Deck 13: Capital Investment Decisions: Appraisal Methods

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/77

العب

ملء الشاشة (f)

Deck 13: Capital Investment Decisions: Appraisal Methods

1

Firms may select projects with short paybacks because

A) projects with longer paybacks may be riskier.

B) shorter paybacks may help reduce liquidity problems.

C) if the risk of obsolescence is high, the firm may want to recover the funds rapidly.

D) All of the above are correct.

A) projects with longer paybacks may be riskier.

B) shorter paybacks may help reduce liquidity problems.

C) if the risk of obsolescence is high, the firm may want to recover the funds rapidly.

D) All of the above are correct.

D

2

The time required for a project to return its investment is the

A) accounting rate of return.

B) interest.

C) net present value.

D) payback period.

A) accounting rate of return.

B) interest.

C) net present value.

D) payback period.

D

3

Projects that, if accepted, preclude the acceptance of competing projects are

A) priority projects.

B) mutually exclusive projects.

C) independent projects.

D) equity projects.

A) priority projects.

B) mutually exclusive projects.

C) independent projects.

D) equity projects.

B

4

If the annual cash flows are not an annuity (equal each period), payback is calculated by

A) dividing the investment required by the average annual cash inflow.

B) dividing the average annual cash inflow by the investment required.

C) accumulating the net cash flows until they equal the initial investment.

D) Payback cannot be calculated for a project with unequal cash flows.

A) dividing the investment required by the average annual cash inflow.

B) dividing the average annual cash inflow by the investment required.

C) accumulating the net cash flows until they equal the initial investment.

D) Payback cannot be calculated for a project with unequal cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following methods consider the time value of money?

A) payback and accounting rate of return

B) payback and internal rate of return

C) internal rate of return and accounting rate of return

D) internal rate of return and net present value

A) payback and accounting rate of return

B) payback and internal rate of return

C) internal rate of return and accounting rate of return

D) internal rate of return and net present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the annual cash flows are an annuity (equal each period), payback is calculated as

A) Annual net cash inflows/Capital investment.

B) Capital investment/Annual net cash inflows.

C) Annual net cash inflows/Present value factor.

D) (Annual net cash inflows - Annual depreciation)/Capital investment.

A) Annual net cash inflows/Capital investment.

B) Capital investment/Annual net cash inflows.

C) Annual net cash inflows/Present value factor.

D) (Annual net cash inflows - Annual depreciation)/Capital investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

7

A firm is considering two projects with the following cash flows:  Each project requires an investment of £120,000. Which project will have the higher net present value?

Each project requires an investment of £120,000. Which project will have the higher net present value?

A) Project A

B) Project B

C) Project A and Project B will have the same net present value.

D) The question cannot be answered from the information provided.

Each project requires an investment of £120,000. Which project will have the higher net present value?

Each project requires an investment of £120,000. Which project will have the higher net present value?A) Project A

B) Project B

C) Project A and Project B will have the same net present value.

D) The question cannot be answered from the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

8

The internal rate of return is the

A) rate of return that sets the project's net present value equal to zero.

B) hurdle rate.

C) cost of capital.

D) required rate of return.

A) rate of return that sets the project's net present value equal to zero.

B) hurdle rate.

C) cost of capital.

D) required rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

9

Future cash flows expressed in present value terms are

A) compounded cash flows.

B) extended cash flows.

C) budgeted cash flows.

D) discounted cash flows.

A) compounded cash flows.

B) extended cash flows.

C) budgeted cash flows.

D) discounted cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is a weakness of the payback method?

A) It emphasizes projects with possible liquidity problems.

B) It ignores the profitability of investments beyond the payback period.

C) It can be used in conjunction with discounted cash flow methods.

D) both a and b above

A) It emphasizes projects with possible liquidity problems.

B) It ignores the profitability of investments beyond the payback period.

C) It can be used in conjunction with discounted cash flow methods.

D) both a and b above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

11

If a project has a net present value of £0 when a discount rate of 10 per cent is used, what can be concluded about the rate of return of the project?

A) The rate of return is greater than 10 per cent.

B) The rate of return is less than 10 per cent.

C) The rate of return equals 10 per cent.

D) The rate of return is 0.

A) The rate of return is greater than 10 per cent.

B) The rate of return is less than 10 per cent.

C) The rate of return equals 10 per cent.

D) The rate of return is 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

12

When the discount rate is decreased,

A) the present value of future cash flows increases.

B) the present value of future cash flows decreases.

C) there is no change in the present value.

D) net present value would equal zero.

A) the present value of future cash flows increases.

B) the present value of future cash flows decreases.

C) there is no change in the present value.

D) net present value would equal zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

13

The accounting rate of return is calculated as

A) Investment/Income.

B) Income/Debt.

C) Income/Investment.

D) Assets/Debt.

A) Investment/Income.

B) Income/Debt.

C) Income/Investment.

D) Assets/Debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following methods uses income instead of cash flows?

A) payback

B) accounting rate of return

C) internal rate of return

D) net present value

A) payback

B) accounting rate of return

C) internal rate of return

D) net present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

15

A firm is evaluating a project that has a net present value of £0 when a discount rate of 8 per cent is used. A discount rate of 10 per cent will result in

A) a negative net present value.

B) a positive net present value.

C) a net present value of £0.

D) The question cannot be answered based upon the information provided.

A) a negative net present value.

B) a positive net present value.

C) a net present value of £0.

D) The question cannot be answered based upon the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

16

Why would a company use the accounting rate of return?

A) to ensure that a new investment will not adversely affect accounting income

B) because it does not consider the time value of money

C) because it is a measure of liquidity

D) all of the above

A) to ensure that a new investment will not adversely affect accounting income

B) because it does not consider the time value of money

C) because it is a measure of liquidity

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

17

A firm is evaluating a project that has a net present value of £0 when a discount rate of 8 per cent is used. A discount rate of 6 per cent will result in

A) a negative net present value.

B) a positive net present value.

C) a net present value of £0.

D) The question cannot be answered based upon the information provided.

A) a negative net present value.

B) a positive net present value.

C) a net present value of £0.

D) The question cannot be answered based upon the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

18

____ are capital budgeting models that identify criteria for accepting or rejecting projects without considering the time value of money.

A) Net present value models

B) Nondiscounting models

C) Discounting models

D) Capital return models

A) Net present value models

B) Nondiscounting models

C) Discounting models

D) Capital return models

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following methods assumes a reinvestment rate equal to the discount rate?

A) payback

B) accounting rate of return

C) net present value

D) internal rate of return

A) payback

B) accounting rate of return

C) net present value

D) internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

20

If the investment's internal rate of return is more than the required rate of return, the investment should be

A) accepted.

B) rejected.

C) put on hold.

D) None of the above are correct.

A) accepted.

B) rejected.

C) put on hold.

D) None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

21

The Bradshaw Company is considering purchasing equipment for £78,000. This equipment will save the company £22,000 in operating costs annually. The payback period for this equipment is

A) 3.5 years.

B) 4 years.

C) 2.2 years.

D) 0.3 years.

A) 3.5 years.

B) 4 years.

C) 2.2 years.

D) 0.3 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

22

Why do the NPV method and the IRR method sometimes produce different rankings of mutually exclusive investment projects?

A) The NPV method does not assume reinvestment of cash flows, while the IRR method assumes the cash flows will be reinvested at the internal rate of return.

B) The NPV method assumes a reinvestment rate equal to the discount rate, while the IRR method assumes a reinvestment rate equal to the internal rate of return.

C) The IRR method does not assume reinvestment of the cash flows, while the NPV method assumes the reinvestment rate is equal to the discount rate.

D) The NPV method assumes a reinvestment rate equal to the bank loan interest rate, while the IRR method assumes a reinvestment rate equal to the discount rate.

A) The NPV method does not assume reinvestment of cash flows, while the IRR method assumes the cash flows will be reinvested at the internal rate of return.

B) The NPV method assumes a reinvestment rate equal to the discount rate, while the IRR method assumes a reinvestment rate equal to the internal rate of return.

C) The IRR method does not assume reinvestment of the cash flows, while the NPV method assumes the reinvestment rate is equal to the discount rate.

D) The NPV method assumes a reinvestment rate equal to the bank loan interest rate, while the IRR method assumes a reinvestment rate equal to the discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

23

A firm is considering a project with annual cash flows of £40,000. The project would have a 10-year life, and the company uses a discount rate of 8 per cent. What is the maximum amount the company could invest in the project and the project still be acceptable?

A) £400,000

B) £268,400

C) £203,200

D) £363,600

A) £400,000

B) £268,400

C) £203,200

D) £363,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

24

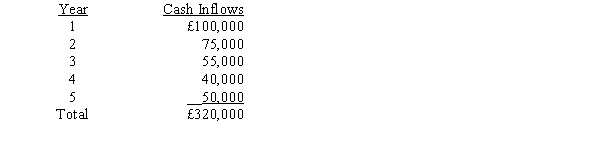

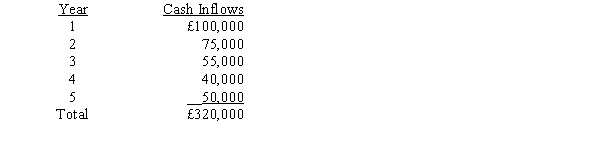

Lewis Manufacturing Company is planning to invest in equipment costing £240,000. The estimated cash flows from this equipment are expected to be as follows:  Assume that the cash inflows occur evenly over the year. The payback period for this investment is

Assume that the cash inflows occur evenly over the year. The payback period for this investment is

A) 3.75 years.

B) 3.25 years.

C) 2.4 years.

D) 1.3 years.

Assume that the cash inflows occur evenly over the year. The payback period for this investment is

Assume that the cash inflows occur evenly over the year. The payback period for this investment isA) 3.75 years.

B) 3.25 years.

C) 2.4 years.

D) 1.3 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

25

A firm is considering a project requiring an investment of £14,150. The project would generate annual cash inflows of £3,300 per year for the next seven years. The approximate internal rate of return for the project is

A) 6%.

B) 8%.

C) 12%.

D) 14%.

A) 6%.

B) 8%.

C) 12%.

D) 14%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

26

The present value of £2,000 to be received three years from now and earning a 12 per cent return is

A) £1,424.

B) £1,760.

C) £2,440.

D) £2,720.

A) £1,424.

B) £1,760.

C) £2,440.

D) £2,720.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

27

Brooks Company invested in a project that is expected to have an annual cash flow of £10,000. The project's life is five years and has an IRR of 14 per cent. How much was the initial investment in the project?

A) £34,330

B) £50,000

C) £36,050

D) £29,140

A) £34,330

B) £50,000

C) £36,050

D) £29,140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

28

Lake Kariba Company is considering buying a new boat that would cost £120,000. The accountant determined that the boat promises an internal rate of return of 10 per cent and has a life of four years. The accountant resigned and the president wanted to check her calculations. What were the approximate annual net cash inflows from the project?

A) £20,490

B) £30,000

C) £37,855

D) Net cash inflows cannot be determined from the information given.

A) £20,490

B) £30,000

C) £37,855

D) Net cash inflows cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

29

A firm is considering a project with annual cash flows of £75,000. The project would have a 7-year life, and the company uses a discount rate of 10 per cent. What is the maximum amount the company could invest in the project and the project still be acceptable?

A) £525,000

B) £365,100

C) £269,325

D) none of the above

A) £525,000

B) £365,100

C) £269,325

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

30

How is working capital needed in the operations of investments treated in discounted cash flow analysis?

A) added to cost of the investment

B) added to cash inflows when recovery occurs

C) both a and b

D) none of the above

A) added to cost of the investment

B) added to cash inflows when recovery occurs

C) both a and b

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

31

The present value of £8,000 to be received each year for ten years and earning a 16 per cent return is

A) £1,655.

B) £1,816.

C) £35,242.

D) £38,664.

A) £1,655.

B) £1,816.

C) £35,242.

D) £38,664.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

32

If NPV and IRR produce different rankings, which method should be used in choosing investment projects?

A) payback

B) accounting rate of return

C) net present value

D) internal rate of return

A) payback

B) accounting rate of return

C) net present value

D) internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

33

The present value of £10,000 to be received five years from now and earning a 12 per cent return is

A) £2,774.

B) £5,670.

C) £17,637.

D) £36,050.

A) £2,774.

B) £5,670.

C) £17,637.

D) £36,050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

34

Ducky Pizza Restaurant purchases a van to deliver pizzas to their customers. The van costs £28,000 and is projected to increase revenues by £10,000 a year and to increase costs by £4,500. The payback period for this van is

A) 2.8 years.

B) 6.2 years.

C) 5.1 years.

D) 0.4 years.

A) 2.8 years.

B) 6.2 years.

C) 5.1 years.

D) 0.4 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

35

Kaylin Company purchased a piece of equipment for £100,000 that had a useful life of 5 years. The equipment had no salvage value. It saves the company £40,000 a year and costs the company £5,000 a year to operate. What is the accounting rate of return on the equipment?

A) 30%

B) 15%

C) 40%

D) 35%

A) 30%

B) 15%

C) 40%

D) 35%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

36

A firm is considering a project with annual cash flows of £120,000. The project would have an 8-year life, and the company uses a discount rate of 12 per cent. What is the maximum amount the company could invest in the project and the project still be acceptable?

A) £488,740

B) £562,614

C) £580,291

D) £596,160

A) £488,740

B) £562,614

C) £580,291

D) £596,160

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

37

Matusadona Company plans to invest £450,000 in a new factory. With a discount rate of 14 per cent, the present value from the factory is £483,000. To yield a 14 per cent internal rate of return, the actual investment cost cannot exceed the £450,000 estimate by more than

A) £63,000.

B) £33,000.

C) £16,500.

D) This cannot be determined from the information given.

A) £63,000.

B) £33,000.

C) £16,500.

D) This cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

38

A firm is considering a project requiring an investment of £100,000. The project would generate annual cash inflows of £26,380 per year for the next five years. The approximate internal rate of return for the project is

A) 8%.

B) 10%.

C) 12%.

D) 16%.

A) 8%.

B) 10%.

C) 12%.

D) 16%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is NOT included in the calculation of net present value of a proposed project? (Ignore income taxes.)

A) salvage value

B) working capital

C) discount rate

D) depreciation expense

A) salvage value

B) working capital

C) discount rate

D) depreciation expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

40

The present value of £2,000 to be received each year for three years and earning a 10 per cent return is

A) £5,560.

B) £4,974.

C) £4,922.

D) £4,600.

A) £5,560.

B) £4,974.

C) £4,922.

D) £4,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

41

Figure 13-6

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. If depreciation is £90,000 per year, JD's accounting rate of return based on the average investment would be

A) 12.0%.

B) 14.5%.

C) 17.0%.

D) 17.5%.

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. If depreciation is £90,000 per year, JD's accounting rate of return based on the average investment would be

A) 12.0%.

B) 14.5%.

C) 17.0%.

D) 17.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following capital investment models would be preferred when choosing among mutually exclusive alternatives?

A) payback period

B) accounting rate of return

C) IRR

D) NPV

A) payback period

B) accounting rate of return

C) IRR

D) NPV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

43

A firm is considering a project with an annual cash flow of £200,000. The project would have a 7-year life, and the company uses a discount rate of 10 per cent. Ignoring income taxes, what is the maximum amount the company could invest in the project and have the project still be acceptable?

A) £718,200

B) £1,400,000

C) £973,600

D) £200,000

A) £718,200

B) £1,400,000

C) £973,600

D) £200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

44

Figure 13-1

A project requires an investment of £90,000 in equipment. Annual cash inflows of £15,000 are expected to occur for the next ten years. No salvage value is expected.

Refer to Figure 13-1. If the annual cash inflows occur throughout the year, payback for the project would be

A) 4.5 years.

B) 4.8 years.

C) 5 years.

D) 6 years.

A project requires an investment of £90,000 in equipment. Annual cash inflows of £15,000 are expected to occur for the next ten years. No salvage value is expected.

Refer to Figure 13-1. If the annual cash inflows occur throughout the year, payback for the project would be

A) 4.5 years.

B) 4.8 years.

C) 5 years.

D) 6 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

45

Figure 13-6

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. Based on quantitative factors, should JD accept, reject, or wait on the project?

A) accept

B) reject

C) wait

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. Based on quantitative factors, should JD accept, reject, or wait on the project?

A) accept

B) reject

C) wait

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

46

Figure 13-3

Glady, Inc., is considering the purchase of production equipment that costs £800,000. The equipment is expected to generate annual cash inflows of £250,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 14 per cent.

Refer to Figure 13-3. Payback for Glady's project is

A) 5 years.

B) 3.2 years.

C) 4 years.

D) 3.125 years.

Glady, Inc., is considering the purchase of production equipment that costs £800,000. The equipment is expected to generate annual cash inflows of £250,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 14 per cent.

Refer to Figure 13-3. Payback for Glady's project is

A) 5 years.

B) 3.2 years.

C) 4 years.

D) 3.125 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

47

Refer to Figure 13-2. The net present value of the project is

A) £24,500.

B) £36,411.

C) £44,200.

D) £46,220.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

48

Figure 13-1

A project requires an investment of £90,000 in equipment. Annual cash inflows of £15,000 are expected to occur for the next ten years. No salvage value is expected.

Refer to Figure 13-1. Using the initial capital investment, the accounting rate of return for the project would be

A) 6.25%.

B) 6.67%.

C) 16.67%.

D) 26.67%.

A project requires an investment of £90,000 in equipment. Annual cash inflows of £15,000 are expected to occur for the next ten years. No salvage value is expected.

Refer to Figure 13-1. Using the initial capital investment, the accounting rate of return for the project would be

A) 6.25%.

B) 6.67%.

C) 16.67%.

D) 26.67%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

49

Figure 13-6

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. JD's approximate internal rate of return of the project is

A) 17%.

B) 15%.

C) 13%.

D) 12%.

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. JD's approximate internal rate of return of the project is

A) 17%.

B) 15%.

C) 13%.

D) 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

50

Figure 13-5

Refer to Figure 13-5. The net present value of the project is

A) (£3,215).

B) £393.

C) £6,102.

D) £6,412.

Refer to Figure 13-5. The net present value of the project is

A) (£3,215).

B) £393.

C) £6,102.

D) £6,412.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

51

A firm is considering a project with an annual cash flow of £240,000. The project would have an 8-year life, and the company uses a discount rate of 12 per cent. Ignoring income taxes, what is the maximum amount the company could invest in the project and have the project still be acceptable (rounded)?

A) £977,480

B) £1,125,228

C) £1,160,582

D) £1,192,320

A) £977,480

B) £1,125,228

C) £1,160,582

D) £1,192,320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

52

Figure 13-6

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. JD's payback for the project is

A) 2.9 years.

B) 3.2 years.

C) 3.25 years.

D) 4.2 years.

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. JD's payback for the project is

A) 2.9 years.

B) 3.2 years.

C) 3.25 years.

D) 4.2 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

53

Figure 13-3

Glady, Inc., is considering the purchase of production equipment that costs £800,000. The equipment is expected to generate annual cash inflows of £250,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 14 per cent.

Refer to Figure 13-3. Excluding the effect of income taxes, Glady's net present value of the project is

A) £165,200.

B) £450,000.

C) £58,250.

D) £233,550.

Glady, Inc., is considering the purchase of production equipment that costs £800,000. The equipment is expected to generate annual cash inflows of £250,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 14 per cent.

Refer to Figure 13-3. Excluding the effect of income taxes, Glady's net present value of the project is

A) £165,200.

B) £450,000.

C) £58,250.

D) £233,550.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

54

Figure 13-3

Glady, Inc., is considering the purchase of production equipment that costs £800,000. The equipment is expected to generate annual cash inflows of £250,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 14 per cent.

Refer to Figure 13-3. If depreciation is £190,000 per year, Glady's accounting rate of return based on the average investment would be

A) 15.0%.

B) 7.5%.

C) 6.25%.

D) 5.5%.

Glady, Inc., is considering the purchase of production equipment that costs £800,000. The equipment is expected to generate annual cash inflows of £250,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 14 per cent.

Refer to Figure 13-3. If depreciation is £190,000 per year, Glady's accounting rate of return based on the average investment would be

A) 15.0%.

B) 7.5%.

C) 6.25%.

D) 5.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

55

Refer to Figure 13-2. The present value of the annual net cash inflows from operations is

A) £77,740.

B) £86,669.

C) £116,411.

D) £124,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

56

Figure 13-5

Refer to Figure 13-5. The present value of the annual net cash inflows from operations is

A) £101,416.

B) £101,897.

C) £102,168.

D) £104,618.

Refer to Figure 13-5. The present value of the annual net cash inflows from operations is

A) £101,416.

B) £101,897.

C) £102,168.

D) £104,618.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

57

Figure 13-3

Glady, Inc., is considering the purchase of production equipment that costs £800,000. The equipment is expected to generate annual cash inflows of £250,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 14 per cent.

Refer to Figure 13-3. The approximate internal rate of return of Glady's project is

A) 16%.

B) 20%.

C) 24%.

D) 25%.

Glady, Inc., is considering the purchase of production equipment that costs £800,000. The equipment is expected to generate annual cash inflows of £250,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 14 per cent.

Refer to Figure 13-3. The approximate internal rate of return of Glady's project is

A) 16%.

B) 20%.

C) 24%.

D) 25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

58

Figure 13-4

A capital investment project requires an investment of £60,000 and has an expected life of four years. Annual cash flows, which occur evenly throughout the year, are expected to be as follows:

Refer to Figure 13-4. Payback for the project is

A) 2.25 years.

B) 2.5 years.

C) 3 years.

D) 2 years.

A capital investment project requires an investment of £60,000 and has an expected life of four years. Annual cash flows, which occur evenly throughout the year, are expected to be as follows:

Refer to Figure 13-4. Payback for the project is

A) 2.25 years.

B) 2.5 years.

C) 3 years.

D) 2 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

59

Figure 13-4

A capital investment project requires an investment of £60,000 and has an expected life of four years. Annual cash flows, which occur evenly throughout the year, are expected to be as follows:

Refer to Figure 13-4. The net present value of the project using a 6 per cent discount rate is

A) £40,960.

B) £43,950.

C) £53,160.

D) £35,040.

A capital investment project requires an investment of £60,000 and has an expected life of four years. Annual cash flows, which occur evenly throughout the year, are expected to be as follows:

Refer to Figure 13-4. The net present value of the project using a 6 per cent discount rate is

A) £40,960.

B) £43,950.

C) £53,160.

D) £35,040.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

60

Figure 13-6

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. JD's net present value of the project is

A) £40,480.

B) £48,625.

C) £50,625.

D) £54,450.

JD, Inc., is considering the purchase of production equipment that costs £400,000. The equipment is expected to generate annual cash inflows of £125,000. The equipment is expected to have a useful life of five years with no salvage value. The firm's cost of capital is 12 per cent.

Refer to Figure 13-6. JD's net present value of the project is

A) £40,480.

B) £48,625.

C) £50,625.

D) £54,450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

61

The problem with the accounting rate of return is that it fails to consider the:

A) profitability of the project.

B) life of the project.

C) timing of cash flows.

D) effect on net income.

A) profitability of the project.

B) life of the project.

C) timing of cash flows.

D) effect on net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

62

The internal rate of return model assumes that all net cash inflows are reinvested at the:

A) project's internal rate of return.

B) discount rate.

C) prime rate.

D) none of the above.

A) project's internal rate of return.

B) discount rate.

C) prime rate.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

63

Dale Davis Company is evaluating a proposal to purchase a new machine that would cost £100,000 and have a salvage value of £10,000 in four years. It would provide annual operating cash savings of £10,000, as follows:  If the new machine is purchased, the old machine will be sold for its current salvage value of £20,000. If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of £2,000. The old machine's present book value is £40,000. If kept, in one year the old machine will require repairs predicted to cost £35,000.

If the new machine is purchased, the old machine will be sold for its current salvage value of £20,000. If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of £2,000. The old machine's present book value is £40,000. If kept, in one year the old machine will require repairs predicted to cost £35,000.

Dale Davis's cost of capital is 14 per cent.

Required:

Should the new machine be purchased? Why or why not?

If the new machine is purchased, the old machine will be sold for its current salvage value of £20,000. If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of £2,000. The old machine's present book value is £40,000. If kept, in one year the old machine will require repairs predicted to cost £35,000.

If the new machine is purchased, the old machine will be sold for its current salvage value of £20,000. If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of £2,000. The old machine's present book value is £40,000. If kept, in one year the old machine will require repairs predicted to cost £35,000.Dale Davis's cost of capital is 14 per cent.

Required:

Should the new machine be purchased? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

64

Compare the various quantitative models used to evaluate capital budgeting proposals. Which models are preferred if used as the only criterion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

65

In computing the net present value of a project, a manager uses a cost of capital number that is too low. This error causes the manager to compute a net present value that:

A) is lower that what it in fact should be.

B) is higher that what it in fact should be.

C) has no effect on the net present value computation.

D) is undefined in mathematical terms.

A) is lower that what it in fact should be.

B) is higher that what it in fact should be.

C) has no effect on the net present value computation.

D) is undefined in mathematical terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

66

A capital investment project requires an investment of £75,000 and has an expected life of four years. Annual cash flows at the end of each year are expected to be as follows:  Required:

Required:

a.

Compute payback assuming that the cash flows occur evenly throughout the year.

b.

Compute the net present value of the project using a 12 per cent discount rate.

Required:

Required: a.

Compute payback assuming that the cash flows occur evenly throughout the year.

b.

Compute the net present value of the project using a 12 per cent discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is a capital investment criterion, but NOT captured in any of the basic capital budgeting models examined in the text?

A) the period of time required to recoup an initial investment

B) various non-quantitative factors

C) the time value of money

D) the company's discount rate

A) the period of time required to recoup an initial investment

B) various non-quantitative factors

C) the time value of money

D) the company's discount rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

68

A capital investment project requires an investment of £450,000. It has an expected life of six years with an annual cash flow of £90,000 received at the end of each year. The company uses the straight-line method of depreciation. Ignore income taxes.

Required:

a.

Compute payback for the project.

b.

Compute the net present value of the project using a 12 per cent discount rate.

c.

Would you recommend this project be accepted? Why or why not?

Required:

a.

Compute payback for the project.

b.

Compute the net present value of the project using a 12 per cent discount rate.

c.

Would you recommend this project be accepted? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

69

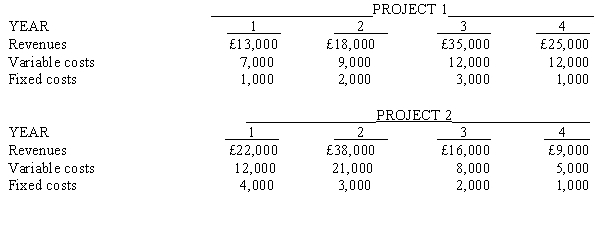

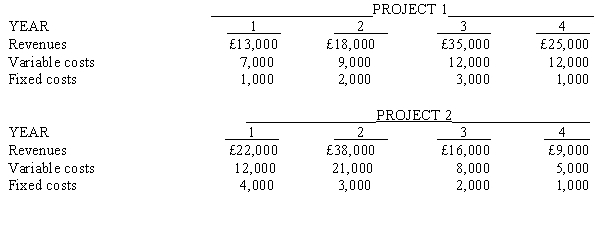

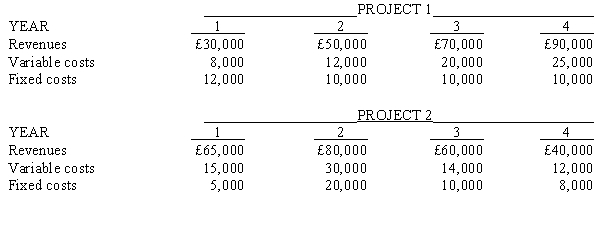

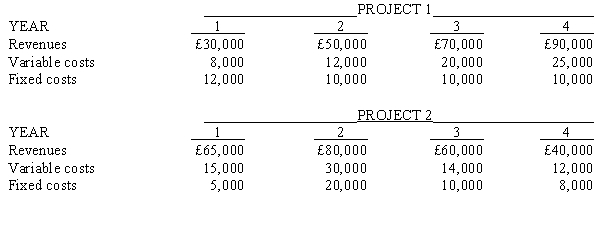

Maxim, Inc., is considering two mutually exclusive projects. Project 1 requires an investment of £40,000, while Project 2 requires an investment of £30,000. Cash revenues and cash costs for each project are shown below.  The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

Required:

a.

Determine the net present value of EACH project using a 16 per cent discount rate.

b.

Prepare a memorandum for management stating your recommendation. Include supporting calculations in good form.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.Required:

a.

Determine the net present value of EACH project using a 16 per cent discount rate.

b.

Prepare a memorandum for management stating your recommendation. Include supporting calculations in good form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

70

A capital investment project requires an investment of £350,000. It has an expected life of ten years with annual cash flows of £50,000 received at the end of each year.

Required:

a.

Compute payback for the project.

b.

Determine the accounting rate of return for the project, based on the initial capital investment.

c.

Compute the internal rate of return for the project.

d.

Compute the net present value of the project using a 14 per cent discount rate.

e.

Would you recommend this project be accepted? Why or why not?

Required:

a.

Compute payback for the project.

b.

Determine the accounting rate of return for the project, based on the initial capital investment.

c.

Compute the internal rate of return for the project.

d.

Compute the net present value of the project using a 14 per cent discount rate.

e.

Would you recommend this project be accepted? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

71

A company invests in a project that realizes an internal rate of return equal to its cost of capital. This project should:

A) increase the value of the company.

B) have little or no effect on the value of the company.

C) decrease the value of the company.

D) cause the company to realize an infinite net present value.

A) increase the value of the company.

B) have little or no effect on the value of the company.

C) decrease the value of the company.

D) cause the company to realize an infinite net present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

72

A capital investment project requires an investment of £1,000,000. It has an expected life of five years with annual cash flows of £240,000 received at the end of each year.

Required:

a.

Compute payback for the project.

b.

Compute the internal rate of return for the project.

c.

Compute the net present value of the project using a 12 per cent discount rate. Ignore income taxes.

d.

Would you recommend this project be accepted? Why or why not?

Required:

a.

Compute payback for the project.

b.

Compute the internal rate of return for the project.

c.

Compute the net present value of the project using a 12 per cent discount rate. Ignore income taxes.

d.

Would you recommend this project be accepted? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

73

A capital investment project requires an investment of £145,000 and has an expected life of four years. Annual cash flows at the end of each year are expected to be as follows:  Required:

Required:

a.

Compute payback assuming that the cash flows occur evenly throughout the year.

b.

Compute the net present value of the project using an 8 per cent discount rate.

Required:

Required: a.

Compute payback assuming that the cash flows occur evenly throughout the year.

b.

Compute the net present value of the project using an 8 per cent discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

74

Van Dyke Company is evaluating a capital expenditure proposal that has the following predicted cash flows:  Required:

Required:

Determine the following values:

a.

Net present value of the investment

b.

Proposal's internal rate of return

c.

Payback period

Required:

Required:Determine the following values:

a.

Net present value of the investment

b.

Proposal's internal rate of return

c.

Payback period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

75

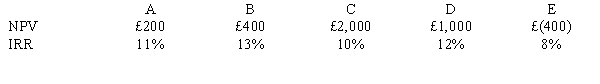

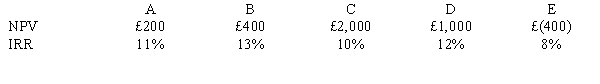

Five mutually exclusive projects had the following information:  Which project is preferred?

Which project is preferred?

A) Project A

B) Project B

C) Project C

D) Project D

Which project is preferred?

Which project is preferred?A) Project A

B) Project B

C) Project C

D) Project D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

76

(Memorandum required)

Simon Enterprises is considering the purchase of a flexible manufacturing system. The savings associated with the system are estimated to be as follows: The system will cost £400,000 and will last ten years. The system would have a salvage value of £30,000 at the end of ten years. The company's cost of capital is 8 per cent.

The system will cost £400,000 and will last ten years. The system would have a salvage value of £30,000 at the end of ten years. The company's cost of capital is 8 per cent.

Required:

Prepare a memorandum to management with your recommendation regarding whether Simon Enterprises should purchase the flexible manufacturing system. Include a discussion of qualitative factors that might influence management's decision. Include your supporting calculations (including NPV analysis.)

Simon Enterprises is considering the purchase of a flexible manufacturing system. The savings associated with the system are estimated to be as follows:

The system will cost £400,000 and will last ten years. The system would have a salvage value of £30,000 at the end of ten years. The company's cost of capital is 8 per cent.

The system will cost £400,000 and will last ten years. The system would have a salvage value of £30,000 at the end of ten years. The company's cost of capital is 8 per cent.Required:

Prepare a memorandum to management with your recommendation regarding whether Simon Enterprises should purchase the flexible manufacturing system. Include a discussion of qualitative factors that might influence management's decision. Include your supporting calculations (including NPV analysis.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

77

Mitchell, Inc., is considering two mutually exclusive projects. Project 1 requires an investment of £80,000, while Project 2 requires an investment of £90,000.

Cash revenues and cash costs for each project are shown below: The company estimates that at the end of the fourth year Project 1 would have a salvage value of £10,000 and Project 2 would have a salvage value of £5,000.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £10,000 and Project 2 would have a salvage value of £5,000.

Required:

a.

Determine the net present value of EACH project using an 8 per cent discount rate.

b.

Prepare a memorandum for management stating your recommendation. Include supporting calculations in good form.

Cash revenues and cash costs for each project are shown below:

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £10,000 and Project 2 would have a salvage value of £5,000.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £10,000 and Project 2 would have a salvage value of £5,000.Required:

a.

Determine the net present value of EACH project using an 8 per cent discount rate.

b.

Prepare a memorandum for management stating your recommendation. Include supporting calculations in good form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck