Deck 3: Mathematics of Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/10

العب

ملء الشاشة (f)

Deck 3: Mathematics of Finance

1

During 2005 the price of a good increased by 8%. In the sales on January 1st 2006, all items are reduced by 25%. If the sale price of the good is $688.50, find the original price at the beginning of 2005.

A)$935

B)$850

C)$558

D)$2,395

E)$925

A)$935

B)$850

C)$558

D)$2,395

E)$925

B

2

Determine the monthly repayments needed to repay a $125,000 loan which is paid back over 20 years when the interest rate is 7% compounded annually. Round your answer to two decimal places.

A)$1,078.39

B)$1,172.24

C)$893.86

D)$983.26

E)$971.79

A)$1,078.39

B)$1,172.24

C)$893.86

D)$983.26

E)$971.79

D

3

A principal of $70,000 is invested at 6% interest for four years. Find the difference in the future value if the interest is compounded quarterly compared to continuous compounding. Round your answer to two decimal places.

A)$158.45

B)$614.05

C)$256.65

D)$620.43

E)$469.93

A)$158.45

B)$614.05

C)$256.65

D)$620.43

E)$469.93

A

4

A principal of $7,650 is invested at a rate of 3.7% compounded annually. After how many years will the investment first exceed $12,250?

A)16

B)14

C)15

D)13

E)12

A)16

B)14

C)15

D)13

E)12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

5

Determine the present value of an annuity if it pays out $2,500 at the end of each year in perpetuity, assuming that the interest rate is 8% compounded annually.

A)$24,550

B)$34,050

C)$31,250

D)$29,450

E)$30,100

A)$24,550

B)$34,050

C)$31,250

D)$29,450

E)$30,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

6

A proposed investment costs $130,000 today. The expected revenue flow is $40,000 at the end of year 1, and $140,000 at the end of year 2. Find the internal rate of return, correct to one decimal place.

A)17.8%

B)20.3%

C)20.0%

D)19.9%

E)18.4%

A)17.8%

B)20.3%

C)20.0%

D)19.9%

E)18.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

7

Find the sum of the first 12 terms of the geometric series 5 - 20 + 80 - 320 + ...

A)16,777,217

B)none of these

C)27,962,025

D)- 16,777,215

E)- 27,962,025

A)16,777,217

B)none of these

C)27,962,025

D)- 16,777,215

E)- 27,962,025

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

8

A project requires an initial investment of $7,000, and is guaranteed to yield a return of $1,500 at the end of the first year, $2,500 at the end of the second year and $x at the end of the third year. Find the value of x, correct to the nearest $, given that the net present value is $838.18 when the interest rate is 6% compounded annually.

A)$4,500

B)$5,500

C)$4,050

D)$5,000

E)$5,250

A)$4,500

B)$5,500

C)$4,050

D)$5,000

E)$5,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

9

Find the present value of $450 in the six years' time if the discount rate is 9.5% compounded semi- annually. Round your answer to two decimal places.

A)$261.05

B)$151.44

C)$187.45

D)$257.85

E)$193.24

A)$261.05

B)$151.44

C)$187.45

D)$257.85

E)$193.24

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

10

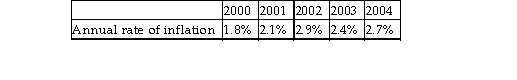

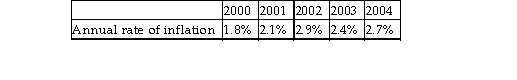

The table below gives the annual rate of inflation during a five- year period.  If a nominal house price at the end of 2000 was $10.8 million, find the real house price adjusted to prices prevailing at the end of the year 2003. Round your answer to three significant figures.

If a nominal house price at the end of 2000 was $10.8 million, find the real house price adjusted to prices prevailing at the end of the year 2003. Round your answer to three significant figures.

A)$10.9 million

B)$9.9 million

C)$11.8 million

D)$10.0 million

E)$11.6 million

If a nominal house price at the end of 2000 was $10.8 million, find the real house price adjusted to prices prevailing at the end of the year 2003. Round your answer to three significant figures.

If a nominal house price at the end of 2000 was $10.8 million, find the real house price adjusted to prices prevailing at the end of the year 2003. Round your answer to three significant figures.A)$10.9 million

B)$9.9 million

C)$11.8 million

D)$10.0 million

E)$11.6 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck