Deck 8: Inventories: Special Valuation Issues

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/141

العب

ملء الشاشة (f)

Deck 8: Inventories: Special Valuation Issues

1

The most common approach to implementing the LCNRV or LCM rule for inventory valuation is to apply it to

A) each individual item of inventory separately.

B) each major category of inventory.

C) the total inventory in the aggregate.

D) inventory items that have increased in value but not to items that have decreased in value.

A) each individual item of inventory separately.

B) each major category of inventory.

C) the total inventory in the aggregate.

D) inventory items that have increased in value but not to items that have decreased in value.

A

2

The gross profit method is an appropriate method for determining the cost of inventory for interim financial statements.

True

3

Precious metals can be valued above costs because they are immediately marketable at a quoted market price.

True

4

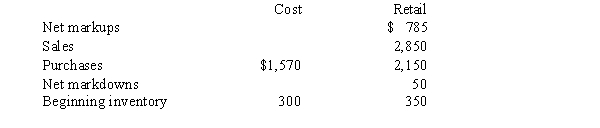

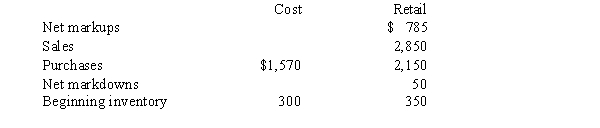

Exhibit 8-1

Rival Inc. uses the lower of cost or market rule in valuing its inventory. Assume the company uses the LIFO method and that one unit has a ceiling constraint of $45.50. The following is other information concerning this unit:

-Refer to Exhibit 8-1. The selling price of this unit must be

A) $49.30

B) $53.00

C) $52.80

D) $49.10

Rival Inc. uses the lower of cost or market rule in valuing its inventory. Assume the company uses the LIFO method and that one unit has a ceiling constraint of $45.50. The following is other information concerning this unit:

-Refer to Exhibit 8-1. The selling price of this unit must be

A) $49.30

B) $53.00

C) $52.80

D) $49.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

5

An auditor may not use the gross profit method to verify the accuracy of the reported cost of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a company recognizes a loss due to inventory write-down then the inventory value subsequently increases due to a market reversal the following year, GAAP does not permit the loss to be recovered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

7

The purpose of dollar-value LIFO retail method is to eliminate the effects of price changes during a period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a purchase on credit is omitted from the purchase account in error and ending inventory is correctly determined, net income for the period would be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under the dollar-value LIFO the cost-to-retail ratio includes net markups and net markdowns from both the current period and beginning inventory. during the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

10

An advantage of the retail inventory method over the gross profit is the retail method uses current-period estimates whereas the gross profit used past periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

11

When applying lower of cost or market under the LIFO or retail inventory method, market value should not be less than

A) replacement value.

B) net realizable value.

C) net realizable value less an allowance for a normal profit margin.

D) replacement value less an allowance for a normal profit margin.

A) replacement value.

B) net realizable value.

C) net realizable value less an allowance for a normal profit margin.

D) replacement value less an allowance for a normal profit margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

12

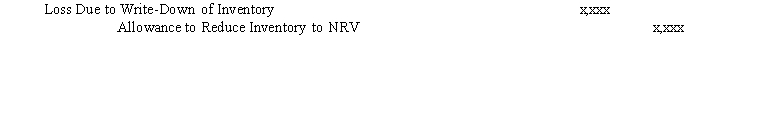

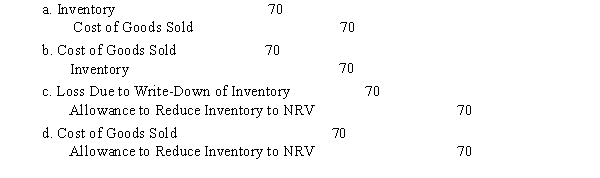

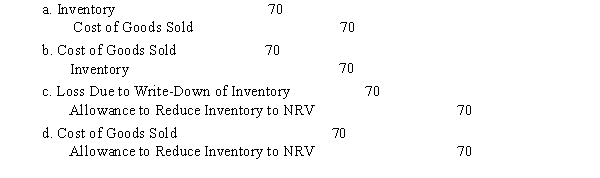

A company using the periodic inventory system to record the reduction of inventory to NRV would record the following journal entry to record inventory at market using the allowance method:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

13

The lower-of-cost-or-market rule must be applied to each individual inventory item but not to groups of items

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which application of the LCNRV or LCM rule will generally result in the lowest valuation for the ending inventory?

A) to each item of the inventory

B) to each major category of inventory

C) to the total inventory in the aggregate

D) To high-cost items but not to low-cost items

A) to each item of the inventory

B) to each major category of inventory

C) to the total inventory in the aggregate

D) To high-cost items but not to low-cost items

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the LIFO or retail inventory method the Net Realizable Value is considered the ceiling that prevents inventory from being valued at amount higher than what the company could reasonably sell it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

16

When applying lower of cost or net realizable value under the FIFO, average cost, or specific identification method, market value

A) is defined as the selling price.

B) is defined as the net realizable value.

C) should not exceed the net realizable value less an allowance for a normal profit margin.

D) should not exceed the net realizable value plus an allowance for a normal profit margin.

A) is defined as the selling price.

B) is defined as the net realizable value.

C) should not exceed the net realizable value less an allowance for a normal profit margin.

D) should not exceed the net realizable value plus an allowance for a normal profit margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

17

The gross profit method is more sensitive to price changes than the FIFO method and produces a more accurate estimate of current period ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

18

Reporting inventory at the lower of cost or market provides a representationally faithful value of inventory; therefore, the application of the lower of cost or market rule is consistent with the materiality principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

19

If ending inventory is overstated for the current period due to a costing error but purchases are correct, the balance sheet at the end of the succeeding year would be correctly stated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

20

A company using the periodic inventory system to record the reduction of inventory to NRV value would record the following journal entry to close beginning inventory using the direct method:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

21

Assume that there is a decline in inventory value in one period, then there is a reversal of value to the original or higher value and a later period. Which of the following statements about recognition of the loss is true?

A) The decline in inventory value and related loss should be recognized in the first period and reversed in the second period in all situations.

B) The decline in inventory value and related loss should be recognized in the first period and reversed in the second period but only if the second period is within the same fiscal year.

C) The decline in inventory value and related loss should be recognized in the first period and reversed in the second period but only if the second period is within a different fiscal year.

D) The decline in inventory value and related loss should never be recognized.

A) The decline in inventory value and related loss should be recognized in the first period and reversed in the second period in all situations.

B) The decline in inventory value and related loss should be recognized in the first period and reversed in the second period but only if the second period is within the same fiscal year.

C) The decline in inventory value and related loss should be recognized in the first period and reversed in the second period but only if the second period is within a different fiscal year.

D) The decline in inventory value and related loss should never be recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

22

Morris Company uses the lower of cost or market rule and applies it using the LIFO method in valuing its inventory. The floor constraint for one item in the inventory is $68.20. The following is other information concerning this unit:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Maxa Company normally sells its inventory at a 20% profit margin on sales. In 2016, the net realizable value of inventory purchased for $75,000 declined to $66,000. There are no costs to complete and dispose of this inventory. Using the LIFO method what is the floor constraint on the valuation of this inventory using the lower of cost or market rule?

A) $60,000

B) $66,000

C) $79,200

D) $52,800

A) $60,000

B) $66,000

C) $79,200

D) $52,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

24

Major Company uses the lower of cost or market rule in valuing its inventory and applies it using the LIFO method. The floor constraint for one item in the inventory is $58.20. The following is other information concerning this unit:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is a justification for valuing inventory above historical cost?

A) Immediate marketability of the inventory at a quoted market price

B) Interchangeability of the units of inventory

C) All of the items listed are justifications for valuing inventory above historical cost

D) Inability to determine appropriate prices

A) Immediate marketability of the inventory at a quoted market price

B) Interchangeability of the units of inventory

C) All of the items listed are justifications for valuing inventory above historical cost

D) Inability to determine appropriate prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

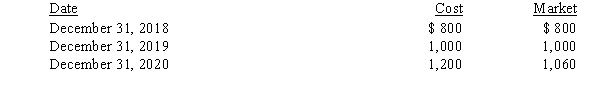

26

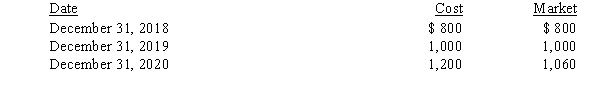

Given the following information for the Raquel Company:  Under the perpetual system, if the direct method of recording lower of cost or market is in use, which December 31, 2020 entry is correct?

Under the perpetual system, if the direct method of recording lower of cost or market is in use, which December 31, 2020 entry is correct?

Under the perpetual system, if the direct method of recording lower of cost or market is in use, which December 31, 2020 entry is correct?

Under the perpetual system, if the direct method of recording lower of cost or market is in use, which December 31, 2020 entry is correct?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

27

In comparison to the allowance method of applying the lower of cost or market rule to the valuation of inventory, the direct method has which of the following deficiencies?

A) The direct method reports a more conservative amount for net income.

B) For the direct method, the loss or loss recovery due to market valuation changes is included in the cost of goods sold amount.

C) The direct method makes changes to the historical cost of inventory reported on the balance sheet.

D) The direct method can only be used with a perpetual inventory system.

A) The direct method reports a more conservative amount for net income.

B) For the direct method, the loss or loss recovery due to market valuation changes is included in the cost of goods sold amount.

C) The direct method makes changes to the historical cost of inventory reported on the balance sheet.

D) The direct method can only be used with a perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

28

In general, it is argued that the lower of cost or market rule is supported most closely by which of the following theoretical assumptions?

A) revenue recognition

B) Representational faithfulness

C) historical cost

D) going concern

A) revenue recognition

B) Representational faithfulness

C) historical cost

D) going concern

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

29

When applying the lower of cost or market rule to the valuation of inventory, the allowance method is considered preferable to the direct method because

A) the allowance method reports smaller losses than the direct method.

B) the allowance method reports a higher inventory net valuation for balance sheet purposes than the direct method.

C) the allowance method reports the inventory loss or loss recovery in a separate income statement account.

D) the allowance method, unlike the direct method, reduces the value of inventory reported on the balance sheet.

A) the allowance method reports smaller losses than the direct method.

B) the allowance method reports a higher inventory net valuation for balance sheet purposes than the direct method.

C) the allowance method reports the inventory loss or loss recovery in a separate income statement account.

D) the allowance method, unlike the direct method, reduces the value of inventory reported on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

30

When comparing the lower of cost to market rule under any of the methods

A) the appropriate market value is determined before comparing it to the cost.

B) the purpose of the ceiling is to ensure that the write-down is sufficient to cover all expected gains.

C) the purpose of the floor is to prevent an excessive gain from being recognized in the future.

D) the process is consistent with the principle of conservatism because the goal is to limit excessive swings in gross margin.

A) the appropriate market value is determined before comparing it to the cost.

B) the purpose of the ceiling is to ensure that the write-down is sufficient to cover all expected gains.

C) the purpose of the floor is to prevent an excessive gain from being recognized in the future.

D) the process is consistent with the principle of conservatism because the goal is to limit excessive swings in gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

31

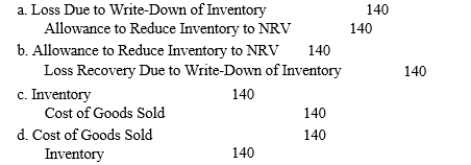

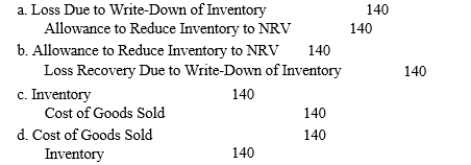

Given the following information for the Tea Company:

Under the periodic system, if the allowance method of recording lower of cost or market is in use, which December 31, 2020 entry is correct?

Under the periodic system, if the allowance method of recording lower of cost or market is in use, which December 31, 2020 entry is correct?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

32

IFRS, like U.S. GAAP, require the use of the lower of cost or market method to value inventory, however some differences do exist. Which of the following is not one of the differences?

A) IFRS eliminate the need to use a ceiling in determining market value.

B) When write-downs occur, IFRS do not specify how the loss must be categorized in the income statement.

C) IFRS allow the reversal of a previous write-down.

D) IFRS define market only as replacement value.

A) IFRS eliminate the need to use a ceiling in determining market value.

B) When write-downs occur, IFRS do not specify how the loss must be categorized in the income statement.

C) IFRS allow the reversal of a previous write-down.

D) IFRS define market only as replacement value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

33

Exhibit 8-1

Rival Inc. uses the lower of cost or market rule in valuing its inventory. Assume the company uses the LIFO method and that one unit has a ceiling constraint of $45.50. The following is other information concerning this unit:

-Refer to Exhibit 8-1. The floor constraint of this unit must be

A) $41.90

B) $38.00

C) $41.70

D) $38.10

Rival Inc. uses the lower of cost or market rule in valuing its inventory. Assume the company uses the LIFO method and that one unit has a ceiling constraint of $45.50. The following is other information concerning this unit:

-Refer to Exhibit 8-1. The floor constraint of this unit must be

A) $41.90

B) $38.00

C) $41.70

D) $38.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which one of the following inventories may not be valued for balance sheet purposes at the inventory's selling price less distribution costs even if it is above the cost of the inventory?

A) grain for an agricultural company

B) crude oil for an oil company

C) gold for a mining corporation

D) laptops for a computer manufacturer

A) grain for an agricultural company

B) crude oil for an oil company

C) gold for a mining corporation

D) laptops for a computer manufacturer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which one of the following statements is true with regard to the lower of cost or market rule?

A) If the direct method is used in applying the lower of cost or market rule, the loss or loss recovery due to market valuation changes is included in cost of goods sold.

B) The lower of cost or market rule must be applied on an individual item basis for financial accounting purposes.

C) With the application of the lower of cost or market rule using the direct method, the account, Allowance to Reduce Inventory to Market, is reported on the balance sheet as a contra asset.

D) The lower of cost or market rule is primarily an application of the going concern assumption.

A) If the direct method is used in applying the lower of cost or market rule, the loss or loss recovery due to market valuation changes is included in cost of goods sold.

B) The lower of cost or market rule must be applied on an individual item basis for financial accounting purposes.

C) With the application of the lower of cost or market rule using the direct method, the account, Allowance to Reduce Inventory to Market, is reported on the balance sheet as a contra asset.

D) The lower of cost or market rule is primarily an application of the going concern assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

36

Generally, valuing inventory above cost

A) violates conservatism and is never allowed.

B) violates the lower of cost or market rule and is never allowed.

C) is acceptable when revenue recognition is not applicable.

D) is acceptable only in selected industries and in certain circumstances.

A) violates conservatism and is never allowed.

B) violates the lower of cost or market rule and is never allowed.

C) is acceptable when revenue recognition is not applicable.

D) is acceptable only in selected industries and in certain circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

37

The major criticism of the lower of cost or market rule for valuation of inventory is that.

A) holding losses are recognized, but holding gains are not.

B) holding gains are recognized, but holding losses are not.

C) the total difference between selling price and cost is usually recognized in the period of the sale.

D) the conservatism principle is violated because of the use of the floor constraint.

A) holding losses are recognized, but holding gains are not.

B) holding gains are recognized, but holding losses are not.

C) the total difference between selling price and cost is usually recognized in the period of the sale.

D) the conservatism principle is violated because of the use of the floor constraint.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which one of the following inventories may be valued for balance sheet purposes at the inventory's selling price less distribution costs even if it is above the cost of the inventory?

A) automobiles for an automobile manufacturer

B) gold for a mining corporation

C) steel for a steel manufacturer

D) athletic shoes for a retail store

A) automobiles for an automobile manufacturer

B) gold for a mining corporation

C) steel for a steel manufacturer

D) athletic shoes for a retail store

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

39

Zoe Company has provided the following values for its 400 units of inventory at the end of 2014:

Under IFRS requirements, the per-unit reported value for Zoe's inventory will be

A) $65.00

B) $54.50

C) $54.20

D) $40.70

Under IFRS requirements, the per-unit reported value for Zoe's inventory will be

A) $65.00

B) $54.50

C) $54.20

D) $40.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

40

Concerning application of the lower of cost or market method under either the LIFO or retail inventory method, which one of the following statements is true regarding the constraints on market value?

A) The upper constraint is estimated selling price less costs of completion and disposal.

B) The lower constraint is net realizable value less costs of completion and disposal.

C) The lower constraint is estimated selling price less a normal profit margin.

D) The upper constraint is estimated selling price less costs of completion and disposal and a normal profit margin.

A) The upper constraint is estimated selling price less costs of completion and disposal.

B) The lower constraint is net realizable value less costs of completion and disposal.

C) The lower constraint is estimated selling price less a normal profit margin.

D) The upper constraint is estimated selling price less costs of completion and disposal and a normal profit margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

41

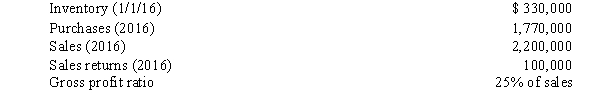

As a result of taking a physical inventory count on December 31, 20106 the Cookie Company inventory was determined to be $425,000. The auditors for Cookie suspected an inventory shortage and used the gross profit method to estimate the ending inventory. The accounting records for the company contained the following information:

Using the gross profit method, what did the auditors estimate as the amount of the inventory shortage at December 31, 2016?

A) $100,000

B) $75,000

C) $15,000

D) $0

Using the gross profit method, what did the auditors estimate as the amount of the inventory shortage at December 31, 2016?

A) $100,000

B) $75,000

C) $15,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

42

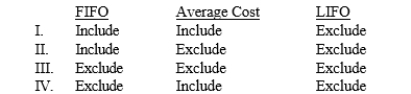

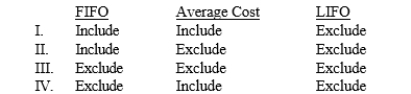

With the retail inventory method, how is the total beginning inventory value used in the calculation of the cost-to-retail ratio for the current period under the following cost flow assumptions?

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which one of the following statements regarding the gross profit method is not true?

A) The gross profit method is not a practical method to use in real-world situations.

B) The gross profit method is often used to estimate the year-end inventory for comparison to actual on-hand inventory.

C) The gross profit method is an acceptable method to estimate the cost of inventory destroyed by a casualty.

D) The gross profit method results in a less accurate inventory valuation than the retail inventory method.

A) The gross profit method is not a practical method to use in real-world situations.

B) The gross profit method is often used to estimate the year-end inventory for comparison to actual on-hand inventory.

C) The gross profit method is an acceptable method to estimate the cost of inventory destroyed by a casualty.

D) The gross profit method results in a less accurate inventory valuation than the retail inventory method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Alexandra Company uses the retail inventory method and the average cost flow assumption for preparation of its interim reports. Information about Alexandra's inventory in the second quarter of 2016 is shown below:

What is the estimated cost of Alexandra's inventory on June 30, 2016?

A) $270

B) $300

C) $585

D) $600

What is the estimated cost of Alexandra's inventory on June 30, 2016?

A) $270

B) $300

C) $585

D) $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

45

Given the following information for Bonnie Bunny Company:

Calculate ending inventory of Bonnie Bunny using the gross profit method.

A) $4,755

B) $4,373

C) $2,445

D) $2,060

Calculate ending inventory of Bonnie Bunny using the gross profit method.

A) $4,755

B) $4,373

C) $2,445

D) $2,060

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

46

At the beginning of 2016, the Joan Company had an inventory valued at $34,375 at cost $50,000 at retail). During the year, Joan purchased inventory for $50,000 $70,000 at retail), and made markdowns of $7,500. Joan's sales in 2016 were $62,500. What is Joan's estimated ending inventory at FIFO cost using the retail inventory method?

A) $37,500

B) $40,000

C) $39,000

D) $34,375

A) $37,500

B) $40,000

C) $39,000

D) $34,375

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

47

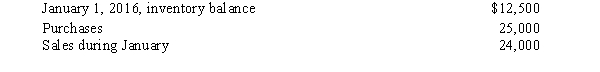

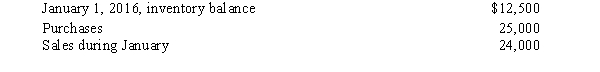

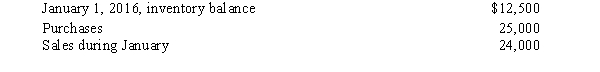

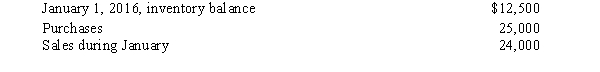

Exhibit 8-2

The Dormer Company uses the gross profit method to estimate its inventory in interim financial statements. The markup on cost is 50%. The following information is available:

Refer to Exhibit 8-2. The estimated inventory at January 31, 2016, is

A) $25,500

B) $21,500

C) $16,000

D) $12,000

The Dormer Company uses the gross profit method to estimate its inventory in interim financial statements. The markup on cost is 50%. The following information is available:

Refer to Exhibit 8-2. The estimated inventory at January 31, 2016, is

A) $25,500

B) $21,500

C) $16,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which one of the following statements regarding the gross profit method is true?

A) The gross profit method is a complicated method to use in practice.

B) The gross profit method results in a more accurate inventory valuation than the retail inventory method.

C) The gross profit method is an acceptable method to estimate the cost of inventory destroyed by a casualty.

D) The gross profit method is often used to calculate the year-end inventory for financial accounting purposes.

A) The gross profit method is a complicated method to use in practice.

B) The gross profit method results in a more accurate inventory valuation than the retail inventory method.

C) The gross profit method is an acceptable method to estimate the cost of inventory destroyed by a casualty.

D) The gross profit method is often used to calculate the year-end inventory for financial accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

49

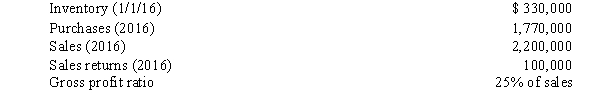

The Sahara Company's inventory was partially destroyed on June 4, 2016, when its warehouse caught on fire early in the morning. Inventory that had a cost of $8,000 was saved. The accounting records, which were located in a fireproof vault, contained the following information:  Using the gross profit method, what is the estimated cost of the inventory destroyed by the fire?

Using the gross profit method, what is the estimated cost of the inventory destroyed by the fire?

A) $130,,000

B) $48,000

C) $39,000

D) $30,000

Using the gross profit method, what is the estimated cost of the inventory destroyed by the fire?

Using the gross profit method, what is the estimated cost of the inventory destroyed by the fire?A) $130,,000

B) $48,000

C) $39,000

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

50

The gross profit method is not used to

A) replace the year-end physical inventory.

B) check the cost generated by a perpetual inventory system.

C) determine the cost of inventory destroyed by fire.

D) develop a sales budget.

A) replace the year-end physical inventory.

B) check the cost generated by a perpetual inventory system.

C) determine the cost of inventory destroyed by fire.

D) develop a sales budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

51

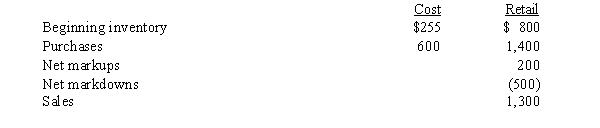

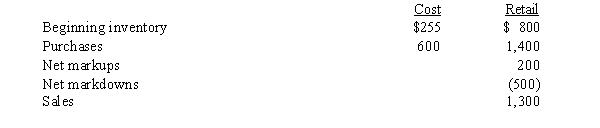

The Rebecca Company provided the following data for its December 31, 2016, inventory maintained on the retail basis.

What is the estimated inventory at December 31, 2016, valued at lower of average cost or market?

A) $87,018

B) $70,522

C) $62,951

D) $44,069

What is the estimated inventory at December 31, 2016, valued at lower of average cost or market?

A) $87,018

B) $70,522

C) $62,951

D) $44,069

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Jamison Company's inventory was destroyed on July 4, 2016, when its warehouse caught on fire early in the morning. Inventory was totally destroyed. The accounting records, which were located in a fireproof vault, contained the following information:

Using the gross profit method, what is the estimated cost of the inventory that was destroyed by the fire?

A) $15,000

B) $23,250

C) $33,000

D) $45,000

Using the gross profit method, what is the estimated cost of the inventory that was destroyed by the fire?

A) $15,000

B) $23,250

C) $33,000

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

53

Relevance of the gross profit margin depends upon

A) the accuracy of the gross profit percentage

B) the net sales

C) applying the overall profit margin to each individual department

D) averaging prior periods' net sales and total sales to verify which is best to use

A) the accuracy of the gross profit percentage

B) the net sales

C) applying the overall profit margin to each individual department

D) averaging prior periods' net sales and total sales to verify which is best to use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

54

The Alpha Company uses the retail inventory method for valuation of its inventory. If an item had a cost of $45, was originally marked to sell at $60, was later priced at $55, and finally was priced at $68, the resulting price change is a

A) net markup of $13.

B) net markdown of $5 and a markup of $8.

C) net markdown of zero and an a markup of $8.

D) net markup of $23.

A) net markup of $13.

B) net markdown of $5 and a markup of $8.

C) net markdown of zero and an a markup of $8.

D) net markup of $23.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

55

As a result of taking a physical inventory count on December 31, 2016, the Mona Lisa Company inventory was determined to be $61,500. The auditors for Mona Lisa suspected an inventory shortage and used the gross profit method to estimate the ending inventory. The accounting records for the company contained the following information:

Using the gross profit method, what did the auditors estimate as the amount of the inventory that should have been on hand at December 31, 2016?

A) $240,000

B) $170,000

C) $125,000

D) $ 61,500

Using the gross profit method, what did the auditors estimate as the amount of the inventory that should have been on hand at December 31, 2016?

A) $240,000

B) $170,000

C) $125,000

D) $ 61,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

56

Exhibit 8-2

The Dormer Company uses the gross profit method to estimate its inventory in interim financial statements. The markup on cost is 50%. The following information is available:

Refer to Exhibit 8-2. The estimated cost of goods sold at January 31, 2016, is

A) $25,500

B) $21,500

C) $16,000

D) $12,000

The Dormer Company uses the gross profit method to estimate its inventory in interim financial statements. The markup on cost is 50%. The following information is available:

Refer to Exhibit 8-2. The estimated cost of goods sold at January 31, 2016, is

A) $25,500

B) $21,500

C) $16,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

57

Consider the following: Code:

A = Gross profit to net sales ratio

B = Gross profit to cost of goods sold ratio

Which equation is correct?

A) A = B / 1 ? B)

B) A = 1 + B) / B

C) A = 1 ? B) / B

D) A = B / 1 + B)

A = Gross profit to net sales ratio

B = Gross profit to cost of goods sold ratio

Which equation is correct?

A) A = B / 1 ? B)

B) A = 1 + B) / B

C) A = 1 ? B) / B

D) A = B / 1 + B)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

58

If the net markdowns are excluded from the calculation of the cost-to-retail ratio in the retail inventory method, what is the effect on the cost-to-retail ratio?

A) The denominator of the ratio will be lower, which results in a higher cost-to-retail ratio.

B) The denominator of the ratio will be higher, which results in a lower cost-to-retail ratio.

C) The numerator of the ratio will be higher, which results in a higher cost-to-retail ratio.

D) The numerator of the ratio will be lower, which results in a lower cost-to-retail ratio.

A) The denominator of the ratio will be lower, which results in a higher cost-to-retail ratio.

B) The denominator of the ratio will be higher, which results in a lower cost-to-retail ratio.

C) The numerator of the ratio will be higher, which results in a higher cost-to-retail ratio.

D) The numerator of the ratio will be lower, which results in a lower cost-to-retail ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

59

For the period from 2016 through 2016, the Charlie Company had net sales of $500,000 and a gross profit of $200,000. During the first quarter of 2018, the company made purchases of $19,500 and recorded sales of $47,500. The inventory value at the beginning of the year was 15,500. What is the estimated cost of Charlie's inventory on March 31, 2018, using the gross profit method?

A) $22,500

B) $15,000

C) $6,500

D) $6,000

A) $22,500

B) $15,000

C) $6,500

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which one of the following statements is not true with regard to the gross profit method of estimating inventories?

A) The gross profit method may be used to determine inventory for interim financial reporting purposes without taking a physical count.

B) The percentage used for the gross profit method is determined by using previous years' historical data.

C) The gross profit method is not as accurate as the retail inventory method.

D) The gross profit method may only be used with a perpetual inventory accounting system.

A) The gross profit method may be used to determine inventory for interim financial reporting purposes without taking a physical count.

B) The percentage used for the gross profit method is determined by using previous years' historical data.

C) The gross profit method is not as accurate as the retail inventory method.

D) The gross profit method may only be used with a perpetual inventory accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

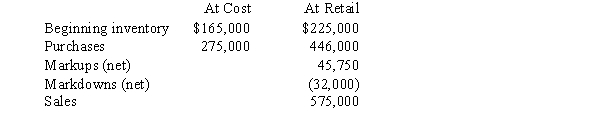

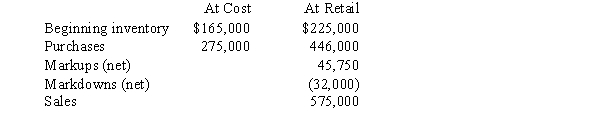

61

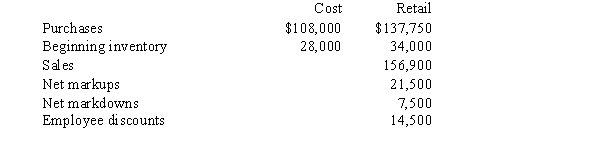

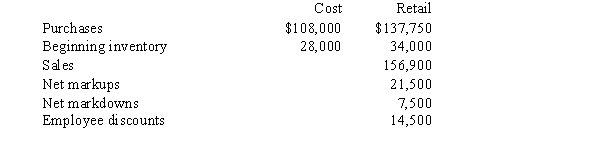

Caroline's Music Store uses the average cost retail inventory method to determine its ending inventory. The accounting records for the current year for Caroline's contained the following information:

What is the cost-to-retail percentage to be used for ending inventory calculations?

A) 70.0%

B) 73.2%

C) 79.4%

D) 77.8%

What is the cost-to-retail percentage to be used for ending inventory calculations?

A) 70.0%

B) 73.2%

C) 79.4%

D) 77.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

62

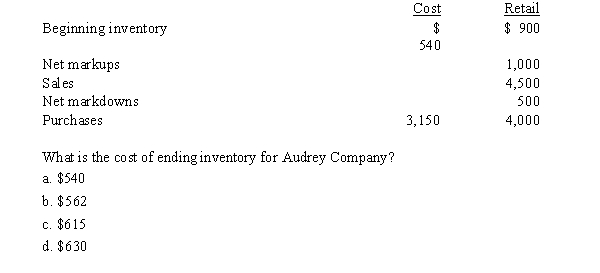

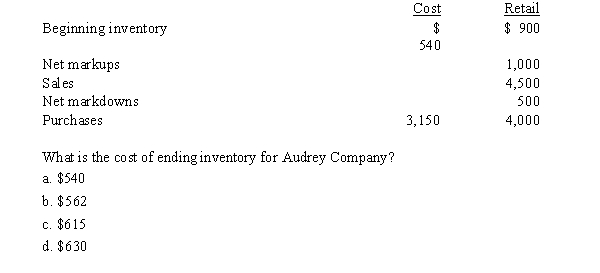

Audrey Company uses the LIFO retail inventory method and reports the following information:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

63

Leslie, Ltd. used the LIFO retail inventory method to determine its ending inventory. The accounting records for the company contained the following relevant information:

What is the LIFO cost of the ending inventory?

A) $6,720

B) $7,706

C) $8,000

D) $8,400

What is the LIFO cost of the ending inventory?

A) $6,720

B) $7,706

C) $8,000

D) $8,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

64

Ann Co. uses the dollar-value LIFO retail method. The beginning inventory, purchased when the price index was 100, had a retail value of $4,000 and a cost of $3,600. During the period, purchases amounted to $60,000 at retail $52,800 at cost). Sales amounted to $56,300. The year-end price index was 110. What is the cost of ending inventory?

A) $6,240

B) $6,504

C) $6,570

D) $6,900

A) $6,240

B) $6,504

C) $6,570

D) $6,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

65

The Sherri's Retail Shop uses the FIFO retail inventory method to determine its ending inventory. The accounting records for the current year for Sherri's contained the following information:  What is the cost-to-retail percentage to be used for ending inventory calculations?

What is the cost-to-retail percentage to be used for ending inventory calculations?

A) 59.9%

B) 60.0%

C) 62.1%

D) 62.5%

What is the cost-to-retail percentage to be used for ending inventory calculations?

What is the cost-to-retail percentage to be used for ending inventory calculations?A) 59.9%

B) 60.0%

C) 62.1%

D) 62.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

66

Laura's Department Store uses the average cost retail inventory method to determine its ending inventory. The accounting records for the current year for Laura's contained the following information:

In addition, the accounting records for Laura's disclosed that purchases returns at cost and retail were $1,950 and $4,250, respectively. What is the cost-to-retail percentage to be used for ending inventory calculations?

A) 75.1%

B) 79.8%

C) 76.8%

D) 78.1%

In addition, the accounting records for Laura's disclosed that purchases returns at cost and retail were $1,950 and $4,250, respectively. What is the cost-to-retail percentage to be used for ending inventory calculations?

A) 75.1%

B) 79.8%

C) 76.8%

D) 78.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

67

Eloise Corp. uses the FIFO retail inventory method and reports the following information:

What is the FIFO value of ending inventory for Eloise Corp.?

A) $5,004

B) $5,053

C) $5,068

D) $5,100

What is the FIFO value of ending inventory for Eloise Corp.?

A) $5,004

B) $5,053

C) $5,068

D) $5,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

68

Barbara Co. presents the following information:

The company uses the average cost retail inventory method. What is the cost of ending inventory?

A) $233.55

B) $255.98

C) $275.80

D) $222.55

The company uses the average cost retail inventory method. What is the cost of ending inventory?

A) $233.55

B) $255.98

C) $275.80

D) $222.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

69

Darla's Card Shop uses the average cost retail inventory method to determine the ending inventory. Darla's accounting records for the current year contained the following information:

In addition, sales returns for the year were $28,000, and employee discounts taken were $6,000. What is the cost of the ending inventory

A) $35,000

B) $50,400

C) $54,600

D) $58,800

In addition, sales returns for the year were $28,000, and employee discounts taken were $6,000. What is the cost of the ending inventory

A) $35,000

B) $50,400

C) $54,600

D) $58,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which one of the following statements is false concerning the retail inventory method?

A) Net markups and markdowns are always added and subtracted in order to compute the retail value of ending inventory.

B) Markups and markdowns are recorded only at retail.

C) In the lower of average cost or market method, net markups are excluded from the computation of the cost- to-retail ratio.

D) In computing the cost-to-retail ratio, purchase discounts affect only the cost of purchases and not the retail amount of purchases.

A) Net markups and markdowns are always added and subtracted in order to compute the retail value of ending inventory.

B) Markups and markdowns are recorded only at retail.

C) In the lower of average cost or market method, net markups are excluded from the computation of the cost- to-retail ratio.

D) In computing the cost-to-retail ratio, purchase discounts affect only the cost of purchases and not the retail amount of purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following variations of the retail inventory method would generally result in the lowest cost-to-retail ratio in a period of declining prices?

A) FIFO

B) LIFO

C) average cost

D) lower of average cost or market

A) FIFO

B) LIFO

C) average cost

D) lower of average cost or market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following statements is true?

A) Application of LIFO for financial reporting purposes must follow the tax laws applicable to LIFO.

B) A company must use FIFO for both tax reporting and financial statement reporting.

C) A company may use FIFO to valuate inventory and LIFO for financial statement reporting purposes.

D) LIFO must be used for financial reporting if it is used for tax purposes.

A) Application of LIFO for financial reporting purposes must follow the tax laws applicable to LIFO.

B) A company must use FIFO for both tax reporting and financial statement reporting.

C) A company may use FIFO to valuate inventory and LIFO for financial statement reporting purposes.

D) LIFO must be used for financial reporting if it is used for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

73

When using the cost-to-retail ratio for the retail inventory method,

A) neither net markups nor markdowns are included in the computation of ending inventory for FIFO inventory.

B) net markups but not net markdowns are included in the computation of ending inventory for LIFO inventory.

C) net markups but not net markdowns are included in the computation of ending inventory for lower-of-cost-or- market inventory.

D) net markdowns but not net markups are included in the computation of ending inventory for Average Cost inventory.

A) neither net markups nor markdowns are included in the computation of ending inventory for FIFO inventory.

B) net markups but not net markdowns are included in the computation of ending inventory for LIFO inventory.

C) net markups but not net markdowns are included in the computation of ending inventory for lower-of-cost-or- market inventory.

D) net markdowns but not net markups are included in the computation of ending inventory for Average Cost inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

74

Kelcie Sports uses the dollar-value LIFO retail method. The price index on January 1, 2016, was 100, and on that date the inventory was $20,000 retail) and $14,000 cost). Additional information follows:

What is the cost of the December 31, 2017, inventory to the nearest dollar)?

A) $14,610

B) $14,638

C) $14,660

D) $15,854

What is the cost of the December 31, 2017, inventory to the nearest dollar)?

A) $14,610

B) $14,638

C) $14,660

D) $15,854

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

75

Debbie's Bling Shop uses the lower of average cost or market retail inventory method to determine its ending inventory. The accounting records for the current year for Debbie's contained the following information:

In addition, the accounting records for Debbie's disclosed that freight-in charges were $6,700 and sales returns were $2,833. What is the cost-to-retail percentage to be used for ending inventory calculations?

A) 71.4%

B) 73.2%

C) 76.7%

D) 78.6%

In addition, the accounting records for Debbie's disclosed that freight-in charges were $6,700 and sales returns were $2,833. What is the cost-to-retail percentage to be used for ending inventory calculations?

A) 71.4%

B) 73.2%

C) 76.7%

D) 78.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following items would not be used in the calculation of the cost-to-retail ratio if the FIFO retail inventory method were used to determine the ending inventory?

A) net markdowns

B) purchases

C) beginning inventory

D) freight-in charges

A) net markdowns

B) purchases

C) beginning inventory

D) freight-in charges

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which one of the following statements is false concerning the retail inventory method?

A) In arriving at a cost-to-retail ratio, sales discounts are deducted from goods available for sale to determine ending inventory at retail.

B) Employee discounts are subtracted from goods available for sale to compute ending inventory at retail.

C) Abnormal inventory spoilage would be subtracted at both cost and retail in the determination of goods available for sale.

D) Purchase returns and allowances must be subtracted from both the cost and retail value of the purchases.

A) In arriving at a cost-to-retail ratio, sales discounts are deducted from goods available for sale to determine ending inventory at retail.

B) Employee discounts are subtracted from goods available for sale to compute ending inventory at retail.

C) Abnormal inventory spoilage would be subtracted at both cost and retail in the determination of goods available for sale.

D) Purchase returns and allowances must be subtracted from both the cost and retail value of the purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

78

Stacie's Shoes uses the FIFO retail inventory method to determine its ending inventory. The accounting records for Stacie's Shoes contained the following information:

The freight-in charges for the merchandise were $7,500. What is the cost of ending inventory for Stacie's Shoes?

A) $55,792

B) $57,200

C) $59,400

D) $61,281

The freight-in charges for the merchandise were $7,500. What is the cost of ending inventory for Stacie's Shoes?

A) $55,792

B) $57,200

C) $59,400

D) $61,281

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following variations of the retail inventory method would generally result in the lowest cost-to-retail ratio in a period of rising prices?

A) FIFO

B) LIFO

C) average cost

D) lower of average cost or market

A) FIFO

B) LIFO

C) average cost

D) lower of average cost or market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is not a general assumption that underlies the retail inventory method?

A) All inventory items are homogenous and have the same markup.

B) The items in ending inventory are in proportion to the items available for sale.

C) There were no changes in the retail price of inventory purchased during the period except the changes captured by markups and markdowns.

D) The cost-to-retail ratio remains constant over the accounting period

A) All inventory items are homogenous and have the same markup.

B) The items in ending inventory are in proportion to the items available for sale.

C) There were no changes in the retail price of inventory purchased during the period except the changes captured by markups and markdowns.

D) The cost-to-retail ratio remains constant over the accounting period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck