Deck 4: Accrual Accounting Concepts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

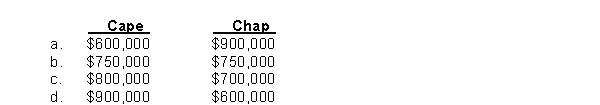

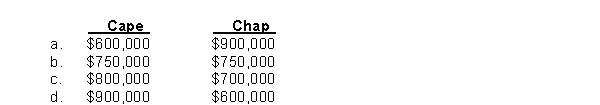

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/147

العب

ملء الشاشة (f)

Deck 4: Accrual Accounting Concepts

1

The first step in activity-based costing is to assign overhead costs to products, using cost drivers.

False

2

Non-value-added activities increase the cost of a product but not its perceived value.

True

3

To achieve accurate costing, a high degree of correlation must exist between the cost driver and the actual consumption of the activity cost pool.

True

4

ABC is particularly useful when overhead costs are an insignificant portion of total costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

5

Any activity that increases the cost of producing a product is a value-added activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

6

Traditionally, overhead is allocated based on direct labor cost or direct labor hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

7

ABC is generally more costly to implement than traditional costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

8

Activity-based costing allocates overhead to multiple cost pools and assigns the cost pools to products using cost drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

9

ABC usually results in less appropriate management decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

10

ABC is particularly useful when product lines differ greatly in volume and manufacturing complexity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

11

Low-volume products often require more special handling than high-volume products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

12

Current trends in manufacturing include less direct labor and more overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

13

Machining is a non-value-added activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

14

Traditional costing systems use multiple predetermined overhead rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

15

A cost driver does not generally have a direct cause-effect relationship with the resources consumed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

16

Activity-based management focuses on reducing costs and improving processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

17

ABC eliminates all arbitrary cost allocations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

18

Engineering design is a value-added activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

19

When overhead is properly assigned in ABC, it will usually decrease the unit cost of high-volume products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

20

ABC leads to enhanced control over overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

21

Not all activities labeled non-value-added are totally wasteful, nor can they be totally eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

22

What sometimes makes implementation of activity-based costing difficult in service industries is that a smaller proportion of overhead costs are company-wide costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

23

An activity that has a direct cause-effect relationship with the resources consumed is a(n)

A)cost driver.

B)overhead rate.

C)cost pool.

D)product activity.

A)cost driver.

B)overhead rate.

C)cost pool.

D)product activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

24

Daffodil Company produces two products, Flower and Planter.Flower is a high-volume item totaling 20,000 units annually.Planter is a low-volume item totaling only 6,000 units per year.Flower requires one hour of direct labor for completion, while each unit of Planter requires 2 hours.Therefore, total annual direct labor hours are 32,000 (20,000 + 12,000).Expected annual manufacturing overhead costs are $800,000.Daffodil uses a traditional costing system and assigns overhead based on direct labor hours.Each unit of Planter would be assigned overhead of

A)$25.00.

B)$30.77.

C)$50.00.

D)need more information to compute.

A)$25.00.

B)$30.77.

C)$50.00.

D)need more information to compute.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sitwell Corporation manufactures titanium and aluminum tennis racquets.Sitwell's total overhead costs consist of assembly costs and inspection costs.The following information is available: Sitwell is considering switching from one overhead rate based on labor hours to activity-based costing. Total overhead costs assigned to titanium racquets, using a single overhead rate, are

A)$60,000.

B)$63,000.

C)$75,000.

D)$84,000.

A)$60,000.

B)$63,000.

C)$75,000.

D)$84,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

26

Often the most difficult part of computing accurate unit costs is determining the proper amount of _________ to assign to each product, service, or job.

A)direct materials

B)direct labor

C)overhead

D)direct materials and direct labor

A)direct materials

B)direct labor

C)overhead

D)direct materials and direct labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

27

Plant management is a batch-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not typical of traditional costing systems?

A)Use of a single predetermined overhead rate.

B)Use of direct labor hours or direct labor cost to assign overhead.

C)Assumption of correlation between direct labor and incurrence of overhead cost.

D)Use of multiple cost drivers to allocate overhead.

A)Use of a single predetermined overhead rate.

B)Use of direct labor hours or direct labor cost to assign overhead.

C)Assumption of correlation between direct labor and incurrence of overhead cost.

D)Use of multiple cost drivers to allocate overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

29

In traditional costing systems, overhead is generally applied based on

A)direct labor.

B)machine hours.

C)direct material dollars.

D)units of production.

A)direct labor.

B)machine hours.

C)direct material dollars.

D)units of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

30

The general approach to identifying activities, activity cost pools, and cost drivers is used by a service company in the same manner as a manufacturing company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which best describes the flow of overhead costs in an activity-based costing system?

A)Overhead costs direct labor cost or hours products

B)Overhead costs products

C)Overhead costs activity cost pools cost drivers products

D)Overhead costs machine hours products

A)Overhead costs direct labor cost or hours products

B)Overhead costs products

C)Overhead costs activity cost pools cost drivers products

D)Overhead costs machine hours products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

32

An "Ordering and Receiving Materials" cost pool would most likely have as a cost driver:

A)machine hours.

B)number of setups.

C)number of purchase orders.

D)number of inspection tests.

A)machine hours.

B)number of setups.

C)number of purchase orders.

D)number of inspection tests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

33

The overall objective of installing ABC in service firms is no different than it is in a manufacturing company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

34

The costs that are easiest to trace directly to products are

A)direct materials and direct labor.

B)direct labor and overhead.

C)direct materials and overhead.

D)none of the above; all three costs are equally easy to trace to the product.

A)direct materials and direct labor.

B)direct labor and overhead.

C)direct materials and overhead.

D)none of the above; all three costs are equally easy to trace to the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

35

Predetermined overhead rates in traditional costing are often based on

A)direct labor cost for job order costing and machine hours for process costing.

B)machine hours for job order costing and direct labor cost for process costing.

C)multiple bases for job order costing and direct labor cost for process costing.

D)multiple bases for both job order costing and process costing.

A)direct labor cost for job order costing and machine hours for process costing.

B)machine hours for job order costing and direct labor cost for process costing.

C)multiple bases for job order costing and direct labor cost for process costing.

D)multiple bases for both job order costing and process costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

36

Ordering materials, setting up machines, assembling products, and inspecting products are examples of

A)cost drivers.

B)overhead cost pools.

C)direct labor costs.

D)nonmanufacturing activities.

A)cost drivers.

B)overhead cost pools.

C)direct labor costs.

D)nonmanufacturing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

37

Advances in computerized systems, technological innovation, global competition, and automation have changed the manufacturing environment drastically by

A)increasing direct labor costs and increasing overhead costs.

B)increasing direct labor costs and decreasing overhead costs.

C)decreasing direct labor costs and decreasing overhead costs.

D)decreasing direct labor costs and increasing overhead costs.

A)increasing direct labor costs and increasing overhead costs.

B)increasing direct labor costs and decreasing overhead costs.

C)decreasing direct labor costs and decreasing overhead costs.

D)decreasing direct labor costs and increasing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

38

Activity-based costing

A)allocates overhead to activity cost pools, and it then assigns the activity cost pools to products and services by means of cost drivers.

B)accumulates overhead in one cost pool, then assigns the overhead to products and services by means of a cost driver.

C)assigns activity cost pools to products and services, then allocates overhead back to the activity cost pools.

D)allocates overhead directly to products and services based on activity levels.

A)allocates overhead to activity cost pools, and it then assigns the activity cost pools to products and services by means of cost drivers.

B)accumulates overhead in one cost pool, then assigns the overhead to products and services by means of a cost driver.

C)assigns activity cost pools to products and services, then allocates overhead back to the activity cost pools.

D)allocates overhead directly to products and services based on activity levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

39

Painting is a product-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

40

Direct labor is sometimes the appropriate basis for assigning overhead cost to products.It is appropriate to use direct labor when which of the following is true?

(1) Direct labor constitutes a significant part of total product cost.

(2) A high correlation exists between direct labor and changes in the amount of overhead costs.

A)(1) only

B)(2) only

C)Either (1) or (2)

D)Both (1) and (2)

(1) Direct labor constitutes a significant part of total product cost.

(2) A high correlation exists between direct labor and changes in the amount of overhead costs.

A)(1) only

B)(2) only

C)Either (1) or (2)

D)Both (1) and (2)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

41

Estimated costs for activity cost pools and other item(s) are as follows: Total estimated overhead is

A)$1,000,000.

B)$1,175,000.

C)$1,450,000.

D)$1,625,000.

A)$1,000,000.

B)$1,175,000.

C)$1,450,000.

D)$1,625,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

42

The last step in activity-based costing is to

A)assign overhead costs to products, using overhead rates determined for each cost pool.

B)compute the activity-based overhead rate per cost driver.

C)identify and classify the activities involved in the manufacture of specific products, and allocate overhead to cost pools.

D)identify the cost driver that has a strong correlation to the activity cost pool.

A)assign overhead costs to products, using overhead rates determined for each cost pool.

B)compute the activity-based overhead rate per cost driver.

C)identify and classify the activities involved in the manufacture of specific products, and allocate overhead to cost pools.

D)identify the cost driver that has a strong correlation to the activity cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

43

One of Hartman Company's activity cost pools is inspecting, with estimated overhead of $140,000.Hartman produces throw rugs (700 inspections) and area rugs (1,300 inspections).How much of the inspecting cost pool should be assigned to throw rugs?

A)$49,000.

B)$70,000.

C)$75,384.

D)$140,000.

A)$49,000.

B)$70,000.

C)$75,384.

D)$140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

44

The first step in activity-based costing is to

A)assign overhead costs to products, using overhead rates determined for each cost pool.

B)compute the activity-based overhead rate per cost driver.

C)identify and classify the activities involved in the manufacture of specific products, and allocate overhead to cost pools.

D)identify the cost driver that has a strong correlation to the activity cost pool.

A)assign overhead costs to products, using overhead rates determined for each cost pool.

B)compute the activity-based overhead rate per cost driver.

C)identify and classify the activities involved in the manufacture of specific products, and allocate overhead to cost pools.

D)identify the cost driver that has a strong correlation to the activity cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is not an example of an activity cost pool?

A)Setting up machines

B)Machining

C)Inspecting

D)Machine hours

A)Setting up machines

B)Machining

C)Inspecting

D)Machine hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

46

To use activity-based costing, it is necessary to know the

A)cost driver for each activity cost pool.

B)expected use of cost drivers per activity.

C)expected use of cost drivers per product.

D)all of the above.

A)cost driver for each activity cost pool.

B)expected use of cost drivers per activity.

C)expected use of cost drivers per product.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

47

As compared to a low-volume product, a high-volume product

A)usually requires less special handling.

B)is usually responsible for more overhead costs per unit.

C)requires relatively more machine setups.

D)requires use of direct labor hours as the primary cost driver to ensure proper allocation of overhead.

A)usually requires less special handling.

B)is usually responsible for more overhead costs per unit.

C)requires relatively more machine setups.

D)requires use of direct labor hours as the primary cost driver to ensure proper allocation of overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

48

Sanborn Industries has the following overhead costs and cost drivers.Direct labor hours are estimated at 100,000 for the year.

- If overhead is applied using activity-based costing, the overhead application rate for ordering and receiving is

A)$1.20 per direct labor hour.

B)$240 per order.

C)$0.12 per part.

D)$6,834 per order.

- If overhead is applied using activity-based costing, the overhead application rate for ordering and receiving is

A)$1.20 per direct labor hour.

B)$240 per order.

C)$0.12 per part.

D)$6,834 per order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

49

A well-designed activity-based costing system starts with

A)identifying the activity-cost pools.

B)computing the activity-based overhead rate.

C)assigning overhead costs to products.

D)analyzing the activities performed to manufacture a product.

A)identifying the activity-cost pools.

B)computing the activity-based overhead rate.

C)assigning overhead costs to products.

D)analyzing the activities performed to manufacture a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

50

Sitwell Corporation manufactures titanium and aluminum tennis racquets.Sitwell's total overhead costs consist of assembly costs and inspection costs.The following information is available: Sitwell is considering switching from one overhead rate based on labor hours to activity-based costing.

- Using activity-based costing, how much assembly cost is assigned to titanium racquets?

A)$15,750.

B)$22,500.

C)$23,625.

D)$31,500.

- Using activity-based costing, how much assembly cost is assigned to titanium racquets?

A)$15,750.

B)$22,500.

C)$23,625.

D)$31,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which would be an appropriate cost driver for the machining activity cost pool?

A)Machine setups

B)Purchase orders

C)Machine hours

D)Inspections

A)Machine setups

B)Purchase orders

C)Machine hours

D)Inspections

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

52

Sanborn Industries has the following overhead costs and cost drivers.Direct labor hours are estimated at 100,000 for the year.

- If overhead is applied using traditional costing based on direct labor hours, the overhead application rate is

A)$9.60.

B)$12.00.

C)$15.00.

D)$34.17.

- If overhead is applied using traditional costing based on direct labor hours, the overhead application rate is

A)$9.60.

B)$12.00.

C)$15.00.

D)$34.17.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

53

An activity-based overhead rate is computed as follows:

A)actual overhead divided by actual use of cost drivers.

B)estimated overhead divided by actual use of cost drivers.

C)actual overhead divided by estimated use of cost drivers.

D)estimated overhead divided by estimated use of cost drivers.

A)actual overhead divided by actual use of cost drivers.

B)estimated overhead divided by actual use of cost drivers.

C)actual overhead divided by estimated use of cost drivers.

D)estimated overhead divided by estimated use of cost drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

54

An example of an activity cost pool is

A)machine hours.

B)setting up machines.

C)number of setups.

D)number of inspections.

A)machine hours.

B)setting up machines.

C)number of setups.

D)number of inspections.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

55

An example of a cost which would not be assigned to an overhead cost pool is

A)indirect salaries.

B)freight-out.

C)depreciation.

D)supplies.

A)indirect salaries.

B)freight-out.

C)depreciation.

D)supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use of activity-based costing will result in the development of

A)one overhead rate based on direct labor hours.

B)one plantwide activity-based overhead rate.

C)multiple activity-based overhead rates.

D)no overhead rates; overhead rates are not used in activity-based costing.

A)one overhead rate based on direct labor hours.

B)one plantwide activity-based overhead rate.

C)multiple activity-based overhead rates.

D)no overhead rates; overhead rates are not used in activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

57

Assigning overhead using ABC will usually

A)decrease the cost per unit for low volume products as compared to a traditional overhead allocation.

B)increase the cost per unit for low volume products as compared to a traditional overhead allocation.

C)provide less accurate cost per unit for low volume products than will traditional costing.

D)result in the same cost per unit for low volume products as does traditional costing.

A)decrease the cost per unit for low volume products as compared to a traditional overhead allocation.

B)increase the cost per unit for low volume products as compared to a traditional overhead allocation.

C)provide less accurate cost per unit for low volume products than will traditional costing.

D)result in the same cost per unit for low volume products as does traditional costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

58

To assign overhead costs to each product, the company

A)multiplies the activity-based overhead rates per cost driver by the number of cost drivers expected to be used per product.

B)multiplies the overhead rate by the number of direct labor hours used on each product.

C)assigns the cost of each activity cost pool in total to one product line.

D)multiplies the rate of cost drivers per estimated cost for the cost pool by the estimated cost for each cost pool.

A)multiplies the activity-based overhead rates per cost driver by the number of cost drivers expected to be used per product.

B)multiplies the overhead rate by the number of direct labor hours used on each product.

C)assigns the cost of each activity cost pool in total to one product line.

D)multiplies the rate of cost drivers per estimated cost for the cost pool by the estimated cost for each cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which would be an appropriate cost driver for the purchasing activity cost pool?

A)Machine setups

B)Purchase orders

C)Machine hours

D)Inspections

A)Machine setups

B)Purchase orders

C)Machine hours

D)Inspections

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

60

Sitwell Corporation manufactures titanium and aluminum tennis racquets.Sitwell's total overhead costs consist of assembly costs and inspection costs.The following information is available: Sitwell is considering switching from one overhead rate based on labor hours to activity-based costing.

- Using activity-based costing, how much inspections cost is assigned to titanium racquets?

A)$22,500.

B)$35,625.

C)$37,500.

D)$52,500.

- Using activity-based costing, how much inspections cost is assigned to titanium racquets?

A)$22,500.

B)$35,625.

C)$37,500.

D)$52,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

61

Hagar Co.computed an overhead rate for machining costs ($1,500,000) of $15 per machine hour.Machining costs are driven by machine hours.If computed based on direct labor hours, the overhead rate for machining costs would be $30 per direct labor hour.The company produces two products, Cape and Chap.Cape requires 60,000 machine hours and 20,000 direct labor hours, while Chap requires 40,000 machine hours and 30,000 direct labor hours.Using activity-based costing, machining costs assigned to each product is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

62

Johnstone Company manufactures two products, Board 12 and Case 165.Johnstone's overhead costs consist of setting up machines, $1,600,000; machining, $3,600,000; and inspecting, $1,200,000.Information on the two products is:

- Overhead applied to Board 12 using traditional costing using direct labor hours is

A)$2,400,000.

B)$3,072,000.

C)$3,340,000.

D)$3,840,000.

- Overhead applied to Board 12 using traditional costing using direct labor hours is

A)$2,400,000.

B)$3,072,000.

C)$3,340,000.

D)$3,840,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which would be an appropriate cost driver for the ordering and receiving activity cost pool?

A)Machine setups

B)Purchase orders

C)Machine hours

D)Inspections

A)Machine setups

B)Purchase orders

C)Machine hours

D)Inspections

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

64

A company incurs $2,700,000 of overhead each year in three departments: Ordering and Receiving, Mixing, and Testing.The company prepares 2,000 purchase orders, works 50,000 mixing hours, and performs 1,500 tests per year in producing 200,000 drums of Goo and 600,000 drums of Slime.The following data are available: Production information for Goo is as follows:

-Compute the amount of overhead assigned to Goo.

A)$ 675,000

B)$ 860,000

C)$1,054,764

D)$1,350,000

-Compute the amount of overhead assigned to Goo.

A)$ 675,000

B)$ 860,000

C)$1,054,764

D)$1,350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

65

Comparing the U.S.to Japan,

A)activity-based costing is used less than in the U.S.

B)U.S.companies show a stronger preference to volume measures such as direct labor hours to assign overhead costs.

C)labor cost reduction is less of a priority in the U.S.

D)developing more accurate product costs is less of a priority in the U.S.

A)activity-based costing is used less than in the U.S.

B)U.S.companies show a stronger preference to volume measures such as direct labor hours to assign overhead costs.

C)labor cost reduction is less of a priority in the U.S.

D)developing more accurate product costs is less of a priority in the U.S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

66

Addison Company manufactures two products, Regular and Supreme.Addison's overhead costs consist of machining, $2,500,000; and assembling, $1,250,000.Information on the two products is:

- Overhead applied to Regular using traditional costing using direct labor hours is

A)$1,075,000.

B)$1,500,000.

C)$2,250,000.

D)$2,675,000.

- Overhead applied to Regular using traditional costing using direct labor hours is

A)$1,075,000.

B)$1,500,000.

C)$2,250,000.

D)$2,675,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

67

In Japan,

A)activity-based costing is used more than in the U.S.

B)companies prefer volume measures such as direct labor hours to assign overhead costs.

C)labor cost reduction is less of a priority.

D)developing more accurate product costs is more of a priority.

A)activity-based costing is used more than in the U.S.

B)companies prefer volume measures such as direct labor hours to assign overhead costs.

C)labor cost reduction is less of a priority.

D)developing more accurate product costs is more of a priority.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

68

Teller, Inc.produces 3 products: P1, Q2, and R3.P1 requires 400 purchase orders, Q2 requires 600 purchase orders, and R3 requires 1,000 purchase orders.Teller has identified an ordering and receiving activity cost pool with allocated overhead of $180,000 for which the cost driver is purchase orders.Direct labor hours used on each product are 50,000 for P1, 40,000 for Q2, and 110,000 for R3.How much ordering and receiving overhead is assigned to each product?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

69

As compared to a high-volume product, a low-volume product

A)usually requires less special handling.

B)is usually responsible for more overhead costs per unit.

C)requires relatively fewer machine setups.

D)requires use of direct labor hours as the primary cost driver to ensure proper allocation of overhead.

A)usually requires less special handling.

B)is usually responsible for more overhead costs per unit.

C)requires relatively fewer machine setups.

D)requires use of direct labor hours as the primary cost driver to ensure proper allocation of overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

70

Clemson Co.incurs $700,000 of overhead costs each year in its three main departments, machining ($400,000), inspections ($200,000) and packing ($100,000).The machining department works 4,000 hours per year, there are 600 inspections per year, and the packing department packs 1,000 orders per year.Information about Clemson's two products is as follows:

- If traditional costing based on direct labor hours is used, how much overhead is assigned to Product X this year?

A)$168,334

B)$242,308

C)$340,000

D)$350,000

- If traditional costing based on direct labor hours is used, how much overhead is assigned to Product X this year?

A)$168,334

B)$242,308

C)$340,000

D)$350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

71

For its inspecting cost pool, Davidson, Inc.expected overhead cost of $300,000 and 4,000 inspections.The actual overhead cost for that cost pool was $360,000 for 5,000 inspections.The activity-based overhead rate used to assign the costs of the inspecting cost pool to products is

A)$60 per inspection.

B)$72 per inspection.

C)$75 per inspection.

D)$90 per inspection.

A)$60 per inspection.

B)$72 per inspection.

C)$75 per inspection.

D)$90 per inspection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

72

A company incurs $2,700,000 of overhead each year in three departments: Ordering and Receiving, Mixing, and Testing.The company prepares 2,000 purchase orders, works 50,000 mixing hours, and performs 1,500 tests per year in producing 200,000 drums of Goo and 600,000 drums of Slime.The following data are available: Production information for Goo is as follows:

-Compute the amount of overhead assigned to Slime.

A)$1,350,000

B)$1,645,234

C)$1,840,000

D)$2,025,000

-Compute the amount of overhead assigned to Slime.

A)$1,350,000

B)$1,645,234

C)$1,840,000

D)$2,025,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

73

Wilder Company manufactures two models of its banjo, the Basic and the Luxury.The Basic model requires 10,000 direct labor hours and the Luxury requires 30,000 direct labor hours.The company produces 3,400 units of the Basic model and 600 units of the Luxury model each year.The company inspects one Basic for every 100 produced, and inspects one Luxury for every 10 produced.The company expects to incur $84,600 of total inspecting costs this year.How much of the inspecting costs should be allocated to the Basic model using ABC costing?

A)$21,150

B)$30,600

C)$42,300

D)$71,910

A)$21,150

B)$30,600

C)$42,300

D)$71,910

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

74

Addison Company manufactures two products, Regular and Supreme.Addison's overhead costs consist of machining, $2,500,000; and assembling, $1,250,000.Information on the two products is:

- Overhead applied to Supreme using traditional costing using direct labor hours is

A)$1,075,000.

B)$1,500,000.

C)$2,250,000.

D)$2,675,000.

- Overhead applied to Supreme using traditional costing using direct labor hours is

A)$1,075,000.

B)$1,500,000.

C)$2,250,000.

D)$2,675,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

75

Ben Gordon, Inc.manufactures 2 products, wheels and seats.The company has estimated its overhead in the assembling department to be $330,000.The company produces 300,000 wheels and 600,000 seats each year.Each wheel uses 2 parts, and each seat uses 3 parts.How much of the assembly overhead should be allocated to wheels?

A)$ 82,500.

B)$110,000.

C)$132,000

D)$141,428.

A)$ 82,500.

B)$110,000.

C)$132,000

D)$141,428.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

76

Addison Company manufactures two products, Regular and Supreme.Addison's overhead costs consist of machining, $2,500,000; and assembling, $1,250,000.Information on the two products is:

- Overhead applied to Supreme using activity-based costing is

A)$1,075,000.

B)$1,500,000.

C)$2,250,000.

D)$2,675,000.

- Overhead applied to Supreme using activity-based costing is

A)$1,075,000.

B)$1,500,000.

C)$2,250,000.

D)$2,675,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

77

Addison Company manufactures two products, Regular and Supreme.Addison's overhead costs consist of machining, $2,500,000; and assembling, $1,250,000.Information on the two products is:

- Overhead applied to Regular using activity-based costing is

A)$1,075,000.

B)$1,500,000.

C)$2,250,000.

D)$2,675,000.

- Overhead applied to Regular using activity-based costing is

A)$1,075,000.

B)$1,500,000.

C)$2,250,000.

D)$2,675,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

78

Companies that switch to ABC often find they have

A)been overpricing some products.

B)possibly losing market share to competitors.

C)been sacrificing profitability by underpricing some products.

D)all of the above.

A)been overpricing some products.

B)possibly losing market share to competitors.

C)been sacrificing profitability by underpricing some products.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

79

One of Hatch Company's activity cost pools is machine setups, with estimated overhead of $300,000.Hatch produces sparklers (400 setups) and lighters (600 setups).How much of the machine setup cost pool should be assigned to sparklers?

A)$300,000

B)$120,000

C)$150,000

D)$180,000

A)$300,000

B)$120,000

C)$150,000

D)$180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

80

Clemson Co.incurs $700,000 of overhead costs each year in its three main departments, machining ($400,000), inspections ($200,000) and packing ($100,000).The machining department works 4,000 hours per year, there are 600 inspections per year, and the packing department packs 1,000 orders per year.Information about Clemson's two products is as follows:

-Using ABC, how much overhead is assigned to Product X this year?

A)$168,334

B)$242,308

C)$340,000

D)$350,000

-Using ABC, how much overhead is assigned to Product X this year?

A)$168,334

B)$242,308

C)$340,000

D)$350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck