Deck 11: Preparing a Worksheet for a Merchandise Company

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

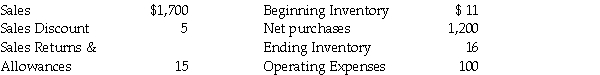

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

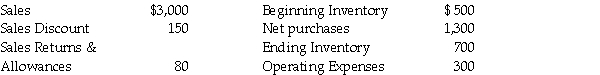

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/123

العب

ملء الشاشة (f)

Deck 11: Preparing a Worksheet for a Merchandise Company

1

The first entry to adjust Merchandise Inventory includes:

A) a debit to Merchandise Inventory.

B) a credit to Merchandise Inventory.

C) a credit to Income Summary.

D) a credit to Purchases.

A) a debit to Merchandise Inventory.

B) a credit to Merchandise Inventory.

C) a credit to Income Summary.

D) a credit to Purchases.

B

2

Unearned Rent is what type of account?

A) Asset

B) Revenue

C) Liability

D) Contra-Asset

A) Asset

B) Revenue

C) Liability

D) Contra-Asset

C

3

The second entry to adjust Merchandise Inventory includes:

A) a debit to Merchandise Inventory.

B) a credit to Merchandise Inventory.

C) a debit to Income Summary.

D) None of these is correct.

A) a debit to Merchandise Inventory.

B) a credit to Merchandise Inventory.

C) a debit to Income Summary.

D) None of these is correct.

A

4

Tim received $3,000 in advance for renting part of his building for 4 months. What is the entry to record the adjustment after one month has passed?

A) Debit Cash; credit Rental Income

B) Debit Cash; credit Unearned Rent Revenue

C) Debit Unearned Rent, credit Rental Income

D) Debit Unearned Rent, credit Cash

A) Debit Cash; credit Rental Income

B) Debit Cash; credit Unearned Rent Revenue

C) Debit Unearned Rent, credit Rental Income

D) Debit Unearned Rent, credit Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

5

The normal balance of Income Summary is:

A) debit.

B) credit.

C) The account does not have a normal balance.

D) It depends on the change of the inventory balance.

A) debit.

B) credit.

C) The account does not have a normal balance.

D) It depends on the change of the inventory balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

6

Net Income equals:

A) Net Sales - Cost of Goods Sold - Operating Expenses.

B) Gross Profit - Operating Expenses.

C) Sales - Sales Returns & Allowances - Sales Discounts - Cost of Goods Sold - Operating Expenses.

D) All of the above are correct.

A) Net Sales - Cost of Goods Sold - Operating Expenses.

B) Gross Profit - Operating Expenses.

C) Sales - Sales Returns & Allowances - Sales Discounts - Cost of Goods Sold - Operating Expenses.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

7

Ending inventory:

A) increases Cost of Goods Sold.

B) decreases Cost of Goods Sold.

C) does not affect Cost of Goods Sold.

D) increases Purchases.

A) increases Cost of Goods Sold.

B) decreases Cost of Goods Sold.

C) does not affect Cost of Goods Sold.

D) increases Purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

8

As Unearned Rent Revenue is earned, it becomes:

A) an asset.

B) a revenue.

C) a liability.

D) an expense.

A) an asset.

B) a revenue.

C) a liability.

D) an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

9

If $6,700 was the beginning inventory, purchases were $12,000 and sales were $6,000. How much was ending inventory last accounting period?

A) $12,700

B) $6,700

C) $0

D) $6,000

A) $12,700

B) $6,700

C) $0

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

10

Unearned Rent Revenue results because:

A) no fee has been paid, and the service is not complete.

B) the fee is earned but not collected.

C) the fee has been collected before the service has been provided.

D) the fee has been paid, and the service is complete.

A) no fee has been paid, and the service is not complete.

B) the fee is earned but not collected.

C) the fee has been collected before the service has been provided.

D) the fee has been paid, and the service is complete.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

11

Sam received $8,000 in advance for renting part of his building. What is the entry to record the receipt?

A) Debit Cash; credit Rent Expense

B) Debit Cash; credit Prepaid Rent Expense

C) Debit Cash; credit Unearned Rent Revenue

D) Debit Cash; credit Rental Income

A) Debit Cash; credit Rent Expense

B) Debit Cash; credit Prepaid Rent Expense

C) Debit Cash; credit Unearned Rent Revenue

D) Debit Cash; credit Rental Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

12

Cost of Goods Sold (under the Periodic Method) equals:

A) Beginning Inventory + Net Purchases + Freight-in + Freight-out + Ending Inventory.

B) Beginning Inventory - Net Purchases - Freight-in + Ending Inventory.

C) Beginning Inventory + Net Purchases + Freight-in - Ending Inventory.

D) Beginning Inventory - Net Purchases + Freight-in + Ending Inventory.

A) Beginning Inventory + Net Purchases + Freight-in + Freight-out + Ending Inventory.

B) Beginning Inventory - Net Purchases - Freight-in + Ending Inventory.

C) Beginning Inventory + Net Purchases + Freight-in - Ending Inventory.

D) Beginning Inventory - Net Purchases + Freight-in + Ending Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

13

If gross profit exceeds operating expenses, the company:

A) had a net loss.

B) broke even.

C) had a net income.

D) liabilities are greater than assets.

A) had a net loss.

B) broke even.

C) had a net income.

D) liabilities are greater than assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

14

When using a periodic inventory method, what account is increased when you buy merchandise inventory?

A) Cost of Goods Sold

B) Inventory

C) Supplies

D) Purchases

A) Cost of Goods Sold

B) Inventory

C) Supplies

D) Purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

15

Rental Income is what type of account?

A) Asset

B) Revenue

C) Expense

D) Contra-Sales

A) Asset

B) Revenue

C) Expense

D) Contra-Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

16

Beginning inventory was $3,600, purchases totaled $20,200 and and Cost of Goods Sold was $17,200. What is the ending inventory? Assume gross profit is $0.

A) $3,000

B) $600

C) $6,600

D) $13,600

A) $3,000

B) $600

C) $6,600

D) $13,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

17

What inventory method is used when the inventory balance is updated only at the end of the accounting period?

A) Periodic

B) Perpetual

C) Interim

D) Cost of Goods Sold

A) Periodic

B) Perpetual

C) Interim

D) Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

18

When the adjustment for Unearned Rent Revenue is made:

A) liabilities decrease.

B) revenue increases.

C) assets decrease.

D) Both A and B are correct.

A) liabilities decrease.

B) revenue increases.

C) assets decrease.

D) Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

19

The normal balance for Unearned Rent Revenue is:

A) a credit.

B) a debit.

C) zero.

D) dependent on circumstances.

A) a credit.

B) a debit.

C) zero.

D) dependent on circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following accounts is NOT a liability?

A) Accounts Payable

B) Salaries Payable

C) Unearned Rent

D) All of the above answers are liabilities.

A) Accounts Payable

B) Salaries Payable

C) Unearned Rent

D) All of the above answers are liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

21

As the Unearned Rent Revenue is earned:

A) the liability account is decreased and the revenue account is increased.

B) the asset account is increased and the revenue account is decreased.

C) the revenue account is decreased and the revenue account is not affected.

D) the liability account is not affected but the revenue account is decreased.

A) the liability account is decreased and the revenue account is increased.

B) the asset account is increased and the revenue account is decreased.

C) the revenue account is decreased and the revenue account is not affected.

D) the liability account is not affected but the revenue account is decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

22

On November 1, Call Center received $4,800 for two years' rent in advance from Garrett Company. The November 30 adjusting entry that Call Center should make is to:

A) debit Rental Income; credit Unearned Rent $4,800.

B) debit Cash; credit Rental Income $4,800.

C) debit Unearned Rent; credit Rental Income $200.

D) debit Unearned Rent; credit Rent Expense $200.

A) debit Rental Income; credit Unearned Rent $4,800.

B) debit Cash; credit Rental Income $4,800.

C) debit Unearned Rent; credit Rental Income $200.

D) debit Unearned Rent; credit Rent Expense $200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

23

The normal balance of Rental Income is:

A) a credit.

B) a debit.

C) zero.

D) dependent on the circumstances.

A) a credit.

B) a debit.

C) zero.

D) dependent on the circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

24

An account never used in an adjusting entry is:

A) Consulting Fees-Revenue.

B) Interest Payable.

C) Cash.

D) Accumulated Depreciation - Equipment.

A) Consulting Fees-Revenue.

B) Interest Payable.

C) Cash.

D) Accumulated Depreciation - Equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

25

The adjustment for supplies used would be to:

A) debit Supplies Expense; credit Supplies.

B) debit Supplies; credit Cash.

C) debit Supplies Expense; credit Inventory.

D) debit Inventory; credit Supplies.

A) debit Supplies Expense; credit Supplies.

B) debit Supplies; credit Cash.

C) debit Supplies Expense; credit Inventory.

D) debit Inventory; credit Supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

26

The adjustment for Unearned Rent Revenue is recorded when:

A) cash is received.

B) rent is earned.

C) revenue is received.

D) payment is made for rent.

A) cash is received.

B) rent is earned.

C) revenue is received.

D) payment is made for rent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

27

From the following items, which would most likely cause the recording of unearned revenue?

A) Receipt of a purchase order

B) Purchase of merchandise on account

C) Legal fees collected after work is performed

D) Subscriptions collected in advance for a magazine

A) Receipt of a purchase order

B) Purchase of merchandise on account

C) Legal fees collected after work is performed

D) Subscriptions collected in advance for a magazine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

28

The financial statement on which Unearned Rent Revenue would appear is:

A) the income statement.

B) the balance sheet.

C) the owner's equity statement.

D) the trial balance.

A) the income statement.

B) the balance sheet.

C) the owner's equity statement.

D) the trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

29

The financial statement on which Rental Income would appear is the:

A) income statement.

B) owner's equity statement.

C) balance sheet.

D) trial balance.

A) income statement.

B) owner's equity statement.

C) balance sheet.

D) trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

30

What financial statement shows the amount for Freight-In?

A) Balance Sheet

B) Statement of Owner's Equity

C) Income Statement

D) Trial Balance

A) Balance Sheet

B) Statement of Owner's Equity

C) Income Statement

D) Trial Balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

31

The adjustment for accrued wages was NOT done; this would cause:

A) liabilities to be overstated.

B) liabilities to be understated.

C) assets to be understated.

D) net income to be understated.

A) liabilities to be overstated.

B) liabilities to be understated.

C) assets to be understated.

D) net income to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

32

Green Realty paid $6,000 rent on a building in advance for two years on May 1. The amount that should be recorded as rent expense as of December 31 at the end of Year 1 is:

A) $2,000.

B) $6,000.

C) $3,000.

D) $1,750.

A) $2,000.

B) $6,000.

C) $3,000.

D) $1,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

33

The goods a company has available to sell to customers are called:

A) Supplies.

B) Freight-in.

C) Cost of Goods Sold.

D) Merchandise Inventory.

A) Supplies.

B) Freight-in.

C) Cost of Goods Sold.

D) Merchandise Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

34

Accumulated Depreciation - Buildings should be shown on the:

A) Income Statement.

B) post-closing trial-balance.

C) Statement of Owner's Equity.

D) The account does not appear on a financial statement since it is a temporary account.

A) Income Statement.

B) post-closing trial-balance.

C) Statement of Owner's Equity.

D) The account does not appear on a financial statement since it is a temporary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

35

Doug paid $3,000 on a one-year insurance policy on March 1. The entry included a debit to Prepaid Insurance. The adjusting entry on December 31 of Year 1 would include a:

A) debit to Prepaid Insurance for $2,500; and a credit to Cash for $2,500.

B) debit to Insurance Expense for $2,500; and a credit to Prepaid Insurance for $2,500.

C) debit to Insurance Expense for $3,000; and a credit to Prepaid Insurance for $3,000.

D) debit to Cash for $3,000; and a credit to Prepaid Insurance for $3,000.

A) debit to Prepaid Insurance for $2,500; and a credit to Cash for $2,500.

B) debit to Insurance Expense for $2,500; and a credit to Prepaid Insurance for $2,500.

C) debit to Insurance Expense for $3,000; and a credit to Prepaid Insurance for $3,000.

D) debit to Cash for $3,000; and a credit to Prepaid Insurance for $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

36

As supplies are used, they become:

A) inventory.

B) a liability.

C) an expense.

D) contra-asset.

A) inventory.

B) a liability.

C) an expense.

D) contra-asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

37

When the adjustment for depreciation is made:

A) total assets decrease.

B) total expenses decrease.

C) total liabilities increase.

D) total revenue decreases.

A) total assets decrease.

B) total expenses decrease.

C) total liabilities increase.

D) total revenue decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

38

The adjustment for Accrued Salaries would be to:

A) debit Salaries Expense; credit Cash.

B) debit Salaries Payable; credit Prepaid Salaries.

C) debit Salaries Expense; credit Salaries Payable.

D) debit Salaries Payable; credit Cash.

A) debit Salaries Expense; credit Cash.

B) debit Salaries Payable; credit Prepaid Salaries.

C) debit Salaries Expense; credit Salaries Payable.

D) debit Salaries Payable; credit Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

39

The adjustment for salaries is necessary:

A) because the employer did not have enough cash to write the paychecks.

B) to recognize the revenue in the period earned.

C) to recognize the expense in the period incurred.

D) only in the month of a holiday.

A) because the employer did not have enough cash to write the paychecks.

B) to recognize the revenue in the period earned.

C) to recognize the expense in the period incurred.

D) only in the month of a holiday.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

40

Mortgage Payable is what type of account?

A) Asset

B) Liability

C) Revenue

D) Contra-Asset

A) Asset

B) Liability

C) Revenue

D) Contra-Asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

41

The perpetual inventory method:

A) is used by more and more companies, large and small due to increasing computerization.

B) is not used by many companies today.

C) is used by companies with a variety of merchandise with low unit prices.

D) does not ever require a physical inventory.

A) is used by more and more companies, large and small due to increasing computerization.

B) is not used by many companies today.

C) is used by companies with a variety of merchandise with low unit prices.

D) does not ever require a physical inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

42

At the start of the year, Southern Lights had $5,000 worth of merchandise. This Merchandise is called:

A) Cost of Goods Sold.

B) beginning inventory.

C) ending inventory.

D) Purchases.

A) Cost of Goods Sold.

B) beginning inventory.

C) ending inventory.

D) Purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

43

Mortgage Payable:

A) has a debit balance.

B) has a credit balance.

C) shows the amount expected to be paid within the current period.

D) is an unsecured loan.

A) has a debit balance.

B) has a credit balance.

C) shows the amount expected to be paid within the current period.

D) is an unsecured loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

44

This amount does NOT change during the period and is added to purchases when computing the cost of goods available for sale.

A) Beginning inventory

B) Ending inventory

C) Supplies

D) Freight-in

A) Beginning inventory

B) Ending inventory

C) Supplies

D) Freight-in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

45

The physical count of inventory was incorrect, which overstated the ending inventory. This would cause:

A) Cost of Goods Sold to be overstated.

B) Cost of Goods Sold to be understated.

C) gross profit to be understated.

D) operating expenses to be understated.

A) Cost of Goods Sold to be overstated.

B) Cost of Goods Sold to be understated.

C) gross profit to be understated.

D) operating expenses to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

46

The ending inventory in Year 1 is the beginning inventory in Year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

47

The beginning inventory is assumed to be sold; therefore, it is added to cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

48

When using the Periodic method, Merchandise Inventory (ending) appears on both the Income Statement and the Balance Sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

49

If ending inventory is overstated this period, beginning inventory will be understated in the next period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

50

Freight-in:

A) adds to the Cost of Goods Sold.

B) reduces the Cost of Goods Sold.

C) does not affect Cost of Goods Sold.

D) increases operating expenses.

A) adds to the Cost of Goods Sold.

B) reduces the Cost of Goods Sold.

C) does not affect Cost of Goods Sold.

D) increases operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

51

When counting supplies, several boxes were missed. This would cause:

A) Supplies to be overstated.

B) Supplies Expense to be overstated.

C) net income to be overstated.

D) Inventory to be understated.

A) Supplies to be overstated.

B) Supplies Expense to be overstated.

C) net income to be overstated.

D) Inventory to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the perpetual inventory system, it is not necessary to take a physical inventory at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

53

The adjustment for depreciation expense was omitted; this would:

A) overstate the period's expenses and overstate the period end liabilities.

B) overstate the period's expenses and understate the period end liabilities.

C) understate the period's expenses and overstate the period's assets.

D) understate the period's expenses and understate the period's assets.

A) overstate the period's expenses and overstate the period end liabilities.

B) overstate the period's expenses and understate the period end liabilities.

C) understate the period's expenses and overstate the period's assets.

D) understate the period's expenses and understate the period's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

54

When the adjustment is made for depreciation, the Depreciation Expense account is increased and the Accumulated Depreciation account is decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

55

Gross profit less operating expenses equals:

A) Cost of Goods Sold.

B) general administrative expenses.

C) net purchases.

D) net income.

A) Cost of Goods Sold.

B) general administrative expenses.

C) net purchases.

D) net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

56

Unearned Rent Revenue is a balance sheet account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Income Summary account is used to adjust beginning and ending inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

58

Interest Expense:

A) is a cost of borrowing money.

B) is included in the "Other Expenses" on the Income Statement.

C) has a normal debit balance.

D) All of the above are correct.

A) is a cost of borrowing money.

B) is included in the "Other Expenses" on the Income Statement.

C) has a normal debit balance.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

59

Recording the adjustment for supplies used will:

A) increase the total liability and increase the total expenses.

B) increase the total assets and increase the total liabilities.

C) decrease the total assets and increase the total expenses.

D) decrease the merchandise inventory and decrease the total expenses.

A) increase the total liability and increase the total expenses.

B) increase the total assets and increase the total liabilities.

C) decrease the total assets and increase the total expenses.

D) decrease the merchandise inventory and decrease the total expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

60

Depreciation on equipment was recorded twice this period. This would cause:

A) expenses to be overstated and total assets to be overstated.

B) expenses to be overstated and total assets to be understated.

C) expenses to be understated and total assets to be overstated.

D) expenses to be understated and total assets to be understated.

A) expenses to be overstated and total assets to be overstated.

B) expenses to be overstated and total assets to be understated.

C) expenses to be understated and total assets to be overstated.

D) expenses to be understated and total assets to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

61

Mortgage Payable is a contra-liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

62

Why is beginning and ending inventory kept as two separate figures in the cost of goods sold under the Periodic method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

63

Marie's Law Firm's unadjusted trial balance includes the following:  Using the above data, record the adjusting entry for $1,000 of the unearned legal fees earned.

Using the above data, record the adjusting entry for $1,000 of the unearned legal fees earned.

Using the above data, record the adjusting entry for $1,000 of the unearned legal fees earned.

Using the above data, record the adjusting entry for $1,000 of the unearned legal fees earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

64

Sales Discount is used when calculating Gross Profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

65

Under the periodic inventory method, the beginning and ending inventories are combined and an average calculated to determine the balance sheet inventory amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

66

Calculate: (a) net sales, (b) cost of goods sold, (c) gross profit, and (d) net income from the following:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

67

The amount of supplies used causes an increase in Supplies and a decrease in Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

68

Under the periodic inventory method, the ending inventory is adjusted by debiting Income Summary and crediting Merchandise Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

69

Adjustments are journalized before recording them in the worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

70

Beginning inventory is adjusted by crediting Merchandise Inventory and debiting Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Freight-in account is an operating expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

72

Under the accrual system, revenue is recognized when cash is paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

73

Calculate: (a) net sales, (b) cost of goods sold, (c) gross profit, and (d) net income from the following:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

74

Under the accrual system, expenses are recorded when incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

75

The amount for beginning inventory is used when calculating Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

76

Indicate the normal balance of each of the following accounts:

a) Purchases Returns and Allowances

b) Merchandise Inventory

c) Freight-In

d) Sales Returns and allowances

e) Unearned Revenue

a) Purchases Returns and Allowances

b) Merchandise Inventory

c) Freight-In

d) Sales Returns and allowances

e) Unearned Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

77

Under the periodic inventory system, an adjustment is not made on the worksheet for inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

78

Mortgage Payable is found on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

79

Under the periodic inventory method, indicate the financial statement(s) on which you would find the following items:

a) Cost of goods sold

b) Freight-In

c) Ending Inventory

d) Beginning Inventory

e) Purchase Discounts

a) Cost of goods sold

b) Freight-In

c) Ending Inventory

d) Beginning Inventory

e) Purchase Discounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

80

Unearned Revenue is a liability account used to record rent fees received in advance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck