Deck 2: An Introduction to Cost Terms and Concepts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/64

العب

ملء الشاشة (f)

Deck 2: An Introduction to Cost Terms and Concepts

1

The direct material cost is £10,000 when 2,000 units are produced. What is the direct material cost for 2,500 units produced?

A) £10,000

B) £8,000

C) £15,000

D) £12,500

A) £10,000

B) £8,000

C) £15,000

D) £12,500

D

2

Direct materials are an example of a

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

B

3

Assuming costs are represented on the vertical axis and volume of activity on the horizontal axis, which of the following costs would be represented by a line that starts at the origin and reaches a maximum value and beyond the point that the line becomes parallel to the horizontal axis?

A) total direct material costs

B) a consultant paid £100 per hour with a maximum fee of £2,000

C) employees who are paid £15 per hour and guaranteed a minimum weekly wage of £300

D) rent on exhibit space at a convention

A) total direct material costs

B) a consultant paid £100 per hour with a maximum fee of £2,000

C) employees who are paid £15 per hour and guaranteed a minimum weekly wage of £300

D) rent on exhibit space at a convention

B

4

Which of the following is an example of a step-fixed cost?

A) cost of disposable surgical scissors, which are purchased in increments of 100

B) cost of soaking solution to clean jewelry (Each jar can soak 50 rings before losing effectiveness.)

C) cost of tuition at £300 per credit hour up to 15 credit hours (Hours taken in excess of 15 hours are free.)

D) cost of disposable gowns used by patients in a hospital

A) cost of disposable surgical scissors, which are purchased in increments of 100

B) cost of soaking solution to clean jewelry (Each jar can soak 50 rings before losing effectiveness.)

C) cost of tuition at £300 per credit hour up to 15 credit hours (Hours taken in excess of 15 hours are free.)

D) cost of disposable gowns used by patients in a hospital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

5

An equipment lease that specifies a payment of £5,000 per month plus £8 per machine hour used is an example of a

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

6

Adams Ltd. rents a truck for a flat fee plus an additional charge per mile. What type of cost is the rent?

A) fixed cost

B) mixed cost

C) variable cost

D) step cost

A) fixed cost

B) mixed cost

C) variable cost

D) step cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which item is not an example of a sunk cost?

A) materials needed for production

B) purchase cost of machinery

C) depreciation

D) All are sunk costs.

A) materials needed for production

B) purchase cost of machinery

C) depreciation

D) All are sunk costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is an example of a fixed cost?

A) power cost in the machining department

B) wood in the manufacture of furniture

C) labour cost paid on a piece basis

D) lease payments on machinery

A) power cost in the machining department

B) wood in the manufacture of furniture

C) labour cost paid on a piece basis

D) lease payments on machinery

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

9

Variable costs,

A) in total, remain constant within a relevant range.

B) on a per unit basis, are constant as activity increases or decreases.

C) on a per unit basis, decreases as activity decreases.

D) in total, decrease when activity increases.

A) in total, remain constant within a relevant range.

B) on a per unit basis, are constant as activity increases or decreases.

C) on a per unit basis, decreases as activity decreases.

D) in total, decrease when activity increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

10

Salaries paid to shift supervisors is an example of a

A) step-variable cost.

B) step-fixed cost.

C) variable cost.

D) mixed cost.

A) step-variable cost.

B) step-fixed cost.

C) variable cost.

D) mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

11

Mixed costs contain both

A) product and period costs.

B) fixed and variable costs.

C) direct and indirect costs.

D) controllable and noncontrollable costs.

A) product and period costs.

B) fixed and variable costs.

C) direct and indirect costs.

D) controllable and noncontrollable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

12

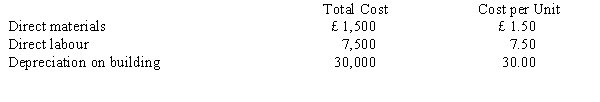

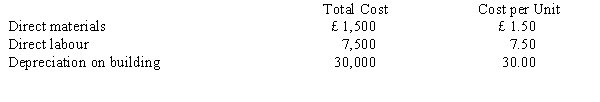

Holly Ltd. has the following costs for 1,000 units:  What is the total amount of direct materials for 100 units?

What is the total amount of direct materials for 100 units?

A) £1.50

B) £3.00

C) £150.00

D) £225.00

What is the total amount of direct materials for 100 units?

What is the total amount of direct materials for 100 units?A) £1.50

B) £3.00

C) £150.00

D) £225.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

13

As the volume of activity increases within the relevant range, the variable cost per unit

A) decreases.

B) decreases at first, then increases.

C) remains the same.

D) increases.

A) decreases.

B) decreases at first, then increases.

C) remains the same.

D) increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

14

Fixed cost per unit is £9 when 20,000 units are produced and £6 when 30,000 units are produced. What is the total fixed cost when nothing is produced?

A) £120,000

B) £270,000

C) £15

D) £180,000

A) £120,000

B) £270,000

C) £15

D) £180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

15

If production volume increases from 8,000 to 10,000 units,

A) total costs will increase by 20 per cent.

B) total costs will increase by 25 per cent.

C) total variable costs will increase by 25 per cent.

D) mixed and variable costs will increase by 25 per cent.

A) total costs will increase by 20 per cent.

B) total costs will increase by 25 per cent.

C) total variable costs will increase by 25 per cent.

D) mixed and variable costs will increase by 25 per cent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements is TRUE about fixed and variable costs?

A) Both costs are constant when considered on a per-unit basis.

B) Both costs are constant when considered on a total basis.

C) Fixed costs are constant in total and variable costs are constant per unit.

D) Variable costs are constant in total and fixed costs are constant per unit.

A) Both costs are constant when considered on a per-unit basis.

B) Both costs are constant when considered on a total basis.

C) Fixed costs are constant in total and variable costs are constant per unit.

D) Variable costs are constant in total and fixed costs are constant per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

17

Assuming costs are represented on the vertical axis and volume of activity on the horizontal axis, which of the following costs would be represented by a line that is parallel to the horizontal axis?

A) total direct material costs

B) a consultant paid £75 per hour with a maximum fee of £1,200

C) employees who are paid £10 per hour and guaranteed a minimum weekly wage of £200

D) rent on exhibit space at a convention

A) total direct material costs

B) a consultant paid £75 per hour with a maximum fee of £1,200

C) employees who are paid £10 per hour and guaranteed a minimum weekly wage of £200

D) rent on exhibit space at a convention

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

18

Sunk costs are

A) future costs that have no benefit.

B) relevant costs that have only short-run benefits.

C) target costs.

D) cannot be avoided.

A) future costs that have no benefit.

B) relevant costs that have only short-run benefits.

C) target costs.

D) cannot be avoided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

19

A supervisor's salary of £2,000 per month is an example of a

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

A) fixed cost.

B) variable cost.

C) step cost.

D) mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following costs is a variable cost?

A) supervisors' salaries

B) research and development

C) materials used in production

D) rent

A) supervisors' salaries

B) research and development

C) materials used in production

D) rent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is an example of a variable cost?

A) insurance on the production equipment

B) direct materials

C) the production supervisor's salary

D) depreciation of the factory building

A) insurance on the production equipment

B) direct materials

C) the production supervisor's salary

D) depreciation of the factory building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is an example of a possible cost object?

A) a product

B) a customer

C) a department

D) All of these could be possible cost objects.

A) a product

B) a customer

C) a department

D) All of these could be possible cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following costs is an example of product costs?

A) selling commissions

B) nonfactory office salaries

C) direct materials

D) advertising expense

A) selling commissions

B) nonfactory office salaries

C) direct materials

D) advertising expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following cost behaviour patterns are unrelated to unit activity?

A) fixed costs

B) variable costs

C) step costs

D) mixed costs

A) fixed costs

B) variable costs

C) step costs

D) mixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

25

Mixed costs

A) are step costs.

B) in total, remain constant within a relevant range.

C) have a fixed and variable component.

D) on a per unit basis, are constant as activity increases or decreases.

A) are step costs.

B) in total, remain constant within a relevant range.

C) have a fixed and variable component.

D) on a per unit basis, are constant as activity increases or decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following costs incurred by a chair manufacturer would be traced to the product cost through direct tracing?

A) the depreciation on factory equipment

B) the supervisor's salary

C) the insurance on the factory building

D) the woodmaker's salary

A) the depreciation on factory equipment

B) the supervisor's salary

C) the insurance on the factory building

D) the woodmaker's salary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

27

Whether a cost is fixed or variable depends on the time horizon. In the long run, all costs are

A) fixed.

B) variable.

C) mixed.

D) step.

A) fixed.

B) variable.

C) mixed.

D) step.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which statement describes step-cost behaviour?

A) discontinuous

B) displays a constant level of cost for a range of output and then jumps to a higher level at some point

C) must be purchased in chunks

D) All of the above describe step-cost behaviour.

A) discontinuous

B) displays a constant level of cost for a range of output and then jumps to a higher level at some point

C) must be purchased in chunks

D) All of the above describe step-cost behaviour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

29

Direct costs

A) are incurred for the benefit of the business as a whole.

B) would continue even if a particular product were discontinued.

C) can be assigned to product only by a process of allocation.

D) are those costs that can be easily and accurately traced to a cost objective.

A) are incurred for the benefit of the business as a whole.

B) would continue even if a particular product were discontinued.

C) can be assigned to product only by a process of allocation.

D) are those costs that can be easily and accurately traced to a cost objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

30

In a traditional manufacturing company, product costs include

A) direct materials only.

B) direct materials, direct labour, and factory overhead.

C) direct materials and direct labour only.

D) direct labour only.

A) direct materials only.

B) direct materials, direct labour, and factory overhead.

C) direct materials and direct labour only.

D) direct labour only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following costs would be classified as fixed costs with respect to volume?

A) the salary of the manager of the Research and Development Department

B) the cost of a copy machine in the Human Resource Department

C) the property taxes on the manufacturing facility

D) all of the above

A) the salary of the manager of the Research and Development Department

B) the cost of a copy machine in the Human Resource Department

C) the property taxes on the manufacturing facility

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following costs is NOT a product cost?

A) rent on an office building

B) indirect labour

C) repairs on manufacturing equipment

D) steel used in inventory items produced

A) rent on an office building

B) indirect labour

C) repairs on manufacturing equipment

D) steel used in inventory items produced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which one of the following sentences about step costs is true?

A) Step costs increase with each additional unit produced.

B) Step costs have no relation to number of units produced.

C) Step costs are constant within certain ranges of activity but differ outside those ranges of activity.

D) Step costs are variable within narrowly defined ranges of activity, but constant over wider ranges of activity.

A) Step costs increase with each additional unit produced.

B) Step costs have no relation to number of units produced.

C) Step costs are constant within certain ranges of activity but differ outside those ranges of activity.

D) Step costs are variable within narrowly defined ranges of activity, but constant over wider ranges of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following costs incurred by a bus manufacturer would NOT be directly attributable to the finished product?

A) the wages paid to assembly-line production workers

B) the tires for buses

C) the windshields for buses

D) the depreciation on factory building

A) the wages paid to assembly-line production workers

B) the tires for buses

C) the windshields for buses

D) the depreciation on factory building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following costs is an indirect product cost?

A) property taxes on plant facilities

B) wages of assembly workers

C) materials used

D) president's salary

A) property taxes on plant facilities

B) wages of assembly workers

C) materials used

D) president's salary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

36

The direct costs of operating a university computer centre would NOT include

A) rent paid for computers.

B) a fair share of university utilities.

C) paper used by the centre.

D) computer consultants' salaries.

A) rent paid for computers.

B) a fair share of university utilities.

C) paper used by the centre.

D) computer consultants' salaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

37

A cost used up in the production of revenues is a(n)

A) unexpired cost.

B) expense.

C) loss.

D) asset.

A) unexpired cost.

B) expense.

C) loss.

D) asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following costs incurred by a furniture manufacturer would be a product cost?

A) lumber

B) office salaries

C) commissions paid to sales staff

D) controller's salary

A) lumber

B) office salaries

C) commissions paid to sales staff

D) controller's salary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following costs would be classified as variable costs with respect to volume?

A) property taxes on the manufacturing facility

B) the wheels on an automobile

C) the cost of installing production equipment

D) all of the above

A) property taxes on the manufacturing facility

B) the wheels on an automobile

C) the cost of installing production equipment

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

40

An equipment lease that specifies payment of £1,000 per month plus £5 per machine hour used is an example of a

A) fixed cost.

B) variable cost.

C) mixed cost.

D) step cost.

A) fixed cost.

B) variable cost.

C) mixed cost.

D) step cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

41

Mulholland Company manufactures various wooden furniture products. If the cost object is a product, a chair, what costs would be considered direct?

A) manufacturing supervisor's salary

B) depreciation on the factory building

C) salary of the worker that glues the legs to the seat of the chair

D) insurance on the factory

A) manufacturing supervisor's salary

B) depreciation on the factory building

C) salary of the worker that glues the legs to the seat of the chair

D) insurance on the factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

42

An example of a period cost is

A) insurance on factory equipment.

B) chief executive's salary.

C) property taxes on factory building.

D) wages of factory custodians.

A) insurance on factory equipment.

B) chief executive's salary.

C) property taxes on factory building.

D) wages of factory custodians.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

43

____ are expensed in the period in which they are incurred.

A) Direct materials

B) Product costs

C) Factory overhead

D) Nonproduction costs

A) Direct materials

B) Product costs

C) Factory overhead

D) Nonproduction costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

44

Selling and administrative costs are classified as

A) product costs.

B) conversion costs.

C) period costs.

D) factory overhead.

A) product costs.

B) conversion costs.

C) period costs.

D) factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following costs is NOT recorded in the company's accounting system?

A) sunk cost

B) opportunity cost

C) direct cost

D) indirect cost

A) sunk cost

B) opportunity cost

C) direct cost

D) indirect cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following costs is a period cost for a manufacturing company?

A) accountant's salary

B) wages of machine operators

C) insurance on factory equipment

D) fringe benefits on factory employees

A) accountant's salary

B) wages of machine operators

C) insurance on factory equipment

D) fringe benefits on factory employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is a product cost?

A) advertising expenditures

B) insurance on the office buildings

C) depreciation of the salesmen's cars

D) depreciation of the production facilities

A) advertising expenditures

B) insurance on the office buildings

C) depreciation of the salesmen's cars

D) depreciation of the production facilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

48

____ are expensed in the period in which they are incurred.

A) Direct materials

B) Product costs

C) Noninventoriable costs

D) Inventoriable costs

A) Direct materials

B) Product costs

C) Noninventoriable costs

D) Inventoriable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

49

Indirect costs are usually allocated rather than traced to cost objects because

A) allocation is required by external reporting requirements.

B) overall accuracy is improved by allocation.

C) no causal relationship exists between indirect costs and the cost object.

D) allocation is more convenient than tracing.

A) allocation is required by external reporting requirements.

B) overall accuracy is improved by allocation.

C) no causal relationship exists between indirect costs and the cost object.

D) allocation is more convenient than tracing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following costs would be included as part of factory overhead?

A) depreciation of plant equipment

B) paint used for product finish

C) depreciation on the corporation's office building

D) paper used in the production of books

A) depreciation of plant equipment

B) paint used for product finish

C) depreciation on the corporation's office building

D) paper used in the production of books

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

51

If total warehousing cost for the year amounts to £350,000, and 40 per cent of the warehousing activity is associated with finished goods and 60 per cent with direct materials, how much of the cost would be charged as a product cost?

A) £70,000

B) £140,000

C) £210,000

D) £350,000

A) £70,000

B) £140,000

C) £210,000

D) £350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

52

Product costs are converted from cost to expense when

A) units are completed.

B) materials are purchased.

C) units are sold.

D) materials are requisitioned.

A) units are completed.

B) materials are purchased.

C) units are sold.

D) materials are requisitioned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

53

All of Jill Enterprise's operations are housed in one building with the costs of occupying the building accumulated in a separate account. The total costs incurred in May amounted to £24,000. The company allocates these costs on the basis of square feet of floor space occupied. Administrative offices, sales offices, and factory operations occupy 9,000, 6,000, and 30,000 square feet, respectively. How much will be classified as a product cost for May?

A) £4,800

B) £3,200

C) £16,000

D) £24,000

A) £4,800

B) £3,200

C) £16,000

D) £24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

54

The wages of a production equipment operator would be classified as

A) direct materials.

B) direct labour.

C) manufacturing overhead.

D) selling and administrative costs.

A) direct materials.

B) direct labour.

C) manufacturing overhead.

D) selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

55

All of the following are product costs EXCEPT

A) direct materials.

B) direct labour.

C) manufacturing overhead.

D) selling and administrative costs.

E) none of the above.

A) direct materials.

B) direct labour.

C) manufacturing overhead.

D) selling and administrative costs.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

56

Prime product costs include

A) only factory overhead.

B) only direct labour.

C) direct labour and factory overhead.

D) direct materials and direct labour.

A) only factory overhead.

B) only direct labour.

C) direct labour and factory overhead.

D) direct materials and direct labour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following items would NOT be classified as part of factory overhead of a firm that makes sailboats?

A) factory supplies used

B) canvas used in sail

C) depreciation of factory buildings

D) indirect materials

A) factory supplies used

B) canvas used in sail

C) depreciation of factory buildings

D) indirect materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

58

TEK, Inc., is considering whether to replace a production machine with a newer model of the same machine. If TEK keeps the old machine, the trade-in value of the old equipment is an example of a(n)

A) sunk cost.

B) opportunity cost.

C) avoidable cost.

D) imputed cost.

A) sunk cost.

B) opportunity cost.

C) avoidable cost.

D) imputed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

59

Direct costs

A) can be assigned to cost objects in an economically feasible way.

B) are typically assigned to cost objects using a cause-and-effect relationship.

C) result in more accurate cost assignments.

D) do all of the above.

A) can be assigned to cost objects in an economically feasible way.

B) are typically assigned to cost objects using a cause-and-effect relationship.

C) result in more accurate cost assignments.

D) do all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

60

Harry has just received his bachelor's degree and is considering two alternatives. (1) He could obtain an entry-level accounting position paying £30,000 per year. (2) He could obtain his master's degree with one more year of study and work part-time for £8,000 per year. The opportunity cost associated with Harry obtaining his master's degree is

A) £-0-.

B) £22,000.

C) £30,000.

D) £38,000.

A) £-0-.

B) £22,000.

C) £30,000.

D) £38,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

61

Unit costs are critical for

A) valuing inventory.

B) determining net income.

C) decisions to enter a new product line.

D) all of the above.

A) valuing inventory.

B) determining net income.

C) decisions to enter a new product line.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is a period cost?

A) the production supervisor's salary

B) direct labour

C) property taxes on the office building

D) property taxes on the production facilities

A) the production supervisor's salary

B) direct labour

C) property taxes on the office building

D) property taxes on the production facilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

63

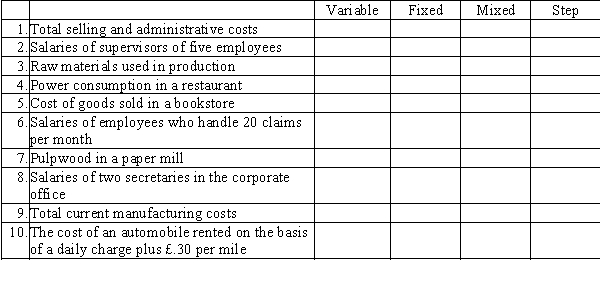

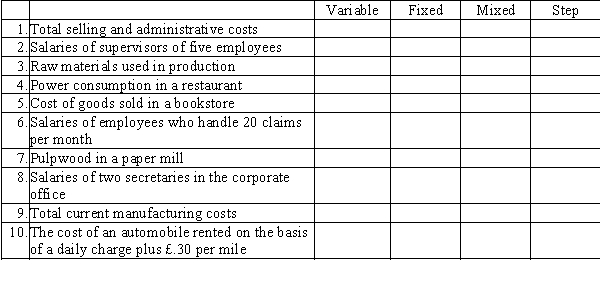

Classify each of the following costs as variable, fixed, mixed, or step by writing an X under one of the following headings (Sales volume is the cost driver).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

64

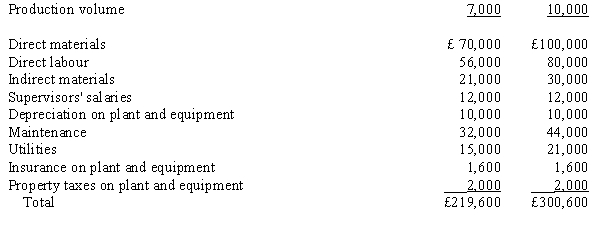

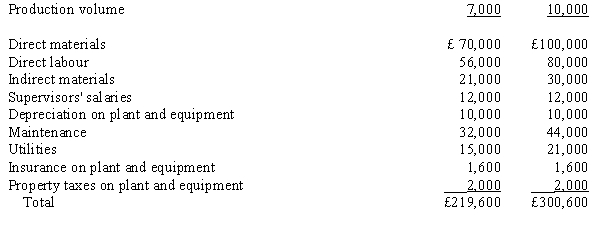

The Penang Company has the following information available regarding costs at various levels of monthly production:  Required:

Required:

a.

Identify each cost as being variable, fixed, or mixed by writing the name of each cost under one of the following headings:

Variable Costs

Fixed Costs

Mixed Costs

b.

Develop an equation for total monthly production costs.

c.

Predict total costs for a monthly production volume of 8,000 units.

Required:

Required: a.

Identify each cost as being variable, fixed, or mixed by writing the name of each cost under one of the following headings:

Variable Costs

Fixed Costs

Mixed Costs

b.

Develop an equation for total monthly production costs.

c.

Predict total costs for a monthly production volume of 8,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck