blankenship and Hobbs, Attorneys.

C)First State Bank.

D)Hilton Hotels.

E)All of the above are service firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

25

Acme Manufacturing Company's controller was classifying costs for the most recent financial statement period.Which of the following should be excluded from the calculation of gross margin?

A)Factory worker wages.

B)Materials used in assembling a product.

C)Conveyer belt maintenance for production of all products.

D)Marketing brochure for the company's new product.

A)Factory worker wages.

B)Materials used in assembling a product.

C)Conveyer belt maintenance for production of all products.

D)Marketing brochure for the company's new product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

26

Cost objects are items or entities to which we allocate the costs from overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a company's revenue is $530,000, profit before taxes is $98,000, and product costs are $390,000 then:

A)The company's gross margin totals $140,000.

B)The company's period costs total $140,000.

C)The company's period costs cannot be determined.

D)The company's contribution margin totals $140,000.

A)The company's gross margin totals $140,000.

B)The company's period costs total $140,000.

C)The company's period costs cannot be determined.

D)The company's contribution margin totals $140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

28

Overhead costs are direct and, as such, are traceable to each product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

29

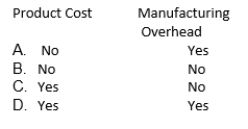

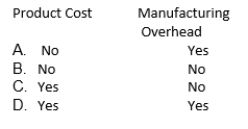

Property taxes on a manufacturing plant is an example of:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

30

The costs associated with getting products and services ready for sale are known as:

A)Sales costs.

B)Conversion costs.

C)Opportunity costs.

D)Product costs.

E)Costs of goods sold.

A)Sales costs.

B)Conversion costs.

C)Opportunity costs.

D)Product costs.

E)Costs of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

31

Tomba Civil Engineers' manager is attempting to calculate its cost of providing services to clients.Its profit before taxes for January is $4,000, and it's selling and administration costs are $8,000, service revenue is $20,000.How much is its cost of providing service?

A)$12,000

B)$4,000

C)$8,000

D)$20,000

A)$12,000

B)$4,000

C)$8,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is most likely a product cost?

A)Advertising expense

B)Sales commissions for the current month

C)Cardboard packaging for the product

D)Janitorial expense for the administrative offices

A)Advertising expense

B)Sales commissions for the current month

C)Cardboard packaging for the product

D)Janitorial expense for the administrative offices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

33

The proportion of cost allocated to a cost object equals the proportion of driver units in that cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements relating to period costs is not correct?

A)Period costs are all costs that are not product costs.

B)Period costs always appear below the line for gross margin.

C)Period costs are not separated from product costs in GAAP income statements.

D)Both A and B are incorrect.

E)A, B, and C are incorrect.

A)Period costs are all costs that are not product costs.

B)Period costs always appear below the line for gross margin.

C)Period costs are not separated from product costs in GAAP income statements.

D)Both A and B are incorrect.

E)A, B, and C are incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

35

Maintenance on factory equipment is a(n):

A)Period cost.

B)Overhead cost.

C)Administrative cost.

D)Product cost.

E)Both B and D are correct.

A)Period cost.

B)Overhead cost.

C)Administrative cost.

D)Product cost.

E)Both B and D are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

36

The costs of management salaries that are not a part of the costs of providing programs or services are referred to as:

A)Period costs

B)Product costs.

C)Cost of goods sold.

D)Conversion costs.

E)None of the above.

A)Period costs

B)Product costs.

C)Cost of goods sold.

D)Conversion costs.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

37

What distinguishes services firms from other firms?

A)Service firms do not incur depreciation costs.

B)Service firms do not use capital resources to perform their functions.

C)The products service firms offer are not tangible or storable.

D)Human capital is an important resource for service firms, but not for other firms.

E)None of the above.

A)Service firms do not incur depreciation costs.

B)Service firms do not use capital resources to perform their functions.

C)The products service firms offer are not tangible or storable.

D)Human capital is an important resource for service firms, but not for other firms.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

38

The overhead allocated to an individual unit or product line is the number of driver units contained in that unit or product line times the overhead rate per driver unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

39

Grand Rapids Rafting Company recorded the following data for the month of October: Inventory purchases for the month of October total:

A)$108,000

B)$136,000

C)$200,000

D)$44,000

A)$108,000

B)$136,000

C)$200,000

D)$44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

40

A cost allocation is a procedure that allocates, or distributes, a common cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

41

In a typical production process, the physical flows for a manufacturer are:

A)Work-in-Process Inventory→Material Inventory→Finished Goods Inventory→Cost of Goods Sold.

B)Material Inventory→Cost of Goods Sold→Finished Goods.

C)Material Inventory→Work-in-Process inventory→Finished Goods Inventory→Cost of Goods Sold.

D)Finished Goods Inventory→Cost of Goods Sold→Material Inventory

E)None of the above.

A)Work-in-Process Inventory→Material Inventory→Finished Goods Inventory→Cost of Goods Sold.

B)Material Inventory→Cost of Goods Sold→Finished Goods.

C)Material Inventory→Work-in-Process inventory→Finished Goods Inventory→Cost of Goods Sold.

D)Finished Goods Inventory→Cost of Goods Sold→Material Inventory

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following includes all the components of conversion costs?

A)Direct materials and direct labor.

B)Prime costs plus fixed overhead.

C)Variable overhead and fixed overhead.

D)Direct labor plus capacity costs

A)Direct materials and direct labor.

B)Prime costs plus fixed overhead.

C)Variable overhead and fixed overhead.

D)Direct labor plus capacity costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

43

Product costs are also referred as:

A)Mixed cost.

B)Selling and administrative costs.

C)Inventoriable costs.

D)Volume cost.

E)Break-even cost.

A)Mixed cost.

B)Selling and administrative costs.

C)Inventoriable costs.

D)Volume cost.

E)Break-even cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

44

Company's controller is calculating the current month's cost of goods manufactured.Which of the following should be considered as part of the calculation?

A)Direct labor and indirect costs.

B)Indirect labor and commission expenses.

C)Manufacturing overhead and the corporate vice president's salary.

D)Cost of materials used and finished goods inventory.

A)Direct labor and indirect costs.

B)Indirect labor and commission expenses.

C)Manufacturing overhead and the corporate vice president's salary.

D)Cost of materials used and finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

45

The cost of purchasing goods from suppliers includes all of the following costs except:

A)Cost of transportation.

B)Amounts paid to suppliers.

C)Sales commissions.

D)Costs of preparing goods for sale.

E)All of the above are included in the cost of purchasing goods from suppliers.

A)Cost of transportation.

B)Amounts paid to suppliers.

C)Sales commissions.

D)Costs of preparing goods for sale.

E)All of the above are included in the cost of purchasing goods from suppliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

46

Product costs include which of the following costs?

A)Manufacturing overhead costs and selling and administrative costs.

B)Variable manufacturing costs and manufacturing overhead costs.

C)Common costs and special costs.

D)Period costs and common costs.

E)Variable costs only.

A)Manufacturing overhead costs and selling and administrative costs.

B)Variable manufacturing costs and manufacturing overhead costs.

C)Common costs and special costs.

D)Period costs and common costs.

E)Variable costs only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

47

Prime costs are:

A)The sum of materials and labor costs.

B)The sum of labor and manufacturing overhead.

C)The sum of fixed and variable overhead costs.

D)The sum of material, labor, and overhead costs.

A)The sum of materials and labor costs.

B)The sum of labor and manufacturing overhead.

C)The sum of fixed and variable overhead costs.

D)The sum of material, labor, and overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

48

Prime costs include:

A)Direct material, direct labor, and manufacturing overhead.

B)Direct material and direct labor.

C)Direct labor and manufacturing overhead.

D)Direct material and manufacturing overhead.

E)Variable overhead and fixed overhead.

A)Direct material, direct labor, and manufacturing overhead.

B)Direct material and direct labor.

C)Direct labor and manufacturing overhead.

D)Direct material and manufacturing overhead.

E)Variable overhead and fixed overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

49

Packaging materials is an example of:

A)Fixed overhead.

B)Direct material.

C)Variable overhead.

D)Period cost.

E)Prime cost.

A)Fixed overhead.

B)Direct material.

C)Variable overhead.

D)Period cost.

E)Prime cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

50

Manufacturing overhead includes which of the following costs?

A)Fixed costs only.

B)Variable costs only.

C)Conversion costs and direct labor.

D)Variable overhead and fixed overhead.

E)Common costs and special costs.

A)Fixed costs only.

B)Variable costs only.

C)Conversion costs and direct labor.

D)Variable overhead and fixed overhead.

E)Common costs and special costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Peterson Company incurred the following costs in the month of May: The company's product costs total:

A)$45,000

B)$47,000

C)$40,000

D)$42,000

A)$45,000

B)$47,000

C)$40,000

D)$42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

52

Gate Grocery's most popular candy bars cost $0.50 each and sell for $0.75.Management determined that it had purchased 3,000 candy bars in February.It began February with 200 bars and had 150 remaining at the end of February.How much is cost of goods sold for February?

A)$1,475

B)$2,287.50

C)$3,050

D)$1,525

A)$1,475

B)$2,287.50

C)$3,050

D)$1,525

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

53

The following costs were incurred in November: Prime costs during the month totaled:

A)$34,000

B)$24,000

C)$43,000

D)$9,000

A)$34,000

B)$24,000

C)$43,000

D)$9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following are the inputs manufacturers use to make their product?

A)Direct material, direct labor, and manufacturing overhead.

B)Period costs and product costs.

C)Conversion costs and direct labor.

D)Common costs and special costs.

E)Direct material, direct labor, and period costs.

A)Direct material, direct labor, and manufacturing overhead.

B)Period costs and product costs.

C)Conversion costs and direct labor.

D)Common costs and special costs.

E)Direct material, direct labor, and period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

55

Billings Company's plant manager is trying to better understand his plant's inventory workflow.He determined that $10 million was spent on raw materials, $2 million on direct labor and $3 million on manufacturing overhead.If raw materials beginning and ending inventories are $2 million and $1 million, respectively, and work-in-process beginning and ending inventories are $6 million and $4 million respectively, how much is cost of goods manufactured?

A)$17 million.

B)$16 million.

C)$15 million.

D)$18 million.

A)$17 million.

B)$16 million.

C)$15 million.

D)$18 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following inventory equations produces the Cost of Goods Sold?

A)Cost of beginning inventory + cost of goods purchased during period - cost of ending inventory.

B)Cost of ending inventory + cost of goods purchased during period - cost of beginning inventory.

C)Cost of beginning inventory - cost of goods purchased during the period.

D)Cost of ending inventory - cost of goods purchased during the period.

E)Cost of ending inventory + cost of goods purchased during the period.

A)Cost of beginning inventory + cost of goods purchased during period - cost of ending inventory.

B)Cost of ending inventory + cost of goods purchased during period - cost of beginning inventory.

C)Cost of beginning inventory - cost of goods purchased during the period.

D)Cost of ending inventory - cost of goods purchased during the period.

E)Cost of ending inventory + cost of goods purchased during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

57

Office rent is an example of a (an):

A)Administrative cost.

B)Product cost.

C)Conversion Cost.

D)Costs of providing product or service.

E)Direct cost.

A)Administrative cost.

B)Product cost.

C)Conversion Cost.

D)Costs of providing product or service.

E)Direct cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is the best example of prime costs for Sharp Edge Mowers?

A)Sales commissions and maintenance on the machine that tightens bolts on lawn mowers during production.

B)Assembly line wages and the cost of tires to be installed on newly assembled lawnmowers.

C)The general manager's salary and the janitorial expense for executives' offices.

D)The interest cost on the manufacturing building and the wages paid for the quality control inspector for the assembly line

A)Sales commissions and maintenance on the machine that tightens bolts on lawn mowers during production.

B)Assembly line wages and the cost of tires to be installed on newly assembled lawnmowers.

C)The general manager's salary and the janitorial expense for executives' offices.

D)The interest cost on the manufacturing building and the wages paid for the quality control inspector for the assembly line

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

59

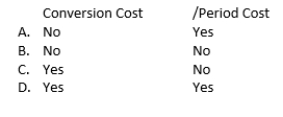

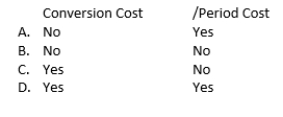

The cost of direct labor in a manufacturing plant is an example of:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

60

Product costs are also known as:

A)Prime costs.

B)Conversion costs.

C)Period costs.

D)Inventoriable costs

A)Prime costs.

B)Conversion costs.

C)Period costs.

D)Inventoriable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following would most likely not be included as manufacturing overhead in a plant which produces cars?

A)Glass used to make windshields.

B)Salary paid to manufacturing plant custodians.

C)Manufacturing plant utility expenses.

D)Real estate taxes on the manufacturing plant

A)Glass used to make windshields.

B)Salary paid to manufacturing plant custodians.

C)Manufacturing plant utility expenses.

D)Real estate taxes on the manufacturing plant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

62

Harms Shoe Company applies manufacturing overhead based on the number of units as the cost driver.Information concerning costs for July follows:

How much is the unit product cost if 1,000 units are produced?

A)$8.00

B)$64.20

C)$53.00

D)$45.00

How much is the unit product cost if 1,000 units are produced?

A)$8.00

B)$64.20

C)$53.00

D)$45.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

63

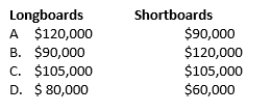

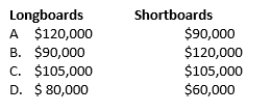

The SurferDude Company manufactures long and short surfboards.The company incurred manufacturing overhead costs of $210,000 in March.They have decided to allocate these costs based on units produced.In March the company produced 8,000 longboards and 6,000 shortboards.The amount of overhead allocated to each product, respectively, would be:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

64

The Merchant Tire Company provided the following information for the month of February: The company's balance in their finished goods inventory account at the end of February is:

A)$23,000

B)$18,000

C)$5,000

D)$41,000

A)$23,000

B)$18,000

C)$5,000

D)$41,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

65

Bass Boss Manufacturing Company manufactures two types of bass boats.Bass Boss provides the following data, pertinent to allocating its annual overhead cost of $435,000: What are the cost objects?

A)Annual overhead costs.

B)Boss Hog and Boss Bear.

C)Units per year.

D)Machine hours/unit.

E)Material and Labor costs/unit.

A)Annual overhead costs.

B)Boss Hog and Boss Bear.

C)Units per year.

D)Machine hours/unit.

E)Material and Labor costs/unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Clarke Company provided the following information for the month of December: The company's cost of goods manufactured for December is:

A)$42,000

B)$24,000

C)$33,000

D)$28,000

A)$42,000

B)$24,000

C)$33,000

D)$28,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is a cost pool?

A)Items that have costs allocated to them.

B)Attributes that are measured for each cost object.

C)The total costs to allocate

D)The rate used to allocate costs

A)Items that have costs allocated to them.

B)Attributes that are measured for each cost object.

C)The total costs to allocate

D)The rate used to allocate costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

68

Bass Boss Manufacturing Company manufactures two types of bass boats.Bass Boss provides the following data, pertinent to allocating its annual overhead cost of $435,000: What are the cost drivers?

A)Overhead costs; Units per year.

B)Boss Hog; Boss Bear.

C)Overhead costs; Machine hours/unit.

D)Machine hours/unit; Material cost/unit; Labor cost/unit

E)Units per year.

A)Overhead costs; Units per year.

B)Boss Hog; Boss Bear.

C)Overhead costs; Machine hours/unit.

D)Machine hours/unit; Material cost/unit; Labor cost/unit

E)Units per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

69

Bass Boss Manufacturing Company manufactures two types of bass boats.Bass Boss provides the following data, pertinent to allocating its annual overhead cost of $435,000: What is the cost pool for Bass Boss?

A)Annual overhead costs.

B)Units per year.

C)Machine hours/unit.

D)Material costs/unit.

E)Labor costs/unit.

A)Annual overhead costs.

B)Units per year.

C)Machine hours/unit.

D)Material costs/unit.

E)Labor costs/unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

70

Bass Boss Manufacturing Company manufactures two types of bass boats.Bass Boss provides the following data, pertinent to allocating its annual overhead cost of $435,000: What is the amount of manufacturing overhead allocated to Boss Bear?

A)$435,000

B)$217,500

C)$100,000

D)$300,000

E)$135,000

A)$435,000

B)$217,500

C)$100,000

D)$300,000

E)$135,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Flynn Company began the period with $15,000 worth of raw materials.During the period they purchased an additional $17,000 worth of materials and issued $24,000 of materials for production.In addition, the company paid $8,000 for direct labor costs and $6,000 in manufacturing overhead costs.The balance in the company's Work-in Process inventory account at the end of the period was:

A)$38,000

B)$46,000

C)$32,000

D)$40,000

A)$38,000

B)$46,000

C)$32,000

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck