Deck 6: Cost Allocation and Activity-Based Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/144

العب

ملء الشاشة (f)

Deck 6: Cost Allocation and Activity-Based Costing

1

Managers should not be held responsible for noncontrollable costs.

True

2

Once the opportunity cost associated with a shared resource is determined, it is unlikely to change.

False

3

One of the reasons that companies allocate costs is to encourage managers to use externally provided services, rather than those that are internally provided.

False

4

Cost allocation is the process of assigning direct and indirect costs to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

5

When service department costs are allocated using actual costs and actual usage, the amount allocated to one department will depend on the usage of other departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

6

The allocation base selected should ideally have a relative benefits relationship with the costs to be allocated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

7

ABC is more likely than traditional costing systems to undercost complex, low-volume products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

8

In order to provide full cost information for external reporting purposes, indirect production costs must be allocated to goods produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

9

Large cost pools that contain many different kinds of costs are most useful to managers in making decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

10

Cost allocation methods that provide the most accurate full cost information for financial reporting, also provide the most accurate information for cost-plus contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

11

Indirect costs occur because resources are shared by more than one cost objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

12

From a decision-making standpoint, the allocated cost should measure the opportunity cost of using a company resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

13

The more costs that are allocated to a cost-plus contract, the smaller the profit will be for the supplier of the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

14

Cost-plus contracts guarantee that the supplier will pay for production costs and the customer will pay a fixed amount or percentage of the cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

15

Allocating actual service department costs allows the service departments to pass on the costs of inefficiencies to the production departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

16

In the direct method of allocating costs, service department costs are allocated only to production departments, not to other service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

17

One of the reasons that companies allocate costs is to allow for the frivolous use of common resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

18

Allocating unitized fixed and variable costs leads to better decision making than allocating total costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

19

Allocating fixed costs on a per unit basis will often cause the managers receiving the allocations to perceive the costs as variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

20

A cost objective is the product, service, or department that will receive the allocated cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

21

Activity-based costing uses benchmarking to compare the cost of an activity in one organization to the cost for a similar activity in another organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is not a step in the cost allocation process?

A)Calculate the cost involved in each step of the production process.

B)Select an allocation base to relate the cost pools to the cost objectives.

C)Form cost pools.

D)Identify the cost objectives.

A)Calculate the cost involved in each step of the production process.

B)Select an allocation base to relate the cost pools to the cost objectives.

C)Form cost pools.

D)Identify the cost objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not a reason that companies allocate costs?

A)To calculate the full cost of products for financial reporting purposes

B)To discourage managers from using external suppliers

C)To reduce the frivolous use of company resources

D)To provide information needed by managers to make appropriate decisions

A)To calculate the full cost of products for financial reporting purposes

B)To discourage managers from using external suppliers

C)To reduce the frivolous use of company resources

D)To provide information needed by managers to make appropriate decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

24

Full cost information

A)is required by GAAP for internal reporting purposes.

B)requires the allocation of indirect costs.

C)provides managers with cost information on uncontrollable costs.

D)treats all costs as fixed costs.

A)is required by GAAP for internal reporting purposes.

B)requires the allocation of indirect costs.

C)provides managers with cost information on uncontrollable costs.

D)treats all costs as fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

25

A contract that specifies that the supplier will be paid for the cost of production as well as some fixed amount or percentage of cost is called a(n)

A)relative-benefits contract.

B)cost-plus contract.

C)allocation cost pool.

D)indirect cost budget.

A)relative-benefits contract.

B)cost-plus contract.

C)allocation cost pool.

D)indirect cost budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

26

A major problem with cost-plus contracts is that they

A)include costs that do not follow GAAP.

B)cause the supplier to take significant financial risks.

C)require the supplier to use variable costing.

D)create an incentive to allocate as much cost as possible to the goods produced under the contract.

A)include costs that do not follow GAAP.

B)cause the supplier to take significant financial risks.

C)require the supplier to use variable costing.

D)create an incentive to allocate as much cost as possible to the goods produced under the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

27

An example of a unit-level activity is the design of a particular product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

28

Indirect costs occur when

A)resources are shared by more than one product or service.

B)costs are directly traced to products or services.

C)controllable costs are incurred by cost objectives.

D)All of these answer choices are correct.

A)resources are shared by more than one product or service.

B)costs are directly traced to products or services.

C)controllable costs are incurred by cost objectives.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

29

Under the ABC approach, costs are assigned to cost drivers based on a chosen cost objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the product, service, or department that is to receive the cost allocation called?

A)Cost-plus recipient

B)Cost objective

C)Cost driver

D)Cost pool

A)Cost-plus recipient

B)Cost objective

C)Cost driver

D)Cost pool

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

31

The process of assigning indirect costs is called

A)benchmarking.

B)tracing.

C)cost allocation.

D)cost unitizing.

A)benchmarking.

B)tracing.

C)cost allocation.

D)cost unitizing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

32

From a decision-making standpoint, the allocated cost should measure the

A)sunk cost of the resource involved.

B)variable costs of the materials purchased.

C)opportunity cost of using a company resource.

D)product cost of the goods produced.

A)sunk cost of the resource involved.

B)variable costs of the materials purchased.

C)opportunity cost of using a company resource.

D)product cost of the goods produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

33

In which of the following industries are cost-plus contracts common?

A)Hybrid car manufacturers

B)Soft drink bottlers

C)Governmental defense suppliers

D)Newspaper publishers

A)Hybrid car manufacturers

B)Soft drink bottlers

C)Governmental defense suppliers

D)Newspaper publishers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is a grouping of individual costs whose total is allocated using one allocation base?

A)Cost objective

B)Cost pool

C)Direct cost

D)Cost driver

A)Cost objective

B)Cost pool

C)Direct cost

D)Cost driver

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

35

A cost objective is the

A)reason for allocating the cost.

B)basis on which costs are allocated.

C)product, service, or department that is to receive the allocation.

D)relative benefit received from using a resource.

A)reason for allocating the cost.

B)basis on which costs are allocated.

C)product, service, or department that is to receive the allocation.

D)relative benefit received from using a resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

36

If managers are not charged for centrally administered services, what may managers likely do?

A)Seek outside suppliers

B)Limit their frivolous use of these services

C)Consider the services as free

D)Evaluate and consider lower-cost alternatives for the services

A)Seek outside suppliers

B)Limit their frivolous use of these services

C)Consider the services as free

D)Evaluate and consider lower-cost alternatives for the services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

37

Activity-based management aims at improving the efficiency and effectiveness of business processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

38

Costs may not be allocated to

A)cost drivers.

B)services.

C)departments.

D)cost objectives.

A)cost drivers.

B)services.

C)departments.

D)cost objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is least likely to be a cost objective?

A)Salaries such as those in the accounting and personnel departments

B)Individual products such as spades and mowers

C)Product lines such as loans and estate plans

D)Departments such as assembly and finishing

A)Salaries such as those in the accounting and personnel departments

B)Individual products such as spades and mowers

C)Product lines such as loans and estate plans

D)Departments such as assembly and finishing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

40

ABC allocates cost pools to cost objectives using cost drivers as the allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements is true concerning lump-sum allocations of service department costs?

A They make fixed costs appear to be variable to the manager receiving the allocation.

B)They are not affected by the activity level in the department receiving the allocation.

C)They make fixed costs appear to be variable to the manager receiving the allocation and are not affected by the activity level in the department receiving the allocation.

D)They do not make fixed costs appear to be variable to the manager receiving the allocation and are affected by the activity level in the department receiving the allocation

A They make fixed costs appear to be variable to the manager receiving the allocation.

B)They are not affected by the activity level in the department receiving the allocation.

C)They make fixed costs appear to be variable to the manager receiving the allocation and are not affected by the activity level in the department receiving the allocation.

D)They do not make fixed costs appear to be variable to the manager receiving the allocation and are affected by the activity level in the department receiving the allocation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is a measure of activity used to distribute indirect costs?

A)Cost objective

B)Cost pool

C)Cost driver

D)Cost unitization

A)Cost objective

B)Cost pool

C)Cost driver

D)Cost unitization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following allocations would not occur when the direct method is used in a manufacturing company?

A)Personnel department costs are allocated to the maintenance department.

B)Maintenance department costs are allocated to the mixing department.

C)Security department costs are allocated to the packaging department.

D)Payroll department costs are allocated to the assembly department.

A)Personnel department costs are allocated to the maintenance department.

B)Maintenance department costs are allocated to the mixing department.

C)Security department costs are allocated to the packaging department.

D)Payroll department costs are allocated to the assembly department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not a criterion typically used to allocate indirect fixed costs?

A)Ability to bear costs

B)Equity

C)Feasible outcomes

D)Relative benefits

A)Ability to bear costs

B)Equity

C)Feasible outcomes

D)Relative benefits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

45

Lump-sum allocations

A)generally changes year after year.

B)do not change when the activity levels of any of the user departments change.

C)are impacted by the usage of the allocated resource by other departments.

D)make fixed costs appear variable.

A)generally changes year after year.

B)do not change when the activity levels of any of the user departments change.

C)are impacted by the usage of the allocated resource by other departments.

D)make fixed costs appear variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

46

Service department costs are allocated to producing departments

A)so that the costs can be allocated to the products in the producing departments.

B)so that less cost is allocated to service departments.

C)so that the service will not be purchased externally.

D)All of these answer choices are correct.

A)so that the costs can be allocated to the products in the producing departments.

B)so that less cost is allocated to service departments.

C)so that the service will not be purchased externally.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

47

The advantage of allocating budgeted rather than actual service department costs is that

A)managers are not motivated to evaluate the charges.

B)only one cost pool is necessary.

C)service departments cannot pass on the costs of inefficiencies and waste.

D)this practice is acceptable under GAAP.

A)managers are not motivated to evaluate the charges.

B)only one cost pool is necessary.

C)service departments cannot pass on the costs of inefficiencies and waste.

D)this practice is acceptable under GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

48

A cost pool is

A)not necessary in cost-plus contracts.

B)useful when separating mixed costs into their fixed and variable components.

C)allocated using a single allocation base.

D)a method of allocating costs among service departments.

A)not necessary in cost-plus contracts.

B)useful when separating mixed costs into their fixed and variable components.

C)allocated using a single allocation base.

D)a method of allocating costs among service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is the overriding concern in forming a cost pool?

A)To ensure that there are no variable costs in the cost pool

B)To ensure that the total amount in the cost pool is less than the direct costs for the product

C)To ensure that only costs which have been budgeted are included in the cost pool

D)To ensure the costs in the pool are homogeneous or similar

A)To ensure that there are no variable costs in the cost pool

B)To ensure that the total amount in the cost pool is less than the direct costs for the product

C)To ensure that only costs which have been budgeted are included in the cost pool

D)To ensure the costs in the pool are homogeneous or similar

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

50

When fixed costs are unitized, they

A)are stated on a per unit basis.

B)may appear to remain the same in total at all levels of activity.

C)may cause managers to use volume-related allocation.

D)All of these answer choices are correct.

A)are stated on a per unit basis.

B)may appear to remain the same in total at all levels of activity.

C)may cause managers to use volume-related allocation.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

51

Managers are correct when they perceive that almost all cost allocations are

A)insignificant.

B)arbitrary.

C)designed to make them look bad.

D)unnecessary.

A)insignificant.

B)arbitrary.

C)designed to make them look bad.

D)unnecessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

52

An allocation of a predetermined amount that is not affected by changes in the activity level of the organizational unit receiving the allocation is called a(n)

A)allocation base.

B)unitized cost.

C)lump-sum allocation.

D)cost driver.

A)allocation base.

B)unitized cost.

C)lump-sum allocation.

D)cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

53

An allocation base

A)is also called a cost objective.

B)is a characteristic that is the same for all cost drivers.

C)ideally uses a cause-and-effect relationship to the cost pool.

D)All of these answer choices are correct.

A)is also called a cost objective.

B)is a characteristic that is the same for all cost drivers.

C)ideally uses a cause-and-effect relationship to the cost pool.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is a method of allocation used to assign service department costs to production departments, but not to other service departments?

A)Equity method

B)Direct method

C)Lump-sum method

D)Traditional method

A)Equity method

B)Direct method

C)Lump-sum method

D)Traditional method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is not a service department in a typical manufacturing firm?

A)Security

B)Fabrication

C)Maintenance

D)Personnel

A)Security

B)Fabrication

C)Maintenance

D)Personnel

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

56

An allocation base

A)is the minimum amount to be allocated to a cost objective.

B)is also called a cost pool.

C)represents the items to which a cost will be allocated.

D)relates the cost pool to the cost objectives.

A)is the minimum amount to be allocated to a cost objective.

B)is also called a cost pool.

C)represents the items to which a cost will be allocated.

D)relates the cost pool to the cost objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements about cost pools is true?

A)The costs in each of the cost pools should be homogeneous or similar.

B)The number of cost pools must be the same as the number of products produced by a company.

C)Only four different kinds of costs may be included in a single cost pool.

D)Each cost pool should include the costs of one expense account.

A)The costs in each of the cost pools should be homogeneous or similar.

B)The number of cost pools must be the same as the number of products produced by a company.

C)Only four different kinds of costs may be included in a single cost pool.

D)Each cost pool should include the costs of one expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not a problem caused by assigning actual service department costs to operating departments based on actual usage of service department activities by the operating departments?

A)The cost assigned to one manager will be affected by the service usage of another manager.

B)Inefficiencies in the service department will be passed along to the operating departments.

C)Operating managers having high peak capacity requirements will not have to bear the full cost of meeting this peak capacity.

D)All of these answer choices are problems caused by assigning actual service costs to operating departments.

A)The cost assigned to one manager will be affected by the service usage of another manager.

B)Inefficiencies in the service department will be passed along to the operating departments.

C)Operating managers having high peak capacity requirements will not have to bear the full cost of meeting this peak capacity.

D)All of these answer choices are problems caused by assigning actual service costs to operating departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

59

What costs are affected by the manager's decisions for which the manager should be held accountable?

A)Indirect costs

B)Controllable costs

C)Sunk costs

D)Pooled costs

A)Indirect costs

B)Controllable costs

C)Sunk costs

D)Pooled costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Copy Department of Hernandez Hardware is budgeted to incur $30,000 per month in fixed costs plus a cost of $0.02 per copy.The company allocates copy costs to user departments as follows:

-Fixed costs are allocated as a lump sum based on budgeted fixed costs and estimated peak demand for each department.

-Variable costs are allocated based on the budgeted rate per copy times the department's actual usage.

Which of the following is an advantage of this allocation scheme over allocating all actual service costs based on actual usage?

A)Departments that use copy services are charged for cost overruns in the copy department.

B)The amount charged to a particular user department is affected by the number of copies used by another department.

C)Managers in departments that use services pay for the fixed costs that fluctuate based on their changing needs.

D)Managers are charged for the activities they use.

-Fixed costs are allocated as a lump sum based on budgeted fixed costs and estimated peak demand for each department.

-Variable costs are allocated based on the budgeted rate per copy times the department's actual usage.

Which of the following is an advantage of this allocation scheme over allocating all actual service costs based on actual usage?

A)Departments that use copy services are charged for cost overruns in the copy department.

B)The amount charged to a particular user department is affected by the number of copies used by another department.

C)Managers in departments that use services pay for the fixed costs that fluctuate based on their changing needs.

D)Managers are charged for the activities they use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

61

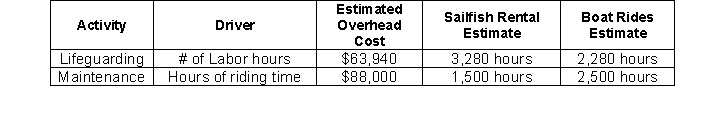

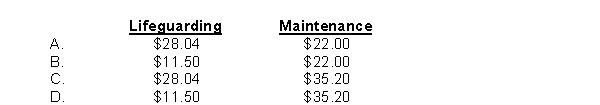

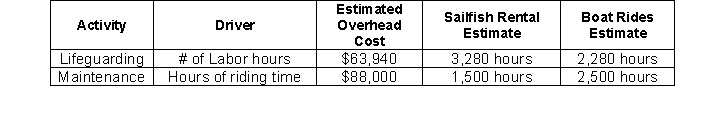

Teal Sports offers 2 different types of water sport activities-sailfish rental and banana boat rides.The company has two different activities-lifeguarding and maintenance-that provide input into its cost objectives.Data on estimated overhead for the year follows:  What overhead rates will be used in each department to assign costs to the banana boat rides?

What overhead rates will be used in each department to assign costs to the banana boat rides?

What overhead rates will be used in each department to assign costs to the banana boat rides?

What overhead rates will be used in each department to assign costs to the banana boat rides?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

62

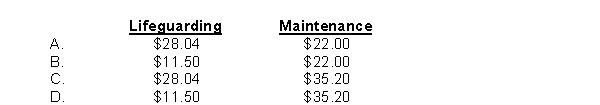

Teal Sports offers 2 different types of water sport activities-sailfish rental and banana boat rides.The company has two different activities-lifeguarding and maintenance-that provide input into its cost objectives.Data on estimated overhead for the year follows: The company provides 2,400 banana boat rides and 1,200 sailfish rentals each year.How much overhead will be assigned to each banana boat ride?

A)$42.20

B) $73.24

C) $22.56

D)$33.84

A)$42.20

B) $73.24

C) $22.56

D)$33.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

63

Companies that use only one or two cost pools rather than several cost pools

A)incurs more cost of record keeping.

B)will experience more profit than if more pools are used.

C)may price products incorrectly due to inaccurate cost allocation.

D)are likely to be using ABC.

A)incurs more cost of record keeping.

B)will experience more profit than if more pools are used.

C)may price products incorrectly due to inaccurate cost allocation.

D)are likely to be using ABC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

64

The traditional approach to cost allocation

A)tends to over-cost high volume core products.

B)usually requires more cost pools than ABC.

C)attempts to identify the activities that cause costs.

D)produces more accurate costs than other allocation methods.

A)tends to over-cost high volume core products.

B)usually requires more cost pools than ABC.

C)attempts to identify the activities that cause costs.

D)produces more accurate costs than other allocation methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

65

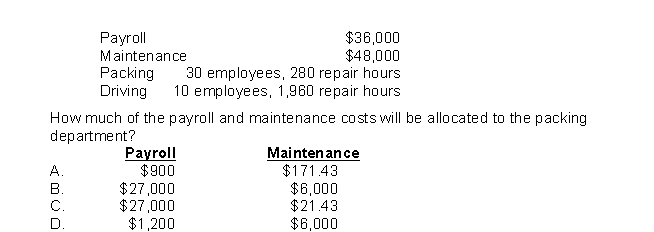

Intermodal Moving uses the direct method and allocates its maintenance costs on the basis of repair hours and its payroll department costs on the basis of employees.Estimated costs and information on the services and production departments follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

66

Marley Music produces toy instruments-trumpet and flute- for children.Molding costs are allocated to products based on a percentage of material costs.Molding costs of $15,000 per month are budgeted and the store anticipates spending $30,000 in materials.By the end of the month, it was determined that actual molding costs were $14,500.If the company spends $6.50 per trumpet for materials, and $3.50 per flute for materials, how much of the molding costs will be allocated to each trumpet?

A)$0.50

B)$0.48

C)$3.14

D)$3.25

A)$0.50

B)$0.48

C)$3.14

D)$3.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

67

The law firm of Barnes & Cohen purchased a new $17,600 copier.Copying costs will be shared by the purchasing, accounting, and information technology departments since those are the only departments that will have access to the machine.The company has decided to allocate the copying cost based on the number of copies made by each department.The sales person who sold the copier to the attorneys expects it will generate 1,000,000 copies.The manager of each department has estimated the number of copies that his or her department will make over the life of the copier: If the purchasing department makes 23,000 copies this quarter, how much copying cost will Barnes & Cohen allocate to purchasing?

A)$405

B)$2,699

C)$506

D)None of these answer choices are correct.

A)$405

B)$2,699

C)$506

D)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

68

The law firm of Barnes & Cohen purchased a new $17,600 copier.Copying costs will be shared by the purchasing, accounting, and information technology departments since those are the only departments that will have access to the machine.The company has decided to allocate the copying cost based on the number of copies made by each department.The sales person who sold the copier to the attorneys expects it will generate 1,000,000 copies.The manager of each department has estimated the number of copies that his or her department will make over the life of the copier: How much overhead will be allocated each time a copy is made by the accounting department?

A)2.2 cents

B)3.9 cents

C)1.76 cents

D)None of these answer choices are correct.

A)2.2 cents

B)3.9 cents

C)1.76 cents

D)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following steps is not involved in the ABC approach?

A)Identify activities that cause costs to be incurred.

B)Allocate costs to products based on activity usage.

C)Group costs of activities into cost pools.

D)Improve processes based on benchmarking.

A)Identify activities that cause costs to be incurred.

B)Allocate costs to products based on activity usage.

C)Group costs of activities into cost pools.

D)Improve processes based on benchmarking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

70

What is the major difference between ABC and ABM?

A)ABC is used in managerial accounting, while ABM is used in financial accounting.

B)ABC focuses on measurement, while ABM focuses on control.

C)The goal of ABC is to accurately control costs, while the goal of ABM is to allocate costs most effectively to cost objectives.

D)There is no difference; ABC and ABM are two names for the same thing.

A)ABC is used in managerial accounting, while ABM is used in financial accounting.

B)ABC focuses on measurement, while ABM focuses on control.

C)The goal of ABC is to accurately control costs, while the goal of ABM is to allocate costs most effectively to cost objectives.

D)There is no difference; ABC and ABM are two names for the same thing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

71

How many distinct activities are used by most companies that design ABC systems?

A)Fewer than 3

B)3 to 10

C)11 to 24

D)25 to 100

A)Fewer than 3

B)3 to 10

C)11 to 24

D)25 to 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

72

Terrel Gifts produces logo platters and cups bearing the name of the city in which the items will be sold to tourists.Indirect logo printing costs are allocated to platters and cups based on the amount of time spent on the logo machine.The company has budgeted indirect logo costs of $4,224 per month and expects to spend 4,800 hours on printing logos each month.Each platter uses 24 minutes and each cup spends 6 minutes on the logo machine.How much of the logo printing costs will be allocated to each platter?

A)$0.35

B)$0.88

C)$21.12

D)$8.12

A)$0.35

B)$0.88

C)$21.12

D)$8.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

73

From the perspective of a manager of a producing department, which of the following is a desired feature of a cost allocation received from a service department?

A)The amount of the allocation should be based solely on the usage of the service by the producing department and not a function of the usage of the service by other departments.

B)The budgeted cost should be allocated rather than actual service department costs.

C)The allocation should force the production manager to pay for fluctuating demands that the production manager is creating.

D)All of these answer choices are correct.

A)The amount of the allocation should be based solely on the usage of the service by the producing department and not a function of the usage of the service by other departments.

B)The budgeted cost should be allocated rather than actual service department costs.

C)The allocation should force the production manager to pay for fluctuating demands that the production manager is creating.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

74

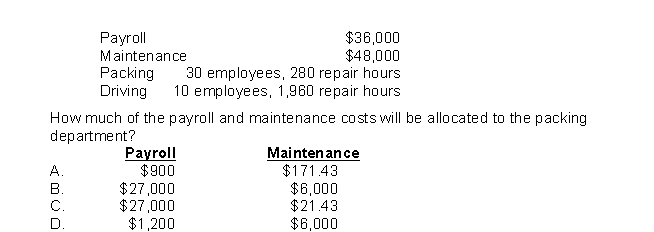

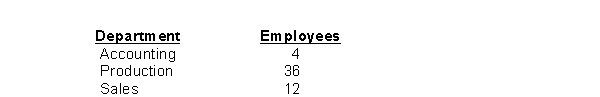

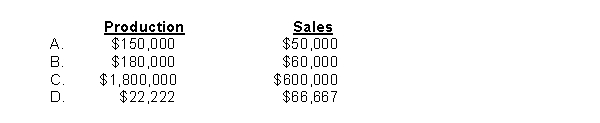

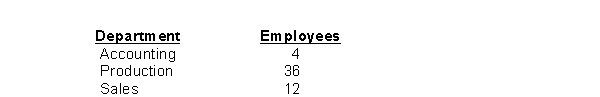

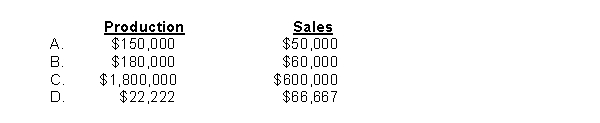

Ransom Widgets allocates the estimated cost of its accounting department, $200,000, to its production and sales departments since the accounting department supports these departments with regard to payroll and accounts payable functions.The accounting department costs will be allocated based on the number of employees using the direct method.Information regarding employees follows:  How much of the accounting department costs will be allocated to the production and sales departments, respectively?

How much of the accounting department costs will be allocated to the production and sales departments, respectively?

How much of the accounting department costs will be allocated to the production and sales departments, respectively?

How much of the accounting department costs will be allocated to the production and sales departments, respectively?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is likely to occur when fewer overhead cost pools are used?

A)Product costs will be less accurate.

B)Recordkeeping will be more expensive.

C)Decisions such as product pricing will be improved.

D)All products will be undercosted.

A)Product costs will be less accurate.

B)Recordkeeping will be more expensive.

C)Decisions such as product pricing will be improved.

D)All products will be undercosted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

76

When activity-based costing is implemented, the initial outcome is that

A)the unit cost of all products will be higher.

B)the unit cost of all products will be lower.

C)the unit cost of low-volume products will be higher and the unit cost of high-volume products will be lower.

D)the unit cost of low-volume products will be lower and the unit cost of high-volume products will be higher.

A)the unit cost of all products will be higher.

B)the unit cost of all products will be lower.

C)the unit cost of low-volume products will be higher and the unit cost of high-volume products will be lower.

D)the unit cost of low-volume products will be lower and the unit cost of high-volume products will be higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is not an advantage of activity-based costing over traditional volume-based costing systems?

A)ABC may lead to cost control improvement as managers are charged for using activities.

B)ABC is less likely than a traditional system to undercost complex, low-volume products.

C)ABC is less costly to implement than traditional systems.

D)ABC allows managers to get an understanding of the cost of their respective department's activities.

A)ABC may lead to cost control improvement as managers are charged for using activities.

B)ABC is less likely than a traditional system to undercost complex, low-volume products.

C)ABC is less costly to implement than traditional systems.

D)ABC allows managers to get an understanding of the cost of their respective department's activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

78

Happy Foods uses ABC costing.Which of the following is most likely to be a cost driver for the cost of cashiering at a convenience store?

A)Cost of items purchased

B)Direct labor cost

C)Number of customers processed

D)Number of employees handling the job

A)Cost of items purchased

B)Direct labor cost

C)Number of customers processed

D)Number of employees handling the job

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is generally true when a company compares activity-based costing (ABC) and traditional volume-based costing?

A)ABC uses fewer cost drivers in an effort to reduce total costs.

B)ABC allocates costs based primarily on production volume.

C)ABC is less expensive.

D)ABC is less likely to undercost complex, low-volume products.

A)ABC uses fewer cost drivers in an effort to reduce total costs.

B)ABC allocates costs based primarily on production volume.

C)ABC is less expensive.

D)ABC is less likely to undercost complex, low-volume products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

80

Freely Service provides residential and commercial monthly swimming pool cleaning services.Information on this service is as follows:

Service revenue $140,000

Direct materials 18,000

Direct labor 44,000

Estimated travel costs for the month total $2,340 and are allocated to each client based on miles driven to each pool cleaning.The company estimates it will clean 50 residential pools and 80 commercial pools per month with 1,200 total miles used for commercial pools and 2,400 total miles used for residential pools.Because commercial pools are much larger, they take 3 hours to clean, while residential pools take a half hour each.During the month, the actual mileage totaled 2,600 miles.How much is the rate at which travel costs will be allocated to residential pools?

A)$0.65

B)$0.975

C)$18.00

D)$8.83

Service revenue $140,000

Direct materials 18,000

Direct labor 44,000

Estimated travel costs for the month total $2,340 and are allocated to each client based on miles driven to each pool cleaning.The company estimates it will clean 50 residential pools and 80 commercial pools per month with 1,200 total miles used for commercial pools and 2,400 total miles used for residential pools.Because commercial pools are much larger, they take 3 hours to clean, while residential pools take a half hour each.During the month, the actual mileage totaled 2,600 miles.How much is the rate at which travel costs will be allocated to residential pools?

A)$0.65

B)$0.975

C)$18.00

D)$8.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck