Deck 5: The Accounting Cycle Completed

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 5: The Accounting Cycle Completed

1

Journal entries that are needed in order to update account balances for internal business transactions (such as supplies and prepaid rent) at the end of the period are:

A) closing entries.

B) adjusting entries.

C) Balance Sheet entries.

D) adjusting Cash.

A) closing entries.

B) adjusting entries.

C) Balance Sheet entries.

D) adjusting Cash.

B

2

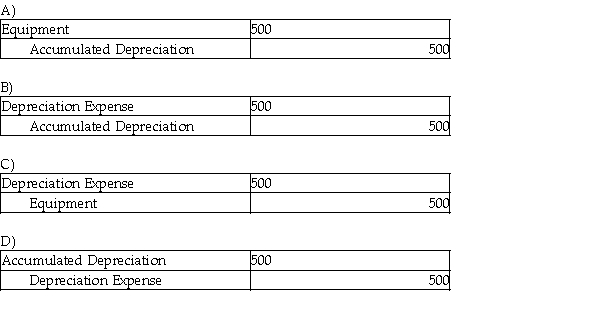

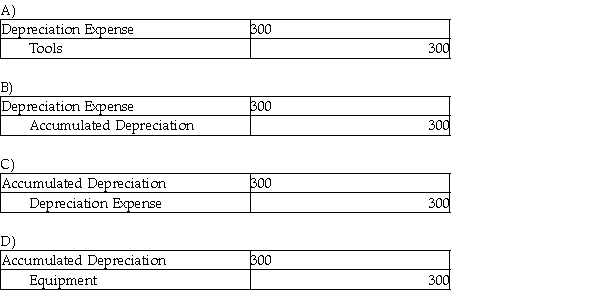

Eav's Event Planning bought a computer on January 1st worth $5,000 with an expected life of 4 years and a residual value of $1,500. What is the adjusting journal entry for December 31 at the end of the first year?

C

3

The adjusting entry for accrued salaries is to:

A) debit Salaries Expense; credit Salaries Payable.

B) debit Salaries Expense; credit Cash.

C) debit Salaries Payable; credit Salaries Expense.

D) debit Cash; credit Salaries Payable.

A) debit Salaries Expense; credit Salaries Payable.

B) debit Salaries Expense; credit Cash.

C) debit Salaries Payable; credit Salaries Expense.

D) debit Cash; credit Salaries Payable.

A

4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

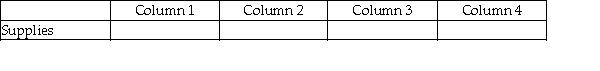

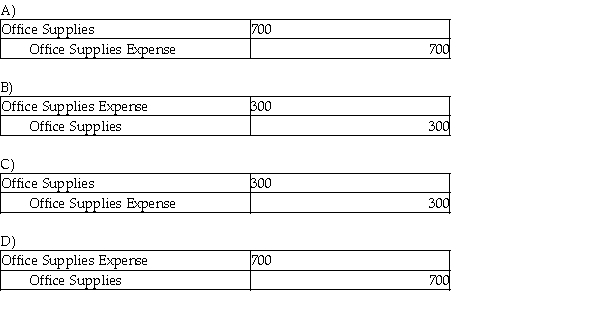

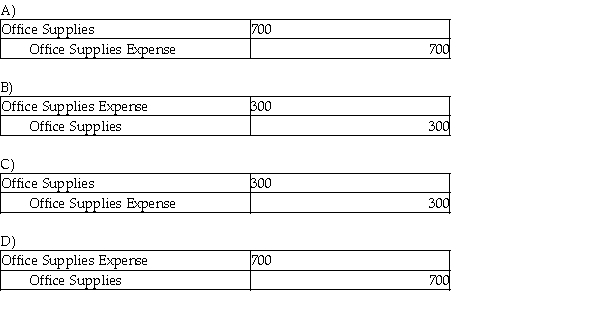

Sandra's Design Studio showed office supplies account showed a balance of $1,000. A count of the supplies left on hand as of June 30 was $700. The adjusting journal entry is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

The adjusting entry to record depreciation for the company automobile would be:

A) debit Cash; credit Accumulated Depreciation, Automobile.

B) debit Accumulated Depreciation, Automobile; credit Automobile.

C) debit Depreciation Expense, Automobile; credit Accumulated Depreciation, Automobile.

D) debit Depreciation Expense, Automobile; credit Automobile.

A) debit Cash; credit Accumulated Depreciation, Automobile.

B) debit Accumulated Depreciation, Automobile; credit Automobile.

C) debit Depreciation Expense, Automobile; credit Accumulated Depreciation, Automobile.

D) debit Depreciation Expense, Automobile; credit Automobile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

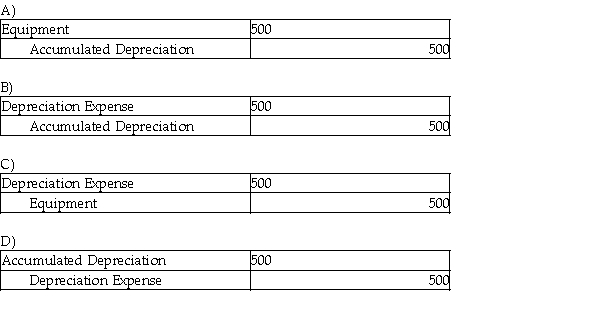

John's Tree Service depreciation for the month is $500. The adjusting journal entry is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

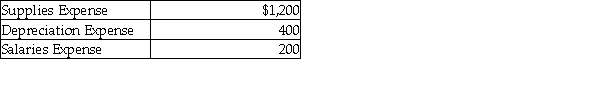

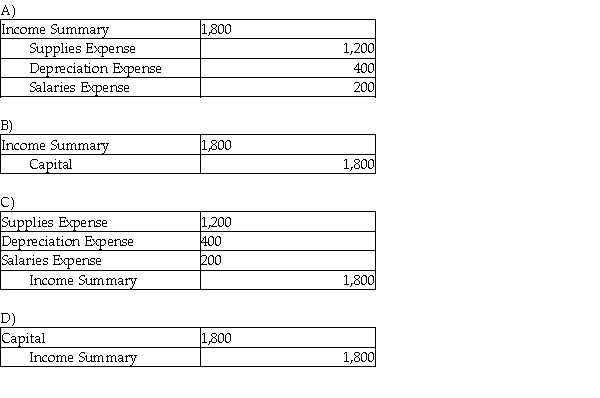

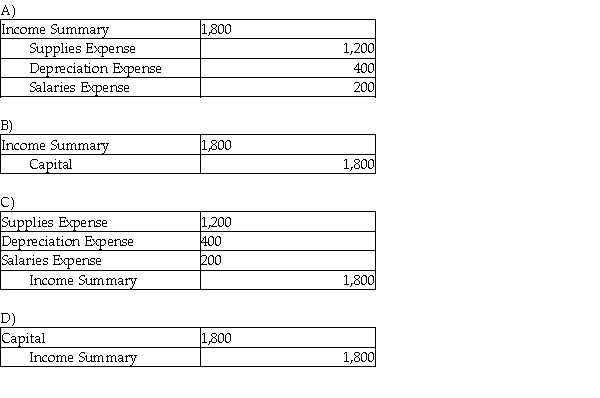

The income statement debit column of the worksheet showed the following expenses:  The journal entry to close the expense accounts is:

The journal entry to close the expense accounts is:

The journal entry to close the expense accounts is:

The journal entry to close the expense accounts is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

Each adjusting entry affects:

A) the income statement.

B) the balance sheet.

C) the cash account.

D) Both A and B are correct.

A) the income statement.

B) the balance sheet.

C) the cash account.

D) Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

The adjusting entry to record the expired rent would be to:

A) debit Prepaid Rent Expense; credit Cash.

B) debit Cash; credit Prepaid Rent.

C) debit Prepaid Rent; credit Cash.

D) debit Rent Expense; credit Prepaid Rent.

A) debit Prepaid Rent Expense; credit Cash.

B) debit Cash; credit Prepaid Rent.

C) debit Prepaid Rent; credit Cash.

D) debit Rent Expense; credit Prepaid Rent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

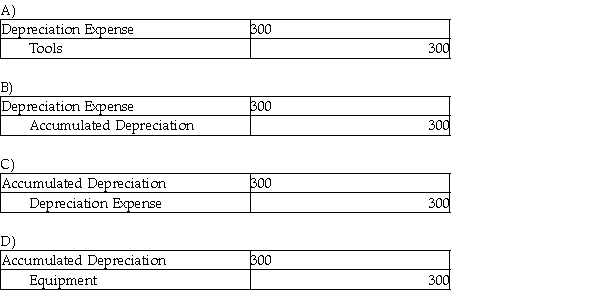

Tom's Electrical Service purchased tools for $6,000. They have an expected life of 30 months and no residual value. The adjusting journal entry for the month is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

The ending balances in the ledger after posting the adjusting entries will be the same amounts that are found on the worksheet in the adjusted trial balance column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

Closing entries are prepared:

A) to clear all temporary accounts to zero.

B) to update the Capital balance.

C) at the end of the accounting period.

D) All of the above are correct.

A) to clear all temporary accounts to zero.

B) to update the Capital balance.

C) at the end of the accounting period.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

Adjusting journal entries:

A) need not be journalized since they appear on the worksheet.

B) need not be posted if the financial statements are prepared from the worksheet.

C) are not needed if closing entries are prepared.

D) must be journalized and posted.

A) need not be journalized since they appear on the worksheet.

B) need not be posted if the financial statements are prepared from the worksheet.

C) are not needed if closing entries are prepared.

D) must be journalized and posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

To close the Withdrawals account:

A) debit Withdrawals; credit Revenue.

B) debit Capital; credit Withdrawals.

C) debit Withdrawals; credit Income Summary.

D) debit Income Summary; credit Withdrawals.

A) debit Withdrawals; credit Revenue.

B) debit Capital; credit Withdrawals.

C) debit Withdrawals; credit Income Summary.

D) debit Income Summary; credit Withdrawals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following accounts is a temporary account?

A) Withdrawals

B) Accounts Receivable

C) Cash

D) Supplies

A) Withdrawals

B) Accounts Receivable

C) Cash

D) Supplies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

Accounts in which the balances are carried over from one accounting period to the next are called:

A) real accounts.

B) nominal accounts.

C) temporary accounts.

D) zero accounts.

A) real accounts.

B) nominal accounts.

C) temporary accounts.

D) zero accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

When the balance in the Income Summary account is a credit, the company has:

A) incurred a net loss.

B) incurred a net income.

C) had more expenses than revenue.

D) no owner withdrawals during the period.

A) incurred a net loss.

B) incurred a net income.

C) had more expenses than revenue.

D) no owner withdrawals during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

When the balance of the Income Summary account is a debit, the entry to close this account is:

A) debit Income Summary; credit Withdrawals.

B) debit Income Summary; credit Revenue.

C) debit Capital; credit Income Summary.

D) debit Income Summary; credit Capital.

A) debit Income Summary; credit Withdrawals.

B) debit Income Summary; credit Revenue.

C) debit Capital; credit Income Summary.

D) debit Income Summary; credit Capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

26

How do you close a revenue account?

A) Debit Capital; credit Revenue

B) Credit Withdrawals; debit Revenue

C) Credit Income Summary; debit Revenue

D) Debit Income Summary; credit Revenue

A) Debit Capital; credit Revenue

B) Credit Withdrawals; debit Revenue

C) Credit Income Summary; debit Revenue

D) Debit Income Summary; credit Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

Closing entries:

A) need not be journalized since they appear on the worksheet.

B) are prepared before adjusting entries.

C) are not needed if adjusting entries are prepared.

D) must be journalized and posted.

A) need not be journalized since they appear on the worksheet.

B) are prepared before adjusting entries.

C) are not needed if adjusting entries are prepared.

D) must be journalized and posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

Income Summary:

A) is a temporary account.

B) is a permanent account.

C) summarizes revenues and expenses and transfers the balance to Capital.

D) Both A and C are correct.

A) is a temporary account.

B) is a permanent account.

C) summarizes revenues and expenses and transfers the balance to Capital.

D) Both A and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following accounts should NOT be closed to Income Summary at the end of the fiscal year?

A) Salaries Expense

B) Fees Earned

C) Utilities Expense

D) Withdrawals

A) Salaries Expense

B) Fees Earned

C) Utilities Expense

D) Withdrawals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following columns of the worksheet are referred to when preparing closing entries to the Income Summary?

A) Adjusted trial balance columns

B) Balance sheet columns

C) Adjustments columns

D) Income statement columns

A) Adjusted trial balance columns

B) Balance sheet columns

C) Adjustments columns

D) Income statement columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

31

How do you close the expense accounts?

A) Debit Capital; credit the expense accounts

B) Credit Capital; debit the expense accounts

C) Credit Income Summary; debit the expense accounts

D) Debit Income Summary; credit the expense accounts

A) Debit Capital; credit the expense accounts

B) Credit Capital; debit the expense accounts

C) Credit Income Summary; debit the expense accounts

D) Debit Income Summary; credit the expense accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

The correct order for closing accounts is:

A) revenue, expenses, income summary, withdrawals.

B) revenue, income summary, expenses, withdrawals.

C) revenue, expenses, capital, withdrawals.

D) revenue, capital, expenses, withdrawals.

A) revenue, expenses, income summary, withdrawals.

B) revenue, income summary, expenses, withdrawals.

C) revenue, expenses, capital, withdrawals.

D) revenue, capital, expenses, withdrawals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

When the balance of the Income Summary account is a credit, the entry to close this account is:

A) debit Income Summary; credit Withdrawals.

B) debit Income Summary; credit Revenue.

C) debit Income Summary; credit Capital.

D) debit Revenue; credit Income Summary.

A) debit Income Summary; credit Withdrawals.

B) debit Income Summary; credit Revenue.

C) debit Income Summary; credit Capital.

D) debit Revenue; credit Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

After posting the closing entries, which of the following accounts is most likely NOT to have a zero balance?

A) Prepaid Insurance Expense

B) Advertising Expense

C) J. Taylor, Withdrawals

D) Medical Fees Earned

A) Prepaid Insurance Expense

B) Advertising Expense

C) J. Taylor, Withdrawals

D) Medical Fees Earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

An account in which the balance is carried over from one accounting period to the next is called a:

A) permanent account.

B) nominal account.

C) temporary account.

D) zero account.

A) permanent account.

B) nominal account.

C) temporary account.

D) zero account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following accounts would NOT be considered a permanent account?

A) Accounts Receivable

B) Depreciation Expense

C) Accounts Payable

D) Prepaid Rent Expense

A) Accounts Receivable

B) Depreciation Expense

C) Accounts Payable

D) Prepaid Rent Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following accounts will be closed directly to Capital at the end of the fiscal year?

A) Salaries Expense

B) Fees Revenue

C) Withdrawals

D) Accumulated Depreciation

A) Salaries Expense

B) Fees Revenue

C) Withdrawals

D) Accumulated Depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

To close the Fees Earned account:

A) debit Fees Earned; credit Capital.

B) debit Fees Earned; credit Withdrawals.

C) debit Fees Earned; credit Income Summary.

D) debit Capital; credit Fees Earned.

A) debit Fees Earned; credit Capital.

B) debit Fees Earned; credit Withdrawals.

C) debit Fees Earned; credit Income Summary.

D) debit Capital; credit Fees Earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

39

When the balance in the Income Summary account is a debit, the company has:

A) incurred a net loss.

B) incurred a net income.

C) had more revenue than expenses.

D) made an error in their closing entries.

A) incurred a net loss.

B) incurred a net income.

C) had more revenue than expenses.

D) made an error in their closing entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

Closing entries will affect:

A) total assets.

B) Cash.

C) Owner's Capital.

D) total liabilities.

A) total assets.

B) Cash.

C) Owner's Capital.

D) total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

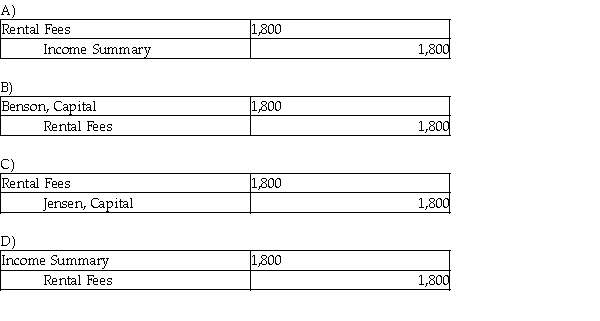

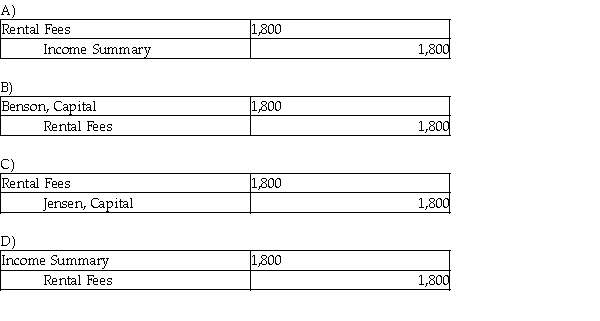

B. Jensen's worksheet showed the revenue account, Rental Fees, $1,800. The journal entry to close the account is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

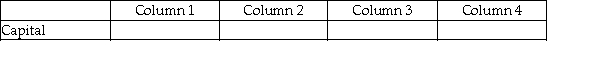

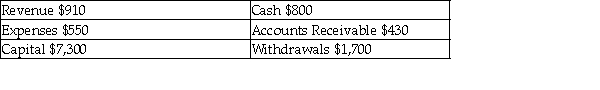

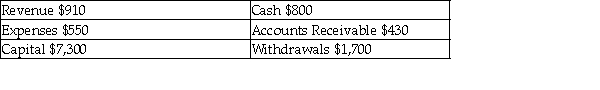

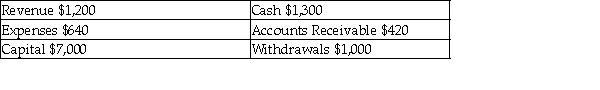

The following normal account balances were found on the general ledger before closing entries were prepared:  After closing entries are posted, what is the balance in the Revenue account?

After closing entries are posted, what is the balance in the Revenue account?

A) $910

B) $0

C) $360

D) Closing entries do not affect Revenue.

After closing entries are posted, what is the balance in the Revenue account?

After closing entries are posted, what is the balance in the Revenue account?A) $910

B) $0

C) $360

D) Closing entries do not affect Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

J. Oakely showed a net loss of $5,500. The entry to close the Income Summary account would include a:

A) debit to Oakely, Capital, $5,500.

B) debit to Income Summary, $5,500.

C) credit to Oakely, Capital, $5,500.

D) credit to Cash, $5,500.

A) debit to Oakely, Capital, $5,500.

B) debit to Income Summary, $5,500.

C) credit to Oakely, Capital, $5,500.

D) credit to Cash, $5,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

The business failed to close any of the revenue accounts. The result of this error is that:

A) revenues will be understated.

B) capital will be understated.

C) the assets will be overstated.

D) the liabilities will be overstated.

A) revenues will be understated.

B) capital will be understated.

C) the assets will be overstated.

D) the liabilities will be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Rent Expense account had a normal balance of $1,100. The entry to close the account would include a:

A) debit to Rent Expense, $1,100.

B) debit to Income Summary, $1,100.

C) debit to Capital, $1,100.

D) credit to Income Summary, $1,100.

A) debit to Rent Expense, $1,100.

B) debit to Income Summary, $1,100.

C) debit to Capital, $1,100.

D) credit to Income Summary, $1,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

The entry to close the Withdrawal account was entered in reverse-the Withdrawal account was debited and Capital credited. The result of this error is that:

A) before closing it, Income Summary will have a credit balance.

B) before closing it, Income Summary will have a debit balance.

C) the end of period capital will be understated.

D) the end of period capital will be overstated.

A) before closing it, Income Summary will have a credit balance.

B) before closing it, Income Summary will have a debit balance.

C) the end of period capital will be understated.

D) the end of period capital will be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

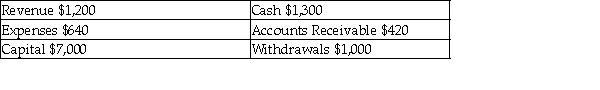

The following normal account balances were found on the general ledger before closing entries were prepared:  After closing entries are posted, what is the balance in the Capital account?

After closing entries are posted, what is the balance in the Capital account?

A) $7,560

B) $7,000

C) $6,560

D) Closing entries do not affect the Capital account.

After closing entries are posted, what is the balance in the Capital account?

After closing entries are posted, what is the balance in the Capital account?A) $7,560

B) $7,000

C) $6,560

D) Closing entries do not affect the Capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

The income statement credit column of the worksheet showed the following revenues:

The journal entry to close the revenue accounts is:

The journal entry to close the revenue accounts is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

The entry to close the revenue account(s) was entered in reverse-Income Summary was debited and the revenue account(s) was/were credited. The result of this error is that:

A) before closing it, Income Summary will have a credit balance.

B) before closing it, Income Summary will have a debit balance.

C) the assets will be overstated.

D) the liabilities will be overstated.

A) before closing it, Income Summary will have a credit balance.

B) before closing it, Income Summary will have a debit balance.

C) the assets will be overstated.

D) the liabilities will be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

The balance in the J. Higgins, Withdrawals account was $3,200. The entry to close the account would include a:

A) debit to Income Summary, $3,200.

B) credit to Income Summary, $3,200.

C) debit to J. Higgins, Capital, $3,200.

D) debit to J. Higgins, Withdrawals, $3,200.

A) debit to Income Summary, $3,200.

B) credit to Income Summary, $3,200.

C) debit to J. Higgins, Capital, $3,200.

D) debit to J. Higgins, Withdrawals, $3,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

M. Sims showed a net income of $8,000. The entry to close the Income Summary account would include a:

A) debit to M. Sims Capital, $8,000.

B) credit to M. Sims Capital, $8,000.

C) debit to Income Summary, $8,000.

D) Both B and C are correct.

A) debit to M. Sims Capital, $8,000.

B) credit to M. Sims Capital, $8,000.

C) debit to Income Summary, $8,000.

D) Both B and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

Closing entries will:

A) decrease the Owner's Capital.

B) increase the Cash balance.

C) either increase or decrease Owner's Capital.

D) not affect the Owner's Capital balance.

A) decrease the Owner's Capital.

B) increase the Cash balance.

C) either increase or decrease Owner's Capital.

D) not affect the Owner's Capital balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

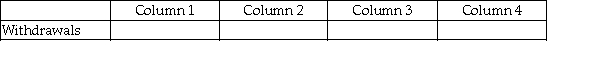

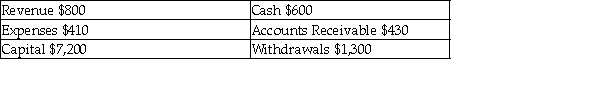

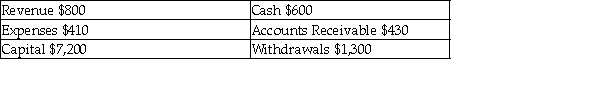

The following normal account balances were found on the general ledger before closing entries were prepared:  After closing entries are posted, what is the balance in the Cash account?

After closing entries are posted, what is the balance in the Cash account?

A) $800

B) $0

C) $200

D) $600

After closing entries are posted, what is the balance in the Cash account?

After closing entries are posted, what is the balance in the Cash account?A) $800

B) $0

C) $200

D) $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

All permanent accounts can be found:

A) on the Income Statement.

B) on the Statement of Owner's Equity.

C) on the Balance Sheet.

D) Permanent accounts do not appear on the financial statements.

A) on the Income Statement.

B) on the Statement of Owner's Equity.

C) on the Balance Sheet.

D) Permanent accounts do not appear on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

On Petro Company's worksheet, the Revenue account had a normal balance of $3,200. The entry to close the account would include a:

A) debit to Cash for $3,200.

B) credit to Income Summary for $3,200.

C) debit to Capital for $3,200.

D) credit to Revenue for $3,200.

A) debit to Cash for $3,200.

B) credit to Income Summary for $3,200.

C) debit to Capital for $3,200.

D) credit to Revenue for $3,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Income Summary account shows debits of $35,824 and credits of $25,977. This results in:

A) Withdrawals of $61,801.

B) a net loss of $61,801.

C) a net income of $9,847.

D) a net loss of $9,847.

A) Withdrawals of $61,801.

B) a net loss of $61,801.

C) a net income of $9,847.

D) a net loss of $9,847.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

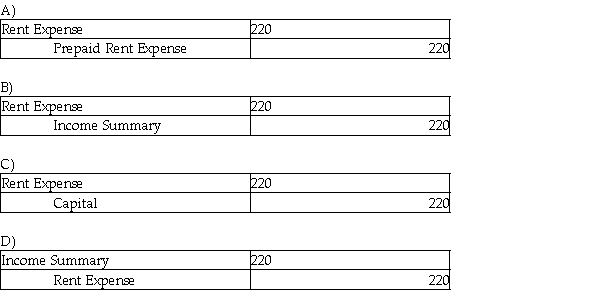

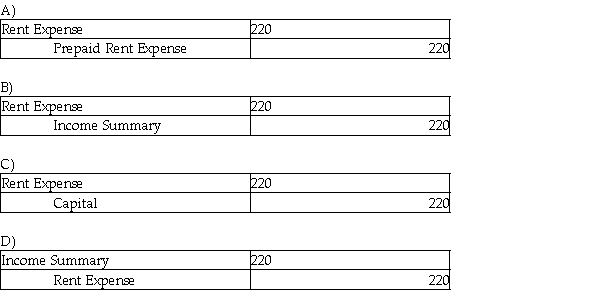

The balance in the Rent Expense account on the worksheet was $220. The journal entry to close the Rent Expense account is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

After closing the revenue, expense, and withdrawal accounts, the capital increased by $2,500. Which of the following situations could have occurred?

A) The company had a net loss.

B) The owner invested an additional amount.

C) The owner made a withdrawal.

D) All of these answers are correct.

A) The company had a net loss.

B) The owner invested an additional amount.

C) The owner made a withdrawal.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

The entry to close Income Summary (net loss) was entered in reverse-Income Summary was debited and Capital was credited. This error will cause:

A) Income Summary to have a credit balance.

B) Income Summary to have a debit balance.

C) the assets to be overstated.

D) the liabilities to be understated.

A) Income Summary to have a credit balance.

B) Income Summary to have a debit balance.

C) the assets to be overstated.

D) the liabilities to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

The entry to close the expense account(s) was entered in reverse-Income Summary was credited and the expense account(s) was/were debited. The result of this error is that:

A) before closing it, Income Summary will have a credit balance.

B) before closing it, Income Summary will have a debit balance.

C) the assets will be understated.

D) the liabilities will be understated.

A) before closing it, Income Summary will have a credit balance.

B) before closing it, Income Summary will have a debit balance.

C) the assets will be understated.

D) the liabilities will be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

The beginning capital balance is $6,200, there are no additional investments, but the owner did withdraw $500 during the accounting period. The period's revenue is $4,300 and expenses total $6,100. What is the ending capital balance (after closing entries)?

A) $6,200

B) $6,700

C) $4,400

D) $3,900

A) $6,200

B) $6,700

C) $4,400

D) $3,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is a temporary account?

A) Depreciation Expense

B) Service Fees Earned

C) Rent Expense

D) All of the above are temporary accounts.

A) Depreciation Expense

B) Service Fees Earned

C) Rent Expense

D) All of the above are temporary accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

When revenue is closed:

A) Owner's Capital will be debited.

B) Expenses will be debited.

C) Income Summary will be credited.

D) None of the above answers are correct.

A) Owner's Capital will be debited.

B) Expenses will be debited.

C) Income Summary will be credited.

D) None of the above answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

The Withdrawals account is closed to the Revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

The entry to close the Fees Earned account would cause:

A) the Capital account balance to increase.

B) the Capital account balance to decrease.

C) the Fees Earned account to decrease.

D) the Income Summary account balance not to be affected.

A) the Capital account balance to increase.

B) the Capital account balance to decrease.

C) the Fees Earned account to decrease.

D) the Income Summary account balance not to be affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

When closing the Income Summary account when there is a net income:

A) Capital would increase.

B) Revenue would decrease.

C) Capital would remain the same.

D) None of these is correct.

A) Capital would increase.

B) Revenue would decrease.

C) Capital would remain the same.

D) None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

When Income Summary has a credit balance and the account is closed:

A) Capital is decreased.

B) Capital is increased.

C) Withdrawals is increased.

D) Revenue is decreased.

A) Capital is decreased.

B) Capital is increased.

C) Withdrawals is increased.

D) Revenue is decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

The revenue accounts debited and the Income Summary account credited would be the result of:

A) closing the Income Summary account-there is a net income.

B) closing the Income Summary account-there is a net loss.

C) closing the revenue accounts.

D) closing the expense accounts.

A) closing the Income Summary account-there is a net income.

B) closing the Income Summary account-there is a net loss.

C) closing the revenue accounts.

D) closing the expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

The entry to close Income Summary (net loss) to Capital was omitted. This error will cause:

A) the ending capital to be overstated.

B) the ending capital to be understated.

C) no error in the ending capital balance.

D) None of these is correct.

A) the ending capital to be overstated.

B) the ending capital to be understated.

C) no error in the ending capital balance.

D) None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

When closing the Income Summary account when there is a net loss:

A) Capital would increase.

B) Capital would decrease.

C) Capital would remain the same.

D) Revenue would decrease.

A) Capital would increase.

B) Capital would decrease.

C) Capital would remain the same.

D) Revenue would decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

The entry to close the Depreciation Expense account would cause:

A) the Capital account balance to increase.

B) the Capital account balance to decrease.

C) the Accumulated Depreciation account balance to increase.

D) None of the above answers are correct.

A) the Capital account balance to increase.

B) the Capital account balance to decrease.

C) the Accumulated Depreciation account balance to increase.

D) None of the above answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

The Withdrawals account is closed to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

The beginning capital balance is $1,600; there are no additional investments or withdrawals by the owner during the accounting period. The period's revenue is $630 and expenses total $600. What is the ending capital balance (after closing entries)?

A) $1,630

B) $2,200

C) $2,230

D) $30

A) $1,630

B) $2,200

C) $2,230

D) $30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Capital account debited and the Withdrawals credited would be the result of:

A) closing the Income Summary account-there is a net income.

B) closing the withdrawal account.

C) closing the Income Summary account-there is a net loss.

D) closing the capital accounts.

A) closing the Income Summary account-there is a net income.

B) closing the withdrawal account.

C) closing the Income Summary account-there is a net loss.

D) closing the capital accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

When the expenses are closed:

A) Owner's Capital will be debited.

B) Income Summary will be debited.

C) Income Summary will be credited.

D) None of the above answers are correct.

A) Owner's Capital will be debited.

B) Income Summary will be debited.

C) Income Summary will be credited.

D) None of the above answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

When the Withdrawals account is closed:

A) Owner's Capital will be debited.

B) Income Summary will be debited.

C) Income Summary will be credited.

D) Revenue will be debited.

A) Owner's Capital will be debited.

B) Income Summary will be debited.

C) Income Summary will be credited.

D) Revenue will be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

There are 7 closing entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

When closing the Withdrawal account:

A) Capital would increase.

B) Capital would decrease.

C) Income Summary will be debited.

D) None of these is correct.

A) Capital would increase.

B) Capital would decrease.

C) Income Summary will be debited.

D) None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is a real account?

A) Cash

B) Accounts Payable

C) Utilities Expense

D) A and B are correct

A) Cash

B) Accounts Payable

C) Utilities Expense

D) A and B are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Income Summary account debited and the expense accounts credited would be the result of:

A) closing the Income Summary account-there is a net income.

B) closing the revenue accounts.

C) closing the Income Summary accounts-there is a net loss.

D) closing the expense accounts.

A) closing the Income Summary account-there is a net income.

B) closing the revenue accounts.

C) closing the Income Summary accounts-there is a net loss.

D) closing the expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck