Deck 19: International Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/86

العب

ملء الشاشة (f)

Deck 19: International Finance

1

If the United States receives $200 billion of foreign investment and at the same time invests a total of $160 billion abroad, then the U.S.

A)capital account balance decreases by $40 billion.

B)official settlements account balance increases by $40 billion.

C)capital account balance increases by $40 billion.

D)balance of payments must be negative.

E)current account must be in surplus.

A)capital account balance decreases by $40 billion.

B)official settlements account balance increases by $40 billion.

C)capital account balance increases by $40 billion.

D)balance of payments must be negative.

E)current account must be in surplus.

C

2

If the prices for the same goods and services are different in two nations, the exchange rate adjusts

Over the long run to achieve

A)interest rate parity.

B)balance of payments account between the two nations equal to zero.

C)a zero current account balance between the two nations.

D)zero net exports for each nation.

E)purchasing power parity between the two currencies.

Over the long run to achieve

A)interest rate parity.

B)balance of payments account between the two nations equal to zero.

C)a zero current account balance between the two nations.

D)zero net exports for each nation.

E)purchasing power parity between the two currencies.

E

3

The current account is the record of

A)foreign investment in the nation minus the nation's investment abroad.

B)the nation's exports but not its imports.

C)payments for imports, receipts for exports, net interest, and net transfers.

D)changes in the government's holdings of foreign currency.

E)a nation's international trading, borrowing, and lending.

A)foreign investment in the nation minus the nation's investment abroad.

B)the nation's exports but not its imports.

C)payments for imports, receipts for exports, net interest, and net transfers.

D)changes in the government's holdings of foreign currency.

E)a nation's international trading, borrowing, and lending.

C

4

In 2010, in the United States the sum of the balance of all three of the balance of payments accounts

Was

A)greatly negative.

B)greatly positive.

C)slightly negative.

D)zero.

E)slightly positive.

Was

A)greatly negative.

B)greatly positive.

C)slightly negative.

D)zero.

E)slightly positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

5

According to the U.S. balance of payments accounts in 2010, U.S. international borrowing is used for

A)private consumption.

B)private and public investment.

C)private saving and public consumption.

D)government expenditure.

E)private and public saving.

A)private consumption.

B)private and public investment.

C)private saving and public consumption.

D)government expenditure.

E)private and public saving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

6

A debtor nation is a country that

A)during its entire history has consistently run a capital account deficit.

B)borrows more from the rest of the world than it lends to it.

C)lends more to the rest of the world than it borrows from it.

D)during its entire history has borrowed more from the rest of the world than it has lent to it.

E)during its entire history has invested more in the rest of the world than other countries have invested in it.

A)during its entire history has consistently run a capital account deficit.

B)borrows more from the rest of the world than it lends to it.

C)lends more to the rest of the world than it borrows from it.

D)during its entire history has borrowed more from the rest of the world than it has lent to it.

E)during its entire history has invested more in the rest of the world than other countries have invested in it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

7

When people expect that the future exchange rate will be lower, they-------------------- the supply of dollars and the current exchange rate -------------------- .

A)increase; rises

B)increase; falls

C)decrease; falls

D)do not change; rises

E)decrease; rises

A)increase; rises

B)increase; falls

C)decrease; falls

D)do not change; rises

E)decrease; rises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

8

Exchange rate changes are

A)very volatile because supply and demand changes reinforce each other.

B)infrequent because the exchange rate rarely changes.

C)very volatile because of government intervention in the market.

D)not very volatile because of government intervention.

E)not very volatile because of offsetting changes in demand and supply.

A)very volatile because supply and demand changes reinforce each other.

B)infrequent because the exchange rate rarely changes.

C)very volatile because of government intervention in the market.

D)not very volatile because of government intervention.

E)not very volatile because of offsetting changes in demand and supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

9

On the foreign exchange market, an increase in a country's exchange rate

A)decreases the quantity demanded of its currency and leads to a movement up along the demand curve.

B)increases the quantity demanded of its currency and leads to a movement up along the demand curve.

C)decreases the demand for its currency and shifts the demand curve rightward.

D)decreases the demand for its currency and shifts the demand curve leftward.

E)increases the quantity demanded of its currency and leads to a movement down along the demand curve.

A)decreases the quantity demanded of its currency and leads to a movement up along the demand curve.

B)increases the quantity demanded of its currency and leads to a movement up along the demand curve.

C)decreases the demand for its currency and shifts the demand curve rightward.

D)decreases the demand for its currency and shifts the demand curve leftward.

E)increases the quantity demanded of its currency and leads to a movement down along the demand curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following generally becomes positive when the value of U.S. exports exceeds the

Value of U.S. imports?

A)the balance of payments account

B)current account

C)the exchange rate

D)capital account

E)the official settlements account

Value of U.S. imports?

A)the balance of payments account

B)current account

C)the exchange rate

D)capital account

E)the official settlements account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

11

In 2011, a dollar could be traded for 100 yen and in 2012 a dollar could be traded for 90 yen. between these two years, the dollar has become --------------------valuable and so the dollar has-------------------- .

A)more; appreciated against the dollar

B)more; appreciated against the yen

C)more; depreciated against the yen

D)less; appreciated against the yen

E)less; depreciated against the yen

A)more; appreciated against the dollar

B)more; appreciated against the yen

C)more; depreciated against the yen

D)less; appreciated against the yen

E)less; depreciated against the yen

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

12

Looking at the U.S. balance of payments from 1980 to 2008, we see that the

A)current account was positive until 1992 then turned negative.

B)current account has been negative for most years and was small in the late 1980s and early 1990s.

C)current account was negative until 1992 then turned positive.

D)capital account has been negative for most years and was small in the late 1980s and early 1990s.

E)official settlements account was large in the 1980s relative to the current account.

A)current account was positive until 1992 then turned negative.

B)current account has been negative for most years and was small in the late 1980s and early 1990s.

C)current account was negative until 1992 then turned positive.

D)capital account has been negative for most years and was small in the late 1980s and early 1990s.

E)official settlements account was large in the 1980s relative to the current account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

13

If the U.S. interest rate differential decreases, then in the foreign exchange market the

A)supply of dollars decreases.

B)quantity supplied of dollars increases.

C)demand for dollars increases.

D)quantity supplied of dollars decreases.

E)supply of dollars increases.

A)supply of dollars decreases.

B)quantity supplied of dollars increases.

C)demand for dollars increases.

D)quantity supplied of dollars decreases.

E)supply of dollars increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which balance of payments account records payments for imports and exports?

A)reserves account

B)capital account

C)official settlements account

D)current account

E)trade account

A)reserves account

B)capital account

C)official settlements account

D)current account

E)trade account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

15

A country has imports of goods and services at $2,000 billion. The interest paid to the rest of theworld is $500 billion. The interest received from the rest of the world is $400 billion. The decrease in official reserves is $10 billion. The government sector balance is $200 billion, savings is $1,800

Billion, investment is $2,000 billion, and net transfers is zero. What is the current account balance?

A)$100 billion

B)$200 billion

C)-$10 billion

D)-$200 billion

E)-$100 billion

Billion, investment is $2,000 billion, and net transfers is zero. What is the current account balance?

A)$100 billion

B)$200 billion

C)-$10 billion

D)-$200 billion

E)-$100 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

16

Everything else the same, in the foreign exchange market which of the following increases the

Demand for U.S. dollars and shifts the demand curve rightward?

A)The expected future exchange rate falls.

B)The Japanese interest rate rises.

C)The U.S. exchange rate rises.

D)The U.S. exchange rate falls.

E)The U.S. interest rate rises.

Demand for U.S. dollars and shifts the demand curve rightward?

A)The expected future exchange rate falls.

B)The Japanese interest rate rises.

C)The U.S. exchange rate rises.

D)The U.S. exchange rate falls.

E)The U.S. interest rate rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

17

Today, one U.S. dollar exchanges for 1.10 euros. The next morning the same dollar exchanges for 1.07 euros. We can conclude that the dollar has --------------------and the euro has-------------------- .

A)depreciated; depreciated

B)appreciated; appreciated

C)depreciated; appreciated

D)depreciated; neither appreciated nor depreciated

E)appreciated; depreciated

A)depreciated; depreciated

B)appreciated; appreciated

C)depreciated; appreciated

D)depreciated; neither appreciated nor depreciated

E)appreciated; depreciated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

18

Suppose IBM purchases a factory in Japan. This purchase is entered into which of the balance of

Payments accounts?

A)purchases account

B)current account

C)trade account

D)official settlements account

E)capital account

Payments accounts?

A)purchases account

B)current account

C)trade account

D)official settlements account

E)capital account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

19

If the exchange rate falls, the quantity of dollars supplied

A)does not change.

B)increases and there is movement up along the supply curve of dollars.

C)increases and there is movement down along the supply curve of dollars.

D)decreases and there is movement up along the supply curve of dollars.

E)decreases and there is movement down along the supply curve of dollars.

A)does not change.

B)increases and there is movement up along the supply curve of dollars.

C)increases and there is movement down along the supply curve of dollars.

D)decreases and there is movement up along the supply curve of dollars.

E)decreases and there is movement down along the supply curve of dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

20

If the United States imports goods and services for a total of $45 billion, exports goods and services for a total of $40 billion, records $4 billion as net interest and zero as net transfers, then the U.S.

Current account balance is

A)$81 billion.

B)zero.

C)$89 billion.

D)-$1 billion.

E)$1 billion.

Current account balance is

A)$81 billion.

B)zero.

C)$89 billion.

D)-$1 billion.

E)$1 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

21

The table has some of the U.S. balance of payments account.

-

If there is no statistical discrepancy, the official settlement account balance equals--------------------

A)zero

B)+$220 billion

C)+$200 billion

D)+$20 billion

E)-$20 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

22

A country has imports of goods and services at $2,000 billion. The interest paid to the rest of the world is $500 billion. The interest received from the rest of the world is $400 billion. The decrease in official reserves is $10 billion. The government sector balance is $200 billion, savings is $1,800 billion, investment is $2,000 billion, and net transfers is zero. What is net exports?

A)$100 billion

B)$0

C)-$200 billion

D)-$100 billion

E)$200 billion

A)$100 billion

B)$0

C)-$200 billion

D)-$100 billion

E)$200 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

23

Suppose that the U.S. government acquires more foreign currency. How does this change affect the balance of payments accounts?

A)The capital account is negative.

B)The official settlements account balance is negative.

C)The capital account is positive.

D)The official settlements account balance is positive.

E)The balance of payments account sum to a positive number equal to the value of the additional foreign currency the government has obtained.

A)The capital account is negative.

B)The official settlements account balance is negative.

C)The capital account is positive.

D)The official settlements account balance is positive.

E)The balance of payments account sum to a positive number equal to the value of the additional foreign currency the government has obtained.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

24

When U.S. official reserves-------------------- , the official settlements account balance becomes negative and when U.S. official reserves --------------------, the official settlements account balance becomes positive.

A)increase; decrease

B)decrease; increase

C)decrease; decrease

D)increase; increase

E)More information is needed about the balances on the current account and the capital account in order to answer this question.

A)increase; decrease

B)decrease; increase

C)decrease; decrease

D)increase; increase

E)More information is needed about the balances on the current account and the capital account in order to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

25

The-------------------- the expected future exchange rate, the greater is the expected profit from holding dollars and so the-------------------- .

A)higher; demand curve for dollars shifts rightward

B)higher; supply curve of dollars shifts rightward

C)higher; demand curve for dollars shifts leftward

D)lower; supply curve of dollars shifts rightward

E)lower; demand curve for dollars shifts leftward

A)higher; demand curve for dollars shifts rightward

B)higher; supply curve of dollars shifts rightward

C)higher; demand curve for dollars shifts leftward

D)lower; supply curve of dollars shifts rightward

E)lower; demand curve for dollars shifts leftward

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

26

If an investment of $100 million from the United Kingdom is made in the United States, the $100 million is listed as a -------------------- entry in the-------------------- account.

A)positive; current

B)negative; current

C)positive; official settlements

D)negative; capital

E)positive; capital

A)positive; current

B)negative; current

C)positive; official settlements

D)negative; capital

E)positive; capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

27

From the early 1990s through 2010, the U.S.

A)current account and U.S. capital account were both positive.

B)capital account was negative.

C)actual balance of payments deficit exceeded what the United States measured as the balance of payments deficit.

D)balance of payments exceeded the capital account.

E)current account was negative.

A)current account and U.S. capital account were both positive.

B)capital account was negative.

C)actual balance of payments deficit exceeded what the United States measured as the balance of payments deficit.

D)balance of payments exceeded the capital account.

E)current account was negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

28

In the United States, the main source of fluctuations in the current account balance is

A)net interest.

B)international debt.

C)net exports.

D)net transfers.

E)exports of capital.

A)net interest.

B)international debt.

C)net exports.

D)net transfers.

E)exports of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

29

The trade between countries is recorded in accounts called the balance of

A)export and import accounts.

B)currency accounts.

C)U.S. official trade account.

D)international trade accounts.

E)payments accounts.

A)export and import accounts.

B)currency accounts.

C)U.S. official trade account.

D)international trade accounts.

E)payments accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

30

When there is a shortage of dollars in the foreign exchange market, the

A)supply curve of dollars shifts rightward to restore the equilibrium.

B)demand curve for dollars shifts leftward to restore the equilibrium.

C)supply curve of dollars shifts leftward to restore the equilibrium.

D)U.S. exchange rate will appreciate.

E)U.S. exchange rate will depreciate.

A)supply curve of dollars shifts rightward to restore the equilibrium.

B)demand curve for dollars shifts leftward to restore the equilibrium.

C)supply curve of dollars shifts leftward to restore the equilibrium.

D)U.S. exchange rate will appreciate.

E)U.S. exchange rate will depreciate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the current account balance is -$100 billion, the capital account balance is $80 billion, then the

Official settlements account balance is

A)0.

B)$180 billion.

C)-$20 billion.

D)$20 billion.

E)-$180 billion.

Official settlements account balance is

A)0.

B)$180 billion.

C)-$20 billion.

D)$20 billion.

E)-$180 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

32

The private sector balance is equal to savings --------------------investment, and the government sector balance is equal to government expenditure --------------------taxes. If there is a deficit in the private sector balance and a deficit in the government sector balance, then there must be a --------------------in net exports.

A)plus; minus; surplus

B)plus; plus; deficit

C)plus; plus; surplus

D)minus; minus; deficit

E)minus; minus; surplus

A)plus; minus; surplus

B)plus; plus; deficit

C)plus; plus; surplus

D)minus; minus; deficit

E)minus; minus; surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

33

The-------------------- the expected future exchange rate, the greater is the expected profit from holding dollars and so the-------------------- .

A)higher; supply curve of dollars shifts leftward

B)higher; supply curve of dollars shifts rightward

C)lower; supply curve of dollars shifts rightward

D)higher; demand curve for dollars shifts leftward

E)lower; demand curve for dollars shifts leftward

A)higher; supply curve of dollars shifts leftward

B)higher; supply curve of dollars shifts rightward

C)lower; supply curve of dollars shifts rightward

D)higher; demand curve for dollars shifts leftward

E)lower; demand curve for dollars shifts leftward

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

34

In the capital account, the largest category of international transactions is

A)exports and imports.

B)net transfers.

C)net interest.

D)statistical discrepancy.

E)foreign investment in the United States.

A)exports and imports.

B)net transfers.

C)net interest.

D)statistical discrepancy.

E)foreign investment in the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

35

If the current account balance is negative, net interest is $100 billion and net transfer is -$100 billion, then

A)imports exceed exports.

B)the official settlements account must be positive.

C)exports exceed imports.

D)the official settlements account must be negative.

E)real GDP exceeds potential GDP.

A)imports exceed exports.

B)the official settlements account must be positive.

C)exports exceed imports.

D)the official settlements account must be negative.

E)real GDP exceeds potential GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

36

A nation that currently has a surplus in its current account is called a

A)net lender.

B)net borrower.

C)creditor nation.

D)debtor nation.

E)capital account surplus nation.

A)net lender.

B)net borrower.

C)creditor nation.

D)debtor nation.

E)capital account surplus nation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

37

Yesterday, the dollar was trading in the foreign exchange market at 1.10 euros per dollar. Today, the dollar is trading at 1.05 euros per dollar. The dollar has-------------------- and a possible reason for the change is --------------------in the U.S. interest rate.

A)depreciated; an increase

B)appreciated; a decrease

C)depreciated; a decrease

D)appreciated; an increase

E)depreciated; because there has been no change

A)depreciated; an increase

B)appreciated; a decrease

C)depreciated; a decrease

D)appreciated; an increase

E)depreciated; because there has been no change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

38

The United States currently is

A)a net lender and has been since the 1980s.

B)a net borrower and has been since the end of World War II in 1945.

C)a net borrower and has been since the 1980s.

D)a net lender and has been since the end of World War II in 1945.

E)neither a net lender nor a net borrower.

A)a net lender and has been since the 1980s.

B)a net borrower and has been since the end of World War II in 1945.

C)a net borrower and has been since the 1980s.

D)a net lender and has been since the end of World War II in 1945.

E)neither a net lender nor a net borrower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the exchange rate rises, then the quantity of dollars demanded-------------------- because with the higher U.S. exchange rate, U.S. exports-------------------- .

A)decreases; decrease

B)does not change; do not change

C)increases; increase

D)decreases; increase

E)increases; decrease

A)decreases; decrease

B)does not change; do not change

C)increases; increase

D)decreases; increase

E)increases; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

40

In the foreign exchange market, when the U.S. interest rate rises, the supply of dollars-------------------- and the foreign exchange rate-------------------- .

A)increases; falls

B)increases; rises

C)decreases; rises

D)decreases; falls

E)increases; does not change

A)increases; falls

B)increases; rises

C)decreases; rises

D)decreases; falls

E)increases; does not change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

41

In 2008, the current account balance was -$706 billion and the capital account balance was-------------------- +$711 billion. Therefore, the official settlements account balance was and the balance of all payments accounts summed was --------------------.

A)-$5 billion; zero

B)positive; positive

C)not enough information to determine; negative

D)negative; negative

E)+$5 billion; zero

A)-$5 billion; zero

B)positive; positive

C)not enough information to determine; negative

D)negative; negative

E)+$5 billion; zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

42

The balance of payments accounts record all of the following EXCEPT the country's

A)international lending.

B)change in official reserves.

C)domestic investment.

D)international trading.

E)international borrowing.

A)international lending.

B)change in official reserves.

C)domestic investment.

D)international trading.

E)international borrowing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the exchange rate changes from 1.10 euros per dollar to 1.00 euro per dollar, the dollar has

A)appreciated against the euro.

B)appreciated against the dollar.

C)depreciated against the euro.

D)depreciated against the dollar.

E)fallen inversely in value.

A)appreciated against the euro.

B)appreciated against the dollar.

C)depreciated against the euro.

D)depreciated against the dollar.

E)fallen inversely in value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

44

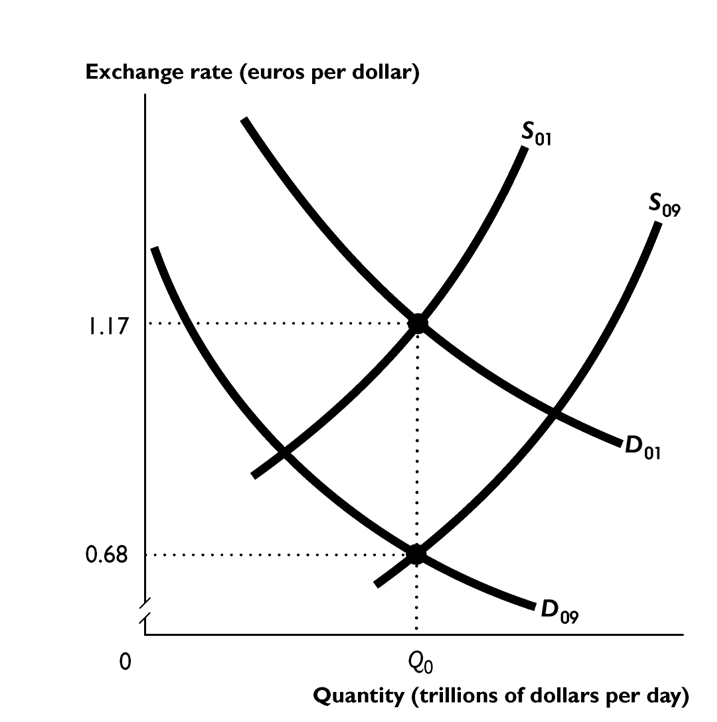

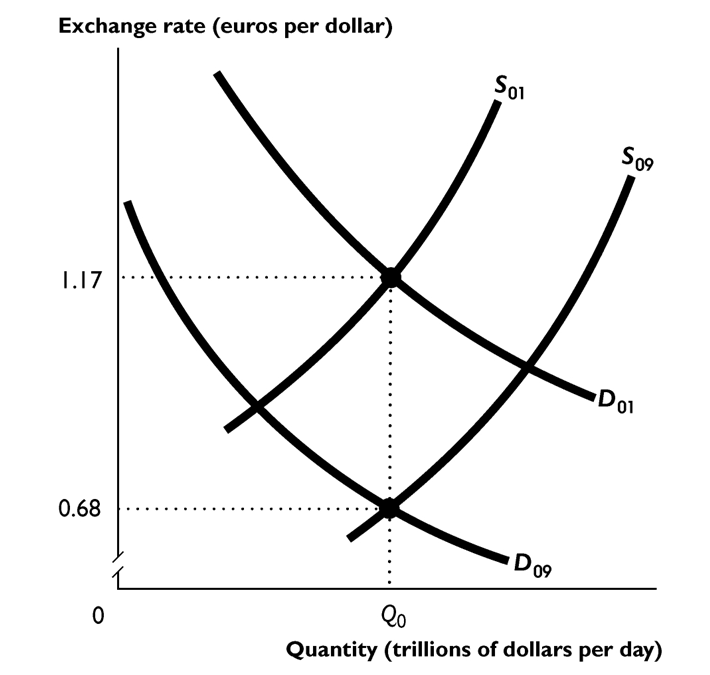

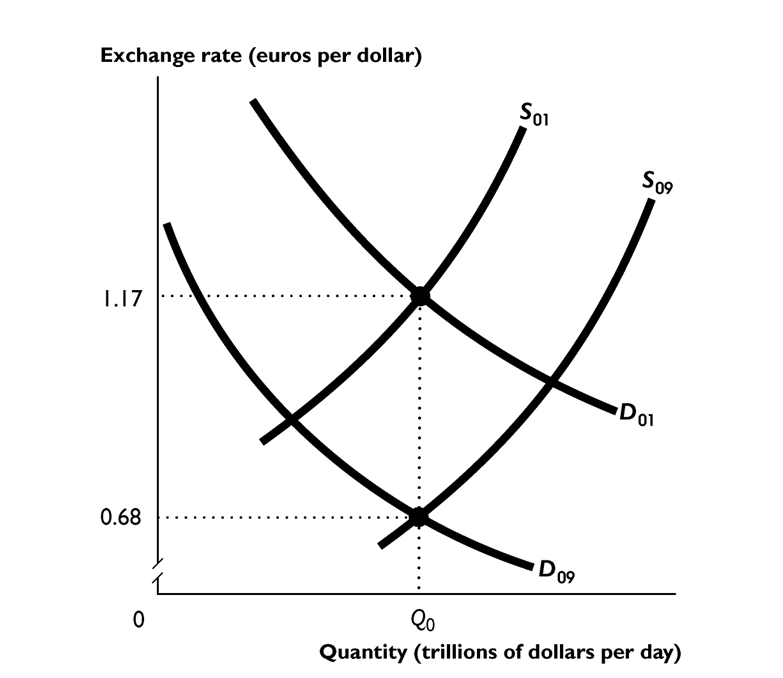

The figure above shows the market for foreign exchange in 2001 and 2009.

-

Which of the following could have lead to the shifts illustrated in the figure above?

I. The U.S. exchange rate was expected to depreciate between 2001 and 2009.

Ii. The U.S. exchange rate was expected to appreciate between 2001 and 2009.

Iii. The U.S. interest rate rose relative to interest rates in other countries between 2001 and 2009.

A)i and iii

B)i only

C)ii only

D)ii and iii

E)iii only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

45

In the long run, the exchange rate between two currencies is

A)constant.

B)undefined.

C)fixed.

D)determined so that the current account balance equals zero.

E)influenced by purchasing power parity.

A)constant.

B)undefined.

C)fixed.

D)determined so that the current account balance equals zero.

E)influenced by purchasing power parity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

46

A nation that is a net borrower each year over time will become a-------------------- nation. A nation that is a net lender each year over time will become a-------------------- nation. Since the early 1980s, the United states has been a --------------------due to the current account --------------------.

A)creditor; debtor; net lender; deficits

B)debtor; creditor; net lender; surpluses

C)debtor; creditor; net borrower; deficits

D)creditor; debtor; net borrower; deficits

E)creditor; debtor; net lender; surpluses

A)creditor; debtor; net lender; deficits

B)debtor; creditor; net lender; surpluses

C)debtor; creditor; net borrower; deficits

D)creditor; debtor; net borrower; deficits

E)creditor; debtor; net lender; surpluses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

47

The figure above shows the market for foreign exchange in 2001 and 2009.

-

What would the Fed have done if it had tried to keep the exchange rate at its 2001 level?

A)buy dollars and buy euros

B)sell dollars and sell euros

C)buy dollars and sell euros

D)sell dollars and buy euros

E)None of the above are correct because the Fed cannot affect the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

48

Suppose that a currency's value is found to be overvalued by using purchasing power parity. Then

A)the currency will depreciate in the future but we don't know when.

B)the currency will appreciate in the future but we don't know when.

C)the interest rate in the country will change in order to restore purchasing power parity.

D)we know when and how much the currency will appreciate.

E)we know when and how much the currency will depreciate.

A)the currency will depreciate in the future but we don't know when.

B)the currency will appreciate in the future but we don't know when.

C)the interest rate in the country will change in order to restore purchasing power parity.

D)we know when and how much the currency will appreciate.

E)we know when and how much the currency will depreciate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

49

The foreign exchange rate is defined as the

A)rate or the speed with which the currencies of the worlds are traded.

B)price at which one currency exchanges for another.

C)volume of the world currencies traded.

D)equal to the amount of the current account deficit.

E)equal to the amount of the capital account deficit.

A)rate or the speed with which the currencies of the worlds are traded.

B)price at which one currency exchanges for another.

C)volume of the world currencies traded.

D)equal to the amount of the current account deficit.

E)equal to the amount of the capital account deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

50

If the U.S. capital account balance has a $30 million surplus and there was no change in official reserves during that year, we know that

A)the United States has a $30 million current account deficit.

B)U.S. net foreign lending must equal $30 million.

C)the United States is a net lender.

D)the United States has a $30 million current account surplus.

E)U.S. official reserves have increased by $30 million.

A)the United States has a $30 million current account deficit.

B)U.S. net foreign lending must equal $30 million.

C)the United States is a net lender.

D)the United States has a $30 million current account surplus.

E)U.S. official reserves have increased by $30 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

51

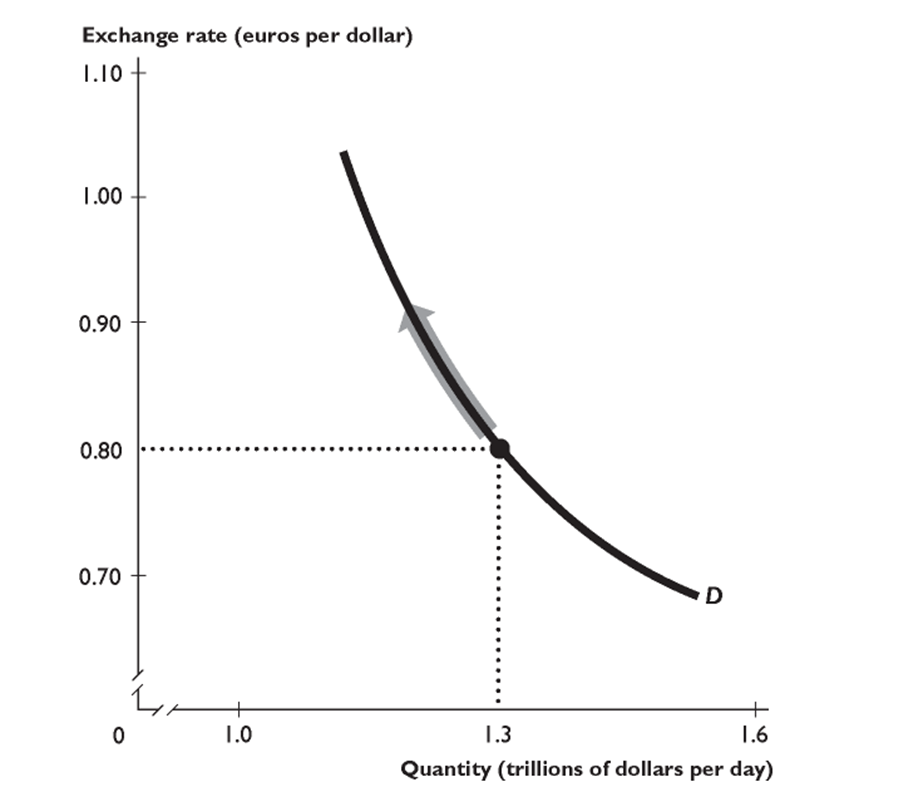

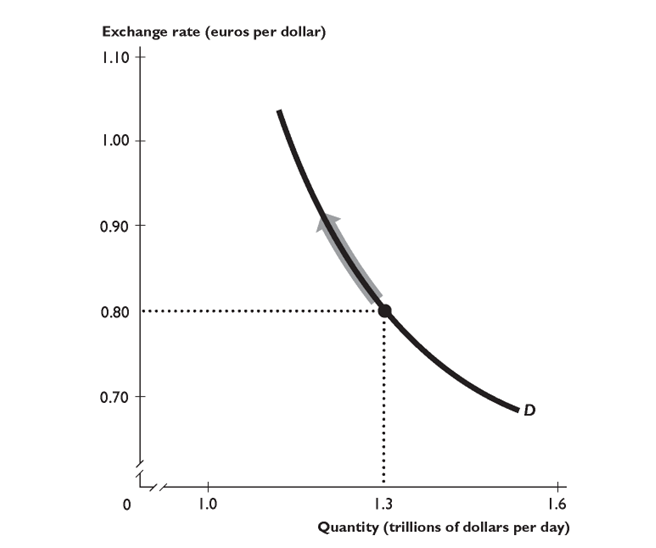

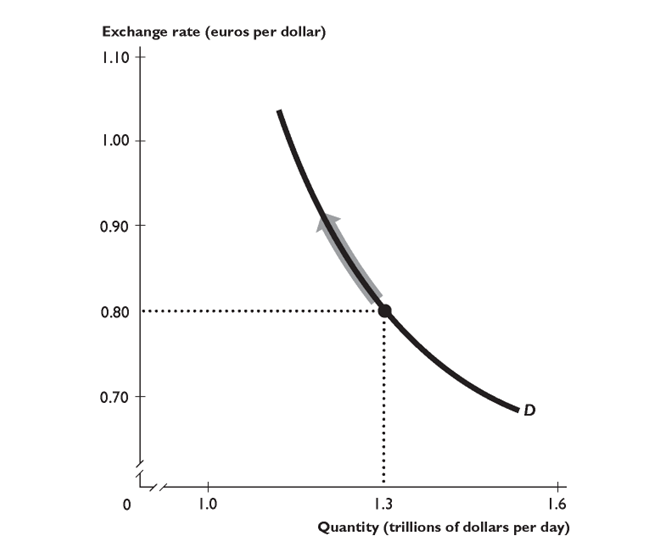

The figure above shows the demand curve for dollars in the foreign exchange market.

-

Which of the following factors could lead to an upward movement along the demand curve as indicated by the arrow?

I. An increase in the U.S. interest rate

ii. A decrease in the U.S. interest rate

Iii. An increase in the expected future U.S. exchange rate.

A)ii only

B)i and iii

C)i only

D)ii and iii

E)None of the factors could lead to the upward movement illustrated by the arrow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

52

If the U.S. interest rate differential rises, then the effect in the foreign exchange market on the

Demand for dollars is that the

A)demand for dollars does not change and the quantity of dollars demanded also does not change.

B)quantity of dollars demanded increases.

C)quantity of dollars demanded decreases.

D)demand for dollars increases.

E)demand for dollars decreases.

Demand for dollars is that the

A)demand for dollars does not change and the quantity of dollars demanded also does not change.

B)quantity of dollars demanded increases.

C)quantity of dollars demanded decreases.

D)demand for dollars increases.

E)demand for dollars decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

53

The figure above shows the demand curve for dollars in the foreign exchange market.

-

When the exchange rate between the U.S. dollar and the euro changes from 1.07 euros per dollar to

0.93 euros per dollar, then the

A)U.S. dollar has depreciated against the euro.

B)U.S. dollar has appreciated against the euro.

C)euro has depreciated against the euro.

D)U.S. dollar has depreciated against the dollar.

E)euro has depreciated against the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

54

The table has some of the U.S. balance of payments account

-

The current account balance is equal to

A)+$220 billion

B)+$200 billion

C)-$200 billion

D)+$20 billion

E)-$220 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

55

In 2008, the U.S. current account balance was -$706 billion, net interest was +$119 billion, net transfers were -$128 billion, and exports were +$1,827 billion. Therefore, imports were--------------------.

A)+$1,112 billion

B)-$2,524 billion

C)+$2,780 billion

D)+$2,524 billion

E)-$1,112 billion

A)+$1,112 billion

B)-$2,524 billion

C)+$2,780 billion

D)+$2,524 billion

E)-$1,112 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

56

In the foreign exchange market, an increase in the exchange rate leads to

A)an increase in the quantity of dollars demanded and a movement along the demand curve for dollars.

B)an increase the quantity of dollars supplied and a movement along the supply curve of dollars.

C)an increase the quantity of dollars supplied and no movement along the supply curve of dollars.

D)an increase in the quantity of dollars demanded and no movement along the demand curve for dollars.

E)a decrease the quantity of dollars supplied and a movement along the supply curve of dollars.

A)an increase in the quantity of dollars demanded and a movement along the demand curve for dollars.

B)an increase the quantity of dollars supplied and a movement along the supply curve of dollars.

C)an increase the quantity of dollars supplied and no movement along the supply curve of dollars.

D)an increase in the quantity of dollars demanded and no movement along the demand curve for dollars.

E)a decrease the quantity of dollars supplied and a movement along the supply curve of dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

57

The demand for the U.S. dollar in the foreign exchange market is a derived demand. A derived

Demand means that the demand is derived from

A)the demand by U.S. residents for foreign goods, services, and assets.

B)government policy.

C)the supply of U.S. dollars.

D)the demand for U.S. goods, services, and assets.

E)the domestic demand for U.S. goods and services.

Demand means that the demand is derived from

A)the demand by U.S. residents for foreign goods, services, and assets.

B)government policy.

C)the supply of U.S. dollars.

D)the demand for U.S. goods, services, and assets.

E)the domestic demand for U.S. goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

58

The exchange rate can be very volatile, yet the quantity of dollars traded might not change much because

A)supply of dollars and the demand for dollars often change in opposite directions.

B)both the demand curve for dollars and the supply curve of dollars are horizontal.

C)the Fed is constantly intervening by buying and selling dollars.

D)supply of dollars and the demand for dollars often change in the same directions.

E)there is only limited quantity of dollars in the foreign exchange market.

A)supply of dollars and the demand for dollars often change in opposite directions.

B)both the demand curve for dollars and the supply curve of dollars are horizontal.

C)the Fed is constantly intervening by buying and selling dollars.

D)supply of dollars and the demand for dollars often change in the same directions.

E)there is only limited quantity of dollars in the foreign exchange market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

59

When a Mexican company purchases a U.S. --------------------made computer, the Mexican company pays for it with

A)Mexican pesos.

B)U.S. dollars.

C)Euros or yen.

D)Mexican goods and services.

E)gold.

A)Mexican pesos.

B)U.S. dollars.

C)Euros or yen.

D)Mexican goods and services.

E)gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

60

If the interest rate on a bank deposit in the United States is 3 percent while a similar deposit earns 6 percent in Britain, then we could expect that deposits would flow to

A)Britain if the pound is expected to depreciate more than 3 percent.

B)Britain if the pound is expected to depreciate less than 3 percent.

C)Britain regardless of exchange rate expectations.

D)the United States if the dollar is expected to appreciate less than 3 percent.

E)the United States regardless of exchange rate expectations.

A)Britain if the pound is expected to depreciate more than 3 percent.

B)Britain if the pound is expected to depreciate less than 3 percent.

C)Britain regardless of exchange rate expectations.

D)the United States if the dollar is expected to appreciate less than 3 percent.

E)the United States regardless of exchange rate expectations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following are balance of payments accounts?

I. capital account

Ii. tariff account

Iii. current account

A)iii only

B)i only

C)ii and iii

D)i and iii

E)ii only

I. capital account

Ii. tariff account

Iii. current account

A)iii only

B)i only

C)ii and iii

D)i and iii

E)ii only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements about the foreign exchange market is correct?

A)The higher the expected future exchange rate, the smaller is the expected profit from holding dollars and so the smaller is the demand for dollars.

B)The higher the expected future exchange rate, the smaller is the expected profit from holding dollars and so the greater is the demand for dollars.

C)The higher the expected future exchange rate, the greater is the expected profit from holding dollars and so the greater is the demand for dollars.

D)The lower the expected future exchange rate, the greater is the expected profit from holding dollars and so the greater is the demand for dollars.

E)The lower the expected future exchange rate, the smaller is the expected profit from holding dollars and so the greater is the demand for dollars.

A)The higher the expected future exchange rate, the smaller is the expected profit from holding dollars and so the smaller is the demand for dollars.

B)The higher the expected future exchange rate, the smaller is the expected profit from holding dollars and so the greater is the demand for dollars.

C)The higher the expected future exchange rate, the greater is the expected profit from holding dollars and so the greater is the demand for dollars.

D)The lower the expected future exchange rate, the greater is the expected profit from holding dollars and so the greater is the demand for dollars.

E)The lower the expected future exchange rate, the smaller is the expected profit from holding dollars and so the greater is the demand for dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

63

The table above gives data on the U.S. balance of payments in 2019.

-

Is the United States a debtor or a creditor nation in 2019?

A)neither a creditor nor debtor nation

B)a debtor nation

C)a creditor nation

D)both a creditor nation and a debtor nation

E)More information is needed to determine if the United States is a debtor or creditor nation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

64

The figure above shows the market for foreign exchange in 2001 and 2009.

Suppose the Fed had tried to keep the exchange rate at its 2001 level. In that case the Fed would have-------------------- dollars and its foreign reserves would have-------------------- .

A)bought; decreased

B)sold; increased

C)bought; increased

D)sold; decreased

E)None of the above are correct because the Fed cannot affect the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

65

If the exchange rate is constant and U.S. imports increase, then in the foreign exchange market the

A)supply of U.S. dollars increases.

B)quantity of U.S. dollars supplied increases.

C)demand for U.S. dollars increases.

D)supply of U.S. dollars decreases.

E)quantity of U.S. dollars supplied decreases.

A)supply of U.S. dollars increases.

B)quantity of U.S. dollars supplied increases.

C)demand for U.S. dollars increases.

D)supply of U.S. dollars decreases.

E)quantity of U.S. dollars supplied decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the U.S. dollars depreciates against the euro, what can the Fed do to keep the dollar's exchange rate stable?

A)buy euros in the foreign exchange market

B)nothing

C)sell dollars in the foreign exchange market

D)buy dollars in the foreign exchange market

E)decrease U.S. imports by increasing tariffs

A)buy euros in the foreign exchange market

B)nothing

C)sell dollars in the foreign exchange market

D)buy dollars in the foreign exchange market

E)decrease U.S. imports by increasing tariffs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

67

The government sector balance equals

A)saving minus investment.

B)government expenditures plus investment.

C)saving plus investment.

D)net taxes minus government expenditures.

E)net taxes plus government expenditures.

A)saving minus investment.

B)government expenditures plus investment.

C)saving plus investment.

D)net taxes minus government expenditures.

E)net taxes plus government expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

68

The price at which one currency exchanges for another currency is called the

A)value of the dollar.

B)money exchange rate.

C)net export exchange rate.

D)currency exchange rate.

E)foreign exchange rate.

A)value of the dollar.

B)money exchange rate.

C)net export exchange rate.

D)currency exchange rate.

E)foreign exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

69

The--------------------always equals zero.

A)sum of current account plus official settlements account

B)sum of capital account plus official settlements account

C)official settlements account

D)sum of current account plus capital account

E)sum of current account plus capital account plus official settlements account

A)sum of current account plus official settlements account

B)sum of capital account plus official settlements account

C)official settlements account

D)sum of current account plus capital account

E)sum of current account plus capital account plus official settlements account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

70

When the United States exports goods and services to France, there is an increase in the

A)U.S. capital account balance.

B)supply of French francs.

C)demand for dollars.

D)supply of dollars.

E)U.S. official settlements account balance.

A)U.S. capital account balance.

B)supply of French francs.

C)demand for dollars.

D)supply of dollars.

E)U.S. official settlements account balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

71

If the exchange rate depreciates, then the

A)quantity of dollars demanded increases.

B)quantity of dollars demanded decreases.

C)supply of dollars decreases.

D)demand for dollars increases.

E)demand for dollars decreases.

A)quantity of dollars demanded increases.

B)quantity of dollars demanded decreases.

C)supply of dollars decreases.

D)demand for dollars increases.

E)demand for dollars decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

72

The current account balance is equal to

A)imports - exports + net interest - net transfers.

B)exports - imports - net interest + net transfers.

C)imports - exports + net interest + net transfers.

D)exports - imports + net interest + net transfers.

E)exports - imports - net interest - net transfers.

A)imports - exports + net interest - net transfers.

B)exports - imports - net interest + net transfers.

C)imports - exports + net interest + net transfers.

D)exports - imports + net interest + net transfers.

E)exports - imports - net interest - net transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

73

To appreciate the U.S. dollar against the Mexican peso, in the foreign exchange market the Fed could --------------------dollars and --------------------pesos.

A)buy; buy

B)sell; sell

C)buy; sell

D)sell; buy

E)None of the above answers are correct because the Fed cannot affect the U.S. exchange rate.

A)buy; buy

B)sell; sell

C)buy; sell

D)sell; buy

E)None of the above answers are correct because the Fed cannot affect the U.S. exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

74

Suppose you own some German government bonds that pay you interest every year. This interest is entered into which of the balance of payments accounts?

A)interest account

B)current account

C)trade account

D)official settlements account

E)capital account

A)interest account

B)current account

C)trade account

D)official settlements account

E)capital account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

75

Because of the large current account deficits accumulated by the United States since 1981, the united States has become a

A)broke nation.

B)creditor nation.

C)balanced nation.

D)nation with no official reserves.

E)debtor nation.

A)broke nation.

B)creditor nation.

C)balanced nation.

D)nation with no official reserves.

E)debtor nation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

76

When the U.S. current account has a deficit, international payments from the United States --------------------U.S. international receipts. To cover the current account deficit, there must be a-------------------- in the combined capital and official settlements accounts.

A)equal; surplus

B)are less than; surplus

C)exceed; deficit

D)exceed; surplus

E)are less than; deficit

A)equal; surplus

B)are less than; surplus

C)exceed; deficit

D)exceed; surplus

E)are less than; deficit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

77

The figure above shows the demand curve for dollars in the foreign exchange market.

-

If the exchange rate rises as shown by the arrow, the price of American exports to foreigners will be

, and foreign nations will demand dollars in order to buy _ American

Exports.

A)higher; more; more

B)higher; fewer; fewer

C)cheaper; fewer; fewer

D)cheaper; more; more

E)cheaper; fewer; more

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

78

Define X = exports, M = imports, S = saving, I = investment, T = net taxes, G = government

Expenditure. Which of the following formulas is correct?

A)X - M = S + I + T - G

B)X - M = S - I - T - G

C)X - M = S + I +T + G

D)X - M = S - I + T - G

E)X - M = S + I -T + G

Expenditure. Which of the following formulas is correct?

A)X - M = S + I + T - G

B)X - M = S - I - T - G

C)X - M = S + I +T + G

D)X - M = S - I + T - G

E)X - M = S + I -T + G

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

79

If the U.S. interest rate differential falls, then the exchange rate--------------------

A)does not change

B)definitely falls

C)definitely rises

D)falls only if it was the U.S. interest rate that changed

E)rises only if it was the foreign interest rate that changed

A)does not change

B)definitely falls

C)definitely rises

D)falls only if it was the U.S. interest rate that changed

E)rises only if it was the foreign interest rate that changed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

80

In the foreign exchange market, which of the following shifts the demand curve for dollars rightward?

A)the expected future exchange rate rises

B)the current exchange rate falls

C)the expected future exchange rate falls

D)the current exchange rate rises

E)None of the above answers is correct

A)the expected future exchange rate rises

B)the current exchange rate falls

C)the expected future exchange rate falls

D)the current exchange rate rises

E)None of the above answers is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck