Deck 17: Advanced Issues in Revenue Recognition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/102

العب

ملء الشاشة (f)

Deck 17: Advanced Issues in Revenue Recognition

1

Revenue is recognized when a contract is enacted.

False

2

The efforts-expended method of recognizing revenue over time is considered to be an output method.

False

3

A constructive obligation is a promise in a contract with a customer to transfer goods or services.

False

4

The first step of the revenue recognition model is to identify the contract with the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

5

When a contract contains an uncertain, variable amount of consideration, GAAP requires that a company only recognizes total consideration as if the uncertainty does not exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

6

A contract modification always results in a new contract if the modification adds distinct goods or services at a price that reflects their stand-alone selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

7

If the customer buys goods and promises consideration in a form of a non-cash asset, the seller values the transaction based on the fair value of the non-cash asset, not on the stand-alone price of the goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

8

A contract may be written, oral, or implied by customary business practices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

9

One type of revenue is the settlement of a liability that occurs as a result of a company's primary operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

10

When a customer pays a seller a significant period of time after the goods are delivered, the consideration received by the seller always includes both transaction revenue and interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

11

The core principle of revenue recognition is that a company should recognize revenue when it has been earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

12

A good is considered distinct if it is a separately identifiable good from which a customer is able to receive benefits either separate from or together with other resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

13

If a contract contains only one performance obligation, no allocation of the transaction price is ever needed to recognize revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

14

A company that is considered to be an agent in a revenue-producing transaction will recognize revenue for the net amount of consideration received from the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

15

There are two types of license: those that are distinct and those that are satisfied over a period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

16

A "contract asset" is a receivable that arises from the performance obligation of a contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

17

The FASB provides a 4-step model for evaluating when a company should recognize revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

18

Nonrefundable fees from customers are recognized as revenue when received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

19

A company must adjust the consideration for the time value of money if the time period between the customer's payment and the company's transfer of goods or services is more than three months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

20

GAAP requires that incremental costs of obtaining a contract must be capitalized and amortized over the time of the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

21

The FASB and the IASB agreed that the fundamental characteristic of revenue recognition is that

A) the term revenue means different things to different companies in different countries.

B) revenue should be recognized when it is earned.

C) revenues are recognized and measured based on changes in assets and liabilities.

D) the number of disclosures required for revenue recognition should be held to a minimum.

A) the term revenue means different things to different companies in different countries.

B) revenue should be recognized when it is earned.

C) revenues are recognized and measured based on changes in assets and liabilities.

D) the number of disclosures required for revenue recognition should be held to a minimum.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

22

Revenue from a contract with a customer

A) is recognized even if the contract is wholly unperformed.

B) is recognized when the customer exercises its right to provide consideration.

C) cannot be recognized even if the performance obligation has been satisfied.

D) cannot be recognized until a contract exists.

A) is recognized even if the contract is wholly unperformed.

B) is recognized when the customer exercises its right to provide consideration.

C) cannot be recognized even if the performance obligation has been satisfied.

D) cannot be recognized until a contract exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

23

Construction in Progress is an inventory account typically valued at on the balance sheet at net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

24

Revenues represent

A) increases in assets and/or decreases in liabilities.

B) increases in assets and/or increases in liabilities

C) decreases in assets and/or decreases in liabilities.

D) decreases in assets and/or increases in liabilities.

A) increases in assets and/or decreases in liabilities.

B) increases in assets and/or increases in liabilities

C) decreases in assets and/or decreases in liabilities.

D) decreases in assets and/or increases in liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

25

Saler Company entered into two contractual agreements with two customers. Customer 1 agreed to buy 5,000 units of Product X11 per month for 24 months at $25 per unit. Customer 2 agreed to purchase advisory services for 12 months at $16,000 per month. Both customers agreed to modify their contracts after 6 months had passed. I. If Customer 1 decides to buy more than 5,000 units in any given month, the price will be $21 for the additional units, which is representative of the stand-alone price for this product in similar situations.

II) Customer 2 agrees to extend the period of time for advisory services to 15 months at the same price and to purchase 2,000 units of Product X11 per month for the next nine months at $15 per unit.

Which of these contract modifications creates a separate contract?

A) I only

B) II only

C) Both I and II

D) Neither I nor II

II) Customer 2 agrees to extend the period of time for advisory services to 15 months at the same price and to purchase 2,000 units of Product X11 per month for the next nine months at $15 per unit.

Which of these contract modifications creates a separate contract?

A) I only

B) II only

C) Both I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

26

On January 1, SaLow Company enters into a contract to provide custom-made equipment to ByHi Corporation for $100,000. The contract terms allow cancellation without penalty by either party at any time prior to delivery of the goods. The contract specifies a delivery date of March 15 but the equipment was not delivered until April 10. The contract required full payment within 30 days after delivery. When should revenue be recognized for this contract?

A) Never, because it includes a termination agreement.

B) March 15

C) April 10

D) May 10

A) Never, because it includes a termination agreement.

B) March 15

C) April 10

D) May 10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a contract modification does not create a separate contract, it is accounted for using

A) either a cumulative catch-up adjustment or a retrospective approach.

B) either a cumulative catch-up adjustment or a prospective approach.

C) either a retrospective approach or a prospective approach.

D) either a cumulative catch-up adjustment, a prospective approach, or a retrospective approach.

A) either a cumulative catch-up adjustment or a retrospective approach.

B) either a cumulative catch-up adjustment or a prospective approach.

C) either a retrospective approach or a prospective approach.

D) either a cumulative catch-up adjustment, a prospective approach, or a retrospective approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

28

The first step of the revenue recognition model is

A) to identify the contract with the customer.

B) to identify the performance obligations to the customer.

C) to recognize revenue when it is earned.

D) to determine the transaction price.

A) to identify the contract with the customer.

B) to identify the performance obligations to the customer.

C) to recognize revenue when it is earned.

D) to determine the transaction price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

29

The FASB and the IASB jointly issued a comprehensive principles-based revenue recognition Model entitled

A) Revenue Recognition.

B) Revenue from Contracts with Customers.

C) Principles of Revenue Recognition.

D) Principle-Based Rules of Revenue Recognition.

A) Revenue Recognition.

B) Revenue from Contracts with Customers.

C) Principles of Revenue Recognition.

D) Principle-Based Rules of Revenue Recognition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

30

Revenues are recognized when

A) net assets increase or decrease as a result of any company activity.

B) net assets increase or decrease as a result of primary operating activities.

C) net assets increase as a result of any company activity.

D) net assets increase as a result of primary operating activities.

A) net assets increase or decrease as a result of any company activity.

B) net assets increase or decrease as a result of primary operating activities.

C) net assets increase as a result of any company activity.

D) net assets increase as a result of primary operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

31

A contract adds distinct goods and services and the contract price does not reflect the stand-alone selling price of these goods and services. How is the contract modification accounted for?

A) as a separate contract

B) prospective method

C) retrospective method

D) cumulative catch-up method.

A) as a separate contract

B) prospective method

C) retrospective method

D) cumulative catch-up method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Partial Billings account is a contra account of the Construction in Progress account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

33

A company must account for a contract modification as a new contract if

A) the modification adds distinct goods or services at a price that reflects their stand-alone selling price.

B) the seller has the right to receive consideration equal to the stand-alone selling price of the promised goods or services.

C) the promised goods or services are distinct and separable from other goods or services promised in the original contract.

D) the promised goods or services are distinct and the contract has commercial substance.

A) the modification adds distinct goods or services at a price that reflects their stand-alone selling price.

B) the seller has the right to receive consideration equal to the stand-alone selling price of the promised goods or services.

C) the promised goods or services are distinct and separable from other goods or services promised in the original contract.

D) the promised goods or services are distinct and the contract has commercial substance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

34

A contract

A) must have commercial substance to be legally enforceable.

B) may qualify for revenue recognition even if one party can unilaterally cancel the contract before performance.

C) must be in writing to be enforceable for accounting purposes.

D) is an agreement that creates enforceable rights and obligations.

A) must have commercial substance to be legally enforceable.

B) may qualify for revenue recognition even if one party can unilaterally cancel the contract before performance.

C) must be in writing to be enforceable for accounting purposes.

D) is an agreement that creates enforceable rights and obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

35

A contract modification does not add distinct goods and services. How is the contract modification accounted for?

A) as a separate contract

B) prospective method

C) retrospective method

D) cumulative catch-up method

A) as a separate contract

B) prospective method

C) retrospective method

D) cumulative catch-up method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

36

The new revenue recognition standard excludes coverage of all the following except

A) leases.

B) long-term construction contracts.

C) insurance contracts.

D) financial instruments.

A) leases.

B) long-term construction contracts.

C) insurance contracts.

D) financial instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

37

On July 10, Boogie Footware agrees to a contract to sell 800 pair of flapper shoes for $16,000 to Twenties, Inc. On September 1, after 500 pair of have been delivered, Boogie and Twenties modify the agreement to reduce the price of the remaining 300 pair of flapper shoes to $10 a pair. During September, Boogie delivers 200 pairs of shoes. How much revenue will Boogie recognize for the month of September?

A) $3,000

B) $2,000

C) $1,625

D) $1,375

A) $3,000

B) $2,000

C) $1,625

D) $1,375

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company should only apply the revenue recognition standard to contracts that meet all of the following criteria except

A) the contract has commercial substance.

B) collectability of consideration is probable.

C) each party's rights regarding goods and services to be transferred are identified.

D) the transaction price is fixed and determinable.

A) the contract has commercial substance.

B) collectability of consideration is probable.

C) each party's rights regarding goods and services to be transferred are identified.

D) the transaction price is fixed and determinable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

39

In January, Cigaro Corp. agrees to a contract to sell 14,000 sports caps for $140,000 to Dilly, Inc. In March, after 5,000 caps have been delivered, Cigaro and Dilly modify the agreement to sell an additional 6,000 caps for $33,000 which is significantly lower than Cigaro's stand-alone selling price at that time. During April, Cigaro delivers 2,000 caps. How much revenue will Cigaro recognize for the month of April?

A) $17,300

B) $16,400

C) $15,500

D) $11,000

A) $17,300

B) $16,400

C) $15,500

D) $11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

40

On April 15, Topper Company agrees to a contract to sell 9,000 tie-dyed flags for $45,000 to PeaceTime, Inc. On August 1, after 5,000 flags have been delivered, Topper and Peace modify the agreement to sell an additional 6,000 flags for $21,000 which is significantly lower than Topper's stand-alone selling price at that time. During August, Topper delivers 1,000 flags. How much revenue will Topper recognize for the month of August?

A) $5,000

B) $4,400

C) $4,250

D) $4,100

A) $5,000

B) $4,400

C) $4,250

D) $4,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

41

BoTeck is a full-service technology company. It provides equipment, installation services, and training services. Customers can purchase any product or service separately or as a bundled package. On May 3, Box-Rite Corporation purchased computer equipment, installation, and training for a total cost of $120,000. Estimated stand- alone fair values of the equipment, installation, and training are $75,000, $50,000, and $25,000 respectively. The transaction price allocated to equipment, installation and training is

A) $75,000, $50,000, and $25,000 respectively.

B) $60,000, $40,000 and $20,000 respectively.

C) $40,000, $40,000, and $40,000 respectively.

D) $120,000 for the entire bundle.

A) $75,000, $50,000, and $25,000 respectively.

B) $60,000, $40,000 and $20,000 respectively.

C) $40,000, $40,000, and $40,000 respectively.

D) $120,000 for the entire bundle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

42

The transaction price for multiple performance obligations should be allocated based on

A) total transaction price less residual value.

B) forecasted cost of satisfying performance obligation.

C) what the company could sell the goods for on a stand-alone basis.

D) selling price from the company's competitors.

A) total transaction price less residual value.

B) forecasted cost of satisfying performance obligation.

C) what the company could sell the goods for on a stand-alone basis.

D) selling price from the company's competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

43

The role of the agent in a principal-agent relationship is to

A) provide goods or services to a customer.

B) arrange for the principal to provide goods or services to a customer.

C) develop and maintain goodwill of the principal's customers.

D) collect payment from the customer and remit it to the principal.

A) provide goods or services to a customer.

B) arrange for the principal to provide goods or services to a customer.

C) develop and maintain goodwill of the principal's customers.

D) collect payment from the customer and remit it to the principal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not an indicator that a promise is separately identifiable within a contract?

A) lack of integration with other promised goods or services.

B) does not modify another good or service.

C) is not dependent on other goods or services.

D) lack of commercial substance like other goods or services.

A) lack of integration with other promised goods or services.

B) does not modify another good or service.

C) is not dependent on other goods or services.

D) lack of commercial substance like other goods or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

45

On January 1, 2017, Oldham Company sold goods to Windall Company in exchange for a 3-year, non-interest- bearing note with a face value of $10,000. If Oldham entered into a separate financing transaction with Windall, an appropriate interest rate would be 8%. Which of the following statements is true about the journal entry that records the transaction when Oldham delivers the goods to Windall on January 1, 2017?

A) Debit Note Receivable for $10,000

B) Credit Sales Revenue $7,600

C) Credit Discount on Note Receivable $2,400

D) Credit Interest Revenue $2,400

A) Debit Note Receivable for $10,000

B) Credit Sales Revenue $7,600

C) Credit Discount on Note Receivable $2,400

D) Credit Interest Revenue $2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

46

On July 15, Zink Jewels agrees to a contract to sell 4,000 promise rings for $100,000 to Costless Stores, Inc. On October 1, after 2,000 rings pair of have been delivered, Zink and Costless modify the agreement to reduce the price of the remaining 1,000 rings to $12 each. During October, Zink Jewels delivers 600 rings. How much revenue will Zink recognize for the month of October?

A) $13,050

B) $7,200

C) $3,300

D) $2,175

A) $13,050

B) $7,200

C) $3,300

D) $2,175

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

47

Bodine Corp. has a contract to deliver cleaning products to the community center. The contract with the aquatic center states that the first 500 gallons of cleaner will cost $16 per gallon. However, the cost will drop to $12 per gallon for all purchases over 500 gallons. Based on its experience, Bodine Corp. estimates that the center will use 800 gallons of chemicals. What transaction price per gallon should Chlorine use for this contract?

A) $16.00

B) $14.50

C) $14.00

D) $12.00

A) $16.00

B) $14.50

C) $14.00

D) $12.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

48

BoTeck is a full-service technology company. It provides equipment, installation services, and training services. For a recent major group sale, the transaction price had a variable component contingent upon a threshold being reached. Revenue allocated to equipment and installation services was recognized in fiscal year 2015; revenue allocated to training services is being recognized over the next two years through the end of 2017. Now, in February 2016, the contingent outcome previously expected has proven to be false and the transaction price has changed such that additional revenue should be recognized for these performance obligations. What is the proper accounting for this change in transaction price for equipment and installation services?

A) prior period adjustment to increase 2015 revenue for the full amount of change

B) increase 2016 and 2017 revenue by allocating adjustment equally to each year for the proportional amount of change

C) increase 2016 revenue by allocating adjustment to January and February equally to each month for the proportional amount of change

D) increase 2016 revenue by adjusting February for the full amount of change

A) prior period adjustment to increase 2015 revenue for the full amount of change

B) increase 2016 and 2017 revenue by allocating adjustment equally to each year for the proportional amount of change

C) increase 2016 revenue by allocating adjustment to January and February equally to each month for the proportional amount of change

D) increase 2016 revenue by adjusting February for the full amount of change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not an indicator that a company may be an agent?

A) The company provides goods or services to customers.

B) The company does not have inventory risk.

C) The company's consideration is in the form of a commission.

D) The company does not have discretion in establishing prices for goods and services.

A) The company provides goods or services to customers.

B) The company does not have inventory risk.

C) The company's consideration is in the form of a commission.

D) The company does not have discretion in establishing prices for goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of these three characteristics I, II, and III) are required in order for a promised good or service to be considered distinct? I. Commercial substance

II) Distinct within the context of the contract

III) Capable of being distinct

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

II) Distinct within the context of the contract

III) Capable of being distinct

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

51

BoTeck is a full-service technology company. It provides equipment, installation services, and training services. Customers can purchase any product or service separately or as a bundled package. On May 3, Box-Rite Corporation purchased computer equipment, installation, and training for a total cost of $120,000. Estimated stand- alone fair values of the equipment, installation, and training are $75,000, $50,000, and $25,000 respectively. The journal entry to record the sale and installation on May 3 will include

A) credit to Service Revenue of $50,000.

B) credit to Sales Revenue for $120,000.

C) credit to Unearned Service Revenue of $20,000.

D) debit to Unearned Service Revenue of $25,000.

A) credit to Service Revenue of $50,000.

B) credit to Sales Revenue for $120,000.

C) credit to Unearned Service Revenue of $20,000.

D) debit to Unearned Service Revenue of $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

52

Noncash consideration should be recognized by the seller on the basis of

A) original cost paid by customer.

B) fair value of what is received from the customer.

C) fair value of what is given up to the customer.

D) fair value of equivalent goods or services.

A) original cost paid by customer.

B) fair value of what is received from the customer.

C) fair value of what is given up to the customer.

D) fair value of equivalent goods or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

53

When multiple service-related performance obligations exist within a contract, they should be accounted for as a single performance obligation when

A) the performance obligations are distinct but interdependent.

B) each service is interrelated and interdependent.

C) the services are capable of being distinct.

D) the services are both capable of being distinct and distinct within the context of the contract.

A) the performance obligations are distinct but interdependent.

B) each service is interrelated and interdependent.

C) the services are capable of being distinct.

D) the services are both capable of being distinct and distinct within the context of the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

54

Donner Construction enters into a contract with a customer to build a warehouse for $600,000 on March 30, 2017 with a performance bonus of $30,000 if the building is completed by August 31, 2017. The bonus is reduced by $10,000 each week that completion is delayed. Donner commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes:

Completed by Probability August 31, 2017 60% September 7, 2017 30% September 14, 2017 10%

What is the transaction price for this transaction?

A) $630,000

B) $625,000

C) $615,000

D) $600,000

Completed by Probability August 31, 2017 60% September 7, 2017 30% September 14, 2017 10%

What is the transaction price for this transaction?

A) $630,000

B) $625,000

C) $615,000

D) $600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

55

The transaction price

A) includes only cash and cash equivalents and does not include non-cash consideration.

B) excludes discounts, coupons, rebates, penalties, or nonrefundable fees.

C) is the amount of consideration a company expects to receive from a customer.

D) must be clearly specified by the contract for each separate performance obligation.

A) includes only cash and cash equivalents and does not include non-cash consideration.

B) excludes discounts, coupons, rebates, penalties, or nonrefundable fees.

C) is the amount of consideration a company expects to receive from a customer.

D) must be clearly specified by the contract for each separate performance obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

56

A customer agrees to pay a seller over time with a promissory note. Which of the following statements related to this situation is false?

A) The transaction price is determined by adjusting the promised amount of future consideration to reflect the time value of money.

B) The objective for the adjusting for time value of money is to separate the contract into a revenue element and a financing element.

C) When adjusting for the time value of money, the seller should use the current prime lending rate as the discount rate.

D) Sellers are not required to adjust for the time value of money if the time period between the customer's payment and the company's transfer of goods or services is less than one year.

A) The transaction price is determined by adjusting the promised amount of future consideration to reflect the time value of money.

B) The objective for the adjusting for time value of money is to separate the contract into a revenue element and a financing element.

C) When adjusting for the time value of money, the seller should use the current prime lending rate as the discount rate.

D) Sellers are not required to adjust for the time value of money if the time period between the customer's payment and the company's transfer of goods or services is less than one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

57

If a contract involves a significant financing component

A) the time value of money is not required to determine transaction price if the payment is more than a year after the transfer occurs.

B) the transaction amount should be based on the current sales price of goods or services.

C) interest is not accrued as a result of the financing component.

D) the time value of money is used to determine the fair value of the transaction.

A) the time value of money is not required to determine transaction price if the payment is more than a year after the transfer occurs.

B) the transaction amount should be based on the current sales price of goods or services.

C) interest is not accrued as a result of the financing component.

D) the time value of money is used to determine the fair value of the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

58

A ______is an explicit or implicit promise in a contract with a customer to transfer goods or services.

A) constructive obligation

B) performance obligation

C) liability obligation

D) constructive liability

A) constructive obligation

B) performance obligation

C) liability obligation

D) constructive liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1, 2017, Oldham Company sold goods to Windall Company in exchange for a 3-year, non-interest- bearing note with a face value of $30,000. If Oldham entered into a separate financing transaction with Windall, an appropriate interest rate would be 10%; therefore, the transaction price would be $22,540. Which of the following statements is true about the journal entry that records the transaction when Oldham delivers the goods to Windall on January 1, 2017?

A) Debit Note Receivable for $22,540

B) Credit Sales Revenue $22,540

C) Debit Discount on Note Receivable $7,460

D) Credit Interest Revenue $7,460

A) Debit Note Receivable for $22,540

B) Credit Sales Revenue $22,540

C) Debit Discount on Note Receivable $7,460

D) Credit Interest Revenue $7,460

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

60

What is the appropriate revenue recognition procedure for upfront payments received in a contract with a customer?

A) capitalize and amortize over the contract term

B) defer recognition until the end of the contract

C) recognize immediately

D) recognize whenever the related performance obligation is satisfied

A) capitalize and amortize over the contract term

B) defer recognition until the end of the contract

C) recognize immediately

D) recognize whenever the related performance obligation is satisfied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

61

In July 2016, Sykick Software Company licenses its accounting software to RayHawk Corporation at a cost of

$30,000 for two years and also enters into a contract to install the software for an additional $3,000. Trident sells the software license with or without installation. The accounting software is not modified or customized by the

customer.

Required:

Prepare journal entry for Sykick to record this transaction assuming that installation will occur in July 2016 when

RayHawk pays Sykick $33,000 per their agreement.

$30,000 for two years and also enters into a contract to install the software for an additional $3,000. Trident sells the software license with or without installation. The accounting software is not modified or customized by the

customer.

Required:

Prepare journal entry for Sykick to record this transaction assuming that installation will occur in July 2016 when

RayHawk pays Sykick $33,000 per their agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

62

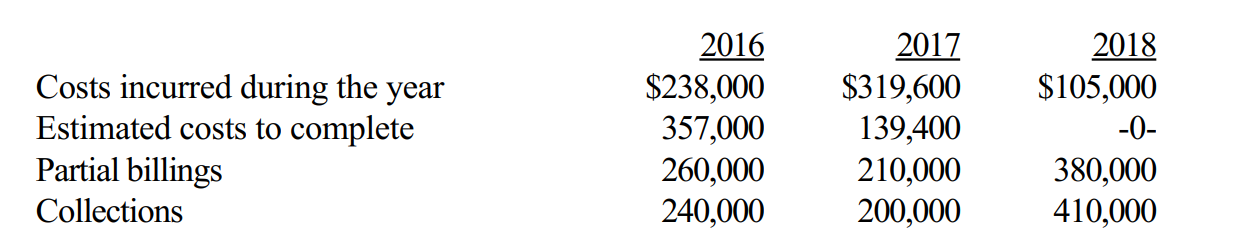

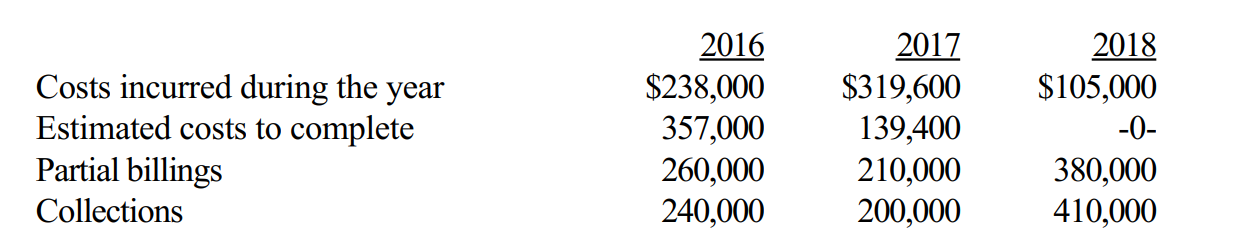

Exhibit 17-2

In 2016, Omega Construction began work on a contract with a price of $850,000 and estimated costs of $595,000. Data for each year of the contract are as follows:

-Refer to Exhibit 17-2. Assuming the performance obligation is satisfied over time, what would be the balance in Construction in Progress at the end of 2017?

A) $557,600

B) $659,600

C) $680,000

D) $782,000

In 2016, Omega Construction began work on a contract with a price of $850,000 and estimated costs of $595,000. Data for each year of the contract are as follows:

-Refer to Exhibit 17-2. Assuming the performance obligation is satisfied over time, what would be the balance in Construction in Progress at the end of 2017?

A) $557,600

B) $659,600

C) $680,000

D) $782,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

63

Consider each of the following scenarios for Bunsen Suppliers Company:

a. The common practice of Bunsen Suppliers is to obtain a written sales agreement. When an Anson Store called on the phone with an urgent need, however, Bunsen orally agreed to deliver goods in exchange for

$6,000, then immediately delivered these goods to Anson without a written agreement.

b. Bunsen Suppliers has a written agreement to deliver goods to Comfort Inc. for $110 per unit. The price will drop to $95 per unit for all units if Comfort purchases more than 1,000 units per month.

c. Bunsen Suppliers has a written agreement with Darwin Company to deliver 800 units of product each

Saturday afternoon. Darwin can alter the quantity or cancel a delivery any time before noon Saturday.

Required:

Determine if a contract exists for each of these scenarios and comment on revenue recognition issues.

a. The common practice of Bunsen Suppliers is to obtain a written sales agreement. When an Anson Store called on the phone with an urgent need, however, Bunsen orally agreed to deliver goods in exchange for

$6,000, then immediately delivered these goods to Anson without a written agreement.

b. Bunsen Suppliers has a written agreement to deliver goods to Comfort Inc. for $110 per unit. The price will drop to $95 per unit for all units if Comfort purchases more than 1,000 units per month.

c. Bunsen Suppliers has a written agreement with Darwin Company to deliver 800 units of product each

Saturday afternoon. Darwin can alter the quantity or cancel a delivery any time before noon Saturday.

Required:

Determine if a contract exists for each of these scenarios and comment on revenue recognition issues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

64

Assuming that the performance obligation is satisfied over time, Construction in Progress represents inventory that is valued at

A) accrued cost.

B) incurred cost.

C) lower of cost or market.

D) net realizable value.

A) accrued cost.

B) incurred cost.

C) lower of cost or market.

D) net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

65

A construction project is expected to take two-and-a-half years to complete. Partial Billings is less than Construction in Progress. The two accounts are reported together on the balance sheet in the

A) current assets section.

B) long-term assets section.

C) current liabilities section.

D) long-term liabilities section.

A) current assets section.

B) long-term assets section.

C) current liabilities section.

D) long-term liabilities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

66

What type of account is Construction in Progress?

A) asset

B) contra asset

C) expense

D) receivable

A) asset

B) contra asset

C) expense

D) receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

67

A Provision for Loss on Contract is reported in the financial statements as

A) a contra-liability account.

B) a loss account.

C) an asset account.

D) a contra-asset account.

A) a contra-liability account.

B) a loss account.

C) an asset account.

D) a contra-asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

68

Able Bakers sells cooking supplies and training services. Under a contract with Putnam Restaurants, Able will provide $60,000 of supplies and three months of training for $2,000 per month. Able's right to receive consideration for cooking supplies is conditional upon providing one month of training services before they can bill the customer for the supplies. When Able delivers the supplies on the first day of training services, Able will recognize

A) $60,000 receivable.

B) $60,000 contract liability.

C) $60,000 contract asset.

D) $60,000 unearned revenue.

A) $60,000 receivable.

B) $60,000 contract liability.

C) $60,000 contract asset.

D) $60,000 unearned revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

69

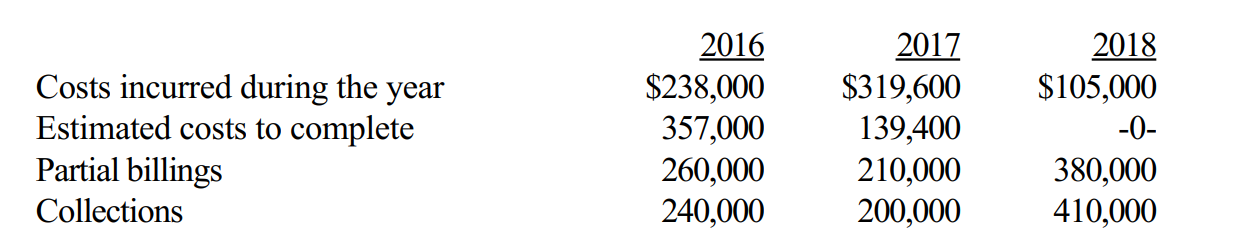

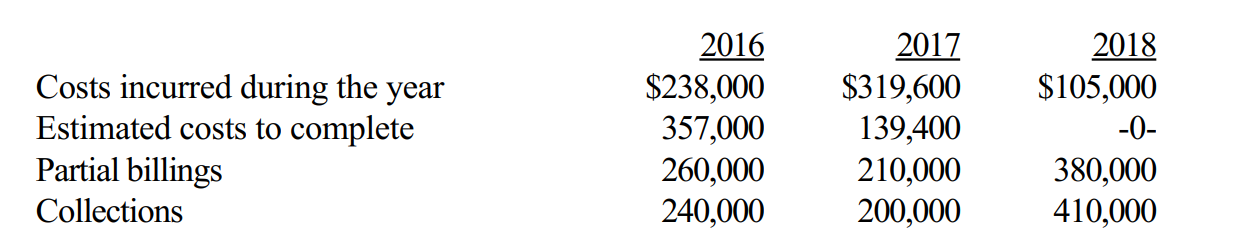

Noyes Construction Corporation contracted to construct a building for $4,500,000. Construction began in 2016 and was completed in 2017. Data relating to the contract are summarized below:

Noyes assumes the performance obligation is satisfied over time. What amount of gross profit should Hayes report for 2016?

A) $0

B) $675,000

C) $810,000

D) $900,000

Noyes assumes the performance obligation is satisfied over time. What amount of gross profit should Hayes report for 2016?

A) $0

B) $675,000

C) $810,000

D) $900,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

70

On January 1, 2017, Carly Fashions Inc. enters into a contract with a regional retail company to provide 500 blouses for $20,000 over the next 10 months. On September 1, 2017, after 400 of the blouses had been delivered 50 blouses per month), the contract is modified.

Required:

a. Fifty blouses were delivered each month for the first 8 months of 2017. Prepare Carly Fashions's monthly journal entry to record revenue.

b. Assume that the contract is modified on September 1 to sell, once the original 500 blouses are delivered, an additional 100 blouses at $35 per blouse, which is the stand-alone selling price on October 1, 2017. The additional blouses are to be delivered in November. Prepare the November journal entry to record the contract modification.

c. Assume instead that the contract is modified on September 1 to alter the price of the additional 100 blouses to

$35 per blouse, which is the stand-alone selling price on October 1, 2017. Assume the blouses are delivered evenly on September 1 and October 1, 2017. Prepare the journal entries for September and October to record this contract modification.

Required:

a. Fifty blouses were delivered each month for the first 8 months of 2017. Prepare Carly Fashions's monthly journal entry to record revenue.

b. Assume that the contract is modified on September 1 to sell, once the original 500 blouses are delivered, an additional 100 blouses at $35 per blouse, which is the stand-alone selling price on October 1, 2017. The additional blouses are to be delivered in November. Prepare the November journal entry to record the contract modification.

c. Assume instead that the contract is modified on September 1 to alter the price of the additional 100 blouses to

$35 per blouse, which is the stand-alone selling price on October 1, 2017. Assume the blouses are delivered evenly on September 1 and October 1, 2017. Prepare the journal entries for September and October to record this contract modification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

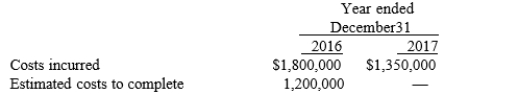

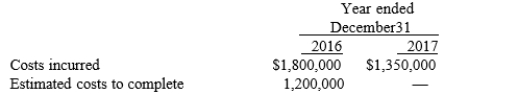

71

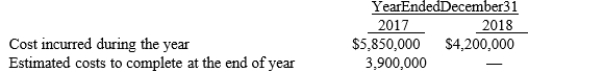

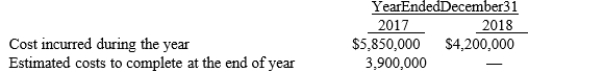

In 2017, Dygress Construction Co. began work on a contract for $16,500,000; it was completed in 2018. The following cost data pertain to this contract:  Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

A) $2,400,000

B) $2,695,000

C) $4,050,000

D) $6,450,000

Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?A) $2,400,000

B) $2,695,000

C) $4,050,000

D) $6,450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

72

What type of account is Partial Billings?

A) asset

B) contra asset

C) liability

D) revenue

A) asset

B) contra asset

C) liability

D) revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

73

Exhibit 17-1

The following information relates to a project of the Cumberland Construction Company: The contract price was $1,200,000. Cumberland uses the cost-to-cost method of revenue recognition.

The contract price was $1,200,000. Cumberland uses the cost-to-cost method of revenue recognition.

Refer to Exhibit 17-1. Assume revenue in the amount of $200,000 was recognized in 2016. What amount of revenue would be recognized in 2017?

A) $840,000

B) $640,000

C) $616,000

D) $416,000

The following information relates to a project of the Cumberland Construction Company:

The contract price was $1,200,000. Cumberland uses the cost-to-cost method of revenue recognition.

The contract price was $1,200,000. Cumberland uses the cost-to-cost method of revenue recognition.Refer to Exhibit 17-1. Assume revenue in the amount of $200,000 was recognized in 2016. What amount of revenue would be recognized in 2017?

A) $840,000

B) $640,000

C) $616,000

D) $416,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

74

A contract asset

A) represents the seller's performance obligation.

B) arises when a customer's payment of consideration occurs prior to the seller's performance under the contract.

C) represents the seller's unconditional right to receive consideration from a customer.

D) arises when the seller's right to consideration from a customer is conditional upon something other than the passage of time.

A) represents the seller's performance obligation.

B) arises when a customer's payment of consideration occurs prior to the seller's performance under the contract.

C) represents the seller's unconditional right to receive consideration from a customer.

D) arises when the seller's right to consideration from a customer is conditional upon something other than the passage of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is not a criterion that indicates a performance obligation is satisfied over time?

A) The customer receives control of a delivered product which has an expected useful life of many years.

B) The seller's performance does not create an asset with an alternative use to the seller and the seller has a right to payment for performance completed to date.

C) The customer simultaneously receives and consumes the benefits of the seller's performance as the seller performs.

D) The seller's performance creates or enhances an asset that the customer controls as the asset is created or enhanced.

A) The customer receives control of a delivered product which has an expected useful life of many years.

B) The seller's performance does not create an asset with an alternative use to the seller and the seller has a right to payment for performance completed to date.

C) The customer simultaneously receives and consumes the benefits of the seller's performance as the seller performs.

D) The seller's performance creates or enhances an asset that the customer controls as the asset is created or enhanced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

76

A construction project is expected to take two-and-a-half years to complete. Partial Billings exceeds Construction in Progress. The two accounts are reported together on the balance sheet in the

A) current assets section.

B) long-term assets section.

C) current liabilities section.

D) long-term liabilities section.

A) current assets section.

B) long-term assets section.

C) current liabilities section.

D) long-term liabilities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

77

Exhibit 17-1

The following information relates to a project of the Cumberland Construction Company: The contract price was $1,200,000. Cumberland uses the cost-to-cost method of revenue recognition.

The contract price was $1,200,000. Cumberland uses the cost-to-cost method of revenue recognition.

Refer to Exhibit 17-1. What amount of revenue would be recognized in 2016?

A) $400,000

B) $192,000

C) $136,000

D) $0

The following information relates to a project of the Cumberland Construction Company:

The contract price was $1,200,000. Cumberland uses the cost-to-cost method of revenue recognition.

The contract price was $1,200,000. Cumberland uses the cost-to-cost method of revenue recognition.Refer to Exhibit 17-1. What amount of revenue would be recognized in 2016?

A) $400,000

B) $192,000

C) $136,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following is an input method for recognizing revenue over time?

A) results-achieved method

B) units-produced method

C) milestones-reached method

D) efforts-expended method

A) results-achieved method

B) units-produced method

C) milestones-reached method

D) efforts-expended method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

79

On January 1, 2017, Fryer Company enters into a contract to supply 600 pastry frying machines to a regional donut retailer. The machines will be delivered at a rate of 25 machines per month over 2 years at a transaction price of $1,000 per machine. The salesperson received a $36,000 sales commission on the date the contract was signed. The journal entry to record the transaction on January 1 will include a

A) debit Prepaid Sales Commissions for $36,000.

B) debit Sales Commission Expense for $36,000.

C) credit Sales Revenue $600,000.

D) credit Sales Revenue $564,000.

A) debit Prepaid Sales Commissions for $36,000.

B) debit Sales Commission Expense for $36,000.

C) credit Sales Revenue $600,000.

D) credit Sales Revenue $564,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

80

Exhibit 17-2

In 2016, Omega Construction began work on a contract with a price of $850,000 and estimated costs of $595,000. Data for each year of the contract are as follows:

-Refer to Exhibit 17-2. Assuming the performance obligation is satisfied over time, what would be the gross profit in 2016?

A) $102,000

B) $260,000

C) $255,000

D) $425,000

In 2016, Omega Construction began work on a contract with a price of $850,000 and estimated costs of $595,000. Data for each year of the contract are as follows:

-Refer to Exhibit 17-2. Assuming the performance obligation is satisfied over time, what would be the gross profit in 2016?

A) $102,000

B) $260,000

C) $255,000

D) $425,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck