Deck 10: Cost Analysis for Management Decision Making

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

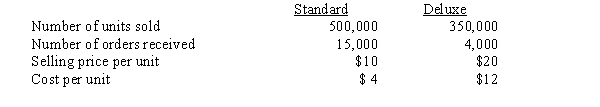

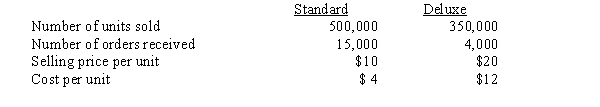

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 10: Cost Analysis for Management Decision Making

1

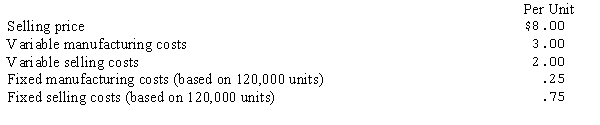

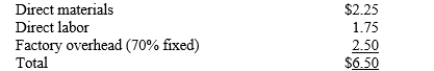

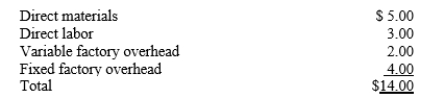

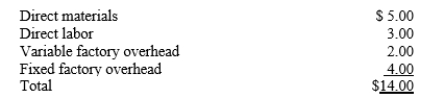

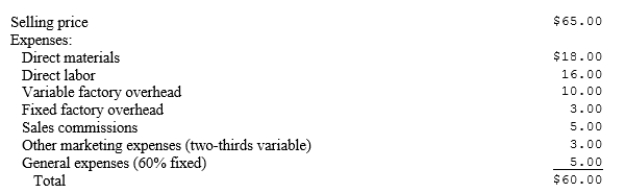

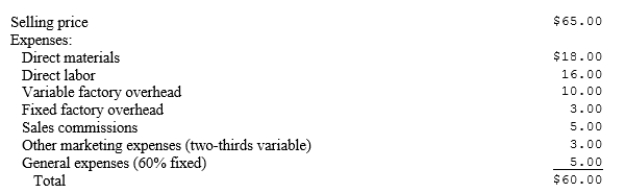

Donellan Company produces a special gear used in automatic transmissions. Each gear sells for $30, and the company sells approximately 500,000 gears each year. Unit cost data for the year follows:  The unit cost of gears for variable costing inventory purposes is:

The unit cost of gears for variable costing inventory purposes is:

A)$14.

B)$17.

C)$20.

D)$24.

The unit cost of gears for variable costing inventory purposes is:

The unit cost of gears for variable costing inventory purposes is:A)$14.

B)$17.

C)$20.

D)$24.

C

Under variable costing, only variable manufacturing costs are assigned to the product. These costs include:

Under variable costing, only variable manufacturing costs are assigned to the product. These costs include:

2

Which of the following does not appear on an income statement prepared using variable costing?

A)Gross margin/profit.

B)Manufacturing margin

C)Fixed production costs.

D)Variable production costs.

A)Gross margin/profit.

B)Manufacturing margin

C)Fixed production costs.

D)Variable production costs.

A

The term commonly used in variable costing to designate the difference between sales and variable cost of goods sold is manufacturing margin. It is a absorption costing statement that would be expected to show gross margin/profit.

The term commonly used in variable costing to designate the difference between sales and variable cost of goods sold is manufacturing margin. It is a absorption costing statement that would be expected to show gross margin/profit.

3

The basic assumption made in a variable costing system with respect to fixed costs is that all fixed costs are:

A)Sunk costs.

B)Product costs.

C)Fixed as to the total cost.

D)Period costs.

A)Sunk costs.

B)Product costs.

C)Fixed as to the total cost.

D)Period costs.

D

The variable costing method assigns all fixed costs to the period in which they originated; therefore, they are all classified as period costs.

The variable costing method assigns all fixed costs to the period in which they originated; therefore, they are all classified as period costs.

4

Which of the following is true about absorption costing?

A)No fixed factory overhead is charged to production.

B)It is also known as direct costing.

C)The term used to designate the difference between sales and cost of goods sold is the "manufacturing margin."

D)Over-applied factory overhead is reflected in the income statement as a reduction cost of goods sold.

A)No fixed factory overhead is charged to production.

B)It is also known as direct costing.

C)The term used to designate the difference between sales and cost of goods sold is the "manufacturing margin."

D)Over-applied factory overhead is reflected in the income statement as a reduction cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

A basic tenet of variable costing is that fixed overhead costs should be currently expensed. What is the basic rationale behind this procedure?

A)Fixed overhead costs will occur whether or not production occurs and so it presents a clearer picture of how changes in production volume affect costs and income.

B)Fixed overhead costs are generally immaterial in amount and the cost of assigning the amounts to specific products would outweigh the benefits.

C)Allocation of fixed overhead costs is arbitrary at best and could lead to erroneous decisions by management.

D)Fixed overhead costs are uncontrollable and should not be charged to a specific product.

A)Fixed overhead costs will occur whether or not production occurs and so it presents a clearer picture of how changes in production volume affect costs and income.

B)Fixed overhead costs are generally immaterial in amount and the cost of assigning the amounts to specific products would outweigh the benefits.

C)Allocation of fixed overhead costs is arbitrary at best and could lead to erroneous decisions by management.

D)Fixed overhead costs are uncontrollable and should not be charged to a specific product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

When evaluating profitability of a segment, costs that would disappear if the company eliminated the segment are called:

A)Direct costs.

B)Common costs.

C)Indirect costs.

D)Fixed costs.

A)Direct costs.

B)Common costs.

C)Indirect costs.

D)Fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

Absorption cost is required for:

A)income tax purposes.

B)external financial reporting but not income tax purposes.

C)both external financial reporting and income tax purposes.

D)neither external financial reporting nor income tax purposes.

A)income tax purposes.

B)external financial reporting but not income tax purposes.

C)both external financial reporting and income tax purposes.

D)neither external financial reporting nor income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

The excess of revenue over variable costs, including manufacturing, selling and administrative, is called:

A)Gross margin.

B)Manufacturing margin.

C)Contribution margin.

D)Segment margin.

A)Gross margin.

B)Manufacturing margin.

C)Contribution margin.

D)Segment margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

What costs are treated as product costs under direct costing?

A)Only direct costs

B)Only variable manufacturing costs

C)All variable costs

D)All variable and fixed manufacturing costs

A)Only direct costs

B)Only variable manufacturing costs

C)All variable costs

D)All variable and fixed manufacturing costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

What factor related to manufacturing costs causes the difference in net earnings computed using absorption costing and net earnings computed using variable costing?

A)Absorption costing considers all costs in the determination of net earnings, whereas variable costing considers only direct costs.

B)Absorption costing "inventories" all direct costs, but variable costing considers direct costs to be period costs.

C)Absorption costing "inventories" all fixed manufacturing costs for the period in ending finished goods inventory, but variable costing expenses all fixed costs.

D)Absorption costing allocates fixed manufacturing costs between cost of goods sold and inventories, and variable costing considers all fixed costs to be period costs.

A)Absorption costing considers all costs in the determination of net earnings, whereas variable costing considers only direct costs.

B)Absorption costing "inventories" all direct costs, but variable costing considers direct costs to be period costs.

C)Absorption costing "inventories" all fixed manufacturing costs for the period in ending finished goods inventory, but variable costing expenses all fixed costs.

D)Absorption costing allocates fixed manufacturing costs between cost of goods sold and inventories, and variable costing considers all fixed costs to be period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

The use of either absorption or variable costing will make little difference in companies

A)with large inventories.

B)using JIT.

C)with high fixed costs.

D)with high variable costs.

A)with large inventories.

B)using JIT.

C)with high fixed costs.

D)with high variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

Johns Company operates in three different industries each of which is appropriately regarded as a reportable segment. Segment No. 1 contributed 60 percent of Johns Company's total sales. Sales for Segment No. 1 were $600,000 and total variable costs were $400,000. Total common costs for all segments were $320,000. Johns allocates common costs based on the ratio of each segment's sales to the total sales. What should be the contribution margin presented for Segment No. 1?

A)$(100,000)

B)$8,000

C)$20,000

D)$200,000

A)$(100,000)

B)$8,000

C)$20,000

D)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

Segment profitability analysis may be used to evaluate the profitability of:

A)Divisions.

B)Sales territories.

C)Product lines.

D)All of these are correct.

A)Divisions.

B)Sales territories.

C)Product lines.

D)All of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

Mobile, Inc., manufactured 700 units of Product A, a new product, during the year. Product A's variable and fixed manufacturing costs per unit were $5.00 and $2.00, respectively. The inventory of Product A on December 31 of the year consisted of 100 units. There was no inventory of Product A on January 1 of the year. What would be the change in the dollar amount of inventory on December 31 if the variable costing method was used instead of the absorption costing method?

A)$800 decrease

B)$200 decrease

C)$500 decrease

D)$200 increase

A)$800 decrease

B)$200 decrease

C)$500 decrease

D)$200 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

A manager can increase income under absorption costing by

A)increasing variable costs.

B)increasing production.

C)increasing fixed costs.

D)increasing leased assets.

A)increasing variable costs.

B)increasing production.

C)increasing fixed costs.

D)increasing leased assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Nolan Company has two segments: Audio and Video. Sales for the Audio Segment were $500,000, and variable costs were 40% of sales. The Video Segment also had sales of $500,000, but variable costs were 60% of sales. Fixed costs directly traceable to the Audio and Video segments were $150,000 and $120,000, respectively. Common fixed costs of $200,000 were arbitrarily allocated equally to each segment. What was the contribution margin of the Audio Segment.

A)$50,000

B)$300,000

C)$200,000

D)$150,000

A)$50,000

B)$300,000

C)$200,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

When evaluating profitability of a segment, costs that are directly identifiable with a specific segment are called:

A)Direct costs.

B)Common costs.

C)Indirect costs.

D)Fixed costs.

A)Direct costs.

B)Common costs.

C)Indirect costs.

D)Fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Net income reported under absorption costing will exceed net income reported under variable costing for a given period if:

A)Production equals sales for that period.

B)Production exceeds sales for that period.

C)Sales exceed production for that period.

D)The variable overhead exceeds the fixed overhead.

A)Production equals sales for that period.

B)Production exceeds sales for that period.

C)Sales exceed production for that period.

D)The variable overhead exceeds the fixed overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is a more descriptive term of the type of cost accounting often called "direct costing"?

A)Prime costing

B)Out-of-pocket costing

C)Variable costing

D)Relevant costing

A)Prime costing

B)Out-of-pocket costing

C)Variable costing

D)Relevant costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Nolan Company has two segments: Audio and Video. Sales for the Audio Segment were $500,000, and variable costs were 40% of sales. The Video Segment also had sales of $500,000, but variable costs were 60% of sales. Fixed costs directly traceable to the Audio and Video segments were $150,000 and $120,000, respectively. Common fixed costs of $200,000 were arbitrarily allocated equally to each segment. What was the segment margin of the Video Segment.

A)$200,000

B)$80,000

C)$(20,000)

D)$150,000

A)$200,000

B)$80,000

C)$(20,000)

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

Franklin Company is a medium-sized manufacturer of bicycles. During the year a new line called "Radical" was made available to Franklin's customers. The break-even point for sales of Radical is $250,000 with a contribution margin ratio of 40 percent. Assuming that the profit for the Radical line during the year amounted to $80,000, total sales during the year would have amounted to:

A)$450,000.

B)$420,000.

C)$400,000.

D)$475,000.

A)$450,000.

B)$420,000.

C)$400,000.

D)$475,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

Kehler Corporation wished to market a new product for $2.00 a unit. Fixed costs to manufacture this product are $100,000. The contribution margin is 40 percent. How many units must be sold to realize net income of $100,000 from this product?

A)200,000

B)250,000

C)300,000

D)350,000

A)200,000

B)250,000

C)300,000

D)350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the selling price and the variable cost per unit both increase 10 percent and fixed costs do not change, what is the effect on the contribution margin per unit and the contribution margin ratio?

A)Contribution margin per unit and the contribution margin ratio both remain unchanged.

B)Contribution margin per unit and the contribution margin ratio both increase.

C)Contribution margin per unit increases and the contribution margin ratio decreases.

D)Contribution margin per unit increases and the contribution ratio remains unchanged.

A)Contribution margin per unit and the contribution margin ratio both remain unchanged.

B)Contribution margin per unit and the contribution margin ratio both increase.

C)Contribution margin per unit increases and the contribution margin ratio decreases.

D)Contribution margin per unit increases and the contribution ratio remains unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Blue Saints Band is holding a concert in Toronto. Fixed costs relating to staging a concert are $350,000. Variable costs per patron are $5.00. The selling price for a tickets $25.00. The Blue Saints Band has sold 23,000 tickets so far. How many tickets does the Blue Saints Band need to sell to achieve net income of $75,000.

A)21,250

B)14,000

C)17,500

D)17,000

A)21,250

B)14,000

C)17,500

D)17,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

The relative percentage of unit sales among the various products made by a firm is the:

A)sales volume.

B)sales margin.

C)sales mix.

D)sales ratio.

A)sales volume.

B)sales margin.

C)sales mix.

D)sales ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Blue Saints Band is holding a concert in Toronto. Fixed costs relating to staging a concert are $350,000. Variable costs per patron are $5.00. The selling price for a tickets $25.00. The Blue Saints Band has sold 23,000 tickets so far. How many tickets does the Blue Saints Band need to sell to break even?

A)23,000

B)20,000

C)14,000

D)17,500

A)23,000

B)20,000

C)14,000

D)17,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

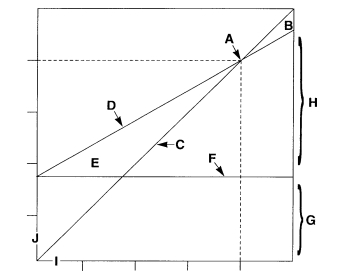

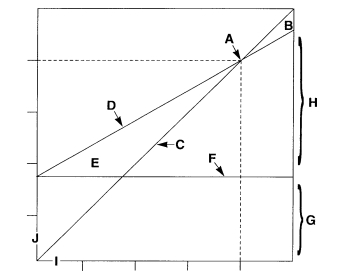

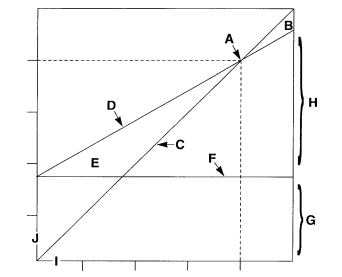

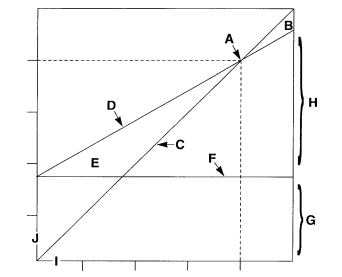

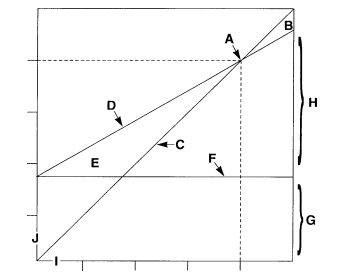

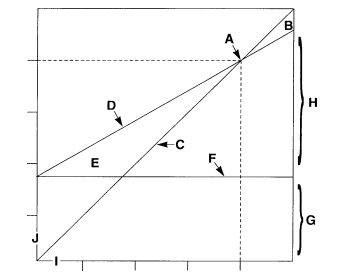

Tennenholtz Company's break-even graph is depicted below. Which area indicates the profitability of the company's product?

A)E.

B)G.

C)B.

D)H.

A)E.

B)G.

C)B.

D)H.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

Consider the income statement for Pickbury Farm:  At what sales level does Pickbury achieve net income of $100,000?

At what sales level does Pickbury achieve net income of $100,000?

A)$700,000

B)$600,000

C)$300,000

D)$530,000

At what sales level does Pickbury achieve net income of $100,000?

At what sales level does Pickbury achieve net income of $100,000?A)$700,000

B)$600,000

C)$300,000

D)$530,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

Consider the income statement for Pickbury Farm:  What is the break-even point in sales dollars (rounded to the nearest dollar)?

What is the break-even point in sales dollars (rounded to the nearest dollar)?

A)$714,286

B)$500,000

C)$266,667

D)$120,000

What is the break-even point in sales dollars (rounded to the nearest dollar)?

What is the break-even point in sales dollars (rounded to the nearest dollar)?A)$714,286

B)$500,000

C)$266,667

D)$120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

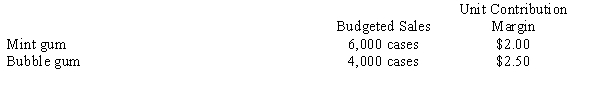

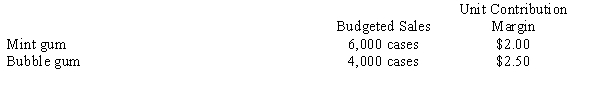

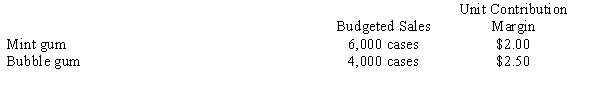

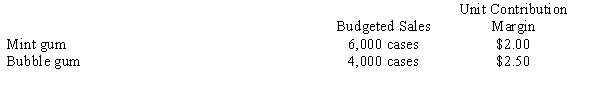

Consider the following information about the Gumm Company:  Budgeted fixed costs are $550,000. The break-even point in total cases is:

Budgeted fixed costs are $550,000. The break-even point in total cases is:

A)250,000

B)275,000

C)220,000

D)200,000

Budgeted fixed costs are $550,000. The break-even point in total cases is:

Budgeted fixed costs are $550,000. The break-even point in total cases is:A)250,000

B)275,000

C)220,000

D)200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Tennenholtz Company's break-even graph is depicted below. The line labeled "D" is:

A)The sales line.

B)The contribution margin line.

C)The total cost line.

D)The variable cost line.

A)The sales line.

B)The contribution margin line.

C)The total cost line.

D)The variable cost line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Company is planning to sell Product Z for $10 a unit. Variable costs are $6 a unit and fixed costs are $100,000. What must total sales be to break even?

A)$266,667

B)$250,000

C)$200,000

D)$166,667

A)$266,667

B)$250,000

C)$200,000

D)$166,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following would cause the break-even point to change?

A)Sales volume increased.

B)Fixed costs increased due to addition to physical plant.

C)Total variable costs increased as a function of higher production.

D)Total production decreased.

A)Sales volume increased.

B)Fixed costs increased due to addition to physical plant.

C)Total variable costs increased as a function of higher production.

D)Total production decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

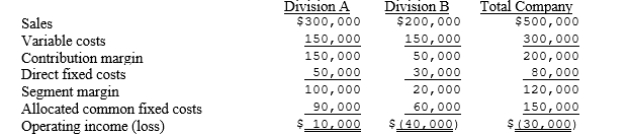

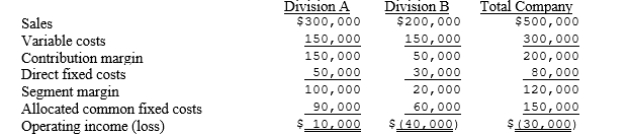

Consider the Marshall Company's segment analysis:  Common costs are allocated arbitrarily based on sales dollars. If Marshall eliminates Segment B, what is the impact on the operating loss of the company?

Common costs are allocated arbitrarily based on sales dollars. If Marshall eliminates Segment B, what is the impact on the operating loss of the company?

A)The loss decreases by $40,000.

B)The loss increases by $20,000.

C)The loss decreases by $60,000.

D)The loss increases by $40,000.

Common costs are allocated arbitrarily based on sales dollars. If Marshall eliminates Segment B, what is the impact on the operating loss of the company?

Common costs are allocated arbitrarily based on sales dollars. If Marshall eliminates Segment B, what is the impact on the operating loss of the company?A)The loss decreases by $40,000.

B)The loss increases by $20,000.

C)The loss decreases by $60,000.

D)The loss increases by $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

Each of the following would affect the break-even point except a change in the:

A)Variable cost per unit.

B)Total fixed costs.

C)Sales price per unit.

D)Number of units sold.

A)Variable cost per unit.

B)Total fixed costs.

C)Sales price per unit.

D)Number of units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

Break-even sales volume in units is determined by:

A)Dividing the fixed cost by the difference between the unit selling price and unit variable costs.

B)Subtracting the fixed cost from the contribution margin.

C)Dividing the fixed cost by the unit selling price.

D)Subtracting the variable cost per unit from the unit selling price.

A)Dividing the fixed cost by the difference between the unit selling price and unit variable costs.

B)Subtracting the fixed cost from the contribution margin.

C)Dividing the fixed cost by the unit selling price.

D)Subtracting the variable cost per unit from the unit selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

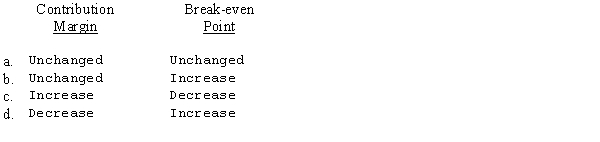

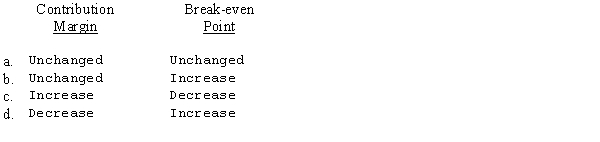

If the fixed costs related to a product increase while variable costs and sales price remain constant, what will happen to (1) contribution margin and (2) break-even point?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

A technique that uses the degrees of cost variability to measure the effect of changes in volume on resulting profits is:

A)Standard costing.

B)Variance analysis.

C)Cost-volume-profit analysis.

D)Segment profitability analysis.

A)Standard costing.

B)Variance analysis.

C)Cost-volume-profit analysis.

D)Segment profitability analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

Consider the following information about the Gumm Company:  Budgeted fixed costs are $550,000. The weighted-average unit contribution margin is:

Budgeted fixed costs are $550,000. The weighted-average unit contribution margin is:

A)$2.25

B)$4.50

C)$2.20

D)$2.30

Budgeted fixed costs are $550,000. The weighted-average unit contribution margin is:

Budgeted fixed costs are $550,000. The weighted-average unit contribution margin is:A)$2.25

B)$4.50

C)$2.20

D)$2.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

A company increased the selling price for its product from $1.00 to $1.20 a unit when total fixed costs increased from $400,000 to $450,000 and variable cost per unit remained unchanged. How would these changes affect the break-even point?

A)The break-even point in units would be increased.

B)The break-even point in units would be decreased.

C)The break-even point in units would remain unchanged.

D)The effect cannot be determined from the information given.

A)The break-even point in units would be increased.

B)The break-even point in units would be decreased.

C)The break-even point in units would remain unchanged.

D)The effect cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

The margin of safety is the amount:

A)by which the sales price per unit exceeds the variable cost per unit.

B)that the contribution margin exceeds fixed cost.

C)by which the profit calculated under absorption costing exceeds the profit calculated under variable costing.

D)that sales can decrease before the company will suffer a loss.

A)by which the sales price per unit exceeds the variable cost per unit.

B)that the contribution margin exceeds fixed cost.

C)by which the profit calculated under absorption costing exceeds the profit calculated under variable costing.

D)that sales can decrease before the company will suffer a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

Bradley Inc. has the capacity to make 100,000 windows. Bradley is currently operating at 80% capacity. The windows usually sell for $20.00 each. Costs for each window follow:  The Army has offered to buy 10,000 windows for $12.00 each for barracks. Bradley should:

The Army has offered to buy 10,000 windows for $12.00 each for barracks. Bradley should:

A)Reject the offer because it currently does not have enough capacity to accept the order.

B)Reject the order because the company will lose $20,000 on the order.

C)Accept the offer because the company will realize $20,000 in additional contribution margin.

D)Accept the offer because the company will realize $40,000 in additional contribution margin.

The Army has offered to buy 10,000 windows for $12.00 each for barracks. Bradley should:

The Army has offered to buy 10,000 windows for $12.00 each for barracks. Bradley should:A)Reject the offer because it currently does not have enough capacity to accept the order.

B)Reject the order because the company will lose $20,000 on the order.

C)Accept the offer because the company will realize $20,000 in additional contribution margin.

D)Accept the offer because the company will realize $40,000 in additional contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

Jasper Company makes two versions of one product, Standard and Deluxe. In November, sales of standard and Deluxe amount to $680,000 and $520,000, respectively. The contribution margin ratio for Standard is 30% and Standard had direct fixed production and administrative costs of $125,000. The contribution margin ratio for Deluxe was 40% and direct fixed costs were $160,000. Common costs that couldn't be allocated in a meaningful way were $100,000.

Prepare a segmented income statement for the month of November.

Prepare a segmented income statement for the month of November.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Company is planning to sell Product Z for $10 a unit. Variable costs are $6 a unit and fixed costs are $100,000. If the company is currently selling 30,000 units, what is the margin of safety in units?

A)5,000

B)10,000

C)25,000

D)20,000

A)5,000

B)10,000

C)25,000

D)20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

The following data relate to a year's budgeted activity for Jorgensen Corporation, a single product company:  Total fixed costs remain unchanged within the relevant range in which the company is currently operating.

Total fixed costs remain unchanged within the relevant range in which the company is currently operating.

a.What is the projected annual break-even sales in units?

b.What dollar amount of sales would Jorgenson need to achieve operating income of $30,000?

c.If fixed costs increased $7,500, how many more units must be sold to break even?

Total fixed costs remain unchanged within the relevant range in which the company is currently operating.

Total fixed costs remain unchanged within the relevant range in which the company is currently operating. a.What is the projected annual break-even sales in units?

b.What dollar amount of sales would Jorgenson need to achieve operating income of $30,000?

c.If fixed costs increased $7,500, how many more units must be sold to break even?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Blue Saints Band is holding a concert in Toronto. Fixed costs relating to staging a concert are $350,000. Variable costs per patron are $5.00. The selling price for a tickets $25.00. The Blue Saints Band has sold 23,000 tickets so far. At the current level of sales, what is the margin of safety ratio?

A)20.0%

B)23.9%

C)15.2%

D)31.3%

A)20.0%

B)23.9%

C)15.2%

D)31.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

The Blue Saints Band is holding a concert in Toronto. Fixed costs relating to staging a concert are $350,000. Variable costs per patron are $5.00. The selling price for a tickets $25.00. The Blue Saints Band has sold 23,000 tickets so far. At the current level of sales, what is the margin of safety in dollars?

A)$137,500

B)$87,500

C)$180,000

D)$115,000

A)$137,500

B)$87,500

C)$180,000

D)$115,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

The difference in cost between two alternatives, such as to make a component part of a final product versus buying the part from an outside supplier is called:

A)Variable cost.

B)Differential cost.

C)Product cost.

D)Indirect cost.

A)Variable cost.

B)Differential cost.

C)Product cost.

D)Indirect cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

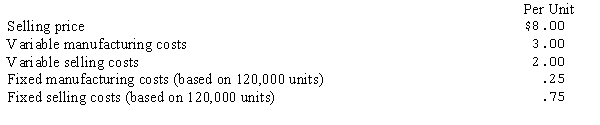

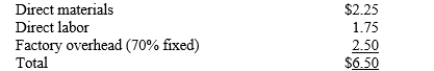

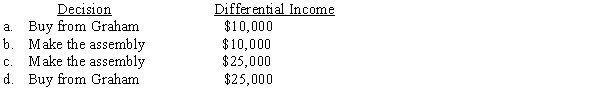

Chapman Corporation manufactures lamps. Management is currently studying whether the company should continue to make the cord assembly or purchase them from Graham Company for $5.25. Chapman needs 20,000 cord assemblies a year. If the part is purchased, the company can not use the released facilities for another manufacturing activity. Chapman's unit cost to manufacture the cord assembly is:  The decision Chapman should make and the related differential income is:

The decision Chapman should make and the related differential income is:

The decision Chapman should make and the related differential income is:

The decision Chapman should make and the related differential income is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

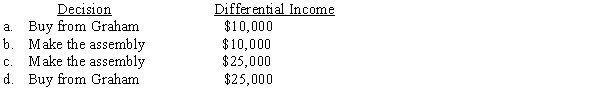

Donellan Company produces a special gear used in automatic transmissions. Each gear sells for $30, and the company sells approximately 500,000 gears each year. Unit cost data for the year follows:  Donellan has received an offer from a foreign manufacturer to purchase 25,000 gears. Domestic sales would be unaffected by this transaction. If the offer is accepted, variable distribution costs will increase $1.00 per gear for insurance, shipping, and import duties. The relevant unit cost to a pricing decision on this offer is:

Donellan has received an offer from a foreign manufacturer to purchase 25,000 gears. Domestic sales would be unaffected by this transaction. If the offer is accepted, variable distribution costs will increase $1.00 per gear for insurance, shipping, and import duties. The relevant unit cost to a pricing decision on this offer is:

A)$18.00.

B)$20.00.

C)$24.00.

D)$26.00.

Donellan has received an offer from a foreign manufacturer to purchase 25,000 gears. Domestic sales would be unaffected by this transaction. If the offer is accepted, variable distribution costs will increase $1.00 per gear for insurance, shipping, and import duties. The relevant unit cost to a pricing decision on this offer is:

Donellan has received an offer from a foreign manufacturer to purchase 25,000 gears. Domestic sales would be unaffected by this transaction. If the offer is accepted, variable distribution costs will increase $1.00 per gear for insurance, shipping, and import duties. The relevant unit cost to a pricing decision on this offer is:A)$18.00.

B)$20.00.

C)$24.00.

D)$26.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

Another term for cost incurred to sell and deliver products is:

A)Differential costs.

B)Administrative costs.

C)General costs.

D)Distribution costs.

A)Differential costs.

B)Administrative costs.

C)General costs.

D)Distribution costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

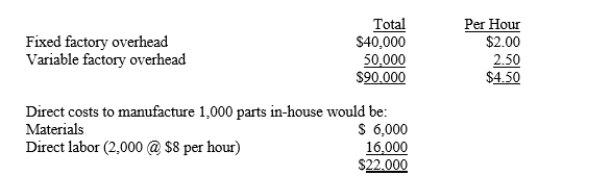

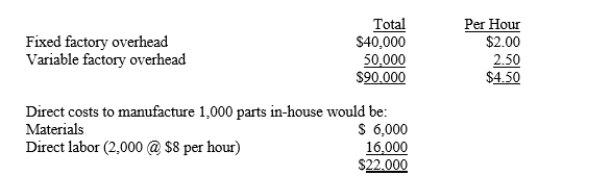

Cleese Company currently purchases a finished part from Idle Company, but is considering using it excess capacity to make the part. Normal capacity is 20,000 hours, but Cleese is currently running at 17,000 hours. Details about budgeted factory overhead follow:  The relevant unit cost Cleese should use to decide whether to make or buy the part is:

The relevant unit cost Cleese should use to decide whether to make or buy the part is:

A)$31.00

B)$24.50

C)$27.00

D)$26.00

The relevant unit cost Cleese should use to decide whether to make or buy the part is:

The relevant unit cost Cleese should use to decide whether to make or buy the part is:A)$31.00

B)$24.50

C)$27.00

D)$26.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Tijama Manufacturing Company has determined the cost of manufacturing a unit of product to be as follows, based on normal production of 50,000 units per year:  Operating statistics for the month of August and September include:

Operating statistics for the month of August and September include:  The selling price is $70 per unit. There were no inventories on August 1, and there is no work in process at September 30.

The selling price is $70 per unit. There were no inventories on August 1, and there is no work in process at September 30.

Prepare comparative income statements for each month under the following methods:

a.Absorption costing method

b.Direct costing method

Operating statistics for the month of August and September include:

Operating statistics for the month of August and September include:  The selling price is $70 per unit. There were no inventories on August 1, and there is no work in process at September 30.

The selling price is $70 per unit. There were no inventories on August 1, and there is no work in process at September 30.Prepare comparative income statements for each month under the following methods:

a.Absorption costing method

b.Direct costing method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

Bradley Inc. has the capacity to make 100,000 windows. Bradley is currently operating at 100% capacity. The windows usually sell for $20.00 each. Costs for each window follow:  The Army has offered to buy 10,000 windows for $12.00 each for barracks. Bradley should:

The Army has offered to buy 10,000 windows for $12.00 each for barracks. Bradley should:

A)Reject the offer because it currently does not have enough capacity to accept the order.

B)Reject the order because the company will lose $20,000 on the order.

C)Accept the offer because the company will realize $20,000 in additional contribution margin.

D)Accept the offer because the company will realize $40,000 in additional contribution margin.

The Army has offered to buy 10,000 windows for $12.00 each for barracks. Bradley should:

The Army has offered to buy 10,000 windows for $12.00 each for barracks. Bradley should:A)Reject the offer because it currently does not have enough capacity to accept the order.

B)Reject the order because the company will lose $20,000 on the order.

C)Accept the offer because the company will realize $20,000 in additional contribution margin.

D)Accept the offer because the company will realize $40,000 in additional contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

Consider the income statement for Pickbury Farm:  What is the margin of safety ratio (to the nearest percentage point)?

What is the margin of safety ratio (to the nearest percentage point)?

A)47%

B)70%

C)30%

D)88%

What is the margin of safety ratio (to the nearest percentage point)?

What is the margin of safety ratio (to the nearest percentage point)?A)47%

B)70%

C)30%

D)88%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

An example of a distribution cost that can be directly assigned to selling activity would be:

A)Advertising costs.

B)Commissions.

C)Sales manager's salary.

D)Telephone expenses.

A)Advertising costs.

B)Commissions.

C)Sales manager's salary.

D)Telephone expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

In performing an activity-based costing study for distribution costs, appropriate cost drivers for preparing orders for shipment would include all of the following except the:

A)Number of orders shipped.

B)Time spent packing orders.

C)Time devoted to selling each product.

D)Number of items per order.

A)Number of orders shipped.

B)Time spent packing orders.

C)Time devoted to selling each product.

D)Number of items per order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

The Blue Saints Band is holding a concert in Toronto. Fixed costs relating to staging a concert are $350,000. Variable costs per patron are $5.00. The selling price for a tickets $25.00. The Blue Saints Band has sold 23,000 tickets so far. How many tickets does the Blue Saints Band need to sell to achieve net income of $50,000 after income tax, assuming the income tax rate is 50%?

A)2,500

B)18,000

C)22,500

D)17,500

A)2,500

B)18,000

C)22,500

D)17,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

The practice of accepting a selling price when there is excess capacity, as long as it exceeds variable cost is called:

A)Contribution pricing.

B)Differential pricing.

C)Capacity pricing.

D)Special pricing.

A)Contribution pricing.

B)Differential pricing.

C)Capacity pricing.

D)Special pricing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

A traditional break-even chart is illustrated below:  Identify each letter on the above chart, using the proper terminology.

Identify each letter on the above chart, using the proper terminology.

Identify each letter on the above chart, using the proper terminology.

Identify each letter on the above chart, using the proper terminology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

Sherpa Manufacturing has the following income statement for 6,000 units:  (a) At what sales volume (in sales dollars) does Sherpa break even?

(a) At what sales volume (in sales dollars) does Sherpa break even?

(b) At what sales volume (in units) does Sherpa break even?

(c) Given the income statement above, compute the margin of safety.

(d) What level of sales volume must be attained to reach net income of $200,000?

(e) What level of sales volume must be attained to reach net income of $180,000, assuming Sherpa had to pay income taxes at a rate of 40%?

(a) At what sales volume (in sales dollars) does Sherpa break even?

(a) At what sales volume (in sales dollars) does Sherpa break even?(b) At what sales volume (in units) does Sherpa break even?

(c) Given the income statement above, compute the margin of safety.

(d) What level of sales volume must be attained to reach net income of $200,000?

(e) What level of sales volume must be attained to reach net income of $180,000, assuming Sherpa had to pay income taxes at a rate of 40%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

Hoctor Industries wishes to determine the profitability of its products and asks the cost accountant to make a comparative analysis of sales, cost of sales and distribution costs of each product for the year. The accountant gathers the following information which will be useful in preparing the analysis:  Advertising expenses total $100,000, with 60% being expended to advertise the Deluxe model. The representatives commissions are 5% and 7% for the standard and deluxe models, respectively. The sales manager's salary of $50,000 is allocated evenly between products. Other miscellaneous selling costs are estimated to be $6 per order received.

Advertising expenses total $100,000, with 60% being expended to advertise the Deluxe model. The representatives commissions are 5% and 7% for the standard and deluxe models, respectively. The sales manager's salary of $50,000 is allocated evenly between products. Other miscellaneous selling costs are estimated to be $6 per order received.

(a) Compute the selling cost per unit.

(b) Prepare an analysis for Hoctor Industries that will show in comparative form the income derived from the sale of each unit for the year.

Advertising expenses total $100,000, with 60% being expended to advertise the Deluxe model. The representatives commissions are 5% and 7% for the standard and deluxe models, respectively. The sales manager's salary of $50,000 is allocated evenly between products. Other miscellaneous selling costs are estimated to be $6 per order received.

Advertising expenses total $100,000, with 60% being expended to advertise the Deluxe model. The representatives commissions are 5% and 7% for the standard and deluxe models, respectively. The sales manager's salary of $50,000 is allocated evenly between products. Other miscellaneous selling costs are estimated to be $6 per order received.(a) Compute the selling cost per unit.

(b) Prepare an analysis for Hoctor Industries that will show in comparative form the income derived from the sale of each unit for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Gaylord Company has sales of $800,000, variable costs of $400,000, and fixed costs of $250,000.

Compute the following:

a.Contribution margin ratio

b.Break-even sales volume

c.Margin of safety ratio

d.Net income as a percentage of sales

Compute the following:

a.Contribution margin ratio

b.Break-even sales volume

c.Margin of safety ratio

d.Net income as a percentage of sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

Westwood Gear, Inc., recently received a special order to manufacture 10,000 units for a Canadian company. This order specified that the selling price per unit should not exceed $50. Since the order was received without the effort of the sales department, no commission would be paid. However, an export handling charge of $5 per unit would be incurred. Management anticipates that acceptance of the order will have no effect on other sales.

The company is now operating at 80 percent of capacity, or 80,000 units, and expects to continue at this level for the coming year without the Canadian order. Unit costs based on estimated actual capacity for the coming year include: Prepare an analysis showing the effect on profits if the special order is accepted by the company. Based on your analysis, should the order be filled, and why?

Prepare an analysis showing the effect on profits if the special order is accepted by the company. Based on your analysis, should the order be filled, and why?

The company is now operating at 80 percent of capacity, or 80,000 units, and expects to continue at this level for the coming year without the Canadian order. Unit costs based on estimated actual capacity for the coming year include:

Prepare an analysis showing the effect on profits if the special order is accepted by the company. Based on your analysis, should the order be filled, and why?

Prepare an analysis showing the effect on profits if the special order is accepted by the company. Based on your analysis, should the order be filled, and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

Tress Enterprises manufactures shampoo and conditioner. Last year, Tress sold 120,000 bottles of product. Unit sales of conditioner amounted to 60% of the number of units of shampoo. This trend is expected to continue. The selling price for both products is $12.00, however, the variable cost of a unit of shampoo is $6.00, while the variable cost of a unit of conditioner is $8.00. Fixed costs are expected to be $420,000.

(a) Compute the number of each product sold.

(b) Compute the weighted-average contribution margin per unit.

(c) Compute the overall break-even point in units.

(d) Compute the unit sales of shampoo and conditioner at the break-even point.

(e) Compute the dollar sales of shampoo and conditioner at the break-even point.

(a) Compute the number of each product sold.

(b) Compute the weighted-average contribution margin per unit.

(c) Compute the overall break-even point in units.

(d) Compute the unit sales of shampoo and conditioner at the break-even point.

(e) Compute the dollar sales of shampoo and conditioner at the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

Busby Company needs 10,000 units of a certain part to use in its production cycle. The following information is available:  If Busby buys the part from Thurco instead of making it, Busby could not use the released facilities in another manufacturing activity. However, twenty percent of the fixed overhead would be avoided because one of the supervisors could be let go.

If Busby buys the part from Thurco instead of making it, Busby could not use the released facilities in another manufacturing activity. However, twenty percent of the fixed overhead would be avoided because one of the supervisors could be let go.

(a) In deciding whether to make or buy the part, what are the relevant costs that Busby must consider.

(b) What decision should Busby make?

If Busby buys the part from Thurco instead of making it, Busby could not use the released facilities in another manufacturing activity. However, twenty percent of the fixed overhead would be avoided because one of the supervisors could be let go.

If Busby buys the part from Thurco instead of making it, Busby could not use the released facilities in another manufacturing activity. However, twenty percent of the fixed overhead would be avoided because one of the supervisors could be let go.(a) In deciding whether to make or buy the part, what are the relevant costs that Busby must consider.

(b) What decision should Busby make?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck