Deck 9: Other Income, Other Deductions, and Special Rules for Completing Net Income for Tax Purposes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/8

العب

ملء الشاشة (f)

Deck 9: Other Income, Other Deductions, and Special Rules for Completing Net Income for Tax Purposes

1

Steve gifted shares in a public corporation to his fifteen-year-old son, Simon. The ACB of the shares was $10,000. During the year, Simon received $500 in dividends from the shares. Simon then sold the shares for $12,000. Which of the following is true for Steve and Simon?

A) Simon will have to claim the dividends and capital gain on his tax return.

B) Steve will have to claim the dividends on his tax return and Simon will have to recognize the capital gain on his tax return.

C) Steve will have to claim the dividends and a capital gain on his tax return.

D) Simon will have to claim the dividends on his tax return and Steve will have to recognize the capital gain on his tax return.

A) Simon will have to claim the dividends and capital gain on his tax return.

B) Steve will have to claim the dividends on his tax return and Simon will have to recognize the capital gain on his tax return.

C) Steve will have to claim the dividends and a capital gain on his tax return.

D) Simon will have to claim the dividends on his tax return and Steve will have to recognize the capital gain on his tax return.

B

2

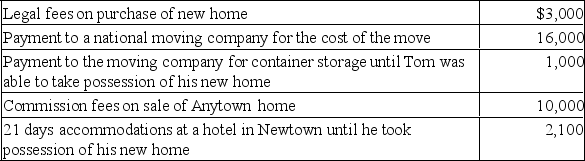

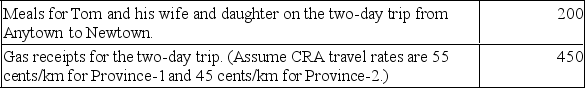

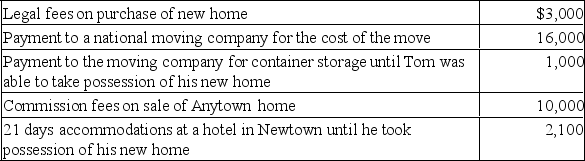

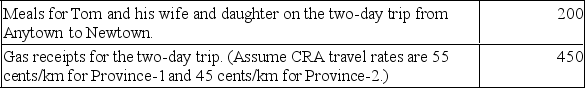

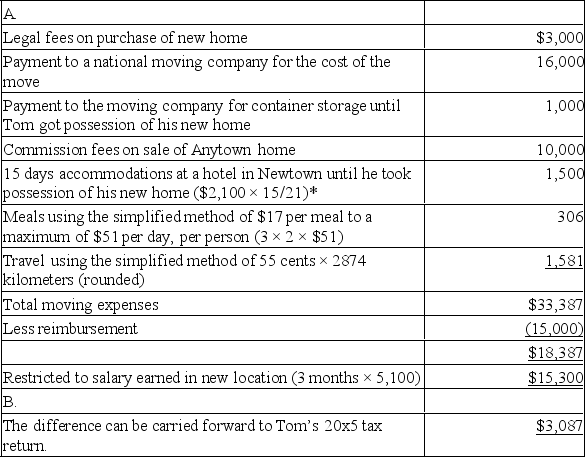

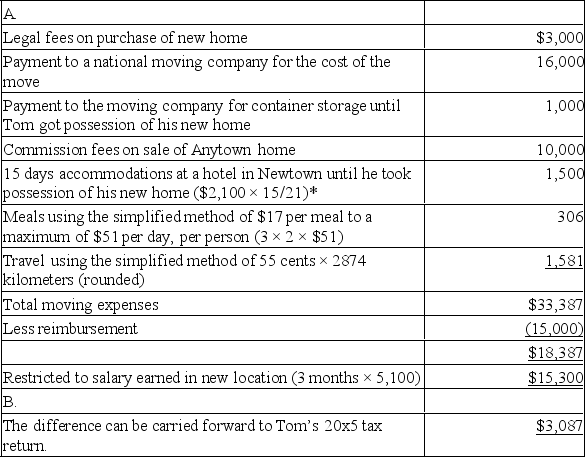

In 20x4, Tom Depuis moved 2874 kilometers from Anytown, Province-1 to Newtown, Province-2 to assume the position of manager for his company at the Newtown head office. Tom began his new job on October 1st. He receives a salary of $5,100 per month at his new job and received $4,500 per month in his former position. Tom has provided you with the following information pertaining to his moving costs:

Tom received a reimbursement of $15,000 from his employer.

Tom received a reimbursement of $15,000 from his employer.

Required:

A. Calculate the maximum amount of moving expenses that Tom can deduct on his 20x4 tax return.

B. Will the moving expenses have any effect on Tom's 20x5 tax return?

Tom received a reimbursement of $15,000 from his employer.

Tom received a reimbursement of $15,000 from his employer.Required:

A. Calculate the maximum amount of moving expenses that Tom can deduct on his 20x4 tax return.

B. Will the moving expenses have any effect on Tom's 20x5 tax return?

A.

*Maximum - 15 days allowed

*Maximum - 15 days allowed

*Maximum - 15 days allowed

*Maximum - 15 days allowed 3

Car Co. is selling its land and building to Truck Co. for $340,000 (Land $200,000; Building $140,000). These values have not been officially appraised, and Truck Co. thinks that the land is only worth $150,000 and the building is worth $190,000. (Car Co. originally paid $100,000 for the land and constructed the building for $150,000. The UCC on the building is currently $130,000.) Which of the following statements is TRUE based on these facts?

A) Future CCA will be higher for Truck Co. if Car Co.'s terms are accurate

B) Car Co. will recognize higher net capital gains if Truck Co.'s terms are accurate

C) Car Co. will recognize higher recapture if Truck Co.'s terms are accurate.

D) The allocation of the costs is irrelevant for tax purposes as the total price is the same under both sets of terms.

A) Future CCA will be higher for Truck Co. if Car Co.'s terms are accurate

B) Car Co. will recognize higher net capital gains if Truck Co.'s terms are accurate

C) Car Co. will recognize higher recapture if Truck Co.'s terms are accurate.

D) The allocation of the costs is irrelevant for tax purposes as the total price is the same under both sets of terms.

C

4

Case One

Marsha had total income of $112,000 and earned income of $75,000 in 20x9. Her 20x8 Notice of Assessment showed unused RRSP contribution room of $12,000. She and her employer each contributed $2,500 to her RPP in 20x8. Marsha anticipates a pension adjustment of $5,500 in 20x9.

Required:

Calculate the maximum RRSP deduction that Marsha can make for the 20x9 taxation year. (Assume 20x9 is 2019.)

Case Two (Independent of Case One)

Marsha is 35 years old. She is considering investing $2,000 per year in a savings account at 8%, or $2,000 in an RRSP at 8%. The money will be invested for the next 30 years and will not be withdrawn until Marsha retires.

Required:

A. Calculate the valuation of each option, net of taxes, if Marsha withdraws all of the money when she turns 65? Assume that her tax rate will be 35% every year until she retires.

B. How much could Marsha contribute to her RRSP each year if $2,000 is the net cost of her investment after the tax savings from her contribution?

Marsha had total income of $112,000 and earned income of $75,000 in 20x9. Her 20x8 Notice of Assessment showed unused RRSP contribution room of $12,000. She and her employer each contributed $2,500 to her RPP in 20x8. Marsha anticipates a pension adjustment of $5,500 in 20x9.

Required:

Calculate the maximum RRSP deduction that Marsha can make for the 20x9 taxation year. (Assume 20x9 is 2019.)

Case Two (Independent of Case One)

Marsha is 35 years old. She is considering investing $2,000 per year in a savings account at 8%, or $2,000 in an RRSP at 8%. The money will be invested for the next 30 years and will not be withdrawn until Marsha retires.

Required:

A. Calculate the valuation of each option, net of taxes, if Marsha withdraws all of the money when she turns 65? Assume that her tax rate will be 35% every year until she retires.

B. How much could Marsha contribute to her RRSP each year if $2,000 is the net cost of her investment after the tax savings from her contribution?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 8 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following examples of income received from private corporations would not be excluded from tax on split income for adult family members?

A) A capital gain from the sale of qualified small business corporation shares

B) Income received from a related business

C) Income received by a 68-year-old business owner's spouse

D) Income received by an uncle

A) A capital gain from the sale of qualified small business corporation shares

B) Income received from a related business

C) Income received by a 68-year-old business owner's spouse

D) Income received by an uncle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 8 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is FALSE regarding Tax Free Savings Accounts (TFSAs)?

A) There is no mandatory age by which a TFSA must be wound up.

B) TFSA contributions are tax deductible.

C) Any unused amounts not contributed in a year may be carried forward indefinitely to future years.

D) Capital gains earned within TFSAs are not taxed.

A) There is no mandatory age by which a TFSA must be wound up.

B) TFSA contributions are tax deductible.

C) Any unused amounts not contributed in a year may be carried forward indefinitely to future years.

D) Capital gains earned within TFSAs are not taxed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 8 في هذه المجموعة.

فتح الحزمة

k this deck

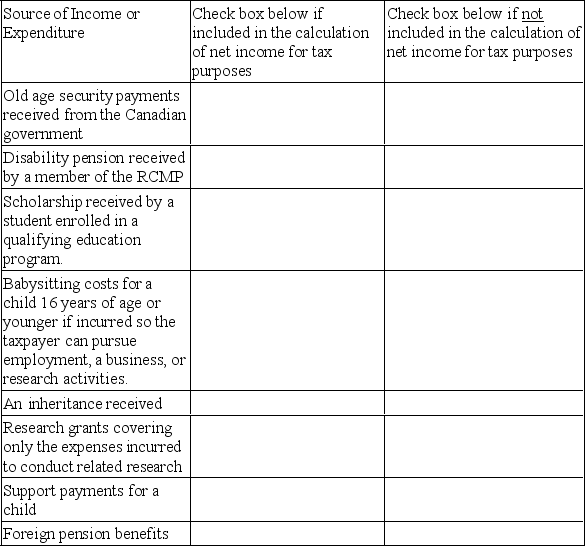

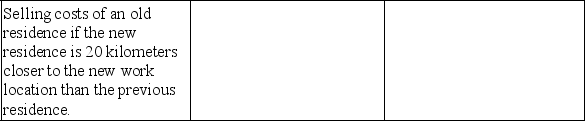

7

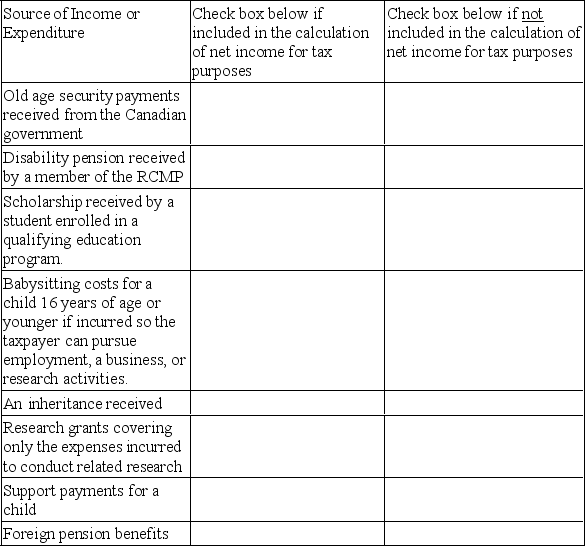

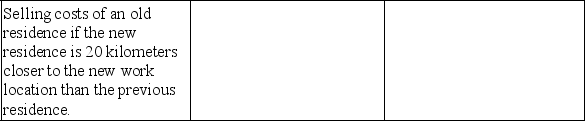

Identify whether the following sources of income and expenditures are included for the calculation of net income for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 8 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following deductions are allowed as 'other' deductions for tax purposes?

A) Contributions to a child's RESP, fees for an appeal in relation to an assessment under the Income Tax Act, and contributions to an individual's RRSP

B) Lump sum support payments to a former spouse, contributions to an individual's RRSP, and fees for an appeal in relation to an assessment under the Income Tax Act

C) Support payments for a child, allowable moving expenses against income at the previous location, and child care expenses

D) Contributions to an individual's RRSP, fees for an appeal in relation to an assessment under the Income Tax Act, and allowable moving expenses against income at the new location

A) Contributions to a child's RESP, fees for an appeal in relation to an assessment under the Income Tax Act, and contributions to an individual's RRSP

B) Lump sum support payments to a former spouse, contributions to an individual's RRSP, and fees for an appeal in relation to an assessment under the Income Tax Act

C) Support payments for a child, allowable moving expenses against income at the previous location, and child care expenses

D) Contributions to an individual's RRSP, fees for an appeal in relation to an assessment under the Income Tax Act, and allowable moving expenses against income at the new location

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 8 في هذه المجموعة.

فتح الحزمة

k this deck