Deck 12: Reporting and Analyzing Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

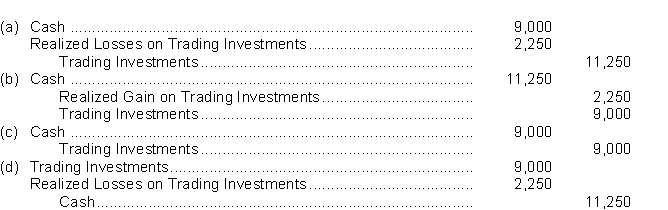

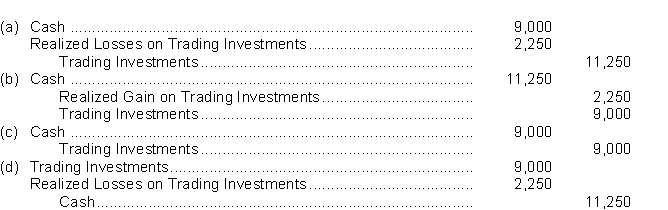

سؤال

سؤال

سؤال

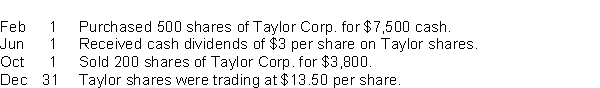

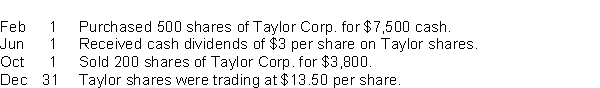

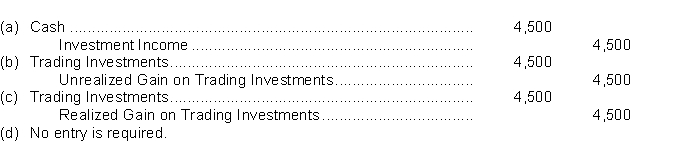

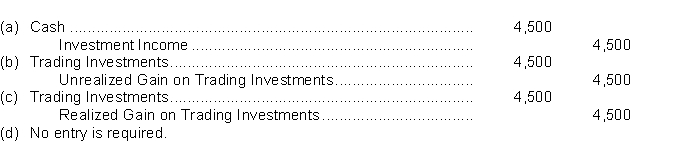

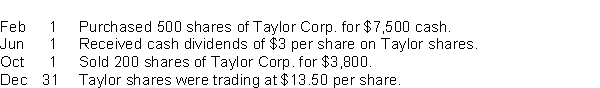

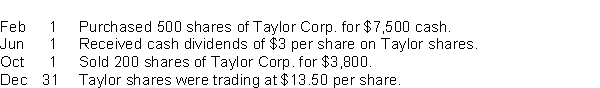

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

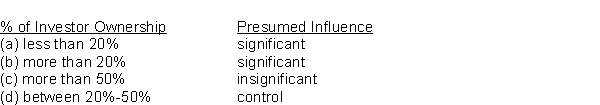

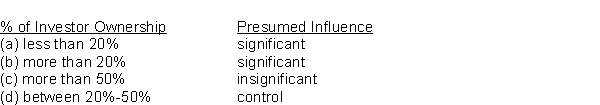

سؤال

سؤال

سؤال

سؤال

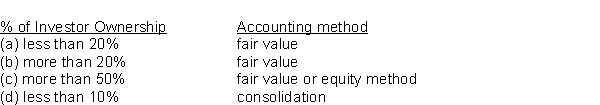

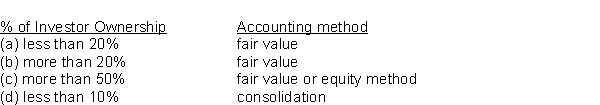

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/117

العب

ملء الشاشة (f)

Deck 12: Reporting and Analyzing Investments

1

Dividends received on investments are accounted for in the same way under the fair value through profit or loss model cost and the equity method.

False

2

The degree of influence determines how a strategic investment is classified.

True

3

If the fair value through other comprehensive income model is used, then unrealized gains and losses are not used to evaluate management.

True

4

Debt investments earn interest income over time and the borrower has an obligation to return the original amount of the investment on a fixed maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

5

Corporations purchase investments in debt or equity securities for the income tax write-off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

6

At acquisition, the investment account is debited for the cost of the shares under both the cost and equity methods of accounting for strategic investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

7

Non-strategic investments that are held for the purpose of earning capital gains are called Trading Investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

8

Unless there is evidence to the contrary, an investor owning at least 20% of the shares of an investee is assumed to have significant influence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

9

When an investee can be significantly influenced, it is known as an associate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

10

Only debt investments can be accounted for using the fair value through other comprehensive income model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under both IFRS and ASPE, investors can use either the cost model or the equity method for significantly influenced investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

12

Non-strategic investments can be classified as short or long-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

13

Equity securities are always classified as long-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

14

Preferred shares are often purchased as strategic investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

15

Using the fair value through profit and loss model of accounting for an equity investment, the journal entry to record the receipt of dividends involves a credit to Dividend Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under both the fair value model and the amortized cost model, investments are adjusted upwards or downwards to reflect their fair value at year end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

17

At acquisition, non-strategic investments are recorded at purchase cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

18

Strategic investments are debt or equity securities that are usually purchased to generate investment income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

19

No unrealized gains and losses are recorded when using the amortized cost model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

20

Using the fair value through profit or loss model, both unrealized and realized gains and losses would be reported in the statement of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

21

Debt investments include all the following except

(a)common shares.

(b)guaranteed investment certificates.

(c)treasury bills.

(d)bonds.

(a)common shares.

(b)guaranteed investment certificates.

(c)treasury bills.

(d)bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under both IFRS and ASPE, the investor must use the effective-interest method to amortize bond premium or discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

23

Corporations invest in other companies for all the following reasons except to

(a)use excess cash until needed.

(b)generate investment revenue.

(c)meet strategic goals.

(d)influence the market value.

(a)use excess cash until needed.

(b)generate investment revenue.

(c)meet strategic goals.

(d)influence the market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

24

Premiums and discounts must be amortized on all bond investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

25

Interest income is calculated by multiplying the carrying amount of the bond investment by the market rate of interest when the bond was purchased prorated by the portion of the payment period covered during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following would never be classified as a long-term investment?

(a)strategic investments

(b)trading investments

(c)investments in associates

(d)bonds with a ten-year maturity

(a)strategic investments

(b)trading investments

(c)investments in associates

(d)bonds with a ten-year maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

27

When investing excess cash for short periods of time, corporations generally invest in any of the following, except

(a)money-market funds.

(b)bankers' acceptances.

(c)equity securities.

(d)treasury bills.

(a)money-market funds.

(b)bankers' acceptances.

(c)equity securities.

(d)treasury bills.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

28

Trading Investments are all of the following except

(a)debt or equity securities.

(b)securities purchased to generate a net income from short-term price fluctuations.

(c)securities held for the purpose of earning capital gains.

(d)strategic investments.

(a)debt or equity securities.

(b)securities purchased to generate a net income from short-term price fluctuations.

(c)securities held for the purpose of earning capital gains.

(d)strategic investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which one of the following would not be classified as a non-strategic investment?

(a)money-market securities

(b)idle cash in a chequing account

(c)trading investments

(d)long-term bonds

(a)money-market securities

(b)idle cash in a chequing account

(c)trading investments

(d)long-term bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

30

Both equity and debt investments are reported as current assets on the statement of financial position at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

31

All the following statements concerning strategic investments are true, except

(a)they include trading investments.

(b)they are purchased for the strategic purpose of influencing relationships between companies.

(c)they are generally long-term investments.

(d)they are equity securities.

(a)they include trading investments.

(b)they are purchased for the strategic purpose of influencing relationships between companies.

(c)they are generally long-term investments.

(d)they are equity securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

32

Consolidated financial statements are appropriate when one company has significant influence over another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

33

Realized gains and losses are always reported in the statement of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

34

Debt investments held to earn interest income are reported at amortized cost in the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

35

If there is a bond premium on a long-term bond investment, the carrying amount of the investment is reduced by the amount of the amortization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

36

Investments in associates are reported as current assets on the statement of financial position at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

37

When investing excess cash for short periods of time,

(a)corporations generally invest in equity securities.

(b)corporations generally invest in debt securities that have both high liquidity and high risk.

(c)corporations generally invest in debt securities that have high risk and low liquidity.

(d)corporations generally invest in debt securities that have low risk and high liquidity.

(a)corporations generally invest in equity securities.

(b)corporations generally invest in debt securities that have both high liquidity and high risk.

(c)corporations generally invest in debt securities that have high risk and low liquidity.

(d)corporations generally invest in debt securities that have low risk and high liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

38

Securities that can be purchased for strategic purposes

(a)include only equity securities to influence relationships between companies.

(b)include only debt investments.

(c)include both equity securities and debt investments.

(d)exclude both equity securities and debt investments.

(a)include only equity securities to influence relationships between companies.

(b)include only debt investments.

(c)include both equity securities and debt investments.

(d)exclude both equity securities and debt investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

39

When an investment in bonds is made, the investment account is debited for the face value of the bond less any premium or plus any discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

40

Short-term investments in bonds are accounted for using the fair value through profit or loss model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

41

On September 15, 2022, Alonso Ltd.sells 150 common shares of Bandi Corp., which were being held as a trading investment.The shares were acquired six months ago at $75 a share.Alonso sells the shares for $60 a share.The entry to record the sale is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is false?

(a)The cost model is used only for equity investments.

(b)The cost model reports realized gains and losses on the statement of income.

(c)The cost model is used to account for equity investments where there is significant influence.

(d)The cost model is very similar to the amortized cost model.

(a)The cost model is used only for equity investments.

(b)The cost model reports realized gains and losses on the statement of income.

(c)The cost model is used to account for equity investments where there is significant influence.

(d)The cost model is very similar to the amortized cost model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

43

All the following investments are generally shown at fair value except

(a)short-term debt investments.

(b)trading investments.

(c)bond investments intended to be held to maturity.

(d)shares purchased with the intention of achieving a capital gain on sale.

(a)short-term debt investments.

(b)trading investments.

(c)bond investments intended to be held to maturity.

(d)shares purchased with the intention of achieving a capital gain on sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

44

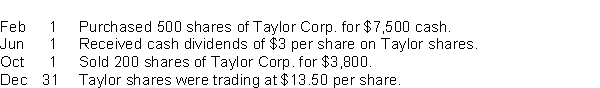

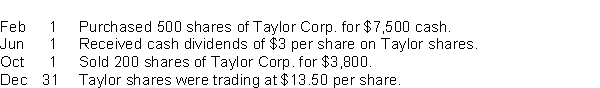

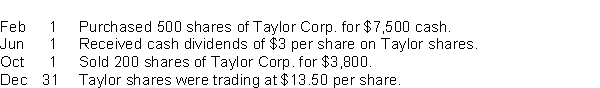

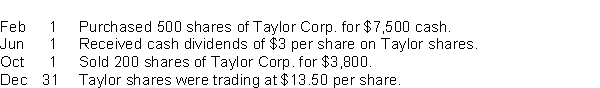

Use the following information to answer questions

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

The entry, if any is required, to record the value of the investment on December 31 would include a debit to

(a)Realized Losses for $450.

(b)Unrealized Loss for $750.

(c)No entry is required.

(d)Unrealized Losses of $450.

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

The entry, if any is required, to record the value of the investment on December 31 would include a debit to

(a)Realized Losses for $450.

(b)Unrealized Loss for $750.

(c)No entry is required.

(d)Unrealized Losses of $450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following statements is not true?

(a)Under the fair value through other comprehensive income model gains and losses are critical to the evaluation of management.

(b)Under the fair value through profit or loss model, both realized and unrealized gains and losses are reported in the statement of income.

(c)Under the amortized cost model, no unrealized gains or losses are reported.

(d)Non-strategic investments are purchased to generate investment income.

(a)Under the fair value through other comprehensive income model gains and losses are critical to the evaluation of management.

(b)Under the fair value through profit or loss model, both realized and unrealized gains and losses are reported in the statement of income.

(c)Under the amortized cost model, no unrealized gains or losses are reported.

(d)Non-strategic investments are purchased to generate investment income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

46

Debt investments are all of the following except

(a)low risk.

(b)classified according to maturity.

(c)equity securities.

(d)debt securities.

(a)low risk.

(b)classified according to maturity.

(c)equity securities.

(d)debt securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

47

Hankers Corporation buys 1,500 shares of Viggo Ltd.'s common shares as a trading investment.The shares are purchased for $45 a share.At year end the shares are trading at $48.The adjusting entry at year end is .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the following information to answer questions

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

The entry to record the receipt of the dividends on Jun 1 would include a

(a)debit to Trading Investments for $1,500.

(b)debit to Dividend Income for $1,500.

(c)credit to Dividend Income for $1,500.

(d)credit to Strategic Investments for $1,500.

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

The entry to record the receipt of the dividends on Jun 1 would include a

(a)debit to Trading Investments for $1,500.

(b)debit to Dividend Income for $1,500.

(c)credit to Dividend Income for $1,500.

(d)credit to Strategic Investments for $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

49

When investing excess cash for short periods of time, corporations generally invest in debt securities that have

(a)high risk and low liquidity.

(b)low risk and high liquidity.

(c)high risk and high liquidity.

(d)low risk and low liquidity.

(a)high risk and low liquidity.

(b)low risk and high liquidity.

(c)high risk and high liquidity.

(d)low risk and low liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

50

Under the equity method,

(a)the receipt of dividends from the investee results in an increase in the investment account.

(b)the receipt of dividends from the investee results in a credit to the Dividend Income account.

(c)the receipt of dividends from the investee results in an increase in the investment account and a credit to the Dividend Income account.

(d)the receipt of dividends from the investee reduces the carrying amount of the investment account.

(a)the receipt of dividends from the investee results in an increase in the investment account.

(b)the receipt of dividends from the investee results in a credit to the Dividend Income account.

(c)the receipt of dividends from the investee results in an increase in the investment account and a credit to the Dividend Income account.

(d)the receipt of dividends from the investee reduces the carrying amount of the investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

51

An advantage of using the fair value through other comprehensive income is that

(a)the effect on other comprehensive income is reported in the statement of income.

(b)unrealized gains and losses are not used to evaluate management.

(c)unrealized losses must be reported on the statement of income, but unrealized gains are reported in other comprehensive income.

(d)unrealized gains must be reported on the statement of income, but unrealized losses are reported in other comprehensive income.

(a)the effect on other comprehensive income is reported in the statement of income.

(b)unrealized gains and losses are not used to evaluate management.

(c)unrealized losses must be reported on the statement of income, but unrealized gains are reported in other comprehensive income.

(d)unrealized gains must be reported on the statement of income, but unrealized losses are reported in other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is not a model used for valuing non-strategic investments?

(a)fair value through profit or loss

(b)cost model through other comprehensive income

(c)fair value through other comprehensive income

(d)amortized cost

(a)fair value through profit or loss

(b)cost model through other comprehensive income

(c)fair value through other comprehensive income

(d)amortized cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

53

On June 1, 2022, Mango Corp.purchased Papaya Corp.common shares for $12,100 as a trading investment.Three months later, Mango sold these shares for $13,000.The entry to record the sale would include a

(a)debit to Cash of $12,100.

(b)credit to Interest Income of $900.

(c)credit to Trading Investments of $13,000.

(d)credit to Realized Gain on Trading Investments of $900.

(a)debit to Cash of $12,100.

(b)credit to Interest Income of $900.

(c)credit to Trading Investments of $13,000.

(d)credit to Realized Gain on Trading Investments of $900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is not correct regarding strategic investments?

(a)They are purchased with the purpose of influencing the investee company.

(b)They are generally classified as investments in associates.

(c)They are frequently debt securities.

(d)The degree of influence determines how a strategic investment is classified.

(a)They are purchased with the purpose of influencing the investee company.

(b)They are generally classified as investments in associates.

(c)They are frequently debt securities.

(d)The degree of influence determines how a strategic investment is classified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

55

If a trading investment in bonds is sold one month after its value was adjusted at year end, the investment account is

(a)debited for the carrying amount of the bonds at the sale date.

(b)credited for the cost of the bonds at the sale date.

(c)credited for the carrying amount of the bonds at the sale date.

(d)debited for the cost of the bonds at the sale date.

(a)debited for the carrying amount of the bonds at the sale date.

(b)credited for the cost of the bonds at the sale date.

(c)credited for the carrying amount of the bonds at the sale date.

(d)debited for the cost of the bonds at the sale date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which one of the following statements is false?

(a)Under the equity method, revenue is recognized when net income is earned by the associate.

(b)When the equity method is used to account for an investment in shares, dividends received are accounted for as a reduction in the investment account.

(c)Under the equity method, the investment account is adjusted annually for a portion of associate's net income and for dividends received.

(d)Under the equity method, revenue is recognized when net income is earned by the investor which may not be when it is earned by the investee.

(a)Under the equity method, revenue is recognized when net income is earned by the associate.

(b)When the equity method is used to account for an investment in shares, dividends received are accounted for as a reduction in the investment account.

(c)Under the equity method, the investment account is adjusted annually for a portion of associate's net income and for dividends received.

(d)Under the equity method, revenue is recognized when net income is earned by the investor which may not be when it is earned by the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following information to answer questions

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

The entry to record the purchase of the Taylor shares on Feb 1 would include a

(a)debit to Long-Term Trading Investments.

(b)debit to Trading Investments.

(c)debit to Strategic Investments.

(d)debit to Investment in Associates.

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

The entry to record the purchase of the Taylor shares on Feb 1 would include a

(a)debit to Long-Term Trading Investments.

(b)debit to Trading Investments.

(c)debit to Strategic Investments.

(d)debit to Investment in Associates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not true about the accounting for Trading Investments?

(a)They are reported as current assets on the statement of financial position.

(b)Realized gains and losses are reported on the statement of income.

(c)They are valued at fair value.

(d)Unrealized gains and losses are reported on the statement of comprehensive income.

(a)They are reported as current assets on the statement of financial position.

(b)Realized gains and losses are reported on the statement of income.

(c)They are valued at fair value.

(d)Unrealized gains and losses are reported on the statement of comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following information to answer questions

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

The entry to record the sale of the shares on Oct 1 would include a

(a)credit to Trading Investments for $3,800.

(b)credit to Realized Gain for $800.

(c)credit to Unrealized Gain for $800.

(d)debit to Unrealized Gain for $3,800.

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

The entry to record the sale of the shares on Oct 1 would include a

(a)credit to Trading Investments for $3,800.

(b)credit to Realized Gain for $800.

(c)credit to Unrealized Gain for $800.

(d)debit to Unrealized Gain for $3,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

60

On October 1 of last year, Hand Tools Corp.purchased 1,500 shares of the Bindo Bank for $72,000 as a trading investment.At year end, December 31, the fair value of these shares was $75,000.On February 1 of this year, Hand Tools sold all these shares for $73,000.The realized gain (loss) that Hand Tools will report this year is

(a)a gain of $2,000.

(b)a gain of $1,000.

(c)a loss of $1,000.

(d)a loss of $2,000.

(a)a gain of $2,000.

(b)a gain of $1,000.

(c)a loss of $1,000.

(d)a loss of $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

61

If 30% of the common shares of an investee are purchased as a long-term investment, the appropriate classification for this investment is most likely

(a)trading investments.

(b)equity investments.

(c)non-strategic investments.

(d)investment in associates.

(a)trading investments.

(b)equity investments.

(c)non-strategic investments.

(d)investment in associates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

62

Under the equity method of accounting for an investment

(a)Dividend Income is credited when dividends are received.

(b)an Unrealized Gain account is credited when the investee reports net income.

(c)the Investment account is credited when the investee reports net income.

(d)the Investment account is credited when dividends are received.

(a)Dividend Income is credited when dividends are received.

(b)an Unrealized Gain account is credited when the investee reports net income.

(c)the Investment account is credited when the investee reports net income.

(d)the Investment account is credited when dividends are received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

63

Under the equity method of accounting for investments in common shares, when a dividend is received from the investee,

(a)the Dividend Income account is credited.

(b)the Investment account is increased.

(c)the Investment account is decreased.

(d)no entry is necessary.

(a)the Dividend Income account is credited.

(b)the Investment account is increased.

(c)the Investment account is decreased.

(d)no entry is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

64

Eurythmics Ltd.owns 20% interest in the shares of Sydney Corporation.During the year, Sydney pays $10,000 in dividends to Eurythmic and reports a net loss of $50,000.Eurythmic's investment in Sydney will affect Eurythmics's net income by

(a)$2,000 increase.

(b)$10,000 decrease.

(c)$10,000 increase.

(d)$12,000 decrease.

(a)$2,000 increase.

(b)$10,000 decrease.

(c)$10,000 increase.

(d)$12,000 decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

65

Republic Corp.owns a 15% interest in the common shares of Wholesome Ltd.During this year, Wholesome pays a total of $25,000 in dividends and reports $160,000 net income.Republic's investment in Wholesome will increase Republic's net income by

(a)$25,000.

(b)$24,000.

(c)$27,750.

(d)$ 3,750.

(a)$25,000.

(b)$24,000.

(c)$27,750.

(d)$ 3,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

66

The receipt of dividends from an investment affects the investment account when which of the following methods is used?

(a)cost method

(b)equity method

(c)fair value through profit or loss model

(d)fair value through other comprehensive income model

(a)cost method

(b)equity method

(c)fair value through profit or loss model

(d)fair value through other comprehensive income model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

67

If the equity method is used to account for an investment in common shares

(a)it is presumed that the investor has no significant influence on the investee.

(b)net income of the investee is ignored by the investor.

(c)net income of the investee is recorded as realized gains, but dividends received are credited to the investment account.

(d)the investment account may be at times greater than the acquisition cost.

(a)it is presumed that the investor has no significant influence on the investee.

(b)net income of the investee is ignored by the investor.

(c)net income of the investee is recorded as realized gains, but dividends received are credited to the investment account.

(d)the investment account may be at times greater than the acquisition cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

68

The equity method should generally be used to account for an investment in shares when the level of ownership is

(a)less than 10%.

(b)between 10% and 20%.

(c)20% or more.

(d)10% or more.

(a)less than 10%.

(b)between 10% and 20%.

(c)20% or more.

(d)10% or more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

69

When the cost method is used to account for an equity investment, the carrying amount of the investment is affected by

(a)the net income of the investee.

(b)dividend distributions of the investee.

(c)both the net income and the dividend distributions of the investee.

(d)neither the net income nor the dividend distributions of the investee.

(a)the net income of the investee.

(b)dividend distributions of the investee.

(c)both the net income and the dividend distributions of the investee.

(d)neither the net income nor the dividend distributions of the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

70

When an investee can be significantly influenced, it is known as a(n)

(a)subsidiary.

(b)associate.

(c)trading investment.

(d)parent.

(a)subsidiary.

(b)associate.

(c)trading investment.

(d)parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

71

If the equity method is being used, the Income from Associates account is

(a)another name for a Dividend Income account.

(b)credited when dividends are declared by the investee.

(c)credited when net income is reported by the investee.

(d)debited when net income is reported by the investee.

(a)another name for a Dividend Income account.

(b)credited when dividends are declared by the investee.

(c)credited when net income is reported by the investee.

(d)debited when net income is reported by the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

72

If a company acquires a 40% interest in another company

(a)the equity method is usually applicable.

(b)it would always have a controlling interest.

(c)one of the fair value models is usually applicable.

(d)the investor does not have the ability to exert significant influence over the investee.

(a)the equity method is usually applicable.

(b)it would always have a controlling interest.

(c)one of the fair value models is usually applicable.

(d)the investor does not have the ability to exert significant influence over the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

73

Aroma Limited owns a 25% interest in the shares of Baltic Corporation.During the year, Baltic pays $10,000 in dividends to Aroma and reports $100,000 net income.Aroma's investment in Baltic will increase Aroma's net income by

(a)$25,000.

(b)$27,500.

(c)$10,000.

(d)$ 2,500.

(a)$25,000.

(b)$27,500.

(c)$10,000.

(d)$ 2,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is the correct match concerning an investor's influence on the operations and financial affairs of an investee?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

75

The ability of an investor to affect the operating and financial activities of another company, even though the investor does not control the company, is known as

(a)significant influence.

(b)control.

(c)a combination.

(d)influence and control.

(a)significant influence.

(b)control.

(c)a combination.

(d)influence and control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

76

On January 1, 2022, Coastal Corp.purchased 30% of the common shares of Mansbridge Corp.for $600,000.During 2022, Mansbridge Corp.reported net income of $75,000 and paid total cash dividends of $15,000.The balance in the Investment in Associates (Mansbridge) account on Coastal's books at December 31, 2022 is

(a)$675,000.

(b)$622,500.

(c)$618,000.

(d)$600,000.

(a)$675,000.

(b)$622,500.

(c)$618,000.

(d)$600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

77

Frisbee Inc.owns a 30% interest in the shares of California Corp.During the year, California pays $10,000 in dividends to Frisbee and reports a net loss of $80,000.Frisbee's investment in California will affect Frisbee's net income by

(a)$10,000 increase.

(b)$3,000 increase.

(c)$24,000 decrease.

(d)$21,000 decrease.

(a)$10,000 increase.

(b)$3,000 increase.

(c)$24,000 decrease.

(d)$21,000 decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following is the correct match concerning the appropriate accounting for strategic investments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

79

If the equity method is being used, cash dividends received

(a)are credited to the Dividend Income account.

(b)do not require an entry because the investee's net income have already been recorded at the proper proportion on the investor's books.

(c)are credited to the Investment in Associates account.

(d)are credited to the Income from Associates account.

(a)are credited to the Dividend Income account.

(b)do not require an entry because the investee's net income have already been recorded at the proper proportion on the investor's books.

(c)are credited to the Investment in Associates account.

(d)are credited to the Income from Associates account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

80

Under the equity method, the Investment in Associates account is increased when the

(a)associate reports net income.

(b)associate pays a dividend.

(c)associate reports a loss.

(d)investment is sold at a gain.

(a)associate reports net income.

(b)associate pays a dividend.

(c)associate reports a loss.

(d)investment is sold at a gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck