Deck 10: Reporting and Analyzing Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/246

العب

ملء الشاشة (f)

Deck 10: Reporting and Analyzing Liabilities

1

Unearned revenues should be classified as Other Revenues and Gains on the income statement.

False

2

A note payable must always be paid before an account payable.

False

3

The higher the sales tax rate, the more profit a retailer can earn.

False

4

Notes payable usually require the borrower to pay interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

5

With an interest-bearing note, the amount of cash received upon issuance of the note generally exceeds the note's face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

6

Interest expense on a note payable is only recorded at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

7

If any portion of a long-term debt is to be paid in the next year, the entire debt should be classified as a current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a retailer sells goods for a total price of $200, which includes a 5% sales tax, the amount of the sales tax is $9.52.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

9

During the month, a company sells goods for a total of $106,000, which includes sales taxes of $6,000; therefore, the company should recognize $100,000 in Sales Revenue and $6,000 in Sales Tax Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

10

Payroll taxes include the employer's share of Social Security taxes as well as state and federal unemployment taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

11

Current maturities of long-term debt refer to the amount of interest on a note payable that must be paid in the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

12

A company whose current liabilities exceed its current assets may have a liquidity problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

13

Interest expense is reported under Other Expenses and Losses in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

14

Notes payable are often used instead of accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

15

Most notes are not interest bearing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

16

A $20,000, 8%, 9-month note payable requires an interest payment of $1,200 at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

17

A current liability must be paid out of current earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

18

Unearned revenues are received before goods are delivered or services are rendered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

19

When a business sells an item and collects a state sales tax on it, a current liability arises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

20

Current liabilities are expected to be paid within one year or the operating cycle, whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

21

The carrying value of a bond is equal to the market price on the date of sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

22

A $150,000 bond with a quoted priced of 102 ¼ is sold for $153,375.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

23

The calculation of interest to be paid each interest period in connection with a bond payable is not influenced by any premium or discount upon issuance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

24

Total interest cost for a bond issued at a premium equals the total of the periodic interest payments minus the premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

25

If $150,000 face value bonds are issued at 102, the proceeds received will be $102,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

26

The face value is the amount of principal and interest due at the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

27

The contractual interest rate is always equal to the market rate of interest on the date that bonds are issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

28

An unsecured bond is one that is issued against the general credit of the borrower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

29

Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

30

Neither corporate bond interest nor dividends are deductible for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

31

Total interest cost for a bond issued at a premium equals the total of the periodic interest payments added to the premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

32

Generally, convertible bonds do not pay interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a bond has a stated value of $1,000 and a contractual interest rate of 6 percent, then the interest paid annually will be $60.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

34

The carrying value of bonds is calculated by adding the balance of the Discount on Bonds Payable account to the balance in the Bonds Payable account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

35

Convertible bonds are often called callable bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

36

Bonds are a form of interest-bearing notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

37

The board of directors may authorize more bonds than are issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

38

Each bondholder may vote for the board of directors in proportion to the number of bonds held.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

39

Metropolitan Symphony sells 200 season tickets for $40,000 that includes a five-concert season.The amount of Unearned Ticket Revenue after the third concert is $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

40

The current market value of a bond is equal to the present value of all future cash payments promised by the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the straight-line method of amortization is used, the amount of unamortized premium on bonds payable will increase as the bonds approach maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

42

A corporation that issues bonds at a discount will recognize interest expense at a rate which is greater than the market rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the market rate of interest at the date of issuance of a bond is greater than the stated interest rate, the bond will be issued at a premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

44

The times interest earned is computed by dividing net income by interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

45

If $500,000 par value bonds with a carrying value of $476,000 are redeemed at 97, a loss on redemption will be recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

46

Material losses on bond redemption are reported as operating expenses on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

47

The classification of a liability as current or noncurrent is important because it may affect the evaluation of a company's liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

48

If bonds are issued at a premium, the carrying value of the bonds will be greater than the face value of the bonds for all periods prior to the bond maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

49

If bonds are issued at a discount, the issuing corporation will pay a principal amount less than the face amount of the bonds on the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

50

The premium on bonds payable may be amortized by the straight-line method if the results obtained by its use do not materially differ from the results obtained by use of the effective-interest method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

51

If $180,000, 6%, bonds are issued on January 1 and pay interest annually, the amount of interest paid will be $10,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

52

If the straight-line method of amortization is used, the amount of unamortized premium on bonds payable will decrease as the bonds approach maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

53

Discount on bonds payable may be amortized by the straight-line method if the results obtained by its use do not materially differ from the results obtained by use of the effective-interest method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

54

When the effective-interest method of amortization is used, the amount of interest expense for a given period is calculated by multiplying the face rate of interest by the bond's carrying value at the beginning of the given period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

55

The debt to assets ratio measures the percentage of the total assets provided by creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

56

Regardless of whether the straight-line method or the effective-interest method is used, the carrying value of a bond issued at a discount will decrease continually over the bond's life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

57

If a corporation issued bonds at an amount less than face value, it indicates that the corporation has a weak credit rating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

58

If the straight-line method of amortization is used, the amount of yearly interest expense will increase as the bonds approach maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

59

If bonds sell at a premium, the interest expense recognized each year will be greater than the bond interest paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

60

If the market rate of interest is greater than the contractual rate of interest, bonds will sell at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is not a current liability on December 31, 2022?

A)A Note Payable due December 31, 2023

B)An Accounts Payable due January 31, 2023

C)A lawsuit judgment to be decided on January 10, 2023

D)Accrued salaries payable from 2022

A)A Note Payable due December 31, 2023

B)An Accounts Payable due January 31, 2023

C)A lawsuit judgment to be decided on January 10, 2023

D)Accrued salaries payable from 2022

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

62

Most companies pay current liabilities

A)out of current assets.

B)by issuing interest-bearing notes payable.

C)by issuing stock.

D)by creating long-term liabilities.

A)out of current assets.

B)by issuing interest-bearing notes payable.

C)by issuing stock.

D)by creating long-term liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

63

Failure to record a liability will probably

A)result in an overstated net income.

B)result in overstated total liabilities and owner's equity.

C)have no effect on net income.

D)result in overstated total assets.

A)result in an overstated net income.

B)result in overstated total liabilities and owner's equity.

C)have no effect on net income.

D)result in overstated total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

64

Current liabilities are due

A)but not receivable for more than one year.

B)but not payable for more than one year.

C)and receivable within one year.

D)and payable within one year.

A)but not receivable for more than one year.

B)but not payable for more than one year.

C)and receivable within one year.

D)and payable within one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

65

In a monthly mortgage payment, the same amount is recorded as interest expense as in the previous month's payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

66

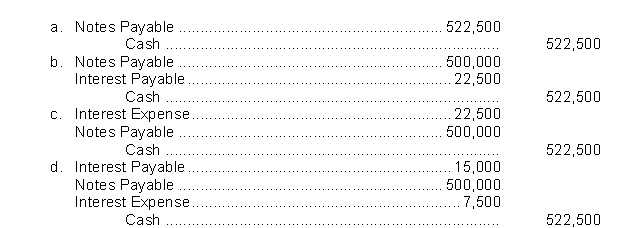

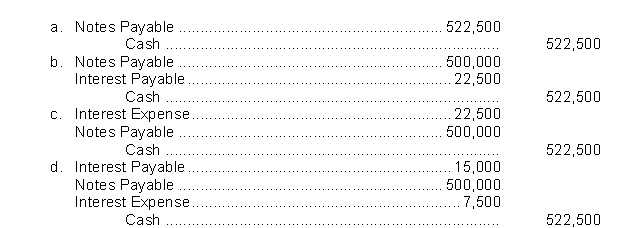

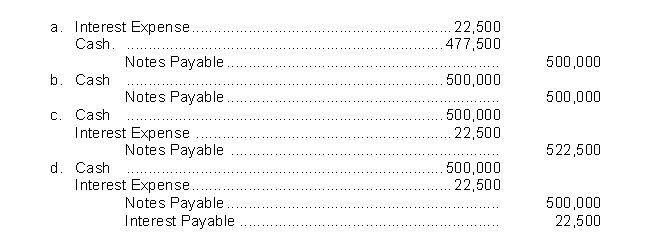

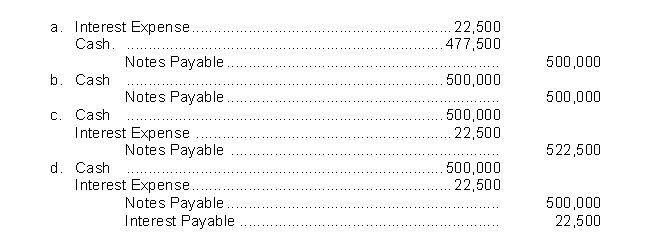

Moss County Bank agrees to lend the Sadowski Brick Company $500,000 on January 1.Sadowski Brick Company signs a $500,000, 6%, 9-month note.What entry will Sadowski Brick Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

67

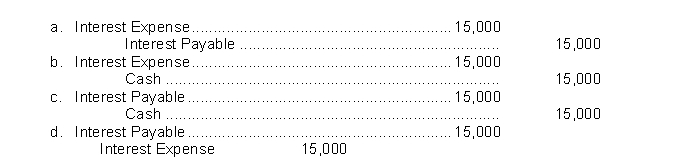

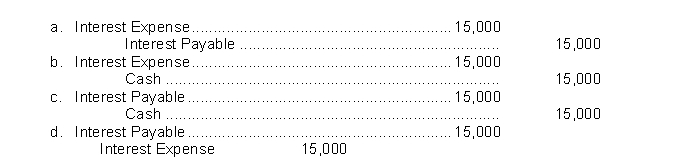

Moss County Bank agrees to lend the Sadowski Brick Company $500,000 on January 1.Sadowski Brick Company signs a $500,000, 6%, 9-month note.What is the adjusting entry required if Sadowski Brick Company prepares financial statements on June 30?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

68

A current liability is a debt that can reasonably be expected to be paid

A)within one year, or the operating cycle, whichever is longer.

B)between 6 months and 18 months.

C)out of currently recognized revenues.

D)out of cash currently on hand.

A)within one year, or the operating cycle, whichever is longer.

B)between 6 months and 18 months.

C)out of currently recognized revenues.

D)out of cash currently on hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

69

Moss County Bank agrees to lend the Sadowski Brick Company $500,000 on January 1.Sadowski Brick Company signs a $500,000, 6%, 9-month note.The entry made by Sadowski Brick Company on January 1 to record the proceeds and issuance of the note is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

70

An installment note calling for equal total payments each period will result in a principal portion that decreases in each successive period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following most likely would be classified as a current liability?

A)Dividends payable

B)Bonds payable in 5 years

C)Three-year notes payable

D)Mortgage payable as a single payment in 10 years

A)Dividends payable

B)Bonds payable in 5 years

C)Three-year notes payable

D)Mortgage payable as a single payment in 10 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

72

With an interest-bearing note, the amount of assets received upon issuance of the note is generally

A)equal to the note's face value.

B)greater than the note's face value.

C)less than the note's face value.

D)equal to the note's maturity value.

A)equal to the note's face value.

B)greater than the note's face value.

C)less than the note's face value.

D)equal to the note's maturity value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

73

Very often, failure to record a liability means failure to record a(n)

A)revenue.

B)asset conversion.

C)footnote.

D)expense.

A)revenue.

B)asset conversion.

C)footnote.

D)expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

74

The effective-interest method produces a constant dollar amount of interest expense to be reported for each interest period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

75

When there are material differences between the results of using the straight-line method and using the effective-interest method of amortization, the effective-interest method should be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

76

Liabilities are classified on the balance sheet as current or

A)deferred.

B)unearned.

C)long-term.

D)accrued.

A)deferred.

B)unearned.

C)long-term.

D)accrued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

77

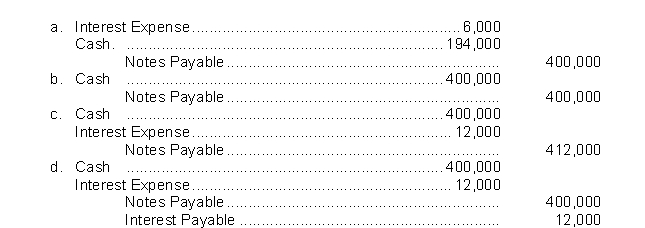

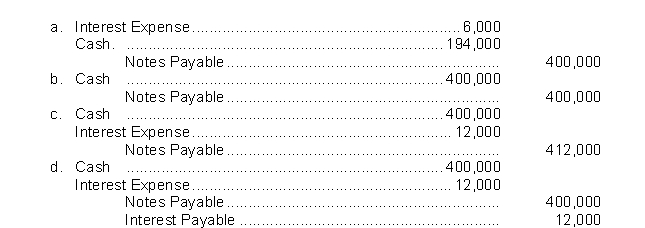

West County Bank agrees to lend Drake Builders Company $400,000 on January 1.Drake Builders Company signs a $400,000, 6%, 6-month note.The entry made by Drake Builders Company on January 1 to record the proceeds and issuance of the note is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

78

When a monthly mortgage payment is made and recorded, the debit to Mortgage Payable represents the reduction in the principal balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

79

An installment note calling for equal total payments each period will result in an interest portion that decreases in each successive period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck

80

Liabilities are classified as current or long-term based on their

A)description.

B)payment terms.

C)due date.

D)amount.

A)description.

B)payment terms.

C)due date.

D)amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 246 في هذه المجموعة.

فتح الحزمة

k this deck