Deck 1: Accounting Concepts and Procedures

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 1: Accounting Concepts and Procedures

1

The type of business organization that can continue indefinitely is known as a:

A) corporation.

B) partnership.

C) sole proprietorship.

D) All of the above

A) corporation.

B) partnership.

C) sole proprietorship.

D) All of the above

C

2

Which of the following will decrease Owner's Equity?

A) A sale of merchandise

B) The purchase of an asset on credit

C) An investment by the owner

D) A withdrawal by the owner

A) A sale of merchandise

B) The purchase of an asset on credit

C) An investment by the owner

D) A withdrawal by the owner

D

3

The function of accounting includes analyzing, recording, classifying, summarizing, reporting, strategic management and environmental assessment.

False

4

Which of the following is a characteristic of a sole proprietorship?

A) Business owned by more than one person

B) Easy to form

C) Each stockholder acts as an owner of the company

D) Can continue indefinitely

A) Business owned by more than one person

B) Easy to form

C) Each stockholder acts as an owner of the company

D) Can continue indefinitely

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

Put the 7 main steps of the accounting process in order (from 1 -7) below:

________ Interpreting

________ Analyzing

________ Recording

________ Classifying

________ Reporting

________ Communication

________ Summarizing

________ Interpreting

________ Analyzing

________ Recording

________ Classifying

________ Reporting

________ Communication

________ Summarizing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the difference between Bookkeeping and Accounting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

Accounting provides information to:

A) investors.

B) government.

C) managers.

D) All of these answers are correct.

A) investors.

B) government.

C) managers.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

A sole proprietorship ends with the death of the owner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

A partnership is a business which:

A) is easy to form.

B) ends with the death of a partner.

C) is owned by more than one person.

D) All of these answers are correct.

A) is easy to form.

B) ends with the death of a partner.

C) is owned by more than one person.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which is an advantage of a sole proprietorship form of business?

A) There is limited personal risk.

B) The business can continue indefinitely.

C) The owner makes all the decisions.

D) The business is legally separate from the owner.

A) There is limited personal risk.

B) The business can continue indefinitely.

C) The owner makes all the decisions.

D) The business is legally separate from the owner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is NOT an Asset?

A) Cash

B) Accounts Receivable

C) Buildings

D) All of the above are Assets.

A) Cash

B) Accounts Receivable

C) Buildings

D) All of the above are Assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

The purpose of the accounting process is to provide financial information about:

A) sole proprietorships.

B) small businesses.

C) large corporations.

D) All of these answers are correct.

A) sole proprietorships.

B) small businesses.

C) large corporations.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Sarbanes-Oxley Act was passed to:

A) prevent financial statement fraud at public companies.

B) replace inventory accounting procedures.

C) improve the accuracy of the company's financial reporting.

D) Both A and C are correct.

A) prevent financial statement fraud at public companies.

B) replace inventory accounting procedures.

C) improve the accuracy of the company's financial reporting.

D) Both A and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

Discuss the advantages and disadvantages of sole proprietorships, partnerships and corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

A corporation:

A) is legally separate from its owners.

B) is owned by stockholders.

C) has limited risk to stockholders.

D) All of the above

A) is legally separate from its owners.

B) is owned by stockholders.

C) has limited risk to stockholders.

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Items owned by the business such as land, supplies and equipment are:

A) Assets.

B) Liabilities.

C) Owner's Equity.

D) Expenses.

A) Assets.

B) Liabilities.

C) Owner's Equity.

D) Expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

A law firm would be considered a:

A) merchandise company.

B) manufacturer.

C) service company.

D) retailer.

A) merchandise company.

B) manufacturer.

C) service company.

D) retailer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is NOT a type of business organization?

A) Corporation

B) Partnership

C) Sole proprietorship

D) An Accounting organization

A) Corporation

B) Partnership

C) Sole proprietorship

D) An Accounting organization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

Generally Accepted Accounting Principles are the procedures and guidelines that must be followed every other year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

The purchase of supplies for cash would affect which account category?

A) Assets

B) Liabilities

C) Capital

D) Expense

A) Assets

B) Liabilities

C) Capital

D) Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

Eileen's Corner Shoppe purchases a desk for cash. This causes:

A) Cash and Capital to increase.

B) Furniture and Cash to increase.

C) Furniture to increase and Cash to decrease.

D) Accounts Payable to increase and Capital to increase.

A) Cash and Capital to increase.

B) Furniture and Cash to increase.

C) Furniture to increase and Cash to decrease.

D) Accounts Payable to increase and Capital to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

Bonnie's Baskets purchases $3,000 worth of office equipment on open account. This causes:

A) Cash and Capital to decrease.

B) Office Equipment and Accounts Payable to increase.

C) Office Equipment to decrease and Accounts Payable to increase.

D) Accounts Payable to increase and Capital to decrease.

A) Cash and Capital to decrease.

B) Office Equipment and Accounts Payable to increase.

C) Office Equipment to decrease and Accounts Payable to increase.

D) Accounts Payable to increase and Capital to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

23

If total liabilities increased by $10,000 and the assets increased by $10,000 during the accounting period, what is the change in the owner's equity amount?

A) No effect on owner's equity

B) Decrease of $10,000

C) Increase of $20,000

D) Decrease of $40,000

A) No effect on owner's equity

B) Decrease of $10,000

C) Increase of $20,000

D) Decrease of $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

The claims of creditors against the Assets are:

A) Expenses.

B) Revenues.

C) Liabilities.

D) Owner's Equity.

A) Expenses.

B) Revenues.

C) Liabilities.

D) Owner's Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

Mary invested cash in her new business. What effect will this have?

A) Increase an Asset and increase a Liability

B) Decrease an Asset and increase a Liability

C) Increase an Asset and increase Owner's Equity

D) Decrease an Asset and decrease Owner's Equity

A) Increase an Asset and increase a Liability

B) Decrease an Asset and increase a Liability

C) Increase an Asset and increase Owner's Equity

D) Decrease an Asset and decrease Owner's Equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

An acceptable variation of the accounting equation is:

A) Assets - Owner's Equity = Liabilities.

B) Revenues = Profit - Expenses.

C) Assets = Liabilities - Owner's Equity.

D) All of these answers are correct.

A) Assets - Owner's Equity = Liabilities.

B) Revenues = Profit - Expenses.

C) Assets = Liabilities - Owner's Equity.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

Logan's Motor Sports buys $47,000 of supplies for cash. Which of the following is a true statement?

A) Total Assets increase.

B) Total Assets are unchanged.

C) Total Assets decrease.

D) Total Liabilities are unchanged.

A) Total Assets increase.

B) Total Assets are unchanged.

C) Total Assets decrease.

D) Total Liabilities are unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

Pat purchased $8,000 of new electronic equipment for her BJ Company on open account. The effect on the basic accounting equation was to:

A) increase Cash $8,000 and increase Equipment $8,000.

B) increase Equipment $8,000 and increase Accounts Payable $8,000.

C) decrease Cash $8,000 and increase Accounts Payable $8,000.

D) decrease Cash $8,000 and increase Equipment $8,000.

A) increase Cash $8,000 and increase Equipment $8,000.

B) increase Equipment $8,000 and increase Accounts Payable $8,000.

C) decrease Cash $8,000 and increase Accounts Payable $8,000.

D) decrease Cash $8,000 and increase Equipment $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

A business received $10,000 from a customer in payment of an amount owed. The effect of the transaction on the accounting equation was to:

A) increase one Asset, decrease another Asset.

B) increase an Asset, increase a Liability.

C) decrease an Asset, decrease a Liability.

D) increase an Asset, increase Owner's Equity.

A) increase one Asset, decrease another Asset.

B) increase an Asset, increase a Liability.

C) decrease an Asset, decrease a Liability.

D) increase an Asset, increase Owner's Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

How does the purchase of supplies on account affect the accounting equation?

A) Assets increase; Liabilities decrease

B) Assets increase; Owner's Equity increases

C) Assets increase; Liabilities increase

D) Liabilities increase; Owner's Equity decreases

A) Assets increase; Liabilities decrease

B) Assets increase; Owner's Equity increases

C) Assets increase; Liabilities increase

D) Liabilities increase; Owner's Equity decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Owner's Equity of Logan's Company is equal to one-half of the total Assets. Liabilities equal $90,000. What is the amount of Owner's Equity?

A) $45,000

B) $90,000

C) $135,000

D) None of these answers is correct.

A) $45,000

B) $90,000

C) $135,000

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

The basic accounting equation is:

A) Assets = Revenues - Expenses.

B) Assets = Liabilities - Owner's Equity.

C) Profit = Revenues - Expenses.

D) Assets = Liabilities + Owner's Equity.

A) Assets = Revenues - Expenses.

B) Assets = Liabilities - Owner's Equity.

C) Profit = Revenues - Expenses.

D) Assets = Liabilities + Owner's Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

The balance sheet contains:

A) Liabilities, Expenses and capital.

B) Assets, Liabilities and Revenues.

C) Expenses, Assets and cash.

D) None of the above is correct.

A) Liabilities, Expenses and capital.

B) Assets, Liabilities and Revenues.

C) Expenses, Assets and cash.

D) None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

Strum Hardware has total Assets of $60,000. What are the total Assets if new building is purchased for $5,000 cash?

A) $70,000

B) $65,000

C) $55,000

D) $60,000

A) $70,000

B) $65,000

C) $55,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

If total Liabilities are $50,000 and Owner's Equity is $35,000, the total Assets must be:

A) $85,000.

B) $15,000.

C) $42,500.

D) $70,000.

A) $85,000.

B) $15,000.

C) $42,500.

D) $70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

If total Liabilities are $2,000 and total Assets are $16,000, Owner's Equity must be:

A) $14,000.

B) $9,000.

C) $16,000.

D) $18,000.

A) $14,000.

B) $9,000.

C) $16,000.

D) $18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

Harvest Moon Company has total Assets of $37,000. If $2,000 cash is used to purchase a new computer, the total Assets would be:

A) $37,000.

B) $35,000.

C) $39,000.

D) $2,000.

A) $37,000.

B) $35,000.

C) $39,000.

D) $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

Assets are equal to:

A) Liabilities + Owner's Equity.

B) Liabilities - Owner's Equity.

C) Liabilities - Revenues.

D) Revenues - Expenses.

A) Liabilities + Owner's Equity.

B) Liabilities - Owner's Equity.

C) Liabilities - Revenues.

D) Revenues - Expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

Katie's Vegetarian Restaurant, with total Assets of $121,000, borrows $27,000 from the bank. Which of the following is a true statement upon borrowing the money?

A) Total Assets are now $148,000.

B) Total Assets are now $94,000.

C) Total Assets are now $175,000.

D) Total Assets are now $121,000.

A) Total Assets are now $148,000.

B) Total Assets are now $94,000.

C) Total Assets are now $175,000.

D) Total Assets are now $121,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

Bob purchased a new computer for the company for cash. The transaction will:

A) increase Computer; increase Capital.

B) decrease Cash; increase Accounts Payable.

C) decrease Cash; increase Computer.

D) increase Supplies; increase Accounts Payable.

A) increase Computer; increase Capital.

B) decrease Cash; increase Accounts Payable.

C) decrease Cash; increase Computer.

D) increase Supplies; increase Accounts Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

In a shift of Assets, the composition of the Assets changes but total Assets do not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

The left side of the accounting equation must always be greater than the right side of the equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

If Total Assets are $68,000 and Total Capital is $30,000, Liabilities must equal:

A) $38,000.

B) $30,000.

C) $98,000.

D) $68,000.

A) $38,000.

B) $30,000.

C) $98,000.

D) $68,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following would result if a business purchased Equipment with a 40% down payment and the rest on open account?

A) Equipment would increase and Cash would decrease.

B) Accounts Payable would increase.

C) Since the equipment has not been paid in full, there is nothing to record.

D) Both A and B are correct.

A) Equipment would increase and Cash would decrease.

B) Accounts Payable would increase.

C) Since the equipment has not been paid in full, there is nothing to record.

D) Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

To distinguish the total on a financial statement, use single underline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

The cash purchase of a truck was recorded as a credit purchase. Due to this error:

A) Assets were understated.

B) Liabilities were understated.

C) Answers A and B are both correct.

D) None of the above is correct.

A) Assets were understated.

B) Liabilities were understated.

C) Answers A and B are both correct.

D) None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

Creditors' claims against Assets are called Liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

A purchase of a vehicle on credit would have what effect on the accounting equation?

A) Total Assets and total Liabilities increase.

B) Total Liabilities are overstated.

C) Total Owner's Equity is overstated.

D) Both A and B are correct.

A) Total Assets and total Liabilities increase.

B) Total Liabilities are overstated.

C) Total Owner's Equity is overstated.

D) Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following would result if the owner withdrew cash from the business?

A) Cash would increase and Capital would decrease.

B) Cash would increase and Withdrawals would increase.

C) Cash would decrease and Withdrawals would increase.

D) An investment by the owner is not a business transaction.

A) Cash would increase and Capital would decrease.

B) Cash would increase and Withdrawals would increase.

C) Cash would decrease and Withdrawals would increase.

D) An investment by the owner is not a business transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

The balance sheet shows the company's financial position as of a particular date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

If the Assets owned by a business total $59,000, Owner's Equity must also total $59,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

Revenue is the same thing as cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

The right side of the accounting equation shows what is owed by the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

If Owner's Equity totals $73,000 and Liabilities total $40,000, then Assets owned by a business totals $113,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the Liabilities owed by a business total $150,000, then the Assets must also total $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following items is NOT listed on the balance sheet?

A) Accounts Payable

B) Accounts Receivable

C) Service Revenue

D) Equipment

A) Accounts Payable

B) Accounts Receivable

C) Service Revenue

D) Equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following transactions would cause one asset to increase and another asset to decrease?

A) The owner invested cash in the business.

B) The business paid a creditor.

C) The business incurred an Expense on credit.

D) The business bought supplies for cash.

A) The owner invested cash in the business.

B) The business paid a creditor.

C) The business incurred an Expense on credit.

D) The business bought supplies for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following would result if the business purchased equipment for cash?

A) Supplies would increase and Cash would decrease.

B) Supplies would increase and Capital would increase.

C) Equipment would increase and Cash would decrease.

D) The purchase of supplies is not a business transaction.

A) Supplies would increase and Cash would decrease.

B) Supplies would increase and Capital would increase.

C) Equipment would increase and Cash would decrease.

D) The purchase of supplies is not a business transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

The purchase of supplies with both cash and on account was recorded as only an open account purchase. Due to this error:

A) Assets would be understated.

B) Liabilities would be overstated.

C) Owner's Equity would be overstated.

D) None of the above is correct.

A) Assets would be understated.

B) Liabilities would be overstated.

C) Owner's Equity would be overstated.

D) None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following transactions would cause an asset to decrease and the Owner's Equity to decrease?

A) The owner invested cash in the business.

B) The business incurred an Expense on credit.

C) The business bought supplies on account.

D) None of the above.

A) The owner invested cash in the business.

B) The business incurred an Expense on credit.

C) The business bought supplies on account.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

If beginning capital was $170,000, ending capital is $93,000, and the owner's withdrawals were $19,000, the amount of net income or net loss was:

A) net income of $77,000.

B) net income of $58,000.

C) net loss of $58,000.

D) net loss of $77,000.

A) net income of $77,000.

B) net income of $58,000.

C) net loss of $58,000.

D) net loss of $77,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

The three elements that make up a balance sheet are Assets, Liabilities and Owner's Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

If a company's Revenues are higher than its Expenses, it will cause:

A) an increase in Owner's Equity.

B) a decrease in Owner's Equity.

C) an increase in Assets.

D) net loss.

A) an increase in Owner's Equity.

B) a decrease in Owner's Equity.

C) an increase in Assets.

D) net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Crystal Clear Imagery received and paid a utility bill for $600 for the month of November. This transaction will:

A) increase Cash and increase Utility Expense.

B) decrease Cash and increase Utility Expense.

C) increase Cash and decrease Utility Expense.

D) increase Utility Expense and decrease Revenue.

A) increase Cash and increase Utility Expense.

B) decrease Cash and increase Utility Expense.

C) increase Cash and decrease Utility Expense.

D) increase Utility Expense and decrease Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

When services are rendered but payment is not made, which account would be increased?

A) Accounts Receivable

B) Accounts Payable

C) Cash

D) Supplies Expense

A) Accounts Receivable

B) Accounts Payable

C) Cash

D) Supplies Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

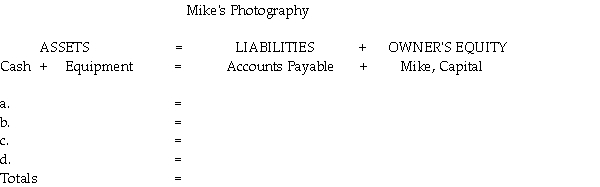

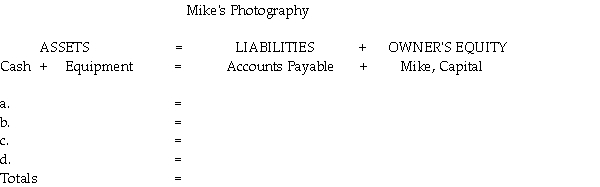

Mike's Photography completes the following transactions:

a. Mike invests $15,000 cash in her company.

b. The company purchases equipment on account, $600.

c. The company purchases additional equipment for cash, $300.

d. The company makes a payment on account for the equipment, $500.

Required: Record the above transactions in the basic accounting equation.

a. Mike invests $15,000 cash in her company.

b. The company purchases equipment on account, $600.

c. The company purchases additional equipment for cash, $300.

d. The company makes a payment on account for the equipment, $500.

Required: Record the above transactions in the basic accounting equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

Ryan withdrew cash from the business to pay his personal cell phone bill. The expanded accounting equation changes include:

A) increase in both Cash and Withdrawals.

B) decrease in both Cash and Withdrawals.

C) decrease in Cash and increase in Withdrawals.

D) increase in Cash and decrease in Withdrawals.

A) increase in both Cash and Withdrawals.

B) decrease in both Cash and Withdrawals.

C) decrease in Cash and increase in Withdrawals.

D) increase in Cash and decrease in Withdrawals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

Revenue, Expenses, and withdrawals are subdivisions of:

A) Assets.

B) Liabilities.

C) Owner's Equity.

D) All of these answers are correct.

A) Assets.

B) Liabilities.

C) Owner's Equity.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

Go Big Red Retail Store collected $16,000 of its accounts receivable. The expanded accounting equation changes include:

A) Cash and Capital increase $16,000.

B) Cash and Revenue increase $16,000.

C) Cash increases and Accounts Receivable decreases $16,000.

D) Accounts Receivable decreases and Capital increases $16,000.

A) Cash and Capital increase $16,000.

B) Cash and Revenue increase $16,000.

C) Cash increases and Accounts Receivable decreases $16,000.

D) Accounts Receivable decreases and Capital increases $16,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

The net income or net loss is calculated on the:

A) balance sheet.

B) statement of Owner's Equity.

C) income statement.

D) None of these

A) balance sheet.

B) statement of Owner's Equity.

C) income statement.

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

If Ol' Fashioned Toys' Revenues are greater than its Expenses during the accounting period:

A) Assets will increase more than Liabilities.

B) Liabilities will increase more than Assets.

C) the business will incur a loss.

D) the business will earn a net income.

A) Assets will increase more than Liabilities.

B) Liabilities will increase more than Assets.

C) the business will incur a loss.

D) the business will earn a net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following transactions affect Owner's Equity?

A) Payment on account

B) Equipment purchase

C) Customer payment

D) A withdrawal

A) Payment on account

B) Equipment purchase

C) Customer payment

D) A withdrawal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

Kim billed her legal clients $12,000 for legal work completed during the month. This transaction will:

A) cause a $12,000 increase in Revenues and Liabilities.

B) cause a $12,000 increase in Revenues and a decrease in cash.

C) cause a $12,000 increase in Assets and Revenues.

D) not be recorded until the cash is collected.

A) cause a $12,000 increase in Revenues and Liabilities.

B) cause a $12,000 increase in Revenues and a decrease in cash.

C) cause a $12,000 increase in Assets and Revenues.

D) not be recorded until the cash is collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

If Liabilities are $22,000 and Assets are $42,000, Owner's Equity will be $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

The accounting equation states that total Assets must always equal total Liabilities plus Owner's Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

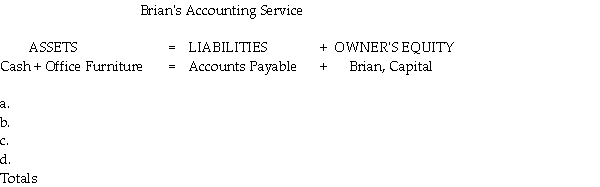

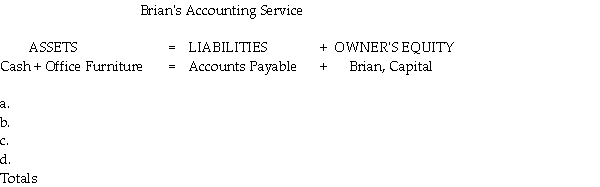

Record the following transactions in the basic accounting equation:

a. Brian invests $30,000 cash to begin an accounting service.

b. The company buys office furniture for cash, $900.

c. The company buys additional office furniture on account, $200.

d. The company makes a payment on the office furniture, $100.

a. Brian invests $30,000 cash to begin an accounting service.

b. The company buys office furniture for cash, $900.

c. The company buys additional office furniture on account, $200.

d. The company makes a payment on the office furniture, $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

If Ol' Fashioned Toys' Revenues are less than its Expenses during the accounting period:

A) owner's withdrawals increase net income.

B) net income causes Liabilities to decrease.

C) the business will incur a net loss.

D) owner's withdrawals increase Owner's Equity.

A) owner's withdrawals increase net income.

B) net income causes Liabilities to decrease.

C) the business will incur a net loss.

D) owner's withdrawals increase Owner's Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

The payment of accounts payable would:

A) increase both Assets and Liabilities.

B) increase Assets and decrease Liabilities.

C) decrease both Assets and Liabilities.

D) decrease Assets and increase Liabilities.

A) increase both Assets and Liabilities.

B) increase Assets and decrease Liabilities.

C) decrease both Assets and Liabilities.

D) decrease Assets and increase Liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

Owner's withdrawals:

A) decrease Assets.

B) increase Expenses.

C) increase Assets.

D) decrease Withdrawals.

A) decrease Assets.

B) increase Expenses.

C) increase Assets.

D) decrease Withdrawals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

Cup's Inc. paid $15,000 in salaries and wages for February. This transaction will:

A) increase Expenses and decrease Revenue.

B) increase Expenses and increase Liabilities.

C) decrease Assets and increase Expenses.

D) increase Assets and Expenses.

A) increase Expenses and decrease Revenue.

B) increase Expenses and increase Liabilities.

C) decrease Assets and increase Expenses.

D) increase Assets and Expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck