Deck 7: Inventories: Cost Measurement and Flow Assumptions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

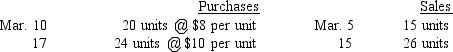

سؤال

سؤال

سؤال

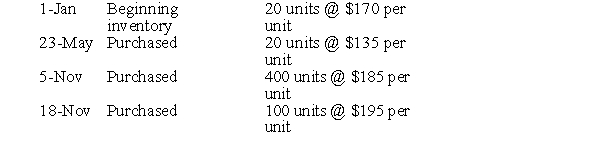

سؤال

سؤال

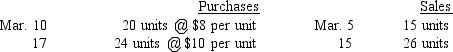

سؤال

سؤال

سؤال

سؤال

سؤال

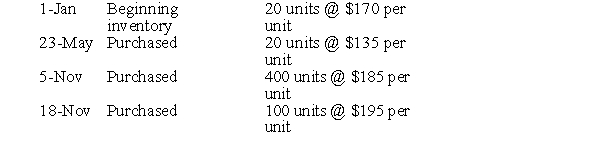

سؤال

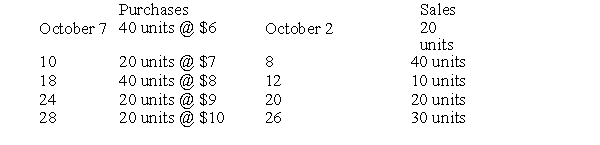

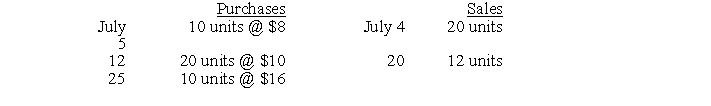

سؤال

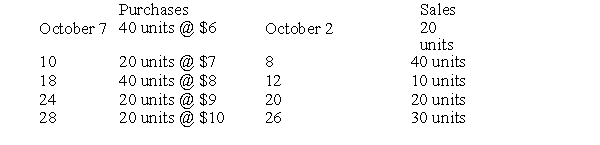

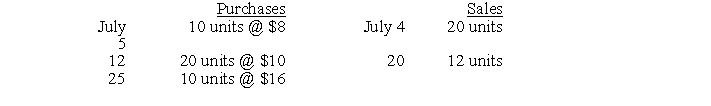

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/114

العب

ملء الشاشة (f)

Deck 7: Inventories: Cost Measurement and Flow Assumptions

1

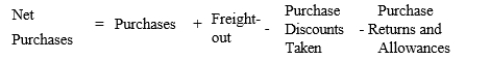

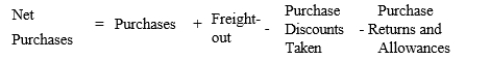

Net purchases is computed as follows:

False

2

In a period of rising prices LIFO produces the highest cost of goods sold and the lowest gross profit.

True

3

Inventory costs include all costs directly or indirectly associated with bringing an item to its existing condition or location for sale.

True

4

A retail firm would normally use an inventory account titled

A) finished goods inventory

B) merchandise inventory

C) goods in process inventory

D) raw materials inventory

A) finished goods inventory

B) merchandise inventory

C) goods in process inventory

D) raw materials inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

5

The use of dollar-value LIFO follows the same methodology as the LIFO method but reduces the record keeping.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

6

In a period of falling prices, FIFO produces the lowest cost of goods sold and the highest gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

7

When goods are shipped FOB shipping point, the seller retains economic control until the goods are received by the buyer; therefore, the buyer should not record the goods into inventory until they are received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

8

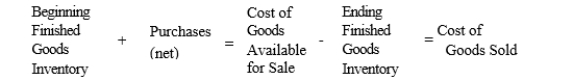

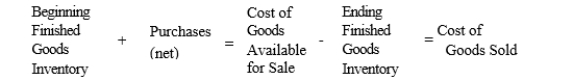

The following relationship is only true for a merchandising firm:

Beginning Inventory

+ Purchases net)

or Production costs

for the period

= Cost of Goods

Available for Sale

Beginning Inventory

+ Purchases net)

or Production costs

for the period

= Cost of Goods

Available for Sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

9

A company's liquidation of inventory under LIFO results in higher income during periods of rising costs. Therefore, management can manipulate earnings by delaying purchases until after the end of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

10

A manufacturing company typically has how many inventory accounts?

A) 1

B) 2

C) 3

D) 4

A) 1

B) 2

C) 3

D) 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

11

When goods are shipped FOB shipping point, the buyer has economic control of the inventory and must record the goods in its inventory accounts as soon as the goods are shipped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

12

The use of inventory pools with dollar-value LIFO overcomes the issues associated with keeping numerous detailed records of individual quantities of each item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

13

The LIFO conformity rule allows a company to use FIFO for financial reporting and LIFO for income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

14

A manufacturing firm would not normally have an account titled

A) goods in process inventory

B) raw materials inventory

C) merchandise inventory

D) finished goods inventory

A) goods in process inventory

B) raw materials inventory

C) merchandise inventory

D) finished goods inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

15

A perpetual inventory system provides management with valuable tools with which to plan and control inventory levels because the amount of inventory is known at any point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a company uses LIFO for annual reporting purposes, it must also use it for interim reporting. This enables external users to accurately compare financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is included in the work in process account?

A) manufacturing overhead

B) direct labor cost

C) cost of raw materials used in production

D) All of these answer choices are included in the work in process account.

A) manufacturing overhead

B) direct labor cost

C) cost of raw materials used in production

D) All of these answer choices are included in the work in process account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

18

The cost of goods sold model for a manufacturer is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

19

The SEC requires a company that uses LIFO to disclose the difference between the LIFO value of the inventory and the FIFO value of the inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

20

The costs of operating a purchasing department are necessary to the purchasing of inventory therefore; those costs should be allocated to inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use the following letters to represent items: P = Purchases net)

C = Cost of goods sold B = Beginning inventory E = Ending inventory

Which equation is correct?

A) B − C + P = E

B) B − E = C + P

C) P − E = B + C

D) B = C − E + P

C = Cost of goods sold B = Beginning inventory E = Ending inventory

Which equation is correct?

A) B − C + P = E

B) B − E = C + P

C) P − E = B + C

D) B = C − E + P

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which one of the following statements is false?

A) A company using the periodic system does not maintain a continuous record of the physical quantities or costs) of inventory on hand.

B) In the periodic system, the costs of acquisition of inventory are debited directly to an inventory account.

C) In the perpetual inventory system, recording in detailed subsidiary records can be in units only, not in dollar costs.

D) When the perpetual system is used, a physical count still needs to be made periodically.

A) A company using the periodic system does not maintain a continuous record of the physical quantities or costs) of inventory on hand.

B) In the periodic system, the costs of acquisition of inventory are debited directly to an inventory account.

C) In the perpetual inventory system, recording in detailed subsidiary records can be in units only, not in dollar costs.

D) When the perpetual system is used, a physical count still needs to be made periodically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

23

A perpetual inventory system

A) only records the inventory on hand at the end of the year physical count

B) keeps a continuous record of the physical quantities of inventory on hand

C) does not maintain a continuous record of the physical quantities of inventory on hand

D) does not maintain a continuous record of the cost of inventory on hand

A) only records the inventory on hand at the end of the year physical count

B) keeps a continuous record of the physical quantities of inventory on hand

C) does not maintain a continuous record of the physical quantities of inventory on hand

D) does not maintain a continuous record of the cost of inventory on hand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

24

The basic criterion for including items in inventory is

A) physical control

B) legal ownership

C) physical possession

D) economic control

A) physical control

B) legal ownership

C) physical possession

D) economic control

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

25

Exhibit 7-1

Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2015. Credit terms of 3/20, n/60 applied. Edwards paid for the purchase on March 18, 2015. Calculate the amount at which Edwards would record the inventory on March 2, 2015, the date of purchase, using the method given.

Refer to Exhibit 7-1. Edwards uses a perpetual inventory system and the net price method.

A) $42,000

B) $76,000

C) $92,150

D) $95,000

Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2015. Credit terms of 3/20, n/60 applied. Edwards paid for the purchase on March 18, 2015. Calculate the amount at which Edwards would record the inventory on March 2, 2015, the date of purchase, using the method given.

Refer to Exhibit 7-1. Edwards uses a perpetual inventory system and the net price method.

A) $42,000

B) $76,000

C) $92,150

D) $95,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Purchases Discounts Taken account may appear in the accounting records if which one of the following methods is used to account for purchase discounts?

A) net price method

B) gross price method

C) allowance method

D) sales price method

A) net price method

B) gross price method

C) allowance method

D) sales price method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following statements is false?

A) FOB shipping point means the buyer has legal title to the goods while they are in transit.

B) FOB shipping point means the buyer has legal title to the goods when they are shipped.

C) FOB destination means the seller has legal title to the goods until they reach the buyer's place of business.

D) FOB shipping point means the buyer acquires legal title to the goods when they reach the buyer's place of business.

A) FOB shipping point means the buyer has legal title to the goods while they are in transit.

B) FOB shipping point means the buyer has legal title to the goods when they are shipped.

C) FOB destination means the seller has legal title to the goods until they reach the buyer's place of business.

D) FOB shipping point means the buyer acquires legal title to the goods when they reach the buyer's place of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

28

The cost of goods sold can be determined only after a physical count of inventory on hand under the

A) perpetual inventory system

B) variable costing system

C) moving average system

D) periodic system

A) perpetual inventory system

B) variable costing system

C) moving average system

D) periodic system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which one of the following types of costs should be included in the cost of a manufactured inventory?

A) abnormal spoilage

B) production supervisory salaries

C) interest costs

D) selling costs

A) abnormal spoilage

B) production supervisory salaries

C) interest costs

D) selling costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

30

When goods are sold FOB shipping point, ownership of the inventory is passed when the

A) inventory arrives at the destination

B) purchase order for the inventory is complete

C) inventory is shipped to the buyer

D) inventory sold is segregated from the seller's other inventory

A) inventory arrives at the destination

B) purchase order for the inventory is complete

C) inventory is shipped to the buyer

D) inventory sold is segregated from the seller's other inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not an advantage of a perpetual inventory system?

A) assists in the prevention of stock outs

B) requires less data processing effort than periodic systems

C) maintains up-to-date inventory and cost of goods sold balances

D) provides evidence of inventory shrinkage

A) assists in the prevention of stock outs

B) requires less data processing effort than periodic systems

C) maintains up-to-date inventory and cost of goods sold balances

D) provides evidence of inventory shrinkage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

32

Exhibit 7-1

Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2015. Credit terms of 3/20, n/60 applied. Edwards paid for the purchase on March 18, 2015. Calculate the amount at which Edwards would record the inventory on March 2, 2015, the date of purchase, using the method given.

Refer to Exhibit 7-1. Edwards uses a perpetual inventory system and the gross price method.

A) $42,000

B) $76,000

C) $92,150

D) $95,000

Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2015. Credit terms of 3/20, n/60 applied. Edwards paid for the purchase on March 18, 2015. Calculate the amount at which Edwards would record the inventory on March 2, 2015, the date of purchase, using the method given.

Refer to Exhibit 7-1. Edwards uses a perpetual inventory system and the gross price method.

A) $42,000

B) $76,000

C) $92,150

D) $95,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

33

Goods in transit shipped FOB shipping point should be included in the inventory of the

A) buyer

B) seller

C) shipping company

D) none of these

A) buyer

B) seller

C) shipping company

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

34

Stansbury Company determined its December 31, 2015 inventory to be $1,000,000 based on a physical count priced at cost. Additional information for the company is as follows: Merchandise costing $90,000 was shipped FOB shipping point from a vendor on December 30, 2015. This merchandise was received and recorded on January 5, 2016.

Goods costing $120,000 were staged on the shipping dock and excluded from inventory although shipment was not

Made until January 4, 2016. The goods were billed to the customer FOB shipping point on December 30, 2015.

What is Stansbury's ending inventory for its December 31, 2015 balance sheet?

A) $1,000,000

B) $1,090,000

C) $1,120,000

D) $1,210,000

Goods costing $120,000 were staged on the shipping dock and excluded from inventory although shipment was not

Made until January 4, 2016. The goods were billed to the customer FOB shipping point on December 30, 2015.

What is Stansbury's ending inventory for its December 31, 2015 balance sheet?

A) $1,000,000

B) $1,090,000

C) $1,120,000

D) $1,210,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is a characteristic of a periodic inventory system?

A) The system does not maintain a continuous record of the quantities of inventory on hand or inventory sold

B) The system reports how much inventory is on hand at all times.

C) The computer tracks inventory upon a sale, and the cost of goods and inventory are immediately updated.

D) Purchases of inventory are recorded to the inventory account.

A) The system does not maintain a continuous record of the quantities of inventory on hand or inventory sold

B) The system reports how much inventory is on hand at all times.

C) The computer tracks inventory upon a sale, and the cost of goods and inventory are immediately updated.

D) Purchases of inventory are recorded to the inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which one of the following statements is true?

A) FOB destination means the buyer has legal title to the goods while they are in transit.

B) FOB shipping point means the seller has legal title to the goods while they are in transit.

C) FOB destination means the seller has legal title to the goods until they reach the buyer's place of business.

D) FOB shipping point means the buyer acquires legal title to the goods when they reach the buyer's place of business.

A) FOB destination means the buyer has legal title to the goods while they are in transit.

B) FOB shipping point means the seller has legal title to the goods while they are in transit.

C) FOB destination means the seller has legal title to the goods until they reach the buyer's place of business.

D) FOB shipping point means the buyer acquires legal title to the goods when they reach the buyer's place of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

37

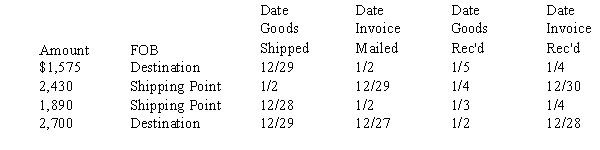

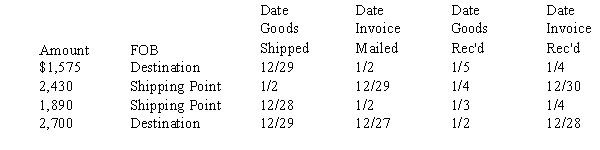

Near the end of 2016, Spruce Co. made the following purchases. The months involved in all cases are December 2016 and January 2017.  What amount of the above purchases should be included in Spruce's inventory at December 31, 2016?

What amount of the above purchases should be included in Spruce's inventory at December 31, 2016?

A) $1,575

B) $1,890

C) $4,320

D) $4,575

What amount of the above purchases should be included in Spruce's inventory at December 31, 2016?

What amount of the above purchases should be included in Spruce's inventory at December 31, 2016?A) $1,575

B) $1,890

C) $4,320

D) $4,575

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a company uses a perpetual inventory system,

A) there is no purchases account

B) the cost of goods sold account is used

C) two entries are required when inventory is sold

D) All of these answer choices are used in a perpetual inventory system.

A) there is no purchases account

B) the cost of goods sold account is used

C) two entries are required when inventory is sold

D) All of these answer choices are used in a perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which one of the following types of costs is excluded from the cost of inventory that is routinely manufactured?

A) interest

B) raw materials

C) normal spoilage

D) insurance

A) interest

B) raw materials

C) normal spoilage

D) insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following are characteristics of a perpetual inventory system?

A) Management knows how much inventory is on hand at all times.

B) Purchases of inventory are recorded to the inventory account.

C) The computer tracks inventory upon a sale and the cost of goods and inventory are immediately updated.

D) All of these answer choices are characteristics of a perpetual inventory system.

A) Management knows how much inventory is on hand at all times.

B) Purchases of inventory are recorded to the inventory account.

C) The computer tracks inventory upon a sale and the cost of goods and inventory are immediately updated.

D) All of these answer choices are characteristics of a perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

41

Exhibit 7-2

Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2015. Credit terms of 3/20, n/60 applied.

Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 18, 2015, what amount is recorded in the Purchase Discounts Taken account?

A) $0

B) $2,850

C) $5,000

D) $3,000

Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2015. Credit terms of 3/20, n/60 applied.

Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 18, 2015, what amount is recorded in the Purchase Discounts Taken account?

A) $0

B) $2,850

C) $5,000

D) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

42

On August 1, Micro Encoders, Inc. had 120 units of a certain software package that cost $6 per unit. During August, the following purchases were made: August 7 60 units @ $9.00 per unit

15 80 units @ $12.00 per unit

21 140 units @ $10.50 per unit

During August, 300 units were sold. If Micro Encoders uses the weighted average method, the cost of ending inventory would be

A) $922.50

B) $2,767.50

C) $937.50

D) $2,812.20

15 80 units @ $12.00 per unit

21 140 units @ $10.50 per unit

During August, 300 units were sold. If Micro Encoders uses the weighted average method, the cost of ending inventory would be

A) $922.50

B) $2,767.50

C) $937.50

D) $2,812.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

43

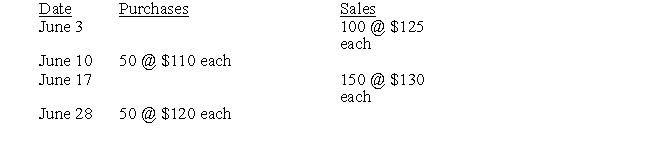

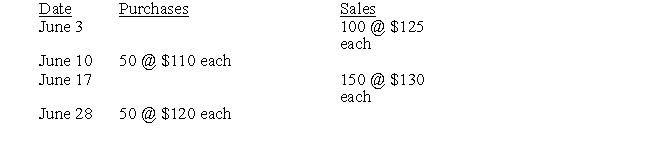

On June 1, Dollar Hardware, Inc. had an inventory of 300 gas grills costing $100 each. Purchases and sales during June are as follows:  What is the cost of Dollar's inventory on June 30 using the FIFO method?

What is the cost of Dollar's inventory on June 30 using the FIFO method?

A) $15,000

B) $16,000

C) $16,500

D) $18,000

What is the cost of Dollar's inventory on June 30 using the FIFO method?

What is the cost of Dollar's inventory on June 30 using the FIFO method?A) $15,000

B) $16,000

C) $16,500

D) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which one of the following is not an advantage of using the FIFO cost flow assumption?

A) produces lowest net income in periods of rising prices

B) provides a relevant ending inventory value

C) is not as susceptible to profit manipulation by management

D) does not produce unusual results when inventory liquidation occurs

A) produces lowest net income in periods of rising prices

B) provides a relevant ending inventory value

C) is not as susceptible to profit manipulation by management

D) does not produce unusual results when inventory liquidation occurs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

45

McClure Corp. purchased raw materials with a cost of $86,000. Credit terms of 3/10, n/60 apply. If McClure uses the net price method, the purchase should be recorded as

A) $77,400

B) $86,000

C) $83,420

D) $88,580

A) $77,400

B) $86,000

C) $83,420

D) $88,580

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

46

Exhibit 7-4

RJ, Inc. had the following activity for an inventory item during June:

-Refer to Exhibit 7-4. Assuming RJ, Inc. uses a periodic weighted average cost flow assumption, ending inventory for June would be

A) $512

B) $560

C) $768

D) $720

RJ, Inc. had the following activity for an inventory item during June:

-Refer to Exhibit 7-4. Assuming RJ, Inc. uses a periodic weighted average cost flow assumption, ending inventory for June would be

A) $512

B) $560

C) $768

D) $720

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which one of the following statements is false?

A) Under conditions of rising prices, the LIFO method results in lower income than the FIFO method.

B) In most cases, the FIFO method approximates the physical flow of items in inventory.

C) The LIFO method produces a higher ending inventory value than the FIFO method.

D) The FIFO method includes holding gains in income.

A) Under conditions of rising prices, the LIFO method results in lower income than the FIFO method.

B) In most cases, the FIFO method approximates the physical flow of items in inventory.

C) The LIFO method produces a higher ending inventory value than the FIFO method.

D) The FIFO method includes holding gains in income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

48

Left Images Printing uses perpetual LIFO in valuing its inventory. The March 1 inventory was 36 units at $6 each. Purchases and sales during March were as follows:  The cost of the ending inventory was

The cost of the ending inventory was

A) $424

B) $312

C) $330

D) $286

The cost of the ending inventory was

The cost of the ending inventory wasA) $424

B) $312

C) $330

D) $286

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which one of the following sets of inventory cost flow assumptions is not susceptible to profit manipulation by management?

A) FIFO and specific identification

B) LIFO and average cost

C) FIFO and average cost

D) LIFO and specific identification

A) FIFO and specific identification

B) LIFO and average cost

C) FIFO and average cost

D) LIFO and specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which one of the following types of costs is most likely to be included in determining the cost of inventory?

A) freight-in costs

B) freight-out costs

C) interest cost for amounts borrowed to finance the purchase of inventory

D) marketing costs

A) freight-in costs

B) freight-out costs

C) interest cost for amounts borrowed to finance the purchase of inventory

D) marketing costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

51

Exhibit 7-4

RJ, Inc. had the following activity for an inventory item during June:

-Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be

A) $512

B) $560

C) $768

D) $720

RJ, Inc. had the following activity for an inventory item during June:

-Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be

A) $512

B) $560

C) $768

D) $720

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

52

Exhibit 7-2

Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2015. Credit terms of 3/20, n/60 applied.

Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 31, 2015, what amount is recorded in the Purchase Discounts Lost account?

A) $0

B) $2,850

C) $4,000

D) $8,000

Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2015. Credit terms of 3/20, n/60 applied.

Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 31, 2015, what amount is recorded in the Purchase Discounts Lost account?

A) $0

B) $2,850

C) $4,000

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

53

Eller Company uses a periodic inventory system. Relevant inventory information for the year follows:  At year-end, 50 units remain in inventory. What is the cost of the ending inventory on a LIFO basis?

At year-end, 50 units remain in inventory. What is the cost of the ending inventory on a LIFO basis?

A) $7,950

B) $7,100

C) $8,750

D) $8,450

At year-end, 50 units remain in inventory. What is the cost of the ending inventory on a LIFO basis?

At year-end, 50 units remain in inventory. What is the cost of the ending inventory on a LIFO basis?A) $7,950

B) $7,100

C) $8,750

D) $8,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

54

La Grange, Inc. reported sales of $1,200 in October and a gross profit of $370. The company had an October 1 inventory of 60 units that had a total cost of $300. October purchases and sales were as follows:  La Grange, Inc., must use

La Grange, Inc., must use

A) LIFO perpetual

B) FIFO

C) weighted average

D) LIFO periodic

La Grange, Inc., must use

La Grange, Inc., must useA) LIFO perpetual

B) FIFO

C) weighted average

D) LIFO periodic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

55

On July 1, Maxwell Company had 40 units of inventory at a cost of $6 per unit. July purchases and sales were as follows:  The cost of goods sold during July was $272. Maxwell must use:

The cost of goods sold during July was $272. Maxwell must use:

A) FIFO

B) LIFO perpetual

C) weighted average

D) LIFO periodic

The cost of goods sold during July was $272. Maxwell must use:

The cost of goods sold during July was $272. Maxwell must use:A) FIFO

B) LIFO perpetual

C) weighted average

D) LIFO periodic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

56

Morton uses the moving average flow assumption. On January 1, there were 180 units on hand and the total inventory cost was $900. On January 10, 40 more units were purchased at a cost of $6 per unit. Sales included 20 units on January 3 and 60 units on January 17. What was the total cost of goods sold recorded for the units sold on January 17?

A) $728

B) $330

C) $100

D) $312

A) $728

B) $330

C) $100

D) $312

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

57

For the year in which prices rise, adoption of a "just-in-time" inventory system will most likely result in

A) a permanent increase in the size of the inventory

B) a reduction in income taxes

C) an increase in total assets

D) an increase in income

A) a permanent increase in the size of the inventory

B) a reduction in income taxes

C) an increase in total assets

D) an increase in income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following inventory cost flow assumptions produces the same ending inventory values under both the periodic and perpetual systems?

A) FIFO

B) LIFO

C) weighted average

D) dollar-value LIFO

A) FIFO

B) LIFO

C) weighted average

D) dollar-value LIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

59

Rubric, Inc. provided the following inventory transaction summary for May: 5/1 Purchased 200 units @ $3.00 per unit

5/15 Sold 40 units

5/21 Purchased 300 units @ $5.00 per unit 5/31 Purchased 40 units @ $10.00 per unit

In addition, it has been determined that Rubric's inventory at the beginning of the month was $400.00 200 units). What was Rubric's cost per unit at the end of May, using the moving average method?

A) $3.00

B) $2.00

C) $4.00

D) $6.00

5/15 Sold 40 units

5/21 Purchased 300 units @ $5.00 per unit 5/31 Purchased 40 units @ $10.00 per unit

In addition, it has been determined that Rubric's inventory at the beginning of the month was $400.00 200 units). What was Rubric's cost per unit at the end of May, using the moving average method?

A) $3.00

B) $2.00

C) $4.00

D) $6.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

60

Concerning purchase discounts, which one of the following statements is true?

A) Purchase discounts taken should be deducted from the acquisition cost of the inventory.

B) The net price method results in recording accounts payable at the maximum value of the liability that the company may be required to pay out.

C) Purchase discounts lost should be included in the cost of inventory.

D) An advantage of the gross price method is that it isolates purchase discounts lost and thus highlights inefficiencies.

A) Purchase discounts taken should be deducted from the acquisition cost of the inventory.

B) The net price method results in recording accounts payable at the maximum value of the liability that the company may be required to pay out.

C) Purchase discounts lost should be included in the cost of inventory.

D) An advantage of the gross price method is that it isolates purchase discounts lost and thus highlights inefficiencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

61

Management's choice to use LIFO or FIFO can make a financial analyst's efforts to compare companies difficult. The financial analyst's job is made easier because of the

A) requirement that the financial statements and tax return must use the same inventory valuation methodology

B) fact that most companies in an industry use the specific identification method

C) use of the weighted average method

D) disclosure of the LIFO reserve

A) requirement that the financial statements and tax return must use the same inventory valuation methodology

B) fact that most companies in an industry use the specific identification method

C) use of the weighted average method

D) disclosure of the LIFO reserve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

62

For companies that have little change in the characteristics of their inventory items, the most appropriate method for computing a cost index for dollar-value LIFO is the

A) inventory pool method

B) double-extension method

C) weighted average method

D) link-chain method

A) inventory pool method

B) double-extension method

C) weighted average method

D) link-chain method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company uses a LIFO reserve because internal reporting

A) and GAAP reporting are not the same as tax reporting

B) and GAAP reporting are the same as tax reporting

C) is the same as GAAP reporting and tax reporting

D) is not the same as GAAP reporting and tax reporting

A) and GAAP reporting are not the same as tax reporting

B) and GAAP reporting are the same as tax reporting

C) is the same as GAAP reporting and tax reporting

D) is not the same as GAAP reporting and tax reporting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which inventory cost flow assumption is not allowed for financial reporting in many foreign countries?

A) specific identification

B) average

C) FIFO

D) LIFO

A) specific identification

B) average

C) FIFO

D) LIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

65

IFRS does not allow the use of LIFO because it

A) would have to be allowed for tax reporting in each country.

B) would result in too many overstatements of income.

C) is inconsistent with any presumed physical flow of inventory.

D) would have to be the only method permitted.

A) would have to be allowed for tax reporting in each country.

B) would result in too many overstatements of income.

C) is inconsistent with any presumed physical flow of inventory.

D) would have to be the only method permitted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

66

Trip Corp. began business in 2015. On December 31, 2015, Trip's single pool of inventory was valued at $300,000, using the dollar-value LIFO inventory method. On December 31, 2016, the value of Trip's inventory at current costs was $450,000. The 2016 year-end cost index was 120. What was the value of Trip's inventory at the end of 2016, using the dollar-value LIFO method?

A) $375,000

B) $390,000

C) $480,000

D) $540,000

A) $375,000

B) $390,000

C) $480,000

D) $540,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following cannot be used as the current cost in dollar-value LIFO calculations?

A) the cost of the first acquisitions in a year

B) the cost of the last acquisitions in a year

C) the cost of the acquisitions in the middle of a year

D) the average cost of all acquisitions in a year

A) the cost of the first acquisitions in a year

B) the cost of the last acquisitions in a year

C) the cost of the acquisitions in the middle of a year

D) the average cost of all acquisitions in a year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

68

Exhibit 7-5

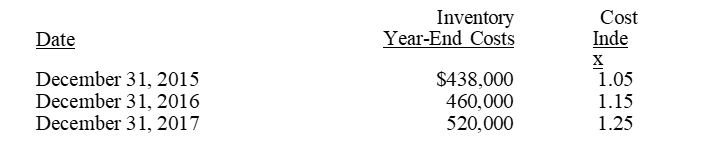

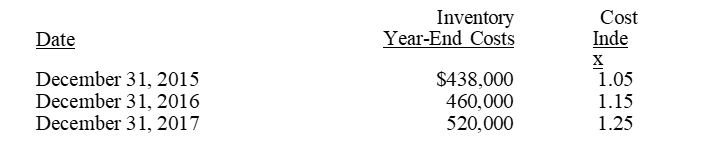

Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2015, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:

-Refer to Exhibit 7-5. The ending inventory at December 31, 2017, using the dollar-value LIFO method would be

A) $422,000

B) $402,000

C) $426,000

D) $420,400

Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2015, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:

-Refer to Exhibit 7-5. The ending inventory at December 31, 2017, using the dollar-value LIFO method would be

A) $422,000

B) $402,000

C) $426,000

D) $420,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

69

Taylor Company changed its inventory cost flow assumption from FIFO to LIFO in a period of rising prices. What would be the effect of this change on ending inventory in the year of the change?

A) increased ending inventory

B) decreased ending inventory

C) no change in ending inventory

D) cannot be determined from the information given

A) increased ending inventory

B) decreased ending inventory

C) no change in ending inventory

D) cannot be determined from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

70

Typically, the impact of the LIFO reserve is to

A) increase cost of goods sold and decrease ending inventory

B) decrease cost of goods sold and decrease ending inventory

C) increase cost of goods sold and increase ending inventory

D) have no effect on cost of goods sold and ending inventory

A) increase cost of goods sold and decrease ending inventory

B) decrease cost of goods sold and decrease ending inventory

C) increase cost of goods sold and increase ending inventory

D) have no effect on cost of goods sold and ending inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

71

The term LIFO reserve refers to

A) a cost flow assumption for valuing inventory

B) a special fund set aside to cover LIFO liquidation

C) inventory pools used in the dollar-value LIFO method

D) any difference between the ending inventory amount under LIFO and the ending inventory amount under FIFO or average cost

A) a cost flow assumption for valuing inventory

B) a special fund set aside to cover LIFO liquidation

C) inventory pools used in the dollar-value LIFO method

D) any difference between the ending inventory amount under LIFO and the ending inventory amount under FIFO or average cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which one of the following is not an advantage of LIFO?

A) In periods of rising prices, less income tax is paid.

B) In periods of rising prices, less holding gains are reported in net income.

C) Record keeping and financial statement preparation are easier.

D) Conservative income statements and balance sheet disclosures result from rising prices.

A) In periods of rising prices, less income tax is paid.

B) In periods of rising prices, less holding gains are reported in net income.

C) Record keeping and financial statement preparation are easier.

D) Conservative income statements and balance sheet disclosures result from rising prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is not a disadvantage of using the FIFO cost flow assumption?

A) creates the highest outflow for income taxes during periods of rising prices

B) does not match current costs against current revenues

C) includes all the holding gains in income during periods of rising prices

D) provides a relevant ending inventory value

A) creates the highest outflow for income taxes during periods of rising prices

B) does not match current costs against current revenues

C) includes all the holding gains in income during periods of rising prices

D) provides a relevant ending inventory value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

74

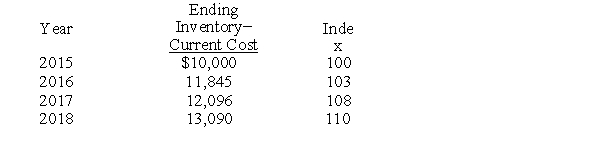

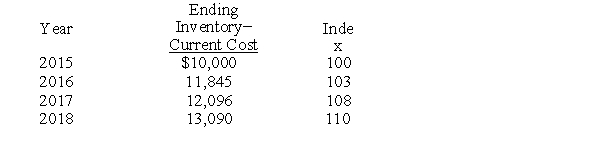

Morris Corp. uses dollar-value LIFO. Certain information follows:

Compute the ending 2018 inventory.

A) $11,900

B) $11,985

C) $12,006

D) $12,090

Compute the ending 2018 inventory.

A) $11,900

B) $11,985

C) $12,006

D) $12,090

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

75

IFRS and GAAP are similar for all of the following inventory accounting standards except IFRS

A) do not allow the inclusion of overhead in inventory

B) have provisions for use of the LIFO cost flow assumption

C) exclude the weighted average approach to inventory valuation

D) require the same cost flow assumption for all inventories that are similar in nature and use

A) do not allow the inclusion of overhead in inventory

B) have provisions for use of the LIFO cost flow assumption

C) exclude the weighted average approach to inventory valuation

D) require the same cost flow assumption for all inventories that are similar in nature and use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which one of the following cost flow assumptions provides the lowest inventory value in periods of rising prices?

A) FIFO periodic

B) LIFO periodic

C) FIFO perpetual

D) moving average

A) FIFO periodic

B) LIFO periodic

C) FIFO perpetual

D) moving average

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

77

The second step in calculating dollar-value LIFO is to

A) compute the change in the inventory level for the year at base-year cost

B) roll back the ending inventory cost to base-year costs

C) value the total ending inventory at current-year costs

D) roll forward the increase to current-year cost by applying the current-year conversion index

A) compute the change in the inventory level for the year at base-year cost

B) roll back the ending inventory cost to base-year costs

C) value the total ending inventory at current-year costs

D) roll forward the increase to current-year cost by applying the current-year conversion index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which one of the following is an advantage of LIFO?

A) In periods of rising prices, less income tax is paid.

B) In periods of rising prices, more holding gains are reported in net income.

C) Record keeping and financial statement preparation are easier.

D) Conservative income statements and balance sheet disclosures result from falling prices.

A) In periods of rising prices, less income tax is paid.

B) In periods of rising prices, more holding gains are reported in net income.

C) Record keeping and financial statement preparation are easier.

D) Conservative income statements and balance sheet disclosures result from falling prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which one of the following statements is true?

A) Income manipulation is difficult under LIFO.

B) Accounting principles do not require that the inventory cost flow approximate the physical flow of goods.

C) Companies may use LIFO for tax purposes and FIFO in the financial statements.

D) In periods of declining prices, LIFO will result in the payment of lower income taxes.

A) Income manipulation is difficult under LIFO.

B) Accounting principles do not require that the inventory cost flow approximate the physical flow of goods.

C) Companies may use LIFO for tax purposes and FIFO in the financial statements.

D) In periods of declining prices, LIFO will result in the payment of lower income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck

80

Dollar-value LIFO uses

A) current cost only

B) cost indexes only

C) current cost and cost indexes

D) numerous detailed records from either a physical count or perpetual records

A) current cost only

B) cost indexes only

C) current cost and cost indexes

D) numerous detailed records from either a physical count or perpetual records

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 114 في هذه المجموعة.

فتح الحزمة

k this deck