Deck 14: Performance Measurement

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/127

العب

ملء الشاشة (f)

Deck 14: Performance Measurement

1

The current ratio should not be interpreted on its own without also looking at the receivables turnover and inventory turnover ratios.

True

2

Earnings before interest and tax (EBIT) is a proxy for the amount available to cover interest payments.

True

3

In horizontal analysis, if an item has a negative amount in the base year, and a positive amount in the following year, the percentage change will exceed 100%.

True

4

Free cash flow is the cash available after a company pays dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

5

When preparing a vertical analysis on an statement of income, sales are represented by 100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

6

The first step in any comprehensive analysis is to perform a horizontal and vertical analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

7

Even if a company has a low debt to total assets ratio, it may have difficulty paying interest on debt if it also has a low times interest earned ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

8

An assessment of liquidity can be done based on only one ratio, such as the current ratio or the receivables ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

9

In the vertical analysis of a statement of financial position, the base for current liabilities is total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

10

Using vertical analysis on the statement of income, a company's net income as a percentage of sales is 15%; therefore, the cost of goods sold as a percentage of sales must be 85%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

11

Profitability ratios are frequently used as a basis for evaluating management's operating effectiveness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a company has sales of $220 in 2021 and $560 in 2022, the percentage increase in sales from 2021 to 2022 is 155%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

13

The receivables turnover ratio is useful in assessing the profitability of receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

14

Liquidity ratios measure the ability of the company to survive over a long period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

15

On a statement of income analyzed vertically, each item is expressed as a percentage of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

16

Comparisons of company data with industry averages provide information about a company's relative position within the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a company has sales of $100 in 2021 (the base period) and $560 in 2022 (the analysis period), the percentage of the base period is 460%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

18

From a creditor's point of view, the higher the debt to total assets ratio, the lower the risk that the company may be unable to pay its obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

19

A solvency ratio measures the net income or operating success of a company for a given period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

20

On a statement of financial position analyzed vertically, total assets are represented by 100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

21

A component of an entity represents a separate major line of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

22

Identifying discontinued items is important if a potential investor is going to use reported net income to estimate a company's value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

23

Factors that may limit the usefulness of financial analysis include alternative accounting policies, professional judgement, other comprehensive income, diversification, inflation, and economic factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

24

The price-earnings ratio reflects investors' expectations about the future profitability of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

25

In horizontal analysis, the percentage of a base-period amount is calculated by

(a)dividing the analysis period amount by the base period amount.

(b)dividing the dollar amount of the change since the base period by the base period amount.

(c)dividing the item under analysis by sales.

(d)dividing the item under analysis by total assets.

(a)dividing the analysis period amount by the base period amount.

(b)dividing the dollar amount of the change since the base period by the base period amount.

(c)dividing the item under analysis by sales.

(d)dividing the item under analysis by total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

26

Horizontal analysis is a technique for evaluating a series of financial statement data over a period of time

(a)that has been arranged from the highest number to the lowest number.

(b)that has been arranged from the lowest number to the highest number.

(c)to determine which items are in error.

(d)to determine the amount and/or percentage increase or decrease that has taken place.

(a)that has been arranged from the highest number to the lowest number.

(b)that has been arranged from the lowest number to the highest number.

(c)to determine which items are in error.

(d)to determine the amount and/or percentage increase or decrease that has taken place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

27

One objective of the statement of income is to separate the results of continuing operations from those of discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

28

Horizontal analysis is also called

(a)percentage analysis.

(b)trend analysis.

(c)vertical analysis.

(d)economic analysis.

(a)percentage analysis.

(b)trend analysis.

(c)vertical analysis.

(d)economic analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

29

An investor interested in purchasing a company's shares for their income potential would be more interested in the company's dividend yield and payout ratios than its price-earnings ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

30

Under which of the following cases would a percentage change not be calculated?

(a)The trend of the amounts is decreasing but all amounts are positive.

(b)There is no amount in the base year.

(c)The trend of the amounts is decreasing but all amounts are negative.

(d)The trend of the amounts is increasing but all amounts are negative.

(a)The trend of the amounts is decreasing but all amounts are positive.

(b)There is no amount in the base year.

(c)The trend of the amounts is decreasing but all amounts are negative.

(d)The trend of the amounts is increasing but all amounts are negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

31

Both the profit margin ratio and the asset turnover ratio affect a company's return on assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

32

When there is a disposal of a component of an entity, the statement of income should report both income from continuing operations and income (loss) from discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

33

The gain (loss) on disposal of a discontinued operation is not reported on the statement of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

34

Dividend yield measures net income generated by each share, based on the market price per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

35

Many firms today are so diversified that they cannot be classified by industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

36

The return on common shareholders' equity is affected by both the return on assets and debt to total assets ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

37

Comparisons of basic earnings per share with other companies and the industry averages are usually not very meaningful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

38

Horizontal analysis of comparative financial statements includes the

(a)development of vertically analyzed statements.

(b)calculation of liquidity ratios.

(c)calculation of dollar amount changes and percentage changes from the previous to the current year.

(d)evaluation of financial statement data that expresses each item in the current period's financial statement as a percentage of a base amount.

(a)development of vertically analyzed statements.

(b)calculation of liquidity ratios.

(c)calculation of dollar amount changes and percentage changes from the previous to the current year.

(d)evaluation of financial statement data that expresses each item in the current period's financial statement as a percentage of a base amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

39

Leveraging and return on common shareholders' equity are closely related.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

40

Comparisons of financial data made within a company are called

(a)intracompany comparisons.

(b)interior comparisons.

(c)intercompany comparisons.

(d)intramural comparisons.

(a)intracompany comparisons.

(b)interior comparisons.

(c)intercompany comparisons.

(d)intramural comparisons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the following information for questions

In performing a vertical analysis, the percentage for accounts receivable is

(a)0.5%.

(b)1.0%.

(c)5.0%.

(d)10.0%.

In performing a vertical analysis, the percentage for accounts receivable is

(a)0.5%.

(b)1.0%.

(c)5.0%.

(d)10.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

42

If, over a three-year period, sales increased by 30%, and cost of goods sold increased by 45%,

(a)the sales trend is unfavourable, but the cost of goods sold trend is favourable.

(b)the sales trend is favourable, but the cost of goods sold trend is unfavourable.

(c)both trends are favourable.

(d)both trends are unfavourable.

(a)the sales trend is unfavourable, but the cost of goods sold trend is favourable.

(b)the sales trend is favourable, but the cost of goods sold trend is unfavourable.

(c)both trends are favourable.

(d)both trends are unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

43

Horizontal analysis

(a)is also called trend analysis.

(b)can be carried out on statement of financial position data but not on statement of income data.

(c)is a technique for evaluating a financial statement item in the current year with other items in the current year.

(d)uses the base year as the most current year being examined.

(a)is also called trend analysis.

(b)can be carried out on statement of financial position data but not on statement of income data.

(c)is a technique for evaluating a financial statement item in the current year with other items in the current year.

(d)uses the base year as the most current year being examined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

44

In vertical analysis of an statement of income, the 100% figure is

(a)net income.

(b)cost of goods sold.

(c)gross profit.

(d)sales.

(a)net income.

(b)cost of goods sold.

(c)gross profit.

(d)sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

45

On financial statements that include vertical analysis, which of the following is set at 100%?

(a)total liabilities

(b)net income

(c)total assets

(d)cost of goods sold

(a)total liabilities

(b)net income

(c)total assets

(d)cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

46

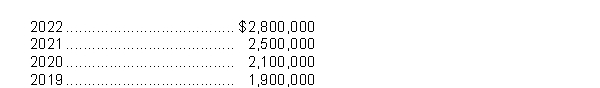

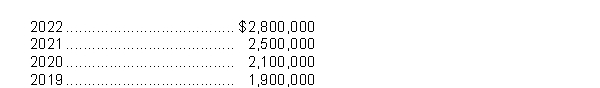

Assume the following sales data for a company:  What is the percentage increase in sales from 2021 to 2022?

What is the percentage increase in sales from 2021 to 2022?

(a)11%

(b)88%

(c)12%

(d)47%

What is the percentage increase in sales from 2021 to 2022?

What is the percentage increase in sales from 2021 to 2022?(a)11%

(b)88%

(c)12%

(d)47%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

47

Horizontal analysis showed a 25% increase in accounts receivable in 2022 over 2021.Vertical analysis showed accounts receivable declining from 7.5% to 6.8% over the same period.Given this information, what conclusion(s) may be reached?

(a)The dollar amount of accounts receivable increased.

(b)The dollar amount of accounts receivable decreased.

(c)It cannot be determined if the dollar amount of accounts receivable increased or decreased.

(d)This result is impossible.An error has been made in the calculations.

(a)The dollar amount of accounts receivable increased.

(b)The dollar amount of accounts receivable decreased.

(c)It cannot be determined if the dollar amount of accounts receivable increased or decreased.

(d)This result is impossible.An error has been made in the calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

48

In horizontal analysis, each item is expressed as a percentage of the

(a)retained earnings amount.

(b)total assets amount.

(c)net income amount.

(d)base year amount.

(a)retained earnings amount.

(b)total assets amount.

(c)net income amount.

(d)base year amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

49

Horizontal analysis

(a)is financial statement data that is viewed horizontally from the right to left across time.

(b)requires the financial statement data under analysis to be divided by the base amount in that financial statement.

(c)is financial statement data that is viewed vertically from top to bottom within the same period of time.

(d)is always used for intercompany comparisons.

(a)is financial statement data that is viewed horizontally from the right to left across time.

(b)requires the financial statement data under analysis to be divided by the base amount in that financial statement.

(c)is financial statement data that is viewed vertically from top to bottom within the same period of time.

(d)is always used for intercompany comparisons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

50

An inventory turnover ratio

(a)measures the number of times, on average, the inventory was sold during the period.

(b)is a measure of solvency that focuses on efficient use of inventory.

(c)that is significantly lower than the industry average usually indicates difficulty with selling that inventory and the likelihood of incurring lower than average storage costs.

(d)that is significantly higher than the industry average may indicate that a company is maintaining inventory levels that are too high.

(a)measures the number of times, on average, the inventory was sold during the period.

(b)is a measure of solvency that focuses on efficient use of inventory.

(c)that is significantly lower than the industry average usually indicates difficulty with selling that inventory and the likelihood of incurring lower than average storage costs.

(d)that is significantly higher than the industry average may indicate that a company is maintaining inventory levels that are too high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

51

In vertical analysis

(a)a base amount is required.

(b)a base amount is optional.

(c)the same base is used across all financial statements being analyzed.

(d)the results of the horizontal analysis are necessary inputs for vertical analysis.

(a)a base amount is required.

(b)a base amount is optional.

(c)the same base is used across all financial statements being analyzed.

(d)the results of the horizontal analysis are necessary inputs for vertical analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

52

All of the following statements about vertical analysis are true except

(a)vertical analysis makes it easier to for intercompany comparisons.

(b)vertical analysis is seldom performed on the statement of income.

(c)vertical analysis makes it easier to compare companies of different sizes.

(d)vertical analysis is seldom performed on the cash flow statement.

(a)vertical analysis makes it easier to for intercompany comparisons.

(b)vertical analysis is seldom performed on the statement of income.

(c)vertical analysis makes it easier to compare companies of different sizes.

(d)vertical analysis is seldom performed on the cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

53

Vertical analysis is a technique that expresses each item in a financial statement

(a)in dollars and cents.

(b)as a percentage of the item in the previous year.

(c)as a percentage of a base amount.

(d)starting with the highest value down to the lowest value.

(a)in dollars and cents.

(b)as a percentage of the item in the previous year.

(c)as a percentage of a base amount.

(d)starting with the highest value down to the lowest value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

54

Horizontal analysis is a technique for evaluating financial statement data

(a)within a period of time.

(b)over a period of time.

(c)on a certain date.

(d)as it may appear in the future.

(a)within a period of time.

(b)over a period of time.

(c)on a certain date.

(d)as it may appear in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

55

A horizontal analysis is being conducted with year one as the base year.If year one equals $900, year two equals $960, and year three equals $995, the percentage of the base period for year three is

(a)89%.

(b)100%.

(c)106%.

(d)111%.

(a)89%.

(b)100%.

(c)106%.

(d)111%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

56

Vertical analysis

(a)is a technique for evaluating a series of financial statement data over a period of time to determine the increase (decrease)that has taken place.

(b)expresses each item in a financial statement as a percent of a base amount.

(c)makes it more difficult to compare different companies.

(d)is also called trend analysis.

(a)is a technique for evaluating a series of financial statement data over a period of time to determine the increase (decrease)that has taken place.

(b)expresses each item in a financial statement as a percent of a base amount.

(c)makes it more difficult to compare different companies.

(d)is also called trend analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

57

All of the following statements about vertical analysis are true except

(a)vertical analysis is also called common size analysis.

(b)amounts on the statement of income are expressed as a percentage of sales.

(c)vertical analysis shows the relative size of each item in the statement of financial position.

(d)vertical analysis is also called trend analysis.

(a)vertical analysis is also called common size analysis.

(b)amounts on the statement of income are expressed as a percentage of sales.

(c)vertical analysis shows the relative size of each item in the statement of financial position.

(d)vertical analysis is also called trend analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

58

In performing a vertical analysis, the base for prepaid expenses is

(a)total current assets.

(b)total assets.

(c)total liabilities.

(d)prepaid expenses in a previous year.

(a)total current assets.

(b)total assets.

(c)total liabilities.

(d)prepaid expenses in a previous year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

59

A receivables turnover ratio that is significantly higher than the industry average may indicate

(a)a collection problem.

(b)that a company's credit-granting policies are too loose.

(c)that a company's collection period is higher than the industry.

(d)that a company's credit-granting policies are too tight.

(a)a collection problem.

(b)that a company's credit-granting policies are too loose.

(c)that a company's collection period is higher than the industry.

(d)that a company's credit-granting policies are too tight.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use the following information for questions

In performing a vertical analysis, the percentage for cost of goods sold is

(a)4.4%.

(b)40.0%.

(c)44.4%.

(d)400.0%.

In performing a vertical analysis, the percentage for cost of goods sold is

(a)4.4%.

(b)40.0%.

(c)44.4%.

(d)400.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

61

The current ratio is a

(a)liquidity ratio.

(b)profitability ratio.

(c)solvency ratio.

(d)cash flow ratio.

(a)liquidity ratio.

(b)profitability ratio.

(c)solvency ratio.

(d)cash flow ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

62

Afrikana Inc.had a balance in the Accounts Receivable account of $820,000 at the beginning of the year and a balance of $880,000 at the end of the year.Credit sales during the year were $5,920,000.The average collection period of the receivables was

(a)45 days.

(b)52 days.

(c)54 days.

(d)104 days.

(a)45 days.

(b)52 days.

(c)54 days.

(d)104 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which one of the following would not be considered a liquidity ratio?

(a)current ratio

(b)inventory turnover ratio

(c)receivables turnover ratio

(d)return on assets ratio

(a)current ratio

(b)inventory turnover ratio

(c)receivables turnover ratio

(d)return on assets ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

64

Handles Corp.reported credit sales of $6,500,000 and cost of goods sold of $3,400,000 for the year.The Accounts Receivable balances at the beginning and end of the year were $525,000 and $575,000, respectively.The receivables turnover ratio was

(a)6.2 times.

(b)11.3 times.

(c)11.8 times.

(d)5.9 times.

(a)6.2 times.

(b)11.3 times.

(c)11.8 times.

(d)5.9 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

65

A liquidity ratio measures the

(a)net income or operating success of a company over a period of time.

(b)ability of the company to survive over a long period of time.

(c)short-term ability of the company to pay its maturing obligations and to meet unexpected needs for cash.

(d)ability of a company to raise capital.

(a)net income or operating success of a company over a period of time.

(b)ability of the company to survive over a long period of time.

(c)short-term ability of the company to pay its maturing obligations and to meet unexpected needs for cash.

(d)ability of a company to raise capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

66

The receivables turnover and inventory turnover ratios are used to analyze

(a)solvency.

(b)profitability.

(c)liquidity.

(d)leverage.

(a)solvency.

(b)profitability.

(c)liquidity.

(d)leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

67

Use the following information for questions

Nelly Inc.reported credit sales of $24,000,000 and cost of goods sold of $18,000,000 for the year.The average inventory for the year was $6,000,000.

The days in inventory during the year was

(a)15 days.

(b)11 days.

(c)91 days.

(d)122 days.

Nelly Inc.reported credit sales of $24,000,000 and cost of goods sold of $18,000,000 for the year.The average inventory for the year was $6,000,000.

The days in inventory during the year was

(a)15 days.

(b)11 days.

(c)91 days.

(d)122 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

68

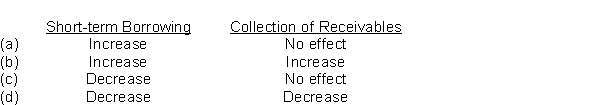

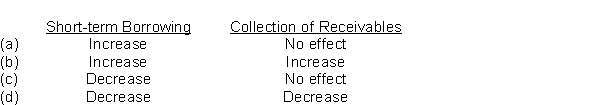

If a company has a current ratio of 1.3:1, what effects will the borrowing of cash by short-term debt and collection of accounts receivable have on the ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

69

Short-term creditors are usually most interested in assessing

(a)solvency.

(b)liquidity.

(c)marketability.

(d)profitability.

(a)solvency.

(b)liquidity.

(c)marketability.

(d)profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

70

A supplier to a company would be most interested in the

(a)asset turnover ratio.

(b)profit margin ratio.

(c)current ratio.

(d)free cash flow.

(a)asset turnover ratio.

(b)profit margin ratio.

(c)current ratio.

(d)free cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

71

A company has a receivables turnover ratio of 12.The average gross accounts receivable during the period is $360,000.What is the amount of credit sales for the period?

(a)$432,000

(b)$3,000,000

(c)$4,320,000

(d)Cannot be determined from the information given.

(a)$432,000

(b)$3,000,000

(c)$4,320,000

(d)Cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

72

The current ratio is

(a)calculated by dividing current liabilities by current assets.

(b)used to evaluate a company's liquidity and short-term debt paying ability.

(c)used to evaluate a company's solvency and long-term debt paying ability.

(d)calculated by subtracting current liabilities from current assets.

(a)calculated by dividing current liabilities by current assets.

(b)used to evaluate a company's liquidity and short-term debt paying ability.

(c)used to evaluate a company's solvency and long-term debt paying ability.

(d)calculated by subtracting current liabilities from current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

73

A common measure of liquidity is

(a)return on assets.

(b)receivables turnover.

(c)profit margin.

(d)debt to total assets.

(a)return on assets.

(b)receivables turnover.

(c)profit margin.

(d)debt to total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use the following information for questions

Nelly Inc.reported credit sales of $24,000,000 and cost of goods sold of $18,000,000 for the year.The average inventory for the year was $6,000,000.

The inventory turnover ratio for the year was

(a)3.0 times.

(b)33.3 times.

(c)4.0 times.

(d)25.0 times.

Nelly Inc.reported credit sales of $24,000,000 and cost of goods sold of $18,000,000 for the year.The average inventory for the year was $6,000,000.

The inventory turnover ratio for the year was

(a)3.0 times.

(b)33.3 times.

(c)4.0 times.

(d)25.0 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

75

Best Baskets Limited (BBL) had a current ratio of 0.8:1 before borrowing $50,000 from the bank with a short-term note payable.What effect did the borrowing transaction have on BBL's current ratio?

(a)The ratio remained unchanged.

(b)The ratio decreased.

(c)The ratio increased.

(d)Cannot be determined.

(a)The ratio remained unchanged.

(b)The ratio decreased.

(c)The ratio increased.

(d)Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

76

A high receivables turnover ratio may indicate that

(a)customers are making payments quickly.

(b)a large portion of the company's sales are on credit.

(c)many customers are not paying their receivables.

(d)the company's sales have increased.

(a)customers are making payments quickly.

(b)a large portion of the company's sales are on credit.

(c)many customers are not paying their receivables.

(d)the company's sales have increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the average collection period is 45 days, what is the receivables turnover?

(a)8.1 times

(b)12.0 times

(c)18.0 times

(d)20.0 times

(a)8.1 times

(b)12.0 times

(c)18.0 times

(d)20.0 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

78

A weakness of the current ratio is

(a)the difficulty of the calculation.

(b)that it doesn't take into account the composition of the current assets.

(c)that it is rarely used by sophisticated analysts.

(d)that it can be expressed as a percentage, as a rate, or as a proportion.

(a)the difficulty of the calculation.

(b)that it doesn't take into account the composition of the current assets.

(c)that it is rarely used by sophisticated analysts.

(d)that it can be expressed as a percentage, as a rate, or as a proportion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

79

Some of the ratios that are used to determine a company's short-term debt paying ability are

(a)asset turnover, times interest earned, current ratio, and receivables turnover.

(b)times interest earned, inventory turnover, current ratio, and receivables turnover.

(c)times interest earned, current ratio, and inventory turnover.

(d)current ratio, receivables turnover, and inventory turnover.

(a)asset turnover, times interest earned, current ratio, and receivables turnover.

(b)times interest earned, inventory turnover, current ratio, and receivables turnover.

(c)times interest earned, current ratio, and inventory turnover.

(d)current ratio, receivables turnover, and inventory turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

80

A company with $60,000 in current assets and $40,000 in current liabilities pays a $1,000 current liability.As a result of this transaction, the current ratio and working capital will

(a)both decrease.

(b)both increase.

(c)increase and remain the same, respectively.

(d)remain the same and decrease, respectively.

(a)both decrease.

(b)both increase.

(c)increase and remain the same, respectively.

(d)remain the same and decrease, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck