Deck 11: Corporations-An Introduction

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/9

العب

ملء الشاشة (f)

Deck 11: Corporations-An Introduction

1

Using general terms, explain how a change in control of a corporation can affect the net-capital losses and the non-capital losses.

When there is a change in control, net-capital losses are deemed to have expired. Non-capital losses may only be used against the business that originated the losses, or against income from a 'similar' business, provided that the original business is not terminated before the losses are used, and the original business must be carried on to earn a profit, or with a reasonable expectation of profit, in the year the loss is deducted.

2

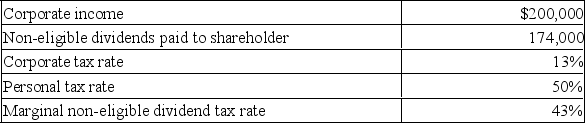

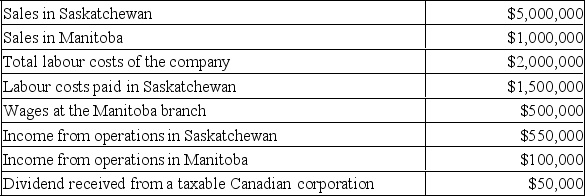

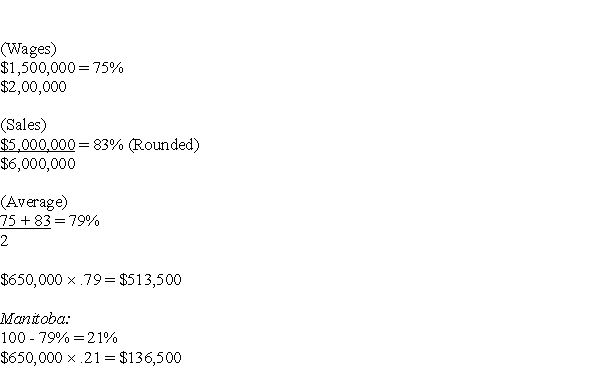

The Canadian tax system practices integration between corporations and individuals. Using the data in Table 1 and assumed rates, illustrate and explain the concept of integration.

Table 1

Table 1

![*Rounded The concept of integration illustrated here shows that as income flows through a corporation and ultimately to an individual, the total tax paid on that income is relatively equivalent to the amount that the individual would have paid had he/she received the income directly, rather than through a corporation. Thus, double taxation is avoided. [However, this example is based on set tax rates which may differ in varying circumstances, and double taxation may occur in some scenarios.]](https://d2lvgg3v3hfg70.cloudfront.net/TB7107/11eb145d_f857_8038_8021_edebf5f8e6b3_TB7107_00.jpg) *Rounded The concept of integration illustrated here shows that as income flows through a corporation and ultimately to an individual, the total tax paid on that income is relatively equivalent to the amount that the individual would have paid had he/she received the income directly, rather than through a corporation. Thus, double taxation is avoided. [However, this example is based on set tax rates which may differ in varying circumstances, and double taxation may occur in some scenarios.]

*Rounded The concept of integration illustrated here shows that as income flows through a corporation and ultimately to an individual, the total tax paid on that income is relatively equivalent to the amount that the individual would have paid had he/she received the income directly, rather than through a corporation. Thus, double taxation is avoided. [However, this example is based on set tax rates which may differ in varying circumstances, and double taxation may occur in some scenarios.] 3

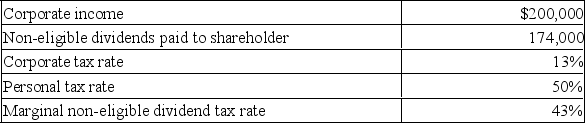

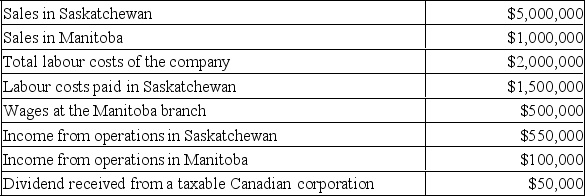

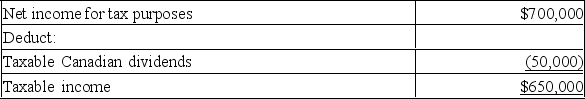

Steven Co. is a public Canadian corporation which was established five years ago. The company's head office is located in Saskatchewan. In 2018, a small branch was established in Manitoba.

In 2019, the company's books included the following:

Required:

Required:

A) Calculate the company's net income for tax purposes for 2019.

B) Calculate the company's taxable income, both federal and provincial. (Round all amounts to two decimal places.)

C) Calculate Steven Co.'s Part I federal tax liability. (Round all numbers to zero decimal points.)

(Use tax rates and amounts applicable for 2019 for each of the above.)

In 2019, the company's books included the following:

Required:

Required:A) Calculate the company's net income for tax purposes for 2019.

B) Calculate the company's taxable income, both federal and provincial. (Round all amounts to two decimal places.)

C) Calculate Steven Co.'s Part I federal tax liability. (Round all numbers to zero decimal points.)

(Use tax rates and amounts applicable for 2019 for each of the above.)

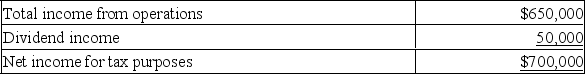

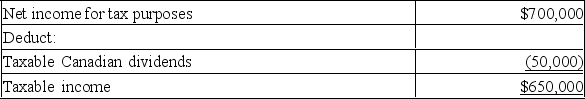

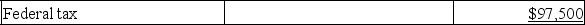

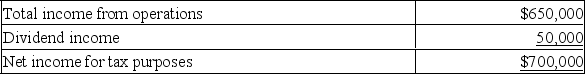

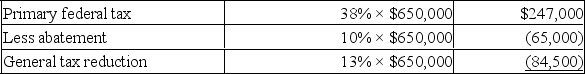

A) Net income for tax purposes:  B) Federal taxable income:

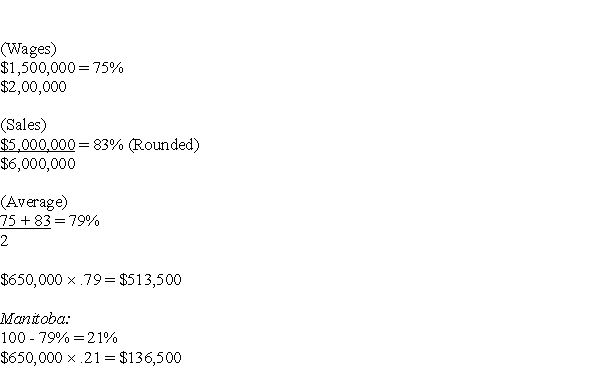

B) Federal taxable income:  Provincial taxable income: Saskatchewan: C) Part I federal tax:

Provincial taxable income: Saskatchewan: C) Part I federal tax:

B) Federal taxable income:

B) Federal taxable income:  Provincial taxable income: Saskatchewan: C) Part I federal tax:

Provincial taxable income: Saskatchewan: C) Part I federal tax:

4

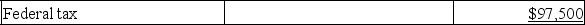

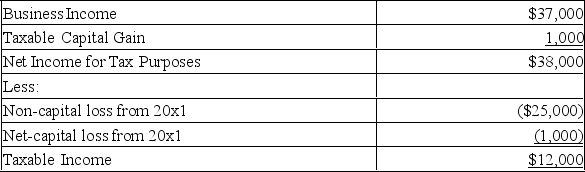

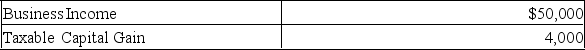

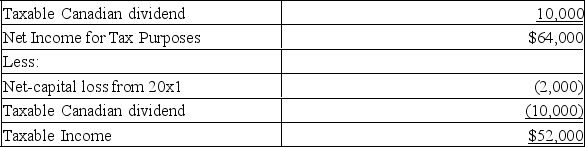

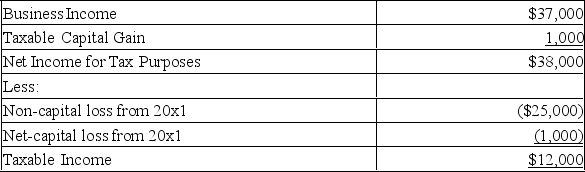

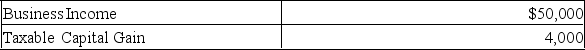

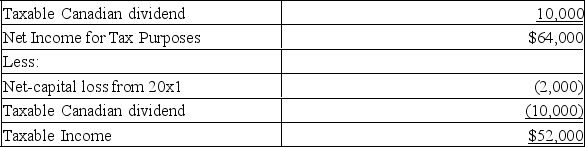

Coffee Co. began operations in 20x0 and recognized $37,000 in business income and $1,000 in taxable capital gains that year. In 20x1, the company incurred a business loss of $25,000, a taxable capital gain of $2,000, and an allowable capital loss of $5,000. Business income for 20x2 was $50,000, taxable capital gains were $4,000, and the company received $10,000 in dividends from a taxable Canadian corporation. Coffee Co. utilizes any unused losses in the earliest years possible, Which of the following taxable incomes are correct after all carry-over adjustments have been made?

B) 20x0: $38,000; 20x1: ($28,000); 20x2: $64,000

C) 20x0: $13,000; 20x1: ($0; 20x2: $61,000

D) 20x0: $37,000; 20x1: $0; 20x2: $27,000

B) 20x0: $38,000; 20x1: ($28,000); 20x2: $64,000

C) 20x0: $13,000; 20x1: ($0; 20x2: $61,000

D) 20x0: $37,000; 20x1: $0; 20x2: $27,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

5

When shares are transferred from one group of shareholders to another and there is a change in control, which of the following applies?

A) Net-capital losses that arise following the change in control are automatically deemed to have expired.

B) Non-capital losses arising prior to the change in control are automatically deemed to have expired.

C) Net-capital losses arising prior to the change in control may be used against income from the business that incurred the loss if that business is carried on at a profit or with a reasonable expectation of profit in the year in which the losses are applied.

A) Net-capital losses that arise following the change in control are automatically deemed to have expired.

B) Non-capital losses arising prior to the change in control are automatically deemed to have expired.

C) Net-capital losses arising prior to the change in control may be used against income from the business that incurred the loss if that business is carried on at a profit or with a reasonable expectation of profit in the year in which the losses are applied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following scenarios is not allowed?

A) The taxable income of ABC Co. is reduced by the amount of dividends received from other taxable Canadian corporations. Mr. Blue's taxable income is reduced by the amount of dividends received from a taxable Canadian corporation.

C) A donation of $5,000 to a registered charity by XYZ Co. in 20x0 is used to reduce XYZ's 20x0 $100,000 net income for tax purposes to a taxable income of $95,000.

D) Little Co. has an $8,000 non-capital loss from a loss that arose in 20x0 and $10,000 of taxable dividends received from a Canadian corporation in 20x1, both of which will be deducted from Little Co.'s 20x1 net income for tax purposes.

A) The taxable income of ABC Co. is reduced by the amount of dividends received from other taxable Canadian corporations. Mr. Blue's taxable income is reduced by the amount of dividends received from a taxable Canadian corporation.

C) A donation of $5,000 to a registered charity by XYZ Co. in 20x0 is used to reduce XYZ's 20x0 $100,000 net income for tax purposes to a taxable income of $95,000.

D) Little Co. has an $8,000 non-capital loss from a loss that arose in 20x0 and $10,000 of taxable dividends received from a Canadian corporation in 20x1, both of which will be deducted from Little Co.'s 20x1 net income for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

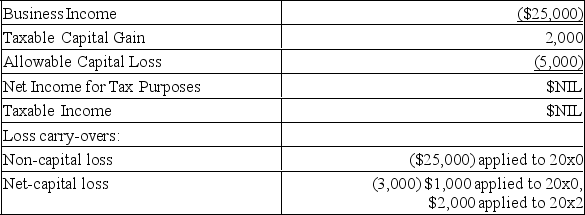

7

Johnson Co. is a CCPC with active business income of $350,000 in 20xx. The company engages in retail and wholesale activities. Capital gains recognized by the company in 20xx totaled $84,000.

Johnson Co. will utilize a net capital loss carry-over of $28,000 on its 20xx tax return.

Required:

Applying tax rates and amounts for 2019, calculate the following for Johnson Co. for 20xx:

a) Net Income for Tax Purposes

b) Taxable Income

c) Federal Tax

Johnson Co. will utilize a net capital loss carry-over of $28,000 on its 20xx tax return.

Required:

Applying tax rates and amounts for 2019, calculate the following for Johnson Co. for 20xx:

a) Net Income for Tax Purposes

b) Taxable Income

c) Federal Tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

8

Bride and Groom Co. is a Canadian controlled private corporation with active business income of $750,000 in 20x9. Dividends were received during 20x9 from a taxable Canadian corporation in the amount of $80,000. The company recognized a $50,000 capital gain during 20x9. The company's year-end is December 31st.

Additional information is as follows:

Net capital loss carry-over from 20x8 is $30,000.

Non capital loss carry-over from 20x8 is $70,000.

Required:

Calculate the following for the company for the 20x9 tax year:

A) Net income for tax purposes

B) Taxable income

C) Part I Federal tax

(Use tax rates and amounts applicable for 2019 for each of the above.)

Additional information is as follows:

Net capital loss carry-over from 20x8 is $30,000.

Non capital loss carry-over from 20x8 is $70,000.

Required:

Calculate the following for the company for the 20x9 tax year:

A) Net income for tax purposes

B) Taxable income

C) Part I Federal tax

(Use tax rates and amounts applicable for 2019 for each of the above.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statements accurately describes the tax treatment of Canadian corporations?

A) Public and private Canadian corporations are eligible for the small business deduction. Public and private Canadian corporations are eligible for the general tax reduction.

C) Public corporations are granted beneficial tax treatment on the first $500,000 of business income.

D) Canadian controlled private corporations recognize the general tax reduction on all business income.

A) Public and private Canadian corporations are eligible for the small business deduction. Public and private Canadian corporations are eligible for the general tax reduction.

C) Public corporations are granted beneficial tax treatment on the first $500,000 of business income.

D) Canadian controlled private corporations recognize the general tax reduction on all business income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck