Deck 13: Accounting for Bad Debts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

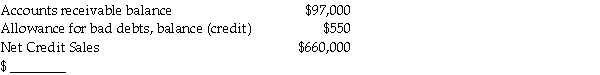

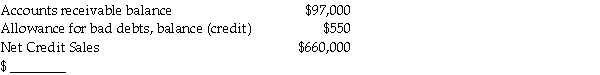

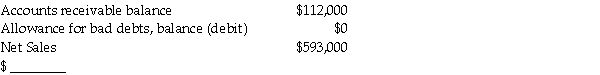

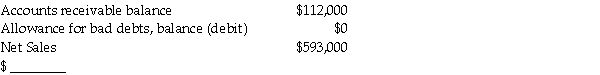

سؤال

سؤال

سؤال

سؤال

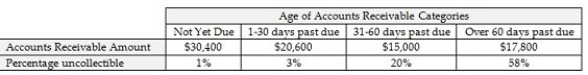

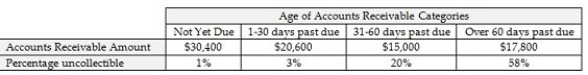

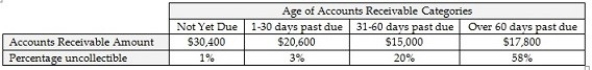

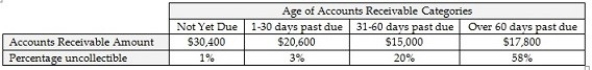

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/120

العب

ملء الشاشة (f)

Deck 13: Accounting for Bad Debts

1

Current assets listed on the balance sheet include:

A) Land.

B) Buildings.

C) Allowance for Doubtful Accounts.

D) Sales.

A) Land.

B) Buildings.

C) Allowance for Doubtful Accounts.

D) Sales.

C

2

Which of the following is considered a permanent account?

A) Allowance for Doubtful Accounts

B) Sales Returns and Allowances

C) Bad Debts Expense

D) Sales

A) Allowance for Doubtful Accounts

B) Sales Returns and Allowances

C) Bad Debts Expense

D) Sales

A

3

Mercury Holdings estimates it will collect $4,200 of the $5,620 owed by customers. The $4,200 is:

A) the Net Realizable Value.

B) the Bad Debts Allowance.

C) the Allowance for Doubtful Accounts.

D) the Gross Accounts Receivable.

A) the Net Realizable Value.

B) the Bad Debts Allowance.

C) the Allowance for Doubtful Accounts.

D) the Gross Accounts Receivable.

A

4

What type of account is a Bad Debts Expense?

A) Asset

B) Expense

C) Contra Asset

D) Liability

A) Asset

B) Expense

C) Contra Asset

D) Liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

5

The Allowance for Doubtful Accounts is adjusted:

A) each time a customer is granted credit.

B) each time a customer's debt is satisfied.

C) within one year of granting credit to a customer.

D) at the end of each accounting period.

A) each time a customer is granted credit.

B) each time a customer's debt is satisfied.

C) within one year of granting credit to a customer.

D) at the end of each accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

6

Before the accounts are adjusted and closed at the end of the year, Accounts Receivable has a normal balance of $600,000 and Allowance for Doubtful Accounts has a debit balance of $40,000. What is the net realizable value of accounts receivable?

A) $560,000

B) $640,000

C) $600,000

D) $40,000

A) $560,000

B) $640,000

C) $600,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Accounts Receivable subsidiary ledger is:

A) updated when a debt is identified as uncollectible.

B) credited when a debt is identified as uncollectible.

C) debited when a debt is identified as uncollectible.

D) Both A and B

A) updated when a debt is identified as uncollectible.

B) credited when a debt is identified as uncollectible.

C) debited when a debt is identified as uncollectible.

D) Both A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is a contra-revenue account?

A) Bad Debts Expense

B) Accounts Receivable

C) Allowance for Doubtful Accounts

D) None of these answers is correct.

A) Bad Debts Expense

B) Accounts Receivable

C) Allowance for Doubtful Accounts

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

9

Uncollectible accounts could:

A) affect accounts payable.

B) ease credit restrictions.

C) decrease cash shortages.

D) be a major cost of selling goods on account.

A) affect accounts payable.

B) ease credit restrictions.

C) decrease cash shortages.

D) be a major cost of selling goods on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

10

When a customer's account is written off:

A) net realizable value of the Accounts Receivable remains the same.

B) net realizable value of the Accounts Receivable decreases.

C) net realizable value of the Accounts Receivable increases.

D) None of the above

A) net realizable value of the Accounts Receivable remains the same.

B) net realizable value of the Accounts Receivable decreases.

C) net realizable value of the Accounts Receivable increases.

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

11

An expense incurred as a result of sales on credit or on account is:

A) Bad Debts Expense

B) Prepaid Rent

C) Insurance Expense

D) Allowance for Doubtful Accounts

A) Bad Debts Expense

B) Prepaid Rent

C) Insurance Expense

D) Allowance for Doubtful Accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

12

The allowance method requires:

A) an estimated entry to Bad Debts Expense.

B) a known individual account to write off bad debts.

C) a known uncollectible amount to write off bad debts.

D) None of these answers is correct.

A) an estimated entry to Bad Debts Expense.

B) a known individual account to write off bad debts.

C) a known uncollectible amount to write off bad debts.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

13

Net Realizable Value can be defined as:

A) the Gross Accounts Receivable.

B) the Current Bad Debts Expense.

C) the amount of Accounts Receivable you do not expect to collect.

D) the Gross Accounts Receivable minus the Allowance for Doubtful Accounts.

A) the Gross Accounts Receivable.

B) the Current Bad Debts Expense.

C) the amount of Accounts Receivable you do not expect to collect.

D) the Gross Accounts Receivable minus the Allowance for Doubtful Accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which financial statement reports an Allowance for Doubtful Accounts?

A) Statement of owner's equity

B) Income statement

C) Balance Sheet

D) None of these answers is correct.

A) Statement of owner's equity

B) Income statement

C) Balance Sheet

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

15

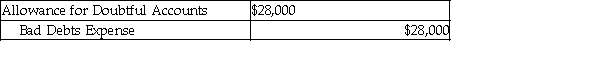

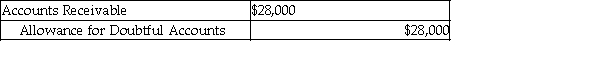

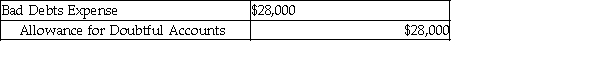

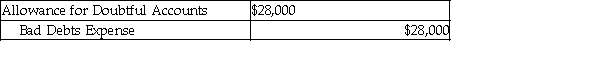

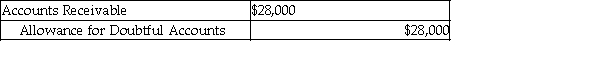

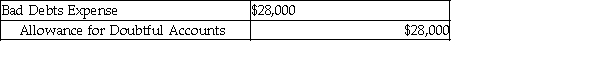

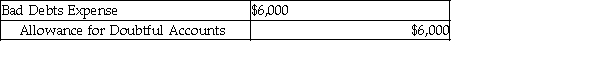

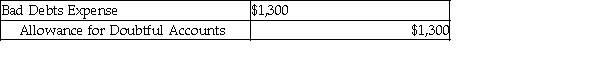

A company uses the allowance method and has estimated $28,000 as uncollectible. The journal entry to record the estimated bad debts is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is considered a temporary account?

A) Accounts Receivable

B) Merchandise Inventory

C) Allowance for Doubtful Accounts

D) Bad Debts Expense

A) Accounts Receivable

B) Merchandise Inventory

C) Allowance for Doubtful Accounts

D) Bad Debts Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

17

Before the accounts are adjusted and closed at the end of the year, Accounts Receivable has a normal balance of $510,000 and Allowance for Doubtful Accounts has a credit balance $3,000. What is the net realizable value of the accounts receivable?

A) $513,000

B) $507,000

C) $510,000

D) $504,000

A) $513,000

B) $507,000

C) $510,000

D) $504,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

18

What type of account is an Allowance for Doubtful Accounts?

A) Asset

B) Contra-asset

C) Revenue

D) Contra-revenue

A) Asset

B) Contra-asset

C) Revenue

D) Contra-revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

19

Bad Debts Expense is:

A) not included in Cost of Goods Sold.

B) considered an expense matched with revenues.

C) listed on the income statement.

D) All of the above.

A) not included in Cost of Goods Sold.

B) considered an expense matched with revenues.

C) listed on the income statement.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

20

Mercury Holdings estimates it will collect $8,930 of the $10,000 owed by customers. The difference of $1,070 represents the:

A) Gross Accounts Receivable.

B) the Net Realizable Value.

C) Allowance for Doubtful Accounts.

D) Value of the Current Unpaid Receivables.

A) Gross Accounts Receivable.

B) the Net Realizable Value.

C) Allowance for Doubtful Accounts.

D) Value of the Current Unpaid Receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

21

Bad Debts Expense is a contra-revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

22

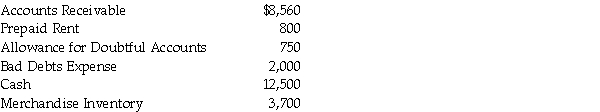

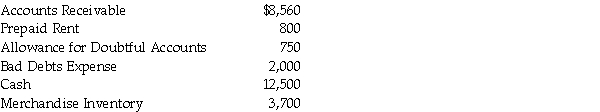

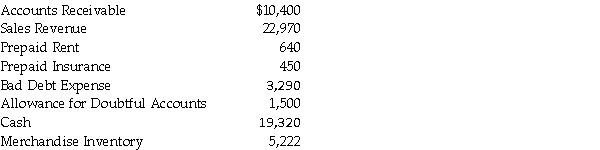

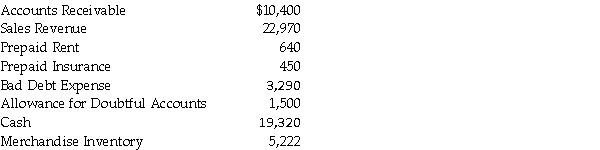

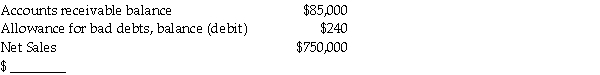

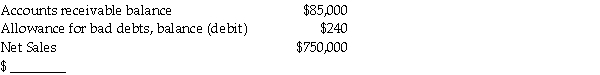

Prepare a partial balance sheet for the Swanson Company at December 31, 201X, from the following information:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

23

Joe's Auto Repair estimates that approximately 3% of net credit sales are uncollectible. Joe's calculates Bad Debts Expense using the:

A) direct write-off method.

B) income statement method.

C) gross method.

D) balance sheet method.

A) direct write-off method.

B) income statement method.

C) gross method.

D) balance sheet method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

24

Gross Accounts Receivable is $23,000. Allowance for Doubtful Accounts has a credit balance of $500. Net credit sales for the year are $140,000. In the past, 3% of credit sales had proved uncollectible, and an aging of the receivables indicates $1,700 is doubtful. Under the income statement approach, Bad Debts Expense for the year is:

A) $2,200.

B) $4,700.

C) $4,200.

D) $1,200.

A) $2,200.

B) $4,700.

C) $4,200.

D) $1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

25

Allowance for Doubtful Accounts is a contra-asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

26

Gross Accounts Receivable is $39,000. Allowance for Doubtful Accounts has a credit balance of $300. Net credit sales for the year are $190,000. In the past, 2% of credit sales had proved uncollectible. What would be the adjusted balance of the Allowance account under the income statement approach?

A) $4,880

B) $4,100

C) $3,800

D) $3,500

A) $4,880

B) $4,100

C) $3,800

D) $3,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

27

A debit balance in Allowance for Doubtful Accounts indicates the estimate for Bad Debts was too low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

28

Gross Accounts Receivable is $21,000. Allowance for Doubtful Accounts has a credit balance of $600. Net credit sales for the year are $132,000. In the past, 3% of credit sales had proved uncollectible, and an aging of the receivables indicates $1,800 is doubtful. Under the balance sheet approach, Bad Debts Expense for the year is:

A) $2,400.

B) $4,560.

C) $3,960.

D) $1,200.

A) $2,400.

B) $4,560.

C) $3,960.

D) $1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

29

The process of classifying accounts of individual customers by age group, where age is the number of days elapsed from due date is specifically called:

A) balance sheet approach.

B) income statement approach.

C) direct writeoff method.

D) aging of Accounts Receivable approach.

A) balance sheet approach.

B) income statement approach.

C) direct writeoff method.

D) aging of Accounts Receivable approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

30

Gross Accounts Receivable is $18,000. Allowance for Doubtful Accounts has a credit balance of $300. Net credit sales for the year are $150,000. In the past, 2% of credit sales had proved uncollectible, and an aging of the receivables indicates $2,100 as uncollectible. What would be the adjusted balance of the Allowance account under the balance sheet approach?

A) $1,800

B) $3,300

C) $2,100

D) $2,400

A) $1,800

B) $3,300

C) $2,100

D) $2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

31

At December 31, 201X, Aaron's Produce unadjusted Allowance for Doubtful Accounts showed a credit balance of $520. An aging of the Accounts Receivable indicates probable uncollectible accounts of $4,000. The year-end adjusting entry for Bad Debts Expense:

A) includes a credit to the Allowance account for $3,480.

B) includes a debit to the Allowance account for $520.

C) includes a debit to the Allowance account for $4,000.

D) includes a credit to the Allowance account for $4,520.

A) includes a credit to the Allowance account for $3,480.

B) includes a debit to the Allowance account for $520.

C) includes a debit to the Allowance account for $4,000.

D) includes a credit to the Allowance account for $4,520.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

32

The normal balance of the Bad Debts Expense account is a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

33

The normal balance of the Allowance for Doubtful Accounts account is a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

34

The adjusting entry for uncollectibles is based on an estimate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

35

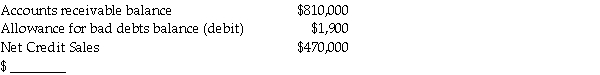

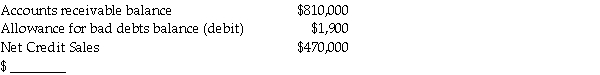

Prepare a partial balance sheet for Tangiers Industries at December 31, 201X, from the following information:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

36

The method based on the Accounts Receivable amount and the aging process is called:

A) income statement approach.

B) direct write off method.

C) balance sheet approach.

D) None of these answers is correct.

A) income statement approach.

B) direct write off method.

C) balance sheet approach.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

37

Ellen's Candies estimates that approximately $2.15 out of every $100 of credit sales proves to be uncollectible. Ellen's Candies calculates Bad Debts Expense using the:

A) balance sheet approach.

B) aging of Accounts Receivable approach.

C) direct write-off method.

D) income statement approach.

A) balance sheet approach.

B) aging of Accounts Receivable approach.

C) direct write-off method.

D) income statement approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

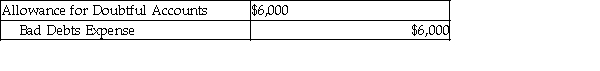

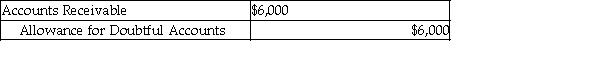

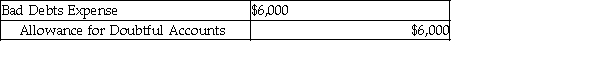

38

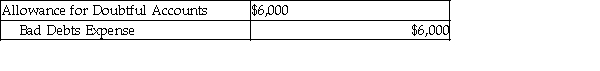

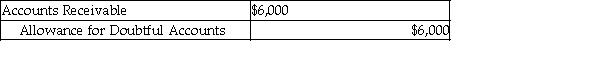

A company uses the allowance method and has determined a customer's bill for $6,000 must be written off. The journal entry to record the write off is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

39

A method that estimates the amount of Bad Debts Expense based on a percentage of net credit sales for the period is called:

A) direct write off method.

B) income statement approach.

C) balance sheet approach.

D) None of these answers is correct.

A) direct write off method.

B) income statement approach.

C) balance sheet approach.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

40

The Allowance for Doubtful Accounts is shown on the balance sheet as a contra-asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

41

What general ledger account is debited to write off a customer's account as uncollectible if using the allowance method for uncollectible receivables?

A) Bad Debts Expense

B) Accounts Receivable

C) Allowance for Doubtful Accounts

D) Bad Debts Recovered

A) Bad Debts Expense

B) Accounts Receivable

C) Allowance for Doubtful Accounts

D) Bad Debts Recovered

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

42

The balance in the Allowance for Doubtful Accounts is ignored under which of the following approaches?

A) Balance sheet approach

B) Income statement approach

C) Direct write-off approach

D) All three approaches

A) Balance sheet approach

B) Income statement approach

C) Direct write-off approach

D) All three approaches

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

43

Sigma reports net credit sales of $480,000. There is a credit balance of $1,700 in the Allowance for Doubtful Accounts. Uncollectible accounts are estimated to be 4% of net credit sales. Under the income statement approach, the adjusting entry would require a debit to Bad Debts Expense for: (Round your calculations to the nearest whole dollar.)

A) $17,500.

B) $19,200.

C) $19,132.

D) some other number.

A) $17,500.

B) $19,200.

C) $19,132.

D) some other number.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

44

Barry Waterhouse uses the aging of Accounts Receivable balance sheet approach to estimate uncollectibles. Not yet due accounts are $260,000, with an estimated uncollectible percentage of 1%. 1-30 days past due accounts are $38,000, with an estimated uncollectible percentage of 5%. Over 30 days past due accounts are $10,700, with an estimated uncollectible percentage of 12%. If the company has a credit balance in Allowance for Doubtful Accounts of $1,000, what is the bad debts expense adjusting entry amount? (Round any intermediate calculations and your final answer to the nearest dollar.)

A) $5,784

B) $6,784

C) $4,784

D) $2,184

A) $5,784

B) $6,784

C) $4,784

D) $2,184

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

45

Using the aging method, estimated uncollectible accounts are $3,200. If the balance of Allowance for Doubtful Accounts is $550 credit before adjustment, what is a Bad Debts Expense for the period?

A) $3,750

B) $2,650

C) $3,200

D) $550

A) $3,750

B) $2,650

C) $3,200

D) $550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

46

June Cleary estimates uncollectibles to be $2,300. There is a debit balance in the allowance account of $520. The adjusting entry amount under the aging of receivable balance sheet approach is:

A) $2,300.

B) $520.

C) $2,820.

D) $1,780.

A) $2,300.

B) $520.

C) $2,820.

D) $1,780.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

47

Milling Direct uses the aging of Accounts Receivable balance sheet approach to estimate uncollectibles. The total percentage of not yet due accounts deemed uncollectible are $1,000, 1-30 days past due accounts deemed uncollectible are $1,220, and over 30 days past due accounts deemed uncollectible are $730. If the company has a debit balance in Allowance for Doubtful Accounts of $800, what is the bad debts expense adjusting entry amount?

A) $800

B) $2,950

C) $3,750

D) $2,150

A) $800

B) $2,950

C) $3,750

D) $2,150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

48

Last year, Plants Unlimited had net credit sales of $696,000 and it had uncollectible accounts of $32,000. Based on last year, what would the percent of estimated uncollectible accounts be this year?

A) 4.40%

B) 4.82%

C) 4.60%

D) 45.98%

A) 4.40%

B) 4.82%

C) 4.60%

D) 45.98%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

49

What general ledger account is credited to write off a customer's account as uncollectible if using the allowance method for uncollectible receivables?

A) Accounts Receivable

B) Allowance for Doubtful Accounts

C) Bad Debts Expense

D) Bad Debts Recovered

A) Accounts Receivable

B) Allowance for Doubtful Accounts

C) Bad Debts Expense

D) Bad Debts Recovered

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

50

A detailed analysis of Accounts Receivable to determine how long each account has been outstanding is called:

A) aging the Accounts Receivable.

B) aging the uncollectible accounts.

C) analyzing the Accounts Receivable.

D) taking a percentage of sales on account.

A) aging the Accounts Receivable.

B) aging the uncollectible accounts.

C) analyzing the Accounts Receivable.

D) taking a percentage of sales on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

51

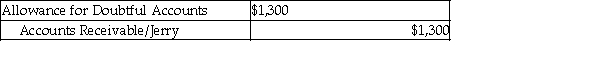

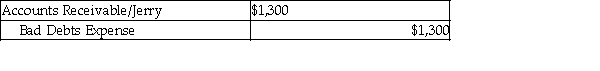

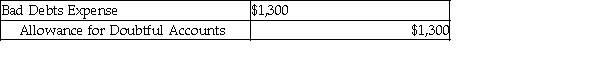

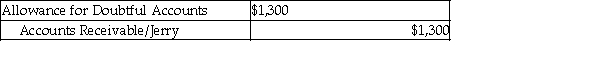

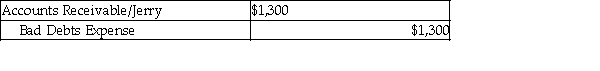

Harp Brewing received a bankruptcy notice from their customer Jerry. If using an allowance method, the entry to write-off his balance of $1,300 would be:

A)

B)

C)

D) None of the above

A)

B)

C)

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

52

When a year-end adjustment is made for estimated bad debts:

A) net income is increased.

B) liabilities increase.

C) net assets increase.

D) net assets decrease.

A) net income is increased.

B) liabilities increase.

C) net assets increase.

D) net assets decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

53

Aircraft Engine Parts' Allowance for Doubtful Accounts had an unadjusted credit balance of $680. The manager estimates that $700 of the Accounts Receivable is uncollectible. Using the balance sheet approach, the year-end adjusting entry for Bad Debts Expense:

A) includes a debit to the Bad Debt Expense account for $20.

B) includes a debit to the Bad Debts Expense account for $700.

C) includes a credit to the Bad Debts Expense account for $1,380.

D) includes a credit to the Bad Debts Expense account for $20.

A) includes a debit to the Bad Debt Expense account for $20.

B) includes a debit to the Bad Debts Expense account for $700.

C) includes a credit to the Bad Debts Expense account for $1,380.

D) includes a credit to the Bad Debts Expense account for $20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

54

Milling Direct uses the aging of Accounts Receivable balance sheet approach to estimate uncollectibles. The total percentage of not yet due accounts deemed uncollectible are $930, 1-30 days past due accounts deemed uncollectible are $1,210, and over 30 days past due accounts deemed uncollectible are $710. If the company has a credit balance in Allowance for Doubtful Accounts of $850, what is the bad debts expense adjusting entry amount?

A) $2,000

B) $2,850

C) $850

D) $3,700

A) $2,000

B) $2,850

C) $850

D) $3,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

55

The income statement approach estimates a percentage of Accounts Receivable that is uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

56

The journal entry to record the estimate of uncollectible accounts includes a:

A) debit Bad Debts Expense; credit Allowance for Doubtful Accounts.

B) debit Bad Debts Expense; credit Accounts Receivable.

C) debit Allowance for Doubtful Accounts; credit Bad Debts Expense.

D) debit Sales; credit Bad Debts Expense.

A) debit Bad Debts Expense; credit Allowance for Doubtful Accounts.

B) debit Bad Debts Expense; credit Accounts Receivable.

C) debit Allowance for Doubtful Accounts; credit Bad Debts Expense.

D) debit Sales; credit Bad Debts Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

57

As the past due time increases for an account, the likelihood of collecting that account:

A) usually goes down.

B) usually goes up.

C) Time does not affect collectibility.

D) None of the above

A) usually goes down.

B) usually goes up.

C) Time does not affect collectibility.

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

58

Barry Waterhouse uses the aging of Accounts Receivable balance sheet approach to estimate uncollectibles. Not yet due accounts are $470,000, with an estimated uncollectible percentage of 1.5%. 1-30 days past due accounts are $100,000, with an estimated uncollectible percentage of 3%. Over 30 days past due accounts are $3,900 with an estimated uncollectible percentage of 10%. If the company has a debit balance in Allowance for Doubtful Accounts of $950, what is the bad debts expense adjusting entry amount? (Round any intermediate calculations and your final answer to the nearest dollar.)

A) $10,440

B) $11,390

C) $9,490

D) $2,440

A) $10,440

B) $11,390

C) $9,490

D) $2,440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

59

Jones Consulting estimates uncollectibles to be $820. There is a credit balance in the allowance account of $390. The adjusting entry amount under the aging of receivable balance sheet approach is:

A) $390.

B) $820.

C) $430.

D) $1,210.

A) $390.

B) $820.

C) $430.

D) $1,210.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

60

Canteen Depot estimated uncollectible accounts in the amount of $900 for the period. There is a credit balance in the allowance account of $400. Under the aging of receivables method, the entry to record bad debts expense is:

A) debit Bad Debts Expense $500; credit Accounts Receivable $500.

B) debit Allowance for Doubtful Accounts $900; credit Bad Debts Expense $900.

C) debit Bad Debts Expense $500; credit Allowance for Doubtful Accounts $500.

D) debit Allowance for Doubtful Accounts $900; credit Accounts Receivable $900.

A) debit Bad Debts Expense $500; credit Accounts Receivable $500.

B) debit Allowance for Doubtful Accounts $900; credit Bad Debts Expense $900.

C) debit Bad Debts Expense $500; credit Allowance for Doubtful Accounts $500.

D) debit Allowance for Doubtful Accounts $900; credit Accounts Receivable $900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

61

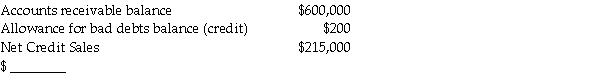

Determine the amount of the adjustment for bad debts given:

Bad debts are estimated to be 3% of credit sales

Bad debts are estimated to be 3% of credit sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

62

The general ledger controlling account for Accounts Receivable shows a debit balance of $222,000. The Allowance for Doubtful Accounts has a credit balance of $7,320. An aging report of accounts receivable accounts resulted in an estimate of $42,000 of uncollectible accounts receivable. Calculate the amount of the adjustment, for the allowance for doubtful accounts, using the balance sheet approach.

Amount of the adjustment ________

Amount of the adjustment ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

63

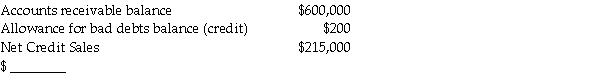

Determine the amount of the adjustment for bad debts given:

Bad debts are estimated to be 6% of receivables

Bad debts are estimated to be 6% of receivables

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

64

Determine the amount of the adjustment for bad debts given:

Bad debts are estimated to be 11% of credit sales

Bad debts are estimated to be 11% of credit sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

65

Prepare the adjusting journal entry for Bad Debts Expense from the following information using the balance sheet approach. The Allowance for Doubtful Accounts has a credit balance of $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

66

Under the balance sheet approach, bad debts expense is $1,500 if the estimated amount of uncollectible accounts is $1,000 and the Allowance for Doubtful Accounts has a debit balance of $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

67

Companies that feel aging is too time-consuming may estimate Bad Debts based on a percentage of total Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

68

On December 31, 2019, Balloon Buddies had a balance in Accounts Receivable of $39,000. Net credit sales for the year were $334,000. The Allowance for Doubtful Accounts has a credit balance of $700. Journalize the recording of the bad debts expense under the balance sheet approach if $1,360 is the estimated amount of uncollectible accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

69

On December 31, 2019, Balloon Buddies had a balance in Accounts Receivable of $39,000. Net credit sales for the year were $334,000. The Allowance for Doubtful Accounts has a debit balance of $700. Journalize the recording of the bad debts expense under the income statement approach if 1.4% of net credit sales is deemed uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

70

Bad Debts Expense is recorded in the year the sale was earned when using the income statement approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

71

Determine the amount of the adjustment for bad debts given:

Bad debts are estimated to be 8% of receivables

Bad debts are estimated to be 8% of receivables

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

72

Prepare the adjusting journal entry for Bad Debts Expense from the following information using the balance sheet approach. The Allowance for Doubtful Accounts has a debit balance of $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

73

The aging of Accounts Receivable is a balance sheet approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

74

Determine the amount of the adjustment for bad debts given:

Bad debts are estimated to be 7% of receivables

Bad debts are estimated to be 7% of receivables

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

75

On December 31, 2019, Balloon Buddies had a balance in Accounts Receivable of $39,000. Net credit sales for the year were $334,000. The Allowance for Doubtful Accounts has a credit balance of $700. Journalize the recording of the bad debts expense under the income statement approach if 2.5% of net credit sales is deemed uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

76

The Allowance for Doubtful Accounts has a credit balance of $5,000. Net credit sales for the year were $900,000. Four percent is the estimated uncollectible based on net credit sales. Calculate the amount of the adjustment, for the allowance for doubtful accounts, using the income statement approach.

Amount of the adjustment ________

Amount of the adjustment ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

77

Using the income statement approach, the balance in Allowance for Doubtful Accounts is taken into consideration when finding the adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

78

On December 31, 2019, Balloon Buddies had a balance in Accounts Receivable of $39,000. Net credit sales for the year were $334,000. The Allowance for Doubtful Accounts has a debit balance of $700. Journalize the recording of the bad debts expense under the balance sheet approach if $1,360 is the estimated amount of uncollectible accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

79

Using the balance sheet approach, the balance in Allowance for Doubtful Accounts is taken into consideration when finding the adjustment using the balance sheet approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

80

Under the balance sheet approach, bad debts expense is $1,000 if the estimated amount of uncollectible accounts is $1,200 and the Allowance for Doubtful Accounts has a credit balance of $200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck