Deck 5: Variable Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/108

العب

ملء الشاشة (f)

Deck 5: Variable Costing

1

When the number of units produced exceeds the number of units sold, variable costing yields a lower net income than if full costing had been used.

True

2

Variable costing income is more useful for decision making because costs are separated by function.

False

3

The cost of goods sold is always greater using variable costing than when full costing is used.

False

4

If a company has no fixed costs, variable costing income will equal full costing income, regardless of any increase or decrease in inventory levels during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

5

In variable costing, fixed manufacturing overhead is considered a period cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the number of units sold is equal to the number of units produced, then contribution margin will equal gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

7

Contribution margin is reported on an absorption costing income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

8

Absorption costing is required for external reporting under generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under variable costing, net income can be increased by increasing production without increasing sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under full costing, all fixed costs of production are included in Finished Goods Inventory and remain there until all inventory units are sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

11

The total amount reported on an income statement for selling and administrative expenseis the same amount regardless if variable of full costing is used..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

12

Absorption costing is another name for variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under variable costing, ending inventory reported on a company's balance sheet includes variable production costs and variable selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

14

The inventoriable cost per unit can be reduced, under variable costing, by decreasing the number of units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

15

During periods in which inventory levels increase, sales revenue will be larger when using full costing than if variable costing is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

16

The cost of ending inventory using variable costing is always greater than or equal to full costing ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

17

Full costing income can be increased by decreasing production even though the additional inventory items will not be sold during the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

18

Income statements of manufacturing firms prepared for external purposes use variable costing because it provides higher profits for making decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under full costing, ending inventory includes both fixed and variable manufacturing and nonmanufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

20

When the number of units produced is greater than the number of units sold, variable costing yields higher income than full costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a company increases production levels without increasing its units sold, both its full costing income and cash flows will be larger than if production were at a lower level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

22

Rango Enterprises' manufacturing costs for 2017 are as follows: What amount should be considered as product costs for external reporting purposes?

A)$183,000

B)$192,000

C)$257,000

D)$248,000

A)$183,000

B)$192,000

C)$257,000

D)$248,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

23

Full costing is

A)more useful for decision making than variable costing because it treats all costs of production as an inventory cost.

B)required for financial reporting under generally accepted accounting principles.

C)less likely to enable managers to manipulate income by increasing production.

D)based on cost behavior.

A)more useful for decision making than variable costing because it treats all costs of production as an inventory cost.

B)required for financial reporting under generally accepted accounting principles.

C)less likely to enable managers to manipulate income by increasing production.

D)based on cost behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

24

In variable costing, which of the following will be included as part of inventory on a company's balance sheet?

A)Fixed production cost

B)Variable selling cost

C)Fixed selling costs

D)None of the answer choices will be part of inventory in variable costing.

A)Fixed production cost

B)Variable selling cost

C)Fixed selling costs

D)None of the answer choices will be part of inventory in variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

25

Diecast Tools' manufacturing costs for 2017 are as follows: What amount should be considered product costs for external reporting purposes?

A)$220,000

B)$293,000

C)$402,000

D)$372,000

A)$220,000

B)$293,000

C)$402,000

D)$372,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following items appears on a variable costing income statement but not on a full costing income statement?

A)Sales

B)Gross margin

C)Net income

D)Contribution margin

A)Sales

B)Gross margin

C)Net income

D)Contribution margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is accounted for as a product cost in variable costing?

A)Product delivery costs to customers

B)Variable manufacturing overhead

C)Fixed manufacturing overhead

D)Product advertising costs

A)Product delivery costs to customers

B)Variable manufacturing overhead

C)Fixed manufacturing overhead

D)Product advertising costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

28

In full costing, which of the following will be included as part of inventory on a company's balance sheet?

A)Fixed production cost

B)Variable selling cost

C)Fixed selling costs

D)None of the answer choices will be in inventory in full costing.

A)Fixed production cost

B)Variable selling cost

C)Fixed selling costs

D)None of the answer choices will be in inventory in full costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

29

Just-in-time (JIT) inventory management systems cause the difference between variable costing income and full costing income to be much greater than if standard inventory levels had been maintained by the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is treated as a product cost in full costing?

A)Sales commissions

B)Product advertising

C)Depreciation on factory machines

D)Security at corporate headquarters

A)Sales commissions

B)Product advertising

C)Depreciation on factory machines

D)Security at corporate headquarters

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

31

A full costing income statement will display a higher net income than variable costing as long as inventory levels continue to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

32

In variable costing, when does fixed manufacturing overhead become an expense?

A)Never

B)In the period when the product is sold

C)In the period when the expense is incurred

D)At the time when units are produced

A)Never

B)In the period when the product is sold

C)In the period when the expense is incurred

D)At the time when units are produced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is accounted for differently in full costing compared to variable costing?

A)Direct material

B)Fixed manufacturing overhead

C)Direct labor

D)Variable manufacturing overhead

A)Direct material

B)Fixed manufacturing overhead

C)Direct labor

D)Variable manufacturing overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

34

Full costing

A)is another name for variable costing.

B)considers fixed manufacturing overhead as an inventory cost.

C)often provides the information needed for CVP analysis.

D)considers fixed production cost as period cost.

A)is another name for variable costing.

B)considers fixed manufacturing overhead as an inventory cost.

C)often provides the information needed for CVP analysis.

D)considers fixed production cost as period cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

35

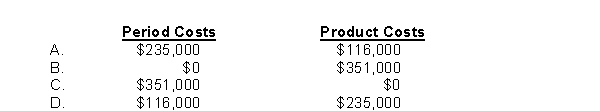

Robley Company's fixed manufacturing overhead costs totaled $235,000 and fixed corporate operating costs totaled $116,000.Under full costing, how should these costs be classified?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

36

Variable costing facilitates CVP analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

37

In full costing, when does fixed manufacturing overhead become an expense?

A)In the period when all other fixed costs are expensed

B)In the period when the product is sold

C)In the period when the expense is incurred

D)At the time units when are produced

A)In the period when all other fixed costs are expensed

B)In the period when the product is sold

C)In the period when the expense is incurred

D)At the time units when are produced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

38

The use of variable costing encourages management of earnings by adjusting production volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

39

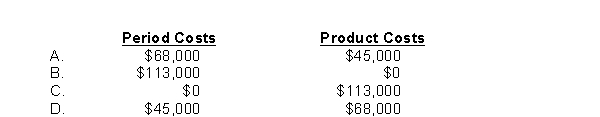

Sticker Creations' fixed manufacturing overhead costs totaled $68,000 and its variable selling costs totaled $45,000.Under full costing, how should these costs be classified?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

40

Cold City Blowers produces snow blowers.The selling price per snow blower is $80.Costs involved in production are: In addition, the company has fixed selling and administrative costs of $88,000 per year.During the year, Cold City Blowers produced 8,600 snow blowers and sold 8,000 snow blowers.There is no beginning inventory.Ignoring taxes, how much will full costing net income differ from variable costing net income?

A)$15,480

B)$14,400

C)$206,400

D)$192,000

A)$15,480

B)$14,400

C)$206,400

D)$192,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

41

Variable costing income is a function of

A)only units sold.

B)only units produced.

C)both units sold and units produced.

D)neither units sold nor units produced.

A)only units sold.

B)only units produced.

C)both units sold and units produced.

D)neither units sold nor units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

42

Anders Supply experienced the following costs in May: During May, the company manufactured 22,000 units and sold 24,000 units.Beginning inventory totaled 3,400 units.If the average selling price per unit was $28, how much is the company's contribution margin?

A)$327,400

B)$352,800

C)$323,400

D)$344,800

A)$327,400

B)$352,800

C)$323,400

D)$344,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

43

Data from Rannier Metals for 2017 is as follows: The company produced 145,000 units during the year and sold 130,000 units.Variable production costs per unit and fixed costs have remained constant all year.Net income for the year was $1,000,000.How much was the company's contribution margin?

A)$765,000

B)$1,235,000

C)$1,365,000

D)Not enough information is provided to determine the answer

A)$765,000

B)$1,235,000

C)$1,365,000

D)Not enough information is provided to determine the answer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

44

Cold City Blowers produces snow blowers.The selling price per snow blower is $100.Costs involved in production are: In addition, the company has fixed selling and administrative costs of $9,360 per year.During the year, Cold City Blowers produced 780 snow blowers and sold 800 snow blowers.Beginning inventory consisted of 50 snow blowers.How much is net income using variable costing?

A)$11,700

B)$12,240

C)$12,840

D)$45,600

A)$11,700

B)$12,240

C)$12,840

D)$45,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

45

When the number of units sold is equal to the number of units produced, the net income using absorption costing will be

A)greater than net income using variable costing.

B)equal to net income using variable costing.

C)less than net income using variable costing.

D)None of the answer choices is always correct.

A)greater than net income using variable costing.

B)equal to net income using variable costing.

C)less than net income using variable costing.

D)None of the answer choices is always correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sol Enterprises' contribution income statement utilizing variable costing appears below: Sol Enterprises

Income Statement

For the Year ended December 31, 2017

Sol produced 21,000 units during the year.Variable costs per unit and fixed production costs have remained constant the entire year.There were no beginning inventories.How much is the dollar value of the ending inventory using variable costing?

A)$5,000

B)$7,900

C)$8,800

D)$2,900

Income Statement

For the Year ended December 31, 2017

Sol produced 21,000 units during the year.Variable costs per unit and fixed production costs have remained constant the entire year.There were no beginning inventories.How much is the dollar value of the ending inventory using variable costing?

A)$5,000

B)$7,900

C)$8,800

D)$2,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

47

Macho Enterprises experienced the following costs in 2017: During the year, the company manufactured 47,000 units and sold 40,000 units.How much is the unit product cost using full costing?

A)$7.70

B)$9.70

C)$8.85

D)$10.85

A)$7.70

B)$9.70

C)$8.85

D)$10.85

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cold City Blowers produces snow blowers.The selling price per snow blower is $100.Costs involved in production are: In addition, the company has fixed selling and administrative costs of $9,360 per year.During the year, Cold City Blowers produced 780 snow blowers and sold 800 snow blowers.Beginning inventory consisted of 50 snow blowers.How much is considered to be product cost under variable costing?

A)$34,400

B)$33,540

C)$29,600

D)None of these answer choices are correct.

A)$34,400

B)$33,540

C)$29,600

D)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

49

Beiber Boxers contribution income statement utilizing variable costing for 2017 variable costing appears below: The company produced 7,000 units during the year.Variable and fixed production costs have remained constant the entire year.There were no beginning inventories.How much is the dollar value of the ending inventory using full costing?

A)$2,000

B)$2,900

C)$3,850

D)None of these answer choices are correct.

A)$2,000

B)$2,900

C)$3,850

D)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

50

Roger Excavating Company experienced the following costs in 2017: During 2017, the company manufactured 100,000 units and sold 80,000 units.If the average selling price per unit was $22.65, what is the amount of the company's contribution margin per unit?

A)$16.40

B)$15.65

C)$18.90

D)$13.65

A)$16.40

B)$15.65

C)$18.90

D)$13.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

51

If the number of units sold is greater than the number of units produced,

A)full costing and variable costing will yield the same net income.

B)variable costing will assign some fixed manufacturing costs to the units in ending inventory.

C)net income will be higher under variable costing than under full costing.

D)inventory levels will increase.

A)full costing and variable costing will yield the same net income.

B)variable costing will assign some fixed manufacturing costs to the units in ending inventory.

C)net income will be higher under variable costing than under full costing.

D)inventory levels will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

52

During the past year, Waxman Electronics manufactured 25,000 speakers during 2017 and sold 26,000 speakers.Production costs during the year were as follows: Sales totaled $3,120,000, variable selling and administrative costs totaled $182,000, and fixed selling and administrative costs totaled $114,000.There were 2,200 speakers in beginning inventory.How much is the contribution margin per unit?

A)$48.00

B)$69.00

C)$62.00

D)None of these answer choices are correct.

A)$48.00

B)$69.00

C)$62.00

D)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

53

Meow Foods had 2,000 25-pound bags of cat food in beginning inventory.During 2017, the company manufactured 16,000 bags and sold 15,000 units.Each bag of food is sold for $17.Assume the same unit costs in all years.The company experienced the following costs: If the company uses variable costing, at what amount is the ending inventory for the year valued?

A)$25,500

B)$28,500

C)$34,500

D)$9,000

A)$25,500

B)$28,500

C)$34,500

D)$9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

54

Acosta Supplies experienced the following costs in 2017: During 2017, the company manufactured 4,000 units and sold 4,200 units.Assume the same unit costs in all years.Beginning inventory consists of 800 units.How much are total variable costs on the company's 2017 contribution margin income statement?

A)$37,800

B)$36,000

C)$33,600

D)$32,000

A)$37,800

B)$36,000

C)$33,600

D)$32,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following items on a variable costing income statement will change in direct proportion to a change in sales?

A)Sales, contribution margin, and net income

B)Sales, variable costs, and contribution margin

C)Sales, variable costs, contribution margin, fixed costs, and net income

D)Sales, variable costs, and fixed costs

A)Sales, contribution margin, and net income

B)Sales, variable costs, and contribution margin

C)Sales, variable costs, contribution margin, fixed costs, and net income

D)Sales, variable costs, and fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

56

Ranger Roadsters experienced the following costs in 2017 (Assume the same unit costs in all years): There were 6,000 units in beginning inventory.During the year, the company manufactured 45,500 units and sold 48,000 units.If net income using variable costing was $82,500, how much is net income using full costing?

A)$78,375

B)$86,625

C)$76,725

D)$88,275

A)$78,375

B)$86,625

C)$76,725

D)$88,275

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

57

Ranger Productions experienced the following costs in 2017: During 2017, the company manufactured 65,000 units and sold 62,000 units.The unit cost is the same throughout the year.Beginning inventory is zero.How much will the company report as total variable product costs on its 2017 contribution income statement?

A)$328,600

B)$601,400

C)$344,500

D)$630,500

A)$328,600

B)$601,400

C)$344,500

D)$630,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

58

The following information relates to Charlin Industries for the year ending December 31, 2017, the company's first year of operations: How much fixed manufacturing overhead would be expensed in 2017 using variable costing?

A)$520,000

B)$130,000

C)$650,000

D)$0

A)$520,000

B)$130,000

C)$650,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

59

Meow Foods had 2,000 25-pound bags of cat food in beginning inventory.During 2017, the company manufactured 16,000 bags and sold 15,000 units.Assume the same unit costs in all years.Each bag of food is sold for $17.The company experienced the following costs: If the company uses full costing, how much will be reported as inventory on the December 31, 2017 balance sheet?

A)$9,000

B)$25,500

C)$28,500

D)$34,500

A)$9,000

B)$25,500

C)$28,500

D)$34,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

60

If a company's income is positive and fixed costs exist, which of the following items will increase or decrease at a greater rate than the change in the amount of sales on a variable costing income statement?

A)Variable costs

B)Fixed costs

C)Contribution margin

D)Net income

A)Variable costs

B)Fixed costs

C)Contribution margin

D)Net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

61

Radial Fuel Cells experienced the following costs in 2017 (Assume the same unit costs in all years): During the year, the company manufactured 50,000 units and sold 45,000 units.Beginning inventory is zero.If net income for the year was $265,000 using full costing, what would net income be if the company used variable costing?

A)$250,000

B)$265,000

C)$270,000

D)$450,000

A)$250,000

B)$265,000

C)$270,000

D)$450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

62

Affinity makes a single product, pool pumps.Information for 2017 appears below: How much is the contribution margin per unit of inventory?

A)$29.00

B)$24.00

C)$23.00

D)$18.00

A)$29.00

B)$24.00

C)$23.00

D)$18.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

63

Last month, Brand Products manufactured 25,000 calculators and sold 23,000 of these calculators at a price of $10.00 each.Manufacturing costs consisted of direct labor, $30,000; direct materials, $32,000; variable manufacturing overhead, $3,500; fixed manufacturing overhead, $21,500.Selling and administrative costs are all fixed and totaled $24,000.Beginning inventory consists of no units.What is Brand Products' net income using full costing?

A)$124,240

B)$125,960

C)$120,720

D)$149,960

A)$124,240

B)$125,960

C)$120,720

D)$149,960

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

64

Affinity makes a single product, pool pumps.Information for 2017 appears below (Assume the same unit costs in all years): Under which method will net income be larger?

A)Variable costing

B)Full costing

C)Net income under both the variable and full costing methods will be the same.

D)The answer cannot be determined from the information provided.

A)Variable costing

B)Full costing

C)Net income under both the variable and full costing methods will be the same.

D)The answer cannot be determined from the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

65

Futon Delight experienced the following costs in 2017 (Assume the same unit costs in all years): There were 600 units in beginning inventory.During the year, the company manufactured 18,000 units and sold 17,600 units.If net income for the year was $54,000 using full costing, how much will net income be if the company uses variable costing?

A)$53,000

B)$50,000

C)$55,000

D)More information is needed to determine the answer.

A)$53,000

B)$50,000

C)$55,000

D)More information is needed to determine the answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

66

Affinity makes a single product, pool pumps.Information for 2017 appears below (Assume the same unit costs in all years): How much is net income for the year under full costing?

A)$78,400

B)$80,400

C)$87,600

D)None of these answer choices are correct.

A)$78,400

B)$80,400

C)$87,600

D)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

67

Last month, Brand Products manufactured 25,000 calculators and sold 23,000 of these calculators at a price of $10.00 each.Manufacturing costs consisted of direct labor, $30,000; direct materials, $32,000; variable manufacturing overhead, $3,500; fixed manufacturing overhead, $21,500.Selling and administrative costs are all fixed and totaled $24,000.Beginning inventory consists of no units.Brand Products uses variable costing.How much will the company's contribution margin increase if sales increase 10%?

A)$16,974

B)$23,000

C)$14,996

D)$12,420

A)$16,974

B)$23,000

C)$14,996

D)$12,420

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

68

If a company employs JIT inventory techniques, which statement is true?

A)Variable and full costing income will differ very little since there is almost no inventory on hand.

B)Variable and full costing income will differ very little since there are almost no fixed costs incurred on production.

C)Variable and full costing income will differ greatly since actual costs are difficult to determine.

D)Variable and full costing income will differ greatly since there will be a large difference between gross margin and contribution margin.

A)Variable and full costing income will differ very little since there is almost no inventory on hand.

B)Variable and full costing income will differ very little since there are almost no fixed costs incurred on production.

C)Variable and full costing income will differ greatly since actual costs are difficult to determine.

D)Variable and full costing income will differ greatly since there will be a large difference between gross margin and contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

69

Last month, Brand Products manufactured 25,000 calculators and sold 23,000 of these calculators at a price of $10.00 each.Manufacturing costs consisted of direct labor, $30,000; direct materials, $32,000; variable manufacturing overhead, $3,500; fixed manufacturing overhead, $21,500.Selling and administrative costs are all fixed and totaled $24,000.Beginning inventory consists of no units.What is Brand Products' net income using variable costing?

A)$125,960

B)$149,960

C)$169,740

D)$124,240

A)$125,960

B)$149,960

C)$169,740

D)$124,240

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

70

Last month, Brand Products manufactured 25,000 calculators and sold 23,000 of these calculators at a price of $10.00 each.Manufacturing costs consisted of direct labor, $30,000; direct materials, $32,000; variable manufacturing overhead, $3,500; fixed manufacturing overhead, $21,500.Selling and administrative costs are all fixed and totaled $24,000.Beginning inventory consists of no units.Brand Products uses full costing.How much will the company's gross margin increase if sales increase 10%?

A)Less than 10%

B)More than 10%

C)10%

D)It depends on other factors not given.

A)Less than 10%

B)More than 10%

C)10%

D)It depends on other factors not given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which is most consistent with cost-volume-profit analysis?

A)Variable costing

B)Full costing

C)Absorption costing

D)JIT

A)Variable costing

B)Full costing

C)Absorption costing

D)JIT

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

72

Affinity makes a single product, pool pumps.Information for 2017 appears below (Assume the same unit costs in all years): How much is the full cost per unit of inventory?

A)$46.00

B)$51.00

C)$57.00

D)$52.00

A)$46.00

B)$51.00

C)$57.00

D)$52.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

73

If a company's levels of total fixed costs and unit variable costs remain unchanged from one year to the next, under which costing method is it possible for managers to manipulate net income through production?

A)Variable costing

B)Full costing

C)Both variable and full costing

D)Neither variable nor full costing

A)Variable costing

B)Full costing

C)Both variable and full costing

D)Neither variable nor full costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which method provides an incentive for managers to produce more units in order to increase income for performance evaluations?

A)Full costing

B)Variable costing

C)Both full costing and variable costing

D)Neither full costing nor variable costing

A)Full costing

B)Variable costing

C)Both full costing and variable costing

D)Neither full costing nor variable costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

75

Waterloo Skyline experienced the following costs in 2017: There was no beginning inventory.During the year, the company sold 190,000 units.If net income using full and variable costing was $939,020 and $905,000, respectively, how many units did the company produce in 2017?

A)192,700

B)2,700

C)187,300

D)46,951

A)192,700

B)2,700

C)187,300

D)46,951

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

76

Affinity makes a single product, pool pumps.Information for 2017 appears below (Assume the same unit costs in all years): How much will be reported for inventory on the balance sheet if variable costing is used?

A)$87,400

B)$96,900

C)$108,300

D)$118,400

A)$87,400

B)$96,900

C)$108,300

D)$118,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

77

Affinity makes a single product, pool pumps.Information for 2017 appears below (Assume the same unit costs in all years): How much is net income for the year under variable costing?

A)$78,400

B)$87,600

C)$80,400

D)None of these answer choices are correct.

A)$78,400

B)$87,600

C)$80,400

D)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

78

Full costing income is a function of

A)units sold only.

B)units produced only.

C)both units sold and units produced.

D)neither units sold nor units produced.

A)units sold only.

B)units produced only.

C)both units sold and units produced.

D)neither units sold nor units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is true when units produced exceed units sold?

A)Full costing and variable costing will yield the same net income.

B)Full costing assigns a portion of the fixed manufacturing costs to the units in ending inventory.

C)Net income will be higher under variable costing than under full costing.

D)Inventory levels will decrease.

A)Full costing and variable costing will yield the same net income.

B)Full costing assigns a portion of the fixed manufacturing costs to the units in ending inventory.

C)Net income will be higher under variable costing than under full costing.

D)Inventory levels will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Crab Shack experienced the following costs in 2017 (Assume the same unit costs in all years): There were 1,800 units in beginning inventory.During the year, the company manufactured 24,000 units and sold 25,000 units.If net income using variable costing was $76,250, how much is net income using full costing?

A)$5,880

B)$79,250

C)$73,750

D)$74,350

A)$5,880

B)$79,250

C)$73,750

D)$74,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck