Deck 4: Completing the Accounting Cycle and Classifying Accounts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

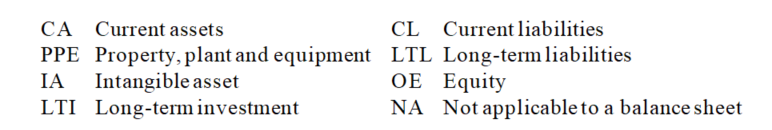

Deck 4: Completing the Accounting Cycle and Classifying Accounts

1

Journal entries recorded at the end of each accounting period to prepare the revenue,expense, and withdrawals accounts for the upcoming year and to update the owner's capital account for the events of the year just finished are:

A)Closing entries.

B)Work sheet entries.

C)Adjusting entries.

D)Final entries.

E)None of these answers is correct.

A)Closing entries.

B)Work sheet entries.

C)Adjusting entries.

D)Final entries.

E)None of these answers is correct.

A

2

Which of the following statements is incorrect? 76)

A)The Income Summary account is a temporary account.

B)Permanent accounts are another name for real accounts.

C)Permanent accounts are another name for nominal accounts.

D)Real accounts remain open as long as the asset, liability, or equity items recorded in the accounts continue in existence.

E)Temporary accounts carry a zero balance at the beginning of each accounting period.

A)The Income Summary account is a temporary account.

B)Permanent accounts are another name for real accounts.

C)Permanent accounts are another name for nominal accounts.

D)Real accounts remain open as long as the asset, liability, or equity items recorded in the accounts continue in existence.

E)Temporary accounts carry a zero balance at the beginning of each accounting period.

C

3

Internal documents prepared by accountants when organizing the information presented in formal reports to internal and external decision makers are called:

A)Adjusting papers.

B)Working papers.

C)Closing papers.

D)Statement papers.

E)Business papers.

A)Adjusting papers.

B)Working papers.

C)Closing papers.

D)Statement papers.

E)Business papers.

B

4

A 10-column spreadsheet used to draft a company's unadjusted trial balance, adjustingentries, adjusted trial balance, and financial statements, and which is an optional step in the accounting process, is a(n):

A)Adjusted trial balance.

B)Post-closing trial balance.

C)Work sheet.

D)Book of final entry.

E)Unadjusted trial balance.

A)Adjusted trial balance.

B)Post-closing trial balance.

C)Work sheet.

D)Book of final entry.

E)Unadjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

Real accounts are

A)Not shown on the balance sheet.

B)Another name for permanent accounts.

C)Income statement accounts.

D)Another name for temporary accounts.

E)Closed at the end of the accounting period.

A)Not shown on the balance sheet.

B)Another name for permanent accounts.

C)Income statement accounts.

D)Another name for temporary accounts.

E)Closed at the end of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

A company shows an $800 balance in Prepaid Insurance in the Unadjusted TrialBalance columns of the work sheet. The Adjustments columns show expired insurance of $600. This adjusting entry results in:

A)$400 in the Income Statement Debit column on the work sheet.

B)$600 more profit.

C)$600 less profit.

D)$400 in the Balance Sheet Credit column on the work sheet.

E)$200 difference between the debit and credit columns of the unadjusted trial balance.

A)$400 in the Income Statement Debit column on the work sheet.

B)$600 more profit.

C)$600 less profit.

D)$400 in the Balance Sheet Credit column on the work sheet.

E)$200 difference between the debit and credit columns of the unadjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

If the Balance Sheet columns of a work sheet fail to balance when the amount of profit is added to the Balance Sheet Credit column, the cause could be:

A)An expense amount entered in the Balance Sheet Debit column.

B)A liability amount entered in the Income Statement Credit column.

C)An asset amount entered in the Income Statement Debit column.

D)A liability amount entered in the Balance Sheet Debit column.

E)A revenue amount entered in the Balance Sheet Credit column.

A)An expense amount entered in the Balance Sheet Debit column.

B)A liability amount entered in the Income Statement Credit column.

C)An asset amount entered in the Income Statement Debit column.

D)A liability amount entered in the Balance Sheet Debit column.

E)A revenue amount entered in the Balance Sheet Credit column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

Accounts that are used to describe revenues, expenses, and owner's withdrawals, andare closed at the end of the reporting period, are:

A)Ledger accounts.

B)Closing accounts.

C)Permanent accounts.

D)Temporary accounts.

E)Real accounts.

A)Ledger accounts.

B)Closing accounts.

C)Permanent accounts.

D)Temporary accounts.

E)Real accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

The information on a work sheet can be used to prepare

A)Interim financial statements.

B)Adjusting entries.

C)Closing entries.

D)Year-end financial statements.

E)All of these answers are correct.

A)Interim financial statements.

B)Adjusting entries.

C)Closing entries.

D)Year-end financial statements.

E)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

When closing entries are made

A)All balance sheet accounts are closed.

B)All permanent accounts are closed but not the temporary accounts.

C)All real accounts are closed but not the temporary accounts.

D)All ledger accounts are closed to start the new fiscal period.

E)All temporary accounts are closed but not the permanent accounts.

A)All balance sheet accounts are closed.

B)All permanent accounts are closed but not the temporary accounts.

C)All real accounts are closed but not the temporary accounts.

D)All ledger accounts are closed to start the new fiscal period.

E)All temporary accounts are closed but not the permanent accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Unadjusted Trial Balance columns of a work sheet total $84,000Office supplies used during the period, $1,200Expiration of prepaid rent, $700.(3)Accrued salaries expense, $500Depreciation expense, $800.(5)Accrued repair service fees receivable, $400.The Adjusted Trial Balance columns total:

A)$84,000.

B)$80,400.

C)$87,600.

D)$85,700.

E)$85,900.

A)$84,000.

B)$80,400.

C)$87,600.

D)$85,700.

E)$85,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accumulated Depreciation, Equipment, Accounts Receivable, and Service Revenue would be sorted to which respective columns in completing a work sheet?

A)Income Statement-Debit; Income Statement-Debit; and Statement of changes in equity or Balance Sheet-Credit.

B)Statement of changes in equity or Balance Sheet-Credit; Statement of changes in equity or Balance Sheet-Debit; and Income Statement-Credit.

C)Statement of changes in equity or Balance Sheet-Debit; Statement of changes in equity or Balance Sheet-Credit; and Income Statement-Credit.

D)Statement of changes in equity or Balance Sheet-Credit; Income Statement-Debit; and Income Statement-Credit.

E)Income Statement-Debit; Statement of changes in equity or Balance Sheet-Debit; and Income Statement-Credit.

A)Income Statement-Debit; Income Statement-Debit; and Statement of changes in equity or Balance Sheet-Credit.

B)Statement of changes in equity or Balance Sheet-Credit; Statement of changes in equity or Balance Sheet-Debit; and Income Statement-Credit.

C)Statement of changes in equity or Balance Sheet-Debit; Statement of changes in equity or Balance Sheet-Credit; and Income Statement-Credit.

D)Statement of changes in equity or Balance Sheet-Credit; Income Statement-Debit; and Income Statement-Credit.

E)Income Statement-Debit; Statement of changes in equity or Balance Sheet-Debit; and Income Statement-Credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Unadjusted Trial Balance columns of the work sheet show the balance in the Office Supplies account at $750. The Adjustments columns show that $425 of these supplies were used during the period. The amount shown as Office Supplies in the Balance Sheet columns is:

A)$325 credit.

B)$750 debit.

C)$425 debit.

D)$325 debit.

E)$750 credit.

A)$325 credit.

B)$750 debit.

C)$425 debit.

D)$325 debit.

E)$750 credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

Closing the temporary accounts at the end of each accounting period

A)Gives the withdrawals account a zero balance.

B)Serves to transfer the effects of these accounts to the proper equity account on the balance sheet.

C)Prepares the withdrawals account for use in the next period.

D)Gives the revenue and expense accounts zero balances.

E)All of these answers are correct.

A)Gives the withdrawals account a zero balance.

B)Serves to transfer the effects of these accounts to the proper equity account on the balance sheet.

C)Prepares the withdrawals account for use in the next period.

D)Gives the revenue and expense accounts zero balances.

E)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

Another name for temporary accounts is

A)Balance column accounts.

B)Contra accounts.

C)Accrued accounts.

D)Real accounts.

E)Nominal accounts.

A)Balance column accounts.

B)Contra accounts.

C)Accrued accounts.

D)Real accounts.

E)Nominal accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following errors would cause the balance sheet columns of a work sheet to be out of balance?

A)Entering a revenue amount in the Balance Sheet Debit column.

B)Entering a liability amount in the Income Statement Credit column.

C)Entering an expense amount in the Balance Sheet Debit column.

D)Entering an asset amount in the Income Statement Debit column.

E)Entering a liability amount in the Balance Sheet Credit column.

A)Entering a revenue amount in the Balance Sheet Debit column.

B)Entering a liability amount in the Income Statement Credit column.

C)Entering an expense amount in the Balance Sheet Debit column.

D)Entering an asset amount in the Income Statement Debit column.

E)Entering a liability amount in the Balance Sheet Credit column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

The Income Summary account is

A)Used in the closing process to summarize the amounts of revenues and expenses.

B)Not a permanent account.

C)The account from which the amount of profit or loss is transferred to the owners' capital accounts in a partnership.

D)A temporary account.

E)All of these answers are correct.

A)Used in the closing process to summarize the amounts of revenues and expenses.

B)Not a permanent account.

C)The account from which the amount of profit or loss is transferred to the owners' capital accounts in a partnership.

D)A temporary account.

E)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements is incorrect? 66)

A)On the work sheet, the accountant sorts the adjusted amounts into columns according to whether the accounts are used in preparing the unadjusted trial balance or the adjusted trial balance.

B)Working papers are invaluable tools of the accountant.

C)After the work sheet is completed, the work sheet information is used to prepare the financial statements.

D)The work sheet shows the effects of adjustments on the account balances.

E)The work sheet is an optional step in the accounting cycle.

A)On the work sheet, the accountant sorts the adjusted amounts into columns according to whether the accounts are used in preparing the unadjusted trial balance or the adjusted trial balance.

B)Working papers are invaluable tools of the accountant.

C)After the work sheet is completed, the work sheet information is used to prepare the financial statements.

D)The work sheet shows the effects of adjustments on the account balances.

E)The work sheet is an optional step in the accounting cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

If, in preparing a work sheet, an adjusted trial balance amount is sorted to the wrong work sheet column, the Balance Sheet columns will balance on completing the work sheet, but with the wrong profit, if the amount sorted in error is:

A)A liability amount entered in the Income Statement Credit column.

B)A revenue amount entered in the Balance Sheet Debit column.

C)An asset amount entered in the Balance Sheet Credit column.

D)A liability amount entered in the Balance Sheet Debit column.

E)An expense amount entered in the Balance Sheet Credit column.

A)A liability amount entered in the Income Statement Credit column.

B)A revenue amount entered in the Balance Sheet Debit column.

C)An asset amount entered in the Balance Sheet Credit column.

D)A liability amount entered in the Balance Sheet Debit column.

E)An expense amount entered in the Balance Sheet Credit column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

Accounts that are used to describe assets, liabilities, and equity, that are not closed aslong as the company continues to own the assets, owe the liabilities, or have equity, and whose balances appear on the balance sheet are called:

A)Nominal accounts.

B)Contra accounts.

C)Accrued accounts.

D)Temporary accounts.

E)Permanent accounts.

A)Nominal accounts.

B)Contra accounts.

C)Accrued accounts.

D)Temporary accounts.

E)Permanent accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

A trial balance prepared after the adjusting and closing entries have been posted, and which is the final step in the accounting cycle, is a(n):

A)Post-closing trial balance.

B)Adjusted trial balance.

C)Book of final entry.

D)Unadjusted trial balance.

E)Work sheet.

A)Post-closing trial balance.

B)Adjusted trial balance.

C)Book of final entry.

D)Unadjusted trial balance.

E)Work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

The J. Dawson, Capital account has a credit balance of $1,200 before closing entries aremade. If total revenues for the year are $65,200, total expenses $49,800, andwithdrawals are $2,400, what is the ending balance in the J. Dawson, Capital account after all closing entries have been made?

A)$16,600.

B)$14,200.

C)$7,600.

D)$23,200.

E)$5,200.

A)$16,600.

B)$14,200.

C)$7,600.

D)$23,200.

E)$5,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

Current liabilities become due

A)Within the operating cycle of a business.

B)Within one year.

C)When bills have to be paid.

D)A or B, whichever is longer.

E)All of these answers are correct.

A)Within the operating cycle of a business.

B)Within one year.

C)When bills have to be paid.

D)A or B, whichever is longer.

E)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which statement is incorrect? 90)

A)Revenue accounts are closed to Income Summary.

B)Income Summary is closed to Capital.

C)Withdrawals are closed to Income Summary.

D)Expense accounts are closed to Income Summary.

E)Withdrawals are closed to Capital.

A)Revenue accounts are closed to Income Summary.

B)Income Summary is closed to Capital.

C)Withdrawals are closed to Income Summary.

D)Expense accounts are closed to Income Summary.

E)Withdrawals are closed to Capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is the final step in the accounting cycle? 99)

A)Preparing an adjusted trial balance.

B)Preparing a post-closing trial balance.

C)Journalizing.

D)Preparing the statements.

E)Preparing a work sheet.

A)Preparing an adjusted trial balance.

B)Preparing a post-closing trial balance.

C)Journalizing.

D)Preparing the statements.

E)Preparing a work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Income Summary account is used

A)To replace the income statement under certain circumstances.

B)To replace the capital account in some businesses.

C)To close the revenue and expense accounts.

D)To determine the appropriate withdrawal amount.

E)To adjust and update asset accounts.

A)To replace the income statement under certain circumstances.

B)To replace the capital account in some businesses.

C)To close the revenue and expense accounts.

D)To determine the appropriate withdrawal amount.

E)To adjust and update asset accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

Revenues 75,000 Income Summary 75,000

B) Income Summary 62,000

Expenses 62,000

C) Capital 10,000

Withdrawals 10,000

D) Income Summary 13,000

Capital 13,000

E)All of these should be journalized in the closing process.

B) Income Summary 62,000

Expenses 62,000

C) Capital 10,000

Withdrawals 10,000

D) Income Summary 13,000

Capital 13,000

E)All of these should be journalized in the closing process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

Current Liabilities

A)Are listed in order of liquidity.

B)Are due to be settled after one year or the operating cycle.

C)Are due to be settled within the shorter of one year or the operating cycle.

D)Are closed at the end of the accounting period to current assets.

E)Are listed in the order in which they are to be paid, with the first one listed to be paid first.

A)Are listed in order of liquidity.

B)Are due to be settled after one year or the operating cycle.

C)Are due to be settled within the shorter of one year or the operating cycle.

D)Are closed at the end of the accounting period to current assets.

E)Are listed in the order in which they are to be paid, with the first one listed to be paid first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

The asset section of a classified balance sheet includes

A)Current assets, long-term investments, property, plant and equipment, and intangible assets.

B)Current assets, liabilities, property, plant and equipment, and intangible assets.

C)Current assets, long-term investments, property, plant and equipment, and withdrawals.

D)Current assets, non-current assets, equity, and intangible assets.

E)Current liabilities, long-term investments, property, plant and equipment, and intangible assets.

A)Current assets, long-term investments, property, plant and equipment, and intangible assets.

B)Current assets, liabilities, property, plant and equipment, and intangible assets.

C)Current assets, long-term investments, property, plant and equipment, and withdrawals.

D)Current assets, non-current assets, equity, and intangible assets.

E)Current liabilities, long-term investments, property, plant and equipment, and intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

Emilia Feridy, the proprietor of EF Services, withdrew a total of $50 to pay for herdaughter's swimming lessons. What is the entry needed to record this transaction?

A)Debit Emilia Feridy, Capital and credit Cash for $50.

B)Debit Emilia Feridy, Withdrawals and credit Cash for $50.

C)Debit Emilia Feridy, Capital and credit Emilia Feridy, Withdrawals for $50.

D)Debit Cash and credit Emilia Feridy, Withdrawals for $50.

E)Debit Emilia Feridy, Withdrawals and credit Emilia Feridy, Capital for $50.

A)Debit Emilia Feridy, Capital and credit Cash for $50.

B)Debit Emilia Feridy, Withdrawals and credit Cash for $50.

C)Debit Emilia Feridy, Capital and credit Emilia Feridy, Withdrawals for $50.

D)Debit Cash and credit Emilia Feridy, Withdrawals for $50.

E)Debit Emilia Feridy, Withdrawals and credit Emilia Feridy, Capital for $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

A post-closing trial balance shows

A)All ledger accounts with a balance, which include some temporary and some real accounts.

B)Only asset accounts.

C)Only revenue and expense accounts.

D)All ledger accounts with a balance, none of which can be real accounts.

E)All ledger accounts with a balance, none of which can be temporary accounts.

A)All ledger accounts with a balance, which include some temporary and some real accounts.

B)Only asset accounts.

C)Only revenue and expense accounts.

D)All ledger accounts with a balance, none of which can be real accounts.

E)All ledger accounts with a balance, none of which can be temporary accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

After all closing entries are made and posted, the balance in the owners' capital accountin the ledger will be equal to:

A)Zero.

B)The beginning balance in owners' capital in the statement of changes in equity.

C)The balance of owners' capital on the post-closing trial balance.

D)The balance of owners' capital on the pre-closing trial balance.

E)Profit or loss for the year.

A)Zero.

B)The beginning balance in owners' capital in the statement of changes in equity.

C)The balance of owners' capital on the post-closing trial balance.

D)The balance of owners' capital on the pre-closing trial balance.

E)Profit or loss for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements is true? 97)

A)Preparing a post-closing trial balance helps to prove the accuracy of the adjusting and closing procedures.

B)Journalizing consists of analyzing and recording transactions in T-accounts.

C)The information on the work sheet can be used in place of preparing financial statements.

D)By using a work sheet to prepare adjusting entries you need not post these entries to the ledger accounts.

E)All of these statements are true.

A)Preparing a post-closing trial balance helps to prove the accuracy of the adjusting and closing procedures.

B)Journalizing consists of analyzing and recording transactions in T-accounts.

C)The information on the work sheet can be used in place of preparing financial statements.

D)By using a work sheet to prepare adjusting entries you need not post these entries to the ledger accounts.

E)All of these statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

The normal order for the asset section of a classified balance sheet is

A)Current assets, prepaid expenses, long-term investments, intangible assets.

B)Intangible assets, current assets, long-term investments, property, plant and equipment.

C)Property, plant and equipment, intangible assets, long-term investments, current assets.

D)Long-term investments, current assets, property, plant and equipment, intangible assets.

E)Current assets, long-term investments, property, plant and equipment, intangible assets.

A)Current assets, prepaid expenses, long-term investments, intangible assets.

B)Intangible assets, current assets, long-term investments, property, plant and equipment.

C)Property, plant and equipment, intangible assets, long-term investments, current assets.

D)Long-term investments, current assets, property, plant and equipment, intangible assets.

E)Current assets, long-term investments, property, plant and equipment, intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

The special account used only in the closing process to temporarily hold the amounts ofrevenues and expenses before the net difference is added to (or subtracted from)the owner's capital account is the:

A)Nominal account.

B)Balance column account.

C)Income Summary account.

D)Contra account.

E)Closing account.

A)Nominal account.

B)Balance column account.

C)Income Summary account.

D)Contra account.

E)Closing account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

The eight recurring steps performed each accounting period, starting with recordingtransactions in the journal and continuing through the post-closing trial balance, is called the:

A)Closing cycle.

B)Natural business year.

C)Accounting period.

D)Operating cycle.

E)Accounting cycle.

A)Closing cycle.

B)Natural business year.

C)Accounting period.

D)Operating cycle.

E)Accounting cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

An error is indicated if the following account has a balance appearing on the post-closing trial balance:

A)Office Equipment.

B)Depreciation expense, Office Equipment.

C)Ted Nash, Capital.

D)Accumulated Depreciation, Office Equipment.

E)Salaries Payable.

A)Office Equipment.

B)Depreciation expense, Office Equipment.

C)Ted Nash, Capital.

D)Accumulated Depreciation, Office Equipment.

E)Salaries Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

A classified balance sheet

A)Shows the effect of profit and withdrawals on owner's capital.

B)Presents revenues, expenses and profit.

C)Shows operating, investing, and financing activities.

D)Organizes assets and liabilities into important subgroups.

E)Measures a company's ability to pay its bills on time.

A)Shows the effect of profit and withdrawals on owner's capital.

B)Presents revenues, expenses and profit.

C)Shows operating, investing, and financing activities.

D)Organizes assets and liabilities into important subgroups.

E)Measures a company's ability to pay its bills on time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

When closing the Withdrawals account

A)Liability account should be credited.

B)The owners' capital account should be debited.

C)The owners' capital account should be credited.

D)The income summary account should be debited.

E)The income summary account should be credited.

A)Liability account should be credited.

B)The owners' capital account should be debited.

C)The owners' capital account should be credited.

D)The income summary account should be debited.

E)The income summary account should be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

The Income Summary account is a(n)

A)Balance Sheet account.

B)Income Statement account.

C)Temporary account.

D)Permanent account.

E)Both Income Statement and Balance Sheet accounts.

A)Balance Sheet account.

B)Income Statement account.

C)Temporary account.

D)Permanent account.

E)Both Income Statement and Balance Sheet accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

The following are the steps in the accounting cycle. List them in the order in which they are completed:Completing the work sheetPostingPreparing an unadjusted trial balanceJournalizingPreparing the statementsClosing the temporary accountsAdjusting the ledger accountsPreparing a post-closing trial balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

Explain why closing entries are a necessary step in the accounting cycle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

The current ratio

A)Measures the effect of operating income on profit.

B)Is used to measure a company's profitability.

C)Is used to measure the relationship between assets and long-term debt.

D)Only relates to noncurrent liabilities.

E)Is used to evaluate a company's ability to pay its short-term obligations.

A)Measures the effect of operating income on profit.

B)Is used to measure a company's profitability.

C)Is used to measure the relationship between assets and long-term debt.

D)Only relates to noncurrent liabilities.

E)Is used to evaluate a company's ability to pay its short-term obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

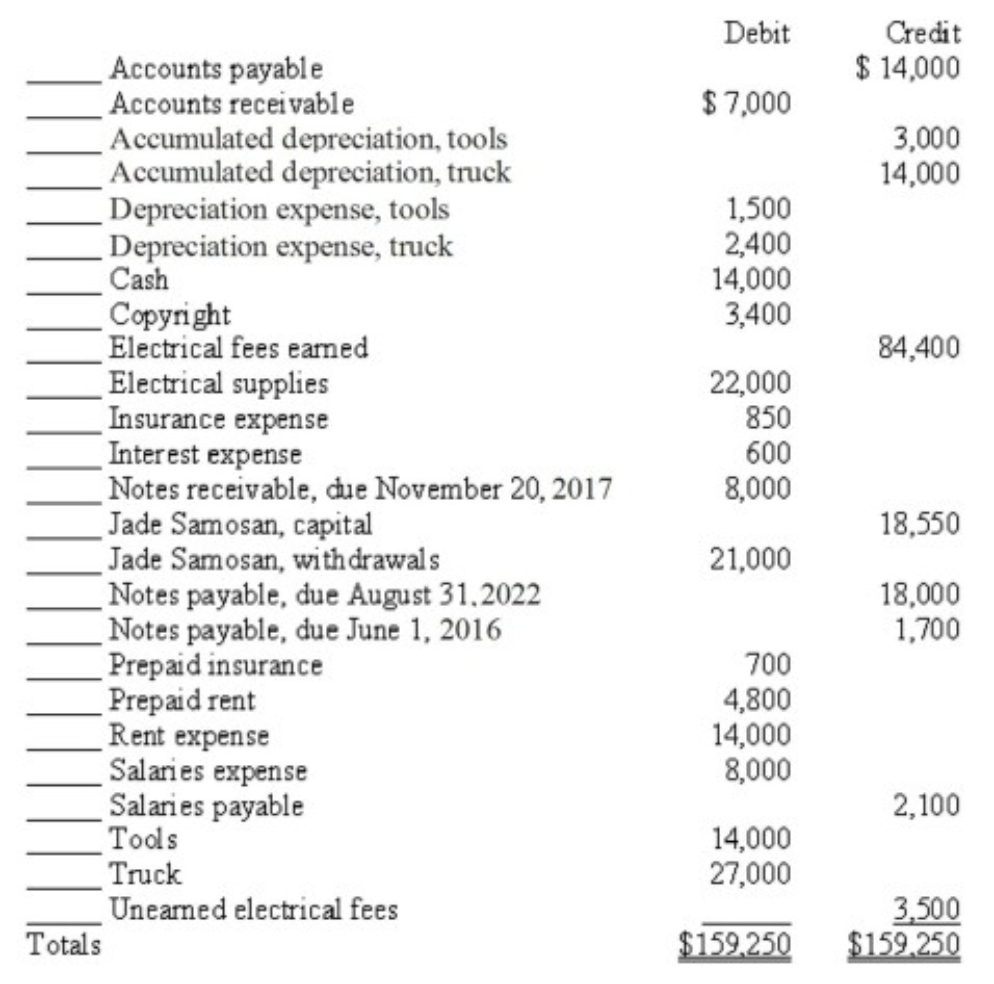

The alphabetized adjusted trial balance for SimCo Electrical Outfitters at August

31, 2015, is shown below. Identify how each account balance would b e classified on a balance sheet given the following classification symbols:

31, 2015, is shown below. Identify how each account balance would b e classified on a balance sheet given the following classification symbols:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

(A)In a sole proprietorship, Income Summary is closed to what account? (B)In following the steps of the accounting cycle, what two steps must be done before preparation of an unadjusted trial balance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

Explain why temporary accounts are closed each period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

131

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

Explain the purpose of closing entries and describe the closing process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

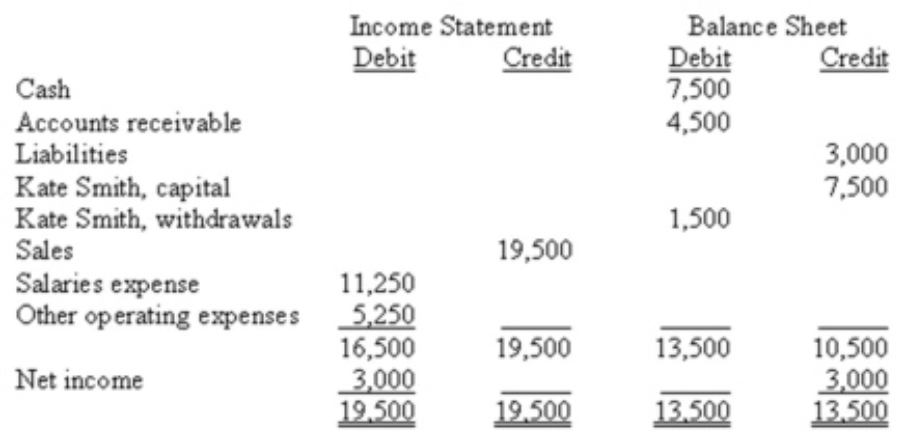

) The items that follow appeared in the Income Statement columns of the work sheet prepared for a sole proprietorship at year-end, December 31, 2015. Also, the owner's withdrawals account was debited for $12,000 during the year.

Prepare the necessary closing entries at December 31.

Prepare the necessary closing entries at December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which statement is true about liquidity? Prepaid Rent is

A)More liquid than cash.

B)Less liquid than land.

C)Less liquid than rent revenue.

D)Less liquid that inventories.

E)More liquid than inventories.

A)More liquid than cash.

B)Less liquid than land.

C)Less liquid than rent revenue.

D)Less liquid that inventories.

E)More liquid than inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

The ending balance of owner's capital is calculated as

A)Assets plus liabilities.

B)Owner's capital account balance minus loss plus the withdrawals account balance.

C)Profit minus the withdrawals account balance.

D)Owner's capital account balance plus profit minus the withdrawals account balance.

E)None of these answers is correct.

A)Assets plus liabilities.

B)Owner's capital account balance minus loss plus the withdrawals account balance.

C)Profit minus the withdrawals account balance.

D)Owner's capital account balance plus profit minus the withdrawals account balance.

E)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

Describe a classified balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

Discuss the purpose of a post-closing trial balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

Indicate beside each of the following accounts whether the account is a temporary or permanent account.(a)Cash(b)Prepaid insurance(c)Unearned Revenue(d)Accounts receivable(e)Insurance expense(f)Smith, capital(g)Smith, withdrawals(h)Rent expense(i)Revenue(j)Supplies(k)Supplies expense(l)Depreciation expense, building(m)Accumulated depreciation, building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

Identify the steps in the accounting cycle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

Describe a work sheet and explain why it is useful

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

Reversing entries

A)Are required by CRA.

B)Are optional.

C)Fix errors in journal entries.

D)Are not posted to the ledger.

E)Are mandatory.

A)Are required by CRA.

B)Are optional.

C)Fix errors in journal entries.

D)Are not posted to the ledger.

E)Are mandatory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Reversing entries are

A)Linked to accrued assets and liabilities that were created by adjusting entries at the end of the previous accounting period.

B)Used to simplify a company's record keeping.

C)Dated the first day of the next accounting period.

D)Optional.

E)All of these answers are correct.

A)Linked to accrued assets and liabilities that were created by adjusting entries at the end of the previous accounting period.

B)Used to simplify a company's record keeping.

C)Dated the first day of the next accounting period.

D)Optional.

E)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

The current ratio

A)Helps to assess a company's ability to pay its debts in the near future.

B)Is current assets divided by current liabilities.

C)Is a measure of a company's liquidity.

D)Suggests there may be problems in a business if it is less than 1.

E)All of these answers are correct.

A)Helps to assess a company's ability to pay its debts in the near future.

B)Is current assets divided by current liabilities.

C)Is a measure of a company's liquidity.

D)Suggests there may be problems in a business if it is less than 1.

E)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

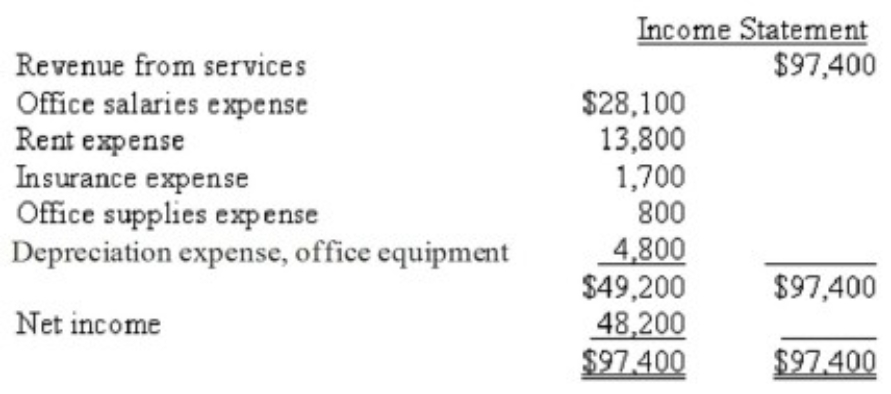

Using the above reference, prepare an income statement, statement of changes in equity and a classified balance sheet. This is Lucie's first year of operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

Explain the purpose of reversing entries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use the balance sheet you prepared above to calculate the current ratio.Comment on the company's liquidity position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

63

Using the information from Lucie Accounting (Ref 4-137), calculate the currentratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck